I started my undergraduate studies in economics in the late 1970s after starting out as…

Its all booming down here folks!

Whichever way the dice tumbles, the deficit terrorists are ready to rehearse their diatribes. In many countries, they couldn’t even wait for growth to return before they started calling for “credible exit plans” and “austerity measures” to “get the ballooning deficits and dangerous debt spirals under control”. The lexicon of doom terminology expanded over the course of 2009 and continues to grow into the new year. Cutting back a fiscal stimulus when the rest of the economy is going backwards is the advice that only a person who has no appreciation of macroeconomics would give. But they have also been at it in Australia which surfed the downturn thanks to an early and significant fiscal stimulus. Here the talk is now along the lines of the “mother of all booms coming”, “overheated housing markets”, “white hot labour markets” and pressure is mounting for a tough May budget and further rises in interest rates. Over-inflated predictions one day are continually shown to be without credibility by the data releases the next day, but by this time the so-called experts have moved on to the next impending data release predicting all manner of catastrophe unless austerity plans are implemented. They have no shame and probably were not brought up very nicely!

My last comment bears on a paper I sat through in 2008 at a meeting in Cambridge where the speaker in between repeated references to ontology, de-constructive paradigms and the rest of it, posed a hypothesis that mainstream economists were like they are because they were weaned too early. Their nasty ways and desire to be in control all the time apparently reflects their innate insecurity brought on by their mothers getting them onto solid food too early. I recall asking the speaker whether she had done a survey and some data analysis to verify the postulate. No such luck – the epistemology or was it the ontology or whatever, was too important to get one’s hand dirty with the data.

But whatever the veracity of that particular hypothesis, there is definitely something wrong with mainstream economists who continually display an arrogance and mean-spiritedness that belies the sophistication of their tool kit. You only have to survive a graduate program in economics at almost any university (I did!) to realise that these characters have deformed perspectives on life.

After all they only have a few theoretical concepts at their disposal that they wheel out relentlessly, most of which have no bearing on anything. They are also mostly second-rate mathematicians who use clumsy algebra to allegedly prove banal propositions that a child could have easily articulated if they could have been bothered distracting themselves from their creative pursuits (like building houses out of wood blocks and the like).

If that was all there was to it, then we might send them sympathy cards and some direction to help lines to assist them in getting over it. But, of-course, it doesn’t end there.

Their pathological ways impact on all of us. From their secure and high-paid employment and comfortable offices, they cajole governments into taking policy actions, which by any measure always damage the poor and insecure members of the community and redistribute real income to the rich and powerful.

But what is worse, these “policy designs” come from flaky, half-baked models that have no applicability to the real world.

Moreover, while they hold these models out to be sophisticated rigorously-consistent, inter-temporal masterpieces – the reality is that they have to be altered in many ad hoc ways to be able to say anything about the real world. For example, some New Keynesian models that purport to derive results about unemployment do not even have a labour market specified in the theoretical model.

But what they don’t stress and what the public never realise is that the claim by these economists to authority based on the “theoretical rigour” of their models is a total sham. Once they add the ad hoc response to anomalies etc, all the theoretical results crumble (that is, the models do not even deliver what their authors claim they do) and what you are left with is the raw, venal prejudice of the economist hiding behind some primitive mathematics.

It would be pitiful if they didn’t exert as much influence as they clearly do.

So instead of sending them directions to help lines we should be sending the entire profession elsewhere. You can mentally construct your own desired destination for this pack of imposters.

Household consumption … flat

Anyway, to get things started, here is a question.

If the Australian economy was requiring fiscal and monetary austerity how come consumer confidence is so flat?

The ABC News reported today (March 10, 2010) that:

[a well-known] … consumer sentiment index remained broadly flat in March at 117.3 points, only 0.2 per cent higher than the February result of 117.

The high profile chief economist of the bank that produces the survey was reported as saying that this is:

… a strong result in a month where official interest rates rose, and indicates that rates may have to rise further before impacting significantly on household spending.

This is a typical piece of mindless commentary. I wonder whether the economist would like to explain why household spending has to be significantly (negatively) impacted?

The latest December quarter National Accounts for Australia, released last Wednesday, provides information on where household consumption spending has been lately.

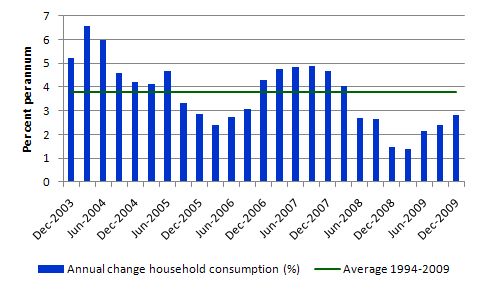

The following graph shows the annual growth in household consumption since December 2003 (blue columns) while the average for the entire period since March 1994 (when the economy started recovering from the 1991 recession) is 3.8 per cent per annum (green line).

