I am late today because I am writing this in London after travelling the last…

A tale of two labour markets

The laboratories are multiplying. We are in an interesting period – I say that in an intellectual sense only – where stark policy decisions have been taken based on certain theoretical economic claims and regular data is arriving which allows us to assess the viability of those claims. So as a researcher it is interesting. As a person I don’t find it interesting that governments are prepared to gamble with peoples’ lives in a self-serving way to appease the elites that fund them. For many years we have had Japan as an Modern Monetary Theory (MMT) laboratory. I gave a talk here in Maastricht yesterday and asked how any mainstream economic theory could explain Japan over the last two decades or so. By any standards if the mainstream macroeconomic theories were of any value then Japan should have very high interest rates and accelerating inflation and the government should have gone broke. It hasn’t and that tells you the value of mainstream theory. Now we have various fiscal austerity experiments being undertaken and the data is coming in daily to tell us that the claims made about the certainty of a “fiscal contraction expansion” are spurious. The most recent British labour force data released this week provides a very interesting laboratory terrain. Two geographic regions within the same nation, two governments (of different status) and two very different economic policy approaches. Result: one side of the border the labour market deteriorates, the other side it improves. So this blog is a tale of those two labour markets – one south of a border the other north. The data provides further evidence that fiscal austerity damages economic prosperity.

While the Murdoch boys don’t seem to be able to escape the scandal their media empire created through the criminal behaviour of their organisation, the Torygraph (aka The Daily Telegraph) continues to define journalistic standards – the standards that require the publication to mislead, lie, and generally make stuff up. It has the largest circulation in the UK of any newspaper. So it is hardly a localised publication.

This article (October 25, 2006) – Strange days at the Daily Telegraph – examines the links between the Daily Telegraph and the Conservative Party.

Now, if I didn’t keep abreast with data developments and the various research analyses available then imagine what I would have concluded had I opened the Daily Telegraph on Wednesday (September 14, 2011) and read this article – Alex Salmond abandons ‘absurd’ SNP economic strategy.

The SNP is a centre-left, social democratic party that won the 2011 Scottish Parliamentary election by a landslide and “became the first party to form a majority government in the Scottish Parliament since its resumption in 1999”. It is also vehemently pushing for Scottish independence.

Just the headline of the Telegraph article biases the reader into thinking that the Scottish National Party economic approach is nonsensical – without foundation – and has been found wanting and so has been abandoned. The words – absurd, forced, abandon – all connote failure.

Reading beyond the bias, all the story really is about is that given the failure of the UK economy to sustain growth in the face of harsh fiscal austerity, the SNP have updated their economic strategy which was released in 2007 before the crisis. The new strategy is more modest and defines new industrial strategies (green economic development). My reading of both documents (the initial strategy and the updated one) is that: (a) the first strategy was caught up in the credit-binged growth rhetoric – using Ireland and Iceland as models for small economies; and (b) the second one is a reality check given the collapse of the global economy and the imposition of fiscal austerity by the British government.

But beyond the sheer “absurdity” of the article, I thought its timing was interesting.

It came out attacking the SNP on the same day that the UK Office of National Statistics released the latest labour force data (September 14, 2011) – a data release that is of extreme embarrassment to the Conservative government in Whitehall.

The National Labour Force release provides an aggregate picture while the Regional data release allows you to dig into the labour market outcomes below the national level.

As an aside, the ONS has improved their data portal dramatically and while still not on the par of other national statistical agencies it is now much more research-friendly and data is more available and easier to access. Some things get better in Britain.

For the national economy, the ONS reports that:

The number of people in employment aged 16 and over decreased by 69,000 on the quarter … The number of men in employment fell by 71,000 on the quarter … with falls in employment for both full-time workers (down 32,000 on the quarter) and part-time workers (down 39,000) on the quarter. There was a small increase of 2,000 in the number of women in employment … The number of people employed in the public sector fell by 111,000 between March and June 2011 … This is the largest fall in public sector employment since comparable quarterly records began in 1999. In June 2011 the public sector accounted for 20.7 per cent of all people in employment, the lowest percentage since September 2008.

