I started my undergraduate studies in economics in the late 1970s after starting out as…

UKs flexible labour market floats on public spending

For some years now we have been reading about how the UK has benefitted from the Thatcher reforms which involved extensive deregulation of the labour market and retrenchment of significant sections of the state. The falling unemployment rate and strong employment growth prior to the crisis were cited as evidence of the claims. Even at the height of the crisis, mainstream (neo-liberal) commentators have asserted that the UK would bounce back quickly on the back of its labour market flexibility. It turns out that new evidence released recently provides a different view of the employment creation and provides an even stronger case for avoiding cut backs in net public spending than was already obvious to those who understand how the monetary system operates. Sadly, the politics in the UK will likely blind the policy makers to the realities.

It is an national election year in the UK and both parties are talking tough about cutting back the public deficit. The likely new PM David Cameron told the BBC Politics Show at the weekend that he would be cutting straightaway but there would be no “swingeing cuts” in the first year of the new government.

Some of Cameron’s rhetoric was comical albeit tragic. Cameron was supported by his shadow chancellor George Osborne who told the BBC that they had to avoid a “Greek-style budget crisis”. Their primary concern will be to address what they called the “albatross of debt” that they claim is choking the nation.

Cameron elaborated that if the Tories don’t cut the deficit immediately and take “money out of the economy … even more money could be taken out of the economy in two ways”:

One, because interest rates could go up as they have done in Greece. Secondly, money gets taken out of the economy because there isn’t the confidence there and it’s confidence we need so badly.

If a macroeconomics student wrote this in an essay they would get 0/10 from me. First, the UK is sovereign in its currency and has its own central bank that can set interest rates where it likes. Greece enjoys neither advantage. Second, how does “money” get taken out of the economy when there is a crisis of confidence? The UK government can always ensure there is enough aggregate demand by sufficiently expansionary fiscal policy.

The fact is that the Labour government in the UK spent like crazy bailing out corrupt and inefficient banks but didn’t do much at all on the fiscal front.

In that context, you might like to look at this graphic from the Harvard Business Review which shows the size of the stimulus packages and the bank bailouts relative to GDP in many nations. I haven’t done any verification checks on their estimates to see whether they are plausible but the comparisons are very interesting.

You will note that in the UK their stimulus represented only 1.2 per cent of GDP compared to say Australia where it represented 7.9 per cent of GDP (I think that is a little high). By contrast, the UK laid out the equivalent of 19.2 per cent of GDP on bank bailouts compared to Australia 0.1 per cent. In terms of the fiscal stimulus champions – you guessed it – China providing fiscal support equivalent of 46.7 per cent of GDP. And which economy is leading the world out of recession?

The current UK Labour government is no better in terms of promoting deficit terrorism although at least they realise that there is a major risk of a double-dip recession. Yet they are still talking about big cuts over the next financial year and with growth about zero and unemployment high there is a need for a higher deficit in Britain not lower. The difference between the two parties in terms of how much cutting is to be done is seemingly around £30 billion.

All this brings me to a report I read yesterday which came out in the last few days from the Centre for Research on Socio Cultural Change at the University of Manchester (where I myself studied in the 1980s as a doctoral student). The Report was entitled – An alternative report on UK banking reform – and seeks to address:

How … Britain reached the current impasse on banking reform, what programme of reforms is necessary and what can be done politically to mobilise for effective reform after the crisis?

So an interesting agenda for someone like me. Accordingly, I started to read on. They argue at the outset that the “current blockage on reform” is “political” and is “above all about weakening the grip of unaccountable financial elites on our political system”.

They say the “roller coaster ride started in autumn 2008 with extreme intervention by UK and US governments as they faced a collapsing financial system; it ends in autumn 2009 with muddled inaction by UK and US governments who are apparently powerless to deliver a safer financial system”.

The Report says that there is no “technical difficulty about what to do” but rather “elite political resistance to doing anything radical”:

The distributive coalition around the City of London has spun a story about the social value of the finance sector whose competitiveness must therefore be maintained. Senior politicians in both major parties have been co-opted into doing nothing by way of (re)regulation which would hinder finance’s continued success.

I really liked the turn of phrase – that “reform is being blocked by a deficit of democracy”. Yes, at last a “deficit” that matters in real terms.

