I started my undergraduate studies in economics in the late 1970s after starting out as…

The value of government

I often get asked by people I have consulted for to write justifications for their existence (that is, the organisation and its charter). Sometimes it is a trade union, another times a government department and on. In each case you have to think out what the essential interactions are between the organisation in question and the rest of the world and articulate some sense of value to those interactions. These calibrations may not necessarily be quantitative but often it is useful if they are because bean-counting economists around the place who read the analysis I provide in this part of my professional life rarely think more broadly and spare the thought – can probably not even spell “social benefit” much less conceive of it. In the current economic crisis the only problems that should be receiving daily scrutiny in the debate are unemployment, real income loss, and the resulting poverty. We rarely see those items headlined. Instead, we are barraged with a virulent confection of bile about things that do not matter – public deficit to GDP ratios etc. And this anti-government campaign is succeeding in part because people believe the rhetoric that government is wasteful and doesn’t do anything. Well I am here to tell you ….

For my whole academic career I have advocated that the government assume the responsibility for providing work to anyone who is unable to find work in the private sector. I have advocated large-scale public works programs to accomplish these ends in developing countries and during major economic downturns. More recently, in my consulting capacity I have been involved in such programs and provided advice to governments about the best way to organise and implement them. I have seen such programs reduce poverty, provide a buffer against major demand collapse and create public goods which subsequently have provided billions of dollars worth of value adding to the private sector.

I am familiar with many such projects that were implemented to alleviate the hardship and penury brought on by unemployment during the Great Depression in the 1930s in various nations. Many of these projects are still delivering value to communities and private business interests some 80 years later.

There are many examples of such public infrastructure which is delivering long-term benefits to current and future generations. Just take a drive down the Great Ocean Road in my home state of Victoria (I live in NSW now) which carved out of the cliff face during the 1930s as a public works job creation project! This is now a multi-million dollar tourist resource that the private sector leverages profits from every day and day-trippers and holiday makers enjoy immensely. The private sector would never have constructed such a road!

I hope all the deficit terrorists out there who are contemplating a holiday to Victoria, Australia take an ethical stance and avoid taking the beautiful journey down the 60 odd kilometres of Ocean Road and stay away. After all – government activity is valueless.

Anyway, in my guise as a major advocate of public works programs and job creation schemes etc over many years and with a relatively high media profile in Australia – I am constantly being accused of suggesting worthless schemes – make-work, boondoggling and leaf-raking exercises that just encourage slothfulness and erode our freedoms etc. The discussion usually turns to accusations that I am advocating socialism and if the attack is particularly enthusiastic the C word enters the fray (which is not *unt but c*****ist). At that point I just say whatever!

Please read my blogs – Fiscal sustainability 101 – Part 2 – Boondoggling and leaf-raking … – for more discussion on this point.

As an aside to the C-word (it is Friday!), I recall a funny story explaining why the National Party in Australia changed its name from the Country Party. This is the rural party in Australia – which is conservative on social issues and preaches free markets but always has its hand out for public subsidies to agriculture. The former Labor Prime Minister Gough Whitlam made fun of them at the time saying they had to change the name because the then Country Party leader had developed a stutter and it was embarrassing to listen to him talk about his party!

Anyway, getting back on track, the question I often ask in these sort of situations is whether anyone knows of anyone ever who has gone into a shop and been asked prior to having their money accepted for the purchase whether they have a “real job” or whether they are a “wasteful public employee” or questions of that intent. I have never been asked.

Remember the golden rule of macroeconomics (which has been my theme this week): Spending equals income! Which has several other golden rules that follow: Income equals and generates spending. Spending generates employment to create the income. Employment makes people feel better and usually means their children will have a better life. Spending can be public and private. The macroeconomy doesn’t discriminate!

The other question that is worth asking is how much productivity does one have to produce to be a superior outcome to zero productivity? I am not suggesting public works or public job creation is even low productivity (that is a loaded term anyway) but the fact is that millions of people around the world right now are achieving zero productivity levels however you construct the concept or calibrate it.

So what exactly is this concept of waste that these idiots continually proffer as a defence against their preferred position that the government do nothing and leave these millions idle – slowing drifting into poverty and social alienation?

The point is that I have heard this over and over again yet been involved and know of many such schemes over many years where such employment is creative and valuable and provides long-lived benefits to both the general community and the private corporate sector.

Government spending more generally …

I have been reading the Co-Chairs Draft Proposal from the US National Commission on Fiscal Responsibility and Reform, which was released on Wednesday (November 11, 2010). If I was religious I would be saying Please god, help us all. As I am not, I will say it anyway!

I will provide more detailed analysis of the material they are starting to pump out in due course. But in the accompanying presentation, the opening slide caught my eye immediately. It said:

We have a patriotic duty to come together on a plan that will make America better off tomorrow than it is today

– America cannot be great if we go broke. Our economy will not grow and our country will not be able to compete without a plan to get this crushing debt burden off our back.

– Throughout our history, Americans have always been willing to sacrifice to make our nation stronger over the long haul. That’s the promise of America:to give our children and grandchildren a better life.

– American families have spent the past 2 years making tough choices in their own lives. They expect us to do the same. The American people are counting on us to put politics aside, pull together not pull apart, and agree on a plan to live within our means and make America strong for the long haul.

I recommend they redraft that slide prior to deleting the remaining 47 slides that follow. Perhaps something along these lines:

- We have a responsibility to come together on a plan that will make America better off tomorrow than it is today given how bad the state of the real economy is now and how weak the government fiscal response has been.

- America cannot be great if the private sector goes broke. Our economy will not grow and our country will not be able to compete without a plan to get this crushing private debt burden off our back. Given the government has no solvency risk (and cannot go broke) and that fiscal policy has the unique capacity to support spending and employment while the private sector restructures its balance sheet, it is our responsibility to recommend a further (jobs rich) fiscal stimulus.

- Throughout our history, Americans have always been willing to sacrifice to make our nation stronger over the long haul. That’s the promise of America: to give our children and grandchildren a better life. And if we succumb to the maniacal protests of the deficit terrorists and cut back net public spending now and drive millions more workers out of jobs then we will be guilty of crimes against our children and grandchildren.

- American families have spent the past 2 years facing tough choices in their own lives because the market system failed due to lax government regulation and dishonest and irresponsible entrepreneurial behaviour. Their situation has worsened because the government did not have the courage to provide enough fiscal support to ensure there was enough spending to support their their jobs. They have been lied to by the press, the conservatives and we have gone along with these lies – the buck stops with the President on this who had shamefully lied to the American people when he told them that the government had run out of money. The American people are now counting on us to stop lying and to face up to the basic macroeconomic rule that spending equals income. The American people know that they have live within their means but they know the government has no such financial constraint and should be spending so that they can be employed and save and that will make America strong for the long haul.

I think that might be better although PowerPoint would probably split the message onto two slides. But it is better to tell the truth on two slides than to lie on one.

On Slide 6 the heading is “Cut Spending We Simply Can’t Afford, Wherever We Find It”. Who is We? Answer: the private sector should never spend more than they can afford. That means they should only run sustainable debt burdens and probably not be in debt overall as a sector. But the US government can always afford to buy whatever there is for sale in US dollars on any given day.

A sovereign government like that in the US is never revenue constrained because it is the monopoly issuer of the currency. It is nonsensical to talk about the US government as if it is a budget-constrained household.

