I started my undergraduate studies in economics in the late 1970s after starting out as…

The austerity mania is just blind dogma

As governments around the world are setting about to scorch their economies with austerity programs very little opposition is coming from my profession. It is quite astounding to me that the more extreme elements (the Ricardian Equivalence theories) are holding sway at present. These notions have been discredited often (see my blog – Pushing the fantasy barrow for a discussion). Generally, the austerity push is not being supported by any credible economic theory which enjoys empirical support. I get the impression that policy makers are now altering settings in an ad hoc manner without any real understanding of how the economy works. It is a triumph of neo-liberal dogman. However, in terms of evidence-based critiques of the austerity push, Bloomberg Opinion published an interesting article (July 13, 2010) – U.K. Bust Needs Big Spender – written by UK academic Vicki Chick and author/debt activist Ann Pettifor (thanks BM). The Op Ed summarises a more detailed research paper which demonstrates that key assumptions of the austerity proponents do not hold over a long historical period. The short message is that things are going to get worse.

One of the underlying claims that the proponents of austerity make is that the deficits (and matching public debt issuance) drive up long-term interest rates and thus increase the cost of borrowing for private investors. So by cutting back government net spending private investors will realise that interest rates will be lower in the future and will start investing.

Despite ignoring completely the fact that investment is heavily influenced by the expectation that aggregate demand (spending) will be strong in the future the alleged relationship between government net spending (and debt-issuance) and interest rates is based on the flawed mainstream macroeconomic theory of crowding out.

The normal presentation of the crowding out hypothesis, which is a central plank in the mainstream economics attack on government fiscal intervention, is more accurately called “financial crowding out”. In this blog – Studying macroeconomics – an exercise in deception – I provide detailed analysis of this hypothesis.

By way of summary, the underpinning of the crowding out hypothesis is the old Classical theory of loanable funds, which is an aggregate construction of the way financial markets are meant to work in mainstream macroeconomic thinking. The original conception was designed to explain how aggregate demand could never fall short of aggregate supply because interest rate adjustments would always bring investment and saving into equality.

Mainstream textbook writers (for example, Mankiw) assume that it is reasonable to represent the financial system to his students as the “market for loanable funds” where “all savers go to this market to deposit their savings, and all borrowers go to this market to get their loans. In this market, there is one interest rate, which is both the return to saving and the cost of borrowing.”

This doctrine was a central part of the so-called classical model where perfectly flexible prices delivered self-adjusting, market-clearing aggregate markets at all times. If consumption fell, then saving would rise and this would not lead to an oversupply of goods because investment (capital goods production) would rise in proportion with saving.

So while the composition of output might change (workers would be shifted between the consumption goods sector to the capital goods sector), a full employment equilibrium was always maintained as long as price flexibility was not impeded. The interest rate became the vehicle to mediate saving and investment to ensure that there was never any gluts.

The supply of funds comes from those people who have some extra income they want to save and lend out. The demand for funds comes from households and firms who wish to borrow to invest (houses, factories, equipment etc). The interest rate is the price of the loan and the return on savings and thus the supply and demand curves (lines) take the shape they do.

This framework is then used to analyse fiscal policy impacts and the alleged negative consequences of budget deficits – the so-called financial crowding out – is derived.

Mankiw (in his First Principles) says:

One of the most pressing policy issues – has been the government budget deficit – In recent years, the U.S. federal government has run large budget deficits, resulting in a rapidly growing government debt. As a result, much public debate has centred on the effect of these deficits both on the allocation of the economy’s scarce resources and on long-term economic growth.

So what would happen if there is a budget deficit (and it is matched by debt-issuance)? The erroneous mainstream logic is that investment falls because when the government borrows to finance its budget deficit, it increases competition for scarce private savings pushes up interest rates. The higher cost of funds crowds thus crowds out private borrowers who are trying to finance investment. This leads to the conclusion that given investment is important for long-run economic growth, government budget deficits reduce the economy’s growth rate.