The other point to note is that real wages continued to decline and labour productivity slumped. All signs of a failing economy. All the major indicators from the Labour Force data for the national economy are consistently bad – and all consistently telling us that the Government’s strategy is damaging the economy.

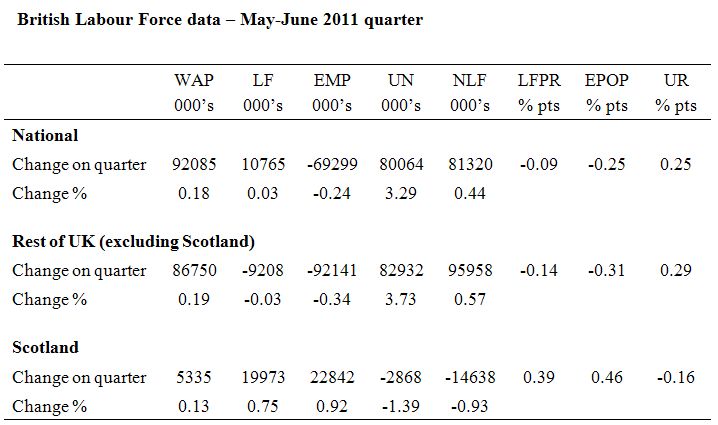

The following Table summarises the main labour force aggregates in terms of changes in the last quarter. This gives an view of where the labour market is heading.

The symbols are WAP = Working age population (aged 16 and over); LF = Labour Force; EMP = employment; UN = unemployment; NLF = Not in the Labour Force; LFPR = labour force participation rate and is 100*LF/WAP; EPOP = employment-population ratio and is100*EMP/WAP; and UR is the unemployment rate and is 100*UN/LF.

On all the indicators provided the rest of the British labour market (excluding Scotland) is deteriorating significantly. Not only is employment falling sharply but participation is also falling.

The falling participation attenuates the rise in unemployment resulting from the employment losses but really just means that disguised (hidden) unemployment is substituting for official unemployment – both forms of unemployment are commensurate.

So the British labour market (excluding Scotland) is suffering from the twin evils – contracting demand and contracting supply. The supply contracting is a result of the demand contraction because workers give up looking for jobs when vacancies shrink.

The situation in the Scottish labour market appears very different. They are experiencing in recent months the twin virtues – expanding demand for labour and expanding supply. So employment is growing very significantly (0.92 per cent in the May-June 2011 quarter) and participation is rising. In that case some of the employment growth is being absorbed by new labour force entrants and so unemployment doesn’t decline by as much as net employment rises.

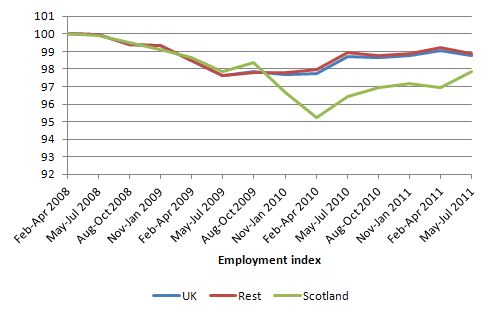

The following graph shows the evolution of employment from the February-April 2008 quarter, which was the peak national employment level in the previous cycle. The time series in indexed to 100 at that national peak and the sample runs to the May-July 2011 quarter (the latest data available).

It is clear that Scottish employment losses were more severe (in a percentage sense) than were experienced by the rest of the British economy although the national losses were large.

The graph also shows that in recent months (since February) the Scottish labour market is now generating employment growth while the rest of the UK labour market is contracting.

North of the border there is employment growth and south there is employment contraction.

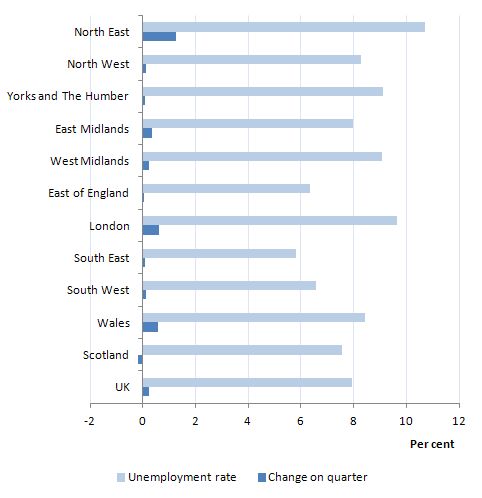

The following graph is taken from the Regional Labour Force data for September 2011 and it shows the unemployment rate and the change in the rate over the last quarter.

