The Reserve Bank of Australia (RBA) increased the policy rate by 0.25 points on Tuesday…

Australia – inflation still falling while the RBA governor keeps inventing ruses to keep hiking rates

It’s Wednesday and there is a lot going on in the data release sense – housing finance, construction and today, the Australian Bureau of Statistics released the latest – Monthly Consumer Price Indicator – which covers the period to April 2023. On an annual basis, the monthly All Items CPI rate of increase was 6.8 per cent down from 6.9 per cent. There is some stickiness in some of the components in the CPI but overall inflation peaked last year and is slowly declining as the factors that caused the pressures in the first place are abating. Tomorrow I plan to discuss an apparent tension in the Modern Monetary Theory (MMT) community as to whether interest rate increases are expansionary or contractionary. But today we just consider the data and then listen to some dub.

Inflation continues to decline in Australia

Today’s data shows the monthly increase in the CPI was down to 0.68 per cent from 0.77 per cent in March.

This new experimental monthly series from the ABS only covers about 60 per cent of the items that appear in the more detailed quarterly release, although the ABS noted that it “is continuing to improve the monthly CPI indicator where possible and has added a new monthly series for electricity prices in the indicator”.

So as time passes, the indicator will get closer to the more accurate standard quarterly measure.

However, as it stands, it still provides good information for assessing where the inflationary pressures are heading.

The ABS Media Release (May 31, 2023) – Monthly CPI indicator up 6.8% in the year to April – noted that:

The monthly Consumer Price Index (CPI) indicator rose 6.8 per cent in the year to April 2023 …

This month’s annual increase of 6.8 per cent is higher than the 6.3 per cent annual rise reported in March 2023, but is below the high of 8.4 per cent recorded in December 2022 …

It’s important to note that a significant contributor to the increase in the annual movement in April was automotive fuel. The halving of the fuel excise tax in April 2022, which was fully unwound in October 2022, is impacting the annual movement for April 2023.

Once again we are seeing price effects of discretionary decisions by government, which are unrelated to the state of overall spending in the economy.

The RBA’s interest rate hiking escapade is all conditioned on there being a demand-side problem.

Clearly, if the government had not manipulated the fuel excise rate then the current inflation rate would be much lower.

So it would be criminal of the RBA to use this figure to argue that inflation is not falling fast enough and then use that to justify a further interest rate rise.

But of course sensible logic disappeared a long-time ago at the RBA.

I will return to that later.

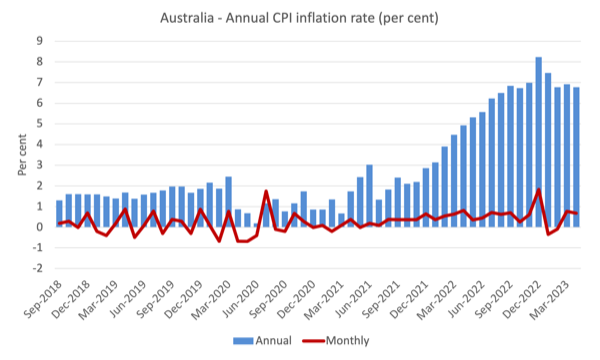

The next graph shows, the annual rate of inflation is heading in one direction – down and quickly.

The blue columns show the annual rate while the red line shows the month-to-month movements in the All Items CPI.

