The US is now a rogue state. One example is the conduct of the US…

Bank of Japan shifts ground – just a little but there is no sign of a major adjustment any time soon

It’s Wednesday and I use this space to write about any number of issues or items that have attracted my interest and which I consider do not require a detailed analysis. The issues discussed may be totally unrelated. Today, I provide my response to yesterday’s decision by the Bank of Japan to vary its Yield Curve Control (YCC) policy, which some commentators are frothing about. The change was very minor and is not a sign that the expansionary position of the Bank is shifting significantly. I also discuss the culture of denial in the US State Department and then rock out to come classic swamp.

Bank of Japan shifts policy – hardly

Yesterday (October 31, 2023), the Bank of Japan put out a new monetary policy announcement – Further Increasing the Flexibility in the Conduct of Yield Curve Control (YCC) – which marginally increased the upper ceiling on the 10-year government bond yield that it will allow the bond markets to set.

Hardly any change.

Some commentators claimed it was in response to the Bank’s “expensive intervention strategy that’s increasingly tested by markets” but I consider that wishful thinking.

The bond markets keep thinking that a major easing in the wind and through short-selling they place bets on that projection.

But they lose as the Bank holds the cards and plays them well.

The Bank still believes underlying inflation is below its preferred annual rate of 2 per cent.

The underlying part is important because, unlike other central banks, the Bank of Japan, correctly in my view, assessed the current inflationary pressures as being ephemeral (transitory) and driven by factors that are not within the control of monetary authorities.

They thus have not shifted monetary policy settings in any substantial way, unlike almost all other central banks, and have thus avoided imposing unnecessary pain on mortgage holders on top of the current cost-of-living pressures.

They are still hoping that by holding what might be considered an ‘expansionary’ policy stance, GDP growth will increase, underlying price inflation will realign upwards, and then wages growth will be stimulated.

No other central bank thinks like that.

The Bank of Japan governor (Ueda) said yesterday that:

We still haven’t seen enough evidence to feel confident that trend inflation will (sustainably hit 2%) … As such, we don’t see a big risk of being behind the curve.

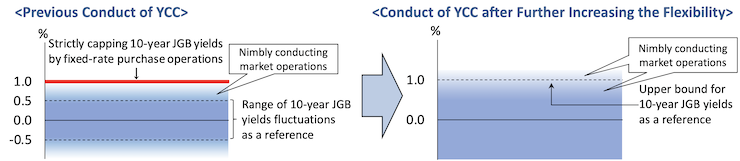

This diagram that accompanied the announcement shows what the shift in the YCC policy amounts to.

Previously, they have targetted a range of yields for 10-year Japanese government bonds (JGBs) between -0.5 and 0.5 per cent, with an upper limit of 1 per cent, which they considered to be a ‘strict cap’.

They then enforced that policy through their bond-buying operations – selling when the yield was in danger of falling too far below the -0.5 per cent mark and vice versa, but always buying enough JGBs in the secondary market to stop the yield from rising beyond 1 per cent.

Remember that bond yields fluctuate inversely with the bond price in the market and the Banl’s buying and selling strategies can manipulate the relevant price.

Effectively, they are now redefining the 1 per cent ceiling on 10-year Japanese government bonds (JGBs) as a “reference point” and will allow the trading range to exceed that in some circumstances.

The Bank noted that:

With extremely high uncertainties surrounding economies and financial markets at home and abroad, the Bank judges that it is appropriate to increase the flexibility in the conduct of yield curve control, so that long‐term interest rates will be formed smoothly in financial markets in response to future developments.

In part, the move acknowledges the fact that the yen has depreciated significantly in the last year and a half as the differential between the Japanese interest rates and those available elsewhere has risen, encouraging an outflow of investments from yen.

However, unlike the mainstream commentary, I don’t sense any panic over the exchange rate.

Even with the declining yen, inflation has fallen fairly quickly.

But the thing that you must always remember when interpreting these small shifts from the Bank of Japan, or fiscal shifts from the Ministry of Finance for that matter, is that policy makers are doing everything they can to allow Japan to escape from the decades of ‘deflation’, which has impoverished wages.

Outside observers who do not understand the psychology that operates within Japan fail to see the policy in that context.

Instead, they apply the neoliberal logic that has dominated policy making elsewhere and think that Japan is aberrant in not ‘fighting’ inflation hard enough, or ‘too lax’ in its spending policies because it runs large and increasing deficits.

