The other day I was asked whether I was happy that the US President was…

The UK government in a race with the Eurozone to ruin their economies

I am in Darwin today – right in the North of Australia. This is the frontier of Australia and merges our nation with Asia to the north. The dry season has just started and so the tropical weather today is glorious – warm and sunny and dry! It is a 6 hour flight from Newcastle and a remote part of our nation despite Darwin being one of our capital cities. But the world is not very far away from anywhere these days in terms of information access and so it is hard to avoid reading the latest data from around the world and analysing it. The news from Europe over the last 24 hours is shocking and the responses by leading politicians is worse. Just as the British Office of National Statistics was announcing that the UK has achieved a double-dip recession for the first time since the 1970s – an achievement that the Government will no doubt erroneously claim is the work of others – Bloomberg published a story (April 25, 2012) – Merkel Pushes Back Against Hollande Call to End Austerity Drive which tells you how far out of touch with reality the Euro leadership is. The UK government is working as hard as it can to undermine its own economy so it can catch up with the Eurozone economies in the race to the bottom of the slime. It beggars belief really. When will the citizens revolt?

The Bloomberg article reported comments made by the German Chancellor at a conference in Berlin on Tuesday (April 24, 2012). She apparently said:

… balanced budgets are the best answer to the debt crisis, rebuffing French Socialist presidential candidate Francois Hollande’s campaign pledge to reverse Europe’s austerity drive.

I wonder if we were to take Dr Merkel aside, away from the Bundesbank and Finance Ministry economist ideologues, and grilled her about what a balanced budget actually means with respect to the capacity of the private domestic sector to save overall, what level of understanding she would have. My guess is not much.

The Euro crisis is in two parts. First, it is a private debt crisis, exposed by the collapse of real estate markets around the world after a decade or more of non-government credit bingeing.

Second, the collapse in non-government spending that resulted created huge output gaps throughout Europe (and elsewhere). These output gaps drove increases in budget deficits (via the automatic stabilisers – collapse of tax revenue etc) and ordinarily, a government would allow that spending floor to remain in place and then augment it with discretionary expansionary fiscal policies.

The speed and size of those discretionary responses would then determine how long the output gap remained large and how robust the recovery phase would be. The rule for a responsible government is clear – maintain the expansionary stimulus for as long as private spending remains below the levels required to maintain zero output (spending) gaps given steady-state government net spending (and external balances – net exports).

The rule is clear and definite. Spending creates income and output growth. Output growth generates employment. Labour force growth adds to the number of people who desire to work at the current wage level while productivity growth reduces the number of people required to produce a given output.

Labour force growth (given productivity growth) thus defines the rate of growth of real output that will generate full employment. It is not magic at all. Just a comparison of the respective growth rates. If output growth is below this required rate then there will be excess capacity and demand-deficient unemployment.

The problem in the Eurozone is that they deliberately created a monetary system that precluded the member-state governments from responding to the collapse in private spending in the appropriate manner. They artificially imposed “fiscal rules” about the permitted size of deficits in member nations (the so-called Stability and Growth Pact) that were violated in many cases just by the cyclical response alone.

That is, the automatic stabilisers (collapse of tax revenue) in many cases pushed the deficits beyond the 3 per cent of GDP threshold so large were the output gaps that emerged in 2008.

Instead of allowing governments to meet this challenge in a responsible way, the Euro elites promoted the idea of fiscal austerity – as per Merkel’s false claim above – and buttressed it with lies taken from my disgraceful profession that private spending is weak because we are scared of the future tax implications of the rising budget deficits – so-called Ricardian Equivalence notions.

As I noted in yesterday’s blog – every time this notion is advanced to predict real world events, the formal Ricardian Equivalence models have got it exactly wrong. There has never been any predictive capacity in the theory.

The overwhelming evidence shows that firms will not invest while consumption is weak and households will not spend because they scared of becoming unemployed and are trying to reduce their bloated debt levels.