Only one of the regional labour markets defined in the ONS geography saw an improvement in the unemployment rate – Bonny Scotland. Everywhere else the situation deteriorated.

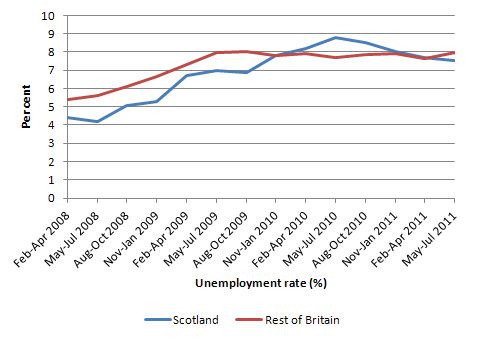

The final graph shows the evolution of the unemployment rate (%) since the peak employment quarter (February-April 2008) for Scotland and the rest of Britain. While the Scottish labour market was more harshly treated by the downturn it is clear that in recent quarters the fall in the unemployment rate has been sharp compared to the rest of Britain which is now seeing rising unemployment rates again after being stuck for several quarters in the high 7’s.

So what is going on?

If you believed the Conservative government it was all their doing. After the ONS released the data the Secretary of State for Scotland issued a statement summarising the data and then claimed:

This reduction in unemployment is welcome news, especially given the ongoing difficulties in the global economy. Despite the difficult finances that this government has inherited, we are taking the decisions that create jobs and opportunities in the long-term. Our macroeconomic policy includes major measures to boost growth, with the creation of the most competitive business tax system in the developed world as we cut corporation tax progressively to the lowest rate in the G7. In addition, the UK Government has boosted tax relief for start-up companies and seen lending to businesses broadly on target through Project Merlin. The UK’s credit rating has also been restored to its highest possible level. Many others agree with our approach, including the managing director of the IMF who endorsed the UK Government’s plan on fiscal consolidation last week and said the UK Government’s policy stance remains appropriate. Our plan has brought stability and confidence to the economy and abandoning this plan could undermine the recovery and further job creation.

Which is about as much cant as you will ever find in a political press release. It is almost obscene that the British government seeks to obsfucate to this degree what is happening.

The one thing missing from the Secretary of State for Scotland’s press release is a summary of what is happening south of the border – which as we have seen is exactly the opposite to the Scottish outcomes. If the fiscal austerity is so bountiful in terms of job creation, business incentives why is it that as soon as you cross the English-Scottish frontier from the north you move from an improving labour market to one that is in rapid deterioration?

Even the most cursory research provides the answer. The Scottish government is not imposing austerity on its economy – quite the opposite – it is using its fiscal capacity (which is equivalent to a state in a federal system) to stimulate aggregate demand.

The Scottish government’s Economic Recovery Plan – provides some guidance to what they have been doing to support public capital works programs and household services in the face of the cuts to public spending imposed on them by the UK government.

The newly-elected Scottish government has been at loggerheads with the Conservative UK government over fiscal austerity. In this Discussion Paper (June 2011) – Borrowing powers in the Scotland Bill – we read:

The UK Government has argued that the scale of the budget deficit limits the options for early implementation of capital borrowing powers for Scotland. In evidence to the Scotland Bill Committee, the Secretary of State for Scotland said: “In the short-term, however, coinciding with the spending review period that we happen to be in, and as we tackle the biggest deficit in post-war history or whatever it is, there will be particular constraints.”

The Scottish Government disagrees with this assessment, both in fact and on policy grounds. In policy terms there is a strong case for additional, immediate targeted economic stimulus through capital investment to strengthen recovery and expand the productive potential of the Scottish (and UK) economy.

