In the annals of ruses used to provoke fear in the voting public about government…

RBA monetary policy decision defies logic

Well, as I write this late in the Kyoto afternoon, Donald Trump has just made a victory speech after an incredible day of election outcomes unfolding. As I wrote last week, the only moral and reasonable position for a progressive to take in this election would be to vote for Jill Stein and send a strong message to the two major candidates that they were totally unelectable. I reject the claim that that strategy would just deliver a victory for Trump. However, the Democrats can’t really deflect blame like that for their horrendous policies in relation to the Israel issue and more. So the US faced a Hobson’s choice and I hope progressive parties elsewhere heed the message of Harris’s loss. But today I want to write a bit about yesterday’s (November 5, 2024) decision by the Reserve Bank of Australia (RBA) to hold their cash rate target interest rate (the policy rate) constant. With inflation falling quickly, there is no logic to that decision. The RBA keep claiming that there is excess demand in the economy but that is an unsupportable claim given the evidence.

In the official – Statement by the Reserve Bank Board: Monetary Policy Decision – the RBA claims that:

… the Board decided to leave the cash rate target unchanged at 4.35 per cent and the interest rate paid on Exchange Settlement balances unchanged at 4.25 per cent.

The last time the rate was changed was 12 months ago (November 8, 2023) when the RBA increased the rate to 4.35 per cent.

The other aspect of this statement that most commentators ignore is the ‘interest paid on Exchange Settlement balances’, which in more general terminology, is the support rate that the RBA pays the banks who hold reserve accounts with the RBA.

The ESA balances are just the reserve balances, which are used to clear all the transactions between banks each day.

That is their purpose.

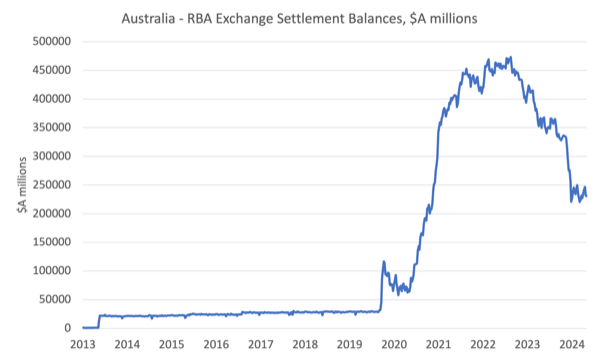

During the early years of the pandemic, the RBA purchased significant quantity of government bonds, which meant that it swapped bonds for increases in these ES balances.

Those purchases have not yet been completely reversed as the following graph depicts.

The balances are still standing at $A230,451 million and the RBA is paying 4.25 per cent on those balances to the banks, which effectively goes to the bank shareholders, a select group.

The point is that while the RBA is screwing low-income mortgage holders with these excessive cash rate targets (which translate directly into mortgage rates), the higher rates are rewarding high income and wealth holders through their financial asset holdings and the bank shareholders through these reserve support payments.

The RBA is thus overseeing a major shift in income distribution in Australia which will increase inequality significantly.

It is interesting that while the mainstream economists and politicians keep trying to claim that the central bank is independent from the treasury function, the RBA governor yesterday demonstrated categorically why that is a fallacy.

The ABC reported on this (November 6, 2024) – RBA governor Michele Bullock gives blunt spending warning to Treasurer Jim Chalmers as election nears –

Note the headline ‘blunt warning’ which was in the form that that the elected government can’t have lower interest rates if it refuses to impose fiscal austerity.

The context was that a federal election is approaching and the RBA claims that the Treasurer might want to engage in a series of “potential splashy pre-election spending promises” and if they did that then the RBA would not reduce interest rates and might actually increase them.

The Governor issued a threat – “we can’t rule anything in or out” on interest rates.

So we have the unelected and unaccountable RBA Governor, representing the Monetary Policy Board, which is also unelected and unaccountable and whose membership is skewed towards corporate interests, threatening the elected government on macroeconomic policy.

That is what ‘independence’ means – nothing.

It is just an excuse that politicians to divert blame for monetary policy decisions to a body we can do nothing about.

It’s a farce.

The question about all this is whether the RBAs decision-making is actually effective in fighting inflation.

The RBA’s justification for holding rates constant follows this logic (from their current policy statement linked to above):

1. “Inflation has fallen substantially since the peak in 2022, as higher interest rates have been working to bring aggregate demand and supply closer towards balance.”

The reality is that the inflation was mostly driven by supply constraints emerging after the pandemic, which were exacerbated by the Ukraine situation and OPEC+ and the claim that it was an excess demand phenomenon is far fetched.

As those supply constraints eased for various reasons, certainly the gap between demand and supply closed.

But the easing of the supply constraints had nothing to do with the monetary policy changes – the driving factors were not interest rate sensitive, so the RBA really had little role in the declining inflation rate.

