I started my undergraduate studies in economics in the late 1970s after starting out as…

We can conquer unemployment

Many readers have written to me asking me to explain the British Treasury view during the Great Depression. This view was really the product of several decades of literature which culminated in the political process during the 1929 British election where the number one issue of the day was mass unemployment. The Treasury View was thoroughly discredited in the immediate period after it was articulated and comprised one side of the famous Keynes versus the Classics debate. When propositions – such as the Earth was flat – are shown to be incorrect constructions of reality the ideas cease to be knowledge and instead become historical curiosities which allow us to benchmark how far our education systems have taken us. However, the same cannot be said for my profession.

Macroeconomics has returned to the discredited Treasury view with some modern embellishments (Ricardian equivalence etc). The major attacks on the of government fiscal stimulus to conquer unemployment now resonate almost exactly with the bunk that was trotted out by the conservatives during the 1929 British election campaign. The modern proponents (centred at Harvard and Chicago) also appear largely unaware of the arguments and seem content to peddle their nonsense oblivious that their “knowledge” ceased to be such 80 odd years ago.

I was thinking about the historical debate today when I read that Ireland is now double-dipping.

The overnight UK Guardian article by Larry Elliot (September 23, 2010) – Ireland’s austerity measures show us how not to do it – provides a good summary of how screwed up that nation has become under the guidance of the deficit terrorists.

Elliot notes that “Ireland is the poster child for deficit hawks” and key figures like ECB boss Jean-Claude Trichet praised their slash and burn approach to the crisis. He notes that they were being held out as a role model for Greece and other nations to follow – if they wanted to regain prosperity.

He notes that the newly-elected British government “bought this argument” and that is “why Britain had an emergency budget within six weeks of the election and is about to experience the deepest cuts in public spending since the 1920s”.

But the facts that are now unfolding tell us that the conservative position was wrong – insanely wrong – and amounts to vandalism and an abuse of human rights.

Elliot asks “how are things going across the Irish Sea?” and says:

Well, figures out today showed that the economy has bombed after briefly flickering into life in the first three months of 2010. There are rumours swirling around Dublin about the viability of Anglo Irish Bank. And the bond markets that were once impressed by the bravery of prime minister Brian Cowen’s government have now turned on Ireland with a vengeance.

The “yield on Irish government bonds and German bunds” has now “widened to a record level”. This was the key indicator that the conservatives were saying would improve.

It isn’t rocket science to understand what has happened. The “budget cuts have impaired the economy’s ability to grow”. You simply cannot withdraw (drastically) the main source of spending and not expect output to fall (dramatically).

Ireland is now enduring three years of negative growth and will take years to restore the confidence of households and firms which will be required to underpin growth in the face of a massive public net spending retreat.

The Irish case study is there for all to see. But they should never have gone down that path if they had fully understood the lessons from the Great Depression. In effect, they have been following the Treasury View which prevailed in the late 1920s in Britain and ensured that the British economy would endure a massive depression once private spending collapsed in 1929.

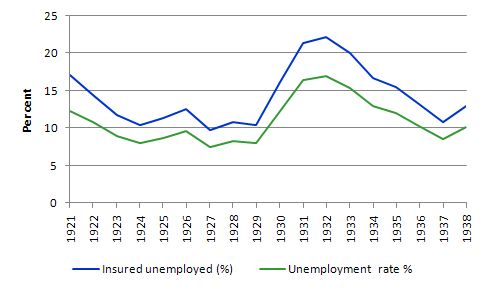

The following graph shows the evolution of unemployment in Britain from 1921 to 1938. Only the onset of World War II saw the rate drop substantially (Source).

During this campaign, the Opposition Liberal Party of the day came into the election campaign with a pledge to reduce unemployment by introducing large-scale public works. The plan was outlined in a speech that the Liberal leader Lloyd George made to all Liberal candidates on March 1, 1929 which is based on the simultaneous release of their manifesto We can conquer unemployment

Here is the scanned front cover of the British Liberal Party’s 1929 election manifesto “We can conquer unemployment”.

In that speech, George pledged:

If the nation entrusts the Liberal Party at the next General Election with the responsibilities of Government, we are ready with schemes of work which we can put immediately into operation, work of a kind which is not merely useful in itself but essential to the well-being of the nation. The work put in hand will reduce the terrible figures of the workless in the course of a single year to normal proportions, and will, when completed, enrich the nation and equip it for competing successfully with all its rivals in the business of the world. These Plans will not add one penny to national or local taxation. It will require a great and sustained effort to redeem this pledge, but some of us sitting at this table have succeeded in putting through even greater and more difficult tasks in the interests of the nation.

So they were arguing that within one year the cyclical unemployment would be resolved via public sector job creation. The plan was fairly bold in political terms and history tells us that the British electorate rejected the party and the Labour Party (who were barely distinguishable from the ruling Tories) took Britain into the Great Depression to the detriment of the nation.

The Liberal Party policies were being developed throughout the 1920s and were consolidated in the 1929 publication. In that publication, which was partly written by John Maynard Keynes, we read that:

THE word written to-day on the hearts of British people, and graven on their minds is Unemployment. For eight years, more than a million British workers, able and eager to work, have been denied the opportunity. At the end of 1928 the total reached a million and a half; a quarter of a million more than a year before. These workers with their dependants, represent four or five million souls. They are a very nation, denied the opportunity to earn their daily bread, condemned to hardship, to wearing anxiety and often to physical and mental demoralisation. What a tragedy of human suffering; what a waste of fine resources; what a bankruptcy of statesmanship!

