Here are the answers with discussion for this Weekend’s Quiz. The information provided should help you work out why you missed a question or three! If you haven’t already done the Quiz from yesterday then have a go at it before you read the answers. I hope this helps you develop an understanding of Modern…

Saturday Quiz – April 27, 2013 – answers and discussion

Here are the answers with discussion for yesterday’s quiz. The information provided should help you understand the reasoning behind the answers. If you haven’t already done the Quiz from yesterday then have a go at it before you read the answers. I hope this helps you develop an understanding of Modern Monetary Theory (MMT) and its application to macroeconomic thinking. Comments as usual welcome, especially if I have made an error.

Question 1:

When a nation is enjoying a strong terms of trade with an external surplus, the government can create more space for non-inflationary spending in the future by running budget surpluses and accumulating them in a sovereign fund.

The answer is False.

So it is often considered that a resources boom which drives strong growth in national income and generates considerable growth in tax revenue is a boost for the government and provides them with “savings” that can be stored away and used for the future when economic growth was not strong. Nothing could be further from the truth.

The public finances of a country such as Australia – which issues its own currency and floats it on foreign exchange markets are not reliant at all on the dynamics of our industrial structure. To think otherwise reveals a basis misunderstanding which is sourced in the notion that such a government has to raise revenue before it can spend.

The fundamental principles that arise in a fiat monetary system are as follows:

- The central bank sets the short-term interest rate based on its policy aspirations.

- Government spending capacity is independent of taxation revenue. The non-government sector cannot pay taxes until the government has spent.

- Government spending capacity is independent of borrowing which the latter best thought of as coming after spending.

- Government spending provides the net financial assets (bank reserves) which ultimately represent the funds used by the non-government agents to purchase the debt.

- Budget deficits put downward pressure on interest rates contrary to the myths that appear in macroeconomic textbooks about “crowding out”.

- The “penalty for not borrowing” is that the interest rate will fall to the bottom of the “corridor” prevailing in the country which may be zero if the central bank does not offer a return on reserves.

- Government debt-issuance is a “monetary policy” operation rather than being intrinsic to fiscal policy, although in a modern monetary paradigm the distinctions between monetary and fiscal policy as traditionally defined are moot.

These principles apply to all sovereign, currency-issuing governments irrespective of industry structure. Industry structure is important for some things (crucially so) but not in delineating “public finance regimes”.

The mistake lies in thinking that such a government is revenue-constrained and that a booming mining sector delivers more revenue and thus gives the government more spending capacity. Nothing could be further from the truth irrespective of the rhetoric that politicians use to relate their fiscal decisions to us and/or the institutional arrangements that they have put in place which make it look as if they are raising money to re-spend it! These things are veils to disguise the true capacity of a sovereign government in a fiat monetary system.

In the midst of the nonsensical intergenerational (ageing population) debate, which is being used by conservatives all around the world as a political tool to justify moving to budget surpluses, the notion arises that governments will not be able to honour their liabilities to pensions, health etc unless drastic action is taken.

Hence the hype and spin moved into overdrive to tell us how the establishment of sovereign funds. The financial markets love the creation of sovereign funds because they know there will be more largesse for them to speculate with at the expense of public spending. Corporate welfare is always attractive to the top end of town while they draft reports and lobby governments to get rid of the Welfare state, by which they mean the pitiful amounts we provide to sustain at minimal levels the most disadvantaged among us.

The claim is that the creation of these sovereign funds create the fiscal room to fund the so-called future liabilities. Clearly this is nonsense. A sovereign government’s ability to make timely payment of its own currency is never numerically constrained. So it would always be able to fund the pension liabilities, for example, when they arose without compromising its other spending ambitions.

The creation of sovereign funds basically involve the government becoming a financial asset speculator. So national governments start gambling in the World’s bourses usually at the same time as millions of their citizens do not have enough work.

The logic surrounding sovereign funds is also blurred. If one was to challenge a government which was building a sovereign fund but still had unmet social need (and perhaps persistent labour underutilisation) the conservative reaction would be that there was no fiscal room to do any more than they are doing. Yet when they create the sovereign fund the government spends in the form of purchases of financial assets.

So we have a situation where the elected national government prefers to buy financial assets instead of buying all the labour that is left idle by the private market. They prefer to hold bits of paper than putting all this labour to work to develop communities and restore our natural environment.