Further, the monetary policy changes have added inflationary pressures to the economy, particularly by adding costs to landlords in a tight rental market, which has seen the rental component of the housing component of the CPI rise substantially.

2. “Headline inflation was 2.8 per cent over the year to the September quarter, down from 3.8 per cent over the year to the June quarter. This was as expected due to declines in fuel and electricity prices in the September quarter. But part of this decline reflects temporary cost of living relief.”

So the CPI inflation rate is now well within their so-called inflation targetting range.

There is no reason why the decline in fuel costs will not continue particularly now that Donald Trump will (unfortunately) put US oil production on steroids, which will counter anything that the OPEC group try to do.

Further, it is true that electricity prices are much lower now because of the fiscal intervention by the federal and state governments in the form of subsidies to the energy providers.

The federal government would be wise, with an election coming in the next few months, to maintain that commitment, given how effective it has been in countering the price gouging from the privatised electricity companies.

I also wonder why the RBA doesn’t ever consider the impacts of administrative policy changes (indexation arrangements, etc), which always push a range of CPI components (health care, insurance, etc) up.

Why aren’t they considered “temporary cost of living burdens”?

3. “The forecast path for underlying inflation reflects a judgement that aggregate demand remains above the economy’s supply capacity, evidenced by the persistence of underlying inflation, surveys of business conditions and ongoing strength in the labour market.”

First, GDP growth (and aggregate expenditure) is almost zero.

Retail sales and household consumption expenditure are flat and/or declining.

Domestic demand is flat.

On what planet would a person seeing those trends conclude that we have an aggregate demand problem?

The implications of the RBA statement is that they will not be happy until GDP growth is negative – that is, a recession and unemployment rises even further than it has in the last year.

Further, the surveys of business conditions all point to a flat economic outlook.

And the only way the ‘ongoing strength in the labour market’ would indicate an inflationary problem was arising from that market would be if wages growth was strong and increasing unit labour costs in real terms.

Nothing could be further from the truth.

4. One of the drivers of the increase in the CPI in recent quarters has been insurance costs.

The reason for this is that insurance companies are becoming increasingly risk averse in the face of the devastating effects of natural disasters arising from climate change.

The increasing incidence of major floods and bushfires, for example, is adding to insurance premiums.

So the question one has to ask is how will increasing interest rates or holding them in what the RBA calls a restrictive stance will reduce this component of the CPI?

Eventually, excessive interest rate levels will kill aggregate spending and drive the economy into recession, particularly if the federal government maintains its own restrictive (surplus-obsessive) fiscal stance.

The implication is that the RBA would want a deep more or less permanent recession to quell the rise in the CPI to offset the insurance effect, which its policy lever has no impact on.

What sort of stupidity is that?

The rising insurance costs will continue until governments take the climate issue seriously.

At present, governments are lacking in urgency in dealing with that situation.

Music – RIP Isaac Hayes

Here is a song from the 1973 album – You’ve Got It Bad Girl – released by – Quincy Jones – who died this week.

The opening track on that album is the classic – – which was released by the New York City band – The Lovin’ Spoonful – in 1966 and marked quite innovative recording techniques and a classic movement between major and minor keys.

The Quincy Jones version is quite different to the original and takes the song into the so-called = Smooth Jazz – genre.

The musicians on the track are:

1. Valerie Simpson – vocals.

2. Dave Grusin – Rhodes electric piano.

3. Eddie Louis – Hammond organ.

Quincy Jones was one of those massive forces in contemporary music and his production skills created some of the greatest musical moments.

I never really liked Michael Jackson’s music but the decision by Quincy Jones to persuade = Eddie Van Halen – to play the lead guitar break on the song ‘Beat it’ was a classic example of his skill in production.

This New York Times obituary (November 5, 2024) – Quincy Jones, the Maestro of the Recording Studio – provides some interesting insights on that topic.

I felt that today’s musical segment had to be devoted to the genius producer.

That is enough for today!

(c) Copyright 2024 William Mitchell. All Rights Reserved.

Trump is the release valve of the pressure building up in the American Society.

It has 4 major meanings:

First the good news: democracy still works in the US, not to compare to the autocratic regime in the EU (or should I say kleptocratic?).

Second, “the lesser evil” theory only works to a certain point, after which people stop caring about which evil is worse.

Third, bidenomics and the supposed great economic output of the US, is the main reason for the dems debacle, as the narrative “look at the GDP, man” doesn’t stand a chance against the question “Do you want 4 more years of this?…”

Fourth, the decline of the American economy can only get worse, as nothing will fundamentally change.

America will never be great again.

It’s the way capitalism works.

The ponzi scheme is over.

Blame it on the communists, migrants or whatever the scapegoat Mr Trump will find to justify the decline.