And in thinking outside of the mainstream the book said:

Here, as elsewhere, we are obsessed by precedent and routine. But the present situation cannot be dealt with by precedent. It is unique in history, and it must be met by unique methods. The countries of Europe have displayed infinite courage, resource and initiative, in rebuilding the towns and areas which the war had ruined; and we must profit by their example, if we do not wish history to brand us as destitute of the high qualities that make reconstruction possible. At the moment, individual enterprise alone cannot restore the situation within a time for which we can wait. The State must therefore lend its aid and, by a deliberate policy of national development, help to set going at full speed the great machine of industry.

The book outlined in exhaustive detail the way in which work could be created by developing new roads, low-cost houses, new drainage systems, telephone network extensions, and enhanced electricity generating capacity.

The proposal argued that the government could raise the money needed by borrowing.

While articulating the direct employment effects of the public works programs, the publication also used the concept of the expenditure multiplier to outlined the indirect employment effects:

In all this, so far, we have taken no account of the large increase in employment everywhere resulting indirectly from the addition to the national purchasing power represented by the wages of those workers directly employed in this way. The income of everyone of these will have increased twice or thrice; arid this will be fleeted at once in a corresponding increase in expenditure on food, clothing, boots, housing, travelling, entertainment, and other amenities. As a result, a stimulus will be given to the whole of the industry and commerce of the country, reflected, in turn, in increased employment.

Keynes (with Hubert Henderson) followed up this publication with the small article – Stanley Baldwin was forced to present a formal attack. The document that the Treasury officials produced which was called Memoranda on Certain Proposals Relating to Unemployment, (Cmd 3331, Presented by the Minister of Labour to the Parliament, May 1929, H.M. Stationary Office) and, in effect, became the formal articulation of the Treasury view.

If you ever get a chance to read this response you will see the resonance with the way the conservatives argue today. The memoranda accused the Liberals of proposing a “dictatorship” and wanting to coerce workers into wasteful endeavours. I would be very rich if I was given a dollar for each time the conservatives have accused me in public lectures etc of advocating communism when I suggest we should introduce a Job Guarantee. Well well-off rather than rich!

Interestingly, the Labour Party in the same campaign was caught out by the bold Liberal plan. They produced their own document – How to Conquer Unemployment: Labour’s Reply to Lloyd George which among other things said the work would be ephemeral and unproductive and that the financial aspects were “madcap”. The Labour Party won the election easily and the conservatives were tossed out. But in a sense, the conservatives (Labour) just swapped places with the conservatives (Tories). Nothing much has changed has it – US Democrats are as bad as the Republicans; British Labour not much better than the Tories; Australian Labour as bad as the Conservative Coalition etc.

But what was the Treasury View?

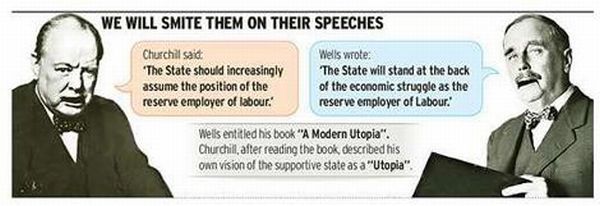

The British Chancellor of the Exchequer in 1929 was none other than Winston Churchill.

As an aside, Churchill had earlier been a big supporter of the Job Guarantee concept. Take a look at this graphic which is borrowed from a Sydney Morning Herald article on November 29, 2006.

While the SMH article is about the allegation that Churchill who was a secret fan of science fiction, “borrowed some of his biggest ideas and most telling phrases from his favourite author, H. G. Wells.”, it is clear that both supported the Job Guarantee. The graphic above is an example of this. Accordingly Churchill gave a major speech early in his career (in 1906) which appeared to be taken from Well’s earlier work A Modern Utopia (1905). Churchill is alleged to have written to Wells just before making his speech and said:

There is so much in your writing that stimulates my fancy that I owe you a great debt.

Among those ideas is clearly a preference for a Job Guarantee as is depicted in the picture. However, that preference was gone by 1929.

The Treasury View stated that the government should always run a balanced budget and that deficits were not expansionary. The election manifesto of the Conservatives was captured by their slogan ‘Safety First’ and they argued that even though unemployment was starting to sky-rocket and bankruptcies were rising sharply, the best strategy was to continue to run orthodox budgets (balanced) and let the markets sort the developing crisis out.

I am sure you have heard similar irresponsible statements from the conservatives in the current crisis.

The Treasury Memoranda (known as the “White Paper”) claimed that there was only finite pool of savings available and if the government was drawing on it to finance the public works program then less would be available for private investment, in particular, foreign investment.

They concluded that the public works programs would not increase net employment because the increasing public employment would come at the expense of a decline in private employment as a result of the reduced private and foreign investment.

We know this argument today as the “crowding out” hypothesis which now no longer merits the status of a hypothesis because it has been categorically disproved over and over in the course of history. It is just a religious belief and I bear no insult to those who “believe” in things that are mythical. It is just that I would base economic policy on things we know work as cause and effect rather than any myths that are held to provide personal spiritual salvation and comfort.

The Treasury Memoranda refuted the Liberal idea that there were idle balances.

Churchill told the House of Commons in April 1929 that he supported:

…. the orthodox Treasury doctrine which has steadfastly held that, whatever might be the political and social advantages, very little additional employment, and no permanent additional employment can, in fact, and as a general rule, be created by state borrowing and state expenditure …

The result was that the newly-elected British Labour Government did not tackle the Great Depression with expansionary policies. It was clear that the archaic ideas held within the British Treasury were dominant and that they considered the gold standard and a balanced budget to be the source of prosperity (via free trade).

