In the annals of ruses used to provoke fear in the voting public about government…

Australia – inflation continues to fall and the RBA should cut interest rates

The Australian Bureau of Statistics (ABS) released the latest – Consumer Price Index, Australia – for the December-quarter 2024 today (January 29, 2025). The data showed that the inflation rate rose by just 0.2 points in the quarter and has fallen to 2.4 per cent on an annual basis (down from 2.8 per cent). The inflation rate has been within the RBA’s inflation targeting range for the last 6 months and with inflationary expectations falling, the RBA has no justification left for holding to its elevated interest rates. Using the RBA’s own logic, interest rates should now be cut.

The summary, seasonally-adjusted Consumer Price Index results for the December-quarter 2024 are as follows:

| Component | Quarter % | Annual % |

| All groups CPI | 0.2 (last 0.2) | 2.4 (last 2.8) |

| Trimmed mean series | 0.5 (0.8) | 3.2 (3.6) |

| Weighted median series | 0.5 (0.9) | 3.4 (3.7) |

The following Table shows the rates of inflation for the major components of the CPI:

| Component | December-quarter % | Last 12 months % |

| All groups CPI | 0.2 | 2.4 |

| Food and non-alcoholic beverages | 0.2 | 3.0 |

| Alcohol and tobacco | 2.4 | 6.2 |

| Clothing and footwear | 0.1 | 1.3 |

| Housing | -0.7 | 1.0 |

| Furnishings, household equipment and services | -0.2 | 1.5 |

| Health | -0.2 | 4.0 |

| Transport | -0.7 | -1.5 |

| Communication | 0.5 | 0.0 |

| Recreation and culture | 1.5 | 3.3 |

| Education | 0.0 | 6.5 |

| Insurance and financial services | 0.8 | 5.4 |

The ABS Media Release – CPI rises 0.2% in the December 2024 quarter – noted that:

The Consumer Price Index (CPI) rose 0.2 per cent in the December 2024 quarter and 2.4 per cent annually …

December quarter’s rise was the same as the 0.2 per cent increase in the September 2024 quarter. These rises were the lowest recorded since the June 2020 quarter when the CPI fell during the COVID-19 outbreak when childcare was free … Annually, the December quarter’s rise of 2.4 per cent was down from 2.8 per cent in the September quarter …

The main contributors to the quarterly rise of 0.2 per cent were Recreation and culture (+1.5 per cent) and Alcohol and tobacco (+2.4 per cent). These rises were largely offset by falls in Housing (-0.7 per cent) and Transport (-0.7 per cent).

The quarterly growth in Recreation and culture was driven by Domestic holiday travel and accommodation (+5.7 per cent). Higher prices for airfares and accommodation coincided with higher travel demand during the school holidays.

The rise in Alcohol and tobacco prices was mostly driven by Tobacco (+5.8 per cent) reflecting the 5.0 per cent annual tobacco excise increase and biannual Average Weekly Ordinary Time Earnings based indexation that applied from 1 September 2024 …

The 2024-25 Commonwealth Energy Bill Relief Fund rebates led to a large fall in electricity prices this quarter …

Automotive fuel prices fell 2.0 per cent this quarter, following a 6.7 per cent drop in the September 2024 quarter, reflecting lower global oil prices.

Observations:

1. The annual inflation rate continues to decline as the main drivers abate.

2. The main drivers reflect price gouging by airline companies during the Summer holiday period and the decision by government to push up its tobacco excise (an administrative decision) – neither reflecting any semblance of excess demand in the economy.

3. The fiscal spending by government to offset the price gouging by electricity companies has clearly been an effective anti-inflationary policy, putting paid to the notion that to defeating a supply-side inflationary spiral requires fiscal austerity.

4. Further evidence of the positive fiscal effect is the effect of the changes in Commonwealth Rental Assistance, which has reduced the escalation in rental inflation.

5. However, note that the rent increases have been being driven by the RBA’s own rate hikes as landlords in a tight housing market have been passing on the higher borrowing costs – so the so-called inflation-fighting rate hikes have been a significant force in driving inflation.

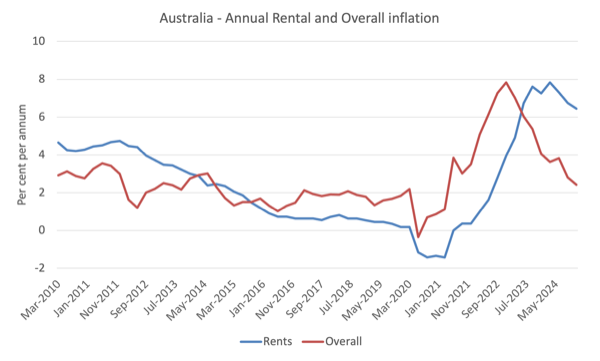

This graph shows that the overall inflation rate peaked in the December-quarter 2022 and has been steadily declining ever since.

