I grew up in a society where collective will was at the forefront and it…

Republican agenda – simple and venal

One of the continuing myths that economists have been responsible for is the notion of – Trickle-down economics or supply-side economics. The popular version of notion is that if there are tax cuts for high income earners and the wealth (reducing capital gains taxes) then saving and investment will rise and the economic growth and productivity growth that ensues benefits even the lowest income earner. In the current debate about the so-called “fiscal cliff” in the US, the Republicans clearly want lower marginal tax rates for the high-income earners while calling for reform to entitlements, which benefit the lowest income recipients. There are countless statements from conservative and not-so-conservative politicians and commentators that cutting the highest marginal tax rates is the best way to stimulate growth. The only problem is that the evidence does not support the claims. Without an evidential basis, the real agenda of the conservatives then becomes transparent. They want to cut entitlements at the bottom end of the income distribution and pocket more at the top end. It is really as simple and as venal as that.

Conservative politicians often use the concept of trickle-down as it suit the interests of the cohorts they represent. The great Canadian institutionalist economist, John Kenneth Galbraith summarised trickle-down notions in this way:

If you feed the horse enough oats, some will pass through to the road for the sparrows.

A so-called “Specialist in Public Finance” working for the Congressional Research Service prepared a research paper – Taxes and the Economy: An Economic Analysis of the Top Tax Rates Since 1945 – which was dated September 14, 2012.

For those not familiar with the Congressional Research Service, it:

… works exclusively for the United States Congress, providing policy and legal analysis to committees and Members of both the House and Senate, regardless of party affiliation … CRS is well-known for analysis that is authoritative, confidential, objective and nonpartisan.

The Report never saw the light of day. It was suppressed in late September after Senior Congressional Republicans pressured the CRS into withdrawing the Report because they did not like its “tone and findings”.

The New York Times article (November 1, 2012) – Nonpartisan Tax Report Withdrawn After G.O.P. Protest – by Jonathan Wiesman, reported that Senior Republicans had:

… raised concerns about the methodology and other flaws … [and] … that people outside of Congress had also criticized the study and that … [CRS officials] … decided, on their own, to pull the study pending further review.

We also learn that the suggestion to withdraw the Report:

… was made against the advice of the research service’s economics division, and that … [the author] … stood by its findings.

Governments regularly suppress commissioned research report. In my own career, I have written several reports on commissioned contracts, which were not published because the results of the research were not what the government wanted. Sometimes, the political agenda changes midstream and so previously commissioned work becomes irrelevant for the new agenda but more often than not it is a case of the government not wanted to have to face the facts.

There was a classic case where a report I co-authored for a large international agency was suppressed after the IMF protested that the organisation in question had no ambit to discuss international macroeconomics. The Report criticised the way the IMF dealt with the poorer Asian nations and recommended larger deficits to deal with poverty and unemployment. I plan to write about that story one day – but I still work for the organisation and so there are contractual matters to worry about. I have two graphics – one with the official front cover of our report with the relevant Report Number and date on the front cover and the other with a different report and title but the same Report Number. More on that saga another day.

The Report’s findings are clear:

Throughout the late-1940s and 1950s, the top marginal tax rate was typically above 90%; today it is 35%. Additionally, the top capital gains tax rate was 25% in the 1950s and 1960s, 35% in the 1970s; today it is 15%. The real GDP growth rate averaged 4.2% and real per capita GDP increased annually by 2.4% in the 1950s. In the 2000s, the average real GDP growth rate was 1.7% and real per capita GDP increased annually by less than 1%. There is not conclusive evidence, however, to substantiate a clear relationship between the 65-year steady reduction in the top tax rates and economic growth. Analysis of such data suggests the reduction in the top tax rates have had little association with saving, investment, or productivity growth. However, the top tax rate reductions appear to be associated with the increasing concentration of income at the top of the income distribution. The share of income accruing to the top 0.1% of U.S. families increased from 4.2% in 1945 to 12.3% by 2007 before falling to 9.2% due to the 2007-2009 recession. The evidence does not suggest necessarily a relationship between tax policy with regard to the top tax rates and the size of the economic pie, but there may be a relationship to how the economic pie is sliced.

