I started my undergraduate studies in economics in the late 1970s after starting out as…

Fiscal austerity – there is another way

I have had very little time today (worse than usual). I gave a 3 hour lecture today on Modern Monetary Theory (MMT) and unemployment to a final-year class in the Social Work program at the University of Newcastle. It was interesting trying to work out how to explain all these concepts, which are intrinsically hard, to a group that has no background in economics. Just the language we use is not universal and so I spent quite a bit of time working out how to communicate. Anyway, the following blog is short as a consequence. But knowing I didn’t have much time, and the blog I am thinking about will require some more digging, I decided to take the chance today to write an Op Ed that was requested from a newspaper in Buenos Aires and which I am late in delivering. They only wanted 5,000 odd characters so it forced me to be disciplined. It is about fiscal austerity and will be translated into Spanish for their readers.

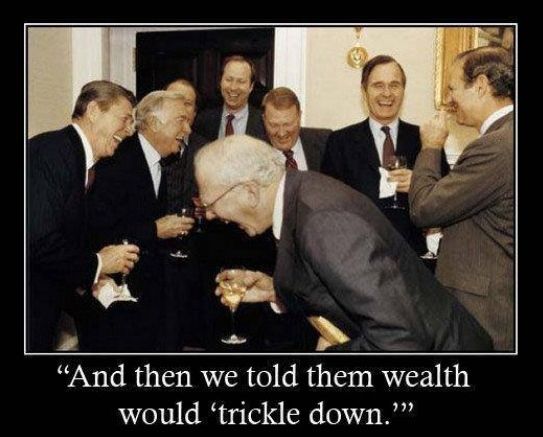

Trickle Down

But before we begin, I was shown this cartoon yesterday which I thought was very humorous in a sick sort of way! It sets the scene.

Fiscal Austerity

The current economic crisis began as a problem of unsustainable private debt growth, driven by an out-of-control financial sector, aided and abetted by government deregulation. It is now an alleged sovereign debt crisis.

As private spending collapsed in 2007-08, budget deficits rose to limit the rise in unemployment. Fiscal stimulus fostered a resumption of growth and the crisis waned.

While unemployment represents a failure of the system to create enough jobs, the neoliberals recast it as an individual problem – poor work attitudes etc – exacerbated by excessively generous welfare payments.

Before the crisis, neoliberals promoted the myth of self-regulating markets and pressured governments to deregulate. They argued that governments should not try to reduce unemployment by running budget deficits. They claimed that whenever governments did try to reduce unemployment, they only made things worse – causing inflation and forcing up interest rates.

After the 2008 fiscal stimulus saved the World economy from a depression, the neoliberals reasserted their anti-government agenda and demanded fiscal austerity. They claimed that budget deficits were unsustainable and would lead to rising interest rates and hyperinflation.

None of these predictions eventuated. Interest rates remain around zero and inflation is contained. But despite millions remaining jobless and poverty rates rising, many nations are falling back into recession because governments have bowed to this pressure and imposed austerity.

Austerity is built on a sequence of lies.

Neoliberals claim that governments, like households, have to live within their means. This analogy resonates strongly with voters because they can readily understand their daily household finances. We know that we cannot run up debt forever.

But government issues the currency and can consistently spend more than it earns. Whereas households have to save to increase future spending, governments can purchase whatever they like whenever there are goods and services for sale in the currency they issue. Governments can never run out of money.

Neoliberals talk about an “expansionary fiscal contraction” – that is, by cutting public spending, private spending will increase. Consumers and firms allegedly anticipate higher future tax burdens and so increase saving now. Austerity signals to the private sector that future tax obligations and frees them to spend more now.

But the evidence is that consumers won’t spend if they fear unemployment and firms won’t hire and produce if sales are flat. Cutting public spending deepens this pessimism. The neoliberals consistently deny human psychology.

Neoliberals say that continuous deficits cause hyperinflation like in Zimbabwe. But increased government spending will not cause inflation if the economy is operating below full capacity.