They considered unemployment to be the result of poor export performance which required industrial development (via private investment) and lower real wages. Accordingly, any policy that diverted what they thought was a “finite pool of savings” away from private investment would not improve the situation.

The Treasury View was demolished by Richard Kahn in 1931, who had studied under Keynes. He noted that total saving is a function of national income and so there is no fixed pool of saving over time unless we believe that income can never change.

At the time, the macroeconomic models in use (which were based on versions of Say’s Law) all assumed that full employment was achieved at all times with departures from that state being ephemeral.

So the Treasury attack on the public works programs were based on a denial of the rising unemployment. What Kahn showed formally was that when there are idle resources (that is, unemployed workers and machines) the reason was a lack of overall spending. An increase in say public investment spending (the public works program) will not only increase employment directly but when the wages are spent other industries benefit. These indirect employment effects arising from the consumption induced from the initial rise in income forms the basis of the idea of the expenditure multiplier.

Please read my blog – Spending multipliers – for more discussion on this point.

As consumption rises so does national saving and the multiplier process continues until the extra consumption (after each successive round) is zero. What we observe is that the final increase in national saving is exactly equal to the initial increase in investment.

Kahn showed categorically that it is total investment that determines total saving not the other way around. This point demolished the “loanable funds theory” that underpinned the crowding out claims. Much later, Pasinetti notes in one of his articles that “investment spending brings forth its own saving”.

The loanable funds doctrine posited that prior saving generated investment. But Kahn showed that is was the opposite and that if the government expanded net spending and simultaneously borrowed then once all the adjustments were exhausted an exactly equivalent amount of savings would be held in the non-government sector.

This was the basis of the belief by Lloyd George that “a budget deficit finances itself”.

I covered the flaws in the Loanable Funds doctrine which is still taught in macroeconomics course today in this recent blog – Budget deficits do not cause higher interest rates

From a Modern Monetary Theory (MMT) perspective, the main points are that from a macroeconomic flow of funds perspective, the funds (net financial assets in the form of reserves) that are the source of the capacity to purchase the public debt in the first place come from net government spending. Its what astute financial market players call “a wash”. The funds used to buy the government bonds come from the government!

This is the MMT equivalent of the statement “a budget deficit finances itself” – although proponents of MMT also point out that a sovereign government doesn’t need to finance its net spending anyway.

But given that governments voluntarily imposes such rules on themselves the funds they borrow are just the same funds they spend.

Further, there is also no finite pool of saving that is competed for. Loans create deposits so any credit-worthy customer can typically get funds. Reserves to support these loans are added later – that is, loans are never constrained in an aggregate sense by a “lack of reserves”. The funds to buy government bonds come from government spending! There is just an exchange of bank reserves for bonds – no net change in financial assets involved. Saving grows with income.

But importantly, deficit spending generates income growth which generates higher saving. It is this way that MMT shows that deficit spending supports or “finances” private saving not the other way around.

So given that the Treasury View was so categorically dismissed in the 1930s and waned during the full employment period, it is a surprise that it is coming back with so much vehemence in the current policy debate.

A modern proponent of the Treasury view is none other than “Mr Efficient Markets” Eugene Fama who is an academic at the University of Chicago. In this – article – written in early 2009 his reasoning brought back the haunting memories of the fallacious British Treasury reasoning.

As an aside, Fama rejects the claim that the financial crisis has exposed the flaws in his beloved efficient markets hypothesis. He claims that the crisis shows that markets are efficient. More about that nonsense another day.

Fama introduced a version of the sectoral balances framework. He provided the following macroeconomics identity:

PI = PS + CS + GS

So private investment (PI) equals the suum of private savings (PS), corporate savings (retained earnings) (CS), and government savings (GS) (the surplus).

He then recognises that “(i)n a global economy the quantities in the equation are global. This means the equation need not hold in a particular country, but it must hold in the world as a whole”.

He then says that:

Government bailouts and stimulus plans seem attractive when there are idle resources – unemployment. Unfortunately, bailouts and stimulus plans are not a cure. The problem is simple: bailouts and stimulus plans are funded by issuing more government debt. (The money must come from somewhere!) The added debt absorbs savings that would otherwise go to private investment. In the end, despite the existence of idle resources, bailouts and stimulus plans do not add to current resources in use. They just move resources from one use to another.

He also noted that “government investments are prone to inefficiency” whereas “private entities must invest in projects that generate more wealth than they cost” (his belief in efficient markets!).

So according to Fama the “stimulus spending must be financed, which means it displaces other current uses of the same funds, and so does not help the economy today.”

That is exactly the logic that underpinned the British Treasury view in 1929.

There are many ways you can refute the arguments as you have already seen.

If you think about the Treasury view as espoused by Fama you will note that the fiscal stimulus is assumed to change (GS – downwards) – that is undermine the fiscal surplus.

He also assumes a finite pool of savings so PS and CS are unchanged. In other words, the only other thing that can change is private investment (PI) which must fall by construction.

The flaw in Fama’s argument is of-course that saving is fixed.

Think about how the impact of a fall in private consumption spending might work in this model. So PS rises. The normal inventory-cycle view of what happens next goes like this. Output and employment are functions of aggregate spending. Firms form expectations of future aggregate demand and produce accordingly. They are uncertain about the actual demand that will be realised as the output emerges from the production process.

The first signal firms get that household consumption is falling is in the unintended build-up of inventories. That signals to firms that they were overly optimistic about the level of demand in that particular period.

Once this realisation becomes consolidated, that is, firms generally realise they have over-produced, output starts to fall. Firms layoff workers and the loss of income starts to multiply as those workers reduce their spending elsewhere.

As national income falls, so does overall saving (as some proportion of the loss of income).