While the basic design of the Eurozone is flawed the situation could have been retrieved if the European Central Bank (ECB) had agreed to fully fund expansionary fiscal deficits in the member states where the output gaps demanded them.

Instead the ECB demanded austerity although behind the scenes via its Securities Management Program (SMP) it ensured that no nation would collapse completely. They have overseen a disgraceful default by the Greek government where investors have taken massive cuts which were entirely avoidable had the central bank acted appropriately to fund the Greek government deficits and allowed it to transition to growth.

The reason why the ECB is so central to the meltdown that is occurring in the EMU is because it is the only institution within the system that can issue the currency without revenue constraints. The flawed design, which forced member states to use a foreign currency and refused to establish a federal fiscal authority capable of meeting asymmetric aggregate demand shocks across the regional units (member states), means that the federal “fiscal” function has to be played by the ECB.

In the absence of that function, the system melts down. The SMP just means that the system bleeds to death a bit more slowly than it otherwise would as one nation collapses into recession. The economic imperative is growth – the political imperative is austerity. The twain shall not meet.

The point is that the problem of the Eurozone did not originate with fiscal settings but it has been made worse by adopting exactly the wrong fiscal response to the crisis – exemplified by the German Chancellor’s claims that balanced budgets are the appropriate response.

If we think about the Eurozone in particular it broadly runs an external balance as a complete monetary block. So a balanced budget in each nation would mean that overall the private domestic sector (aggregated across all member states) would be spending exactly what it earned.

But within the Eurozone itself, the overall external balance is comprised of significant external surpluses and corresponding and offsetting external deficits. The surplus nations would be experiencing private domestic surpluses while the deficit nations would be experiencing on-going private domestic deficits (that is, the private sector would be spending more than it was earning and accumulating debt).

That sort of situation is unsustainable because the private domestic sectors in the external deficit nations will eventually face unsustainable balance sheets and spending will be curtailed. The balanced budgets would then be compromised and a spiral of stagnation would result.

In external deficit nations, the budget deficit has to rise to support the desire of the private domestic sector to save overall. If it doesn’t, then recession or stagnancy is the result. Fiscal rules that impose the same behaviour across all member states irrespective of their external capacities fail.

Further, a truly sovereign nation can adjust to external imbalance (surplus or deficit) via exchange rate movements. The Eurozone nations cannot enjoy that flexibility and so the imposition of balanced budget rules onto nations with external deficits means that domestic stagnation is almost guaranteed.

The German Chancellor also signalled to the Berlin conference that her understanding of macroeconomics doesn’t go beyond what students are taught in mainstream undergraduate programs. It is a crude and flawed understanding.