Neoliberals say that deficits drive up interest rates! Deficits have risen sharply in recent years but interest rates have remained close to zero. Japan has been running large deficits since the early 1990s and has maintained zero interest rates and low inflation ever since. The neoliberal lie forgets to mention that the central bank sets interest rates, not the market.

The Eurozone is different because member-states use a foreign currency (Euro) and have to borrow to cover deficits. They are thus dependent on bond markets. No progress will be made there until governments restore their own currencies and use deficits to stimulate growth. The only lesson to be drawn from Europe is that governments should retain their own currencies and use deficits to pursue full employment.

Austerity denies history. The Great Depression taught us that without government deficit spending, capitalism is prone to delivering lengthy periods of unemployment.

The neoliberal assault on the use of fiscal policy began in the 1970s, with the rise of monetarism. Since then, most nations have failed to create enough jobs relative to the preferences of their workforces.

Neoliberal economists and their supporters failed to predict the crisis and their solution, austerity, is now making things worse.

The basic macroeconomic rule is that spending equals income, which drives employment growth. Austerity undermines necessary spending.

The major economies are suffering from deficient private spending and a massive overhang of private debt. Persistently high unemployment means that our economies are forgoing massive production and income-earning opportunities. Unemployment also causes many other social problems.

As long as private spending is subdued, governments should expand budget deficits. That’s the only way the advanced economies will drive growth fast enough to absorb the huge pool of unemployed.

As a start, I would introduce a Job Guarantee that offers a minimum wage job to anyone who wants to work but cannot find employment. Job Guarantee workers would enjoy stable incomes, and their increased spending would boost confidence throughout the economy and underpin a private-spending recovery.

Sustainable growth requires substantially lower levels of private sector indebtedness. In most cases, this will require ongoing budget deficits. We need to get used to that fact.

Conclusion

The fiscal austerity argument is very current given the Australian Treasurer’s speech today saying that despite sharp declines in tax revenue as the Australian economy slows under the yoke of fiscal austerity, the government will have to cut spending deeper to ensure it achieves its surplus ambitions in the upcoming budget. I will write about his latest statement soon.

Further, the Australian government has all but rejected the so-called Gonski Report which was published a few weeks ago and estimated that $A5 billion (at least) was necessary to bring Australian public education up to minimum standards. The fiscal austerity over many years has starved the public education system of necessary funds. But while we have an ageing society and a crucial need to develop higher productivity in our future labour force, the Australian Government claims that running a surplus is its priority. It is a tragedy of ignorance.

That is enough for today!

Letter published in Ottawa, Canada

Keep people working

Re: Why public service cuts may not be all bad news for Ottawa’s economy, March 23.

Job cuts that are small in comparison to the overall economy may not hurt much – just as banging your thumb with a hammer will not be overly painful if it’s just a small tap.

But why hit yourself at all, and why fire public servants?

At a time when Statistics Canada is reporting an increase in unemployment insurance recipients, how does sending more people out to look for jobs that don’t exist help the economy?

When the private sector does not deliver jobs, it is the responsibility of government to keep people working by providing public services and by funding public infrastructure renewal.

Austerity at a time of a weakening labour market is an ideological aberration.

Larry Kazdan, Vancouver

© Copyright (c) The Ottawa Citizen

Read more: http://www.ottawacitizen.com/business/Keep+people+working/6376438/story.html#ixzz1qUWdK8Cx

Bill. Having recently found your web-site, I apologise if I am going over something you have already covered. The NY Fed has two staff reports from 2009 links follow. One is easy to read about Banks holding excess reserves. The other is heavy in math but the bones of it are about some financial theories change when interest rates approach zero.

I would appreciate how these two documents align with MMT … or not.

http://newyorkfed.org/research/staff_reports/sr402.html http://newyorkfed.org/research/staff_reports/sr380.html

Bill,

what newspaper will it be published in?

thanks

Larry,

Excellent letter to the Citizen, my friend. Keep it up!

“”The Eurozone is different because member-states use a foreign currency (Euro) and have to borrow to cover deficits.””

Isn’t it true that all countries NEED to borrow to cover deficits?

It is certainly true in the U.S.