That doesn’t mean (all you goldies out there) that the US government should spend without discretion or control. It should only spend to ensure its socio-economic program to advance public purpose is being progressed and only in net amounts that ensure that nominal spending growth doesn’t outstrip the real capacity of the economy to absorb it with output increases. If the two aims are mutually inconsistent (that is, the implied size of government to deliver this program and the current size of the private sector overall add up to more than the real economy can support) then the government can either reduce its program ambitions (a political issue) or reduce the size of the private sector (via taxation increases etc). But none of these choices and decisions are financial in nature. They are mostly of a political nature.

And the hypocrisy is stunning

Meanwhile, the German moralists are going hard at it after the publication on November 7, 2010 of a story in the Athens-based Magazine – Proto Thema. For those who read Greek here is the original story.

The translation of the headline is broadly: “Sir, where did you get the Porsche?”

Even though I was brought up in the second-largest Greek speaking city in the world outside of Athens – that is, Melbourne, Victoria – I have to defer to my Greek-speaking friends for a perfect translation.

They tell me the story went like this:

Faced with one of the largest European affairs wasting resources, especially at European level, of more than 150-200 million, distinguished professors of major universities in the country appear to be the European Anti-Fraud Office (OLAF) and the Greek Justice.

Apparently, some well-known Greek university professors (mainly from the IT fields from two Athens institutions) took money from EU research programs and “suddenly came into possession of expensive properties and Porsche cars”.

European fraud investigators from OLAF performed surprise raids on their homes, their university offices and a known IT company and siezed computer HDDs.

The accusation is that these professors accepted EU research funding and published fake research studies and used invoices from suppliers in countries with tax havens to launder the funding into personal uses.

Apparently, the professors earn around 1,500 to 2,000 Euro per month but are now in the possession of expensive villas and cars and took luxurious holidays and didn’t spare the fine wine.

The outrage in Germany is clearly very strong given they think they bailed out Greece for billions this year. The German press has made a meal of the story.

My reaction: some people are dishonest. Dishonest people are in public and private life and always take advantage of lax regulations. The financial collapse was driven, in part, by cheats who relentlessly lobbied governments to free up markets (which means abandon the checks and balances on them) and then rorted the system for what they could.

If this story about the professors is true it just tells me that the EU rules surrounding research funding and the accountability for such funding is poorly designed and/or implemented.

It doesn’t tell me that public spending is intrinsically wasteful. It doesn’t tell me that fiscal austerity will improve anything. It doesn’t tell me that the Germans have a moral right to inflict widespread hardship on the Greek people because they are lazy, cheats and whatever else they can be called.

I have been a recipient of a substantial amount of public research funding over many years in Australia via the Australian Research Council. The ARC provide a highly competitive grant scheme and the grants deliver very high status to their recipients. Being successful in this regard has allowed me, in part, to build a research centre at the University. But it would be impossible for me to channel the funding into fine villas and cars even if I wanted to. Why? Answer: there are strict regulations and auditing!

Anyway, on the subject of German hypocrisy and the claims that export-led growth combined with fiscal austerity claims will improve things consider the following.

Take a look at this beauty! I am trying to appeal to all those militaristic types out here by calling this awful black thing beautiful – you know, penetrate a new market for the dissemination of Modern Monetary Theory (MMT) ideas. Note the flag!

In the accompanying description, the German magazine Der Spiegel says:

Modernste U-Boote mit Brennstoffzellentechnik: Trotz Finanzkrise haben etwa die Griechen insgesamt sechs Boote der Klasse 214 bei den deutschen Howaldtswerken (HDW) geordert, die zu ThyssenKrupp Marine Systems gehören.

Meaning? These state-of-the-art U-boats (submarines) are equipped with fuel cell technology : Despite the financial crisis, the Greeks have ordered a total of six boats of the Class 214 from the German company HDW, which is owned by ThyssenKrupp Marine Systems.

Get the picture? The Greek government which is being coerced by the Euro bosses (who are, in turn, being coerced by the Germans) and seriously cutting back their social spending are still buying very expensive arms from the Germans.

I sent the Treasurer in the Greek government an E-mail today urging their government to increase increase social spending by implementing (in the first instance) a Job Guarantee which would attenuate the collapse of private spending while they designed some other public initiatives to arrest their decline. I also said they should pull out of the Euro this weekend in the process. Moreover I recommended that at the same time they should immediately abandon all contracts to purchase military equipment from Germany and France and make peace with Turkey in the process!

But the general point is that Germany is looking better than Greece because it is exporting still while at the same time demanding the nations they export to cut government spending (but presumably not on goods that the Germans sell).

Some explanatory text from an article in :

Vor den Deutschen rangieren in der Rangliste der Waffenhändler nur noch die USA und Russland; hinter ihnen die von hiesigen Rüstungsmanagern beneideten Franzosen und Briten. Nach Berechnungen des anerkannten Stockholmer Friedensforschungsinstituts SIPRI lag der deutsche Weltmarktanteil zwischen 2005 und 2009 bei elf Prozent. Den wiederum größten Anteil an Kriegswaffen made in Germany erhielten demnach die Türkei (14 Prozent), Griechenland (13 Prozent) und Südafrika (zwölf Prozent). Im Jahr 2008 etwa erlaubte die Bundesregierung die Ausfuhr von Rüstungsgütern im Wert von fast sechs Milliarden Euro.

Translation: “Germany ranks third in the world behind the US and Russia in world sales of armaments. According to data available from the acknowledged Stockholm Peace Research Institute, the German share of the world market over 2005-2009 averaged eleven percent. The largest buyers of military equipment made in Germany were Turkey (14 percent of total sales), Greece (13 percent) and South Africa (twelve percent). In 2008, the federal government allowed military equipment worth almost six billion euros to be exported”.

If you read the SIPRI Yearbook 2010, which carries the subtitle Armaments, Disarmament and International Security you will stumble on the following Table.

So the two big nations in Europe – France and Germany – have been pushing this stuff onto Greece like there will be no tomorrow while at the same time accusing them of over-spending and public waste.

The Greek people should revolt and the German and French citizens should join them in sympathy. This ruling-class hypocrisy is bringing them all down to their knees.

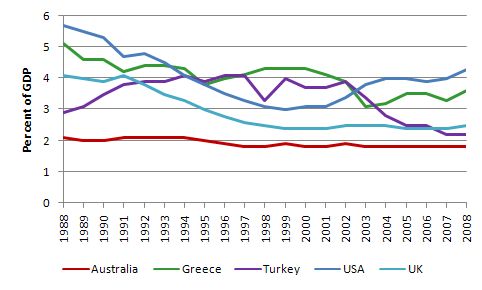

Excellent data on military expenditure is available from the Stockholm International Peace Research Institute. The following graph shows military expenditure from 1988 to 2008 as a percent of GDP for selected countries. Message for Greece – Turkey is disarming!

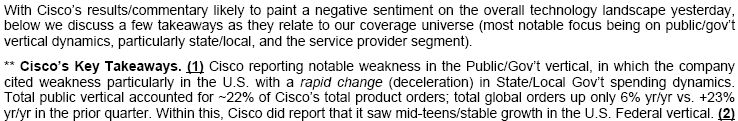

The theme broadened for me today though. I was sent the latest specialist Enterprise Hardware/Software & Hard Disk Drives sector financial briefing this morning (thanks Marshall) from a leading financial information company in this field. The briefing carried the heading – Cisco Fall-Out: Public & SP Vertical Weakness a Focus – and the relevant extract follows (if you can translate the esoteric language!):

I am from a profession that hides behind jargon to ensure that our messages are garbled. It is a control mechanism which allows my pompous colleagues to sound authoritative when in fact all they are pumping out is drivel. What they say is dangerous, but drivel nonetheless.