While official Scottish documents also have neo-liberal overtones (“the need for fiscal consolidation” etc) there is no doubt that the Government has sought to maintain employment creation as a priority.

On May 8, 2011, the UK Independent carried this article – Cameron offers major concessions to Salmond – which recounted how:

Alex Salmond has won his first concession from David Cameron after his party’s historic election victory on Thursday, with a pledge that Scotland can begin borrowing hundreds of millions of pounds to fund public projects in future years. The Government has acceded to the Scottish National Party leader’s demands for immediate authority to borrow at least £300m annually from the Treasury to help boost Scotland’s economic recovery. Mr Salmond had been demanding the change – in the face of resistance from Westminster – during the passage of the Scotland Bill, which will devolve a number of economic powers from London to Edinburgh.

The point is that the Scottish government – which does not issue the currency – is behaving as a “state” government should – using borrowing to fund major capital projects to support jobs while private spending is weak. It understands that revenue growth will come with growth and that growth will only occur if public spending supports it.

In constrast to the opening media offering, the article from the UK Guardian (September 14, 2011) – Salmond urges Osborne to follow Holyrood’s lead – provides a totally different perspective on the Labour Force release.

The Guardian says:

Scotland’s first minister, Alex Salmond, has urged Conservative chancellor George Osborne to reverse his deep spending cuts after new employment figures showed that different Scottish policies on job creation were having a “powerful” effect … Salmond said the “very strong figures” were evidence that the Scottish government’s strategy of accelerating capital investment last year, improving access to finance for small and medium companies, and operating a no-compulsory-redundancy policy in the public sector had succeeded.

A number of policy measures taken by the SNP are supporting growth – “Its freeze on council tax since 2007, abolition of prescription charges and introduction of 0% interest rates for small firms had all helped bolster the recovery. The Scottish government has also pressed ahead with infrastructure spending such as extensions to the M74 and M80 motorways and new hospitals”.

While the figures for Scotland are on the surface good news, I wouldn’t want to give the impression that all is well in Bonny Scotland. First, the economic effects of their own infrastructure and related policy initiatives will be swamped by the fiscal cuts at the national level should the Tories persist with their plans to trash the economy.

Second, the Scottish government’s “decision to bring forward capital spending last year from this year’s Treasury grant to Scotland” allowed it to “accelerate investment” but will be at the expense of future spending. Fiscal stimulus is a flow and has to be maintained year-in-year-out if it is to produce sustained effects. You cannot conclude that a fiscal stimulus fails if it is withdrawn before the non-government spending gap is narrowed.

But the reality is that the Scottish government bought some time for itself and unless the national economy improves quickly the downsides of bringing the capital spending forward will be harsh.

Third, public sector jobs are being lost as the fiscal cuts impact.

Fourth, youth unemployment continued to rise in Scotland and is now at alarming proportions.

At any rate, what the Scottish data establishes is that fiscal austerity is damaging when private spending is too weak to fill the gap left by the public net spending cuts. Even in the face of increasing national cuts that are impacting on Scotland as well as other areas, the Scottish decisions to maintain public spending has delivered positive outcomes.

If it uses the borrowed funds wisely – that is, in an employment rich manner – then they will be able to resist the fiscal austerity further although they will not escape it given the relative size of the Scottish government’s spending capacity.

Conclusion

As a researcher, I look for information from data that provides ways in which distinctions between competing theoretical positions can be assessed. The latest UK Labour Force data doesn’t prove that MMT is “correct” nor that fiscal austerity is bad.

But it does help us eliminate spurious claims like those of the Secretary of State for Scotland who cannot explain why, if the national policies are working, the situation is different on one side of a border to the other.

A much more plausible story would exploit the fact that the border defines different government areas and that the behaviour of governments on each side of the border is different. There is no doubt that the Scottish government has been working at ways to attenuate, resist, whatever, the national austerity imposed on Britain by the Conservative government. There is no doubt it has sought to accelerate public spending as a means of stimulating employment.

That is an strategy that MMT would recommend. And then data comes out and demonstrates there are profound differences in performance in the labour markets on either side of the border. The data is thus consistent with the theory although I never say it proves anything. What I would say is that the geographically-disparate results are not consistent with the claims made by those who support fiscal austerity.