Can someone tell this genius that the current household spending is relatively moderate and has been buttressed in the recent quarters by the significant fiscal stimulus that the federal government delivered to shore up the economy from impending collapse last year?

Please read my blog – GDP growth but black clouds on the horizon – for more discussion on the recent National Accounts in Australia.

Now the vast majority if not all the business economists are demanding further rises in interest rates following last week’s fourth hike in the current tightening cycle.

The same economist noted above told ABC News that:

History suggests 7 per cent is a significant threshold mortgage rate for consumers …

Apparently, there is an out of control housing boom that needs to be arrested immediately.

Housing activity plummets

So here is another question.

With households carrying debt to income ratios which are more than 20 per cent higher than they were last time the RBA tightened rates and clear evidence that the housing market is now waning as the fiscal stimulus (first-home buyers grant) is withdrawn, why would we want higher interest rates – given that by their own logic (which is questionable) the higher interest rates damage the housing market?

The ABS released its monthly Housing Finance, Australia data for January today.

All the talk leading up to the release from the business economists centred on how hot the housing market was and the need to stop it in its tracks with monetary policy tightening and fiscal contraction.

In today’s ABC News report – Housing finance plummets, we read that:

Figures from the Australian Bureau of Statistics show the number of people taking out owner-occupier home loans in January fell 7.9 per cent to just over 51,000 during the month. The market had been expecting a rise of 2 per cent.

That “market” again – the banking geniuses!

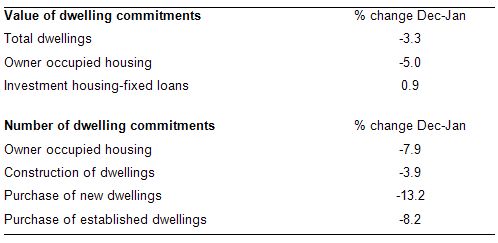

The following Table summarises the seasonally-adjusted results provided by the ABS today. They clearly do not signal a housing boom is underway.

To see the evolution of the housing market over the last year, the following graph is taken from the data released today and shows the total value and number of dwelling commitments in Australia between January 2009 and January 2010.

But to understand how far off the mark the “market economists” are you have to understand what drove the growth in the early part of 2009? Guess what? The fiscal policy stimulus would be the (only) correct answer.

The Government continued with its ill-thought out (but stimulative) first home-owners’ grant which was like a free kick to the housing market. With that now being withdrawn reality sets in and the private spending intentions are not capable, at this time, of supporting growth in that market.

The data shows that the “number of first homebuyers as a percentage of total owner-occupier borrowers also fell slightly from December to January”.

Some commentators are claiming today that it is the interest rate rises that have driven this decline. To which I say, I doubt it. Perhaps at the margin but the driving force has been the loss of the relatively significant subsidy via the fiscal package.

This Report today said that:

The January result was the fourth straight month of decline and the largest monthly fall in the number of new owner-occupied housing loans since June 2000.

The decline started around the time of the fiscal withdrawal and before the interest rate hikes began.

Last week (March 3, 2010) as the RBA put up interest rates we read in this report that:

FINANCIAL markets are confident the Reserve Bank will continue pushing up interest rates after yesterday’s rise, but are busily debating how aggressively the board will tighten the screws.

Today, things are not so clear.

Some of the economists are creeping out and saying that this will reduce the likelihood of a further rate rise … at least next month.

But the overwhelming point is that the rhetoric usually falls short of the facts – even when the facts are so filtered to suit the agenda of the person commenting.

Which takes us to the labour market and the alleged inflation threat

And here is another question.

If 13.5 per cent labour underutilisation rates signals a labour market that is “white hot” what new meaning does that term have given that in usual parlance the expression means “marked by intensity or vehemence especially of passion or enthusiasm”?

Melbourne Age economics correspondent Peter Martin reported today (March 10, 2010) that with the labour market improving – he used the term “white hot” – which I think overstates the true situation – that bank economists are warning that “Australian home owners face steep interest rate rises this year”.

He quotes the same chief economist that said household consumption had to be curtailed. Maybe he was the only one not playing golf yesterday!

Anyway this character is apparently “worried that the surge of employment offers will push up wage offers and inflation”.

He was quoted as saying:

We are beginning this upturn with inflation at the top of the Reserve Bank’s target band rather than the bottom, as would be typical … If you wait for the official figures to tell you you’ve got an inflation problem, you have already missed it. That’s what the Reserve Bank did last time around. They won’t make that mistake this time, and that’s why we could see much higher interest rates by the end of the year.