Anyway, I won’t go into the banking side of the Report which is worth reading in its own right. What interested me was a smaller, almost incidental section of the report on the British labour market.

But first some backtracking to put the next bit into context. Leading up to the crisis, the mainstream analysis of the UK labour market has been waxing lyrical about its resilence and flexibility that they trace back to the Thatcher period which was built on by Major then Blair, although the latter did take some action to retrench the worst of the Thatcher madness (for example, restoring a minimum wage).

It doesn’t need repeating that the Monetarists from Chicago dominated macroeconomic policy makers in the late 1970s and set the blueprint for Thatcher’s England. Unions, welfare provisions, employment protection and the like became enemies of the state and a wholesale cutting back of the public sector occurred to make way for “entrepreneurship” and allow the market to operate without the constraints imposed by the Welfare State and all its inefficiencies.

What followed was a massive program of privatisation (utilities, transport, communications etc); the breaking up of the unions and the seizure of their assets; the abolition of minimum wages and other employment protections; increased pressure on those receiving income support to obey activity tests if of working age; and major outsourcing of almost every state function include IT systems; social security and employment services administration; health care, garbage collection, and a host of other things.

So the government agencies that previously had delivered services now became contract brokers to promote so-called “labour market flexibility” – all the outsourcing and subcontracting had to be monitored. The obsession with cutting the state extended to privatising all training institutions and welfare-to-work rules forced the young, the disabled and single parents into activity tests.

Labour hours were also deregulated which raised the curious inconsistency that the neo-liberals claimed they supported family values but then reduced regulations that made it easier for workers to spend time with their families rather than being compelled by employers to work shifts and at weekends for no extra pay.

All of this in the name of flexibility. A similar trend occurred in Australia.

The Monetarist putsch was given new policy impetus in 1994 with the publication of OECD Jobs Study, which provided the blueprint for labour market deregulation and underpinned the pernicious welfare-to-work policies that various governments began to implement in the 1990s. During the period following the publication, the OECD constantly pressured governments to abandon the hard-won labour protections which provided job security and fair pay and working conditions for citizens. Please read my blog – The OECD is at it again! – for more discussion on this point.

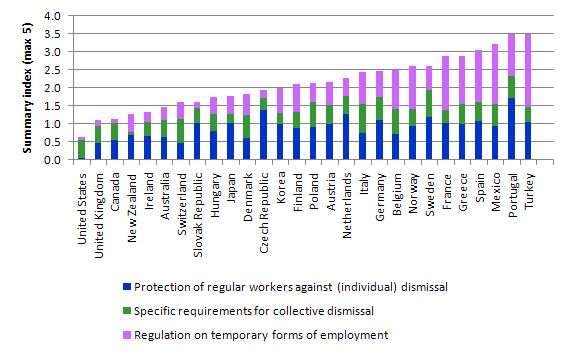

The following graph is reproduced from Figure 3.9, page 96 of the OECD Employment Outlook 2006 and shows the index of employment protection legislation (as at 2003) for OECD countries. The data is available HERE.

The graph clearly shows that by 2003, the United Kingdom was a very deregulated labour market.

These trends also led to a plethora of self-congratulatory commentaries about the resilience and flexibility of the UK labour market. Articles like this one – OECD hails UK flexible labour as key to success (June 20, 2006) – started to appear on a regular basis.

The report said that:

The UK’s flexible labour market has led to employment levels that are the envy of Europe and the USA, according to new research from the OECD … The UK came seventh out of 30 OECD countries in terms of employment levels, with 74% of the working age population having jobs.

Even as the the recession was becoming evident you had economic editors from the Financial Times saying things like:

… there is something in the labour market flexibility story. Companies are hoarding labour (productivity is falling like a stone) while anticipating recovery and employees are accepting severe wage restraints. So far, the numbers are encouraging. It could have been much, much worse – as it is in the US.

Of-course, as the chart above shows, the OECD considered the US to have less employment protection than the UK so the story lacks consistency. But the mainstream is always ignoring facts that get in the way of their ideological slant.

I also read recently (from a mainstream commentator – I cannot find the article again) that the UK would quickly bounce back from the recession – much more quickly than other nations – because of its resilient and flexible labour market.

