It’s Wednesday and I just finished a ‘Conversation’ with the Economics Society of Australia, where I talked about Modern Monetary Theory (MMT) and its application to current policy issues. Some of the questions were excellent and challenging to answer, which is the best way. You can view an edited version of the discussion below and…

Labour market measurement – Part 2

I am now using Friday’s blog space to provide draft versions of the Modern Monetary Theory textbook that I am writing with my colleague and friend Randy Wray. We expect to complete the text by the end of this year. Comments are always welcome. Remember this is a textbook aimed at undergraduate students and so the writing will be different from my usual blog free-for-all. Note also that the text I post is just the work I am doing by way of the first draft so the material posted will not represent the complete text. Further it will change once the two of us have edited it.

Chapter 10 The Labour Market

Sections 10.1 and 10.2 were sketched in this blog – The labour market is not like the market for bananas, while Section 10.3 was started in this blog – Labour market measurement – Part 1.

We resume Section 10.3 today.

Two derivative measures capture a lot of public attention. First, the Unemployment Rate is defined as:

… the number of unemployed persons as a percentage of the civilian labour force.

The US unemployment rate in October 2012 was 7.9 per cent. This was derived from a labour force estimate of 155,641 thousand and total estimated unemployment of 12,258 thousand.

Second, statisticians publish the Employment-Population ratio, which is:

… the proportion of an economy’s working-age population that is employed.

Note that the denominator of these two ratios is different. The unemployment rate uses the labour force while the employment-population ratio uses the working age population.

We will see why this difference matters later when we consider the way the labour market adjusts over the economic cycle and how this impacts on our interpretation of the state of the economy as summarised by the unemployment rate and the employment-population ratio.

[NEW TEXT FOR TODAY STARTS HERE]

The unemployment measure noted above is what economists refer to as a stock measure. The unemployment rate is defined as a ratio of two stocks – the number of unemployed (numerator) and the labour force (denominator). The stock measure of the unemployment rate is compiled by the national statistician at a point in time, usually monthly.

We usually consider a higher unemployment rate to be worse than a lower unemployment rate because it signals, in a narrow sense, the extent of idle labour that could be brought into production and income generation should aggregate demand increase.

However, there are some complications with this interpretation that need to be carefully understood. First, the unemployment rate is a narrow measure of labour underutilisation because it ignores underemployment and hidden unemployment, which we consider in Section 10.5.

Second, it doesn’t provide any information about the flows of workers into and out of the labour market. There are times when we might conclude that a rise in the unemployment rate is in the short-run a sign of a strengthening economy.

In the next section, we consider flow measures of the unemployment rate.

Third, the unemployment rate doesn’t tell us anything about the duration of unemployment. We will consider duration measures of the unemployment in Section 10.6.

10.5 Flow measures of unemployment

Each period there are a large number of workers that flow between the labour market states – employment (E), unemployment (U) and not in the labour force (N). The stock measure of each state indicates the level at some point in time, while the flows measure the transitions between the states over two periods (for example, between two months).

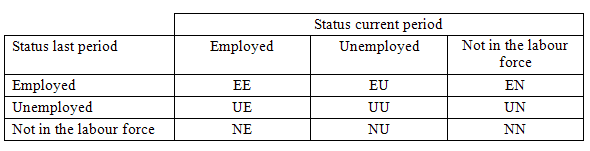

National statisticians measure these flows in their monthly labour force surveys. The various stocks and flows are denoted as follows (single letters denote stocks, dual letters are flows between the stocks):

- E = employment, with subscript t = now, t+1 the next period

- U = unemployment

- N = not in the labour force

- EE = flow from employment to employment (that is, the number of people who were employed last period who remain employment this period)

- UU = flow of unemployment to unemployment (that is, the number of people who were unemployed last period who remain unemployed this period)

- NN = flow of those not in the labour force last period who remain in that state this period

- EU = flow from employment to unemployment

- EN = flow from employment to not in the labour force

- UE = flow from unemployment to employment

- UN = flow from unemployment to not in the labour force

- NE = flow from not in the labour force to employment

- NU = flow from not in the labour force to unemployment

Figure 10.3 provides a schematic description of the flows that can occur between the three labour force framework states.