So, in that sense, aren’t WE and almost every other country in the world exactly the same?

Are we not all constrained via legal commitments, at least internally if not through trade international agreements, to paying for government services by both taxation and borrowing?

Including the Eurozone and EMU countries?

If so, then, in order to fund so-called deficits without issuing debts, it would seem to require changes to existing laws. I don’t see ANYONE proposing to do exactly that, with the exception of Congressman Kucinich in the US.

http://kucinich.house.gov/UploadedFiles/NEED_Act_FINAL_112th.pdf

While true that Lerner’s ‘functional-finance’ proposal advocates a change to allow the government to exercise its rights at ‘printing’ the money needed to restore full employment and price stability, getting the government on that fiscal path requires legislation like the Kucinich Bill.

Well done Larry from a fellow Canuck. I am in Ontario, where we just released our Bankers budget. For all non Canadians, today is federal budget day. It will likely be ugly and most certainly out of paradigm. Our finance minister (a lawyer with a BA in sociology) has fully bought into the household analogy.

Circuit: Great work on your recent post with Joseph Laliberte and generally on a great blog.

Prof Mitchell: You’re an inspiration – keep it up. If your lecture goes well today, maybe you can provide that as an intro to MMT piece. I’m an Engineer and have been learning MMT for over a year and still learning. I always struggle on how to pull people into the conversation without overwhelming them.

Acorn,

Scott Fulwiller has looked about as closely at Fed operations as is humanly possible and wrote this:

http://www.moslereconomics.com/wp-content/pdfs/MMT-Scott-Fullwiler.pdf

Thank you very much for this nice, concise, non-economist write-up, will be very useful. Since you intend to give this to an actual newspaper, I am gonna annoying enough to put out that “Austerity signals to the private sector that future tax obligations” won’t work 🙂 Does one need to add “won’t rise” or something?

I posted at http://pshakkottai.wordpress.com/2012/03/29/another-proof-of-mmt/

which shows a graph of wealth and its growth using

(Federal Deficits = Net Private Savings+ net imports), applies to USA and other nations that have their own currencies. It is a proof in numbers using data from

http://www.bea.gov/national/nipaweb/Ni_FedBeaSna/DownSS2.asp?3Place=N

“It was interesting trying to work out how to explain all these concepts, which are intrinsically hard, to a group that has no background in economics. Just the language we use is not universal and so I spent quite a bit of time working out how to communicate.”

It seems to me that over 50% of economics is just getting the definitions correct. I don’t believe the following terms should be used or used by themselves: income, inflation, and money. Even the definition of debt can be problematic.

“They only wanted 5,000 odd characters so it forced me to be disciplined.”

Actually, I think that is a good thing. Most of the time shorter is better. People should be as “information dense” as possible.

The Iron Grip of Accounting Identities

http://www.cepr.net/index.php/blogs/beat-the-press/the-iron-grip-of-accounting-identities

Dean Baker says:

“If we have negative national savings, then either the private sector must have negative savings or the public must have negative savings or some combination where they both run deficits. All of this is definitional, it necessary follows from the trade deficit.”

In other words,

current account deficit = private deficit plus gov’t deficit

I don’t believe that is totally correct. I don’t see why this is not possible.

current account deficit = private deficit plus gov’t deficit plus currency printing entity deficit

bill, could you address that question in tomorrow’s Q&A 5? Thanks!

It seem everybody draws their own conclusions from the Great Depression. Bill, you write that “Great Depression taught us that without government deficit spending, capitalism is prone to delivering lengthy periods of unemployment”. How so? The government spending was generally small prior to depression, and yet it only happened in 1929, why? Why the economic growth of 1933-36 when increases in private consumtion spending were much higher thean meagre government deficits? How does MMT explain that? It seems that the revival of 1933-36 wasn’t driven by the government spending at all.

Acorn,

MMT’s take on excess reserves:

https://billmitchell.org/blog/?p=6617

https://billmitchell.org/blog/?p=6624

As the the Eggertsson’s paper, he wrote one with Krugman, based on a framework which was criticized by Bill couple of days ago:

https://billmitchell.org/blog/?p=18797

Krugman and Eggertsson have a faulty view of the monetary system.