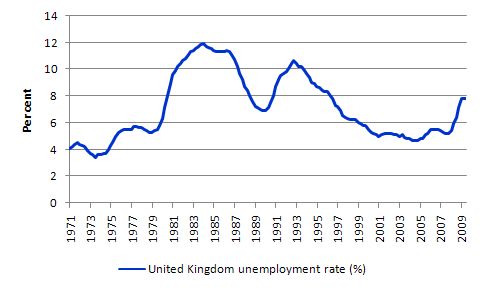

Anyway, despite this rhetoric, the UK did not achieve anything like full employment in its most recent growth period. The following graph is taken from the OECD Main Economic Indicators and shows the UK unemployment rate since 1971.

But the period of declining unemployment after the 1991 recession has been taken as evidence that the Thatcher reforms worked although most countries enjoyed falling unemployment over this period whether they embraced the OECD Jobs Strategy or not.

Further, Britain like other economies has substituted declining unemployment with rising underemployment (and rising inequality).

With that background rehearsed, we can now go back to the Report on banking I started to consider earlier.

Chapter 3 is entitled Questioning the value of finance: taxes paid and jobs created and they say their analysis challenges “the established narrative about finance as the ‘goose that lays the golden egg'” They show that the finance sector takes from the public purse more than it contributes in tax revenue. So another morass of corporate welfare. Hardly surprising.

On page 34 they conclude that “the UK gets relatively little in return by way of job creation” from the financial sector:

Despite rapid expansion of finance output and profits from the mid 1990s, the total numbers employed in the finance sector were more or less flat, at 986k in 1992 and 1,054k in 2007 … Numbers employed are not hugely increased by adding on para-finance and out of sector employment sustained by demand from finance …

Regionally, the effect of finance is to concentrate rather than diffuse prosperity. The distributed nature of retail and continuing wholesale activity in the North is counterweighted by the intense centrifugal forces around wholesale finance in London.

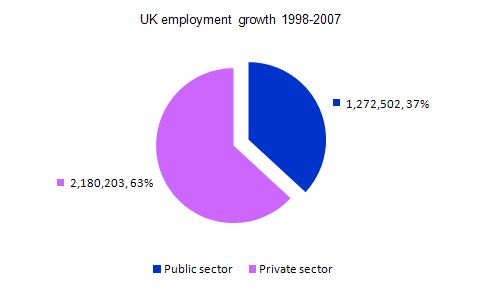

But what interested me the most was their analysis of net employment growth in the UK between 1998 and 2007 (the pre-crisis years of New Labour). The following graph is taken from Exhibit 10 (page 36) and shows UK employment growth from 1998-2007 and includes full- and part-time net job creation. The total increase in employees was 3,452,705.

The Report says that New Labour started “to increase expenditure on health and education services” which had been severely downgraded by the Tories and were “favoured by swing voters”. So there were political motives. But this had the consequence of expanding:

… state and para-state employment because service delivery was inherently labour intensive and the employment gains were distributed right across the country … These broadly distributed gains had a very variable impact in the different regions … the public sector crucially accounted for more than half the employment creation in ex-industrial regions like the West Midlands and the North East. In such regions, there was effectively no private sector job creation under New Labour other than that driven by the regional multiplier effects from consumption spending by state and para-state employees.

But this pie chart is somewhat misleading. One of the Report’s author told The Times that:

We more or less knew that finance had made a negligible contribution to employment … We were intellectually curious about the gap between the official figures on public sector employment and what we call the para-state.

And it is here we also come back to the deregulation years where a massive public workforce was outsourced and sub-contracted out to the private sector but as we now know continued to be dependent on the public purse. This relates to the “para-state” mentioned in the preceding quote.

The Report considers:

para-state employment … [to be] … activities such as rubbish collecting or nursery education which depend for revenue on government funding, together with parts of private healthcare and other sectors partly dependent on government support.

It includes consultants employed by central government and local authorities who are officially in the private sector but whose work would disappear if the public spending taps were turned off.

Once they made this decomposition (into para-state and “true” private sector jobs), the Report’s authors concluded that of the 2.2 million private jobs created under New Labour since 1998 (shown in the pie-chart) less than one million were “true private sector jobs, while 1.27m were in this wider public sector”.

If you re-do the arithmetic this means that, in fact, around “57% of new jobs created during the period 1997-2007 were state or “para-state” – dependent on government spending”. Further, more “80% of new jobs for women nationally depended on the state” (Source).

