The other day I was asked whether I was happy that the US President was…

Greek government should tell Troika it is prioritising a fall in unemployment

The UK Guardian reported (February 6, 2012) – Disbelief as Greek politicians delay deal on €130bn rescue package – that the German Ma’am is becoming “exasperated”. Such discomfort. Apparently, the fact that the Greek government has to engage in some discussions with other interests in Greece before signing up to further extremely damaging cuts is upsetting the German leader. She claimed that “Time is of the essence. A lot is at stake for the entire eurozone”. She is probably right. The quicker Greece cuts further the faster its exit from the Eurozone will be. But Merkel’s discomfort is nothing compared to what the Greek population is feeling at present. The Hellenic Statistical Authority or EL.STAT reported that the October 2011 unemployment rate in Greece was 18.2 per cent compared to 13.5 per cent in October 2010 and 17.5 per cent in September 2011. It will continue to rise as long as the government buys the Troika-line and imposes worse austerity. But it seems that the Greek government has become totally obsessed with fiscal ratios – that is, totally neo-liberal-centric – and is losing focus on a human tragedy that they are causing. The Greek government should tell the Troika it is prioritising a fall in its unemployment rate – like it or lump it!

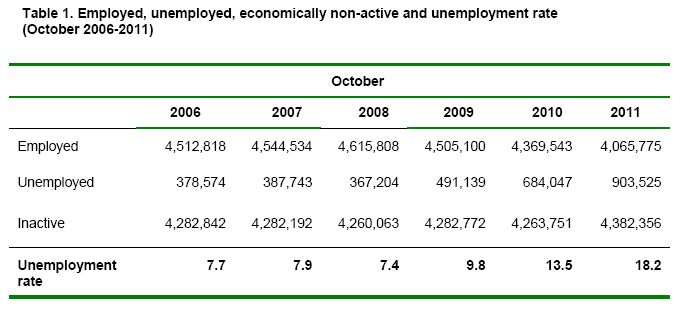

The following Table is taken from the latest EL.STAT Labour Force publication (October 2011) – Table 1 and provides a comparison of the major labour force aggregates as at October from 2006 to 2011.

Some simple arithmetic reveals that the Greek economy has lost (in net terms) around 447 thousand jobs (a 10 per cent decline) since 2006 while official unemployment has risen by 138 per cent.

If you take into account the drop in participation (implied) by the rise in the Inactive component of the working age population then you can compute that an addition 99,514 are hidden unemployed – discouraged from active participation by the lack of jobs growth.

If you add that into the official unemployed (and correct the labour force accordingly) then the implied broader unemployment rate in October 2011 was 19.8 per cent.

The addition of underemployed workers would make this situation even worse.

EL.STAT also reports that in 2006 the unemployment rate for the 15-24 years old cohort was 22.6 per cent and for 25-34 year olds it was 10.7 per cent. By October 2011, these rates had risen to 45.5 per cent and 25.3 per cent, respectively.

That is the future of the nation lying idle.

But the political leaders (alleged Socialists nonetheless) who have overseen this tragic decline had their minds on other things or so it seems.

There has been an unfolding story in Greece over the last several months (thanks Vassilis) about how Eurostat and officials in EL.STAT under the influence of the senior government politicians have contrived to overstate the 2009 budget deficit figure so they could more easily impose the harsh austerity program demanded by the Troika (EU, ECB and the IMF) on its population. A program that has been behind the rapid deterioration in the labour market.

In September 2011, the English-language Greek newspaper Ekathimerini ran a story (September 19, 2011) – Prosecutor to probe ex-statisticians’ claims – which reported that an allegation had been made “by a former employee of the Hellenic Statistical Authority (ELSTAT)” that “Greece’s deficit for 2009 was artificially inflated so the country could qualify for a bailout”.

The Greek budget deficit was revised in 2009 budget from 13.6 per cent to 15.4 percent of GDP in November 2010 which changed the dynamic of the Euro crisis. The revision accelerated moves by the EU to provide a bailout and the ECB to insulate the Greek government from the private bond markets.