The analysis relies on layers of myths which have permeated the public space to become almost “self-evident truths”. Obviously, national governments are not revenue-constrained so their borrowing is for other reasons – we have discussed this at length. This trilogy of blogs will help you understand this if you are new to my blog – Deficit spending 101 – Part 1 | Deficit spending 101 – Part 2 | Deficit spending 101 – Part 3.

But governments do borrow – for stupid ideological reasons and to facilitate central bank operations – so doesn’t this increase the claim on saving and reduce the “loanable funds” available for investors? Does the competition for saving push up the interest rates?

The answer to both questions is no! Modern Monetary Theory (MMT) does not claim that central bank interest rate hikes are not possible. There is also the possibility that rising interest rates reduce aggregate demand via the balance between expectations of future returns on investments and the cost of implementing the projects being changed by the rising interest rates.

But the Classical claims about crowding out are not based on these mechanisms. In fact, they assume that savings are finite and the government spending is financially constrained which means it has to seek “funding” in order to progress their fiscal plans. The result competition for the “finite” saving pool drives interest rates up and damages private spending.

A related theory which is taught under the banner of IS-LM theory (in macroeconomic textbooks) assumes that the central bank can exogenously set the money supply. Then the rising income from the deficit spending pushes up money demand and this squeezes (real) interest rates up to clear the money market. This is the Bastard Keynesian approach to financial crowding out.

Neither theory is remotely correct and is not related to the fact that central banks push up interest rates up because they believe they should be fighting inflation and interest rate rises stifle aggregate demand.

Further, from a macroeconomic flow of funds perspective, the funds (net financial assets in the form of reserves) that are the source of the capacity to purchase the public debt in the first place come from net government spending. Its what astute financial market players call “a wash”. The funds used to buy the government bonds come from the government!

There is also no finite pool of saving that is competed for. Loans create deposits so any credit-worthy customer can typically get funds. Reserves to support these loans are added later – that is, loans are never constrained in an aggregate sense by a “lack of reserves”. The funds to buy government bonds come from government spending! There is just an exchange of bank reserves for bonds – no net change in financial assets involved. Saving grows with income.

But importantly, deficit spending generates income growth which generates higher saving. It is this way that MMT shows that deficit spending supports or “finances” private saving not the other way around.

Acknowledging the point that increased aggregate demand, in general, generates income and saving, Luigi Passinetti the famous Italian economist had a wonderful sentence I remember from my graduate school days – “investment brings forth its own savings” – which was the basic insight of Keynes and Kalecki – and the insight that knocked out classical loanable funds theory upon which the neo-liberal crowding out theory was originally conceived.

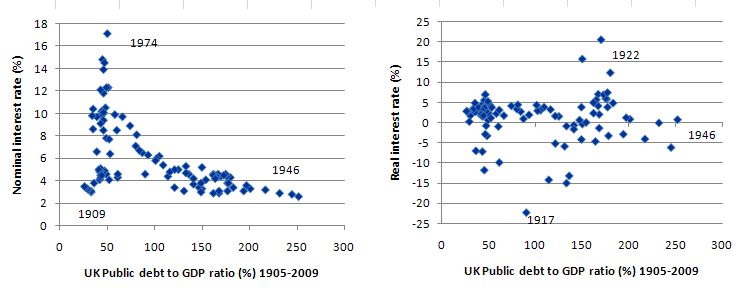

The following graph uses data available in the Appendix of the paper mentioned in the introduction (basically Charles Feinstein’s data with modern inclusions – see below) and shows the relationship from 1905 to 2009 between the UK public debt ratio as a percent of GDP (horizontal axis – both panels) and the nominal (left-panel) and real (right-panel) long-term UK public debt yields (the interest rate). I dated some of the outlying observations for reference purposes.

The obvious conclusion is that over this very long historical period, which spanned several different monetary systems and bond-issuing arrangements (gold standard; Bretton Woods; and fiat currency) and different exchange rate setting arrangements (fixed, floating, crawling peg etc), there is no evidence to support the basic mainstream macroeconomics prediction that rising public debt ratios cause long-term (investment) interest rates to rise.

It doesn’t matter if you construct the argument in nominal or real terms. The text book argument is actually in real terms.