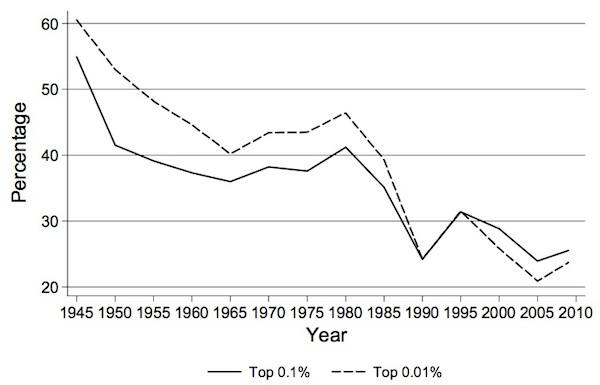

The Report produced the following graph, which shows the average tax rate (vertical axis) from 1945 to 2009 for the highest income-recipients in the US.

There has been an extraordinary reduction in the top marginal tax rates over the period show but the call is continually for ever more cuts. The same trend has occcurred for capital gains tax rates.

There is a dispute about whether mainstream economists have ever held out the trickle-down theory. Noted free-market economists have denied that the assertion that lower marginal tax rates at the high-income levels would stimulate growth is intrinsic to mainstream theory.

But a classic example of the advocacy is to be found in Robert Barro’s Macroeconomics 1984 text book.

A more recent example was the Report from the so-called National Commission on Fiscal Responsibility and Reform – The Moment of Truth. A related issue that will be debated in the coming weeks is that the Co-Chairman of that Commission was none other than Erskine Bowles, a former cabinet member in the Clinton Administration.

He is being suggested to replace the current Treasury Secretary in the new Obama Administration. If he does then it will be a wasted four years for America.

He is also now running the Fix the Debt campaign, which is supported by a host of conservative organisations that demonstrate an advanced lack of understanding of how the economic system operates.

The “Fix the Debt Plan” would drive the US economy back into recession and damage the prospects of millions of Americans in their search for work. It was based on a deeply flawed understanding of what the problems facing the US economy were and remain. It was predicated on the idea that the social security and health care systems would become insolvent in the not too distant future.

It provides a “yes” answer to the most simple question of them all – can the US government run out of dollars? Of-course, the US government can never run out of dollars. So at the most elemental level Mr Bowles is willing to perpetuate the most basic lies to advance his interests.

Please read my blog – The brightest minds can be so dumb in particular circumstances – for more discussion on Erskine Bowles.

Among all the nonsense in the Moment of Truth Report about “patriotic duty” the basic agenda was clear – “Sharply reduce … [tax] … rates”; “Enact tough discretionary spending caps”, cut health care and pension entitlements; introduce fiscal rules.

The Report recommended the top tax rates be cut more than the lower rates:

Cut rates across the board, and reduce the top rate to between 23 and 29 percent. Real tax reform must dedicate a portion of the savings from cutting tax expenditures to lowering individual rates. The top rate must not exceed 29%.

Consider the immediate response from Republican Speaker in the US House of Representatives, John Boehner – 2013 Should Be the Year We Begin to Solve Our Debt Through Tax & Entitlement Reform .

He said:

The members of our majority understand how important it is to avert the fiscal cliff … And it is why I outlined a responsible path forward, where we can replace the spending cuts and extend the current rates, paving the way for entitlement reform as well as tax reform with lower tax rates … This will bring jobs home, result in a stronger, healthier economy. And a stronger, healthier economy means more Americans working and more revenues …

As an aside, there is a major dissonance in the Republican narrative. On the one hand they claim that deficits undermine the prosperity of the economy and wheel our various economists (such as Robert Barro, John Taylor and others) who claim that the fiscal stimulus did nothing to promote growth and that the US economy would have recovered more quickly without it.

Then you read (during the election campaign) that major suppliers of military equipment are up in arms (excuse the pun) over proposed federal spending cuts. The capitalists are supported by leading Republicans including their Presidential candidate who claim the spending cuts will cause untold damage to the economy and devastate states such as Virginia.

Then you read that it Republicans “understand how important it is to avert the fiscal cliff”.

It is obvious that there is a logical disconnect in their string of arguments, which leads to the reasonable conclusion that their deficit terrorism is really about distribution of income and who should get the benefits from government spending.

The Republicans and their think-tanks that provide them with the fodder are really aiming to undermine the US system of social security and health care, inasmuch as that system benefits the lowest income recipients.

