I have been thinking about the recent inflation trajectory in Japan in the light of…

Inflation has peaked, the supply side is recovering, and the interest rate rises were for what?

So the IMF has come late to the transitory inflation party. What was obvious months ago is now at the forefront of IMF forecasts. Better late than never I suppose. It is becoming clear that most indicators are still not predicting a major demand-side collapse in most nations. Growth has moderated slightly and the forward indicators are looking up. At the same time, the inflation data around the world is suggesting the price pressures have peaked and lower inflation rates are expected. Real wages continue to fall, which means that the inflationary pressures were not being driven by wages. So no wage-price spiral mechanism at play. And PMI data and related indicators (such as shipping costs, etc) suggest the supply constraints which drove the inflationary pressures are easing. So has all this been the work of the interest rate rises imposed on nations by central bankers (bar Japan)? Not likely. The rising interest rates and falling inflation are coincidental rather than causal. Which means the damage to low income debt holders and the bank profits boom from the higher rates was for what?

What were the central bankers thinking?

Now that the IMF has bought into the inflation is subsiding (quickly) one wonders what the technocrats advising the central bank monetary policy committees (variously named around the world) are thinking.

We have had this gung ho central bank push for higher interest rates (except the very wise Bank of Japan) and what do we observe:

1. Growth is still bubbling along in most countries.

The EU economy is hard to assess because of the ridiculous way that Ireland accounts for capital investment these days.

The most recent national accounts data (released by Eurostat on January 31, 2023) – GDP up by 0.1% in the euro area and stable in the EU – suggests that if you take Ireland out (which is recording a 15.7 per cent annual growth rate for the December-quarter 2022), then the EU would be close to zero growth.

For example, in the December-quarter, Germany’s growth rate was negative (-0.2 per cent) as was Italy (-0.1 per cent).

The overall EU GDP growth rate for the December-quarter was 0.1 per cent with Ireland recording 3.5 per cent.

So perhaps Europe is heading for recession.

But given what is going on there (with the Ukraine situation etc), that is hardly a surprise and has scant to do with the recent decisions by the ECB.

2. Consumers in the US are still borrowing strongly.

The data on consumer credit in the US – Consumer Credit – G.19 – published by the Federal Reserve Bank, doesn’t show any fundamental slowdown in the percentage growth in outstanding consumer credit.

3. Wages are not overtaking the movements in the CPI (see below).

4. The inflation data around the world has peaked.

5. In its most recent World Economic Outlook Update (released January 30, 2023) – Global inflation will fall in 2023 and 2024 amid subpar economic growth – the IMF has predicted there will not be a global recession.

They are predicting a ‘faster fall in inflation’ is highly likely.

6. The – Purchasing Managers Index (PMI) – data for China, which was released on January 31, 2023, shows that even though people are dying in large numbers from the hard-to-fathom health policy shifts, economic activity was strongly higher in January 2023, with domestic consumption and orders driving the economy.

The rebound in the services sector was even stronger than it was for the manufacturing sector.

The following graph shows the movements over the last 12 months up to the end of January 2023.

The message is that the supply-side constraints are easing quickly.

So we have a problem.

There is an observational equivalence issue arising.

Those who think the interest rate increases were justified will point to the turn in the inflation data as ‘evidence’ that the monetary policy shifts worked.

Those who don’t think the interest rate increases were justified (such as this writer) will argue that the turn in the inflation data has come before any identifiable impacts of the rate rises can be discerned.

Which means the two phenomena – the rate rises and the inflation mechanism – are not causally related, just coincidentally related at this time.

The former group would have to point to economies tanking into recession and total spending collapsing to have any chance of relating the monetary policy shifts to the turn in the inflation data.

After all, that is how monetary policy (rate hikes) is meant to work in an environment of demand-pull inflation – that is, too much nominal spending chasing the available supply.

But as I have argued before, this period since the pandemic began has been rather extraordinary given the supply side impacts.

So yes, we might observe pockets of excess demand (spending) which have put a strain on prices.

But if the excess demand is the result of a temporary collapse in supply, which is on the path back to where it was before the pandemic, then it is a rather dangerous proposition to deal with price pressures that may arise as if nominal demand is outstripping the ‘normal’ growth in productive capacity.

Why dangerous?

Simply because if the central banks push rates hard enough against a rather resistance demand side then they will ultimately hurt low income earners who hold mortgages, most of whom will have borrowed up to (and probably beyond given the corrupt banking sector) their limits.

Which means that if rates suddenly start rising, those households then move closer to default and loss of homes to the banks under foreclosure mechanisms.

And, meanwhile, one of the largest income redistributions is being engineered by the central banks as the bank shareholding class rubs its hands together as bank profits boom.

And while that is happening, the temporary supply side constraints start to ease and productive capacity returns to more ‘normal’ levels and the ‘excess demand’ evaporates not because of changes in the demand side but because the supply constraints ease.

The rate rises have been a flagrant abuse of policy.