The allegations that the revisions were flawed were made by Zoe Georganta who is a Professor of Applied Econometrics and Productivity, at the University of Macedonia in Greece.

A similar report – Prosecutor orders preliminary probe into charges of artificial inflation of 2009 deficit (September 19, 2011) – said that the entire El.STAT management board (excluding the Chairman) but “but including Georganta, was ordered to resign by Finance Minister Evangelos Venizelos in a surprise decision on Thursday”. It appears that this order came before Georganta made the allegations.

Zoe Georganta claimed that:

Elstat intentionally, and after being pressured by Eurostat, inflated the 2009 revised deficit from roughly 12-13 percent to 15.4 percent … in order to justify the adoption of more and tougher fiscal measures in Greece … the upward revision was made possible by including expenditures from public utilities in the general government spending … This method is in conflict with the Eurostat practices … The 2009 deficit was artificially inflated to show that the country had the biggest fiscal shortfall in all of Europe, even higher than Ireland’s which was 14 percent.

Her allegations were supported by the former EL.STAT vice-president, who himself is “facing felony charges for violation of personal data protection”.

The Financial Prosecuter didn’t waste time and on September 27, 2011 a further story – Former EL.STAT board member testifies in 2009 deficit furor – said that:

Zoe Georganta … testified for six hours before two prosecutors within the framework of an investigation into allegations that Greece’s state deficit for 2009 was intentionally inflated …

You can read more about this HERE.

The trail of the story continued on November 28, 2011 when this article – Statistics chief to testify in criminal probe – reported that the EL.STAT chief would testify before the Hellenic Supreme Court of Civil and Penal Law – the famed “Areiospagos” = which is the modern equivalent of the ancient Areopagus, the “Rock of Ares” overlooking the Acropolis.

The EL.STAT boss (a former IMF official) “denied any wrongdoing” and said that the matter was:

… an unprecedented case of statisticians being investigated for producing figures under EU regulations … Any attempt to manage statistics in the national interest is a recipe for disaster … These allegations are very serious … We have followed EU regulations. The statistics we have been accused of ‘cooking’ are the ones that did not receive any reservations from Eurostat.

This particular Report extended Georganta’s claims to say that the “the inclusion of a number of utilities under general government data inflated the deficit and that this was done under German pressure to justify harsh austerity measures”.

More recently (January 22, 2012) this report – Cracks in Pasok, government – says that the financial enquiry has now been referred to the Greek Parliament “to investigate possible criminal responsibility of George Papandreou and Yiorgos Papakonstantinou”. That is, the former PM and Finance Minister.

This referral is in the context of the current negotiations that are under way in Athens to stitch up even more fiscal contraction which will plunge Greece further into recession.

This January 2010 document – Report on Greek government deficit and debt statistics – provided a comprehensive account of the issue.

On November 10, 2009, Economic and Financial Affairs Council (ECOFIN) asked Eurostat to investigate the “renewed problems in the Greek fiscal statistics”.

The October 2 and 21, 2009 the “the Greek authorities transmitted two different sets of complete Excessive Deficit Procedure (EDP) notification tables to Eurostat” which effectively changed GDP and budget deficit data and Eurostat noted that:

Revisions of this magnitude in the estimated past government deficit ratios have been extremely rare in other EU Member States, but have taken place for Greece on several occasions. The most recent revisions are an illustration of the lack of quality of the Greek fiscal statistics (and of macroeconomic statistics in general) and show that the progress in the compilation of fiscal statistics in Greece, and the intense scrutiny of the Greek fiscal data by Eurostat since 2004 (including 10 EDP visits and 5 reservations on the notified data), have not sufficed to bring the quality of Greek fiscal data to the level reached by other EU Member States.

Eurostat firmly blamed “methodological weaknesses and unsatisfactory technical procedures” in relevant offices (including the Greek Statistical Institute) and “inappropriate governance” including within the Ministry of Finance.