But Bill commented commendably on the paper you quote here https://billmitchell.org/blog/?p=10920 , it is an empirical paper

Ron T said: “Why the economic growth of 1933-36 when increases in private consumtion spending were much higher thean meagre government deficits? How does MMT explain that?”

I have never gotten a good answer to this, but it could have to do with an increase in the amount of medium of exchange from raising the price of gold.

“I don’t believe the following terms should be used or used by themselves: income, inflation, and money.”

And saving.

Particularly saving.

Bill

If you get a minute, is there any chance you could translate this debate re keen, Krugman and MMT that appeared in the FT yesterday, into Australian for me?

Thanks

http://ftalphaville.ft.com/blog/2012/03/28/939631/steve-keen-and-the-minsky-moment/

Neil, how do you want to change saving?

@ joebhed

US “borrowing” to fund its deficit is superfluous. It can spend money regardless of whether or not that borrowing takes place. In fact, from a strict accounting perspective, where borrowing must include and increase in current liabilities, the US cannot borrow in it own currency, as it is merely swapping one set of its IOUs for another, a tranaction that nets no new current liability.

Backatcha

That the government “can spend money regardless of whether or not that borrowing takes place.”

Where, exactly, is it laid out how they do that?

I mean, in a practical and, you know, operational sense.

Does the government KNOW it can spend without receiving taxes and/or the proceeds from its borrowings?

Does the government know that it does not need to debate a debt ceiling anymore because the government can just spend without borrowing?

Does anyone in the government know, and where did they learn, that there is no need to receive funds from anywhere in order to pay for goods and services?

The borrowing being, as you say, superfluous.

I’m not asking about the obvious potential for any monetarily sovereign government to issue its money.

I’m asking about the system in place in the great global private monetary economy where the private bankers create the nations’ monies as a debt, thus indebting national governments; in lieu as it were , of that monetary sovereignty.

I guess its also worth asking if that same government is aware that….. “the US cannot borrow in it own currency”……. by definition.

Thanks.

Andy,

According to the article in FT you linked to above, Krugman is quoted as saying this:

“Keen then goes on to assert that lending is, by definition (at least as I understand it), an addition to aggregate demand. I guess I don’t get that at all. If I decide to cut back on my spending and stash the funds in a bank, which lends them out to someone else, this doesn’t have to represent a net increase in demand”

Even the newest of newcomers to MMT would immediately spot the fallacy here. Banks don’t lend their depositor’s funds, nor do they lend reserves.

After the drubbing he got in the comments section of his NYT articles on MMT I thought Krugman might’ve spent some time with his head in a book, but it appears he’s learnt nothing.

@John Armour: There does seem to be a phenomenon where many (most?) economists do not understand banking operations. The people who have actually worked in Banks … Warren Mosler, or Michael Pettis, seem to have a much better understanding of how monetary systems actually, in fact, work.

This is a great post, Bill.

Australia is lucky to have an economist of your persuasion. Austerity is not the way to go. I agree with MikeB above (thanks Mike): here is Canada, people are totally indoctrinated with the idea of balancing the budget. So much so that it’s not unusual to hear people say that unemployment (public service cuts) is a reasonable cost for balancing the budget. A ridiculous notion.

joebhed: “Isn’t it true that all countries NEED to borrow to cover deficits?

“It is certainly true in the U.S.”

Congress has not limited U.S. coinage. The Secretary of the Treasury could have any amount of platinum coins minted, with no set relation between the amount of platinum and the face value of the coins. See, for instance, http://johnsville.blogspot.com/2011/07/debt-watch-coin-trick-trillion-dollar.html 🙂

I guess it will be published in Página 12, one of the propaganda media of Queen Cristina.

Hi Bill,

I did check out your site for the first time and came across this your latest entry.