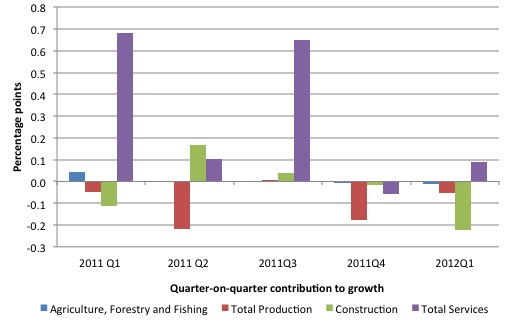

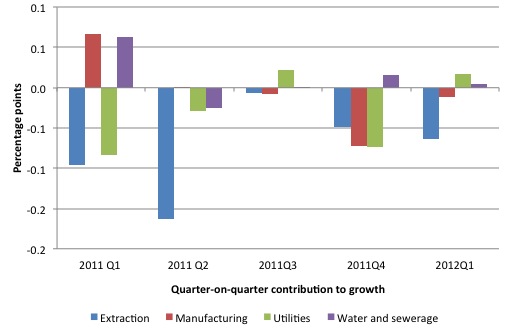

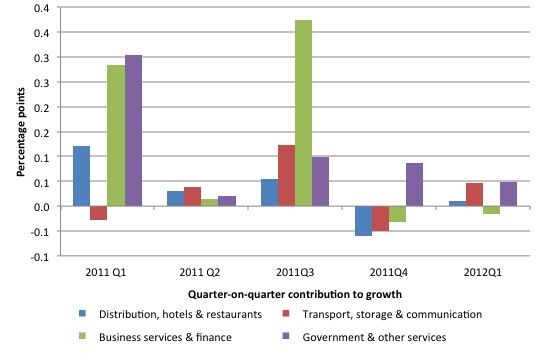

Invoking the erroneous household budget equals government budget analogy she said: All users of a currency know that. But every issuer of a currency also knows that they can spend whenever there are goods and services available for sale in the currency they issue. Every issuer of a currency also knows what a nonsensical statement it is to say that a government can “save” its own currency. That is a totally inapplicable concept. Saving is when households forgo consumption that would be permitted given their disposable income in order to expand their future consumption possibilities beyond their projected financial resource access. All revenue-constrained spending units have to save to expand future consumption possibilities (in one way or another). A currency-issuing government can consume whenever they want (subject to real constraints relating to availability) irrespective of what they did last period. That is the unique capacity of a sovereign government. It makes no sense to say that a government is “saving” its own currency once we understand that saving is an act of intertemporal (across time) consumption smoothing and risk management. Amidst all that neo-liberal nonsense, came the real world reminder of what the ideological obsession with austerity is doing – on the ground rather than in the plush European meeting rooms where Merkel and Co hang out eating and drinking and making deranged decisions that impact badly on millions – the UK had returned to recession and this was the first time since the 1970s that it had double-dipped. When a nation goes into recession, it is a sign that government policy has not reacted quickly enough to the decline in non-government spending (private domestic and/or external). What the government does next determines how long the recession lasts and how robust the subsequent recovery is. The aftermath of a recession is typically an entrenched pool of long-term unemployed. The more quickly the government reacts with fiscal support for overall spending the smaller the overall income losses and the smaller is the pool of unemployed that has to be mopped up with faster than normal employment growth. However, when a nation double-dips – that is goes back into recession soon after it began recovering from a previous recession then the fault lies unequivocally with government. A double-dip recession always means that the government has failed to provide sufficient fiscal support for a sufficient duration given non-government spending behaviour. A double-dip recession condemns a government – and exposes it as an incompetent economic manager. The other salient point is that the history of double dip recessions tends to occur after a government bows to conservative pressure and/or its own ideological biases against the use of budget deficits and begins to withdraw fiscal support for growth long before the private sector has re-organised itself, regained confidence and resumed more normal spending growth. Think 1937 in the US, 1997 in Japan, 2012 in Britain – they are all related by this government-generated sabotage of their own economies. Double-dip recessions are entirely avoidable if appropriate macroeconomic policies are followed. The following graph shows the broad sectoral contributions to real GDP growth (quarterly) over the last five quarters. The service sector has been keeping the economy growing over the last year but in the March quarter its relatively modest contribution to real GDP growth (0.1 percentage points) was swamped by zero (Agriculture) negative contributions (Manufacturing -0.1 pts; Construction -0.2 pts) from the remaining sectors. The construction and manufacturing sectors are now performing poorly and the trend is to worsen. Overall, growth in real construction fell a staggering 3 per cent – the largest fall since the height of the recession in the March quarter 2009. Industrial production fell by 0.4 per cent (Manufacturing 0.1 per cent). The move into recession is being mainly driven by government spending cut backs and a rapidly deteriorating real wage situation which is not the combination that would lead to a private domestic sector spending recovery. Nominal pay has grown by 1.1 per cent in the first quarter 2012 which is about 1/3 the inflation rate. That is a dramatic real wage decline. Britain is also not being helped by the Eurozone collapse given that the Eurozone is its largest export market. Please read my blog – Fiscal austerity – the newest fallacy of composition – which explains why export-led growth strategies, which are the darlings of the neo-liberal gang, fail when fiscal austerity is imposed across the board. By killing domestic spending in the Eurozone, the fiscal austerity is also killing British export growth (and vice versa). The next two graphs break the production and services sector (respectively) into their sub-aggregates and show the contribution to real quarterly growth at that level (in percentage points). It is clear that the production side of the economy has in broad decline for the best part of 12 months. This indicates a lack of consumer spending and the unwillingness of firms to invest (given the consumption and export outlook). The lack of confidence reinforces itself and can only really be broken by a significant government boost, exactly the opposite to what is happening. As noted in the broad sectors graph above, the service sector has been providing the growth engine for the UK economy through the third-quarter 2011, but that contribution is now receding and failing to offset the consistent decline in production industries. It is worth noting that the government sector is still contributing to growth which means that the worst of the fiscal austerity is yet to come. Up until now, the worst impacts of the austerity appear to be to undermine the confidence of the private sector. Once the government contribution turns negative then the pace of the overall real GDP contraction will become more rapid. Conclusion More evidence, more ridiculous political input. It is interesting to watch nations chase each other down the rat hole into oblivion and observe the degree of tolerance in each of the societies to the malaise that is being imposed on them by their political leaders. It is also a vast human tragedy and history will definitely not judge this era very kindly. I have some meetings to attend now. That is enough for today!

