I started my undergraduate studies in economics in the late 1970s after starting out as…

The denial of gravity

I was talking about economics at lunch-time today (as you do) and my company was irate about a TV interview that aired last night on the national public broadcaster (the ABC). The source of the angst was the increasing tendency of interviews on the ABC (and other media outlets) to express ill-informed opinions that serve to bias the interview and reinforce the dominant neo-liberal ideology. Such behaviour conditions the public to accept highly contestable propositions as fact, constructions of which, then defines the “solutions” and leave off the discussion table alternative scenarios and propositions that, in fact, represent the responsible policy options given the circumstances. This bias is part of a more general syndrome that defines the neo-liberal era, which is the equivalent of denying gravity. We are now fed a string of statements that parade as authoritative commentary or evidence that are, in fact, total fabrications and deny basis relationships that are at the heart of our monetary systems. This denial of “gravity” has become an art form and is used to bully us into accepting outcomes that advance the interests of the elites and undermine broader social welfare. It is a most extraordinary conflation of values and lies.

The ABC segment in question aired on last night’s (March 4, 2012) ABC National 7.30 current affairs program – Federal Minister identifies Western Sydney challenges.

The host of the program (one Leigh Sales, a non-economist) interviewed the Federal Tertiary Education Minister (Chris Bowen, who has an undergrad degree in economics, specialising in industrial relations).

The interview was focusing on spending initiatives in Western Sydney, where the Federal government will be decimated in the September poll but is trying to salvage some votes at present.

Ms Sales seemed obsessed with how these spending initiatives stacked up against “responsible government” – “we have a deficit that we’re trying to turn around to a surplus is called responsible government”.

The Minister attacked the opposition proposal to “take back tax cuts we’ve introduced” and “pension increases” to which Ms Sales said:

And I’m making the point that that’s responsible when you’re trying to rein in a budget deficit.

This was followed up sometime later by this comment from Ms Sales:

But, we’re in a situation where we have a federal budget deficit. The Government continues to announce programs and spending, so for example the NDIS, the Gonski education reforms, this road plan where there is not a clear pathway to actually make these things happen.

This is an example of where the so-called “hard-hitting” ABC interviewer imposes her (totally uneducated and ill-formed) opinions onto the national debate. Her role is to tease out the opinions of the interviewee and subject them to alternative credibility tests (by having a number of different viewpoints from those better able to comment than her).

So what does Ms Sales know about “a situation where we have a federal budget deficit”? She obviously thinks it is bad and imposes that view on the exchange. That sort of journalism has become the norm for the ABC, our public broadcaster.

The ABC is, in fact, now a principle gospel agency for neo-liberalism. It lost its independence on economic matters a long time ago. While I give a lot of interviews to the ABC, the ratio of neo-liberal economic comment to alternative comment is massive. We are swamped daily with “deficits are bad” dogma from the ABC journalists, even if it is sometimes subtle and hard to detect.

I did an interview today where the journalist suggested I held views that placed me in the camp of the dinosaurs – that is, the past. Apparently, my views have no traction in the current debate because Keynesianism is dead. This is a familiar refrain in fact. The sort of dismissive comment is “that is Keynesian thinking – it is no longer applicable”.

Well apart from my views not being what an informed insider would term “Keynesian”, there are some key propositions in macroeconomics that have defied the change in the dominant paradigm towards neo-liberalism (which is called various things among economists but I just use the popular nomenclature here – a belief in self-regulating markets).

There are two levels of discourse. One operates at the level of values and ideology and it is clear that my “collectivist”, “interventionist”, “regulating”, “government-led”, “full employment should be the goal”, “unemployment is evil”, “social values matters”, “there is such a thing as society”, “macroeconomic constraints dominate individual choice” and all the rest of such ideas, values etc are no longer representative of the dominant neo-liberal paradigm.

Sure enough – they reflect values that dominated in the past before I was born and I was educated on the tail end of that system of ideas and values. And so there is a struggle that can be fought at that level about which value system is preferable – one that cares for people and the environment or one that cares about narrow goals like private (corporate) profit and is willing to leave an increasing number of people behind just to push the corporate agenda faster.

So the fact that I hold what many now would claim to be “old fashioned” values, which are not relevant to this age – might render some meaning to the term “dinosaur”. But all value systems are contestable and, usually, historically dependent and change. I think we will eventually abandon this dysfunctional approach to policy making as an increasing number of people are impoverished by it (even if only in a relative sense).