Figure 10.3 Labour Market Flows Matrix

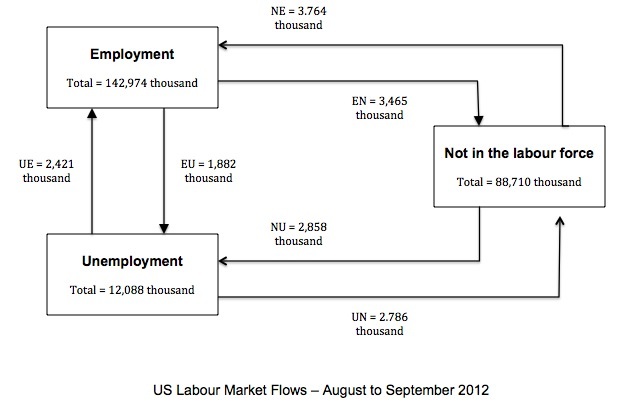

To give you some idea of the magnitude of these flows between any given months, Figure 10.4 summarises the flows for the US labour market for the period between August and September 2012. The data comes from the US Bureau of Labor Statistics.

The data shows us that total US employment in September 2012 was 142,974 thousand, total unemployment was 12,088 thousand and the number of persons who were counted as being not in the labour force was 88,710 thousand. The sum of these stocks is equal to the working age population (the population above the age of 16 years).

The flows data show that between the months of August and September 2012, 2,421 thousand workers who were unemployed in August 2012 moved into employment (UE) by September 2012. Similarly, 1,882 thousand workers who were counted as being employed in August 2012 moved into the unemployment pool (EU) in September 2012.

In terms of flows between the labour force and not in the labour force, there were 3,465 thousand workers who were counted as being employed in August 2012 who exited the labour force (EN) in September 2012 and 2,786 workers who were counted as being unemployed in August 2012 who left the labour force (UN) in September.

Flowing into the labour market, were 3,764 thousand new entrants who became employed (NE) and 2,858 thousand new entrants who ended up in unemployment (NU) in September 2012.

Figure 10.4 Gross Flows in the US Labour Market, August-September 2012, thousands

Source: US Bureau of Labor Statistics

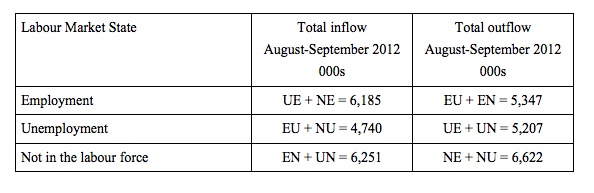

We can also calculate the total inflows and outflows from the three labour force states between any two periods of interest. Figure 10.5 shows these calculations for the US labour market for the period between August and September 2012.

The total inflow into employment is measured by the sum, NE + UE and for the period show equalled 6,185 thousand whereas the total outflow from employment, measured by the sum, EU + EN was 5,347 thousand. The net flow was thus positive and equal to 838 thousand workers.

The total inflow into unemployment is measured by the sum, EU + NU and for the period show equalled 4,740 thousand whereas the total outflow from unemployment, measured by the sum, UE + UN was 5,207 thousand. The net flow was thus negative (meaning unemployment fell over the period) and equal to -467 thousand workers.

Finally, the total exits from the labour force is measured by the sum, EN + UN and for the period show equalled 6,251 thousand whereas the total new entrants into the labour force, measured by the sum, NE + NU was 6,622 thousand. The net flow was thus negative and equal to -371 thousand workers.

Figure 10.5 Total inflow and outflow from labour force states, United States, August to September 2012, thousands

Source: US Bureau of Labor Statistics.

We can thus understand the stock measures of the labour market states in each period by considering the net flows between two periods.

Total employment at any point in time (Et) is given by the following expression:

(10.1) Et = Et-1 + UEt + NEt – EUt – ENt

In terms of the actual flows in the US labour market between August and September 2012 summarised in Figures 10.4 and 10.5, Equation 10.1 is evaluated as (in thousands):

(10.1a) 142,974 = 142,101 + 2,421 + 3,764 – 1,882 – 3,465

Changes in employment in any period, ΔE is the total inflows minus the total outflows:

(10.2) ΔE = Et – Et-1 = UEt + NEt – EUt – ENt

Total unemployment at any point in time (Ut) is given by the following expression:

(10.3) Ut = Ut-1 + EUt + NUt – UEt – UNt

Equation 10.3 is evaluated as (in thousands):

(10.3a) 12,088 = 12,544 + 1,882 + 2,858 – 2,421 – 2,786

Thus changes in unemployment in any period, ΔU is the total inflows minus the total outflows:

(10.4) ΔU = Ut – Ut-1 = EUt + NUt – UEt – UNt

In Box 10.2, we will use these expressions to calculate the so-called transition probabilities, which are the probabilities that transitions (changes of state) occur.