The attempts by households overall to increase their saving ratio may be thwarted because income losses cause loss of saving in aggregate (the Paradox of Thrift). So while one household can easily increase its saving ratio through discipline, if all households try to do that then they will fail. This is an important statement about why macroeconomics is a separate field of study.

Typically, the only way to avoid these spiralling employment losses would be for an exogenous intervention to occur – in the form of an expanding public deficit or a boost to net export.

So total saving always adjusts to changes in income and if a budget deficit can initially increase income then it will not compromise the capacity of firms to invest in productive capacity.

The other point relates to what investment means in these national income accounting frameworks and there is a good treatment of that by Brad Delong HERE, which provided some amusement today (it is funny!).

DeLong’s conclusion is apt:

These mistakes are, literally, elementary ones. They were elementary when R.G. Hawtrey and the other staffers of the British Treasury made them in the 1920s.

They carry the implication not just that government cannot stimulate or depress the economy, but that no set of private investment or savings decisions can stimulate or depress the economy either, and thus that there can be no business cycle fluctuations from any source whatsoever–because every action that shifts savings or investment simply moves resources from one use to another.

What is extraordinary is that these mistakes are being rederived today, at the end of the 2000s–without any consciousness of their past or of the refutations of them made by past theory and history.

I think it is time to draw a line in the sand: no more economists who know nothing about the economic history of the world or the history of economic thought.

Conclusion

We should all drink to that!

Saturday Quiz

The Saturday Quiz will be back sometime tomorrow – about as hard as it was last week!

That is enough for today!

The whole argument seems to be based around the idea that it is good to maximize the funds available for private investment. The problem is that we now have far too much money available for private investment. That creates asset price bubbles and chasing after them is what really does crowd out productive investment. Why on earth would a bank want to loan money to develop a new medicine or energy source when high frequency trading can give day in day out massive profits.

An enlightening post. I didn’t realise the liberals were the true progressive party in that 1929 British election.

I have just reread Lerner, 1943. “Functional Finance and the Federal Debt,” Social Research 10: 38-51.

I have just realised I didn’t understand it properly.

Lerner’s functional finance system isn’t neoclassical synthesis Keynesianism/classical Keynesianism at all, since both of these held that the budget should be balanced over the cycle.

Lerner says:

full employment can be maintained by printing the money needed for it, and this does not increase the national debt at all.

Lerner, “Functional Finance and the Federal Debt,” Social Research 10: p. 43.

Yet no country has really implemented Lerner’s functional finance model in the way he prescribed? Or am I wrong?

It seems that the truly revolutionary functional finance system of Lerner (which was a natural development of Keynes’ thinking) was aborted, and instead Keynes’ ideas were hijacked by neoclassical synthesis Keynesians, who still had the archaic and dangerous belief in “sound money” principles.

Presumably the Post Keynesians like Richard Kahn, Joan Robinson and Nicholas Kaldor never really came to grips with Lerner’s thought either?

>The whole argument seems to be based around the idea that it is good to maximize the funds available for private >investment. The problem is that we now have far too much money available for private investment. That creates asset price >bubbles and chasing after them is what really does crowd out productive investment. Why on earth would a bank want to loan >money to develop a new medicine or energy source when high frequency trading can give day in day out massive profits.

Why ?? Because the sovereign government is well within its power to create an environment where that is not the case

http://delusionaleconomics.blogspot.com/2010/06/gpec-how-could-australia-get-more-of-it.html

stone: The whole argument seems to be based around the idea that it is good to maximize the funds available for private investment. The problem is that we now have far too much money available for private investment. That creates asset price bubbles and chasing after them is what really does crowd out productive investment. Why on earth would a bank want to loan money to develop a new medicine or energy source when high frequency trading can give day in day out massive profits.

This is why taxing away economic rent and eliminating cheating is crucial to incentivizing productive investment that generates income/demand and provides the supply to consume it. If the funds available in the global economy were committed to productive investment that generates employment, hence income, hence demand for the products and services generated by the investment, everything would be humming along for everyone – provided that the productive investment was also invested in sustainability and R&D leading to innovation.

Incentives and disincentives such as targeted taxation can be used to target flows and to prevent non-productive stocks from building.

We know this argument today as the “crowding out” hypothesis which now no longer merits the status of a hypothesis because it has been categorically disproved over and over in the course of history.

A hypothesis remains a hypothesis even after it has been discredited.

It is just a religious belief and I bear no insult to those who “believe” in things that are mythical.

But you fail to understand what a religious belief it. It’s nothing to do with any lack of evidence – indeed many people who believe in God do so because of the evidence!

It is just that I would base economic policy on things we know work as cause and effect rather than any myths that are held to provide personal spiritual salvation and comfort.

Good! I look forward to you abandoning the myth that the private sector desire to net save!

Andrew: Yet no country has really implemented Lerner’s functional finance model in the way he prescribed? Or am I wrong?

Art Laffer, a GOP economic architect, understands these principles and built the Reagan GOP economic policy on it – the one that G. W. H. Bush called “voodoo economics” in the primary campaign when he was contesting for the GOP nomination. Laffer’s policy approach was opposite to the fiscally conservative economic policy traditionally espoused by the GOP. G. W. Bush took this to heart in cutting taxes and spending lavishly on war simultaneously. As you may recall, when confronted in the fiscal imbalance, then Vice-President Cheney said, “Reagan proved that deficits don’t matter.” There was no problem with inflation owing to the Fed keeping rates low, and the GOP having undermined the bargaining power of labor to keep wage increases in check. So there was a run up in asset prices, increasing the wealth effect of the middle class, leading them to borrow more than they could handle based on stagnant income. The rest is history.

