In the annals of ruses used to provoke fear in the voting public about government…

Japan inflation now falling fast – monetary and fiscal policy settings have been vindicated

The latest information from Japan suggests that in December 2023, its inflation fell sharply for the second consecutive month and that one might conclude the inflation episode is coming to an end. The Bank of Japan made the assumption that this supply-side inflation was temporary and would subside fairly quickly once those constraints eased. And they were right. All the other central banks somehow convinced themselves that the inflation was demand-driven and have been needlessly pushing up interest rates. The experiment is nearly over and I think it is clear that the Japanese path was the sound one. At that point, the New Keynesian academics and officials should resign. After that, as it is Wednesday, we have some music to soothe our souls.

Japan’s inflation rate tumbling

Every now and then you read about the famous ‘widowmaker’ trade where financial market types think they can outsmart the Bank of Japan.

The widowmaker trade is so-named because it causes massive losses.

These trades can be on any asset but the classic is the bet on Japanese Government Bonds (JGBs) where investors (aka gamblers) short sell the market in the hope that yields will rise in the future when their contracts are ending and they have to actually deliver the assets they currently do not own.

They short-sell because they think that the Bank of Japan will increase interest rates – like other central banks – which will, in turn push up yields on all financial assets and drive the price of fixed income assets like JGBs down.

So they can then swoop in to the market at the time their forward contract ends, buy the bonds at a cheaper price than when the contract was formed, and make a killing.

The only problem is that it has never works in the way hoped for.

The gamblers come out of university or elsewhere and think the textbook applies.

The Bank of Japan has for the last thirty years demonstrated that courses in monetary economics provide no knowledge.

In the last year or so, the widowmakers have been at it constantly, thinking that the final elements of what has been termed ‘Japanification’ will topple – that is, that the Bank of Japan will relent in the face of rising inflation and start pushing up rates.

Each month or so, I read some financial market briefing document that predicts the Bank is about to tighten monetary policy.

When the Bank makes minor adjustments to policy – such as the recent small change to its Yield Curve Control ceiling – the gamblers go crazy and assume the floodgates are about to open.

People can still make profits via yen carry trades – that is, borrowing yen at the low rates and selling it for higher interest-earning currencies.

But the JGB short sellers are not likely to be satisfied any time soon.

I say that because the latest inflation data from Japan is hardly going to provide a signal to the Bank of Japan that it should raise rates, even if it followed the logic that other central banks use.

The official data from e-Stat (the Japanese government statistics agency) goes up to November 2023.

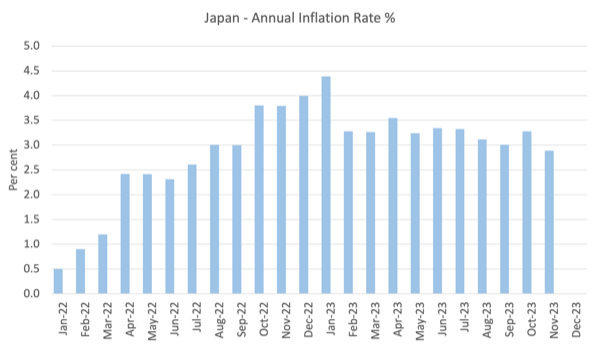

Here is the monthly inflation rate since January 2022.

It was then running at 2.9 per cent but the monthly change between October and November 2023 was -0.187 – deceleration in the inflation rate from 3.3 per cent.

Before we get the latest e-Stat data for December, a poll conducted by Reuters which is discussed in this article – Japan Dec CPI likely hit 18-month low, fuelling steady view on BOJ: Reuters poll – suggests that that the deceleration is continuing with food and energy price increases moderating rather quickly.

Further:

The poll also showed December wholesale prices likely fell for the first time in nearly three years …

Which tells me that the Bank of Japan has no signal at all upon which to change its current monetary policy settings – negative policy rate and a 1 per cent 10-year JGB ceiling.

Japan’s inflation episode is about over.

We will get the official data on Friday, January 19, 2024.

I will talk more about this when I speak in London next week.

The point is that once again Japan provides an example, even if the policy makers are in denial about what they are doing, of how mainstream macroeconomics is off the mark.

I have read comments on earlier posts that I have written saying that the Bank of Japan operates using Monetarist logic – that inflation is the result of an excessive monetary base.

It is true that their official discussions talk about how they watch the monetary base.

But if they were truly Monetarist then they would not have defied the rest of the world in the last few years and held rates constant.

That decision separates them from the rest of the central banks who have behaved in a thoroughly orthodox fashion over the last few years – inflation rise, push up rates.

The point I make is that what Japan provides us with is a tested example of what happens when the government and its central bank runs policy settings that are beyond what most economists would think reasonable.

The differences between Japanese fiscal and monetary policy settings and those in place elsewhere over the thirty or so years are not just trifling variations.