Of-course, we have modern testimony that supports the Modern Monetary Theory (MMT) conclusion that there is no financial crowding out. Japan over the last several decades is a good case. Further, yields in the current environment are low and stable. But the Feinstein plus dataset demonstrates that for a long historical period there is no mainstream causality operating.

Another aspect of the austerity is that government spending cuts will stimulate growth and that increasing net public spending undermine growth. Allegedly this impact works via (Ricardian) effects whereby private spending is cut when public spending rises because the private agents expect higher taxes and higher interest rates.

Recall Trichet’s response (from yesterday’s blog):

It is an error to think that fiscal austerity is a threat to growth and job creation. At present, a major problem is the lack of confidence on the part of households, firms, savers and investors who feel that fiscal policies are not sound and sustainable. In a number of economies, it is this lack of confidence that poses a threat to the consolidation of the recovery. Economies embarking on austerity policies that lend credibility to their fiscal policy strengthen confidence, growth and job creation.

So we should find a strong negative relationship between public spending growth and real GDP growth if this proposition is correct. MMT predicts a strong positive relationship between growth in public spending and real GDP growth – via its impact on aggregate demand.

The paper written by Chick and Pettifor from which the Bloomberg article noted in the introduction is taken from – The Economic Consequences of Mr Osborne.

The paper updates the famous historical macroeconomics dataset constructed by the late British economic historian Charles Feinstein. The dataset was originally published in Feinstein’s classic work National Income, Expenditure and Output of the United Kingdom, 1855-1965

The authors note that the government spending time series (from 1905-2010) is:

… based on final demand of government and exclude transfer payments such as benefits and interest payments. From an economic point of view, final demand is likely to be more important to outcomes and follows most directly from deliberate policy action.

In other words, it nets out the cyclical impacts of the automatic stabilisers on government spending and gives a measure of the discretionary (now called structural) decisions taken by government when designing their fiscal intervention.

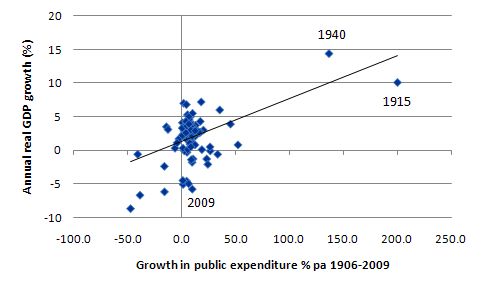

The following graph also taken from the Feinstein plus macroeconomics dataset which spans the period 1905 to 2009 shows the annual growth in UK public spending (horizontal axis) and the annual growth in real GDP (vertical axis) for the UK. There is a very clear positive relationship between growth in government spending and real GDP growth over this long historical period.

You may consider the two outliers might alter this conclusion. I can assure you that it doesn’t. I removed them and re-examined the relationship both graphically and using econometric (regression) analysis and there remains a strong and statistically significant relationship between growth in government spending and real GDP growth.

So the austerity proponents have another problem to address if they are to explain how we will get growth emerging when government net spending is being slashed and growth in aggregate demand deliberately cut back as a consequence.

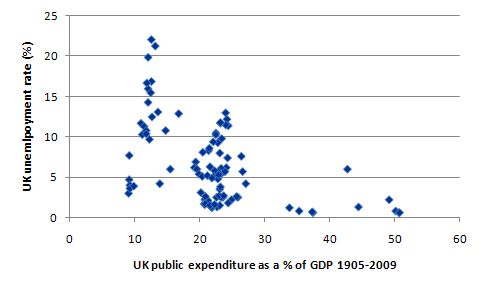

The final graph in this series plots public spending as a percent of GDP (horizontal axis) and the UK unemployment rate in percent (vertical axis) from 1905-2009. While this relationship bears further analysis because you can see there are possibly three segments (clusters) the data will not support an hypothesis that cutting public spending as a percentage of GDP will improve the unemployment rate. The opposite is the supportable hypothesis.

This introduction was background to the Chick and Pettifor paper which was summarised in the Bloomberg Op Ed piece – U.K. Bust Needs Big Spender.