So while this was not what Lerner envisioned, the thinking that led to it is based on those principles. Laffer is still behind the present GOP push for deeper tax cuts regardless of what it would do to the deficit.

Aidan: But you fail to understand what a religious belief it. It’s nothing to do with any lack of evidence – indeed many people who believe in God do so because of the evidence!

Belief is acceptance of truth without evidence. Where there is evidence, there is knowledge instead of belief. That is Philosophy 101.

Then Philosophy 101 is wrong, Belief is acceptance of truth without absolutely conclusive evidence. That’s entirely different to a total lack of evidence, or overwhelming evidence to the contrary, even though there are many things (religious and otherwise) that people do continue to believe despite overwhelming evidence to the contrary.

>Belief is acceptance of truth without absolutely conclusive evidence

If we’re going to redefine words to mean what they want them to mean then rational discussion goes out the window.

The particular definition given above is of course self contradictory. We cannot know anything is “true” without conclusive evidence.

The root word of “believe” is “lief”, which is an old word that means “to wish”. To believe then means to devoutly wish something is true and act as if it were even if the evidence does not actually support it.

However language changes over the years and in common discorse belief simply means to hold that something is true, with or without evidence.

Personally I try not to have beliefs, but to have faith, which is not at all the same thing. I think “beliefs” are the main cause of all our problems. The reason Bill has so much trouble convincing people of the obvious truth of many of his views is just that people hold on to beliefs in the face of evidence.

Fama: “The problem is simple: bailouts and stimulus plans are funded by issuing more government debt. (The money must come from somewhere!)”

Now, since the parenthetical statement is false under a fiat currency, once it is corrected, the argument becomes one in favor of funding bailouts and stimulus plans without issuing more gov’t debt, but simply by creating the money. 🙂

Aidan, you are talking about reasons, not evidence. Evidence is empirical. Evidence provides is a publicly available criterion that anyone with adequate qualifications can check. There can be disagreements over what constitutes good evidence, but evidence that is not compelling remains in the realm of conjecture. This is what statistics and probability are employed to resolve, as well as experimental design, peer review, and so forth, that constitute scientific method. Science is about evidence. Philosophy is about reasons where evidence is either lacking owing to limitation or unavailable in principle. For example, a mathematical proof is not based on evidence for its truth, which is purely syntactical and a priori.

Min, some hold that even currency is government “debt” in the sense of it being a government liability. But it is not a debt obligation that must be satisfied from revenue, selling assets, or borrowing for the currency issuer, as it is for currency users. That is the difference that these folks are apparently missing. It feeds into the government-finance-is-like household-finance false analogy. But I suspect that Fama knows little if anything of monetary economics and government finance.

“Nobody knows anything.”

William Goldman

Hmmm … I think Bill thinks more along the line of Philip K. Dick “Reality is that which, when you stop believing in it, doesn’t go away.”

The following graph shows the evolution of unemployment in Britain from 1921 to 1938. Only the onset of World War II saw the rate drop substantially.

The graph seems to show a steady decline in the rate following a peak in 1932, except for a slight uptick at the end. Not sure how that matches the above sentence. Are you saying that mobilization prior to the actual war, which started in 1939, is responsible for the steady decline?

Ken

Tom Hickey: “Min, some hold that even currency is government “debt” in the sense of it being a government liability. But it is not a debt obligation that must be satisfied from revenue, selling assets, or borrowing for the currency issuer, as it is for currency users. That is the difference that these folks are apparently missing.”

If I understand Fama correctly (which I well may not) when he says that the gov’t must issue debt because “the money must come from somewhere”, he envisions taxpayers saving up the money to pay the debt back in the future. As you say, though, that is different from currency. The gov’t does not have to save up dollars so that they can redeem dollars. 😉

Tom Hickey,

Art Laffer, a GOP economic architect, understands these principles and built the Reagan GOP economic policy on it – the one that G. W. H. Bush called “voodoo economics”

But then the supply siders/GOP economic advisers have never directly created money to fund budget deficits.

Lerner argued that the very idea that the budget deficit has to be funded $ for $ by borrowing from the private markets is a myth.

Lerner argued that you could use fiat money creation to hold the stock of government debt at the ideal level.

Maybe Australia’s pre-1981 tap system of issuing bonds was more like what Lerner envisaged?

Tom Hickey says:

Saturday, September 25, 2010 at 0:17

then Vice-President Cheney said, “Reagan proved that deficits don’t matter.”

That’s an interesting comment. The US right wing is perfectly happy to run a deficit budget when in power and it suits them. Yet, in opposition they take a fiscally conservative stance. That happens to be very popular among the T bags, due to the household budget analogy.

The right wing is whipping up a popular hysteria against the national debt. Obama and the Dems are petrified to run a big stimulus package. Sigh! ….. weak politicians are so handcuffed by opinion polls.

I will laugh my little cotton sock off if the Republicans change tack and run a strong stimulus budget in power. They will claim the economy is purged of waste (by efficient free markets) and ripe for stimulus.

I’m laughing hysterically already.

Min: If I understand Fama correctly (which I well may not) when he says that the gov’t must issue debt because “the money must come from somewhere”, he envisions taxpayers saving up the money to pay the debt back in the future. As you say, though, that is different from currency. The gov’t does not have to save up dollars so that they can redeem dollars.

Min, the argument that public debt has to be repaid by the public through future taxation is bogus, as we know, since the public “debt” is actually nongovernment savings. Those savings accounts (bonds) will just get switched back to deposit accounts (reserves) when they are exchanged or redeemed at maturity. The implication that the interest “has to be paid” out of taxes too, since it goes on the deficit is also bogus, in that government funds itself through currency issuance, it is not funded by taxpayers.

