The US is now a rogue state. One example is the conduct of the US…

Latest European Union rules provide no serious reform or increased capacity to meet the actual challenges ahead

It’s Wednesday and we have discussion on a few topics today. The first relates to the new agreement between the European Parliament and the European Council that was announced on February 10, 2024, which purports to reform the fiscal rules structure that has crippled the Member States of the EMU since inception. The reality is that the changes are minimal and actually will make matters worse. I keep reading progressives who claim the EU fiscal rules are no longer operative. Well, sorry, they are and the temporary respite during the pandemic is now over and the new agreement makes that very clear. I also express disappointment that high profile progressives continue to misrepresent Modern Monetary Theory (MMT) as they advance their own agenda, which effectively provides support to the sound finance narratives. Then some updated health data which continues to support my perspective on Covid. And then some anti-fascist music. What’s not to like.

Europe walking the plank as usual

I know there are some MMTers out there who think that the fiscal malevolence of the powers to be in the European Union has been effectively muted by the decision during Covid to invoke the emergency rules in the Stability and Growth Pact (SGP) and the Fiscal Compact and suspend the operation of the Excessive Deficit Mechanism.

Such a view was never accurate and I have found it unhelpful.

But the agreement between the European Parliament and the European Council announced on February 10, 2024 in Brussels – Commission welcomes political agreement on a new economic governance framework fit for the future – demonstrates the folly of thinking that the austerity politics and penchant for neoliberal corporatism among the EU elites has gone.

The agreement aims to:

… strengthen Member States’ debt sustainability, and promote sustainable and inclusive growth in all Member States through growth-enhancing reforms and priority investments.

How will it do that?

By simplifying the current fiscal rules framework and to create “greater national ownership and better enforcement”.

It requires less government debt to be issued – which means fiscal deficits will have to be cut.

Remember this is largely a system where 20 out of 27 Member States surrendered their own currencies and adopted a foreign currency – the euro.

Other states peg their currencies to the euro and follow the same fiscal rules.

The euro is foreign to the 20 Member States because the individual Member States do not issue the currency they use and that their governments spend.

Such spending must be backed by taxation revenue and deficits have to be funded by recourse to borrowing from private investors, who know full well that such debt carries the risk of default.

Over the course of the last 24 years we have seen regular situations where the bond markets have assessed that that risk is too high and demanded crippling bond yields in return.

And on some occasions, the ECB (the currency issuer) had to intervene and suppress the capacity of the private bond markets in order to push down yields and save the Member State in question from insolvency and exit.

The system also deliberately maintained the bulk of the fiscal responsibility at the national level refusing to create a federal capacity that aligns with the capacity of the federal government in other federations (Canada, Australia etc).

And then it deliberately hamstrung those Member States by the fiscal rules which meant that the individual governments could not reasonably respond to a major crisis to protect their citizens from economic and financial chaos.

The GFC demonstrated that very clearly.

So under the new agreement, the Member States “will present annual progress reports to facilitate more effective monitoring and enforcement of the implementation of these commitments.”

The so-called “fiscal surveillance process” reinforces the top-down power at the Commission level and its ability to trample the democratic rights of the citizens in the Member States.

The reality is that the EMU gives the Member States no real power and then disciplines if they try to use it.

The fiscal rules agreed are functionally no different to the past rules:

For Member States with a government deficit above 3% of GDP or public debt above 60% of GDP, the Commission will issue a country-specific “reference trajectory”. This trajectory will provide guidance to Member States to prepare their plans, and will ensure that debt is put on a plausibly downward path or stays at prudent levels.

For Member States with a government deficit below 3% of GDP and public debt below 60% of GDP, the Commission will provide technical information to ensure that the deficit is maintained below the 3% of GDP reference value over the medium term. This will be done at the request of the Member State.

So kill prosperity if it rears its ugly head and keep people in a repressed state if it doesn’t.