If I was the British Prime Minister I would just call a National TV Address – admit that I had been caught up in the ideological thrall of neo-liberalism and that I had seen the damage it was doing – and immediately announce a major public capital works program (fixing up some of the appalling infrastructure that you find in most British towns) and a major injection to public health and education and a Job Guarantee.

That would be leadership and would show he has learnt something from the latest Labour Force data.

Friday’s music segment

On the plane coming over last week I read Patti Smith’s latest book – Just Kids – which documents the early years that she spent in New York (late 60s onwards) and her very beautiful relationship with Robert Mapplethorpe (who became a controversial photographer). The memoir ends with his death from AIDS in 1989.

This New York Times Review is a sympathetic discussion of the book.

The book won the US National Book Award for the best non-fiction book last year (2010). I found the book to be magnificent in every sense. So over to Patti Smith with one of her classic songs.

It is from her 1975 Horses album and starts with the classic line “Jesus died for somebody’s sins but not mine”. The Album cover (shown in the video) was taken by Robert Mapplethorpe (and is number 26 on Rolling Stone Top 100 Album Covers.

The track is a medley with “In Excelsis Deo” followed by “Gloria”. In the book she tells us how that combination emerged – an outcome of the three-chord structure – E D A – that both songs share. John Cale produced the record. This was before the Clash, before the Sex Pistols, before punk per se.

Saturday Quiz

A special northern hemisphere version of the Saturday Quiz will appear sometime tomorrow. Please note all time references are in terms of Eastern Australian Standard Time.

Given I will be compiling the Quiz from the Land of Austerity it will be fitting that it is tough, mean, and totally dysfunctional. What is false will be claimed to be true – that sort of stuff.

That is enough for today!

Bill,

Great stuff as always. I did hear on Radio 4 today that Scotland also had implemented a policy of no forced layoffs in the public sector. The UK other than Scotland is shooting itself in the foot worse than anything I’ve seen, even in the US. It would be so nice if Cameron and Co. would or could just stand up and admit they were getting it wrong, but these are very ideologically stubborn people. To them it’s all about money….they think Britain doesn’t have any.

I’m not sure that what Scotland has done is all that clever. They’ve managed to get their hands on some money by whatever means, and they’ve spent it. That creates jobs, of course. If someone would like to give me a billion, I could create any number of jobs in my neck of the woods.

But that all begs the $64k question, namely what’s the cause of the UK’s 5% or so inflation? That is a question that’s got Neil Wilson puzzled and worried – see first comment after Bill’s 13th Sept post. And its got me puzzled as well. If that inflation is primarily down to temporary factors, like the effect of the 2008 devaluation of Sterling and the rise in world commodity prices, then there is no problem: Scotland’s policy can be replicated in England. But if the inflation is the beginnings of a wage price spiral then Scotland is in a sense sponging off England: Scotland is enjoying the advantages of profligate spending, while the rest of the UK pays the price in terms of excess inflation and excess unemployment.

Hi Billy, love your blog… everything you say makes perfect sense to me about neo liberalism and the results of what happens when governments inflict these kamikaze policies on the masses. you have explained cause & effect very comprehensibly. I would be very grateful to you if you could please write an article about what can the average person like me do to help bring about an end to such neo liberal policies & agendas ? I have the misfortune of living in Ireland where the so called troika boot is on everyones neck.

@ Ralph Musgrave

I don’t see how that follows. If Britain are experiencing a wage-price spiral — which, by the way, I don’t think they are, I think the inflation has to do with VAT rises, commodity prices and devaluation — with a high unemployment rate this doesn’t have anything to do with government spending per se.

The only possible cause would be British unions demanding higher wages in light of higher prices. This is occuring but to what extent it is influencing inflation is unclear. But if this is a wage-price spiral this is the root of the problem, not government spending. The problem, if it is real, would be institutional, not fiscal.

So, even if you’re right, there’s zero ‘sponging’ going on here. If you are correct the problem is your unions and not Scotland’s spending. In these circumstances you have two options: return output capacity to the economy through increased employment thereby stopping the wage-price spirals as unused output comes on line OR break the unions.