They oppose cutting the billions of corporate handouts but promote cutting a few dollars being given to a person who can no longer feed their children.

The New York Times “Taking Note” blog (November 9, 2011) – Boehner’s Opening Gambit – said that Boehner:

… stated that raising the top rates would kill jobs, citing a widely discredited study by Ernst & Young, and “slow down our economy,” ignoring a new analysis by the Congressional Budget Office, which said it would reduce GDP growth by .1 percent – temporarily.

Anyway, if you undertake an undergraduate course in economics you will be bombarded with “theories” as to why top marginal tax rates damage econoic activity.

The CRS Report notes that economists claim that:

… reduced tax rates could boost saving and investment, which would increase the productive capacity of the economy and productivity … some argue that reduced tax rates increase labor supply by increasing the after-tax wage rate. There is substantial evidence, however, to suggest that labor supply responses to wage and tax changes are small for both men and women.

I have long taught that at the aggregate level, the labour supply curve (relating wages to hours of work supplied) is largely unresponsive to tax rate changes.

However, the mainstream theories teach students that there are strong responses driven by so-called income and substitution effects. Like all orthodox labour supply theory, the treatment of tax responses rely on arbitrary assertions to generate the major theoretical conclusion. In other words, the theory is ambiguous and can only be made operational by imposing “cooked up” assertions.

In these models, the labour supply function is based on the idea that the worker has a choice between work (a bad) and leisure (a good), with work being tolerated only to gain income. The relative price mediating this choice (between work and leisure) is the real wage which measures the price of leisure relative to income. That is an extra hour of leisure “costs” the real wage that the worker could have earned in that hour. So as the price of leisure rises the willingness to enjoy it declines.

The worker is conceived of at all times making very complicated calculations – which are described by the mainstream economists as setting the “marginal rate of substitution between consumption and leisure equals to the real wage”. This means that the worker is alleged to have a coherent hour by hour schedule calibrating how much dissatisfaction he/she gets from working and how much satisfaction (utility) he/she gets from not working (enjoying leisure). The real wage is the vehicle to render these two competing uses of time compatible at a work allocation where the worker maximises satisfaction.

So why is the labour supply function upward sloping with respect to real wages – that is, the theory asserts that as the real wage rises workers will continue to supply more labour hours.

The mainstream analysis motivates the following thought experiment as an attempt to explain what happens when a “price changes” – in this case, the real wage.

They isolate two separate “effects” on such a real wage change (say a rise): (a) a substitution effect; and (b) an income effect.

The substitution effect refers to the impact on the worker’s decision to supply hours of labour when the real wage changes. So if the real wage rises, work becomes relatively cheaper (compared to leisure) and the mainstream theory asserts via the so-called law of demand that people demand less of a good when its relative price rises. So real wage up, less leisure, more work.

But there is another effect to consider – the so-called income effect. When the real wage rises, the worker now has more income for a given number of hours of work. The mainstream theory of normal goods (as opposed to inferior goods – the distinction is just made up largely) tells us that when income rises a consumer will consume more of all normal goods. The opposite is the case for an inferior good.

Leisure is considered to be a normal good as are other consumption goods the worker might buy with the income he/she earns. So as the real wage rises, the income effect suggests that the worker will demand more of all normal goods (because they have higher incomes for a given number of working hours) including leisure. That is the worker will work less!

Now think about a tax rate in this model. The labour supply function can be conceived of as expressing the relationship between the number of hours a worker chooses to supply and the net real wage (that is, the amount post tax).

So without a tax system, the model above describes the “perfectly competitive model” that students get beguiled by in their initial studies and they are told that this is the most efficient outcome.

The imposition of a tax rate now reduces the relative price of leisure (compared to work) because it amounts to a real wage cut for the worker. So in this model, the so-called income and substitution effects work in opposite directions. The substitution effect reduces the opportunity cost of leisure and thus leads to an increase choice for leisure. So the substitution effect says that the imposition of a tax causes a reduction in labour supply.

But the tax hike also reduces income at each level of hours worked. So for the same quantity of work, the person is able to command less goods. To enjoy the same quantity of goods as before they have to work more when there are higher taxes. In other words, the income effect predicts the worker will work more.