So this wonderfully flexible and resilient private labour market has not produced the massive employment growth that the neo-liberal rhetoric would lead you to conclude. The vitality of the economy and, in particular, its more disadvantaged regions, has been dependent on deficit spending for years.

So this brings me back to the beginning and the plan to cut back the net spending. We now have a very significant context for concern that is not well understood.

The Report says:

The subvention of banking and anti-recessionary measures have wrecked public finances and raised the UK government deficit from 3% to 13% of gross domestic product (GDP) which, for Tories or Labour, means sustained expenditure and employment cuts in the public sector and excruciating problems in all the ex-industrial regions. This raises one major question: where are the jobs going to come from in the next ten years in outer Britain where state and para-state employment has so far covered the atrophy of the private sector?

Conclusion

I see this as another piece of evidence exposing the neo-liberal myths and further demonstrating the importance of net public spending as a promoter of sustained employment and economic growth. The UK did not sustain relative strong employment growth (at least in terms of recent history) because of its Thatcher experiment. The evidence indicates a dominant public sector role even before the crisis.

The evidence also suggests that the scale of the fiscal stimulus in the UK has been relatively small (this is not considering the ridiculous bailouts) and that cutting back on that stimulus to satisfy the loons in the conservative press and some threatening types in ratings agencies would be a very big mistake.

Bill: Thanks for the charts and figures – all interesting stuff. But I think you’ve confused some issues.

Advocates of flexible labour markets (which includes me) don’t, or at least shouldn’t argue that flexibility will get us out of a recession, nor (strictly speaking) that it will create employment. They argue that it improves the inflation unemployment trade off.

Having done that, and assuming the government/central bank machine pitches demand at the maximum level consistent with avoiding too much inflation (i.e. assuming the deficit is the right size) then employment will be higher than it otherwise would be.

Put another way, for a given degree of labour market efficiency or flexibility (and assuming the deficit is pitched at the optimum level) I don’t see that it makes much difference to employment levels whether government grabs 25% of GDP or 75%.

What inflation unemployment trade-off ? Seriously Ralph reach for the rabbit because the economics coming out of your hat is ridiculous.

Alan: Are you saying there is NO relationship? In which case the solution to unemployment is dead simple: arrange a huge increase in demand (e.g. a trillion, trillion dollar Bernanke helicopter drop).

Personally I think a trillion trillion dollar helicopter drop would boost inflation (to put it mildly). But perhaps I’m wrong.

Dear Ralph

Why exaggerate? There is no way that a trillion, trillion dollars is needed to restore full employment.

The December quarter US GDP (seasonally adjusted) $US14,463.4 billion and real $US13,155 billion (2005 dollars). It would require about 2 per cent of GDP to offer everyone currently unemployed a job at minimum wages which is about $US289 billion nominal. That is a long way from a trillion, trillion. I believe the GS boss is about to receive a $US100 million bonus to put it in perspective.

Why make it out to be so outlandish? That is the sort of polemic that the deficit terrorists use to scare people who do not understand the way the monetary system operates.

best wishes

bill

Agree with Bill. In my simulations of a JG at roughly the minimum wage in the US economy for mid-1980s through mid-2000s, the max spending on the program was about 1.4% of GDP in 1992 when unemployment in reality reached about 8%. I also included an additional 20% of total spending on JG workers to cover supervisors, non-labor costs, etc (all included in the 1.4% of GDP).

Sorry about my exaggeration: I was just trying to establish that if demand rises too fast and too far, unemployment falls, and excessive inflation kicks in at some point. I’ll try to be more sensible in future.

Re my above criticism of Bill’s very informative article, I could have put this better, so I’ll try again.

In the final few paras, Bill concludes that because the public sector has expanded in the UK, that therefore, 1, it is DEFICIT spending that has kept employment up, and 2, that somehow this disproves the merits of labour market flexibility.

Re “1”, I don’t see why a large (or small) public sector should have much effect on employment levels. To illustrate, if government hires / sacks 100,000 employees and raises / lowers taxation by the right amount, the effect would be to destroy / create about 100,000 jobs in the private sector. Net effect on employment: around zero.

In contrast, if the DEFICIT is increased, that raises TOTAL employment, assuming the effect is not too inflationary. I.e. the proportion of GDP grabbed by the public sector and the deficit are two “levers” that governments can move independently of each other.

