My friend Alan Kohler, who is the finance presenter at the ABC, wrote an interesting…

The poorest nations are increasingly beholden to the hedge funds

We kid ourselves when talking about change. I see a lot of Op Ed material recently from the so-called Left that seems to suggest, for example, that those concerned about climate change are really just handing the keys to capital who will use the appetite for ‘change’ to impose punitive policy shifts that will damage the poorer households and communities, while at the same time, strengthen the elite control over income distribution and governments. There are elements on the Left that also think we can ‘heal’ Capitalism – somehow by redefining what ‘capital’ means. This morphs into an assertion that the major problem is that private banks can create credit at will such that we have allowed ‘allowed the credit commons to be privatised’, which in turn drives an unsustainable need for growth to continue to pay interest. I will comment more on that idea in another post – as part of my Degrowth series. But the relevant point here is that Capitalism has created institutions that work to perpetuate the power relations that define who owns capital. These institutions extend to the multi-lateral, government funded organisations such as the IMF and the World Bank, who now function quite differently to the way they were originally conceived. I was thinking about that while reading the latest World Bank publication – International Debt Report 2022 (released December 6, 2022) which captures what is really wrong with Capitalism and leads one to conclude that ‘healing’ requires killing the patient!

The Report, itself, is harrowing reading.

We understand that the problems outlined are another aspect of the massive redistribution of global income from poor to rich that is going on as a consequent of the rising interest rates that central banks are implementing.

I have written about that several times – most recently in this blog post – Champagne socialists in the banking sector reaping millions from public money (November 23, 2022).

In that post and others, I have focused on within-nation transfers – from low-income debtors to bank shareholders (rising debt burdens), from central banks to bank shareholders (increased payments on excess reserves).

In the accompanying media release – Debt-Service Payments Put Biggest Squeeze on Poor Countries Since 2000 – the World Bank states that:

The poorest countries eligible to borrow from the World Bank’s International Development Association (IDA) now spend over a tenth of their export revenues to service their long-term public and publicly guaranteed external debt-the highest proportion since 2000 …

External debt for low- and middle-income countries has more than doubled over the last 10 years.

The debt for the 75 IDA countries, which are those considered the most poor – “defined as GNI per capita below an established threshold and updated annually ($1,255 in the fiscal year 2023)” (Source) – has “nearly tripled to $1 trillion” over the last 10 years.

With the central banks pushing up interest rates, in their ideologically-motivated but futile attempt to deal with inflationary pressures that are being driven by non-interest rate sensitive causes, the debt problem for the poorest nations is becoming terminal.

The latest World Bank report shows that:

About 60% of the poorest countries are already at high risk of debt distress or already in distress.

This is on top of the pandemic-related health disaster these nations face – given their lack of health resources to deal with it, and the ravages of climate change on food production and infrastructure continuity.

The debt problem is multi-dimensional:

1. Much of the debt is denominated in US dollars so exports are necessary to generate the foreign exchange.

2. Countries borrow to build export infrastructure and reduce spending on domestic infrastructure – such as health and education – which delays any long-term human capacity building.

3. The export-led imperative then undermines local sustainable agriculture and creates environmental havoc in the case of primary commodity production (such as mining).

4. Flooding the world markets with exports often drives down prices to a level that makes paying the original debt back problematic.

5. More debt is then taken on, and institutions such as the IMF and the World Bank then insist, as conditionality for making this debt available, on the country engaging in domestic austerity – which further undermines the spending on education and health.

6. Then rising interest rates in advanced nations not only make the debt servicing more expensive but also sucks speculative capital back into US dollar-denominated assets and causes the currencies of other nations to depreciate. As a consequence, the debt servicing burden rises even further.

7. Social instability rises and governance structures become corrupted.

And the vicious cycle continues.

I saw a film about Haiti the other day which detailed the way in which the society is collapsing with private militias in league with corrupt government officials wreaking havoc.

The nation’s fabric is destroyed.