However at this stage there are no possible “scientific” or rigorous conclusions to be drawn from the analytical framework. Which of these effects dominates? The model cannot tell us. There is a lot of ad hoc manipulation with various scenarios proposed but nothing can be advanced further from the model as it is set up.

The so-called elegance and rigour of their framework gives away to the mainstream economists just asserting that the substitution effect dominates. It becomes as simple as that. So the supply function is upward sloping in terms of real wage (and pivots down but remains upward sloping if there is a marginal tax rate imposed).

If that wasn’t the case, then there is a danger the labour supply curve might not intersect the equally asserted shape of the labour demand curve and then the theoretical framework would not even predict an equilibrium relationship between real wages and employment, which is, after all, its purpose.

There have been lots of attempts at finding out which effect dominates when tax rates change. These include Econometric modelling, experimental studies and interview studies. All are rife with problems which I will not elaborate on here.

Notable studies of the affect of higher marginal tax rates are inconclusive. One famous study (James and Nobes, 1998, The Economics of Taxation: Principles, Policy and Practice, Prentice Hall) summarised the literature on interview studies in this way (page 63):

… there appears to be no substantial disincentive effects from taxation. Instead, it appears that there are both small incentive and small disincentive effects which tend, of course, to offset each other, so that the net effect on the taxation of labour is likely to be small.

The results from the other methodologies are equally inconclusive.

The CRS Study also provides a number of references to studies that find there is no evidential basis to the mainstream claim about the incentive effects of taxation.

The CRS Report considers the “income” and “substitution” effects in relation to the impact of high-income tax cuts on private saving. It concludes that logically:

… the effect of taxes on private saving is ambiguous. If taxes are reduced, the after-tax return on saving is larger; consequently, individuals may be able to maintain a target level of wealth and save less (wealth will grow due to the higher after-tax returns). This is the income effect and has lower taxes leading to less saving. However, the reduced after-tax return changes the relative price of consuming now (saving less) and future consumption (saving more) in favor of future consumption. This is the substitution effect and has lower taxes leading to more saving. The actual effect of a tax reduction depends on the relative magnitudes of the income and substitution effects.

So as before the mainstream theory is not conclusive and a fair interpretation of it is that it cannot be used to justify any proposition, even though lecturers promote the assertion that substitution effects dominate.

But the point is that the theory can only be assessed as useful if the empirical world is consistent with it. However, like many “predictions” from mainstream theory, the two notional effects are not observable. They are a logical decomposition of the total effect.

So empirical studies have focused on the total change in labour supply or saving in relation to changes in marginal tax rates. Then by inference the relative dominance of the two conceptual impacts can be determined.

The CRS Report provides a comprehensive literature survey, which students will find a useful starting point. It finds that the evidence supports the conclusion that:

… the top tax rates are not associated with private saving … Other research suggests that taxes generally have had a negligible effect on private saving … [and] … the top tax rates do not … have a demonstrably significant relationship with investment … [nor] … productivity growth.

In relation to real per capita GDP growth, which arguably is a measure of material well-being, the CRS Report finds that on the balance of evidence assembled:

It would be reasonable to assume that a tax rate change limited to a small group of taxpayers at the top of the income distribution would have a negligible effect on economic growth.

So what has been the impact of the dramatic reduction in marginal tax rates over the last decades in the US? Predictably, the CRS study finds that:

the income shares … [of the top 1 and 10 per cent] … were relatively stable until the late 1970s and then started to rise. In 1945, the income share of the top 0.1% was 4.2%, increased to 12.3% by 2007, fell during the 2007-2009 recession, and started to rise again in 2010 … The income share of the top 0.01% followed the same overall trend …

There is a strong negative relationship between the top tax rates and the income shares accruing to families at the top of the income distribution. These results suggest that as the top tax rates are reduced, the share of income accruing to the top of the income distribution increases – that is, income disparities increase … Similar results by other researchers have been obtained for other countries.

Conclusion

The CRS study provides a comprehensive evidence base to demonstrate that the major propositions underpinning the conservative putsch for top-income marginal tax cuts are not supported by the evidence available. In fact, all the propositions advanced by those who want deficit reduction via tax cuts and spending cuts are unsupported.

It is no wonder the Republicans wanted the CRS Study suppressed. A second’s reflection will lead to you to the real underlying agenda. What they say they believe (tax cuts help growth etc) is just a smokescreen for their desire to attack entitlements at the lower end of the income distribution. It is as simple and as venal as that.