As noted above the full paper (with the Feinstein plus dataset) is published as – The Economic Consequences of Mr Osborne.

The paper is interesting for a number of reasons and is focused on providing some evidence to challenge the current fiscal orthodoxy which is imposing pro-cyclical austerity measures on economies around the world and is thus deliberately increasing unemployment and reducing economic growth.

The first reason the paper is interesting is because it:

… looks at national accounts information for government expenditure to examine ‘genuine’ ‘consolidations’, episodes when nominal spending actually fell. These are contrasted with fiscal expansions. Spending figures are shown alongside outcomes for public debt, interest rates, unemployment, GDP and prices. Outcomes are seen as running almost entirely contrary to conventional wisdom, or at least contrary to thinking derived from microeconomic considerations: fiscal consolidation increases rather than reduces the level of public debt as a share of GDP and is in general associated with adverse macroeconomic conditions. The exception was the consolidation after World War II.

Second, it updates the famous historical macroeconomics dataset constructed by the late British economic historian Charles Feinstein. The dataset was originally published in Feinstein’s classic work National Income, Expenditure and Output of the United Kingdom, 1855-1965.

Bloomberg Opinion published an interesting article (July 13, 2010) – U.K. Bust Needs Big Spender – written by UK academic Vicki Chick and author/debt activist Ann Pettifor.

You can get the academic paper that the Op Ed piece was based on HERE.

Chick and Pettifor argue that:

Until recently, there was almost complete agreement on the need for a period of synchronized austerity across Europe. This consensus, at a time of private- sector weakness and banking fragility, is very worrying … Today’s dominant doctrine, espoused by George Osborne, the new chancellor of the Exchequer, is even more severe than the “Treasury view” of the 1920s and ’30s, which merely stood in the way of increases in expenditure.

This is an interesting insight. The mainstream position is now more extreme than it was during the 1930s. At that point, there was very little macroeconomics thinking (as I explain in this blog – Fiscal austerity – the newest fallacy of composition). But the UK Treasury was stridently opposed to using fiscal policy to stem the demand collapse following the financial collapse in the late 1920s.

Now, the viewpoint categorically denies what we learned in the 1930s. The Great Depression only ended with the massive fiscal expansions leading into the Second World War. During the 1930s, the fiscal expansions stimulated growth but the conservatives kept curtailing the initiatives for fear that inflation and higher interest rates would result.

Chick and Pettifor concur on this point:

Keynes’s approach to widespread economic failure and his critical role in triggering recovery after 1934 have been entirely disregarded. In the Great Depression of the 1930s, he confronted the Treasury view that increases in public expenditure would divert resources from private business.

He developed a theory showing that, in an economy with spare productive capacity and unemployment of labor, government expenditure would create employment. Keynes advocated increasing investment expenditure rather than encouraging consumption. Expenditure by the newly employed would then create private-sector economic activity by a multiple of the original expenditure. This was “the multiplier.”

MMT shares these elements in terms of aggregate demand insights. There is no robust, empirically supported theory that tells us that widespread austerity (that is, deliberately undermining spending) stimulates production.

If you study Keynes you will also gain insights into the relationship between public expenditure and public debt.

Chick and Pettifor note in the Op Ed piece that “It may seem obvious that if you want to cut debt, you cut expenditure, but Keynes showed that the government finances were very different from a household budget. For him, macroeconomic outcomes were often the reverse of outcomes based on microeconomic reasoning.” I explain this point in the blog – Fiscal austerity – the newest fallacy of composition.

In the paper, Chick and Pettifor elaborate:

The public sector finances are not analogous to household finances. Given spare capacity, public expenditures are not only productive but also foster additional activity in the private sector. Productive activity generates revenue and economises on benefits (and then debt interest) expenditures. This was one of Keynes’s central conclusions: “For the proposition that supply creates its own demand, I shall substitute the proposition that expenditure creates its own income” (Collected Writings, Volume XXIX, p. 81).

Conversely, reducing expenditure would reduce income. Equally, reducing public expenditure will increase income only if it is outweighed by expansions in private expenditure.