By the way: was America that great in the past?

Great is not only a economic measure.

Korea, Vietnam, Chile, Argentina, Brasil, Afghanistan, Palestine, Lebanon, Lybia, Syria, Pakistan, almost all of Africa (just to name a few) are not in the “great” category of the american empire.

I don’t think Democrats will ever their lesson no matter who anyone votes for. This isn’t to shame people who voted for third parties, it’s just that electoral politics is rotten.

The foreign policy issues aren’t nor were they ever the top voter issues. These were the economy and things like abortion rights. The notion that a majority of American voters give two hoots what happens in e.g. Sudan or Moldova is frankly a superficial analysis.

The Biden administration, for all its glaring obvious faults, did manage a semblance of inflation reduction without mass unemployment. Since Americans tend to be angry because ‘gas’ isn’t available for cents and battery eggs can’t be had for a dollar, this was never going to be enough. We have to accept that machine-gunning so-called ‘Bidenomics’ because it wasn’t close enough to ideal economic policy is just silly. As if that was ever going to be the case among people who are commonly neoliberals.

The idea that voting for Jill Stein somehow makes corporate Democrats suddenly ‘think again’ is not even realistic, since clearly a good portion of that entire electorate aren’t ‘progressives’ and voting for Jill Stein is for them about as crazy as voting for a Democrat. So the even smaller portion of remaining actual ‘progressives’ would hardly have made a difference.

@Ferdinand You are right, most Americans do not care about foreign policy, they are selfish, especially if it doesn’t them personally. However, it does drive turnout down among younger people who do care, and given how tight the margins are, that matters. You know very well Sudan & Moldova aren’t Palestine. U.S. gives direct military aid to Israel, no other country gets the special treatment.

Inflation did erode real wages throughout 2022 and early 2023. Keep in mind Trump was elected the first time for similar reasons, the economy being perceived as ‘terrible’ after 8 years of Obama neoliberalism, all the broken promises.

Democrats don’t think again because Americans aren’t ‘progressive’, it is because they don’t care. They work for the oligarchs and their interests. Americans like ‘progressive’ policies, for example, controlling corporate price gouging was one of Kamala’s policies which she rarely mentioned was extremely popular.

“Harris’s price gouging proposal is designed to help address the top economic issue of respondents: cost of living. A majority of those polled (66%) indicated that the cost of living was one of their biggest economic concerns right now.” “Nearly half (44%) of all those polled agreed that it would strengthen the economy.”

It’s from Guardian you can Google the quote for source.

Democrats will never learn their lesson. Hillary Clinton lost EC but won popular vote in 2016, one of the most unpopular politicians with zero charisma.

Now, Kamala Harris did worse than her, despite not being historically unpopular. Why? Because she had zero policies, I’m not talking about Gaza. I’m talking about increased minimum wages, medicare for all, jobs programs The only thing she had was abortion and clearly that wasn’t enough.

This sums up pretty accurately why Trump is heading back to the Oval Office.

https://wingsoverscotland.com/how-it-happened/#more-147851

And don’t forget he was the one who cut COVID “era” benefits and increased military and police spending at the same time

https://slate.com/news-and-politics/2023/03/snap-benefits-food-stamps-biden-welfare-poverty.html

Democrats rushed to anoint Harris, forgoing a full vetting, after Biden dropped out. MANY Democrats asked for a thorough process to select a new candidate. Such voices were ignored.

A west coast progressive lawyer has zero appeal to middle America. Harris’ people knew that she had zero appeal to middle America, so they chose Tim Walz, the popular governor of midwestern state, as her running mate. But voters tend to focus on the top of the ticket.

Look at the exit polls, or the electoral map: Trump won because he captured large majorities of the white working class (men and women). Interestingly, he lost all age groups except one: 45-64. This is the group that is old enough to remember when the American middle class was strong, and American manufacturing was strong. They want that world back.

This group is also socially conservative.

And this group voted in droves.

When are Left-leaning people going to realise that Left-leaning political parties aren’t ‘Left’ at all? The ‘educated’ Left are what John Berry once described as “educated beyond their comprehension” (quoted from Orr, 2004), “… people made more errant by the belief that their ignorance has been erased by mere possession of facts, theories, and the sheer weight of learnedness” (Orr, 2004). These people are what I call the ‘pretentious class’ and can be found in the media, universities, governments (political institutions/parties), public service departments, businesses, think tanks, and unions. I’ve had enough of them. I won’t be pussy-footing around with them anymore. They need to be called out for what they are – self-serving ignoramuses who pretend they’re on the side of ‘good’ when they are a major part of the problem.

Hi Bill

Great piece of music as well, long time l did not read about Valerie Simpson. She made up a succesful duo with her husband Nickolas Ashford back in the 80s. Who does not remember “Solid” ?(1985). Thanks