Fama’s saying that “all that money must come from somewhere” reveals that he doesn’t have a clue about how the modern monetary system works in the case of a monetarily sovereign government as the monopoly issuer of a nonconvertible floating rate currency, like the US. The political restraints the government has imposed on itself do not change this fact, they just disguise it as far as MMT’s operational analysis is concerned.

Andrew, Lerner argued that the very idea that the budget deficit has to be funded $ for $ by borrowing from the private markets is a myth.

Lerner argued that you could use fiat money creation to hold the stock of government debt at the ideal level.

The government does not have to borrow to finance itself and it does not borrow to finance itself under the present regime, even though it may look that way. It just requires that all deficits be saved in the from of government securities. The amount of net financial assets generated by deficits is not changed by tsy issuance, only the composition of the those assets. As Warren says, reserves are zero-interest bonds and tsy’s are interest-bearing bonds. Whether the government does or does not issue offsetting “debt” makes no difference to the amount of nongovernment NFA. Tsy issuance is just a reserve draining monetary operation that facilitates the Fed hitting its target overnight rate. So much ado about nothing if it were not for the unnecessary interest subsidy for bond holders.

I will laugh my little cotton sock off if the Republicans change tack and run a strong stimulus budget in power.

The GOP has two wings, the fiscal conservatives and the Reaganites. Both agree that the GOP’s chief purpose is to cut taxes and privatize the commons. But the fiscal conservatives want to cut spending to balance the budget, while the Reaganites not so much. The Reaganites have been in control of the party for some time, and now they are being challenged by the fiscal conservatives. We will have to see how this plays out when they return to power.

“The Reaganites have been in control of the party for some time, and now they are being challenged by the fiscal conservatives. We will have to see how this plays out when they return to power.”

Tom,

I have come to believe the fiscal conservative stance is being driven hard by Baby Boomers. Trying to ring fence their wealth and enjoy a prosperous retirement. A lot of the bogus economic talk stems from this dynamic.

From my layman’s perspective, I see big problems ahead. If the boomers are successful, a ever larger slice of consumption will be enjoyed by unproductive (retired) wealth holders. The productive working sector of economy (gen X,Y) will be getting relatively diminishing rewards for their work efforts.

It seems the conservatives are willing to let the overall economy slide to protect their slice of the pie. Boomers have a big voice, so my money is on the conservatives.

You seem to have a good grasp of the situation. What say ye?

Andrew, in the US, polls show that the public is overwhelmingly for policy and programs that the liberals either have passed or are proposing – like SS, healthcare reform, the safety net, and raising taxes on the wealthy. They are also for financial reform and against the bank bailout without accountability. The liberals were not completely successful in advancing their agenda owing to the solid opposition of the conservatives, not only in the opposition but also in their own party. The conservatives in Congress are less popular in polls than the liberals. The problem in the coming election is with likely voters. Conservative voters are fired up, and liberal voters are not, since they feel betrayed by the political compromises undertaken by the Obama administration. If liberal voters show up percentage wise in the numbers that conservatives do, the liberals will easily win, at least as polling indicates.

I don’t see that the Boomers have anything to gain with the conservatives, since the conservative positon really doesn’t benefit the middle class and the Boomers are mostly middle class. Moreover, the ultra-conservatives are hell-bent on getting rid of SS and Medicare. That definitely scares the Boomers, since these are its lifelines. Because of the Boomers numbers and approaching retirement, SS and Medicare are called the “third rail” of US politics. Any party grabbing the third rail with both hands will be instantly electrocuted. What the conservatives as the front men for Wall Street really want is SS privatization, which WS regards as the prize. This windfall would greatly increase WS fees and it would also drive up asset prices.

The fact is pretty well established that the conservative positon of eliminating all taxes, especially inheritance and capital gains, excepting the income tax and making it a flat tax equally applicable to all is being driven by the ultra-wealthy, in fact, just a few super-rich families. This would not make a substantial difference for most Boomers.

The Boomers would like to see unemployment come down so they can continue working until retirement, and also equity and housing values increase so they can recoup the loss of their nest egg. That doesn’t look good under the policy the conservatives are proposing, which on the face of it at least involves retrenchment.

However, it is difficult to generalize about the GOP position because there is now a war going on between the conservatives and ultra-conservatives, and they have not yet defined the position of their party. It will be be done until they attain power and their intra-party brawl comes to a head in the voting. This will be interested since a unified front is needed to pass legislation, and they are not unified around key policies at present.

I have a distant and vague memory of a phrase that says: “the economy grows only when something of value is added to it”. Perhaps this has something to do with what E. Fama meant by: “(The money must come from somewhere!)”. I think it follows that mediums of exchange do not qualify as “something” which can be added but instead only that which represents the “something”. It would also seem to follow that the phrase “the economy grows only when something of value is added to it”, and, ‘supply-constrained’, mean the same thing?

Tom Hickey: “Fama’s saying that “all that money must come from somewhere” reveals that he doesn’t have a clue about how the modern monetary system works in the case of a monetarily sovereign government as the monopoly issuer of a nonconvertible floating rate currency, like the US.”

Tom, I accidentally recorded a talk by the head of the John Birch Society on CSPAN the other day. He understood the difference between fiat money and commodity money (although he thought that the gold standard was commodity money). He just hates fiat money, that’s all. 😉 Now Fama may not understand all of the ins and outs of modern fiat money, but I find it hard to believe that he, as a prominent economist, doesn’t know as much as the head of the John Birch Society. It is easier to think that he is lying, playing to an ignorant audience. (In his mind it may be a white lie, like Paulson’s saying that the reason for the bailouts was so the banks could start lending again.)