Bill, thanks again for writing an excellent piece. I do have a question, hope you or someone else can provide an answer. From reading many of your blogs and some other (MMT) sites, it’s clear to me now how government austerity at the same time the private sector tries to save (pay of debt) is a sure way to a recession. With my limited economic knowledge, it’s easy enough to understand that if -everybody- tries to spend less then he receives as income at the same time, the net result for the whole system is a downward spiral.

However, one important aspect I still fail to understand, even after reading a lot, is the other direction: economic growth. Take the EU. How is the economy of the EU and its countries supposed to grow and how will it be possible for governments to reduce their debts (relatively as a %GDP)? From what I understand, once an economy grows, the governments will get more tax returns and government debt is reduced (relatively) automatically. But where is that money coming from? Isn’t it so that in the private sector, any money creation always goes together with the same amount in debt creation? So if the central government (currency issuer) is not pumping money in the system, where would it come from?

What would help me best I think is some simple example of an economic model with some numbers, but without the complex math you often see in economic papers.

The only sustainable way to reduce government debt as a share of GDP while allowing the economy to grow (the way we measure government debt, anyway) is for the government to continue to spend more than it taxes, as required to balance the private sector’s net demand for financial assets by spending new money into existence (i.e. not issuing sufficient government debt to cover the gap between public spending and taxation, but instead allowing the monetary base to increase). This will allow for growth at full employment without a reliance on growing private sector indebtedness or increasing the issuance of government bonds.

@Steve: if it’s that simple, why doesn’t anyone in the EU understand this? I live in the EU and I just don’t understand the system. The ECB gives money to private banks for 1%, those banks buy government bonds for 3%, so basically get free money from the ECB. And then those same private financial institutions (the “markets”) complain about governments having too much “debt” (having sold all those bonds!). And the markets also complain about people not spending enough. Of course, people cannot spend since they as well really need to pay of their debts (mainly mortgages)! And governments reduce their spending as well. It just doesn’t make any sense. But I’m no economist. I just think about those 10-40% of the people not working, doing nothing, producing nothing, just because there’s some big negative number on a computer somewhere (the debt!!).

Just this morning I read an article in our paper about why this magical 3% goal (gov. shortage) exists in the EU. The article explained this is the magical number because it’s exactly the number small enough to not get too much inflation. That if governments (or ECB) would “create” too much money, there would be too much inflation which would equate to reducing our (the citizens) savings.

Dear Matt (at 2012/04/26 at 18:45)

Thanks for your comment.

You said:

My first bit of advice is that I wouldn’t read that newspaper any longer – it obviously perpetuates lies and myths.