Ralph Musgrave says:

Friday, September 16, 2011 at 18:21

“But that all begs the $64k question, namely what’s the cause of the UK’s 5% or so inflation?”

According to J. R. Sargent, inflation in the UK is evidence that the ‘credit crunch’ undermined the ‘supply side’ of the UK economy and that the {limited} reflationary policies may have taken the UK economy past full employment output.

There’s absolutely no evidence of wage inflation in the UK, except amongst bankers and corporation executives. Wages are level, or falling, or hours are falling.

IIRC, there is some evidence that commodity price inflation has been caused by QE – money held in bonds as an investment has to be re-invested somewhere, and some of that has leaked into commodity speculation. I’ll try to find a link.

The UK inflation figure is mainly due to the VAT increase and this year’s energy price increases. Next year inflation will be significantly lower. There is certainly no wage – price spiral in the UK at the present time.

“money held in bonds as an investment has to be re-invested somewhere”

That’s looking at the horse from the wrong end. It is not the seller of the bond that is the driver. They would have sold the bond whether QE happened or not. The question is what did the buyer that was outbid by the QE money do.

I just can’t see somebody who wanted the absolute safety of a government bonds suddenly going out and buying oil futures.

The commodity speculation was IMHO due to the expectation of increased inflation that hasn’t happened (and won’t happen), and the increased borrowing was for speculation purposes only.

VAT hike was 2.5% at the beginning of the year. That explains most of the 4.5% inflation. Funny how government tasks it’s one arm, the central bank, to keeping price rises low and on the other hand it pushes them up by the action of it’s own. What do they want, really?

All public policy is both “social engineering” and political-economy experiment. “Social engineering” is a slightly dated term which was popular with religious and political right wings. These groups used it in a perjorative sense to attack any policy prescription which was not their own. Their policies were “natural”, “true” and “correct” but left-social policy was “unnatural” and thus “social engineering”.

To reiterate my point, ALL public policy is both “social engineering” and political-economy experiment. This being so, it appears to me that we (the people of the world) need to run a full MMT experiment. I have been thinking along these lines for some time and Bill’s post about Scotland has prompted me to post. My initial thoughts were that Australia should use the NT for an MMT experiment. A full fledged MMT experiment (properly designed) could be run with the Northern Territory as the test case. However, this might run into some of the problems that Scotland exemplifies; for example being a sub-national unit with a “state government” which cannot issue its own fiat currency and being open to charges of somehow sponging of the rest of the nation during the experiment.

The alternative then is to run a full MMT experiment in a nation state with that nation state’s full concurrence. I would suggest New Zealand would be the perfect candidate. (I am not being ironic here, I am being quite serious. I love NZ… except when the All Blacks beat the Wallabies.) A small nation state like New Zealand could be set up to run an indemnified full MMT experiment. By indemnified, I mean that insurance indemnities could be taken out by the NZ government and assisting governments to fully insure the NZ economy and people against economic catastrophe (highly unlikely IMO) if the experiment went wrong. The Chinese might be wise enough and far-seeing enough to take a major insurance postition to assist the NZ experiment. Australia should also take a position at least equal to the foreign aid assistance (several billions) it should have given to NZ (IMO) following the Christchurch earthquakes.

The experiment would have to be carefully designed in terms of MMT prescriptions, timelines and measures to ensure events like currency attacks and intentional acts of international financial sabotage did not compromise the experiment. (There would be many enemies who would want to engineer a failure of the experiment.)

So that’s my suggestion. Why not a fully internationally backed experiment to fully test MMT in NZ, say over ten years? With full indemnity insurance, New Zealanders would be guaranteed of a rescue package if the experiment failed. If the experiment succeeded it would be wonderful news for New Zealand and the world and a breakthrough for empirical economics.

In addition, the MMT lobby ought to work with the Greens in Australia. Attempting to work with even Labor would be hopeless. Labor are completely captured and suborned by corporate capital in general and mining capital in particular. The Greens are the only party which realistically recognises that environmental limits place limits on human economics. As these limits are fast approaching, the Greens will soon appear as the ONLY realistic party. The main pro-capitalist parties (Lib and ALP) will be soon be exposed as having totally fantastical endless growth policies which ignore the fact that a real sustainable economy is a sub-system of the biosphere depends on the real sustainable resource flows in that biosphere (governed by the laws of thermodynamics).