That is enough for today!

(c) Copyright 2012 Bill Mitchell. All Rights Reserved.

I once took a college psychology course in which the professor taught that Freud’s theory was that all of our impulses come from our anus. I am not joking. It was an idea so stupid that I had to laugh. Unfortunately, the other students seemed to accept what was said. But, now that I think of it I am beginning to believe that that is exactly where CNBC, Pete Peterson, and the finance industry gets there reasoning from.

By the way, when it comes to taxes no one ever mentions depreciation and amortization. How much does that take out of the economy for the benefit of finance? Shouldn’t the conversation really be about moving taxes off of labor and onto FIRE sector, as Michael Hudson suggest?

@GLH, I’m glad I didn’t take that course! Also, I think taxes are only on labour to the extent that they reduce consumption of the product they help to produce. In other words, cutting payroll tax does not boost employment unless it feeds through to lower output prices.

Well, what can I say – this is America we’re talking about here. At least one entire political party is in the pockets of big business and the wealthy, we have already done well but still just aren’t satisfied. There is something serious unpleasant with the culture there when this is considered okay. Greatest country on Earth I think not.

You know what, I think it’s up to Americans to fight back. It’s no use hand-wringing where I am outside the country. They’re are plenty in America with the political will.

A while back, Mankiw had an op-ed where he was complaining about how his marginal tax rate was reducing the amount of work he was willing to do. [I thought that was a good thing actually.] I entered the ensuing controversy and followed all the many arguments as to why this didn’t make Mankiw want to work more instead of less. In the end, they all reduced to a single statement: The rich are different. Didn’t you know that, Bill? 🙂

“The popular version of notion is that if there are tax cuts for high income earners and the wealth (reducing capital gains taxes) then saving and investment will rise and the economic growth and productivity growth that ensues benefits even the lowest income earner.”

Replace “economic growth and productivity growth” with “real AS growth” so there won’t be high levels of price inflation (the 1970’s). Assumes the most common definition of economics (unlimited wants/needs and limited resources) is true and ignores the real AD side.

“In the current debate about the so-called “fiscal cliff” in the US, the Republicans clearly want lower marginal tax rates for the high-income earners while calling for reform to entitlements, which benefit the lowest income recipients. There are countless statements from conservative and not-so-conservative politicians and commentators that cutting the highest marginal tax rates is the best way to stimulate growth.”

Replace “to stimulate growth” with to grow the real AS side and ignore the real AD side.

Benedict@Large said: “A while back, Mankiw had an op-ed where he was complaining about how his marginal tax rate was reducing the amount of work he was willing to do.”

So if mankiw’s tax rate gets raised above 100%, can we get him to take back his past work?

And, “[I thought that was a good thing actually.]”

Me too!

Notice how housing debt was supposed to trick people into retiring later. When that failed, the rich are now using gov’t debt to get people to retire later (cut Social Security and Medicare, which are retirement benefits).

To see how different the rich see themselves as being, compared to the rest of us, just have a read of G William Domhoff’s Bohemian Grove and Other Retreats: A Study in Ruling-Class Cohesiveness (1974). I have seen secret films of their ritual of Cremating Care enacted after sundown. It is either a hoot or scary, depending on how you view such gatherings. At the very least, such secret meetings have the effect of socially reinforcing differences those at the grove feel about the ‘others’ who are never invited. The late historian Christopher Lasch contended (in The Revolt of the Elites and the Betrayal of Democracy) that the rich are now so isolated in their bubble that they consider themselves generally exempt from the rules that constrain the rest of us who are not so financially well endowed.

@ Bill Mitchell

You might be interested in the paper mentioned in this post if you haven’t seen it.

http://economistsview.typepad.com/economistsview/2012/10/does-taxing-the-wealthy-hurt-growth.html

The words ‘trickle down’ are never used anymore. The Republicans quickly realized just how condescending that sounds. By whatever name, it derives its power from the wealth of the tricklers of course. However, people are catching on. If you think the election of Barack Obama (admittedly he has largely continued the support of the wealthy) owes nothing to that, you would be mistaken.

Romney was portrayed as an elitist, silver-spoon in his mouth, Wall-Street ****bag, which he is. Of course not everyone believes this (or he would have gotten 10 votes), but that is why he lost.