Irishman here. It’s a pity our politicians don’t read this blog! Our politicians will, unfortunately, do whatever the IMF deem appropriate.

If i understand it correctly, a sovereign Government spends by creating the money; not by taking it from tax revenues. But what about Ireland in the Euro? Can Ireland spend in the same manner as, say, Australia or Britain or does Irish spending have to be funded?

Sorry, McCardle, but Ireland gave up monetary sovereignty when it signed up for the European Monetary Union. 🙁

rayllove, money doesn’t come from adding something of value to growth the economy. It is generated either from deficit expenditure or credit. although if supply does not keep pace with the real resources demanded based on income, drawing down saving, selling assets, or using credit, then prices will be bid up and inflation will occur.

Generally speaking, at the end of a cycle, consumers borrow more than usual to purchase, and businesses invest to supply the increasing demand, but due to diminishing returns at full capacity and the lag time to ramp up production, demand gets ahead of supply, so that inflation occurs. Then the Fed raises rate to make borrowing more costly, demand decreases, and wholesale orders in the pipeline result in excess inventory. Businesses cut back, unemployment rises, and recessions sets in.

Thanks Tom,

A truly informative post. I see I asked the right person.

Truth said, I am a slightly embarrassed about my ignorance. Though to be fair, I am a long way from the US. My window to your universe is Fox and CNBC. 🙂

I am a little suprised at the extent of the influence of the Uber rich conservatives. It’s like a bad Hollywood movie with evil bond type villains. Almost too fantastical to believe.

McCardle

Your hope is to exit the Euro and run and run a job creation budget under the punt.

Think of Jean Claude Trichet and his banking gang as the modern day Black and Tans.

Tom,

Without adding something of value to an economy, other than “deficit expenditure or credit”, an economy has nothing but useless pieces of paper. You have the dynamics backwards in other words. The ‘something of value’ comes first and the ‘paper’ (digital) can never be anything more than a medium of exchange.

Put another way, an economy can flourish without “deficit expenditure and credit” but there is not an economy without goods and services.

Plus, “credit” is growth neutral, it is the interest that remains as residual growth. The expansion of the money supply is simply the mediums of exchange being added to keep pace with economic activity.

Lending is not about creating growth, lending is about accelerating growth.

rayllove, it was Karl Marx who said that capitalism works as Money1->Goods->Money2. So, first comes money (credit), then come goods, and then the initial credit is repaid and profit realized. This is the way all modern companies operate and this logic is ingrained into any course on corporate finance under the Weighted Average Cost of Capital concept.

@McCardle

There is hope for the Irish within the EMU system, but you’d have to try and use a little sleight of hand and hope the ECB doesn’t notice.

http://www.3spoken.co.uk/2010/09/solution-to-european-debt-crisis.html

@raylove

One of the key findings of MMT is that the debt comes first. It is the imposition of a punishable tax or debt in a fiat currency that can be shown to cause a demand for that currency and creation of real stuff to facilitate that exchange.

You can do it yourself with a Monopoly set if you have kids. It’s quite scary how the Monopoly Money economy fires up. You can model transfer payments, ‘foreign’ exchange rates, fines.

Bill’s example uses business cards (https://billmitchell.org/blog/?p=1075)

Sergei, Neil,

I have owned a small manufacturing company for 20+ years and never have I needed a loan. We extract the raw materials necessary to produce our products and the sale of those products has always allowed a positive cash flow. This method of building-up a small business is a slow one, no doubt, but it is not at all uncommon. Karl Marx, like most economists, oversimplified the dynamics in an effort to explain them. It all becomes fairly obvious just how misleading economists have been when one realizes that the bulk of the global population produces and creates growth without ever taking on debt.

Go out and find a tree that produces nuts. Harvest the nuts and sell them. The economy will expand by the value of the nuts because you will have added something that did not exist before.

So it is obviously possible to add to an economy without debt, think of gold rushes etc., or all of what has been produced and harvested on ‘commons’. Investment can of course accelerate and enlarge the process and this would thereby be the very essence of Capitalism, which is based on making assumptions about the future. But this is not a ‘chicken and egg’ proposition because ‘growth’ is possible without lending but not without goods and services. This ties ‘growth’ entirely to goods and services with lending being based on assumptions of economic activity in the future, but those assumptions are based on the values of the goods and services as expressed in their potential for ‘growth’. Because, like I said above, without adding something of value to an economy, whether that be in the present or the future, other than “deficit expenditure or credit”, an economy has nothing but useless pieces of paper. So the notion that “deficit expenditure or credit” is what generates growth is a flawed way of understanding how an economy works. Growth is ‘accomplished’ by a combination of lending, adding currency, resource extraction, production, and the value given to labor and services, all in unison. But to say that growth is “generated” by “deficit expenditure or credit” is simply inaccurate.

rayllove: Without adding something of value to an economy, other than “deficit expenditure or credit”, an economy has nothing but useless pieces of paper. You have the dynamics backwards in other words. The ‘something of value’ comes first and the ‘paper’ (digital) can never be anything more than a medium of exchange.

That is true, and MMT agrees that real resources are the basis of economics, and that money is secondary. But this is not Fama’s contention in the quoted in Bill’s post. The quote reveals that he think that the government is financially constrained when it is not. MMT admits that there are real constraints on government.