But then the neo-liberals get ahead of themselves. Not content to dominate the values debate they also deny gravity. The motivation is clear. They know they have to obscure what they are doing. In some cases they are dumb and largely ignorant of what they are up to.

But in other cases I would conjecture that they know damn well what the causes and effects of their actions are and are smart enough to know that if the public shared that knowledge, then their elite hegemony might fall rather quickly.

So they have to deny basic propositions that transcend shifts in value systems and pertain to the basic operations on a monetary economy. This is the second level of discourse. These propositions are as “true” today as they were 40 years ago. They have to be denied now and dismissed as being “old fashioned” or “inapplicable” because they expose the basic lie that the neo-liberal value system hides behind.

Last week, the UK Telegraph article (February 27, 2013) – Olli-Rehn-backs-George-Osbornes-austerity-drive.htmlOlli Rehn backs George Osborne’s austerity drive – quoted Olli Rehn, who holds one of the ECs elite positions – European Economic and Monetary Affairs Commissioner.

He claimed that the UK was setting up growth by pursuing fiscal austerity. A gravity defying act nonetheless.

The logic went thus:

The level of public debt in the UK is reaching 100pc of GDP and this is a level that is normally considered to have a drag on growth for quite some time. I don’t believe that fiscal consolidation plans should be reversed, as growth is now set to start to pick up … It … [fiscal consolidation] … is still decisive in affording favourable financing conditions into the UK and therefore it should be maintained.

One form of the gravity denial syndrome is the “fiscal contraction expansion”, which Mr Rehn is a key expounder. This is a specific form of the species – “cut spending and income grows”. In this case the focus is on government spending.

There are all sorts of fancy underpinnings that are dragged out to obscure the crudity of this conjecture and provide it with a semblance of authority – an authority that is drawn from mainstream economic theory – as if that wasn’t a joke in itself.

One such piece of sophistry is the notion of Ricardian Equivalence, the modern version of which was developed by Robert Barro at Harvard. His predictions (or those of his followers) have been proven wrong so many times that it is difficult to keep count.

For non-economists – this piece of neo-liberal dogma says that the non-government sector (consumers explicitly) having internalised what they consider to be the government budget constraint (that eventually debt will have to be paid for with taxes) will negate any government spending increase whether the government “finances” its spending via taxes or borrowing. So if the government spends and borrows, consumers will anticipate higher future taxes and spend less now offsetting the stimulus.

Please read my blog – Ricardians in UK have a wonderful Xmas – for a detailed critique of this “theory”.

In contradistinction to the gravity deniers, Modern Monetary Theory (MMT) is about the real world and starts with some basic macroeconomic principles like – spending equals income.

The basic macroeconomic rule – spending equals income – (the equivalent of gravity) is being ignored by governments who have been captured by the neo-liberal dogma that self-regulating private markets will deliver prosperity to all if only governments reduce regulation and run budget surpluses with low taxation.

There have been scores of mainstream economic lies that this crisis has exposed including deficits cause inflation; deficits cause interest rates to rise; there is a money multiplier; or the spending multiplier is well below one. Even the IMF has had to admit they lied about the latter in their earlier forecasts and “modelling”.

Modelling is a word that invokes serious behaviour. But in the hands of the IMF it is really about designing a structure that reinforces in a numerical way the crude religious beliefs held by the organisation about the economy.

But this piece of gravity-denying sophistry is one of the most basic neo-liberal lies – that if governments cut their spending the private sector will fill the gap. Mainstream economic theory claims that that private spending is weak because we are scared of the future tax implications of the rising budget deficits.

The overwhelming evidence from research studies shows that firms will not invest while consumption is weak and households will not spend because they scared of becoming unemployed and are trying to reduce their bloated debt levels.

Anyway, a pretty amazing denial of gravity from Mr Rehn there.

A few days later (March 3, 2013), the UK Telegraph ran a story about the (crazy) situation in Italy – Anger builds in Italy as old guard plots fresh technocrat take-over.

The story was about Mr Grillo and his “conclave” fighting what they call a “civic revolution”. The article was dismissive of the rights of non-elite political activists taking control of their nation.

That doesn’t mean I think the so-called Grillini have a clue about the way the monetary system operates or what the real constraints on the Italian system are. But if their popular action brings down the Euro monetary system then that will, in the long-run, be a constructive contribution to human progress in Italy and the rest of the member states.

The article was a put-down. How dare these civilians with no experience garner the popular vote. We read that they were “fresh-faced idealists in their 20s or early-30s with no experience in public life” and their first meeting saw “many sitting on the floor with their napsacks as if it was opening day at university. Their first action was to create a “Google group” to handle logistics”.