You can get more detail from Cisco’s 2010 Annual Report

But if you cut through all this financial talk the message is very clear. Here is a large private company that employs tens of thousands of people – currently employing 72,600 people (Source).

Bloomberg reported on Cisco’s poor figures with an extraordinary headline – Cisco Shortfall Shows Risks in Government Spending Cuts.

Everybody repeat that headline a few times in between repeating the mantra for the week – spending equals income.

The Bloomberg report says that:

Disappointing sales and profit forecasts from Cisco Systems Inc. show cutbacks in government spending that pose risks for companies that rely on the sector for growth.

Governments in Europe, Japan and some U.S. states reduced orders as their budgets came under pressure … State government orders fell 48 percent in the last quarter from the previous period …

The challenges for Cisco, which gets about 22 percent of its business from the public sector, may signal broader risks for businesses that depend on government spending. Companies in technology, construction and health care draw revenue from state and local governments, which reduced their spending in the third quarter and cut into U.S. economic growth.

Spending equals income. The macroeconomic system does not distinguish between public or private spending. A $ spent is a $ of income generated and a part of a job (whether in the public or private sector) supported.

The Bloomberg report couldn’t be clearer saying that “cutbacks at the state and local level are starting to weigh on companies doing business with those governments. The slowdown in municipal and state expenditures is putting a bigger burden on private industries and consumers to spend at a pace that maintains the economic recovery”.

Spending equals income. Income follows output which generates employment. If the private sector will not spend then the government has to fill the gap. If not, profitable private companies who would otherwise be in good shape start to struggle. They lay off workers and the loss of income that results reverberates throughout the rest of the economy.

Please read my blog – Spending multipliers – for more discussion on this point.

So if you cannot get your head around the value of public employment schemes (but keep trying) it should be much easier to understand Cisco’s dilemma. The public cutbacks are undermining their markets. The lost spending is reducing their income. The reduced income will reduce their employment levels. The workers who lose their jobs will stop spending … and then …

Get your heads around that!

Cutting government spending will reduce the tax burden

In the current debate, the proponents of fiscal austerity keep wheeling out the Ricardian Equivalence line which I have written about a lot in this blog and in my academic work. Briefly, the mainstream macroeconomists claim that the reason that the private sector is not spending at present is because they are expecting higher taxes in the future because they expect the budget deficits will have to be paid back sometime and so they are saving up to pay those tax bills.

The reality is that there are not a host of Ricardian consumers and firms just waiting to spend up big as they perceive their “future tax burdens” will be reduced by the austerity packages. That is one of the biggest hoaxes to emerge from mainstream macroeconomics. It is a bald-faced lie and does not withstand empirical scrutiny. They just think if they keep repeating the same thing repeatedly then eventually it becomes true. It will never be true.

Please read my blogs – Pushing the fantasy barrow and Fiscal austerity – the newest fallacy of composition – for more discussion on this point.

But for Cisco workers and all the other public and private sector workers who depend on government contracts etc for their livelihood and the other workers who, in turn, depend on the spending of this first group of workers for their employment, it is completely true that fiscal austerity will reduce their tax burdens.

You don’t have to pay tax if you don’t have a job!

Conclusion

I have run out of blog time today but the message should be clear.

I hope you all continue to spread it so that it may grow.

Saturday Quiz

The Saturday Quiz will be back sometime tomorrow – even harder than last week!

That is enough for today!

The other day I watched a video of Ben Bernanke giving a talk at a university in Florida. At the very beginning he explained how the banks took in savings and used them as reserves to make loans. Thanks to this and similar blogs I was able to understand that he was either disingenuous or ignorant of how the system worked. But, if the Fed chairman talks that way, then it is no wonder that the rest of the political elite is so out of touch with economics. I’m not an important person and the people around me won’t listen to my views about much of anything, so what I learn won’t help this country. But, I do appreciate this blog because it has helped me understand a lot about economics. The only problem I have is watching the experts on TV that keep calling for deficit reduction. I have gone to some of the commentators web sites and asked them to start reading this and similar blogs, but I can’t see that it has done any good.

Golden ??? Or should it be worded “Fiat Rule” ?

Dear Ramanan (at 2010/11/12 at 18:15)

Golden is just fine!

By the way we are still waiting for you to present case studies of actual countries running budget deficits who have no public borrowing in foreign currencies and who experienced a catastrophic collapse of their floating currency along the lines you assert will always follow. It has been some weeks now! Remember that Iceland, which is the only example you have tried to offer to date, fails (dismally) to support your assertions.

best wishes

bill

Dear Bill,

Yes I will sometime.

But as I said earlier the point is that nations go into austerity faced by constraints imposed due to external debt. I did not at all mean a catastrophic fall in currency. Its so easy to miss what I said – the situation which you present generally under the excuse “debt ratios are meaningless” will not happen without going through a currency collapse is what I meant. Its easy to say “Ramanan says currency will collapse” and ending the discussion there.

As for cases with governments having external debt in foreign currency – do ask how they went into the situation. Your logic seems to be defending a theory saying that “there can be no accidents” when a case is presented by saying “the person who was driving was drunk”.

The comments I have written at many places are to highlight the fact that fiscal policy can’t do the job unless the external sector allows it to!

Doing some minor study on Australia – will let you know when you write something up about the external debt. Search RBA for import/export currency invoice data! And correspondent banking transactions involved when imports are made. Apart from the US, most nations do not seem to have a choice about the currency. And as for the United States – Tim Geithner has clearly seen something there and is negotiating hard to achieve something about trade deficits!

Bill, always a pleasure to read you bashing Germany. In the meantime I came across a posting from Robert Reich, the former secretary of labor. It’s titled Why We Should Beware Budget-Deficit Mania Unfortunately it contains a familiar line:

I sent him a short e-mail explaining that such metaphors are not really helpful and erroneous. With friends like that who needs an enemy? No wonder the US public subscribes to an analogue metaphor “if families must tighten the belt so must government”.

It’s unbelievable how many references to the budget deficit we hear everyday on television news and in the daily rags. It’s become the new political correctness. Pompous newsreaders have a special derogatory tone of voice they reserve for the term.

We have to wait until QE is a proven damp squib. Without that distraction it might becomes more obvious that spending cuts (in the UK) cause demand to collapse and the economy to contract. Maybe a few more people can add 1 + 1 to make 2. It doesn’t help with the idiot talking heads on CNBC shouting “printing money” at every opportunity. Although I suspect the producers are consciously supporting the front running of major trading desks.

BTW. There was a request the other day to look at economies of other countries other in Asia (e.g. Indonesia). If you are looking other countries Bill. I request a peek at Argentina. I understand after the bond defaults they refuse to issue government bonds. If the sky is not falling around their ears without Government borrowing. I’d love to hear how the bond vigilantes try to explain that.

Bill,

“the government can either reduce its program ambitions (a political issue) or reduce the size of the private sector (via taxation increases etc).”

What’s your take on the alternative interpretation of this which is that government can increase the ‘demand’ for money by increasing interest rates (instead of using taxation – practically at all). I’m presuming there that means increased stocking of currency by the domestic and external sectors – so that those sectors increase their net-savings and balance out the spending.

There are a few people banging the monetary sovereignty drum out there who then go onto suggest that the Government should eliminate taxes, spend whatever is required and then use monetary policy to control inflation.

I see this as sort of ‘privatising’ the demand management function of taxation – delegating it to non-government sector currency hoarders instead.

Leaving aside the greater flexibility, distributional capabilities and your preference for fiscal policy, would such a system reach an equilibrium in practice in your view? Given that monetary policy has failed to cause currency destocking by reducing interest rates is it likely that there would be a point/set of circumstances in the opposite direction where no matter how high the interest rate was set you wouldn’t get the amount of net-saving required to control inflation.