Japan has pushed large fiscal deficits relative to other nations and a mainstream economist would say their monetary policy settings are extreme.

So we have been able to see over an extended period what happens when those ‘extreme’ settings are in place.

And what we see is that the mainstream predictions fail badly across all the major aggregates.

That is why Japan is important to study and understand.

GIMMS London Event – Friday, January 26, 2024

This time next week I will be on a aeroplane heading to London, which will be the first time I have been there since February 2020.

I hope to return to regular trips there but we will see how this one goes – I am risk averse to Covid.

The following week I will be taking my usual classes at the University of Helsinki, which for the last 3 years I have been doing via Zoom.

I have warm clothes on the ready!

Anyway, my first engagement in London next week will be on Friday, January 26, 2024 and it is being organised by the wonderful women from – GIMMS.

There has been a major policy experiment conducted in the last few years which seems to have escaped the attention of the media and commentators.

It is very rare that we have the chance to compare two diametrically opposed approaches to a global problem that has impacted on all nations.

But since 2021, most central banks have significantly increased interest rates to, in their view, combat the inflationary pressures that emerged.

These nations have also tightened fiscal policy to, allegedly, ‘support’ the anti-inflationary stance of their central banks. Japan, in contradistinction has held interest rates constant while also increasing their fiscal policy stimulus to help households and firms deal with the rising cost-of-living pressures.

The nations that implemented contractionary policies not only misunderstood the nature of the inflationary pressures, but also demonstrated the poverty of the mainstream policy approach.

In this talk, I discuss the reasons the mainstream approach failed and why it is unfit for purpose.

Date and time: Friday, January 26, 2024 from 13:00.

Location: Unite, 128 Theobalds Road London WC1X 8TN United Kingdom

The organisers at GIMMS note that they would ask that people assemble from 13.00 onwards for a prompt 13.30 start to make the most of this important opportunity.

Coffee and cake will be available in the break which will be followed by a Q&A session.

Ticket link: https://www.eventbrite.co.uk/e/gimms-event-professor-bill-mitchell-tickets-788915095287

I receive no payment for this event.

I hope to see all the gang there and I would hope you will wear masks at the event to protect yourself and those around you.

Music – Recuerdos De La Alhambra

This is what I have been listening to while working today.

In the early 1970s I was studying classical guitar at the Melbourne Conservatorium and I was particularly attracted to to the works of – Francisco Tárrega – who was one of the originators of what we now call ‘classical guitar’.

I studied his playing closely.

The piece – Recuerdos De La Alhambraa – is an exquisite piece of music and a great test of both right and left hand techniques.

The right hand part requires the ‘tremelo technique’ with the fingers playing the same string in quick succession to give the impression of a continuous sound.

The challenge is to be smooth so the listener can barely hear the individual finger strokes.

It is a very difficult thing to learn.

The piece is very nostalgic for me.

I spent hours trying to play it well.

It was written in 1899 for Tárrega’s patron after they visiting the palace of Alhambra in Granada.

I visited the palace some years ago and thought about this music.

Listening to the whole catalogue of Tárrega’s worth is a great backdrop to a morning’s work.

This particular version comes from a Deutsche Grammophone CD released in 2002 – The Art of Segovia.

It is played by the maestro – Andrés Segovia – who as a young boy went to live in Granada to further his musical education.

It was a pretty sound move by the ‘sounds’ of it.

That is enough for today!

(c) Copyright 2024 William Mitchell. All Rights Reserved.

As ever mainstreamers have reconciled Japan with their beliefs. Here’s a quote from the recent ‘Economics Explained’ video on Japan (Something weird is happening in Japan). About as mainstream a channel as there is with an inexplicable 2.5 million subscribers. This video has 1.7 million views.

Neil,

Inflation very bad, except when it would be very good. Got it. Companies innovate when they have safe, guaranteed, income, not due to pressure of competition; uh huh, that surely makes sense. Small problem, why aren’t foreign companies taking advantage?

The charade of IMF in November 2023 convinced RBA to hike rates and rollback infrastructure projects. It’s reason, the infrastructure spending boom has pushed the economy beyond full capacity and requires further rate hikes to tame inflation.

How many times do the goal posts need changing? Does the IMF just pluck excuses out of an imaginary book?

Have I missed something.

“People can still make profits via yen carry trades – that is, borrowing yen at the low rates and selling it for higher interest-earning currencies.”

This seems like an open invitation to make money almost without limit. What keeps it in manageable proportions? What keeps hedge funds from running wild with it?

@John Sterling – Currency carry trades have risk.

If the borrowed currency (say, yen) appreciates versus the lent currency (euro, USD, etc.) then the trade could result in a loss. So there is exchange rate risk. The trade has other risks too (interest rate risk, counterparty risk, etc.)

Hedge funds certainly engage in the trade, but they have to monitor risks closely.