There is an additional element on top of what we already have known that has been identified in recent years.

The World Bank Report notes that:

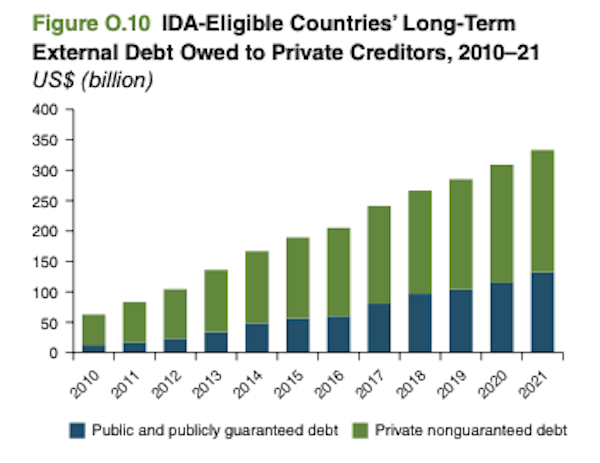

Over the past decade, the composition of debt owed by IDA countries has changed significantly. The share of external debt owed to private creditors has increased sharply. At the end of 2021, low- and middle-income economies owed 61% of their public and publicly guaranteed debt to private creditors – an increase of 15 percentage points from 2010 … Also, the share of debt owed to government creditors that don’t belong to the Paris Club (such as China, India, Saudi Arabia, United Arab Emirates, and others) has soared. At the end of 2021, China was the largest bilateral lender to IDA countries, accounting for 49% of their bilateral debt stock – up from 18% in 2010.

The following graph is taken from the Report (Figure 0.10) and shows how the composition of the debt has shifted to provide sources.

While the debt is not guaranteed by the state, the private creditors have “a claim on a country’s international reserves, especially when the private entities cannot hedge their foreign currency liabilities against foreign currency assets.”

These foreign creditors are “primarily commercial banks”.

So the nations have become beholden to hedge funds.

This UK Guardian article – BlackRock urged to delay debt repayments from crisis-torn Zambia (April 11, 2022) – gave us a preview of who is involved.

New York-based Blackrock “was among the private sector lenders that had refused to reduce the interest rate or delay payments on Zambian bonds” despite the nation cutting spending on on “health and social care … by a fifth in the past two years to balance its budget”.

The nation has endured a severe drought that has compromised its hydropower capacity. It tried to diversify into solar energy but the combination of the borrowing needed for this infrastructure shift and then the pandemic has undermined its capacity to repay foreign-currency denominated debts.

But the likes of Blackrock are not the only ones squeezing the nation.

The IMF, in its inimitable way, has only been prepared to extend loans for basics on the condition that the government ends “fuel subsidies to households and businesses” a shift which has pushed “the inflation rate above 20%” in 2001.

Blackrock moved in and hoovered up the country’s bonds “at rock-bottom prices when it was clear that the country was already in trouble”.

This shift has been accelerated, in part, because of the fiscal surplus obsession in the advanced nations, which have largely reneged on their Foreign Aid commitments as the neoliberal domination of policy design intensified over the last 20-30 years.

The richest nations could easily cancel all debts and fund a new multinational agency that was charged with advancing humanity rather than maintaining cosy offices in the big cities and imposing punitive conditionality onto the poorest nations.

Meanwhile, the UN is persisting with its – 2030 Agenda – which has lofty aims, including World peace and the eradication of poverty, and the protection of “the planet from degradation” but hasn’t a hope in hell of succeeding while nations are at the nehest of these hedge funds and sociopathic organisations such as the IMF and the World Bank.

The challenges facing these countries are immense – health, climate, poverty, housing, energy dependence, gangs, corruption – the list goes on.

It is almost trite to conclude that the way out is via a so-called debt jubilee.

The UK-based – Debt Justice (formerly named the ‘Jubilee Debt Campaign’) – does good work and understands the issues at one level.