I can see the attractions for using monetary policy. Taxation is a pejorative terms and politics has tried to hide tax increases recently instead of explain its functions. Yet people cheerfully accept interest rate adjustments on a month by month basis even though (in some cases) they take more money off them than tax rises would. So pragmatically the interest rate inflation control system is easier to adopt than the taxation one, because it is currently in place.

I’d be quite happy if the money spent with Cisco was used to fund Job Guarantee places for all the displaced engineers. Then they could spend their time improving the Free Software router O/S and I might be able to get a device without bugs in its IPv6 implementation that I can’t fix!

But enough of my micro economic problems…

Neil Wilson,” There are a few people banging the monetary sovereignty drum out there who then go onto suggest that the Government should eliminate taxes, spend whatever is required and then use monetary policy to control inflation.” –

-I can think of quite a lot of people who would just stop working and live off the interest from their savings if that were tried. That would impact real economic output just as badly as unemployment. Perhaps more so.

Bill, I have heard that after independence, India prevented famines by implementing road building programs whenever crop failures occurred. I have also marveled at the Icefield Parkway road in Canada that was built as a make-work program in the 1930s. BUT the road programs in the last few decades in Japan were just waste and pollution because they already have too many roads. In the UK we could electrify all the railways or improve house insulation or provide decent palliative care to every person who dies. The very hard job is deciding what is wise and what (like the bridges to nowhere in Japan) is just pollution for the hell of it. I really think that governments are not always best placed to make those judgments. I think that if a citizen’s dividend put money in everyone’s pockets then consumer power would direct the economy better than governments are able to -so long as asset price bubbles are prevented by an asset tax.

Dear Bill,

In regard to getting the message out there: unfortunately I am not an economist – and one thing this blog has taught me – people think that the devil is in the detail; so I wouldn’t ever attempt an explanation of MMT. I do try to understand what has happened on our planet in terms of a broad human approach to the economy, and write a sequence of statements as an outline in discussion. Would appreciate if anyone who does understand MMT properly could correct any straying from MMT logic below. Thanks in advance! Cheers …

jrbarch

_______________________________________________________________________________________________________________________

People

Values & Trust

– Human beings ‘value’ things;

– They do not like their values compromised;

– Sometimes they exchange things according to their values;

– Values are dynamic, and can never be frozen or represented objectively in time;

– When kids play they demonstrate this dynamic interaction of values – settlement can only be had when each party to an agreement is satisfied – each child is themselves the ‘in the moment value’;

– That is why people wish each other ‘peace’ first – then comes prosperity – they know relationships come first;

– People created ‘credit’ as a somewhat imperfect ‘store of value’ – the ‘credit’ of one person a ‘debit’ for another (shall now refer to these simply as credits);

– When a debt is extinguished, so too is the credit – they sum to zero;

– When human beings respect each other, values and credits are sustained – honesty trust, confidence, respect, right human relationships, are always the life breath of credits;

– The amount of goods and services that can be exchanged is limited only by the natural world, and human creativity productivity and relationships;

– Credits in these are represented by ‘real numbers’;

– In times gone by, credits recorded ongoing exchanges in goods and services equal to their outstanding value – these records were cleared regularly, simplifying the agreements between diverse parties;

– As a somewhat awkward convenience, people created ‘money’ as a physical token representing some of the credit extant.

‘Credit’ Credits

– The clearing function extended to a loan (‘credit numbers’ creation) function, distinct from the real numbers of the economy;

– As soon as credit numbers are written down, they are parasitic to the real numbers unless used to grow the real economy;

– They are especially parasitic if multiplied fraudulently, and used to extract from the real economy;

– Credit numbers creation requires perfect regulation.

Sovereign Government

– Credits can now only be recorded in terms of the real numbers provided by government;

– Credit numbers can be created by banks, and used to grow the real economy under the caveat above;

– Real numbers are provided by government equal to the outstanding values of exchanges in this growth;

– Real numbers can only be created and destroyed by government;

– Governments can create as many real numbers as there is capacity in the economy to sustain them;

– Therefore, subject to real constraints, there is no reason why any government cannot provide to the people full employment, and adequate food clothing shelter health education and infrastructure.

Ergo, there can never be a deficit of credits; only a deficit of humane values!

I have an idea for a you-tube video. I’ll start by saying:

“I’m really worried about the national debt. I mean, everybody in Washington talks about the national debt, but nobody does anything about it. I wish there was something that I, personally, could do to decrease it. Oh, wait! I know!”

Then I’ll take a dollar bill out of my pocket and light it on fire. I’ll let it burn up in my hand and then drop the smoldering end of it on a plate or something.

Then I’ll say:

“There! I feel much better now. I reduced the national debt by one dollar. If everybody in the world would just do the same thing with all of their dollars and dollar assets, the national debt would disappear! But wait a minute. If everybody did that, what would we use to buy food and pay our taxes? If there weren’t any dollars, wouldn’t somebody – the government – just have to print some more? And wouldn’t we start having a national debt all over again?

But if that’s the case, then that scary national debt clock in New York is really a national and international dollar-saving wealth clock. It’s counting the rate at which people and companies are choosing to save their wealth in dollars. It’s measuring the net intensity of the worldwide private-sector demand for U.S. dollars and Treasury securities. And all the government has to do to meet that demand is keep on spending at that same rate.

Of course, we aren’t exactly doing that right now. We meet a lot of the demand by issuing bonds. If we shifted gears a little, we could meet that same demand by giving every unemployed American a job and health care coverage. We could fix all of our roads, dams, bridges and airports, weatherize all of our homes and office buildings, install solar panels on every rooftop and fund green-energy research and development to amp up the fight against global warming.

Hmm. I’m starting to regret my decision to reduce the national debt. I mean, individuals like me have a role in all of this too. When I burned up that dollar bill, I reduced the effective aggregate demand in the economy by one dollar as well. If I had spent that dollar on an ice-cream cone instead, then not only would I have enjoyed an ice-cream cone, but the ice-cream vendor would have enjoyed an additional dollar of income. She probably would not have burned it up either. She probably would have re-spent it on something nice for herself and her family.

When you think about it, you realize that all of the money that we collectively earn in a year is equal to all of the money that we have collectively spent in that year. Like the ice-cream vendor, we are only able to earn our income because someone, somewhere spends an equivalent sum on goods or services of some kind. If everyone perversely decided not to spend any money (or went out in the back yard and made a bonfire of theirs), the net effect would be that no one could receive any income. No spending, no income. Simple.

Unfortunately, there is one perverse entity in America that does something quite similar to what I mistakenly did with my dollar bill – our government. For, as the issuer of our currency, the government has the unique ability to spend arbitrarily – it can spend whatever it decides to spend. Nothing prevents it from spending enough to ensure full employment, for example.

Instead, the government arbitrarily withholds a portion of its spending power from the economy. It’s as if they printed up a few billion dollar bills and then, instead of spending them, just lit them on fire. Only it’s worse. If they had actually printed them, at least the printers and other workers at the mint would have gotten extra shifts. There would have been a little more income for paper mills and ink suppliers. And if the dollar bills were burned in a furnace, at least a little physical comfort might have been derived from them. Instead, those never-printed dollars just represent an opportunity (now gone forever) to reduce at least a little of the human suffering this financial crisis is inflicting on America.”