An understanding of modern monetary theory will tell you that all the efforts to create sovereign funds are totally unnecessary. Whether the fund gained or lost makes no fundamental difference to the underlying capacity of the national government to fund all of its future liabilities.

A sovereign government’s ability to make timely payment of its own currency is never numerically constrained by revenues from taxing and/or borrowing. Therefore the creation of a sovereign fund in no way enhances the government’s ability to meet future obligations. In fact, the entire concept of government pre-funding an unfunded liability in its currency of issue has no application whatsoever in the context of a flexible exchange rate and the modern monetary system.

The misconception that “public saving” is required to fund future public expenditure is often rehearsed in the financial media.

First, running budget surpluses does not create national savings. There is no meaning that can be applied to a sovereign government “saving its own currency”. It is one of those whacko mainstream macroeconomics ideas that appear to be intuitive but have no application to a fiat currency system.

In rejecting the notion that public surpluses create a cache of money that can be spent later we note that governments spend by crediting bank accounts. There is no revenue constraint. Government cheques don’t bounce! Additionally, taxation consists of debiting an account at an RBA member bank. The funds debited are “accounted for” but don’t actually “go anywhere” and “accumulate”.

The concept of pre-funding future liabilities does apply to fixed exchange rate regimes, as sufficient reserves must be held to facilitate guaranteed conversion features of the currency. It also applies to non-government users of a currency. Their ability to spend is a function of their revenues and reserves of that currency.

So at the heart of all this nonsense is the false analogy neo-liberals draw between private household budgets and the government budget. Households, the users of the currency, must finance their spending prior to the fact. However, government, as the issuer of the currency, must spend first (credit private bank accounts) before it can subsequently tax (debit private accounts). Government spending is the source of the funds the private sector requires to pay its taxes and to net save and is not inherently revenue constrained.

You might have thought the answer was maybe because it would depend on whether the economy was already at full employment and what the desired saving plans of the private domestic sector was. In the absence of the statement about creating more fiscal space in the future, maybe would have been the best answer.

The following blogs may be of further interest to you:

- A mining boom will not reduce the need for public deficits

- The Futures Fund scandal

- A modern monetary theory lullaby

Question 2:

Only one of the following propositions is possible (with all balances expressed as a per cent of GDP):

- A nation can run a current account deficit accompanied by a government sector surplus of equal proportion to GDP, while the private domestic sector is spending less than they are earning.

- A nation can run a current account deficit accompanied by a government sector surplus of equal proportion to GDP, while the private domestic sector is spending more than they are earning.

- A nation can run a current account deficit with a government sector surplus that is larger, while the private domestic sector is spending less than they are earning.

- None of the above are possible as they all defy the sectoral balances accounting identity.

The best answer is the second option – “A nation can run a current account deficit accompanied by a government sector surplus of equal proportion to GDP, while the private domestic sector is spending more than they are earning”.

This is a question about the sectoral balances – the government budget balance, the external balance and the private domestic balance – that have to always add to zero because they are derived as an accounting identity from the national accounts.

To refresh your memory the balances are derived as follows. The basic income-expenditure model in macroeconomics can be viewed in (at least) two ways: (a) from the perspective of the sources of spending; and (b) from the perspective of the uses of the income produced. Bringing these two perspectives (of the same thing) together generates the sectoral balances.

From the sources perspective we write:

GDP = C + I + G + (X – M)

which says that total national income (GDP) is the sum of total final consumption spending (C), total private investment (I), total government spending (G) and net exports (X – M).

From the uses perspective, national income (GDP) can be used for:

GDP = C + S + T

which says that GDP (income) ultimately comes back to households who consume (C), save (S) or pay taxes (T) with it once all the distributions are made.

Equating these two perspectives we get:

C + S + T = GDP = C + I + G + (X – M)

So after simplification (but obeying the equation) we get the sectoral balances view of the national accounts.

(I – S) + (G – T) + (X – M) = 0

That is the three balances have to sum to zero. The sectoral balances derived are:

- The private domestic balance (I – S) – positive if in deficit, negative if in surplus.

- The Budget Deficit (G – T) – negative if in surplus, positive if in deficit.

- The Current Account balance (X – M) – positive if in surplus, negative if in deficit.