The so-called ‘enhanced enforcement’ part of the deal still defaults to the Commission opening an “Excessive Deficit Procedure” and if the particular Member State doesn’t play ball with the Commission then the latter will ensure the “fiscal adjustment period … [is] … shortened.

That is, the austerity will be made even more harsh.

Importantly:

The rules on opening a deficit-based Excessive Deficit Procedure remain unchanged.

So that is the modern reality in Europe – nothing much has changed – despite the spin of some progressive economists to the contrary.

The agreement was the topic of an interesting report I read this week from the Confederation Syndicat European Trade Union (ETUC), which is the peak body of trade unions in Europe.

The Report (published April 7, 2024) – Navigating Constraints for Progress: Examining the Impact of EU Fiscal Rules on Social and Green Investments – argues that:

The political agreement between the Council and the European Parliament has introduced new numerical debt and deficit benchmarks, mandating annual

reductions in debt and deficits that will require unnecessary budget cuts.

That is obvious.

The ETUC report concludes that:

… the revised regulations are fixated on achieving economically ungrounded … debt and deficit-to-GDP ratios, and relegate reforms and investments to secondary concerns. They fail to prioritise pressing social, climate, employment, and demographic challenges amid a backdrop of widening social disparities, accelerating climate change, geopolitical tensions at Europe’s borders, and an ageing population.

In other words, the EU bosses and the European Parliamentarians have framed the purpose of fiscal policy as achieving certain financial ratios and have set parameters for those ratios at levels that make it impossible to achieve solutions to the actual challenges facing the Continent (and the Globe in general).

That is the hallmark of the neoliberal era – to divert the role of fiscal policy away from pursuing functional outcomes that benefit humanity and the planet we depend upon towards meaningless goals that actually undermine those desirable outcomes.

The scale of public investment that is required in the coming period to deal with “social and green investment needs” will be massive and will require either substantial European-level expenditure or the abandonment of the fiscal rules at the Member State level.

Neither option are possible in the EU given the ideological entrapment that is embedded in the legal structure (the treaties) which will be almost impossible to change.

An individual nation will have to exit the treaty structure (that is, exit the Eurozone and probably the EU given the way the Commission constructs the situation) if they want to deal with the emergencies before them.

I don’t see any dynamic that is present where a nation will take that step.

So the grinding disaster will continue until either social and/or environmental chaos creates a major revolt – the least desirable outcome.

The ETUC Report documents the damage that privatisation and public private partnerships have done in Europe – “failed to deliver value for money” and lining the pockets of the profit recipients at the expense of the required investment.

Same story everywhere.

The Report documents the EU’s “investment gaps to meet its green and social goals” and I actually think they understate the scale of the problem.

The logical conclusion is that:

Using Commission projections for deficits under the European Council’s proposal for fiscal rules, we see that all countries breaching fiscal limits would be unable to meet our minimum estimate for social spend …

And that doesn’t take into account the ‘green’ investment that is urgently required.

They conclude in that context that:

… even the majority of countries that currently meet the EU’s fiscal rules will be unable to afford to meet their social and green investment gaps as they will become limited by the 3% deficit rule.

Recipe for disaster and the European elites will be retired on fat pensions as the skies fall down on the rest of the citizens.

So progressives, please refrain from suggesting that the pandemic has changed the underlying policy outlook in Europe.

How to Fix Capitalism

Last month (March 9, 2024), The Saturday Paper, which is a progressive media source in Australia, published an interview with Mariana Mazzucato on the topic of – How to Fix Capitalism (behind a paywall).

It was very disappointing even though I agreed with many of the points she made, especially about sellers’ inflation.

She said when companies go broke the “taxpayer has to bail them out”.

She talked about why it was good that “excess profits were taxed directly to then cover the cost of living rises in the population” (in Spain).

She defended the right of capitalists to make profits.

She was then asked:

Should governments be wary of taking on more debt, though? Debt servicing costs are high and they’re climbing higher with interest rising. You’re not a modern monetary theorist, I understand, so where do you see the threshold?