So not the sumptuous opulence that the Euro elites treat themselves too when they get together to work out how they will maintain their hegemony, while the Eurozone unemployment rate approaches 12 per cent and youth unemployment rates are now in sight of 60 per cent in some nations.

The opulence of Brussels presumably should indicate competence, a “google group” the opposite. My understanding of the purpose of government is not to run fiscal and monetary policy so that growth is squashed and millions are deliberately rendered unemployed. They might treat themselves to expansive lunches and enjoy the trappings of office but the Eurozone elites have demonstrated their incompetence beyond question.

Anyway, after leaving the impression that we should dismiss “Mr Grillo’s wild rhetoric as comic chatter”, the inimitable Mr Rehn was then featured in the article. The lead-in was a statement from an ECB governor (Benoit Coeure) who argued that the manic (my words) pursuit of fiscal austerity was endangering the “social contract” and breeding “nationalist temptations”. In other words, undermining the whole reason the Europeans decided to form a political union in the first place.

Mr Couere noted “that record unemployment across much of Europe – reaching 59pc for Greek youth — was eroding the job skills of a generation and doing lasting damage to future growth”.

Well Mr Rehn had this to say about that:

Given that average debt exceeds 90pc of GDP in the EU, I don’t think there’s any room for manoeuvre to leave the path of budgetary consolidation … We won’t solve our growth problems by piling new debt on top of our old debt … John Maynard Keynes himself would not be a Keynesian today’s circumstances.

A pretty amazing denial of gravity.

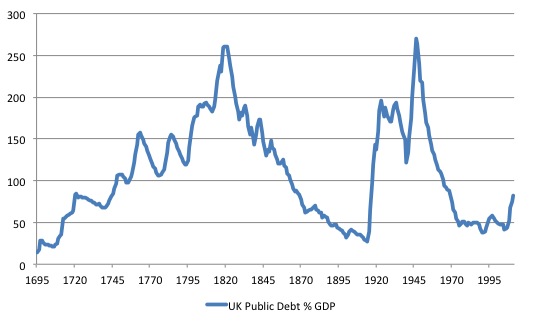

The IMF has published what they call the – Historical Public Debt Database. An explanatory paper is available (published November 2010) – A Historical Public Debt Database .

This database allows us to view public debt to GDP (%) data from the United Kingdom going back to 1692. The following graph starts at 1695 (so the horizontal axis satisfies my sense of order). Now a word of caution is in order. The historical period shown is not homogenous in terms of the monetary arrangements that were operating.

So in that sense there are discreet periods – various Gold Standard arrangements with convertibility and fiat arrangements with no convertibility and different exchange rate arrangements – which mean they are not strictly or even advisedly comparable.

I thought you might like to see the entire history.

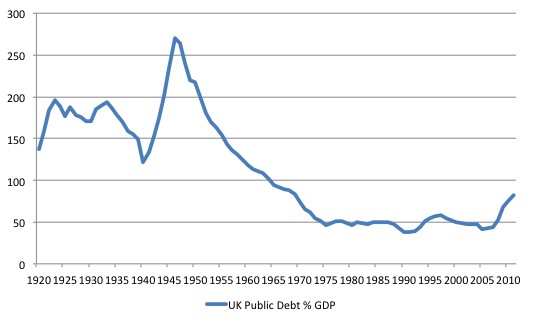

The next graph just zeros in on the Keynes and post Keynes period (1920 to 2011). Presumably Mr Keynes was well aware of the data pertaining to his era at the time he encouraged the British government to abandon the “Treasury View”, which emphasised wage cutting and fiscal austerity and, instead, engage in large-scale fiscal expansion designed to stimulate growth.

And this was a period where the British government was bound by convertible currency arrangements (although these collapsed during the Depression).

I wonder if Mr Rehn actually knows about history? Once Keynes’ ideas became the dominant policy approach more debt was “piled on” and growth blossomed. The growth then allowed the public debt ratio to decline rapidly in the full employment era up to the 1970s.

The current public debt ratio is Britain looks positively low relative to the state that prevailed when Keynes was advocated budget deficits as a means to boost effective demand and employment growth.

Mr Rehn is a classic gravity denier.

I wouldn’t want anyone to think I thought the public debt ratio mattered. It is one of those derivative financial ratios that have little importance.

I was in Timor Leste last week and there was a very large international conference – “Development for All” – run by the UN and the g7+ (with other agencies). The agenda was to inform the “Post-2015 Development Agenda” to “Stop conflict, build states and eradicate poverty”. These are all aims that are central to my research focus. I am also building a network in TL, which I hope will manifest in some innovative employment policy.