@stone

“I can think of quite a lot of people who would just stop working and live off the interest from their savings if that were tried. That would impact real economic output just as badly as unemployment. Perhaps more so”

I don’t know. The idea at that point would be that the economy was booming sufficiently that you want people to ‘lock in their savings’, so I think that’s the idea.

If you think about it there is little difference between unemployment benefit and interest. Both source from government spending – one direct spending, the other interest on bank reserves/bonds.

GLH: The other day I watched a video of Ben Bernanke giving a talk at a university in Florida. At the very beginning he explained how the banks took in savings and used them as reserves to make loans.

Thanks for clearing that up. I was wondering whether he was actually ignorant of the mechanics, and it seems he is.

Bill,

Please read the following and tell me what you think:

http://www.housepricecrash.co.uk/forum/index.php?showtopic=154382

Stone: I fully agree with you that where bureaucrats allocate resources one tends to get an inefficient allocation of resources. That’s one of the reasons I wrote a paper arguing that traditional “make work” / “workfare” / WPA schemes have big weaknesses, and that a better alternative is to subsidise the unemployed into temporary jobs with EXISTING employers, public and private. See: http://mpra.ub.uni-muenchen.de/19094/

“So what exactly is this concept of waste that these idiots continually proffer …”

Quite simple, Bill. I’m actually surprized that you don’t know.

It is a waste when money is spent without some business person somewhere having a chance to make money. It is the wasted opportunity for profit. No thing/no labor has value (i.e., it is a waste) if it does not produce an opportunity for profit.

And now a word from Mammon …

“You don’t have to pay tax if you don’t have a job!”

The US unemployed still have to pay income taxes on the unemployment benefits they get. 🙁

Neil Wilson “If you think about it there is little difference between unemployment benefit and interest. Both source from government spending – one direct spending, the other interest on bank reserves/bonds.”-

-I agree with you that they are the same in the ways you describe. The difference is that a different set of people receive the payouts. Almost by definition, the people who would stop working to live off the interest are those who -were they to loose their jobs- would receive no means tested benefits until they had run down their savings. Perhaps they would be emotionally more able to cope without working than the typical person on unemployment benefit. However if Marx’s “from each according to their ability” is the aim then we might miss out on the labor of the especially talented but not especially motivated workers. I know a bunch of people who have worked in lucrative jobs for a few years and then just bummed about on the proceeds ever since. I sort of think such people are the ones that society can least afford to have bumming about. Personally I’d rather have a citizen’s dividend such that people were more able to take voluntary underemployment irrespective of whether they had previously had a well paid job. That would avoid a bias where the least employable ended up doing the most work.

Nice post and comments. As I’m sure people can see if they read the U.S. blogs and news sources, here the deficit hawks are completely in control now. It’s gotten much worse after the recent election. Nearly two years of Fox and other right wing sources hammering on about scary debt and deficit numbers every day have convinced the public. Nearly every politician has to toe this line or risk being voted out.

GLH: “The only problem I have is watching the experts on TV that keep calling for deficit reduction. I have gone to some of the commentators web sites and asked them to start reading this and similar blogs, but I can’t see that it has done any good.”

Good job, GLH! We just have to keep going and ring the alarm bell. When a critical mass of alarm sound accumulates in the society, things will start changing.

And it is easier to defend MMT position, imagine if you had to defend the mainstream economic position – difficult job.

Neil Wilson “If you think about it there is little difference between unemployment benefit and interest. Both source from government spending – one direct spending, the other interest on bank reserves/bonds.”-

-Isn’t a devastating problem (with the interest-rates-rather-than-tax scheme) that people who actually needed to borrow money wouldn’t be able to afford to do so? Perhaps asset prices would fall enough that houses and farms could be bought outright but how would companies expand or new inventions be converted to products? It would only work in a 100% government sector economy and personally I think governments find it well nigh impossible to effectively command economies. When it comes to organizing things in a productive way, I think there is no substitute for a private economy battling amongst itself for a fixed stock of money :).

I might be totally wrong, but it seems to me that Bill and other promoters of MMT spend a bit too much energy in the wrong direction, namely, the fact that a sovereign government cannot go broke, explaining the intricacies of crediting and debiting of account at the central bank etc. All this is just to convince people that government cannot run out of money.

I think most people understand this, because they understand that in the end the government can print as much money as it wants: the fact that no actual printing needs to take place is almost irrelevant, because the result of deficit is increase of money supply in whatever form (am I correct here?)

So… the main problem is to explain why this ability to spend as much as you want won’t “debase the currency”, cause inflation and so on. Granted, these issues are addressed, but it seems to me they are taking a back seat, obscured by all the details of how spending operates, instead of taking the central stage.

So, for myself I say this: government can never run out of money to spend, the only problem can be if this money is spent unproductively, in which case inflation will occur.

Am I correct? We need something that can be explained really easily in order to get the point across. Several pages of best blog in the world cannot do this.

masoor h. khan:

Great post, hope they read and reply. Seems like a strange site – what are they about?

Peter, see Bill’s post Modern monetary theory and inflation – Part 1

Andrew wilkins

>>I request a peek at Argentina. I understand after the bond defaults they refuse to issue government bonds. If the sky is not falling around their ears without Government borrowing. I’d love to hear how the bond vigilantes try to explain that.

Argentina currently has about 25% inflation. Unions are putting in wage requests higher than that i think. The president has decided the government should spend to help the economy as exports have suffered or suffered earlier, and at the same time there is an economic boom. Just google it.

Andrew,

I’m not sure where you got the 25% from. I googled a few pages and saw there is a controversy. Government sources saying single digit and some private banks saying late teens. CIA factbook and others seem to point to high single digits and low teens.

It’s confusing because some references talk about Argentinian notes, others say the Argentinian Government is still not issuing bonds. Straight off the bat I’ll assume a whole load of misinformation and bullshits from international banks, trying to get their greedy claws into the pie. Within Argentina itself there is probably corruption, the states seem to be fighting central government. Neo-libs will try to bugger up whatever good intentions a left leaning Government may have.

I’m hoping someone (without bias) can say what’s going right and what’s going wrong from an MMT perspective.

Here it is.

“Speculation inflation is running at about 25 percent — more than double the official rate — will prompt policy makers to step up note auctions to drain cash from the financial system, driving up the badlar, said GlobalSource Partners, a Buenos Aires-based research company. ”

We need to know what is supposed to be wrong with the official numbers and what the vested interest of the research is.

“And this anti-government campaign is succeeding in part because people believe the rhetoric that government is wasteful and doesn’t do anything.”

Isn’t it equally odd how conversely some economists and academics believe all Government spending is efficient and productive and that any un/underemployed is too high? This also deflects legitimate criticism of waste.

Let me elaborate with an example.

Let’s say in a town of 1000 eligible workers the best qualified, smartest, hardest working etc get the best jobs first and so on all the way down the line.

At what point do the beach bums, drug dealers, lazy and inept people kick in? Maybe at 950? So that leaves 5% unemployed. Even if the economy had need to fill 1000 jobs, the simple fact of the matter may be that employers do not want the remaining 50 available. Is that not then full employment and what is the point of pursuing further job creation?

I have read on here for many months how Bill spins Australia’s remarkable employment success to the same ends…if the unemployment rate rises then high rates are putting undue pressure on the economy so the rba is wrong. If unemployment falls then is might be because the participation rate has fallen due to workers giving up and therefore the rba should be easing not hiking, and so on.

Not once have I ever read that MMT acknowledges human nature (lazy workers, corrupt Government spending) and that maybe there is a level where full employment leaves an economy prone to capacity constraints.