The 3 per cent goal is the total budget outcome. So, for example, it could be made up of a balanced structural budget and a 3 per cent cyclical deficit (that is, a recession situation probably). It could also be a 3 per cent structural and 0 per cent cyclical (that is, full employment situation given cyclical balance is zero). It could be a 3 per cent structural surplus and a 6 per cent cyclical component – that is, deep recession.

In each case, the dynamics of inflation will be very different.

There was never a proper justification for the SGP fiscal rules. They were later justified (ex post) but all those justifications were deeply flawed anyway.

best wishes

bill

@Matt

People don’t get it because economics is almost always a product of ideology and faith. What is practiced is more akin to theology than science.

Thanks Bill for your reply. I’ll keep the paper just for the other stories and comics then 😉

But as to my first question about growth. Let’s say we have a EU country with a government debt of some value (say 60% GDP). And a balanced budget. So it taxes exactly what it spends. And lets assume import/export is balanced (or doesn’t matter). Now, what I don’t understand yet is how this economy is supposed to grow, without someone getting (more) in debt. For this economy to grow, there has to be someone or some company going to a bank and borrowing money in the first place. Say company X borrows 1 million from a bank and invests that. That company spends that 1 million in the economy. Great. But the company has to repay that same amount of money, plus interest. When it does that, that money is destroyed again. Disappears.

So someone has to get in debt to make the economy grow isn’t it? If the government isn’t doing it, someone else has to. That’s just our economic (fiat money) system, right. Money is created out of debt. Bookkeeping. So why is it that that debt is a problem? Why does it have to be repaid? If everything is paid back, isn’t all money destroyed?

It’s the same as with all those mortgages we have on our houses. Now our government is saying these need to be paid off. Half the population here borrowed money from a bank to buy a house. About 600 billion if I’m correct. In the meantime, those houses have decreased in “value”. So if everybody somehow would repay all those mortgages worth 600 billion, the system as a whole ends up with a net loss (say the houses are worth only 400 billion). 200 billion will be gone.

Somewhere I’m missing something in my (simplified) model …. I know it should be simple (basically) but my brain hurts thinking about it all.

@ Steve

Unfortunately the neo-lib policy in the UK has driven growth by allowing the private banks to loan new money (debt) into existance, fuelling a property bubble. The electorate (specifically the property owning older and more likely to vote part) have been duped by the political class into believing they were doing well on the back off grossly unrealtistic property values. Current policy in the UK has done much to back the banks and desparately maintain the unsustainable property values. The revolt needs to come from the young who are currently excluded from both employment and rent seeking (property ownership) sadly these the section of the society least likely to vote and thus be supported by the politicians.

Bill,

The degree of tolerance shown to our politcians (and supporting economists/elites) is under severe strain! We have no choice (in the UK) but to wait until 2015 before we can vote the idots out. Sadly the replacement set of idiots are just that…idiots. Ed Balls is hopelessly compromised no matter how right he seems regarding pace and depth (of cuts) he, and the labour party, still thinks cuts are necessary and that the deficit should be the focus of attention. I see our friends over the Channel (French and Dutch) are at least taking the first oppotunities they have to vote the neoliberals/neoconservatives out but I’m not holding my breath…

Matt, You say “For this economy to grow, there has to be someone or some company going to a bank and borrowing money in the first place.” My answer is “not necessarily”.

Economies can grow or shrink simply because the velocity of circulation of money speeds up or slows down, and the latter is determined by amongst other things the state of consumer and business confidence, or “exuberance” to use Alan Greenspan’s word.

E.g. the velocity of circulation of money in New York State halved approximately between roughly 1929 and 1931.

@NeilT: yes, over here (Netherlands) the conservatives have put themselves out of power and we get new elections. But all parties follow the same mantra of spending cuts for the government and at the same time expecting citizens to pay back their debts (mortgages mainly). While at the same time saying other EU countries do the same (-1 + -1 = …?). The only difference is that the neoconservatives put the most strain on the most vulnerable part of the population (like mentally ill, disabled people, unemployed, etc). So it’s good they are out of power (partly) for a while, but I don’t expect any new economic insights from other parties.