Anyway there were sovereign leaders and ministers from a large number of countries at this conference. After general sessions, the first afternoon went into “break out” groups and I participated in the “Inclusive growth and Job Creation” session.

The “facilitators” included a Mr. Samuel Jackson, former Minister of State for Economic and Financial Affairs of the Republic of Liberia who now touts himself as a “Business Development Consultant”. The other facilitators were from the World Bank.

There was also an editorial assistant who was taking notes.

The World Bank representative opened – “to stimulate discussion” – with a slideshow noting the problem of a lack of jobs and the rising poverty caused by unemployment. We heard that 200 million people, a “disproportionate share of them youth, are unemployed and actively looking for work”.

The presentation told us that “an estimated 620 million youth, the majority of them women, are neither working nor looking for work”.

That “Just to keep employment rates constant, around 600 million new jobs will have to be created over a 15-year period.”

There were other awful statistics presented.

At one point, the World Bank official said “we know that 95 per cent of jobs are created in the private sector, therefore the solution has to be found in the private sector”. The presentation deteriorated further with talk about structural adjustments and problems of regulative impediments to growth.

Mr Jackson then bowled in and took over and diverted the discussion from job creation to inclusive growth and we were asked to define it and cogitate about it. He said clearly structural solutions were required and that we shouldn’t want to reduce the largesse that the rich enjoy but rather increase the fortunes of the poor. The debate then got bogged down in arcane definitions.

Some character then hi-jacked it further with a claim that there are plenty of jobs in his island nation (Marshall) but the unemployed do not have the skills. Lots of agreement about that and the discussion then concentrated on training and supply-side impediments. All mostly irrelevant to the elephant in the room – a dramatic shortage of jobs which is being made worse by the policy frameworks being advanced and imposed on governments by the multi-lateral agencies such as the World Bank, the OECD and the IMF.

At that state, I put my hand up and introduced some basic propositions. Such as – if the situation is really that bad then doesn’t it mean that the dominant policy framework centred on fiscal austerity, export-led growth that these agencies espouse – has failed and we need to replace it?

Such as – spending equals income – which, in turn, underpins job creation.

Such as – the debates about structural mismatch might be relevant in specific instances but the session was about a dramatic shortage of jobs overall. That is a separate debate to structural mismatch.

Such as – the lack of job creation is a reflection that there is insufficient aggregate demand whatever the composition of employment that is being generated.

Such as – if the non-government sector cannot drive aggregate demand growth at levels sufficient to employ those who want jobs (like 200 million or more) then there is only one other sector that can do the trick. And that means budget deficits – continuous and at whatever level is required to generate sufficient spending growth relative to real productive capacity (including the queue of unemployed and underemployed labour).

Such as – the private sector has never generated enough employment to satisfy the aspirations of those seeking work.

The World Bank official and Mr Jackson shifted uneasily during my contribution. Many in the audience showed signs of empathising with my viewpoint.

At the end of the session, the person taking notes read out what had gone down during the session so we would be able to “accept” what the sentiment of the group was and that viewpoint would be taken back to the general sessions to guide the development of the overall Post-2015 strategy.

All my points – need for increasing deficits, prioritising macroeconomic policy over structural policy, large role for government employment guarantees (with examples of where I have worked in developing economies) – were read out and the group nodded assent that they were part of the overall discussion.

Session ends.

Next morning the facilitators donned their rapporteur hats (representing our forum) and provide the general session with the key points of our discussion the day before. You will not be surprised to learn that it appeared that the facilitators had been a totally different space to that shared by the rest of us. There was no mention of any of the points I had raised.

The reportage rehearsed the same IMF, World Bank line – full of motherhood statements and neo-liberal code. Full of gravity denial. But, of-course, in all the official documentation you will read about how these agencies “consulted” experts and brought together the research evidence to form this new development agenda.

Meanwhile, the poorest nations will continue to stagnate.

Some good did come out of that session and I am expanding the network and will be back in TL soon to take a proposition to the President and Prime Minister.

Conclusion

Tomorrow the fourth-quarter Australian national accounts come out. That is what I will be writing about.

That is enough for today!

(c) Copyright 2013 Bill Mitchell. All Rights Reserved.

Adherents to Ricardo Equivalence hang out with climate change deniers and flat-earthers at the weekend.