Total employment at any point in time (Et) is given by the following expression:

(10.1) Et = Et-1 + UEt + NEt – EUt – ENt

In terms of the actual flows in the US labour market between August and September 2012 summarised in Figures 10.4 and 10.5, Equation 10.1 is evaluated as (in thousands):

(10.1a) 142,974 = 142,101 + 2,421 + 3,764 – 1,882 – 3,465

Equation 10.3 is evaluated as (in thousands):

(10.3a) 12,088 = 12,544 + 1,882 + 2,858 – 2,421 – 2,786

Economists thus consider the labour market to be very dynamic and the extent of this dynamism is measured by the gross flows between the three labour market states. Further, these flows are highly cyclical. For example, in a recession the flow EU increases while the flow UE declines. Workers also drop out of the labour force in greater numbers during a recession and more new entrants end up unemployed than in employment.

10.6 Duration measures of unemployment

[MORE TO COME HERE]

Conclusion

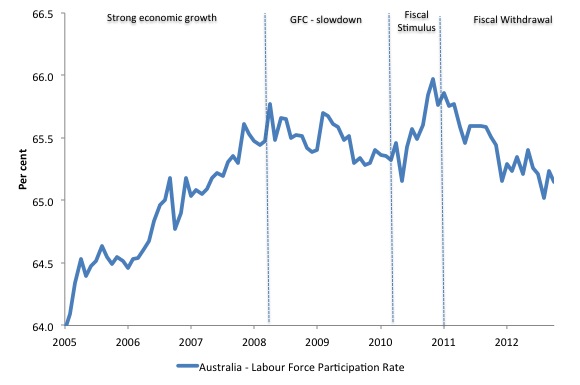

THIS CHAPTER WILL CONTINUE TO UNFOLD NEXT WEEK. I HAVE TO CONSIDER DURATION MEASURES OF UNEMPLOYMENT. I HAVE TO COMPLETE TWO EMPIRICAL BOXES – PARTICIPATION IMPACTS AND TRANSITION PROBABILITIES.

I THEN WILL CONSIDER THE BROADER CONCEPTS OF LABOUR UNDERUTILISATION.

THEN THE CHAPTER WILL MOVE ONTO THEORETICAL DEBATES IN MACROECONOMICS CENTRED ON THE CONCEPT OF INVOLUNTARY UNEMPLOYMENT.

A FEW WEEKS OF WORK TO GO ON THIS CHAPTER YET.

CHAPTER 11 WILL BRING ALL THIS DISCUSSION TOGETHER TO DISCUSS THE PHILLIPS CURVE AND THE JOB GUARANTEE. THAT WILL BE EXCITING – N’EST-CE PAS (-:

Saturday Quiz

The Saturday Quiz will be back again tomorrow. It will be of an appropriate order of difficulty (-:

That is enough for today!

(c) Copyright 2012 Bill Mitchell. All Rights Reserved.

Can’t wait for the book to be published 🙂

A small remark: Imho it would be more intuitively if you number the figures in the chronological order of their appearance (i.e. after “Figure 10.5” comes “Figure 10.6″and not “Figure 10.2”)

cheers

Daniel

One number that would be interesting to quote is the number of employees who remain in employment. This is your flow EE, which can be deduced from the numbers in figure 10.4.

Since Et = EE + EU + EN, we get

EE = Et – EU – EN = 142,974 – 1,882 – 3,465 = 137,974.

This means that the probability of staying in employment over two months is 96.3%, which contrasts with the numbers you were quoting for the UK over three months that were over 98% .

Another thing to remark on here is that the flows between employment and not in the labour force are bigger than the flows between employed and unemployed. This suggests to me that there are many people classed as not in the labour force who should be classed as unemployed.