When one appraises the underlying trends, it is possible to mount a story that says that this inflationary period has broken the back of the long deflationary cycle and the policy makers want to lock that in.

The Bank statement yesterday said that:

the Bank expects that underlying CPI inflation will increase gradually toward achieving the price stability target of 2 percent, while this increase needs to be accompanied by an intensified virtuous cycle between wages and prices

The projection period ends in fiscal year 2025 – so they are being patient and one should not expect any radical shifts in policy in the meantime.

It is also possible that the current inflationary episode, being transitory in nature, will end and Japan will plunge back into its deflationary past.

I have had discussions with experts who worry about that and want further fiscal expansion to make sure that doesn’t happen.

It is hard to be definitive either way at present, except to say that the decisions by the Bank of Japan are likely to be very gradual as they observe wages growth increasing – which is their desired aim.

Some commentators are frothing about the movements in the yen.

The currency depreciated marginally yesterday after the announcement but the changes were so small as to be irrelevant to the formation of any assessment.

The large step depreciation that occurred in 2022 was clearly the result of the US Federal Reserve Bank pushing up interest rates and sucking funds into the US dollar.

Since that adjustment the yen has been relatively stable.

Moreover, the Trade Ministry is happy because the real exchange rate (the measure of international competitiveness) has improved significantly and the trade account moved back into surplus in September after the pandemic.

The current account went further into surplus.

No-one who understands the Japanese situation is worried about the external sector despite the sense of panic that the media commentators like to invoke.

There are some officials with principles

I am still getting E-mail flack for previous comments I have made about the current abuses of human rights by the IDF in Gaza.

Apparently, I know nothing about the complexity of the conflict.

Well, in fact, I actually know quite a lot about the complex history of the region and the successive bad decisions by colonial and other authorities which, in part, have got the region to where it is at.

I also know about abuses of innocent citizens on both sides of the conflict.

But what I know more clearly, and, which in my view could only be contested by the most venal of minds, is that deliberately killing thousands of innocent children in the name of national security is indefensible and a clear example of human rights violation.

There is no gray area when considering that.

The gray area is whether this action by the IDF will improve national security and history tells us that the actions by the Israeli government over many years have done little to achieve that goal and it is time to adopt a different approach that gives some hope to the Palestinians, who have a legitimate historical claim to the lands in the south Levant.

I read an interesting article in the Washington Post (October 23, 2023) – This is not the State Department I know. That’s why I left my job – which was written by “a former director in the State Department’s Bureau of Political-Military Affairs” in the USA.

Rarely do you see a former senior official in a bureacracy so publicly out the morality of his/her former organisation.

He clearly isn’t a cleanskin having “worked in the State Department bureau responsible for arms transfers and security assistance to foreign governments” which involved sending US manufactured weapons to other nations.

He notes that for the first time in October 2023 a bridge was crossed where:

… a complex and morally challenging transfer in the absence of a debate.

He resigned his position because he could no longer justify working in that capacity given that:

1. “U.S.-provided arms have not led Israel to peace.”

2. “Rather, in the West Bank, they have facilitated the growth of a settlement infrastructure that now makes a Palestinian state increasingly unlikely, while in the densely populated Gaza Strip, bombings have inflicted mass trauma and casualties, contributing nothing to Israeli security.”

He reports that after the murder by Hamas of innocent civilians, the Israeli government requested more weapons from the US:

… including for a variety of weapons that have no applicability to the current conflict.

The requests were controversial but were waved through without serious consideration.

Now, the writer says, US arms are clearly being used to deliberately murder civilians, including children, and the US State Department are complicit.

They have apparently blocked information flowing to external embassies about how the weapons they sell can be used because they know the weapons being supplied to the IDF:

… will inflict civilian harm and violate human rights. But the department was so adamant to avoid any debate on this risk, even the publication of a pending department release about the CHIRG was blocked.

While the official who resigned does not oppose the sale of weapons where protections for civilians can be guaranteed, he formed the view that:

The absence of a willingness to hold that debate when it comes to Israel is not proof of our commitment to Israel’s security. Rather, it is proof of our commitment to a policy that, the record shows, is a dead end — and proof of our willingness to abandon our values and turn a blind eye to the suffering of millions in Gaza when it is politically expedient.