These balances are usually expressed as a per cent of GDP but that doesn’t alter the accounting rules that they sum to zero, it just means the balance to GDP ratios sum to zero.

A simplification is to add (I – S) + (X – M) and call it the non-government sector. Then you get the basic result that the government balance equals exactly $-for-$ (absolutely or as a per cent of GDP) the non-government balance (the sum of the private domestic and external balances).

This is also a basic rule derived from the national accounts and has to apply at all times.

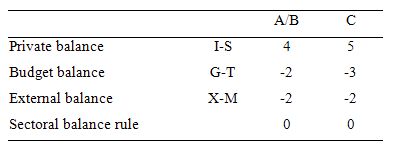

The following Table represents the three options in percent of GDP terms. To aid interpretation remember that (I-S) > 0 means that the private domestic sector is spending more than they are earning; that (G-T) < 0 means that the government is running a surplus because T > G; and (X-M) < 0 means the external position is in deficit because imports are greater than exports.

The first two possibilities we might call A and B:

A: A nation can run a current account deficit with an offsetting government sector surplus, while the private domestic sector is spending less than they are earn

B: A nation can run a current account deficit with an offsetting government sector surplus, while the private domestic sector is spending more than they are earning.

So Option A says the private domestic sector is saving overall, whereas Option B say the private domestic sector is dis-saving (and going into increasing indebtedness). These options are captured in the first column of the Table. So the arithmetic example depicts an external sector deficit of 2 per cent of GDP and an offsetting budget surplus of 2 per cent of GDP.

You can see that the private sector balance is positive (that is, the sector is spending more than they are earning – Investment is greater than Saving – and has to be equal to 4 per cent of GDP.

Given that the only proposition that can be true is:

B: A nation can run a current account deficit with an offsetting government sector surplus, while the private domestic sector is spending more than they are earning.

Column 2 in the Table captures Option C:

C: A nation can run a current account deficit with a government sector surplus that is larger, while the private domestic sector is spending less than they are earning.

So the current account deficit is equal to 2 per cent of GDP while the surplus is now larger at 3 per cent of GDP. You can see that the private domestic deficit rises to 5 per cent of GDP to satisfy the accounting rule that the balances sum to zero.

The final option available is:

D: None of the above are possible as they all defy the sectoral balances accounting identity.

It cannot be true because as the Table data shows the rule that the sectoral balances add to zero because they are an accounting identity is satisfied in both cases.

So what is the economic rationale for this result?

If the nation is running an external deficit it means that the contribution to aggregate demand from the external sector is negative – that is net drain of spending – dragging output down.

The external deficit also means that foreigners are increasing financial claims denominated in the local currency. Given that exports represent a real costs and imports a real benefit, the motivation for a nation running a net exports surplus (the exporting nation in this case) must be to accumulate financial claims (assets) denominated in the currency of the nation running the external deficit.

A fiscal surplus also means the government is spending less than it is “earning” and that puts a drag on aggregate demand and constrains the ability of the economy to grow.

In these circumstances, for income to be stable, the private domestic sector has to spend more than they earn.

You can see this by going back to the aggregate demand relations above. For those who like simple algebra we can manipulate the aggregate demand model to see this more clearly.

Y = GDP = C + I + G + (X – M)

which says that the total national income (Y or GDP) is the sum of total final consumption spending (C), total private investment (I), total government spending (G) and net exports (X – M).

So if the G is spending less than it is “earning” and the external sector is adding less income (X) than it is absorbing spending (M), then the other spending components must be greater than total income

The following blogs may be of further interest to you:

- Barnaby, better to walk before we run

- Stock-flow consistent macro models

- Norway and sectoral balances

- The OECD is at it again!

Question 3:

Under current institutional arrangements, the change in the ratio of public debt to GDP will exactly equal the primary deficit plus the interest service payments on the outstanding stock of debt both expressed as ratios to GDP plus the changes in the monetary base arising from official foreign exchange transactions.

The answer is False.