Furthermore I do think raising the C word is a legitimate criticism of some of the views here. Nationalising banks, clipping secured debt holders to redistribute wealth and other hairbrained schemes to penalise the successful is inherently communist when collectively applied. Oddly, there has never been a communist society that boasts fair distribution of wealth and true government for the people without corruption and moral oppression. If there were then I would be a supporter for sure.

Perhaps MMT deserves to be pursued by those who maybe arent so leftist if it is to more widely adopted.

If you give the beach bum a broom and $300 a week to spend, he might spend it straight into a vibrant beach culture of surf board shops and cafes. The $300 could create a lot of turnover in economic activity. He’ll treat himself to a surfboard he otherwise might have stolen and buy coffees he would never have had. Who says the economy is at full capacity when the barista and surf shack guys still have slack time in the day. Beach bum may build self esteem and do a bit of brushing once in a while. The JG enhances the whole community.

On the other hand you can call him a lazy C, kick his ass. Give him $50 a week and not spend the $250. He’ll almost certainly be drinking cheap wine, pissing all over the cafe floor and stealing Bills surfboard. That’s not a good outcome.

Maybe you want to spend the saved $250 on a deserving case. Buy some high profit goods from a successful rich guy with a strong IP patent. The tight wad might be paying peanuts to workers in China and stuffing the profits in a dark vault never to be seen again. That’s a bad economic outcome. Tax breaks to the ultra rich will have the same result.

“Not once have I ever read that MMT acknowledges human nature (lazy workers”

Vincent Quirk made some excellent points about the JG scheme in his guest blog. Read through the comments too.

https://billmitchell.org/blog/?p=11941

Andrew Wilkins

On Argentinian inflation unless we have friends there it is hard to know what is happening but according to this article inflation is officially 11.5% and wages were agreed at 25% increases. I saw elsewhere wage increases of 38% around may june

http://en.mercopress.com/2010/11/12/inflation-or-no-inflation-that-is-the-question-for-the-argentine-government

Part of the problem is that Argentinians eat monster amounts of Beef and beef is one of the few food commodities that has continued to rise to new record highs – compared to wheat which is related to grain the cows might eat in winter, which is below the record heights by quite a bit and soya beans another principal export are also not getting good world prices.

I do my best to be objective about these things and as i say unless we know people in Argentina it is hard to know what is going on. Apparently inflation is much higher in Venezuela.

Ray,

I can assure you, I ,for one, am faaaaar from a Communist.

To the extent you caution against government involvment/authorities and I interpret you see this as a slippery slope towards ‘communism’ (Im sort of putting words in your mouth i know), you specifically mentioned that you bristle against nationalizing banks.

Think of bank at present. A group (upon getting a license from the government) can put in 10M and then go out and acquire at least 100M in assets (good work if you can get it!). The only way they can get away with this is from being in cahoots with the government. Banks are in effect a private/public partnership, with the big bad government actually putting in 90 to the investors 10, if you can see it this way.

Are not all bankers ‘communists’ in this way? Corrupt minority partners with a corrupt majority partner government? Why do we let them get away with this? So we cant be accused of being a ‘communist’? Please spare me.

Speaking for myself, this conservative, for one at least, can tell when he is being rolled.

Resp,

Call me what you like, Leftie, Commie bastard …. whatever. Couldn’t give a toss any more. I like the term Socialist, it has a pleasant ring to it. Call me a Socialist.

I believe we get more out of our time on the planet, if we put more effort into working together. Just refraining from trampling weaker, less educated, or less lucky members of society would be a start. Where does the current selfish paradigm end?

Sitting in a McMansion, in a gated community with armed guards. Driving through slums to get to the office. Peering out of the windows of an armoured SUV, hobo’s scrabbling for scraps. No thanks.

Even though I’m far from perfect myself. I’m proud and happy to advocate a less selfish and co-operative existence.

I am tempted to join the Communist party just to annoy Ray.

Ray,

“Isn’t it equally odd how conversely some economists and academics believe all Government spending is efficient and productive”

Please name one. There certainly aren’t any of them here.

Isn’t it equally odd how conversely some economists and academics believe all Government spending is efficient and productive and that any un/underemployed is too high?

This is as odd as these economists insisting that 2 + 2= 4. These statements are close to being truths of logic, not just empirically observable ones. (Depending on how you interpret them – contrary to the above comment, I think that seeing them as near-tautologies is the important interpretation.)

“All Government spending is efficient” is quite true before the point of full employment. Government efficiency is not a concept that even makes sense before that point. And in many areas of life, there is just no fact-based debate possible that government does some things everywhere in the world more efficiently than the private sector – delivers more for less – e.g. health care and provision for retirement.

The Job Guarantee directly addresses the issues you state – it “hires off the bottom” – people like me and my friends: lazy and inept drug-dealing beach bums. The distinction you are making goes back to Lerner’s distinction between high and low full employment. High full employment is better. Getting to the “level where full employment leaves an economy prone to capacity constraints” – where classical economics starts to be true – is the goal, the whole point of MMT’s main policy recommendations.

The point of pursuing further job creation is that it will increase national & private wealth and happiness, more than pay for itself, give the JG employees and everyone else better lives, stabilize prices, stabilize the economy and make planning easier for everyone. It will reduce social pathologies enormously, including the most destructive of all, addiction to mainstream macroeconomics, a cult of innumeracy that can only appeal to minds sunk far deeper in madness than lazy inept drug-dealing beach bums.

@Ray

“Isn’t it equally odd how conversely some economists and academics believe all Government spending is efficient and productive and that any un/underemployed is too high? This also deflects legitimate criticism of waste.”

Cmon Ray!!! I’ve seen you on here for a while. Why do you feel the need to just make shit up like this? To me its a sign you have lost all ability to find legitimate criticism. Theres plenty of talk about real waste, much of it coming form our financial sector. Bill and Warren both advocate heavily for honest national discussions about what govts need to spend on. After all thats done, its still likely (and acceptable) that the US will spend a greater % of their govt spending on military than Australia will, simply because their citizens are more insecure and feel good with big planes and guns. Thats an acceptable outcome that the monetary system can accommodate. Currently US is bullied by the MIC and their corporate minions cry about job losses secondary to cutbacks in military spending (its miraculous how govt spending can create JOBS….. for them). An important aspect of the JG program is its …………………..VOLUNTARY nature. The job is offered not required, so any remaining unemployment is voluntary so to speak.

“Not once have I ever read that MMT acknowledges human nature (lazy workers, corrupt Government spending) and that maybe there is a level where full employment leaves an economy prone to capacity constraints.”

More hyperbole! Your losing credibility by the minute. MMT acknowledges capacity constraints as the ONLY real restraints, NOT budget defcits, NOT national debt, NOT inability to “borrow” from foreigners. You are entering pathological liar territory with these comments, you’ve been here long enough to know the answers to these criticisms. You may not agree, but they have been addressed.

“Furthermore I do think raising the C word is a legitimate criticism of some of the views here. Nationalising banks, clipping secured debt holders to redistribute wealth and other hairbrained schemes to penalise the successful is inherently communist when collectively applied.”

Matt Frankos answer about the banks is perfect. Read it over and over and over. Penalize the successful? Please spare me. Thats always the cry of the pathetically narrow minded “Ive got mine crowd”.

“Oddly, there has never been a communist society that boasts fair distribution of wealth and true government for the people without corruption and moral oppression. If there were then I would be a supporter for sure.”

Govts are always corrupted by those with money. Thats why certain things just need to be untouchable. Things that act as automatic stabilizers should be off the table when business cycles turn down. Minimum wage- Pay It or the govt pays it via a JG. Unempl Insur. no limits. Social Sec. – keep your grubby paws off it. The govt is there to determine what the level of the floor will be. Too many on the right want the floor to be absolute destitution……… it needs to be discussed on these terms so their sociopathic leanings will be exposed.