This reverses the claims made by Say’s Law that any level of aggregate supply (production) will always be purchased because demand always adjusts. What Keynes and MMT show is that firms produce (and employ labour) in the expectation that aggregate demand will be at a certain level. They have no way of knowing that demand will be consistent with these expectations but because time stops everything from happening at once they have to make guesses.

Once spending decisions are taken and acted on, the firms then find out whether they have overproduced or underproduced. If they have overproduced – that is overestimated aggregate demand – they observe an unintended build-up of inventories. That signals to firms that they were overly optimistic about the level of demand in that particular period.

Once this realisation becomes consolidated, that is, firms generally realise they have over-produced, output starts to fall. Firms lay-off workers and the loss of income starts to multiply as those workers reduce their spending elsewhere. At that point, the economy is heading for a recession.

So the only way to avoid these spiralling employment losses would be for an exogenous intervention to occur. While the question suggests that this intervention would come from an expanding public deficit, it could come from an expansion in net exports. To expand net exports usually requires structural changes that go beyond a valid cyclical response.

Alternatively, if firms are underproducing (relative to capacity) and current demand, then the inventory cycle works in reverse and the increased expenditure “creates its own income” and saving. Once again negating the claims of those who believe in crowding out theories.

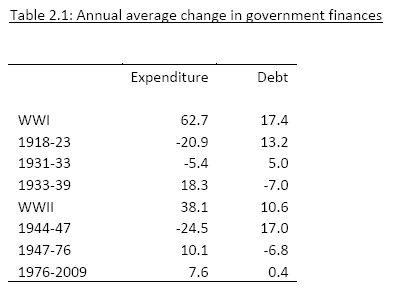

Chick and Pettifor examine eight historical episodes defined according to changes in policy for government expenditure are examined and their summary statistics for “public debt and government expenditure” are shown in the following Table (reproduced from their Table 2.1). You can find out how they chose these periods in the paper.

They say that their “eight episodes” allow them to compare “changes in the public debt (as a percentage of gross domestic product) … with those in public expenditure. The results stand wholly opposed to the conventional wisdom”. The details of what happened in each period is described in the paper.

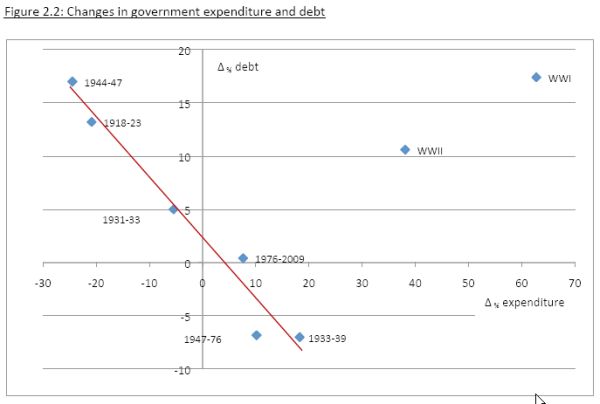

The following graph is a reproduction of their Figure 2.2 and shows “the average annual change in (i) government debt as a percentage of GDP and (ii) the percentage growth in nominal spending of government expenditure” for the periods corresponding to those in Table 2.1.

They conclude that “there is a very strong negative association between public expenditure and the public debt, excluding the two outliers for the world wars. As public expenditure increases, public debt falls, and vice-‐versa.”

That all makes sense because government spending increases GDP growth faster than the debt increases.

The overall results of their detailed analysis in the paper are summarised in the Op Ed piece as follows:

Comparing for each episode the average annual change in the public debt as a share of GDP and the average annual growth in government expenditure in cash terms, we have results that are perhaps even more remarkable than Keynes might have imagined. There is a very strong relationship between changes in government expenditure and the public debt.

But, outside the two world wars, the relationship goes in the opposite direction to that predicted by most commentators: Increases in public expenditure are associated with reductions in public debt. Very roughly, so long as there is unemployment, for every percentage rise in government expenditure, the public debt falls by half a percent, and vice-versa. This is very compelling evidence in favor of Keynes’s insights.