However, rental inflation lagged the rise in overall inflation in 2021 and really only took off after the RBA started hiking interest rates.

Once the RBA ended its current hiking cycle, the rental inflation has stabilised and is now falling.

Trends in inflation

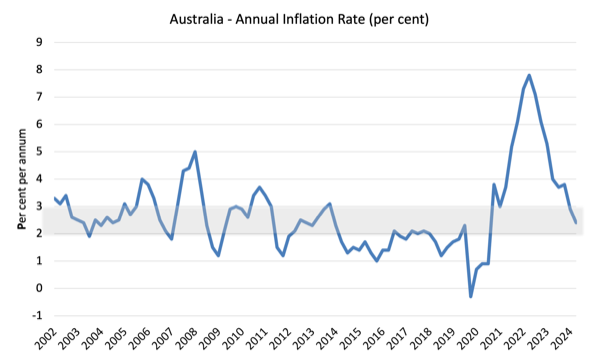

Over the 12 months to December the inflation rate was 2.4 per cent (down from 2.9).

The peak was in the December-quarter 2022 when the inflation rate was 7.8 per cent.

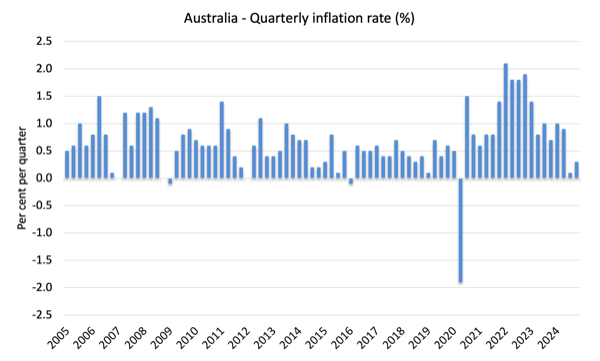

The following graph shows the quarterly inflation rate since the December-quarter 2005.

The next graph shows the annual headline inflation rate since the first-quarter 2002. The shaded area is the RBA’s so-called targetting range (but read below for an interpretation).

What is driving inflation in Australia?

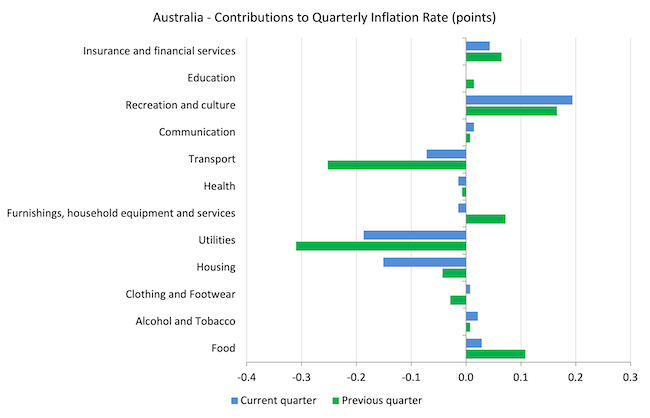

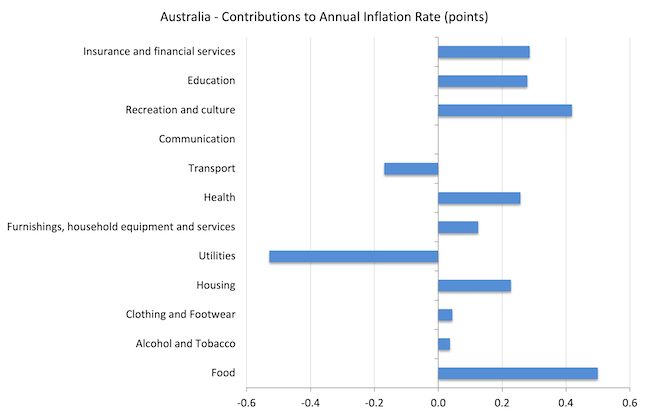

The following bar chart compares the contributions to the quarterly change in the CPI for the December-quarter 2024 (blue bars) compared to the December-quarter 2023 (green bars).

Note that Utilities is a sub-group of Housing and are significantly impacted by government administrative decisions, which allow the privatised companies to push up prices each year, usually well in excess of CPI movements.

The impact of fiscal policy on that sub-group via the electricity rebates has obviously been significant, which goes to show that governments can moderate inflation through expansionary fiscal policy if the drivers are from the supply-side.