@Ralph: you’re right. But for levels of debt to decrease, the money is taken out of circulation isn’t it? I mean, we could theoretically wire each other money as quick as we can and by the two of us increase the economy by 100% in a day. But that doesn’t solve any debt “problem”.

Perhaps money should have an expiry date. Then we could be reasonably confident that it would all be spent, rather than saved, and that its utility as a medium of exchange would be maximized. Why do we need financial stores of wealth?

With the external account in balance the government MUST net spend at some point to monetize growth or gains. True, the existing money base and animal spirits can/will generate velocity for a while, but mathematically speaking this is un-sustainable and will eventually (soon) reach equilibrium and come to rest (stable state). Such stability is the death knell of an economy, as the sytem requires exitation to function. An economy must remain out of equilibrium to function.

When an economy grows various components (pension funds, returns on equities, property appreciation, etc.) grow on balance sheets as “paper” gains. Provided these gains are not realized (cashed out) then the economy can get along for a while without the government net-spending but at some point people will want to start spending the gains and if enough try to do it at the same time the system will begin to sieze up – it would be the equivalent of a bank run.

Credit money cannot monetize these gains by definition since credit adds no net money to the system – every credit dollar comes with an equal offsetting liability.

Further, business investment by definition removes more money from the economy than it adds, since the goal of business investment is to make a profit. Profits and savings can only occur under one of two scenarios, either the profit is at the expense of others within the system or the profits and savings desires are monetized by net government spending.

This is relatively simple arithmetic. If additional velocity of spending creates any gains the gains cannot be realized without net government spending.

(engineering view of economics)

Bill have you read this article ‘Why Does Uncle Sam Borrow?’ by Dan Kervick over at New Economic Perspectives?

I’ve been closely following/studying the MMT (Modern Monetary Theory) economic group for over a year-and-a-half. Prior to finding them, I had absolutely no clue as to what was going on economically in the world, and I was terrified. Now I have absolute confidence I know what is going on economically in the world, and I am terrified.

Over the past year and a half, Bill Mitchell, Warren Mosler and Randy Wray have gotten absolutely everything exactly right. They have not missed a beat. And mainstream economists have gotten it exactly wrong. Even so-called liberal economists, such as Paul Krugman, still hitch their teams to the neoliberal economic ghost ship and play the neoliberal fiddle while Rome burns. One would think after a year-and-a- half of being completely wrong, the economic advisors and world leadership would begin to listen? No matter how many times the MMT group points out that the emperor is wearing no clothes, the world leaders and economic advisors– even the liberals–continue to admire the fantastic imaginary fabrics and ignore the naked, bloating, unclothed bodies before them.

From Obama to Merkel, having faith in economic beliefs that don’t work in the real world seems to be a required mantra in today’s conservative march down the rabbit hole. Oh, how I wish for a real pragmatist like FDR. Do we all have to be standing in soup lines and lying in the gutter before we see that we’ve got it all wrong?

Seems deficit terrorism is beginning to crack. France and the Netherlands are probably the most important reason. From W. Mosler’s site:

http://www.telegraph.co.uk/finance/financialcrisis/9226543/Brussels-to-relax-3pc-fiscal-targets-as-revolt-spreads.html

Matt, I assume the “debt problem” you refer to is the national debt.

I suggest that is a complete non-problem. A national debt can be disposed of simply by printing money and buying it back, or ceasing to roll it over. If that is too inflationary, then part of the money for the “buy back” can be obtained in a deflationary manner: by getting the money from raising taxes.

Mix the above two methods of paying off the debt in the right proportions, and you get whatever stimulatory / deflationary effect you like.

So if an economy is booming because confidence rises and the velocity of circulation of money rises too much, then it would be desirable to get a relatively large amount of the money from raised taxes.