“Perhaps MMT deserves to be pursued by those who maybe arent so leftist if it is to more widely adopted.”

If it were properly understood it would be accepted by folks of all stripes.

I probably live to the left of Mr Franko, but Ive seen nothing he’s written in these comments sections that I dont agree with. We are not very different. The left right divide is very uninformative.

Well said, Greg.

Ray, if you actually bothered to understand what you’re critiquing (and I use that word lightly, as normally a critique suggests one has a clue what they are critiquing, which you clearly don’t), you’d see that there are quite a few MMT sympathizers that are on the right side of the political spectrum. MMT sympathizers are all over the spectrum, in fact, since MMT’s description of the monetary system isn’t about politics. Go to Mosler’s site and watch someone take up a left-ish view on some issue (it happens sometimes) and see how quickly other regulars there take the opposing view. Tom Hickey can vouch for the fact that his politics aren’t uncontroversial there.

“Oddly, there has never been a communist society that boasts fair distribution of wealth and true government for the people without corruption and moral oppression.”

Correct. That’s because communism doesn’t work.

What you need is Anarchism, and you’ll be able to find out about that by typing ‘sudo apt-get install anarchism’ on a decent computer operating system.

Scott,

I have quite a lot of time for particular MMT proposals, in particular a job guarantee. There are also many things I do not agree with.

However, anyone who thinks that MMT is a politically “neutral” theory is engaging in some serious self-delusion. The main ideas of MMT (as presented by Bill) are all clearly on the left of the political spectrum. This is not a criticism, it is just the way it appears to the world.

The fundamental insights of MMT are all related to a greater involvement of government in the economy, in particular the labour market. Bill is continuously advocating an expansion of the role of government in Australia, in pursuit of public purpose. I don’t think he would argue with this, and I don’t think it’s wrong or controversial to characterise this position as being generally on the left side of politics.

The fact that the MMT “description of the monetary system is not political” is neither here nor there. Describing the way the monetary system operates is trivial and tells us nothing of importance about things we want to know about. It doesn’t tell us anything about economic growth, unemployment, the efficiency of government versus the private sector, and so on.

I understood all there was to know about how the monetary system works long before I ever heard about MMT, and I don’t agree with quite a few of the policy recommendations that MMT advocates. Does this mean I actually have a flawed understanding of the money market, or does it mean that there is a politically/idealogical component to MMT that actually has nothing to do with the monetary system? You tell me what you think.

ouch.

Let me point it out how I interpret some of the MMT proponents here.

Bill clearly is never satisfied with the monthly job numbers as I have mentioned before and each month presents charts and components within to claim things really aren’t as good as all the silly bank economists are claiming and to show that the RBA should not raise rates in response (or should even ease). Regardless of how many jobs are created there is (and always will be underemployed people in Australia).

Therefore the Government should embark on fiscal stimulus and not be constrained by recording deficits to reduce underemployment close to nil (as the deficit terrorists warn).

Furthermore given Australia is a sovereign state there is little constraint on the extent of Government spending to ensure everyone has a job (if necessary at some point in time we can haircut the wealthy bondholders anyhow).

The above comic scenario is clearly circular and never ending as unemployment will always be too high as we hear each month even though Australia is clearly experiencing skill shortages in many areas (I was recently on site at a mine and that sector has pretty much cornered the engineering labour market in Australia).

So when does the thought of fiscal constraint ever outweigh the marginal benefit of cleaning up the relatively small remaining unemployed group (which by definition may contain less desirable workers)?

Ray,

it’s just that the outlook of many people here and elsewhere is irreconcilable with your attitude of “I’m alright Jack, so f**k anyone who isn’t”.

Ray,

If you understood the job guarantee proposal you would understand there are very clear and certainly non “circular” answers to your questions. Personally, however, I don’t have the interest or patience to go through them or link to them for someone who makes up their mind about MMT before they understand it–you’re a dime a dozen. Maybe someone else will help you out, though.

Gamma

The proposals may appear to some to be left of center, though on balance I actually have better luck discussing core MMT proposals with individuals that are right of center (note Bill’s difficulties with the Greens, for instance). The analysis, however, is politically neutral, and you won’t convince me otherwise. I’ve seen too many people right of center push MMT analysis to believe that an understanding of basic accounting and monetary operations is politically biased. As just one example, I was just posting a piece written by Warren Mosler and Tom Nugent for the National Review back in 2004 (which Brad DeLong then bashed as conservative garbage).

Gamma,

“The fact that the MMT “description of the monetary system is not political” is neither here nor there. Describing the way the monetary system operates is trivial and tells us nothing of importance about things we want to know about. It doesn’t tell us anything about economic growth, unemployment, the efficiency of government versus the private sector, and so on.”

I’ve heard that many times. Pardon my French, but that’s just a bunch of crap. You can’t solve ANY of those problems without understanding the monetary system. Yes, MMT’s descriptions don’t give you THE answers, but it wasn’t intended to, and Bill has noted that many times here. But if you don’t see how understanding the monetary system matters for making good policies related to unemployment, growth, govt efficiency, etc., then there’s nothing here to discuss and I don’t know why you waste your time.

Is it just me that thinks it is perverse that we have a system where business is presumed to have a right to exist on its current margins, yet real people don’t?

If there is a skills shortage in an industry, then the businesses there should be required to compete ferociously for the privilege of using the people. That means higher productivity, tighter margins and more attractive jobs. And yes it means lots of those businesses going to the wall.

The system should force the number of businesses and jobs to shrink down to the available people. We should never have a system that forces people to shrink down to the available jobs.

Evolution shows us that pinch points create the greatest advances and developments as the fittest are forced to evolve or die. If I was in power and people started whining about skills shortages I’d tell them to start training and innovating if they want to avoid going the way of the Dodo.

Neil Wilson @ 5:44

This is why business fight to reduce the bargaining power of labor through policies like union busting and a buffer of unemployed. They want to set prices monopolistically, not negotiate on a level playing field. That’s the whole point of existing economic policy regarding labor. It’s what I would call soft exploitation. But it begins turning back into hard exploitation during tough times, when labor is expendable. That’s why this system is called capitalism. Capital rules and labor is supposed to quietly follow.

If you can understand: How the monetary systems work. How private sector business profits feed into private sector savings. How bank loan credits and debits net to zero. How Governments increase net financial assets by deficit spending.

Add onto that: A basic understanding of progressive taxation.

Then understand this ………. For the past 25 years business profits have increased at a rate far greater than labour wages. Business owners have pocketed the bulk of the benefits of productivity gains in the last 25 years.

Unless your head is stuck completely at your own own “arse”, it’s obvious what’s going wrong with the World.

For 90% of the population: Big Business is the enemy NOT Big Government.

Gamma: “Describing the way the monetary system operates is trivial and tells us nothing of importance about things we want to know about. It doesn’t tell us anything about economic growth, unemployment, the efficiency of government versus the private sector, and so on.”

I would agree except for the fact that, as far as I can tell, the debt/deficit hawks are mostly right wing, and use the idea that the gov’t is broke to attack social programs. Maybe the truth about money tells us nothing of importance, but lies about money are significant propaganda.