PZ,

It’s even more amusing than that. If you look at the BoE Balance Sheet you’ll find that QE is unravelling – bank reserves are falling week on week. 16% (£23bn) of the QE money has gone missing from the system over the last eighteen months.

MMT says that can only happen if somebody is draining those reserves. Yet the Debt Management Office is supposed to only cover the deficit with ‘matched funding’ and their accounts show that is exactly what they are doing.

Some of it is explained by the expansion in Notes and Coins. But the rest is hidden in the catch all ‘Other Liabilites’ pot on the BoE Balance Sheet. So what’s going on?

My theory is that the QE money is being steadily transferred back to the QE vehicle – Bank of England Asset Purchase Fund Facility Ltd. The coupons from all those Gilts are not being recycled back into the government’s spending system. I’ve asked the Bank of England for the Cash position of the company to confirm that.

So again HM Treasury is undoing the work of the Bank of England – handing out more corporate welfare than it needs to, even under its own stupid ‘funding’ rules, while continuing to fire public sector workers.

Neil,

Perhaps more govt debt is being issued to give the banks assets to leverage (not sure why).

As far as UK prices go companies are deleveraging even more than households are. Those that sell essentials like energy, food, retail banking etc do not compete very well (they tend to ‘co-operate’) and are exploiting households. If the govt likes capitalism so much, they should be looking in to this.

@Jason:

What you can do to change things long term is to push your local unions and try having them working to engage people in politics. Labour can only be freed by labour itself. Democracy has to be bottom-up. I would recommend applying extra-parliamentary pressure to parties. Social Democracy is nothing without a peoples movement and a teaspoon of sound populism. Parties are slow, stupid machines and will always be in the hands of capital until people have a mass movement and can force them to listen. It’s like a combination of the Chinese political attitude to fix social issues before they become political ones and our western parliamentary democracy. Social Democratic parties are hollow shells that imitate the right if there’s no movement to guide them.

Myself, i live in a rather small place, although autonomous with it’s own parliament. We’re about 30 000 people. Politics has become passivised and the Social Democrats here have moved to the right with guidance of their idiot leader. I am part of an independent youth organisation which was founded with two purposes: 1. Learn together and teach each other and 2. Take part in politics without engaging directly with the parliament. We’ve taken part in politics for about a year now and we have achieved quite a lot by just pushing. We’re invited to most debates and fora. It’s been easier than we thought it would be. What we’re trying to do is to make sure people voting for the Social Democratic Party do so because they trust the party will listen to them and never otherwise. We want to eliminate the voter-party democratic deficit. It’s working quite well thus far and people we know in the party are sensing a little bit of internal struggle. The hope is to get the leader replaced before next election. None of us aspire to have that position, we just want the party to be better disciplined by it’s voters.

There will always be sensible people in these parties, but they seldom have the courage to question and challenge the leadership and hierarchical structure. Once they feel their opinions have voter-support, they do.

Oh geez. I don’t know if that’s a good answer, but hopefully you get the message. Political parties will never cannot be disciplined passively by voters leaving them, but have to be so through the voters communicating directly with them.

Hi – I’m Scottish and support independence for Scotland – I state that to establish the political parameters that encompass what I am going to say.

While this article does describe what is going on on one level it fails to include the high level of subsidy that Scotland already gives the rest of the UK in a surplus tax balance of £1,000 per head more into the Treasury than out, according to Professor Hughes Hallet. Nor does this include UK Government money that is supposed to be Scotland’s under the Barnet formula but in fact never leaves the UK Treasury as it is reclaimed as Scotland’s share of running the UK. Currently the Secretary of State for Scotland is refusing to release Scotland’s share of the fossil fuel levy (£200 million) and the number two at the Treasury Danny Alexander claims that to release this sum would mean he would have to reduce Barnet consequentials by the same sum (which is palpable tripe).