US compensation

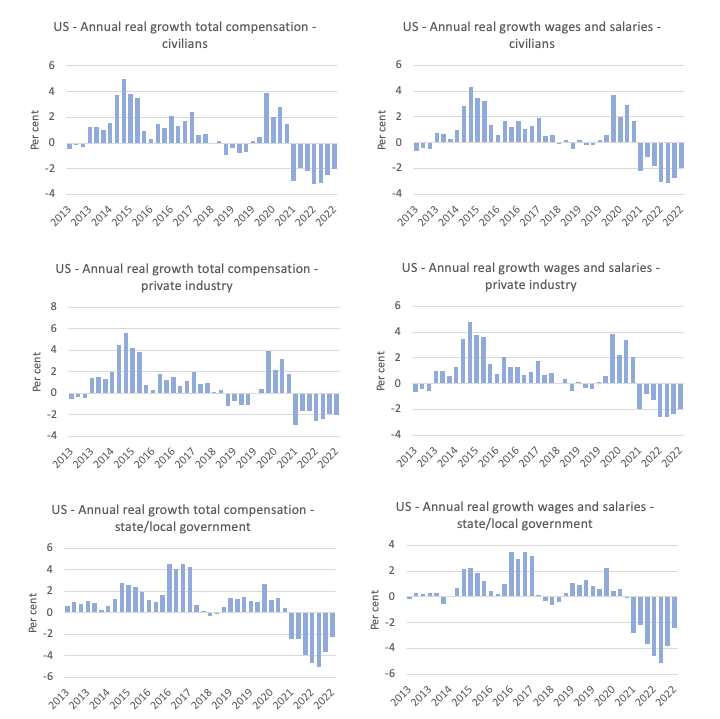

The latest data from the US Bureau of Labor Statistics on workers’ compensation is further compensation that the alleged ‘wage-price spiral’ that central banks have been hinting at as justification for their irresponsible interest rate rises is an illusion or should I saw delusion.

Real wages fell in all categories – civilian workers, private industry, and state and local government.

The following graph shows the situation for these groups in terms of total compensation and wage and salaries, the difference between benefits etc that are added onto wages and salaries.

Also note the vertical scale is different in the case of state and local government workers who are experiencing much harsher real pay cuts relative to the already harsh cuts for private workers and civilians in general.

The point is that since the inflationary pressures emerged in 2021 and intensified in 2022, nominal wages across the US economy have been lagging behind the movements in the CPI.

They have not been driving the CPI shifts.

The next graph shows the data in a different way.

I indexed the real total compensation for private industry and state and local government workers at 100 at the start of the pandemic (March-quarter 2020).

The graph shows the significant real cuts in total compensation since the pandemic accelerating in 2021 and 2022.

For All private industry workers, real total compensation is about the same as before the pandemic (December-quarter 2019).

However, for state and local government workers the December-quarter 2022 outcome in real terms takes them back to the September-quarter 2016.

Devastating.

MMTed and edX MOOC – Modern Monetary Theory: Economics for the 21st Century – enrolments now open

MMTed invites you to enrol for the edX MOOC – Modern Monetary Theory: Economics for the 21st Century – is now open for enrolments.

It’s a free 4-week course and the course starts on February 15, 2023.

You will be able to learn about MMT properly with lots of videos, discussion, and more. Various MMT academics make appearances.

For those who have already completed the course when it was previously offered, there will be some new material available this time.

New video and text materials will be presented to discuss the current inflationary episode from an MMT perspective.

There will also be a few live interactive events where students can discuss the material and ask questions with me.

Further Details:

https://edx.org/course/modern-monetary-theory-economics-for-the-21st-century

Music – for travelling

Sometimes you need to really concentrate on a new album and play it several times to appreciate the nuances and subtlety of the performance by the artist(s) and the mastering by the producer.

Just such an album is – Voices – by the post minimalist composer – Max Richter.

It was released on July 31, 2020 and was “inspired by the Universal Declaration of Human Rights”.

This article (June 25, 2020) – Max Richter Announces New Album ‘Voices’ – provides some background about how the readings were organised and sourced.

The album has a voiced section (with various readings) and then the voiceless version of the music.

Here is the full album, which uses what Max Richter refers to as a “negative orchestra” (“nearly all basses and cellos”).

At some stages in the album you think you hear a deep rumbling – one of the deepest sound the human ear can hear I suspect – and it is a very stark background to the negative orchestra.

The whole album is 56 minutes then repeats in voiceless mode.

My favourite track is Mercy with the solo violin played by – Mari Samuelson.

Mercy begins at 48:51 and then at the end of the second version of the album.

A breathtaking way to spend 10 hours driving a car I can tell you.

Here is a short video from Max Richter explaining the motivation of the album and its meaning.

He always has a very sound and progressive intent behind his music.