Phrases like “Severe irregularities” – “non-respect of accounting rules” – “Poor cooperation” – “non-transparent or improperly documented bookkeeping” – etc were used by Eurostat to describe the situation.

Apparently, the revisions that were made to Greek government deficit and debt figures in April 2009 to October 2009 were “innappropriate” but Eurostat said they were based “on the knowledge available at the time and took place after the Greek authorities, under advice from Eurostat” had made the changes.

The major items of contention was how to account for revenue and expenditure in the public hospital system in Greece. There were also issues relating to the “exclusion from revenue of written-off extra-budgetary accounts” which related to areas of government that were to be scrapped under the austerity measures.

The Greek government responded to the criticism in the Eurostat Report with a new law (3832/2010) which provided for the:

The establishment of the Hellenic Statistical Authority (ELSTAT) as an independent Authority subject to the control of the Greek Parliament.

This brought its statistical agency into line with accepted practices elsewhere in the advanced world.

The saga played out some more in the official data releases from Eurostat.

In Eurostat’s April 22, 2010 publication – Provision of deficit and debt data for 2009 – First notification – they expressed “reservations” about the Greek data:

Reservations on reported data

Greece: Eurostat is expressing a reservation on the quality of the data reported by Greece, due to uncertainties on the surplus of social security funds for 2009, on the classification of some public entities and on the recording of off-market swaps. Following completion of the investigations that Eurostat is undertaking on these issues in cooperation with the Greek Statistical Authorities, this could lead to a revision for the year 2009 of the order of 0.3 to 0.5 percentage points of GDP for the deficit and 5 to 7 percentage points of GDP for the debt.

The footnote (5) to this “reservation” said “The term “reservations” is defined in article 15 (1) of Council Regulation 479/2009. The Commission (Eurostat) expresses reservations when it has doubts on the quality of the reported data”.

The final “accepted” revisions to the Greek fiscal data were published in Eurostat’s (November 15, 2010) release – Provision of deficit and debt data for 2009 – Second notification.

In this document, Eurostat noted the following:

Reservations on reported data

Greece: Eurostat is lifting the reservation on Greek data expressed in its News Release 55/2010 of 22 April 2010. Eurostat and the Hellenic Statistical Authority have addressed all of the issues identified in the last reservation during a series of EDP methodological visits.

I cannot comment on the Greek legal system (for want of knowledge and specialist expertise). I also cannot be clear on some of the accounting documents that are only available in the Greek-language or so it seems.

But the documentation provided by Eurostat (referred to above) is comprehensible and that agency is first-class in applying best-practice techniques for data gathering and harmonisation.

There are no doubt significant issues in Greece that the government is keen to suppress. This report from December 31, 2011 – Prosecutors’ resignation spurs political storm – documents “the resignation of two financial crime prosecutors who cited state interference with their high-profile investigations”.

But all this is a distraction from the main issue. Why is the Greek polity so willing to bow to the wishes of Merkozy (mostly the “Mer”) and inflict harsh economic measures on their people?

More recently (January 21, 2012) this article – So, what is the real truth about the Greek catastrophe? – puts the budget revision scandal in a new perspective.

The Report asks “how accurate” are the stories that Greece systematically defrauded “Europe”:

… (by) forging its economic performance in order to enjoy the benefits of membership of a privileged club, at the expense of its partners and the euro.

They note that as the crisis unfolded the deficit forecasts and preliminary data releases for “the majority of European governments were inaccurate … for example … Britain had predicted a deficit of 8.2% that finally reached 11.4%, the Netherlands predicted a surplus of 1.2% that turned out to be a deficit of 5.4% and Portugal predicted a deficit of 3.9% that rose to 9.3%”.

Further, the IMF is continually providing nonsensical forecasts. Please read my blog – IMF – the height of hypocrisy but still wrong as usual – for more discussion on this point.

I noted in the blog that the IMF has a long history of providing overly optimistic growth forecasts at a time when it is bullying national governments to impose fiscal austerity. The opposite is also the case, their growth estimates that typically conservative when governments are introducing fiscal stimulus packages, which I put down to the use of models that deny the strength of fiscal policy (and the related multipliers).