One of the worst examples of work in this genre is this Policy Exchange “thing”: http://www.policyexchange.org.uk/publications/category/item/controlling-spending-and-government-deficits-lessons-from-history-and-international-experience

Maybe in the UK they are trying to shape reality to match the contention that ‘private spending is weak because we are scared of the future tax implications of the rising budget deficits’. Everyday, since the coalition government came to power the media screams – oh my god the deficit! Who knows how much this idiotic fearmongering has impacted spending decisions, especially early on.

The media is bloody quiet about the contraction of broad money, though.

Bill, the disconcerting thing about the interview for me was that the MP didn’t contradict any of Sales’ commentary irrespective of how ill informed it was, not simply how ignorant she was. I have come to expect this from mainstream media commentators.

Sean Fernyhough,

From the link you provided above, I’ve just spotted this gem on page 11:

In other words they are saying that failed attempts at expansionary fiscal contraction should be ignored, and we should just look at where growth actually happened. And we should ignore the possibility that the growth might have been even larger without the cuts.

I’ve read it all. It also suggests that austerity works because the economy eventually recovers (at least in the aggregate numbers).

Austerity does work eventually. Enough people leave the country (or die) and the economy takes enough of a battering that things stabilise.

The point is that there is a better way – but that way involves creditors taking a cold bath and malinvestment being driven out viciously while ordinary people are protected from the clear out.

Austerity is the other way around.

As I see it the problems in the economy are straightforward.

i) there is a poverty of jobs.

ii) gambling on financial assets is more profitable than generating income from providing real goods and service

iii) this is brought about because we are ruled by a bunch of bankers.

We need to Bin The Bankers.

Maybe I am reading too much into this but I see Bill slightly misreading the interviewer’s method. Bill says;

1. “This is an example of where the so-called “hard-hitting” ABC interviewer imposes her (totally uneducated and ill-formed) opinions onto the national debate.”

and then;

2. “Her role is to tease out the opinions of the interviewee and subject them to alternative credibility tests (by having a number of different viewpoints from those better able to comment than her).”

I’ve noticed interviewers using the method of being devil’s advocate; putting forward the beliefs and views of an opposition who are not present at that same interview. Thus these beliefs and views are not necessarily those of the interviewer.

Having said the above, I do not agree with the technique. This technique and its adverserial debating / interview method are suited to highlighting opposing views, obtaining rhetorical riposts and generating ongoing, circular and endless controversy, all of which which the media thrive on. They are not suited to investigating and uncovering objective truth where objective truth exists. But then that is consistent with the implicit post-modern (or is it 1984?) view that there are no objective truths at all only viewpoints.

First, they (the neocons) make the case that only viewpoints matter. Then they make the case that only one viewpoint matters. Soon there IS only one viewpoint. That is how it is done. I hope you have enjoyed your trip to the future. It has landed you in 1984.

@ikonoclast

I don’t think Bill has misread Sales’ technique at all. While I agree with you that interviewers often introduce alternative viewpoints, they usually do so in a question format, such as “isn’t it true that …” or “so and so says that …” and the like. Sales uttered her alternative viewpoint as if it were a fact, and rather aggressively at that, as if the interviewee was being remiss for not taking account of this ‘fact’ in his answers to her questions. This is not the way to conduct a so-called objective interview.

Why does anyone expect journalists to know better when people who are supposed to be economics experts spout rubbish? For example, there was an interview with David Murray, ex CEO of the Commonwealth Bank, who said, when he was interviewed on th ABC, that Australia was heading down the same path as Greece.

To Ikonoclast

Leigh Sales is doing more than playing devil’s advocate. She is imposing value into the debate and values that reflect those of neoliberal orthodoxy. I have heard both Tom Iggulden and Chris Uhlmann do the same when referring to there being “no money in the kitty” or “the government is broke”. On Bill’s statement he is often interviewed by the ABC, that is funny because I can’t recall heaing him or his comments on any ABC programme in recent times, though they would all be the better off for it.

A lot of material I’ve had the displeasure of viewing on the ABC over the last few years is worthy of being categorised as dinosaur thinking. Come to think of it, that’s why I use the internet. So I can be exposed to new intelligent thinking. The dearth of the quality of media is breathtaking.

Just because i’t’s called Neo liberal does not mean it is neo or liberal. It’s more or less propaganda.

Well, Bill, maybe he called you a dinosaur but in all fairness you’re not going to be the one that is extinct with your views which is exactly where the current crowd is heading.

Though failure has an inerrant ability to be portrayed as wisdom by fools as they learn from failure and repeat it over and over and teach others failure too.

It’s better to have one’s integrity and be thought a fool than to lose it and be one.