@ Dale Pierce

Interesting idea for a You Tube video. 🙂 I am afraid, however, that you will lose most people when you say that a dollar bill is gov’t debt. That made sense when you could redeem it for gold or silver, but now all you can redeem it for is another dollar bill, or the equivalent. That’s a funny kind of debt. “I have an IOU that I can cash in for another IOU.” Huh? But pointing out that we could consider the National Debt Clock as the National Savings Clock is a great idea. 🙂

Andrew Wilkins says:

Monday, November 15, 2010 at 12:06

Interesting points AW.

“A basic understanding of progressive taxation.”

Progressive taxation had a top-tier of 60% and now sits just under 50%. Stamp duties are progressive and crush the bigger spenders as does GST to those with higher consumption levels.

Is this system not draconian enough for you Andrew or are you going to tell me that all wealthy people are tax cheats and don’t pay their fair share?

“For the past 25 years business profits have increased at a rate far greater than labour wages. Business owners have pocketed the bulk of the benefits of productivity gains in the last 25 years.”

I am assuming you are talking banks and miners mainly here? All these are listed on the stock exchange and super funds (mums and dads) are significant ‘business owners’…ditto those who have taken some time to understand basic investment principles. Small business owners deserve every cent they made as most take a risk and go to the wall or make less than the average wage.

“Unless your head is stuck completely at your own own “arse”, it’s obvious what’s going wrong with the World.

For 90% of the population: Big Business is the enemy NOT Big Government”

Speaking from my butt, I’d actually say the cause of the problem is Big Government. Isn’t it the guys who have made the rules and get to swing the big stick who should take some responsibility? There obviously aren’t enough comrades in Australia who want the type of Government you advocate so surely the buck rests with the electorate and the officials in power rather than those operating within the system (or are all corporations basically evil and operate illegally)? I will use Fannie/Freddie as a basic example of lawmaking gone mad.

The pursuit of profit in the marketplace creates competition, demand for labour, better technology, medicines and overall quality of life. Surely the Government should be competent enough to take responsibility to ensure there is a fair system to manage the flow of money and scale of profits and create a society which offers equity to the less well off (which certainly is not 90%)?

Min: I am afraid, however, that you will lose most people when you say that a dollar bill is gov’t debt.

Better to say that currency is a government “liability” rather than a “debt,” since this is the correct accounting terminology. Reserves and currency are cb liabilities. They are not typically called “debts.” Using “debt” in this sense is misleading.

Two ways to the path of failure: a) Try to succeed, but fail; b) Try to fail, and fail. Path b) is much easier to pull off than Path a). Path a) implies that there were some lessons learned from failure. But Path b) implies that you want to fail in the first place.

Now then, one easy way to wreck a government: Try to fail, and fail. Cuts in government programs is a good example. Let’s say that there is a government sponsored health insurance program but you flat out hate it. What next? You bully everyone else who do not think the way you do with ideological mantras like ‘government waste’, ‘socialism’, blah, blah. In the next legislative session, you succeed in reducing the funds for this program. What next? You then make tirades … ‘Hey, look! This program is not even providing things it was intended for. Would it not be better to cut such an ineffective program?’ In the meantime, you conveniently leave out this program has not even been adequated funded in the first place. You also conveniently leave out government must run certain programs because these things are something the market does not adequately provide. While the government may not provide solutions to everything, neither does the market.

We now have an intellectual desert: While there have been many out there crying about this or that not working, far fewer out there asking about how to make something work, and make it work better? Intellectual desert indeed …

Andrew Wilkins says:

Monday, November 15, 2010 at 12:06

“Then understand this ………. For the past 25 years business profits have increased at a rate far greater than labour wages. Business owners have pocketed the bulk of the benefits of productivity gains in the last 25 years.”

I meant to say AW, that you will find most of these productivity gains are from technology (computers, better machinery etc) rather than workers becoming more physically or mentally adept at the same role.

Therefore I don’t follow why their wages would move in-step with these productivity gains. If employers have invested the capital then shouldn’t the bulk of productivity gains reside with the business?

Debit says:

Tuesday, November 16, 2010 at 10:57

I find the problem with big Government is that you multiply the indecision inherent with bureaucrats. Take the Sydney transport system. Even in the news this week, bus and ferry timetables don’t match train timetables. Each of the three sub-transport departments is now so unwieldy that the waste is tangible and probably beyond repair.

All it needs is one small team to take charge and dictate how transport will operate (Minister for Transport presumably) yet the pushback is staggering and we again lapse into inaction (Northwest rail cancellation/compensation being a good example).

Sure, this type of bureaucracy hires lots of people but it is not efficient and perhaps resources could be better used overseeing/regulating the private sector.

The RBA is independent of political meddling, perhaps many of the problems mentioned could be solved by legislating a process where lobbying is removed from the enactment of Govt policy.

Ray, “you will find most of these productivity gains are from technology (computers, better machinery etc) rather than workers becoming more physically or mentally adept at the same role. Therefore I don’t follow why their wages would move in-step with these productivity gains. If employers have invested the capital then shouldn’t the bulk of productivity gains reside with the business”

-That may fit in with some people’s sense of justice and in the short term provide incentives to productive business but if investment gains become out of step with earnings, then more and more of the economy becomes dedicated to “owning” rather than “doing”. It is an evolving situation that will mean that less and less of the economy will be engaged in productive endeavors with each decade that goes past. That is the real waste in the system as I see it. If an asset tax were implemented so that the currency were not allowed to expand in step with productivity gains, then employers would be running to stay still. If they made less productivity gains than their competitors, then they would go bust. There would be no accumulating surplus to inflate the FIRE sector.

Ray, “you will find most of these productivity gains are from technology (computers, better machinery etc) rather than workers becoming more physically or mentally adept at the same role. Therefore I don’t follow why their wages would move in-step with these productivity gains. If employers have invested the capital then shouldn’t the bulk of productivity gains reside with the business”

Computers, “new technology”, etc. was developed with public funding. So maybe government should tax away all such productivity gains from private sector? What do you think?

Re transport system I have plenty of examples of exactly the opposite. So who is “more” right here? Just elect a better government and problem solved. It is your personal failure and not the failure of the government.

“You get the government that you deserve” (c)

Sergei “Re transport system I have plenty of examples of exactly the opposite. So who is “more” right here? Just elect a better government and problem solved.”

-I think it is fascinating which things where can be tackled successfully by direct government execution. I get the impression that very big, obvious and groundbreaking projects seem easiest for governments to execute. The Apollo Moon missions are the classic example (sadly a moronic stunt that provided no benefits). Mundane, day to day messy complexity seems to require a private sector. Has any government anywhere ever successfully provided a reliable food supply system?

“I meant to say AW, that you will find most of these productivity gains are from technology (computers, better machinery etc) rather than workers becoming more physically or mentally adept at the same role.

Therefore I don’t follow why their wages would move in-step with these productivity gains. If employers have invested the capital then shouldn’t the bulk of productivity gains reside with the business?”

OK. Let the workers stop working and see what level the output drops. If it drops by the amount of the worker’s wages, then your argument stands. If it drops further then it does not.

Marginal productivity theory is another load of neo-classical baloney.

Ray

Arguing that you dont like your government is not the same as arguing there is no way for govt to be a positive force. Yes I think governments have gotten extremely ineffective in areas, extremely unresponsive to the citizens in areas and extremely wasteful of valuable resources in areas. The solution is not get rid of govt but make it DO better work. I would also point out that this trend started to really snowball in the early 80’s when Reagan/Thatcher decided to not LET govt be a positive force, out of pure ideological opposition. Today, even many democrats in America acquiesce to this paradigm. In that regard Reagan won, he poisoned the people to govt actions. However today its becoming more and more evident that the private sector cannot turn this around alone. Their stock of savings is not high enough to generate the spending necessary to spur the growth needed.