To which she replied:

Your debt to GDP is crazy low, though. I mean, if it’s a problem at all for Australia. Even for a country where its very high it might not be a problem. Modern monetary theory is actually correct, theoretically. It’s not correct politically, because its obviously naïve to say, “Oh just print money, it doesn’t matter”.

And then proceeded to rave about public debt to GDP ratios and how if government’s invest while accumulating debt that is good but otherwise government debt can be dangerous.

You can see why I was disappointed by the interview and the points which she repeated regularly on her recent tour of Australia.

People should refrain from making comments on topics they have no understanding of.

By claiming that MMT is “not correct politically” reveals that misunderstanding is present here.

What does it mean “not correct politically”?

MMT is a framework for understanding how modern (post 1971) monetary institutions function and what the capacities of the currency-issuer are and what the consequences of using those capacities in different ways are.

It makes no sense to say that that framework is politically correct or incorrect.

Politicians might decline to acknowledge the efficacy of the framework, and, instead, hide behind economic fictions to obscure the impact and intent of their policy interventions, but that says nothing about the MMT framework.

It just tells us that the politicians are liars and in the service of others that they prefer to shield from our eyes.

Of course, anyone who summarises MMT as “Oh just print money, it doesn’t matter” is either stupid, ignorant or deliberately misrepresenting our work to advance their own agendas.

That comment was a disgrace.

Causes of death in Australia – latest data

Today (April 10, 2024), the Australian Bureau of Statistics (ABS) released the latest – Causes of Death, Australia – data for 2022, which also contained some interesting time series data.

While heart disease remains the “leading cause of death … COVID-19 caused 9,859 deaths and became the third leading cause.”

This was the first time since 1970 that “An infectious disease (influenza and pneumonia) was last in the top 5 leading causes of death”.

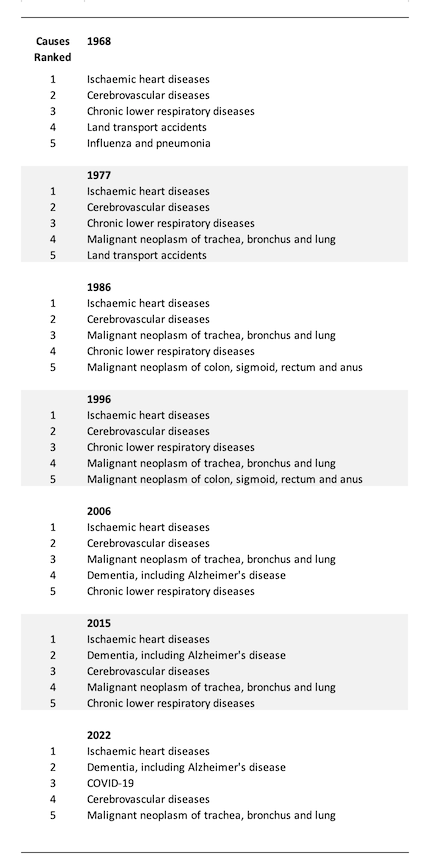

I created this table from the data, which ranks causes of death from first to fifth since 1968, which gives some insights into changing age profiles (for example, the rise in dementia and related diseases) and the problem that Covid has become.

The ABS note that in 2020 and 2021, Covid was lowly ranked as a cause of death (33rd and 38th respectively), which, of course, was when the Australian governments (federal and state) were actually running policies designed to minimise the infection rate.

Any semblance of (sensible) policy was abandoned in late 2021 and the results speak for themselves.

I am not suggesting we should have persisted with the lockdowns, which were beneficial in the short-run.

But to abandon mandatory mask wearing and other restrictions, and to largely stop publishing the data on a regular basis, and to push the need for on-going vaccination into the background, just doesn’t makes sense from a public health perspective.

We have seen massive government campaigns to prevent people from smoking tobacco and they have been spectacularly successful in reducing the health problems arising from that behaviour.