Three points I want to make here:

1 – Usually we are told that rate reductions in the US have led to economic growth and job creation. They like to cite the 1920s, 1960s, 1980s, and 2000s as the evidence, and indeed in all cases unemployment dropped (or did it? … at least it did in the 1980s). Since government is not revenue constrained, what is the problem with lower rates, particularly if it could promote private-sector spending?

—

2 – Is there really a problem with the restructuring of Medicare and Social Security, if this introduces more price competition in health care service provision, and if it also might allow for private allocation of retirement assets (in both cases voluntary)? I look at the success in México and Chile with their retirement accounts and believe we could do far better here. I don’t recall the Republican position as being supportive of actual cuts in benefits, though Democrats have claimed that for decades, because there really is no need to do that considering the basis of MMT. In the case of Medicare, how much of the amount spent actually goes to those whom it was intended for, as opposed to those who would game the system and pocket fraudulent gains?

—

3 – Long ago, we disparaged the phrase “trickle down” as a leftist construct because it implied that there was a faster way to get money to people – namely cut them a check. Now I realise that MMT essentially advocates this as a form of stimulus, although the Job Guarantee and use of infrastructure projects (clearly these are sorely needed, so why couldn’t Democrats actually do these when they had the votes in Congress in 2009?) are the more preferred way to go. The larger question I have here is does the government actually create “wealth” as I understood it – that is technological innovation leading to productivity gains and the freeing up of income for other pursuits? I have read where the average American 100 years ago spent something like 80% on food, clothing and housing but now spends 50%, thus freeing up much capital for other purposes and greatly aiding economic expansion (I would add to that the availability of cheap energy, much of it found in Texas starting in 1901). Having learned what I have thus far about MMT, I believe the continued deficit spending over that period has been most helpful as it provided the currency needed as the population (and thus the economy) grew. So what’s wrong with lower tax rates? From these blogs, I hear that taxation mostly exists at the federal level as a means of preventing inflation during economic booms. Thanks to the “automatic stabilzers” we would see revenue increases in good times – are you perhaps saying that if rates were too low, there would more inflationary pressure as not enough money would be pulled out of the economy?

—

I am curious on the response to these, and I do hope it will be illuminating (as opposed to thermal …)

Professor;

Slightly off topic, although I thought this was encouraging.

Interview with special guest Dr. Stephanie Kelton

http://harryshearer.com/le-shows/october-28-2012/

Melia-Aneta Sese

The problem is with the word “restructuring”, which almost always means shifting costs onto the consumer.

Look, the primary problem with US healthcare is that prices have been rising above the rate of inflation (and GDP growth) for over 3 dozen years, and this rate of increase is unsustainable. The reason this is happening (and the reason it happens in any market) is that the demand continually outstrips the supply. There is a choke on the introduction of new health care supply, and observing the length of this choke, one must conclude it is deliberate. [Indeed, according to Tom Buchmueller, the Obama administration’s Council of Economic Advisors point man on ObamaCare, the bill does almost nothing to address this, and the decision to omit it was deliberate.]

So what does this restructuring/cost shifting actually accomplish in such an environment? Quite simply, it shifts the demand curve, making more and more procedures, especially those involving critical care, unaffordable to more and more people. Instead of addressing the choke on supply, which would introduce more price competition, it attempts to remove demand by pricing the product out of reach. To put this more graphically but no less accurately, it kills people to stabilize prices.

It is primarily our money system that results in unjust “trickle-up”:

1) The so-called “credit-worthy” and the banks are allowed to steal the purchasing power of everyone else. The most “credit-worthy” are not coincidentally the already rich.

2) The banks and others with idle money are allowed a risk-free return by lending to the monetary sovereign. The interest payments are a waste of the monetary sovereign’s limited ability to create money without debasing the value of it.

3) The existence of the government-backed credit cartel precludes the widespread use of money forms that “share” wealth and power (such as common stock) rather than concentrate them.

A key reason that the tax-rate reductions of the Bush administration have been insufficiently stimulative is because they came with expiration dates from Day 1. People don’t make the sorts of changes in their behavior that would give the economy a boost unless they have confidence that today’s tax regime will be in place when the payoff from increased work, saving or investment is realized. Therefore, Democrats should support making the Bush tax cuts permanent, but they will not because they are deficit hawks.