Organisations like it are clear that they want debt cancellation.

I want that too.

But like movements that advocate ‘green new deals’ or ‘deep adaptation’ or ‘degrowth’ or other progressive-sounding ideals, there is a shortage of reality in their advocacy.

The massive escalation of debt held by the poorest countries and the damaging increases in debt servicing which is funnelling trillions into the hands of the richest people on this globe is only a proximate expression of the problem.

Claiming we can ‘heal’ Capitalism by a debt jubilee or some other approach – like more corporate social responsibility – focuses on the symptom not the cause.

The cause is the power held by vested interests that own financial capital.

GND agendas may well lead to decarbonisation but only because the elites have been able to find new ways of redistributing income to themselves in the lower carbon environment.

The planet will only be saved under current institutional arrangements if the elites can continue to prosper.

The hedge fund managers in New York couldn’t give a toss about the poverty in Zambia or the on-going inability of African nations to present a stable and sustainable solution to poverty.

The financial elites profit from poverty.

That is the reality.

How will the owners of capital ever come to agree to initiatives that will undermine their ownership and, in turn, their power?

Conclusion

By focusing on the proximate problem and avoiding discussing the elephant in the room, progressive voices get nowhere.

We might feel warm inside that we are doing ‘something about it’.

But, meanwhile, the same dynamics are driving the show and morphing here and there into different forms to keep us all silent on what really needs to be done.

The political Marxists and Anarchists of the C19th knew full well what needed to be done.

The rest of us meanwhile are busy comparing flat screen TV sizes in glossy catalogues or similar.

That is enough for today!

(c) Copyright 2022 William Mitchell. All Rights Reserved.

Graph needs fixing Bill.

Thanks

Good article Bill thanks!!

Well said Bill. Thanks for all the analysis this year. A big help in understanding what’s really going on. A light in the darkness. Cheers.

Colonialism never went away.

Thanks Bill, more sobering reading

Collective humanity is easily distracted and preoccupied by effects to the exclusion of dealing with the causes until it is too late (the “she’ll be right” syndrome). The immediate/urgent displaces the important. The micro takes precedence over the macro. We think linearly and find great difficulty in envisaging exponential growth/change. Better to feel upbeat and optimistic than contemplating reality. The salve instead of the excision. So many different ways of spelling out why humanity is sleepwalking toward a cliff despite the many historic examples from which we refuse to learn lessons. The shear madness of it all.

Knowing what should be done but not having the power to make it happen is a massive burden when, if paying attention, it can be seen that most of society is not angry enough, is comatose, distracted or indoctrinated by TINA and governments are in thrall to private finance. Makes it very difficult to see how change can occur without a revolution.

Of course, capitalism cannot be “healed” by re-defining capital. Capitalism is designed to be a self-replicating system that “heals” itself after any attempts at changing the power structures. It is capitalism itself that must be re-designed, yet this cannot be done without also re-designing the social structure of capitalism that supports it – another system designed to be self-replicating by making itself an objective reality that rejects any alternative. Mainstream economic dogma. There Is No Alternative.

Within this structure capital cannot be re-defined or re-designed either, as our objective reality will cause us to see any such attempt as either implausible or as a threat to our “economic security”. In fact, within this system capital cannot even re-design itself, since it is also designed to be self-replicating and self-accumulating. It can only pretend to be “green” as far as is necessary to protect itself. See how evil/brilliant this design is?

Design theory gives us an opening. There is always a gap between the social and individual interpretation of an object. These can never be the same, as our individual experiences add meanings beyond our social conditioning. This gap is where we must work. When enough individual interpretations have changed, such that people see beyond the veil of capitalist objective reality; the social interpretation can also change, and this changes the very nature of the social structure of capitalism – reinterpretation of a design changes its meaning and its utility. Thus, the pathway is opened to both individual and social understanding of the possibility that capitalism, capitalist production, work, value, and capital itself can all be re-designed.