If we left out the last part of the question “plus the changes in the monetary base arising from official foreign exchange transactions” then the answer is true. The official foreign exchange transactions do change the monetary base but have no accounting impact on the ratio of public debt to GDP

So without that addition, the answer would be true as long as you note the caveat “under current institutional arrangements”. What are the institutional arrangements that are applicable here? I am referring, of-course, to the voluntary choice by governments around the world to issue debt into the private bond markets to match $-for-$ their net spending flows in each period. A sovereign government within a fiat currency system does not have to issue any debt and could run continuous budget deficits (that is, forever) with a zero public debt.

The reason they is covered in the following blogs – On voluntary constraints that undermine public purpose.

So given they are intent on holding onto these gold standard/convertible currency relics the answer is true.

The framework for considering this question is provided by the accounting relationship linking the budget flows (spending, taxation and interest servicing) with relevant stocks (base money and government bonds).

This framework has been interpreted by the mainstream macroeconommists as constituting an a priori financial constraint on government spending (more on this soon) and by proponents of Modern Monetary Theory (MMT) as an ex post accounting relationship that has to be true in a stock-flow consistent macro model but which carries no particular import other than to measure the changes in stocks between periods. These changes are also not particularly significant within MMT given that a sovereign government is never revenue constrained because it is the monopoly issuer of the currency.

To understand the difference in viewpoint we might usefully start with the mainstream view. The way the mainstream macroeconomics textbooks build this narrative is to draw an analogy between the household and the sovereign government and to assert that the microeconomic constraints that are imposed on individual or household choices apply equally without qualification to the government. The framework for analysing these choices has been called the government budget constraint (GBC) in the literature.

The GBC is in fact an accounting statement relating government spending and taxation to stocks of debt and high powered money. However, the accounting character is downplayed and instead it is presented by mainstream economists as an a priori financial constraint that has to be obeyed. So immediately they shift, without explanation, from an ex post sum that has to be true because it is an accounting identity, to an alleged behavioural constraint on government action.

The GBC is always true ex post but never represents an a priori financial constraint for a sovereign government running a flexible-exchange rate non-convertible currency. That is, the parity between its currency and other currencies floats and the the government does not guarantee to convert the unit of account (the currency) into anything else of value (like gold or silver).

This literature emerged in the 1960s during a period when the neo-classical microeconomists were trying to gain control of the macroeconomic policy agenda by undermining the theoretical validity of the, then, dominant Keynesian macroeconomics. There was nothing particularly progressive about the macroeconomics of the day which is known as Keynesian although as I explain in this blog – Those bad Keynesians are to blame – that is a bit of a misnomer.

This is because the essential insights of Keynes were lost in the early 1940s after being kidnapped by what became known as the neo-classical synthesis characterised by the Hicksian IS-LM model. I cannot explain all that here so for non-economists I would say this issue is not particularly important in order to develop a comprehension of the rest of this answer and the issues at stake.

The neo-classical attack was centred on the so-called lack of microfoundations (read: contrived optimisation and rationality assertions that are the hallmark of mainstream microeconomics but which fail to stand scrutiny by, for example, behavioural economists). I also won’t go into this issue because it is very complicated and would occupy about 3 (at least) separate blogs by the time I had explained what it was all about.

For the non-economists, once again I ask for some slack. Take it from me – it was total nonsense and reflected the desire of the mainstream microeconomists to represent the government as a household and to “prove” analytically that its presence within the economy was largely damaging to income and wealth generation. The attack was pioneered, for example, by Milton Friedman in the 1950s – so that should give you an idea of what the ideological agenda was.

Anyway, just as an individual or a household is conceived in orthodox microeconomic theory to maximise utility (real income) subject to their budget constraints, this emerging approach also constructed the government as being constrained by a budget or “financing” constraint. Accordingly, they developed an analytical framework whereby the budget deficits had stock implications – this is the so-called GBC.

So within this model, taxes are conceived as providing the funds to the government to allow it to spend. Further, this approach asserts that any excess in government spending over taxation receipts then has to be “financed” in two ways: (a) by borrowing from the public; and (b) by printing money.

You can see that the approach is a gold standard approach where the quantity of “money” in circulation is proportional (via a fixed exchange price) to the stock of gold that a nation holds at any point in time. So if the government wants to spend more it has to take money off the non-government sector either via taxation of bond-issuance.

However, in a fiat currency system, the mainstream analogy between the household and the government is flawed at the most elemental level. The household must work out the financing before it can spend. The household cannot spend first. The government can spend first and ultimately does not have to worry about financing such expenditure.