That is the inherent bias of their macroeconomic modelling is to downplay the role of government deficits and give excessive weight to Ricardian type effects with respect to private sector spending.

The errors are systematically biased rather than randomly so.

So the Report asks why has Greece been singled out for scrutiny?:

… it was only Greece who was accused of falsifying its data and being unreliable. And that by its own government! One wonders what caused this sudden and precipitous self-criticism.

There is an interesting (recent) historical account of how the current Greek government came to power in 2009. The Socialists claimed at the time of its election that there was “money” and its draft budget for 2010 “included a whole set of allocations, such as wage and pension increases, public expenditure increases, a solidarity allowance and pledges for not imposing additional taxes”.

The deposed government (under Kostas Karamanlis) had (March 2009) “warned that the international crisis, and the country’s excessive debt, posed serious threats and made a futile effort to reach consensus on the basis of cutting expenditure and of restraint by parties and syndicates”.

He called an election so that the cuts could be owned by the new government as a mandate from the people. The Report says that the current government opposed the austerity strategy as a ploy to gain office. The newly-elected government had on several occasions opposed the proposed spending cuts says that “there should be increases in expenditure instead of cuts”.

The question the writer is interested in exploring is:

Why was Greece accused of forgery, corruption and all the rest by its own government?

The answer is that “despite being briefed by both Greek and foreign officials on the situation before elections, it had created expectations and it had given promises, on which it could not deliver”.

The problem was that in making the revisions – which I accept Eurostat’s explanation about as above – the newly-elected Greek government thought it was just consolidating its power and “put the blame on its predecessor and make any economic rebound seem more impressive”.

But that is where they came unstuck. The “socialist” government was infested with neo-liberal thinking and clearly were inveigled into accepting the Ricardian dream that fiscal austerity would cause a jump in private sector spending and a resumption of growth.

Then by announcing that the deficit was actually worse than previously thought, it was clear that to everyone (other than the neo-liberal ideologues) that the automatic stabilisers were alive and well and causing havoc in the Greek economy – as anyone who knows how the macroeconomy works predicted.

It may have escaped them that the fiscal austerity was causing their main goals to (in their language) worsen rather than improve. That was entirely predictable.

It shows that it was foolish to focus on these financial ratios (even for an EMU nation) rather than the real economy outcomes, which, incidentally drive these financial ratios.

And then, as the Report notes the government:

… failed to anticipate the impact the new figure, and her allegations, would have on world financial markets, their reaction, and the disaster it would provoke for Greece and the EU.

Conclusion

There is now a growing chorus (which I will discuss later in the week) calling for a growth strategy to replace the austerity program that is being inflicted on Greece and elsewhere in Europe.

That should be the main focus of the Greek government.

There is a national election in April for Greece and it is now clear that the opposition parties are trying to (as the UK Guardian puts its) “disassociate itself from reforms increasingly seen as counter-productive”.

Hopefully, the political process will yield an alternative path that defaults, eschews austerity and starts rebuilding the Greek economy. Any way ahead is painful now. Better to restore currency sovereignty than commit the nation to more or less permanent austerity.

That alternative will leave a significant portion (currently around 50 per cent) of Greek youth without any hope.

I am travelling the next few days and so there might be a guest blog tomorrow and perhaps even Thursday. Complex negotiations are proceeding (-:

That is enough for today!

Thank you Bill! Safe travels!

I read that one of the reasons that Greek finances were in trouble is tax evasion. I can’t argue with this apparent fact except to say that it begs some questions about the dynamics of the Greek economy and Greek finances that MMT might be particularly well equipped to answer. For example was Greece simply an economy with low taxes? In which case there’s a lot more that you’d need to say before showing that this was a cause of Greece’s current problems.

Any conclusion based on economic stats produced from an “officlal” source in regard to Greece should be disregarded.