Osborne’s economic policies will, if sustained for any length of time, not only increase U.K. unemployment and social dislocation, but they will also increase the public debt. Sooner or later, governments, financial markets and international authorities will be forced to recognize the validity of Keynes’s analysis, just as they were forced to do in the 1930s.

The present course will cause unnecessary harm to the U.K. economy. The only rational response is to change direction immediately.

Conclusion

While the empirical work conducted by Chick and Pettifor is relatively simple it is also very powerful. It adds to all the rest of the evidence that is denied by the austerity proponents that fiscal policy is very effective in stimulating production and employment.

Any of the theoretical ruses used by the those promoting austerity have been shown to be logically and empirically flawed before. Some of the claims used to support the scorched earth approach are just made up on the spot.

The prediction is that growth will be stagnant for years to come and the austerians will remain in denial and look for scapegoats – for example, they will say the fiscal stimulus packages eroded private sector confidence.

The Saturday Quiz will appear tomorrow and run over the next two days (I am taking a break in Sydney for 2 days – cinema, theatre, picnics) and the Answers and Discussion will appear on Sunday as usual (EAST).

That is enough for today!

I’m just coming back to the blogosphere after a very long lay off, and I’m both surprised and very pleased to find one or two excellent blogs have cropped up which give due credit to the work of people like Wynne Godley, and that treat the economy as an interrelated system of stocks and flows that moves through time – as well as getting the adding up right in both numerical and conceptual terms.

Although I’m not an “academic” economist, I do have degrees in the subject, and work professionally in the broad field. Ever since my undergraduate days I’ve been continually amazed at the conceptual confusion that most modern macro texts seem to wallow in because they do not address the stock / flow issues, adding up constraints, and the conceptual relation between real and financial flows early on. – with knock on effects for the level of economic understanding more generally.

More power to your elbow. I’ll be reading your posts with interest.

Bill,

are you sure about your conclusions?

IMF has just published a new paper titled “Budget Consolidation: Short-Term Pain and Long-Term Gain” (link http://www.imf.org/external/pubs/cat/longres.cfm?sk=24044.0 ). Their conclusion is “Over the longer run, well-targeted permanent reductions in budget deficits lead to a considerable increase in both the growth rate and the level of output.”

So who is right?

I am just joking 🙂

Bill’s rebuttal of the austerian view is complicated. I think he should have mentioned a much simpler answer to the austerian view, which MMT has up its sleeve.

This is just to have the government / central bank machine print extra money and spend it in a recession, and conversely, rein in money via extra taxes and extinguish money if inflation looms. As to the national debt: get rid of it. As Warren Mosler points out we could perfectly well cease creating national debt and let it wither away in a few years. See here (especially 2nd last para):

http://www.huffingtonpost.com/warren-mosler/proposals-for-the-banking_b_432105.html

Anyone who wants reassurance as to the ease with which this can be done, see:

http://printingmoneyisgood.blogspot.com/

As to the interest rate, let it find its own level. Milton Friedman argued for the above sort of “no national debt” policy here:

http://www.jstor.org/pss/1810624?cookieSet=1

Finally, did Abba Lerner advocate a “no national debt” policy – anyone know?

Bill,

This is off topic for today but seems like something you may want to address in future:

http://mpettis.com/2010/07/the-capital-tsunami-is-a-bigger-threat-than-the-nuclear-option/

It essentially makes the argument that because of foreign sectoral balances globally, the US budget deficit structurally leaks jobs to the rest of the world. Our budget deficit is in fact creating jobs, but jobs in Germany, Japan and China. What policy responses are available?

If you’ve already addressed this, I’ve only followed your blog for six months or so, please note a link.

Thanks,

john

Bill:

What an excellent paper, thanks for the link! Even a non-academic such as I might be able to do the googling/research for the US historical data and see how it maps to the UK.

It’s nice to see some UK heterodox economists being mentioned. Victoria Chick is, of course, the author of one of the best books on Keynes, namely “Macroeconomics after Keynes” (1983). And it’s one of her PhD students, namely Geoff Tily (“Keynes’s General Theory” 2007), who seems to have influenced Ann Pettifor to adopt a Keynesian position.