From a policy perspective, they believed (via the flawed Quantity Theory of Money) that “printing money” would be inflationary (even though governments do not spend by printing money anyway. So they recommended that deficits be covered by debt-issuance, which they then claimed would increase interest rates by increasing demand for scarce savings and crowd out private investment. All sorts of variations on this nonsense has appeared ranging from the moderate Keynesians (and some Post Keynesians) who claim the “financial crowding out” (via interest rate increases) is moderate to the extreme conservatives who say it is 100 per cent (that is, no output increase accompanies government spending).

So the GBC is the mainstream macroeconomics framework for analysing these “financing” choices and it says that the budget deficit in year t is equal to the change in government debt (&DeltaB) over year t plus the change in high powered money (&DeltaH) over year t. If we think of this in real terms (rather than monetary terms), the mathematical expression of this is written as:

which you can read in English as saying that Budget deficit (BD) = Government spending (G) – Tax receipts (T) + Government interest payments (rBt-1), all in real terms.

However, this is merely an accounting statement. It has to be true if things have been added and subtracted properly in accounting for the dealings between the government and non-government sectors.

In mainstream economics, money creation is erroneously depicted as the government asking the central bank to buy treasury bonds which the central bank in return then prints money. The government then spends this money. This is called debt monetisation and we have shown in the Deficits 101 series how this conception is incorrect. Anyway, the mainstream claims that if the government is willing to increase the money growth rate it can finance a growing deficit but also inflation because there will be too much money chasing too few goods! But an economy constrained by deficient demand (defined as demand below the full employment level) responds to a nominal impulse by expanding real output not prices.

But because they believe that inflation is inevitable if “printing money” occurs, mainstream economists recommend that governments use debt issuance to “finance” their deficits. But then they scream that this will merely require higher future taxes. Why should taxes have to be increased?

Well the textbooks are full of elaborate models of debt pay-back, debt stabilisation etc which all “prove” (not!) that the legacy of past deficits is higher debt and to stabilise the debt, the government must eliminate the deficit which means it must then run a primary surplus equal to interest payments on the existing debt.

Nothing is included about the swings and roundabouts provided by the automatic stabilisers as the results of the deficits stimulate private activity and welfare spending drops and tax revenue rises automatically in line with the increased economic growth. Most orthodox models are based on the assumption of full employment anyway, which makes them nonsensical depictions of the real world.

More sophisticated mainstream analyses focus on the ratio of debt to GDP rather than the level of debt per se. They come up with the following equation – nothing that they now disregard the obvious opportunity presented to the government via &DeltaH. So in the following model all net public spending is covered by new debt-issuance (even though in a fiat currency system no such financing is required). Accordingly, the change in the public debt ratio is:

So the change in the debt ratio is the sum of two terms on the right-hand side: (a) the difference between the real interest rate (r) and the GDP growth rate (g) times the initial debt ratio; and (b) the ratio of the primary deficit (G-T) to GDP.

A growing economy can absorb more debt and keep the debt ratio constant. For example, if the primary deficit is zero, debt increases at a rate r but the debt ratio increases at r – g.

Thus, if we ignore the possibilities presented by the &DeltaH option (which is what I meant by current institutional arrangements), the proposition is true but largely irrelevant.

You may be interested in reading these blogs which have further information on this topic:

Wouldnt a sovereign fund that purchased a share of future foreign production, for example say they bought an oil field, be able to count on a share of that real production? And if so, wouldnt that leave more room for non-inflationary spending in the future by increasing the total real resources available in the first place?

According to John Freebairn:”An increasing structural deficit is inconsistent with the bi-partisan policy of budget balance over the economic cycle; it is unsustainable; and it threatens the ability of governments to assist the economy to recover from inevitable future international and domestic shocks.”

Krugman attacked MMT again in his NYT column.

Rather than attack MMT I’d say Krugman made a dill out of himself by demonstrating how little he understood about MMT.

Also note the regularity in which Krugman pulls the liquidity trap out of the hat to meet his columns quota. Same old crap he’s been spinning since he was writing for SLATE.

It’s really a waste of time reading anything Krgman writes.

I don’t think Paul actually attacked MMT by name – after all he was using some of our terminology (see my post from Monday), but he did pay lip service to the notion that “something must be done about deficits.”