1. In December 2022, the annual rate recorded was 8.2 per cent.

2. In January 2023, the annual rate was 7.5 per cent.

3. In February 2023, the annual rate was 6.8 per cent.

4. In March 2023, the annual rate was 6.9 per cent.

5. In April 2023, the annual rate was 6.8 per cent.

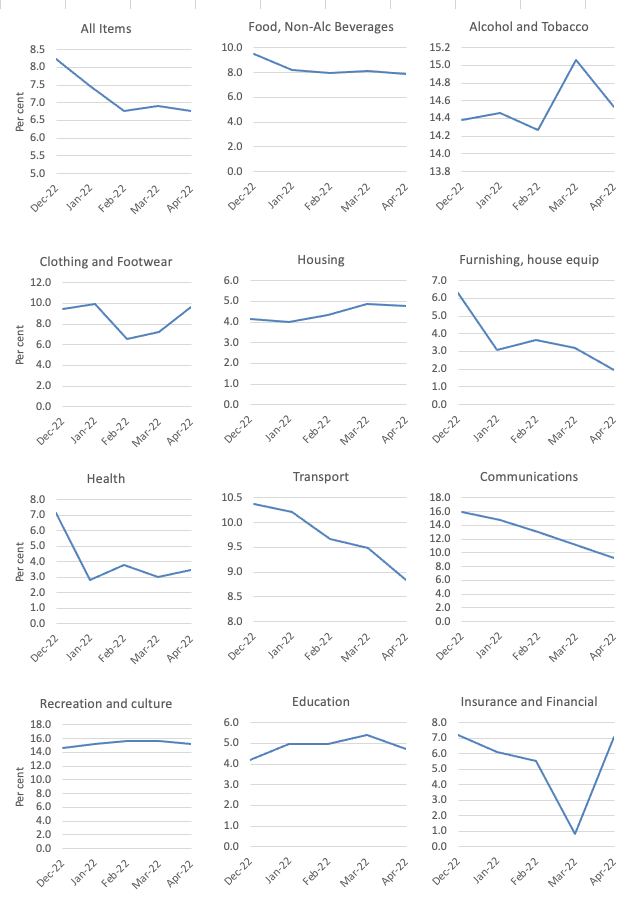

The next graph shows the movements between December 2022 and April 2023 for the main components of the All Items CPI.

In general, the initial sources of the CPI pressure are in rapid decline and some of the derivative components – for example, clothing and footwear (derivative because transport costs were higher for a while).

The rise in education costs are, in part, due to price gouging from the private school operators, sensing they can get well ahead of unit cost rises without anyone noticing.

Health care costs rose because of indexing arrangements in private health insurance – again an administrative artefact inspired by the privatisation of health protection.

And the financial sector is back in town with massive profit seeking (see graphs below).

But overall, the inflation rate is declining as the supply factors ease.

Interestingly, the RBA governor appeared today before the Commonwealth Senate Estimates Committee, which serves to grill public figures on what they have been up to.

Today the hearnig from the Economics Legislation Committee interrogated the RBA boss but the official transcript is not yet available.

However, the ABC radio and TV services covered the hearings and we learned among other things that:

1. The RBA admitted today that it has been underpaying an ‘unspecified’ number of its employees many thousands of dollars in pay.

And if that wasn’t bad enough it called in PwC, the private management and accounting firm to work out the solution.

Why is that scandalous?

Well PwC has now been uncovered for systematically using confidential information gained from their consulting contracts with the federal government about tax policy to help their private clients increase their profits.

The consultancy were designed to advise on policies that would clamp down on corporate tax avoidance.

It now appears that PwC abused the trust that is basic to consulting contracts with government to further their own ends and undermine public purpose.

Neoliberalism has seen the public service hollowed out and these accounting and management consultancy firms move in to fill the space in policy development.

Public policy is meant to advance general well-being.

But PwC saw these consultancies as an open door to help itself with the unwitting government handing over confidential information via these contracts.

So for the RBA to continue to use PwC is a scandal in itself.

But we are now learning that PwC has many contracts with various government departments worth millions if not billions.

Corruption is obvious.

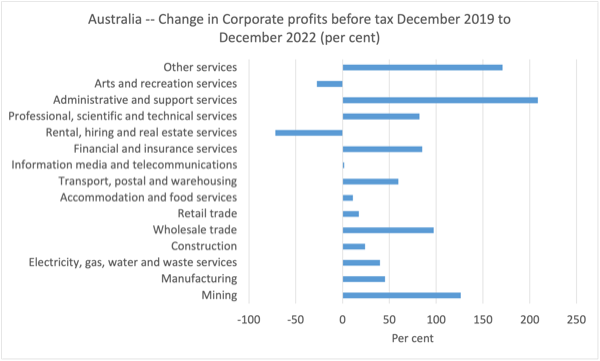

2. The governor was asked whether profit gouging is driving inflation and he flatly denied it and stated that “Profits have not risen outside the resources sector.”

Well that statement is not quite accurate is it?

The first graph derived from official ABS data show the that profits have been rising in most industrial sectors and the second graph shows the that profits have risen relative to sales in most sectors.

The resource sector has enjoyed substantial growth in profits since the pandemic. But so have many other sectors.