I do not agree with your assumptions as one major aspect is not addressed, namely the spirit of the rule of law with regard to the presently existing mal-investments caused by the anchor-less policies of central banks. We all know by now that major costs have arisen mainly due to cheap money that was used for ill-advised investments. The present policies try to transfer the resultant costs to the public via the extreme actions of central banks and away from the investors (mainly banks). The idea to separate the risk from an investment is in itself a breach of the spirit of the rule of law in that innocent bystanders are made to take the brunt of irresponsible actions whereas those that created those mal-investments are rewarded as a result.

Western Society was to a great deal successful due to its adherence to the rule of law. The present actions by most Western Governments do however undermine this very important principle. The strategies that led us to this juncture are not being re-evaluated but simply intensified.

The reference to Japan is not reasonable as during their period of deleveraging they enjoyed the benefit of the other major economies being in a credit-expansionary phase and were able to absorb the trading surpluses produced by Japan. What really happens in Japan will only be seen, once the export volume collapses.

The rule of law intends to reward positive (for society as a whole) activity while punishing those that behave unethically. This is a MUST to avoid that capitalism functions are turning into some form of crony capitalism. Monetary as well as fiscal policies have therefore to consider these aspects as a matter of urgency to avoid the further deterioration of the spirit of fundamental values within our society.

“Isn’t it true that all countries NEED to borrow to cover deficits?”

Only if you assume a particular cause and effect.

The actual causality is that people are saving or wanting to save. The difference in the Eurozone is that they can do that saving in a completely different jurisdiction that shares a central bank with your jurisdication. Therefore the transaction can clear without requiring a willing exchange party going in the opposite direction.

The key understanding is that it is the private sector that is saving and is pushing money elsewhere.

To Min

I didn’t mean theoretically speaking.

I’m all for the government actually exercising its money-issuing power.

Bill says to use deficits to achieve full-employment.

Great.

Lerner says to just have the government spend the money into existence for that purpose.

Ignore borrowing.

Either Lerner’s direct spending or the $1T coin would become ‘permanent’ money; that is non-debt-based.

The issuance of the $1T coin needs to be tied to the government’s budgeting, therefore needing Congress to approve that action.

Might as well have the Congress recognize its power to issue ALL the money, like in the Kucinich Bill, and have the GUV issue ALL the money debt-free..

It seems to me that most people here want to solve the problem of too much debt with issuing more debt. This compares to the idea to heal an alcoholic with a bottle of Jack Daniels; certainly this alcoholic will feel much better for a while; until the final collapse.

The problem was created over the past 30 years by Central Banks that did not apply proper control over the banking system but went to its rescue whenever slight difficulties occurred. All the deregulation and/or self-regulation in a sector that requires a straight-jacket to ensure that no systemic risk will arise at a later stage.

The solutions are difficult as with the high levels of credit in the system, many mal-investments have shown up that need to be written off as the economic means to service and return the principle within a reasonable period of time have diminished. This in itself has little to do with the quantity of monetary units in the system.

If we do now offer more free money, it will mostly produce additional mal-investments that will be a burden to all of us in the future. We suddenly will not be able to avoid “hyperinflation” as people will lose trust in the currency. The path between hyperinflation and a deflation will become tighter and tighter until we slip down into one of the two. No policy will be able to avoid it if we do not face the facts and start to act like adults and recognise that there simply is no free lunch in the long term.

Linus Huber said: “It seems to me that most people here want to solve the problem of too much debt with issuing more debt.”

I guess you haven’t read my posts?

The solution to too much debt is not more debt.

The solution to too much lower and middle class debt owed to the rich is not more lower and middle class debt owed to the rich nor is it more gov’t debt owed to the rich.

Too much debt (both private AND gov’t) is a medium of exchange problem.

I’m of the opinion that an economy should have zero private debt and zero gov’t debt. I’m not in favor of a gold standard. I’m not in favor of price deflation.

Hi

I have been reading along for a while and trying to get my head around MMT. And I agree that its hard to get a little bit wet in this waters of MMT.

I am sociologist (with a minor in economics so not a complete philistine) and the idea of hearing a 3 hour lecture on MMT directed at social workers sounds like it would be great. So did anyone record it? Do you have a way to get the outline up so I can get my head around it from a more familiar perspective?

Cheers

Shane

Cheers

Shane