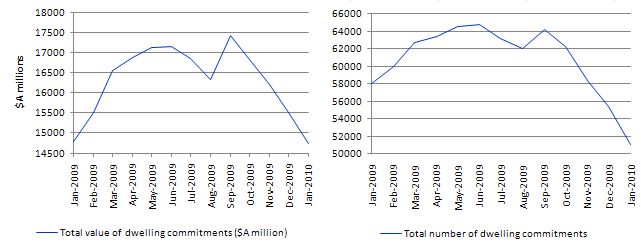

Just as a check on the hubris, the following diagram is taken from the ABS CPI data series and shows the history of the annual rate of inflation since 1949. The green line is the 3 per cent upper limit that the RBA uses to determine its monetary policy. While there are different inflation rates – underlying, trend etc – the fact remains that Australia is nowhere near having an “inflation problem”.

And it is highly questionable whether the annual inflation rate is any where near the “top of the RBA’s target band”. Certainly, the All Cities CPI inflation measure is at the bottom end of the band.

Further, the ABS will release the February Labour Force data tomorrow which will give us the latest update on how the labour market is doing. However, we have to remind ourselves daily when the hubris of being “near to full employment” starts coming from the business economists that the persistent data trend is that around 13.5 per cent of willing labour resources are underutilised – 5.5 per cent without a job at all and 8 per cent underemployment wanting an average of about 14.5 hours extra per week.

Real wages growth is virtually flat in Australia and did not even grow robustly in the peak of the last boom. There was and will be further wage rises in the mining sector. But folks let me remind you that industry employs about 180,000 workers in a labour force of 11 million. There are spending multipliers for sure but the harsh deregulation of the labour market over the neo-liberal period has all but eliminated the old flow-on effects operating through wage contours.

In the torrent of anti-government, anti-stimulus media coverage which allows these pathological economists to rehearse their tired platitudes on a daily basis, there was very nice commentary the other day in the Sydney Morning Herald by Leon Gettler (March 3, 2010) entitled – Low unemployment, high underemployment.

Gettler says that:

One of the most striking features of today’s labour market is the growth of under-employment, people who are stuck in jobs where they don’t have enough hours … The unemployment stats don’t tell us the full story … Of the 10.9 million people with jobs, 811,600 or over 7 per cent were underemployed. There are people out there who aren’t getting enough work, people in part-time jobs who want full-time work or people in jobs that don’t employ their skills. Many of them once had comfortable full-time jobs with benefits and career opportunities. Now, they are cobbling together smaller jobs often at lower pay. More than half wanted full time work of 35 hours a week. It represents a deep change in the employment structure and it could become permanent as companies try to run leaner. What impact does underemployment have?

If you look at the data here you will see that the army of underemployed people is growing. One suspects this trend will continue even as the recovery kicks in as companies try to keep their costs down. While the economy is improving, we are not yet in a boom market so spending will be constrained.

Get the picture!

Gettler also noted that a growing number of older workers are chronically underemployed (48 per cent of those aged 45-54 years, and 45 per cent of those aged 55 years)

He says that:

… there are too many HR managers out there who can’t understand older workers. Most of them are younger so they have no idea of what it’s like to be in that group. So instead of redesigning their jobs to do things like mentoring and coaching, they are cutting their hours.

So before we start using terms such as “white hot” and predicting a major wages breakout we should be asking the corporate sector why they are deliberately wasting available labour – experienced and inexperienced – while at the same time screaming for more labour market deregulation to further impoverish the workers they offer jobs to.

Why do these bank economists avoid commenting on this huge pool of labour hours that are doing nothing? Why not use the positions they have as public commentators to start lobbying governments to create the work if the private sector will not?

Why persist in perpetuating the myth that the labour market is so tight that a wages breakout is the main danger?

By the way, our chief bank economist quoted above also claimed that the federal budget will be easily back in “surplus in 2011-12”. Which I can only say – someone please help us if it is – given that net exports are not about to go positive any time soon, mining boom or not.

And if the budget does go back into surplus on the back of austerity cuts in the May budget and the rising revenue from the growth in the resources sector then you can also predict one other thing. The private domestic sector will be in deficit and increasing its indebtedness.

Do you ever get the feeling we have been there before?

Conclusion

Australia is on the other side of the crisis – probably. But the rhetoric is now about the dangers of overheating and so the pressure for fiscal austerity is more easily explained to the populace than when the economy was in free-fall.

But the pressure from the lobby groups and professional commentators reflects the same agenda as it does in the UK or the US which are both far from being “on the other side” of the crisis.