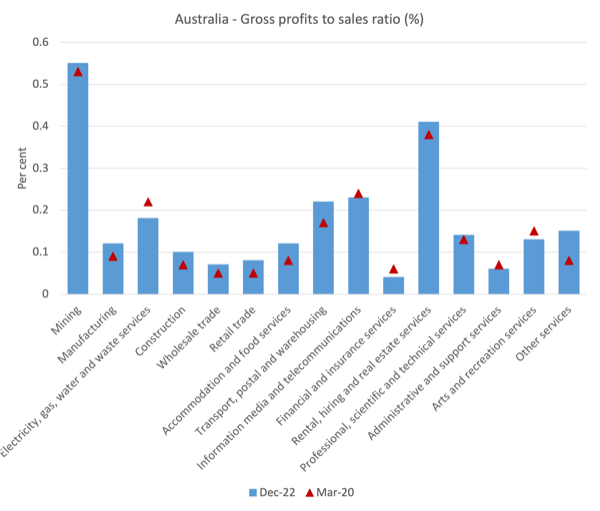

This graph shows the gross profits to sales ratio and the red triangles depict the March-quarter 2020 at the onset of the pandemic and the blue columns show the December-quarter 2022 results.

If the bar is above the triangle then it means that firms are expanding profits per unit of sales.

That clearly has been happening right across the industrial landscape.

It is a pity the Senate Committee members were not better informed and able to force the RBA governor to retract his assertion.

His assertion is of course cover for what he is doing with monetary policy.

He couldn’t justify the interest rate increases if profit gouging was a major factor driving the inflation (which it now is, despite his denials).

3. The governor pulled out the inflation expectations card again because the old sorry ‘we risk a wage-price spiral’ ruse to justify the rate rises is wearing a little thin, given that wages are clearly not driving the inflationary episode.

So what else but to fall back on the other old ruse that one of the reasons he gave for the last interest rate rise, in the face of falling inflation:

… was to reinforce the idea in the community’s mind that we’re serious about this, that we will do what’s necessary to get inflation to come down …

But with inflation already peaking in the second-half of 2022 and no data suggesting that inflationary expectations were anything other than benign, this claim that the rates have to keep rising to make people realise the RBA was serious is parlous at best.

4. He tried to disperse blame back on the fiscal policy by claiming that the “Capital stock not rising in line with the population means Australians have less capital to work with” and that more investment by government is required.

He particularly argued that there was a need for more housing stock and governments had to invest more.

But previously he has warned that if the government didn’t tighten fiscal policy then interest rates would rise by more than they have already done so.

Why didn’t the senators pick him up on this?

Music – St Germain

This is what I have been listening to while working this morning.

This track – Dub Experience II – appeared on the 1995 debut studio album – Boulevard – French band – St Germain.

Maybe referring to St Germain as a band is pushing it a bit given that it is the state alias for the French house and jazz producer who assembles a few actual musicians to accompany his sampling and other effects.

Anyway, this is a beautifully produced dub which I reacquainted myself with yesterday on a long flight from Perth to Melbourne.

The whole album is worth listening to.

That is enough for today!

(c) Copyright 2023 William Mitchell. All Rights Reserved.

There’s an interesting quote in the book “Ten Crisis” by the Chinese scholar Wen Tiejun.

It’s about Mao Zedong’s first political campaigns, known as “San Fan Wu Fan” or “cultural revolution” as it has became known in the west.

I’m not here to defend it.

I understand that everything has two sides and I never choose one of them, because there are always drawbacks in whatever side you choose.

The west depicts “cultural revolution” as some kind of bloodbath but the Chinese see it as the “struggle against (…) corruption, wastefulness and bureaucratization and (…) bribery, theft of state property, tax evasion, shoddiness and economic spying.” (page 26).

What I can say for shure is that it was about eliminating the remininescent of the Kuomitong party, that was in power before Mao, and took refuge in the island known as Taiwan, afterwards.

And whether they suceeded, if they dwindled the levels of corruption, tax evasion and shodiness, or if they only changed the way it was beeing done and created new forms of corruption, it’s beside the point I’m trying to make here.

What I’m saying is that all of the “3 harms” and “5 venoms” of the quote are all living and thriving among us today – in the west.

And whether one sympathises with the Chinese communist regime or not, we all agree that none of those “harms” and “venoms” are good stuff (even if some of us could be praticioners of some of them).

And I must point to the “shodiness” on the quote.

The level of shodiness in the public mediatic debate is increasing at an alarming rate.