Dear JimW, you wrote:

“I read that one of the reasons that Greek finances were in trouble is tax evasion. I can’t argue with this apparent fact except to say that it begs some questions about the dynamics of the Greek economy and Greek finances that MMT might be particularly well equipped to answer. For example was Greece simply an economy with low taxes? In which case there’s a lot more that you’d need to say before showing that this was a cause of Greece’s current problems.”

Greece’s top income-tax rate is 45% for individuals and 20% for corporations. (The corporate tax rate was actually lowered from 25%, in stages, starting a few years back.) In this, Greece is not, in any sense, much different from what goes on in the rest of Europe – or the Eurozone. But, even though there’s still some egg on my face after failing to spot the correct answer in Statement #3 of last Saturday’s Bill Mitchell Quiz, I will dare comment on what you ask.

Tax evasion has, indeed, been a very popular sport among Greeks in the last decades. This has provided the Greek population, in general, with a significant amount of “hidden money”. The research branch of the Greek Industrial Association, in a study published a few years ago, was estimating that the country’s “black economy” amounted to 40 percent of yearly GDP. In my opinion, this has helped alleviate, albeit temporarily, the squeeze on household income instigated by the recent austerity measures. On the other hand, a country, such as Greece, with more money going out of it than coming in, cannot avoid failling into a squeeze, if that country operates under a foreign currency and its fiscal authority is limited to collecting taxes. And the squeeze comes faster when that country tries to eliminate state deficits.

There are many more faults in the Greek economy, aside from tax evasion: Endemic corruption in the civil service; a very extensive bureaucracy; a thick jumble of laws, often contradictory; significant impunity for lawbreakers of any kind, due to the inefficiency of law enforcement agencies and the huge backlog in court cases; etc.

But is there’s one lessaon that MMT imparts (or should impart) on any analyst of the “Greek Crisis” is that these illnesses cannot, by themselves, be the cause of the debt crisis – but, rather, its accelerators. In other words, Greece is, simply, the first Eurozone member to cry “Uncle” – unfortunately. (And I’m saying “unfortunately” because if on the dock had been instead one of the major economic powers of the Eurozone, the Euro chiefs would have most probably been forced to deal with the issue in depth and without the “punitive” approach now adopted towards a peripheral economy.)

As things stand, Euro chiefs disparage and isolate the Greek Crisis, presenting as its causes Greece’s chronic social problems, such as the ones mentioned above, in addition to a lot of shameful and unjust stereotyping (“Greeks are lazy”; “Greeks are cheats”; etc.)

Cheers,

Vassilis Serafimakis

david morris wrote:

“Any conclusion based on economic stats produced from an “officlal” source in regard to Greece should be disregarded.”

Actually, in the past few weeks, we have learned that, if anything, the Greek government has most probably been exaggerating the deficit, with the fantastic notion that, this way, the austerity measures would have been more palatable to the Greek population.

Whatever kind of “creative accounting” the Greek authorities had been engaged in, in order to enter the Eurozone in the early 2000s (like a man using a fake ticket to enter a theatre full of dynamite), is in the past. The “creative accounting”, if anything, continues on the Employment data, whereby Greek authorities, like most western advanced economies, under-report the extent of unemployment in most strata of the population. I would dare say that Greece must actually be European champions in the 17-25 age bracket – but we’re too modest to claim the title.

Cheers,

Vassilis Serafimakis

Dear Vassilis,

Similar studies have been made in Portugal and even though they didn’t reach the same numbers, I trust the methodology to be the same – basically they use the data of physical currency circulating to make those estimates. That means that a society with a tradition in holding and using more physical currency (such as the Portuguese), tendency that is aggravated with the distrust in the banking sector, will produce bigger estimates for tax evasion and parallel economy.

Dear Talvez…, I have no doubt that the iMF and EU wizards have been including the 40 percent “hidden income” figure to their calculations of how the austerity measures would hit Greeks. If you increased the denominator, the cuts seem smaller. I have no doubt either that the Greek government’s “negotiators” were agreeing to such calculations.

@Vassilis

I’m just saying the 40% figure for tax evasion may be well superior to the real numbers of parallel economy.