But more to the point, I think national debts are pointless. Milton Friedman in 1948 advocated a monetary regime in which there is no government borrowing. See paragraph starting “Under the proposal…” (p.250) here:

http://nb.vse.cz/~BARTONP/mae911/friedman.pdf

Plus I attacked the whole idea of national debts here:

http://mpra.ub.uni-muenchen.de/23785/

Coincidentally, there is a post today by Dan Kervick at the New Economic Perspectives site which also attacks the whole idea of national debts:

http://neweconomicperspectives.org/2012/04/why-does-uncle-sam-borrow.html

I understand MMT says no matter where the money come from (is just issued by government) but if there are REAL RESOURCES available for the economy to grow. We are so focused on those bills that we forget we don’t eat money, we don’t use money for anything. What really matters is real resources, real food, real cars, real houses, real services… money is just a tool to facilitate the process of transferring such resources between individuals that doesn’t know each other, and probably will never meet. And Japan really demonstrates that there’s no need at all to reduce public debt. Public debt is just an accounting trick to “raise funds” that aren’t really needed because money can be (and is) created at will by the government

@Ralph: I understand what you mean and I fully agree with what you describe. But in my case, I’m talking about debt in the situation of a single European country. That single country doesn’t have his own money anymore. It’s a user of the Euro, just as any household is a user of the money of its’ country. So when, for example, the Dutch state is going to pay off its’ debt, it is really paying off debt. And if that same governments wants its’ citizens to pay off their debts (the mortgages) at the same time, there is only one way for the economy to go: down (just assuming import/export is net zero). Everybody is paying off debts at the same time. In other words, everybody in the EU is going to spend less then he/she/it earns. At the same time. I’m no economist, but a bit of high school math tells me that if everybody in the EU starts spending less then he earns, the economy shrinks. And when the economy shrinks, everybody earns less. And everybody has to cut spending even more then before to still pay off the debt. Etc etc etc.

I heard there are villages in Greece that have started creating their own money, pieces of paper that can be traded for goods and services, and it’s working pretty well for these villages.

The only exit for an euro country is to get money from ECB or leave the monetary union (preferably both in the mentioned order). Maybe just menacing to leave the euro would be sufficient for the ECB to release some money. With the actual norms it will be possible for example that the ECB lent money to some other EU institution, say European Bank for Reconstruction and Development, and that institution to the country. The big problem are fiscal rules being now imposed on constitutional level, but that can be avoided too, because (for example in spain) constitution doesn’t fix the rates, that are named by law, and could be easily changed to say 15% for the budget deficit in order to allow some growth coming from public spending

Bill,

I stumbled on this today:

http://yanisvaroufakis.eu/2012/04/25/why-wont-germany-turn-joseph-halevis-insightful-analysis-circa-1995/

It theorizes a deep institutional structure in German finance with the export of deflation as a goal. It makes sense of seemingly senseless behavior. Of course its not sustainable, but it has been for 30 at the Bundesbank, and its done quite well by them and it leaves everyone else in the world holding the bag, so what’s not to like if you’re at the Bundesbank? Like George Bush, these guys have been rewarded for all their failures, so why expect them to change?

Any system that depends on growth and that collapses when growth turns negative is by definition a ponzi scheme.

As long as we have not found a solution to distinguish dept, it is simply pushed around until the inevitable crisis. Irredeemable paper money systems have two other intractable problems: unstable interest rates and unstable foreign exchange rates. In their desperate attempts to “hedge” these un-hedgable risks, the banking system creates endless derivatives, and derivatives of derivatives. And this leads to the other problem. Markets increasingly become the casinos for speculators. Speculators push interest rates and foreign exchange rates to even greater extremes. And with every fluctuation, real damage is done to the real businesses that produce the goods and services necessary to feed us and keep our economy alive.