We have seen massive government campaigns to improve road safety and driving habits with the obvious reductions in the road toll being the result.

So why has the governments abandoned any public policy on Covid, which is now clearly a major cause of death in Australia, not to mention the trail of long-term illness it leaves those who it doesn’t kill with?

Music – The Partisan

This is what I have been listening to while working this morning.

I was updating the library on my iPhone last night to prepare for some flights later in the week and I added the 1969 album – Songs from a Room – recorded by – Leonard Cohen – (who died 8 years ago – can you believe that?).

In 1970, when I first started university, we used to listen to this album every day in the shared house I live in on Dandenong Road in Melbourne.

It spun a web over us.

This song – The Partisan – is on that album and one of my favourites.

It has an interesting history being composed in 1943 by a Russian musician with lyrics from a French resistance leader.

It was broadcast by the BBC’s French service to inspire the efforts of the resistance against the fascist German invaders.

Here is Leonard Cohen’s version.

And here is the original version – La Complainte du partisan – recorded in 1963 by Anna Marly (the composer).

It is very different but nonetheless pleasing.

We need more anti-fascist anthems, given current trends in the world.

That is enough for today!

(c) Copyright 2024 William Mitchell. All Rights Reserved.

What’s particularly amusing is that ‘issuing debt’ is really ‘printing money at interest’ within that analogy.

Therefore why is ‘printing money at interest’ somehow better than ‘printing money at no interest’?

Moreover if somebody wants to use the ‘printing money’ analogy rather than the correct crediting accounts view, then they need to accept that taxes are ‘shredding money’, and bank deposits are ‘putting money in a drawer for safe keeping’. Otherwise they are very likely to respond emotionally rather than rationally.

The economics profession ought to have some sanction against anyone touting themselves as an economist and using or typing the words print(ing) and money in the same sentence.

What can you expect when the blob is run by an IMF empolyee?

The empire rules.

Maybe the empire wishes (demands?) the blob to go to war, so that their enemies deplet their arsenals on the EU, and then make them a easy target to bomb.

Far-fetched, you say?

Just look at Gaza!

Europe’s problem is the neocon neoliberal infestation starting a proxy war to weaken Russia which backfired on them spectacularly!!

@Patrick B

Prof Steve Keen would have (climate) scientists referee mainstream publications, mostly regarding climate, in order to have a talk about their academic standards. The goal is to get the mainstream kicked out of academia or made to conform to some rigor.

Some may recall that the three Amigos of economics, Kelton, Raworth and Mazzucato were spoken of together some while ago. That doesn’t seem to have continued as Mazzucato has become the current darling of “progressive” economists and politicians who operate with a flawed macroeconomics. While I’m not a fan (even though she does say a number of good things along the way) as she is too much “the market will fix it (together with public investment)” in her nonstop somewhat self-important gumflapping.

Maybe she has been seduced by her rapid fame and significant consultancies and comes up with gobbledegook like MMT is “not correct politically” in the interests of self preservation instead of saying, say, “MMT is not acceptable to the politicians that I’m trying to influence” or some such.

I find it cognitively dissonant for anyone of critical intelligence to say “Modern monetary theory is actually correct, theoretically.” and follow that up with “It’s not correct politically, because obviously it’s naive politically to say, “Oh, just print money, it doesn’t matter.””. I cannot imagine that Kelton hadn’t made plain to Raworth and Mazzucato the world of macroeconomics with an MMT understanding. Mazzucato’s use of “naive politically” in her explanation may have a further meaning than in just falsely referencing the “just print money, it doesn’t matter” statement. Whatever it is there appears to be a significant intellectual dishonesty in her words.

The real world and the political world remain apart.

After someone has had COVID-19, the risks of getting or dying of heart disease in the next two years is roughly doubled, though the numbers are different among the various different heart diseases.

So in the list of the top five, the heart disease still in first place hides part of the harm done by COVID-19.

The effect might last longer than two years, but I haven’t seen data on that yet.

Three “Amigas”, surely?