Saying these things is not anti-semitic. It is not anti-Jewish.

It is anti the brutality of an out of control regime that is not only pursuing a strategy that will create even deeper enmity in the future but is murdering innocent children who are blameless in the short run.

The US government is facilitating and that is shameful but unsurprising given that nation’s past martial history.

And save your typing fingers if you want to write and tell me how disgusted you are about me being concerned about the murder of innocent children.

Just stop reading my blog posts!

The Smith Family Manga – Episode 3 is coming this Friday

We don’t encourage binge viewing at – MMTed – so Season One of our new Manga series – The Smith Family and their Adventures with Money – is being released on a weekly basis.

In Episode 3, Elizabeth does some arithmetic! After the incessant quarreling between father Ryan and son Kevin over the origin of the currency, Elizabeth reads a blog post that Kevin mentioned in her spare time.

She tries to engage Ryan about what she has learned and he is in denial

Friction within the Smith Family is rising but the clarity about the monetary matters should be increasing.

Tune in Friday, November 3, 2023 for the next instalment.

Music – J.J. Cale

Last night, I joined a local band of top Kyoto musicians at the famous – Jittoku – club in Kyoto and we rocked into the night with a packed house.

Japanese audiences are really great and it was a top night – loud, plenty of electric guitars and some good memories.

Given the band and I don’t rehearse regularly we chose songs that satisfied two criteria: (a) they are well known; and (b) we know them!

The latter condition means we can step up and play them and the band is tight.

One song we played was the classic – J.J. Cale – song – Cocaine – which first appeared on his 1976 album – Troubadour.

While a lot of people thought it was a pro-Cocaine song, it was actually the opposite.

The band on the song was:

1. J.J. Cale – vocals, guitar bass.

2. Kenny Buttrey – drums – a famous Nashville session player.

3. Reggie Young – electric lead guitar = another famous Memphis sound studio player.

A really classic song.

That is enough for today!

(c) Copyright 2023 William Mitchell. All Rights Reserved.

Among the many stupid impacts of interest rate rises, there is one that should be alarming everybody. It is pricing out wind farm construction – which is finance heavy up front.

Because it’s far better to give rich people free money than get on with addressing climate change.

Instead wind farm developers are demanding higher guaranteed prices to build farms to cover the cost of financing – which is, of course, inflationary.

We need an MMT informed position on this. Suppressing home construction is bad enough, but delaying energy transformation is catastrophic.

Thank you Bill for your principled and knowledgeable words on the biblical barbarity.

It is a mystery to me how BOJ convinces ANY investors to buy long term bonds at around 1 percent yield, especially in light of the dramatic decline in value of the Yen versus US Dollar in last 5 years.

How applicable is the Japanese experience in managing long-term interest rates to suggestions that the US Fed could do something similar if it were to choose so?

Is there a market in Japan for long-term bonds issued by corporations, comparable to the US market?

Are investors willing to purchase privately-issued long term Japanese bonds at rates anywhere close to the BOJ rates for long-term government bonds?

Those who think it is inappropriate to condemn the cruelty being inflicted on Ghaza might do well to listen to political scientist and author Norman Finkelstein.

Finkelstein’s parents both survived the Nazi death camps, the only members of their respective families to do so.

He says that Holocaust survivors fell into two groups – those like his parents whose experience made them believe that such horror should never be repeated against anyone, anywhere, and those who would extend that level of protection only to Jews.

Finkelstein aligns himself with the first group, but says the Israeli government is guided by the values of the second group.

Finkelstein compares the experience of the Ghaza population in their prison with that of his parents in the concentration camps, including their feelings toward those outside, aware of but indifferent to their suffering.

He sees a chilling connection between the roughly one million Palestinian children facing possible anihilation in Ghaza and the one million Jewish children believed to have perished in the Holocaust.

I am reminded of a 1970 conversation recounted by John Pilger with an old Jewish friend in Israel who confessed feeling both sympathy and fear when he saw Palestinians in a refugee camp. He said they displayed the same bitterness and determination he had felt as a boy growing up in the Warsaw Ghetto.

@Dave Wilson Gerald Kaufman, former Labour minister (died 2017) expressed similar thinking in a speech in the HofC during the earlier 2008-9 Gaza War. Pity he isn’t around to castigate our latest Govt. and Starmer and his followers (he would doubtless have been thrown out of the Party a while ago had he lived).