Wynne Godley will be well-known to Bill’s readers. Jacob Epstein used Wynne’s head to model St. Michael’s Victory over the Devil on Coventry Cathedral. As I pass Epstein’s work every Friday, I like to think that it’s Wynne pressing his foot down on the head of mainstream economics! See the photograph at http://en.wikipedia.org/wiki/Wynne_Godley .

A quick question … is there any MMT literature that nuances the conventional story of how we get hyperinflations ?

I can see how one might do this ….. a fiscal crisis, alongside high inflation may lead to a govt monetising. This might not be inflationary by itself, but if inflation conitinues at a high level, a switch point may arise where a type of quantity theory dynamic arises ….. whereby money burns holes in pockets and people immediately try to substitute it for real goods, completing the vicious circle.

But I’d be interested to know if there’s anything worth reading around on this. Grateful for any pointers.

Bill et al.

Given that we are talking about more deficit spending to increase demand by reducing employment, and given that the article you refer to backs MMT’s claim that domestic inflation should not be something to worry about given the over capacity in the economy, I have been picking up on this idea of a time lag between demand increasing, and supply increasing to match it.

My understanding is that this time lag can cause temporary price increases. I thought of something the government could do to reduce this time lag, that follows on from the fact that all money enters the economy from the government sector:

The government could produce a monthly report showing how their spending breaks down, presented as injections into each socio/economic group, and how these injections of cash are increasing or decreasing. Those businesses which sell to consumers, will know which groups are their target market, and will be able to project their potential sales and therefore their own demand from their suppliers. As the information passes up the supply chain, this should reduce the time lag, and help to reduce temporary increases in prices. If this information was distributed electronically as datasets, companies can automatically upload the data into their forecasts and models, and in turn make th output of these models available electronically to their suppliers, and so on.

Perhaps the time lag could be reduced to less than 2 months.

Kind Regards

Charlie

rjw,

Others around here may know something better, but in may I saw this on Creditwritedowns:

http://www.creditwritedowns.com/2010/05/mmt-hyperinflation-in-the-usa.html

Sorry, meant reducing UNemployment (not employment) in the first line of the revious comment.

Sergei

I know you were just kidding, so this isn’t necessarily a reply, but just wanted to note quickly for whomever is interested that after reading the abstract of that IMF paper, it is based upon simulations of the IMF’s DSGE model, not empirical evidence. I would expect a DSGE model to give those sorts of results, actually, given that DSGE models aren’t stock-flow consistent and specify incorrectly a number of financial relationships (such as the loanable funds market, etc.).

Best,

Scott

Adding to my comment above, this time lag between demand and supply during a recovery delays the recovery in unemplyment levels, which is much more of a problem that temporary price increases.

Perhaps such a system would not work the way I imagine, but it’s a thought.

Kind Regards

Charlie

@Charlie

Interesting thought. Although I do think this issue should not cause you to worry about. Look at it from the firms perspective. Due to diminished aggregate demand you have what: either idle production capacity or a full inventory or both. Now demand increases which shows up in the firms order book. Firms will thus sell off inventory and ramp up production. The last thing they will think about is raising prices. There’s such a thing as competition in capitalism.

As a side note: I’ve realized that some economists are really desperate to find some sign of inflation to confirm their discredited theories. So they are now for instance studying the development of consumer product packaging over time. Some products like orange juice, tuna, … seem to shrink in regard to packaging while being sold for the same price. Heureka: Hidden inflation!

To inject some healthy skepticism, I’d ask how the time periods were chosen for the last table and graph. I understand leaving out the world wars, but the other time periods are of varying durations, which may suggest fitting the data to the preferred conclusion.

Stephan et l.

I agree my initial refernce to price increases is flawed (I noticed my neo-liberal up-side-down thinking and tried to correct it in the later coments), but I still think that if firms can see ,a 12 month projection of public sector wage levels and benefits by income group, and if it sees wages for particular socio-economic groups (that are relevant to them) increasing, they can a) learn that there is some direct correlation between government spending and demand for their product/service, and b) take braver decisions about employment and investment during a recovery.