Re flexibility, it is difficult to PROVE anything here, and I don’t think the evidence in Bill’s article proves much. Ideally one needs to measure different countries’ flexibility and compare that to their employment levels. But there is so much background noise (i.e. differences between different countries) that this is a difficult exercise.

Ralph,

I don’t think the purpose of the JG is to create a large public sector. It is to provide productive work while acting as an automatic stabilyzer. Utlimately, the size of the deficit will be determined by the public’s desire to net save. With a JG, the size of the public sector will not be determined by how much the govt wants to spend, but how high the tax code is, forcing the govt to spend more.

Dear Ralph,

For the many millions of people wanting to work that cannot find a job because the private sector alone is incapable or creating the jobs needed do you really think any unemployed person cares about your piss weak syllogistic economic reasoning ?

You constantly go to the extreme to point out what is possible rather than what is likely.

You said:

“Re flexibility, it is difficult to PROVE anything here, and I don’t think the evidence in Bill’s article proves much. Ideally one needs to measure different countries’ flexibility and compare that to their employment levels. But there is so much background noise (i.e. differences between different countries) that this is a difficult exercise.”

So why even mention flexibility? By your own admission it’s difficult to prove anything and yet it is the constant theme underpinning pretty much all of your economic reasoning.

With respect to measuring flexibility and difficulties comparing countries you are again exaggerating or going to the extreme to force accross your point of view. Rather than saying “it’s difficult to compare countries” why not tell the truth and say it’s intractable / impossible to measure it even in a single district let alone at a national level.

Keep writing and posting though Ralph because you do a much better job than I could ever do in exposing just how pathetic mainstream economics is.

David Cameron has a serious point about the debt, even if he didn’t explain it well. The UK government has been been running deficits even before the credit crunch; worse still, the money has been spent very inefficiently, so the costs have outweighed the direct benefits. Then when the government decided to rescue the banks, they took on an enormous amount of debt. Now there is a serious thread of loss of confidence in the pound if nothing is done. It’s already fallen substantially, but it could get a lot worse.

Aidan, The sky is not falling.

The government has no budget constraint in terms of its own money.

The value of the pound is not solely based on the level of government debt either.

Some industries may even do better when the pound loses value. Others not so well.

The loss of confidence (if it is real or can even be measured) should be with the idiots reporting these non-events more so than with the currency itself.

Alan, of course the sky isn’t falling. But the pound is.

It seems to me to be rather disingenuous to claim the government has no budget constraints in terms of its own money. Why, for example, do you not consider the need to service its debt to be a budget constraint?

Why do you feel the need to point out to me that the value of the pound is not solely based on the level of government debt? Did you really fail to notice that I’d already mentioned another factor that affects it: confidence. When people think the currency is going to fall, they sell it, which causes it to fall.

Of course the biggest driver is the import/export balance, but last time I checked that still wasn’t in Britain’s favour. And yes, a devalued pound would help in that regard, but there are significant downsides as well. It results in much higher inflation, and more British assets fall into foreign hands (the latest example being Kraft buying Cadbury’s).

There is a need to keep total government spending up, but the need to stop wasting money is more important than ever.

The discussion about “para-state,” job creation reminds me of this article about how U.S. private sector job creation over the past decade has been virtually non-existent:

http://www.businessweek.com/the_thread/economicsunbound/archives/2009/06/a_lost_decade_f.html

Seems that it isn’t only in the U.K. that the labor market floats on public spending.

Ralph, correct me if I’m wrong, but it seems you are imaging a graph of inflation vs spending to be a straight line with a / slope. In actual fact it’s more like _/ in other words a flattish line until you hit full employment, then it starts to slope up. This is because as demand rises companies produce more and hire more. They only start raising prices when they either have a market share they are happy with or can’t expand capacity any more.

Aidan, the need for the UK to service it’s debt is an obligation and not a budget constraint. The UK government has a fiat currency and therefore infinite Pounds at it’s disposal. No matter how much interest they are paying, they still have just as much capacity to credit bank accounts as they do with no interest payments. As for the connection between inflation and foreign exchange rates, here in Australia we have had wild swings in the Au$-US$ ratio over just a few years with no notable effects on inflation.