It also demonstrates that monetary policy is ineffective in dealing with this type of inflation.

One of the main drivers – Recreation and Culture – was due to the December holidays travel boost.

The next graph shows the contributions in points to the annual inflation rate by the various components.

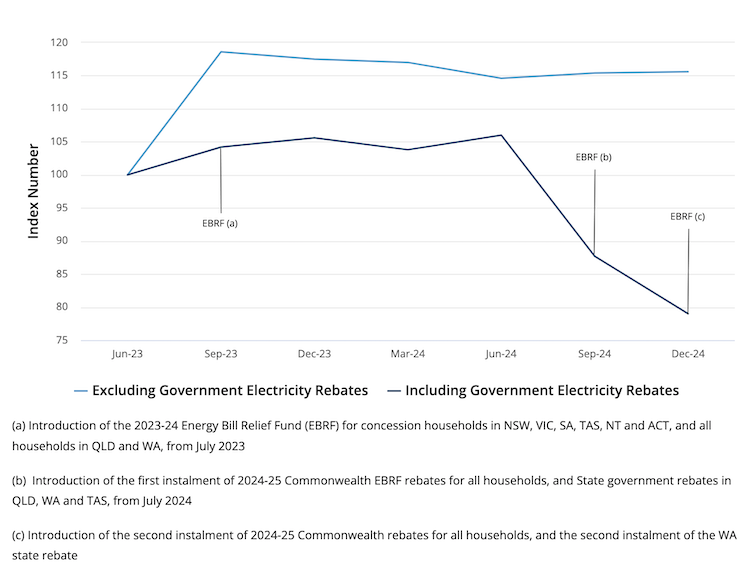

The ABS noted that:

Electricity prices fell 9.9 per cent in the December quarter and 25.2 per cent in the past 12 months.

The introduction of the 2024-25 Commonwealth Energy Bill Relief Fund (EBRF) rebates from July 2024 were the main driver for the fall in electricity prices this quarter …

Excluding the rebates, electricity prices would have risen by 0.2 per cent in the December 2024 quarter.

The next graph is taken from the ABS and shows the impact of fiscal policy in reducing the inflation rate.

EBRF refers to the government’s Energy Bill Relief Fund.

Inflation and Expected Inflation

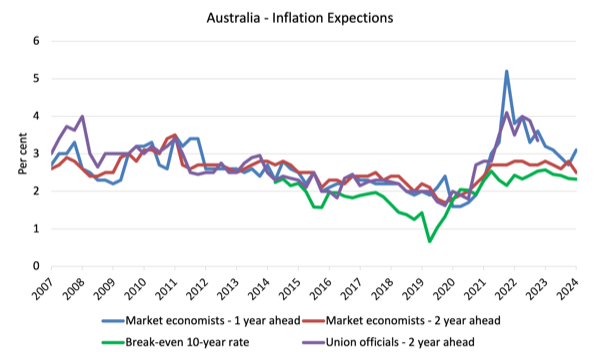

The following graph shows four measures of expected inflation produced by the RBA from the December-quarter 2005 to the December-quarter 2023.

The four measures are:

1. Market economists’ inflation expectations – 1-year ahead.

2. Market economists’ inflation expectations – 2-year ahead – so what they think inflation will be in 2 years time.

3. Break-even 10-year inflation rate – The average annual inflation rate implied by the difference between 10-year nominal bond yield and 10-year inflation indexed bond yield. This is a measure of the market sentiment to inflation risk. This is considered the most reliable indicator.

4. Union officials’ inflation expectations – 2-year ahead – this series hasn’t been updated since the December-quarter 2023.

Notwithstanding the systematic errors in the forecasts, the price expectations (as measured by these series) are now falling.

The Break-even 10-year inflation rate and the Market economists’ inflation expectations 2-year ahead the expectations remain well within the RBA’s inflation targeting range (2-3 per cent) and are declining.

The RBA has been claiming that inflation is not falling fast enough – and the longer it remains above the inflation targetting range, the more likely it is that a wage-price spiral and/or accelerating (unanchored) expectations will drive the rate up for longer.

Neither claim can be remotely justified given the data and was just cover for their policy mistakes.

Implications for monetary policy

What does this all mean for monetary policy?

The Consumer Price Index (CPI) is designed to reflect a broad basket of goods and services (the ‘regimen’) which are representative of the cost of living. You can learn more about the CPI regimen HERE.

The RBA’s formal inflation targeting rule aims to keep annual inflation rate (measured by the consumer price index) between 2 and 3 per cent over the medium term.

However, the RBA uses a range of measures to ascertain whether they believe there are persistent inflation threats.