In each case, the deficit terrorists have an abiding hatred for government intervention and want a free slate to redistribute real income towards the class elites.

In a not insignificant way, the ability to repress the access by worker’s to the real income they produce provides the capacity for the “unproductive” financial sector to get their hands on more of the nation’s real output than otherwise. The agenda is so clear if you think about it for even a second.

The fact remains that despite all the rhetoric to the contrary, the Australian economy for the most part is still fragile and is not yet being supported by strong growth in private spending.

In this context, it is madness to even contemplate scaling back the fiscal stimulus. Unfortunately, the mainstream commands the ears of the policy makers and so the May budget will be a first – an election year budget that has harsh cut-backs in spending proposed.

That is enough for today!

In the US, the talk is about moving the goal posts. President of Fed. Reserve Bank of Chicago floated the idea of increasing the “target” for full employment to 5.25%. Outrageous, like its just some number – no big deal. This just provides cover to policy makers and screws working class families.

Bill:

I done some Googling and reading of ABC but I wondered if you (or a commenter) could briefly explain the difference between the AU and US stimuli? You note that Australia had a significant and early stimulus – was there a large proportion going to bank bailout as compared to US, etc. I understand there was not a Lehman moment in the AU and that the US as reserve currency has different priorities. Was the AU public less indebted relative to the US, so that stimulus funds tended to be spent rather than saved/debt reduced? What were the major differences that would point to why the AU appears more successful than the US?

Thx,

PEB

Dear pebird

In Australia, there were zero bailouts to the banks although the federal government introduced a bank deposit guarantee and a wholesale bank loan guarantee which effectively allowed the banks to avoid funding shortages (and make good profits on the public’s back). But this didn’t involve any funds going from government to the banks (the latter paid a small fee for the guarantee).

The fiscal stimulus was also targetted to consumers first (December 2008) then infrastructure second (from February 2009 and still going). Further, some stimulus targetted at the car industry occurred as earlier in 2008.

Further, there are no balanced budget rules on States here and they went into deficit for the first time in many years so unlike the US situation there was no state drain on the federal injection.

The Australian household sector is more indebted relative to its income than the US household sector. Further, the household saving ratio rose sharply here as it did in the US – as the household sector tried to reduce their debt exposure a little. It hasn’t been as successful as it should have been and therein lies a danger for the future.

Finally, a big difference between the two countries lies in the fact that we are a commodity exporting nation plugged straight into the Asian growth story whereas the US is a manufacturing exporter in decline. The rapid resumption of growth in China courtesy of their massive fiscal expansion has helped hold up the terms of trade and has allowed our export sector to recover fairly quickly. Another mining boom is probably underway. While this sector is relatively small it does generate significant national income. The US trade sector has been the converse of that picture of late.

best wishes

bill

Bill: You say “there are no balanced budget rules on States here and they went into deficit for the first time in many years so unlike the US situation there was no state drain on the federal injection”. Does the australian federal govt automatically fund the states’ deficit then?

Thanks Vinodh

Hi Bill,

Just thought I’d throw in another contradictory RBA comment from this morning’s newspapers – assistant governor Philip Lowe was reported as saying that the low housing starts were a problem, as Australia suffers from a housing shortage at present, presenting a supply-side inflation risk. Consequently, planning constraints needed to be relaxed.

Given that the RBA’s interest rate rises are intended, as I understand, to make loans (including for housing) more expensive as a means of reducing inflation, I found it curious that the Bank was raising rates and restricting housing starts, and then commenting that the reduced housing starts were an inflation risk!

Dear Vinodh

Given that the Australian states are users of the currency and therefore have a financing constraint (unlike the federal government) – they have to borrow to cover their deficits. The borrowing is coordinated through the Australian Office of Financial Manangement. They never have a problem “funding” themselves, even if during the neo-liberal years they ran surpluses – only to find – surprise, surprise – that the public infrastructure they were responsible for became severely degraded (for example, railway bridges became unusable because of cracks in the structures etc).

best wishes

bill

Hi Bill,

You write:

“… ill-thought out (but stimulative) first home-owners’ grant …” Can you elaborate on how this was ill-thought out, or point to an earlier posting? My convern with it has been that it encourages individuals to become indebted at exactly the wrong time, but maybe you have some additional thoughts?

Thanks for all the hard work you put into your blog! Cheers,

David

Bill:

Thank you – very informative. I wish California had the borrowing capabilities that AU states enjoy! The community (city) colleges and state universities out here have canceled summer sessions for lack of funding. We wouldn’t want anyone to retool themselves during a recession/depression, would we.

Thanks,

PE Bird