He commented on the album:

I like the idea of a piece of music as a place to think, and it is clear we all have some thinking to do at the moment. The Universal Declaration of Human Rights is something that offers us a way forward. Although it isn’t a perfect document, the declaration does represent an inspiring vision for the possibility of better and kinder world.

He goes further in this NPR interview (August 2, 2020) – Composer Max Richter On ‘Voices,’ A New Album That Envisions A Better World.

Here is a review of the album from British Gramophone – Richter Voices.

That is enough for today!

(c) Copyright 2023 William Mitchell. All Rights Reserved.

Problem is, the names in the mainstream on both sides of the Atlantic, have been positioning themselves for over a year now, to say look didn’t our models do well. Just like they did after 2008. That’s how they have used Twitter.

It’s the voting public that needs to be convinced and they’ve been carpet bombed with nonsense from a 1000 feet. To the point, the majority still believe money is scarce and needs to be found and holes are in the budgets like that of a household so sacrifices have to be made. Sacrifices being a framing tool that will allow neoliberal reforms to continue faster than ever. Allow the forward planning of the FIRE sector to keep allocating both skills and real resources. Private investment will remain the key words over government spending making sure the rentier class stay in charge.

This is after everybody watched in real time in front of their TV dinners how things really worked up close. They still cannot connect the dots and will continue to vote against their own interests.

Running beside all of that you have – The rise of the moral elite

http://robinmcalpine.org/reset-part-one-the-rise-of-the-moral-elite/

Even if it is possible to fix that it will take several generations to do so. Looking at history and what it reaches us, there is a very good chance the ruling class will just wait it out. While passing their power to their own generations.

Pretty sure the unspoken reason for the rate rises was so that mainstream economists could say “look, it worked” when inflation inevitably fell. Protecting the paradigm.

Article in the Guardian yesterday https://www.theguardian.com/commentisfree/2023/jan/31/bad-economics-bbc-tory-austerity-uk-politics by James Meadway (representing The Progressive Economy Forum, a mixed bunch of economists and commentators) on the bad economics pumped out by the BBC, doesn’t go nearly far enough and still clings to misleading ideas and language, but is a step in the right direction.

Fixed-rate mortgages (the norm here in America) have made inflation a HUGE benefit to debtors. Banks and other mortgage creditors, on the other hand, have suffered LARGE losses (take a look at any mortgage-backed security ETF).

Not only will future mortgage payments be made with less valuable dollars (a large benefit to debtors by itself), but the benefit of home price appreciation (inflation) has FAR exceeded the loss of real consumer purchasing power because of the enormous leverage provided by the fixed-rate mortgage.

I’m tempted to say that the answer to the problem of higher interest rates is the FIXED-RATE mortgage.

Reply to @Derek Henry

Interesting article that by McAlpine. However I really do not like the language framing. To me, helping people and offering advice and expertise is a moral act. So withdrawing advice is immoral. Pretending the latter is “woke” and “giving people their own agency” is a libertarian new age brainworm. It is fundamentally anti-morality. There is no such thing as a new woke moralism, that stuff is barbarism disguised as fake “freedom”. The language of freedom and autonomy has to be weighed on the scales of justice, and I find that whole new liberalism movement to be profoundly unjust.

Human beings are social creatures, our complete individual autonomy leads to our rapid death. Our complete capture to state authoritarianism and extreme immoral centrally planned state communism is also a kind of death at the other end of the social spectrum, the Borg hive mind end.

As well as “Reclaiming the State” we, the people, the heterogeneous unwashed masses, also need to reclaim ordinary decent morality, not let the libertarian nuts claim that language. Justmy2centsworh.

… just to clarify, I was agreeing with McAlpine. The Cambridge academic he references is a garbage brain, not worth naming (his ideas are garbage, I cannot ever comment on the individual soul).

Wow, an amazing increase in employment in the U.S. up 517,00 vs. an estimate of 120,000. What happens now? The Fed takes the fed funds rate up, up, and away? Foolish. When people go to work they earn money. They spend money. The GDP goes up, not down. Higher minimum wages spur further spending. Higher interest rates buoy savers accounts allowing them to spend more. Retirement in the U.S. averages 10,000 highly paid workers per week! They will contribute to spending but not to average earnings. Even though Fed policy is to slow the economy, business loans are increasing. Productivity is rising. Looks like good times ahead. Check out global equity markets.

Thomas Nugent, hopefully someone at the Fed reads Billyblog. They might realize as supply constraints ease, so might price pressures. I’m sure some of them are aware but I doubt they will have the courage to react appropriately.

The most respected financial newspaper in the U.S. is the Wall Street Journal. Back in the early Eighties, the editorial page endorsed supply side economics and probably promoted the widespread use of this economic theory culminating in the Reagan/Trump presidencies. On a number of occasions, I have written letters to the editor pointing out the value and consistency of MMT. For whatever reason, the current editors appear unwilling to listen to any evidence of the value of MMT as a driving economic force and prefer to stick to the old ideas that dominated the Nixon Administration in the early Seventies: “We are all Keynesians now.”