You would think that as Scotland exports 25% of its electrical generation capacity to England and Northern Ireland that Scottish consumers would benefit. It actually turns out Scottish consumers are subsidising English consumption (ave unit price in Scotland 6.5p vs 5.5p in the SE of England) due to the ludicrous charging system imposed by the Westminster controlled National Grid.

Given that Scotland holds the bigger reserves of oil and gas than Bahrain you would also expect that fuel oil and petrol prices would be lower in Scotland. Wrong again. On average Scotland is paying 10p per gallon more for petrol than the SE of England even though over 33% is landed in Scotland at Grangemouth for processing in the petro-chemical complex there.

The biggest problem for Westminster is that a large chunk of its £1 Trillion debt is mortgaged against oil and gas sitting off the Scottish coast.

So the political impact of the SNP’s actions since 2007 is to increasingly invite the question, just what is Westminster for which has seen the figures now supporting Scotland leaving the Union Treaty rise from 23% in 2007 to a small majority in favour in May 2011 (40:38% + don’t know/ won’t say). Routinely a significant 60 to 70% of Scots wish a federated UK with less power held by Westminster.

In behind all the ‘bring forward’ of public contracts there has also been seen sizeable inward investment from overseas industry in Scotland’s world leading, oil production, offshore wind farm development and tidal power while overall Scotland is currently 3rd in the world when rating active patents vs GDP according to the UK CBI. The Scottish Government estimates it has attracted inward investment in excess of £1 billion in the last year alone – including £200 million investment by Mitsubishi in Scottish tidal power technology, Amazon has just invested £150 million on a new distribution and packaging centre bring 1000 jobs to Fife. This is not happening anywhere else in the UK, currently.

Thus we Scots can see what a Government that bats for us is achieving against a Westminster Government predicated on ensuring the survival of the ‘City of London’ and stating to the world at every turn that the Scots are too wee, too poor and too stupid to be independent.

We the sovereign people of Scotland know better, that is why there is a working SNP majority in the Scottish Parliament where ,no matter what Westminster likes to tell the world, under the 1689 Scottish Claim of Right and the 1707 Treaty of Union lies our sovereignty, as a representative democracy protected by Scotland’s independent Laws and constitutional practice for ‘all time’.

“The biggest problem for Westminster is that a large chunk of its £1 Trillion debt is mortgaged against oil and gas sitting off the Scottish coast.”

No it’s not. The debt is denominated in Sterling, therefore it is not ‘real resources, blood, sweat and tears’ debt, but merely an accounting fiction. Read the documents here to see why.

So you need another reason.

“Scottish Government estimates it has attracted inward investment in excess of £1 billion in the last year alone – including £200 million investment by Mitsubishi in Scottish tidal power technology, Amazon has just invested £150 million on a new distribution and packaging centre bring 1000 jobs to Fife.”

Which means that outward profit extraction will be to the same amount and more. Which means that you’re in the same boat of Ireland – large GDP, but small GNP. Nothing stays in the country.

Much better that the Scottish government secedes, creates its own currency (following Iceland, not Ireland), and then creates the jobs locally focussing on a domestic small business agenda rather than headline grabbing international businesses that just extract profits while underpaying the local labour force.

NW – not matter which way you spin the bottle – there is no “Union dividend” coming Scotland’s way – nor has there ever been and there is no argument to support Scotland’s remaining in this dominant menage

What you’re not being told by our woefully pliant UK main stream media and the BBC, is that the “UK” as you know it, is devoid of inspiration and lacks the wheels of industry to stop it going down the tubes.

It’s clear that Scotland cannot afford to stay part of it, even if it did not also feel, to most Scots that the time was fast approaching to become responsible for our own future and who would stop a country that wanted to take the fullest responsibility for its own revenue and expenditure.

If truth be told, England would probably fare much better by dissolution of the Union. The whole UK political machine is so democratically corrupt a new system, so radically needed would be forced out. Life in Great Britain is changing and it’s irrevocable.

So the bottle may spin – but the die is cast for Scotland’s future. It looks bright and we will wish for England and Wales and Northern Ireland to have nothing but the best for their futures, both as friends and good neighbours.