Does this make design the key to the Marxist revolution? No. It won’t be a revolution; it will be a re-design.

Capitalism is not the problem. The political system that the capitalists have captured is the problem.

A completely robust and transparent political system is required – this is not beyond the realms of possibility if society at large can see it has the power. It requires the mass of individuals to dedicate themselves to reform.

Marxist revolution requires dedicated action from individuals acting in concert.

If individuals acting in concert can toss out capitalism then individuals acting in concert can reform capitalism.

Emerging market debt has tanked. Those invested in EM debt lost significant sums of money, whether the debt was publicly traded or privately held. Nobody made any money on these loans. That’s why Blackrock and others are so uptight.

Also, I’d challenge the notion that rising rates imply a transfer from low-income debtors or central banks to bank shareholders, given the context of high inflation. As long as interest rates remain below the rate of inflation (negative real rates), the transfer goes the other way – toward the low-income debtor or central bank, and away from bank shareholders. Simple example: HUGE gains have accrued to those holding fixed-rate mortgages from the leverage provided by those loans, given inflation in real-estate.

Good post. Don’t think the wealthy few – and most other people, actually realise the size that elephant is now. We’re certainly heading for a reckoning, that’s for sure. And the impact on hedge funds and all financial institutions has barely begun.

I commend Tom Murphy’s blog – his article in Nature during the summer probably is familiar to you given the theme, but this recent post provides a measure of clarity to what lies ahead. How does society prepare itself for the inevitable collapse?

https://www.nature.com/articles/s41567-022-01652-6.epdf?sharing_token=yNwL92oPzcpklZSqVsr-ndRgN0jAjWel9jnR3ZoTv0N0u2htmeT1Hou6SrdtT_vjhsjDi8mPyrY6gILuO1cIPYM5r9vTrCV6dFSGWkHiq63t24rvELuWNN1w82farMIezAYiWj7ialZ8KkzI_SEgHP98WBPRE6PFu8lx9H4EP5A%3D

JOHN B.: Currency issuing governments of developing AND developed nations should NEVER borrow, and central banks should maintain a near zero interest rate policy (ZIRP).

With appropriate intervention by the IMF/World Bank/BIS.

Then the likes of Black Rock would have to get real jobs, like building houses or growing food in sufficient supply in both cases.

“Then the likes of Black Rock would have to get real jobs, like building houses…” The likes of Black Rock aren’t interested in production, their MO is rent extraction. They may build houses, but they won’t sell them, they’ll rent them out. That’s what’s going on here in UK. Businesses rent their premises because they aren’t interested in maintaining property, even though, in UK, that means they pay rent + property tax. Most families, and even some single people, prefer to do their own maintenance. The best people to own homes are those who live in them. LVT is the solution to this basic form of rent extraction.

Re “the sociopaths at the World Bank”, there appears to be a glimmer of light:

https://www.ft.com/content/044b7e7d-84c7-4b9d-90e9-8b2449ae36f5

“World Bank chief economist calls for overhaul of government bailouts

Indermit Gill says existing framework offers developing countries ‘too little, too late’.

The World Bank’s chief economist has called for an urgent overhaul of the system for dealing with unsustainable debts, as the institution warns of a coming wave of sovereign defaults by developing countries.”

Reply to @JohnB

Fair point about EM loans gone bad. But it takes two to tango. If Blackrock buy a risky asset, they deserve a risk of loss. They are still being a$$holes even as they lose.

New debtors are still losing out, despite past fixed rate holders gaining from inflation once the wages catch up. But wages are not catching up, they’d need to be sellers in other markets, not laborers.

The folks getting basic income from the bonds are going backwards in real terms as you note, but is that the story you really want to sell? They can afford to take the inflation hit. People forced to take out fresh credit just to survive are the other side of the story. They not making gains at all until wages inflate, which they likely will not, and I’d enjoy seeing you tell a group of them that they are making gains against the rich.