The quote that Bill cites makes it clear that Fama is taking about government being financially constrained, not a reference to real goods and services.

rayllove: So it is obviously possible to add to an economy without debt,

Modern economies all run on state money. All of this money is someone’s liability. Either the liability of the government issuing it or someone’s debt corresponding to credit extension in the commercial banking system. While it is true that simple exchanges can take place through barter or some token like a fixed amount of gold, and there are probably some people doing this – there is even a fellow living without money and writing about it – the world economy runs on state money (dollars, pounds sterling, euros, etc.) and all of it is someone’s liability.

Tom,

Now you are talking about how ‘money’ is created. But my previous comment was about how ‘growth’ is “generated”. You claimed that I said that :”money doesn’t come from adding something of value to growth the economy”, when, I suggested nothing of the sort. Your claim that “growth” is “generated” by “deficit expenditure or credit” is completely wrong and I explained why in my previous comment. Changing the context of what I said is part of your delusion about economics, you seem to need ‘money’ and ‘growth’ to be one and the same so as to defend your previous faults, this, I suppose, comes from the same lack of mental discipline that leads to claims such as: “Fama’s saying that “all that money must come from somewhere” reveals that he doesn’t have a clue about how the modern monetary system works in the case of a monetarily sovereign government as the monopoly issuer of a nonconvertible floating rate currency, like the US.” E. Fama is of course one of the most accomplished economists of our time and you are accusing him of not having a “clue” on something he has probably known since his high-school days . Your statement is in fact ludicrous. The MMT faithful have a long way to go if they are ever to be taken seriously, learning to show respect for those who know far more about this subject that what ‘your beliefs’ allow you them credit for, would be a open-minded place to start. Learning to argue honestly and accurately would be a good next step.

My views are not consistent with those of Eugene Fama.

Rayllove, I think you have hit the nail on the head with your insistence that MMTers more clearly define what they mean by “economic growth”. As far as I can make out they just mean an accounting sense of the phrase so that issuing more money than is withdrawn as tax in itself gives “economic growth” in nominal $ terms. To my mind if the amount of money was fixed or even reducing (deflation) but more loves of bread were made and eaten and more children were educated or whatever then that would give a genuine “economic growth” even if in nominal terms there was negative “economic growth”.

Stone,

But recently here in US, money supply has been increasing, not decreasing, have you seen this chart yet:

http://research.stlouisfed.org/fred2/series/WRESBAL

while this part of the ‘measure of money’ was increasing by 12,000 % in US: real estate has fallen by 35%, petro by 50%, Nat Gas by about 75%, stock market by 30%, and interest rates have fallen can you believe it?

Shouldnt have prices increased by now (2 years+)? Do you have any data on how long it usually takes for such a money supply increase to have the predicted effect of increasing prices? Id like to get a jump on it…and Im starting to become tired of waiting now after 2 years+. Is there any hope left?

Resp,

Matt,

During the period after WW2 savings rates were high… and demand for ‘everything’, but especially houses, was very strong. Coming out of the Great Recession, conversely, savings rates are low and demand for ‘everything’, but especially for houses, is very weak. So, consider those differences and then you should be able to understand why counter-cyclical spending will work in certain conditions while only exacerbating a liquidity trap in other conditions. Obviously, prices will not increase regardless of how much the money supply is increased in liquidity trap conditions if aggregate demand is weak to a severe degree… and, at some point stagflation occurs if demand remains weak with an excess in the money supply. And so, the only way to create self-supporting jobs is to increase exports but this puts labor in the US in a more competitive position with global labor. This means wage inflation can not keep pace with price inflation so stagflation in these conditions would be devastating for the US workforce, and especially so, at a time when households are deleveraging and losing their homes in record numbers. So, there is no ‘quick’ solution and a ‘new normal’ is a certainty.

Matt Franko, money supply increases are no longer geographically linked to consequent asset price increases because it is now so easy for money to flow from one part of the world to another. Also asset prices increase in fits and starts. Japan pumped loads of money into the global economy but never itself got an asset price bubble but the yen carry trade transfered $1T to asset price bubbles in the rest of the world in the run up to the 2008 crisis. The world stock markets and the gold price have recovered since 2008 and the money supply increases are accounting for that. Private deleveraging has somewhat counteracted governments increasing the money supply but that just gives more scope for when an asset bubble really gets going somewhere in the world. The very fact that the increase in asset prices is so uneven means that it transfers wealth to those elite speculators who are most ahead of the game.

Matt Franko, now that the USA is a source of “cheap money” money supply is flowing out via a carry trade.

ftalphaville.ft.com/blog/2009/11/25/…/debunking-carry-trade-denial/

rayllove, you are right to say what you say because you own a mining company. You mine stuff that already exists in the ground and similar logic can be applied to nuts, applies etc. But how did you get to your mine and your tree? And that is the essence of capitalism. When companies borrow they pay for resources including labour. Labour then goes and decides how to spend its income. And when labour spends it creates value and growth because its expenditure validates previous production decisions. It is not production that creates value but expenditure. However there are two types of expenditures: corporate and household. In today’s world corporate expenditure typically and surely not always is financed by debt because corporates have limited liability. It is not an oversimplification of Marx or economists but a description of reality. Whether reality is good or bad is never included in description but comes with judgement :).

Sergei,

No. Based on your model a self-employed producer with no employees does not add to GDP. In the US, 70% of all small businesses do not have any employees.

When something of value is added as inventory it becomes an asset. It matters not whether that involves any lending or not. When a miner extracts an ounce of gold, for instance, that commodity becomes insurable as an asset. It also provides the miner with collateral that can be borrowed against. Something that did not exist until it was mined and quantified was added to the economy as growth and that increases GDP.

When a lender extends credit this also increases GDP but as the principle of that loan is paid down this decreases GDP so principle is growth neutral. The interest adds to the money supply and to growth.