Please read my blog post – Australian inflation trending down – lower oil prices and subdued economy – for a detailed discussion about the use of the headline rate of inflation and other analytical inflation measures.

The RBA claims it does not rely on the ‘headline’ inflation rate.

Instead, they use two measures of underlying inflation which attempt to net out the most volatile price movements.

The concept of underlying inflation is an attempt to separate the trend (the persistent component of inflation) from the short-term fluctuations in prices.

The main source of short-term ‘noise’ comes from “fluctuations in commodity markets and agricultural conditions, policy changes, or seasonal or infrequent price resetting”.

The RBA uses several different measures of underlying inflation which are generally categorised as ‘exclusion-based measures’ and ‘trimmed-mean measures’.

So, you can exclude “a particular set of volatile items – namely fruit, vegetables and automotive fuel” to get a better picture of the “persistent inflation pressures in the economy”.

The main weaknesses with this method is that there can be “large temporary movements in components of the CPI that are not excluded” and volatile components can still be trending up (as in energy prices) or down.

The alternative trimmed-mean measures are popular among central bankers.

The authors say:

The trimmed-mean rate of inflation is defined as the average rate of inflation after “trimming” away a certain percentage of the distribution of price changes at both ends of that distribution. These measures are calculated by ordering the seasonally adjusted price changes for all CPI components in any period from lowest to highest, trimming away those that lie at the two outer edges of the distribution of price changes for that period, and then calculating an average inflation rate from the remaining set of price changes.

So you get some measure of central tendency not by exclusion but by giving lower weighting to volatile elements. Two trimmed measures are used by the RBA: (a) “the 15 per cent trimmed mean (which trims away the 15 per cent of items with both the smallest and largest price changes)”; and (b) “the weighted median (which is the price change at the 50th percentile by weight of the distribution of price changes)”.

So what has been happening with these different measures?

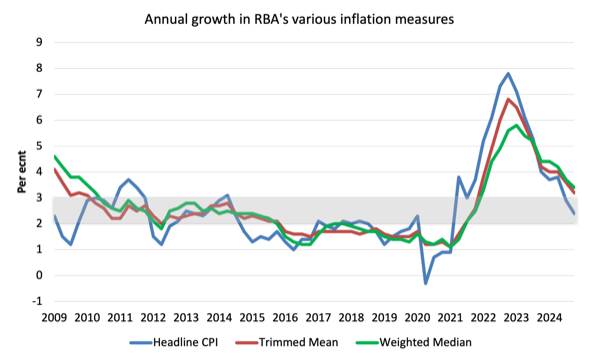

The following graph shows the three main inflation series published by the ABS since the December-quarter 2009 – the annual percentage change in the All items CPI (blue line); the annual changes in the weighted median (green line) and the trimmed mean (red line).

The latest data for the three measures shows:

| Component | Quarter % | Annual % |

| All groups CPI | 0.2 (last 0.2) | 2.4 (last 2.8) |

| Trimmed mean series | 0.5 (0.8) | 3.2 (3.6) |

| Weighted median series | 0.5 (0.9) | 3.4 (3.7) |

The following graph shows the evolution of these series since 2009.

How to we assess these results?

1. The RBA’s preferred measures remain outside the targeting range and they have been using that fact to justify their rate hikes since May 2022 even though the factors that have been driving the inflation until late 2022 were not sensitive to the interest rate increases.

2. The RBA also claimed the NAIRU was 4.25 per cent and with unemployment stable at around 3.9 per cent, they considered that justified further rate rises. However, if inflation is falling consistently with a stable unemployment rate then the NAIRU must be below the current official unemployment rate of 4 per cent.

3. There is no evidence that inflationary expectations are accelerating – quite the opposite and that has been the case for some months now.

4. There is no significant wages pressure.

5. A major contributor to the current situation – rents – are, in part, being pushed up by the interest rate rises.

6. There is no justification for any further rate rises, especially given the slowdown in retail sales noted above.

Conclusion

The latest CPI data showed that the inflation rate is falling fast and is firmly within the RBA’s inflation targeting range with no signs of an acceleration pending.

It is now well below the RBA’s forecasts, which, in turn means that the policy settings by the RBA are wrong (using their own logic).

Once again it is looking like the RBA has made a monumental error in driving interest rates up so high, when the factors driving the inflation episode were not sensitive to those changes and were always going to abate on their own accord.

That is enough for today!

(c) Copyright 2025 William Mitchell. All Rights Reserved.

Hi Bill,

Would cutting the interest rate have any significant effect on exchange rates with our largest trading partners, and therefore pose any risk of importing inflation?

Many thanks

I would expect commodities prices to have more impact on the Australian dollar exchange rate than interest rates would.