I doubt the private sector gets any up-to-date information about government spending on wages and benefits (let alone future projections) aggregated in ways that are useful to them.

The reason why I think the speed of the recovery in the levels of employment is key, is because the longer people are unemployed, the harder it is for them to re-enter the workplace (at least generally). The hidden costs of unemplyment would be significantly reduced if firms could see that an increase in orders is not a one-off but something that would be sustained due to increased government spending.

Perhaps I’m barking up the wrong tree.

Kind Regards

Charlie

Scott, since you raised this topic could you please point to a not super technical analysis of DSGE models and its inconsistencies? Thank you

Sergei,

Here are two that I could find quickly:

http://blogs.ft.com/maverecon/2009/03/the-unfortunate-uselessness-of-most-state-of-the-art-academic-monetary-economics/

http://www.voxeu.org/index.php?q=node/4283

Best,

Scott

Note that Ann Pettifor was one of those who predicted the crisis well in advance, for some reason being missed out of Bezemer’s ‘hall of fame’.

There are some nice comments on her blog from August 2007 saying “relax, we’ll have forgotten all about this in 12 months’ time”!

“The following graph also taken from the Feinstein plus macroeconomics dataset which spans the period 1905 to 2009 shows the annual growth in UK public spending (horizontal axis) and the annual growth in real GDP (vertical axis) for the UK. There is a very clear positive relationship between growth in government spending and real GDP growth over this long historical period.

“You may consider the two outliers might alter this conclusion. I can assure you that it doesn’t. I removed them and re-examined the relationship both graphically and using econometric (regression) analysis and there remains a strong and statistically significant relationship between growth in government spending and real GDP growth.”

The graph did not survive a copy and paste.

Eyeballing the graph, a couple of impressions.

First, the “outliers” are 1915 and 1940, which correspond to the start of WWI and WWII. The huge growth of spending for war has a positive effect on GDP. Big surprise.

Second, if we take those years out, doesn’t the slope increase? I. e., in more normal times isn’t the effect of gov’t spending greater per pound than at the start of major wars?

Third, in more normal times, isn’t the effect strongly influenced by large negative values? I. e., don’t large reductions in gov’t spending strongly reduce GDP?

OC, correlation is not causation. 🙂

Thanks to Bill for showing as well as can be done that austerity does not pay and is not worth the price, especially for the losers of wages and things.

Ultimately, austerity equals reducing the amount of money in existence, which gets measured as reduced aggregate demand, not exactly what we want with millions already unemployed.

So, why?

And, who should be in charge of reducing the amount of money.

The markets, or the government?

On the amount of money to be in circulation?

So, yeah, austerity is a fact of life in the downhill, money-contracting phase of the debt-money system business cycle.

Just ask the IMF.

In case you didn’t notice, their entire purpose has become vainly attempting to save the debt-money system for the debt-industrialists.

Which is not exactly economics.

But the monetary system is.

And right now, ours is owned and operated under what Bill likes to call – a self-imposed constraint.

The way to ensure stability in monetary policy and from there the economy is by taking the wheel back from the casino operators.

A little austerity on the bankers wouldn’t be bad.

Better than fighting between social security and an educated public.

A Program for Monetary Reform

At economicstabilty.org

John Makin of the conservative American Enterprise Institute recognizes the symptoms and offers a correct diagnosis, but, predictably, prescribes the wrong treatment.

It is time to face down the threat of deflation, Financial Times, July 16.

I’ve seen this kind of thinking before in economics (supply/demand and so forth), and it seems to make remarkable basic errors in understanding the physical concepts of equilibrium and steady-state systems. You have to show that all parts of the system you’re not considering change at rates that are much, much faster or much, much slower; you have to show that the parts of the system you are consider change at the same rates; you have to show that the system has “a long time” relative to that time scale to settle without new inputs; you have to show that the system is already “close to” your steady state; you have to show that a steady state is even possible.

If you don’t show all of those — you’re just making up non-physical crap. Equilibrium is a powerful simplifying concept — but it’s not generally applicable in any system that shows memory. Now, do economic systems show evidence of memory? If so, the entire neo-classical system has to be abandoned from step one.