@Linus: exactly, well said. In the current situation Goldman Sachs and others do precisely that. Sell the most obscure derivatives to naive “customers”, knowing they sell crap, at the same time bet against those “products” they just sold, wait for what happens and in the end regular people and real institutions like schools or cities end up having high debts, no pensions, etc being forever indebted to those financial institutions. Of course it’s also the fault of those institutions buying these products. In our country slowly it’s discovered how all kinds of public institutions like small villages or schools have been speculating with their money (=the tax payers’ money), loosing big. And now the regular hard working citizens have to suffer, in other words work harder and longer for less money to pay off the debts to the small financial elite. The elite in the banks that are being supported with free money/bailed out in all kinds of ways right now. Justified by politicians by saying that if the banks are not supported “the economy will collapse”. While at the same time cutting spending hard and raising taxes.

@Matt

Yes, Goldman and the other debt-factories are the definition of Minsky’s ponzi financiers.

Matt, If EVERY country in the EZ tried to pay off its debt by having everyone save (or raising tax on EZ citizens) then the effect, as you say, would be pointless deflation and unnecessary unemployment.

This is the equivalent to a monetarily sovereign country enduring deflation so as to pay off its debt: the exercise is pointless. Such a country, as I said above, can just print money and buy back debt (combined with a bit of extra tax as necessary). The EZ can do likewise.

In fact the EZ seems to have realised in the last few days that it has arrived at the above absurd position, because even EZ core countries are beginning to suffer austerity. As Bill says in his post today, “Madame Austerity” is no longer quite so fashionable.

As distinct from where EVERY EZ country is in recession, if the core is doing OK while the periphery is in recession, then as you say, if periphery countries save so as to pay off debt, that just makes their recession so much the worse.

But that’s the quaint and very defective method the EZ has chosen for dealing with uncompetitive countries: uncompetitive countries endure recession till their costs come down.

Hope my explanation makes sense – probably not!!

Speaking of Eurozone, since governments literally borrow to fund deficits,is it correct to assume that there arent any NFAs added in the eurozone economy ?

@ Ralph

The inflationary is not sustainable. We have to find a way to liquidate unsustainable debt instead of creating more.

There simply are no easy ways to deal with the bust after a boom created by a credit bubble.

Correction: The inflationary path

“There simply are no easy ways to deal with the bust after a boom created by a credit bubble”

Yes there is. You accommodate the excess savings by injecting an equivalent offset of fiat money while tightly regulating the private banks and deal with those excess savings in the future with taxation if they ever causes excess spending.

That turns excess savings into the economic equivalent of Methane Clathrates – completely inert for as long as they stay frozen.

The current economic commentators are the same as the extreme climate doomsayers who are so frightened of the supposed consequences of the Clathrates melting that they want to eliminate 6.5 billion humans and induce another ice age.

@Ralph: yes, your explanation makes sense. Thanks. I’m just an amateur in economics and trying to learn all this stuff, so any explanation helping that is appreciated. Because I’m no expert, it’s not possible to understand the exact ins and outs of money streams, the different kinds of financial vehicles, interest rates, how bond markets work, etc. I can only look at the big picture and understand how an economy works. Via via I came across this talk by Dirk Bezemer about Creating a Socially Useful Financial System, which clarified some important points to me as well:

http://www.youtube.com/watch?v=qvBuK8yQxbY

Not to worry, Neil. Humans couldn’t induce another ice age if they tried. CO2 levels would have to drop to below 280ppm, and even if we stop emitting CO2 tomorrow, it’ll be centuries before the natural carbon cycle draws down that much CO2.

“Not to worry, Neil. Humans couldn’t induce another ice age if they tried.”

Indeed. But that doesn’t stop the nutters believing it.

Hence the parallel with ‘expansionary fiscal contraction’. 🙂

“I wonder if we were to take Dr Merkel aside, away from the Bundesbank and Finance Ministry economist ideologues, and grilled her about what a balanced budget actually means with respect to the capacity of the private domestic sector to save overall, what level of understanding she would have. My guess is not much.”

Just to offer some perspective, in election debates Mrs. Merkel famously was unable to tell the difference between ‘net’ and ‘gross’. (makes you wonder why they voted for her?!)

Also, her original election platform (before she decided she might like to win the election) was a flat tax on income, plus trebling vat. (compared to that, all austerity looks like lenience)