Besides the gigantic number of specialists that apear in every possibel theme (just remember how the media kept feeding us specialists on covid related subjects, to remind everybody that there was a pandemic going on), we have now a new disease: shodiness and plain stupidity are trying to become the norm.

I even believe that the trope about AI is just another form of shodiness, as we keep hearing about what is coming out of it.

The same thing happens in macro-economics, as we keep hearing about the shodiness of mainstreamers, speaking about all those fairy tales that have been debunked long ago.

Causes of unexpected price changes can be determined, no?

If unexpected price change moves in the same direction as the change in quantity, then the price change is demand-driven (in this type of analysis). If unexpected price change moves opposite to quantity, then the change is supply-driven. (There are ambiguous cases, too.)

Central banks appear to be using this type of analysis to argue that there are significant factors in inflation that are demand-driven. The graphs that portray this type of analysis (for example, from the San Francisco Fed) show larger demand-driven inflation impact than supply-driven.

I’m not suggesting that these analyses are “correct” … Just trying to determine whether the RBA uses, and presents, this type of analysis to determine the sources of inflation?

It would be nice if they’d just put up their hands and say: “yes we know interest rates are a distributional variable, and we’re putting them up to look after our own”.

I prefer an honest crook.

@Neil Wilson,

On reflection I’m still not confident in approaching again the particular Greens Senator re promotion of MMT in Parliament, given her remark that “now is not the time because we have high inflation.” How does the JG manage inflation in supply constraint scenarios? Rationing in war happens for a reason.

And my ANU acquaintence who said “MMT is communism” has a point : the very concept of the JG and ZIRP *mandated by government* might obviously be regarded as “communism”. Indeed central banksters look after their own, as you said.

Meanwhile, at least the US might wake up to the fact that government debt can continue forever, without the sky falling down, as they try to solve the ongoing fake ‘debt ceiling’ drama once and for all.

Just stumbled across this blog, good content! Will save it for future reference.

The issue I have with any CPI analysis is that the world has moved to a capital 1st lens. Those with capital, and in turn assets are accelerating wealth at a rate far exceeding a worker who operates on a wage basis. Years ago, you used to be able to become wealthy with a high paid career and a savings mindset, today that is not true.

Wealth is created by asset ownership over time and the CPI does little to recognize this fact. Its seen in action every weekend with older folks who are asset rich constantly outbidding those trying to get a foot hold into a home. The older person will likely have a much smaller income than the younger people, but to a bank that does not matter as the equity in their other assets is used as security, thus avoiding the need for deposits.

As purchasing power is eroded for the wage worker with cost of living spikes, the relative impact to an asset owner is much smaller due to their overall wealth appreciation and asset basket being larger. With a long enough period, this small benefit gets magnified year after year.

Over 65’s continue to spend through these times due to equity accrued primarily in Australian housing, shares and superannuation funds. Under 45’s who have debt are currently restricting their spending and facing the majority of the cost of living spikes (family, food, debt, education, energy, transport). Debt and serviceability to achieve asset parity is the key item here. Unless the CPI starts to include the cost to acquire and achieve asset ownership, CPI to me is a meaningless statistic used by CB’s (via the OCR) to entrench inequality to the benefit of asset owners.

I agree with Neil Wilson. I’d feel a lot better if the RBA just came out and said we are doing this to please X and we don’t care about the impact it has upon anyone else.

I’d also feel better if the Constitution could be amended to show that the RBA Governor and Board were in charge not the Government – to avoid any confusion.

Most importantly though, I’d like to see an end to voting.

Pretty impressive use of a B Flat Minor.

AFAIK, this is Bill’s thinking about how to reply to the Green MP.

Bill wrote in Thur’s blog about FRBSF’s report, “So it was better taking the Japanese route and waiting for the supply side to resolve while at the same time protecting the most disadvantaged households from the temporary cost-of-living stress with fiscal injections.

. . Using macroeconomic policy to kill off spending would just leave a legacy of higher unemployment and lost incomes as the supply side overcome its constrained environment.”

As I read it, there is little or nothing that can be done about supply shortages causing inflation, except maybe a price freeze, so instead the Gov. sends checks to people who need help paying the higher prices.

I hope this helps you with the MP.

So the RBA have the power to force us into a recession and throw hundreds of thousands of us into unemployment, but can’t even run their own payroll?

How comforting.