The Reserve Bank of Australia (RBA) increased the policy rate by 0.25 points on Tuesday…

Banks gouging super profits, yield curve inversion – nothing good is out there

It’s Wednesday and we have some snippets that really just make way for the music feature. Today, I consider the recent inversion of the US yield curve, which is typically a sign that recession is around the corner. We also learn that while most people are being hit with rising prices and flat wages, the banks are recording record net interest income as a result of their non-competitive, cartel like behaviour. And we wonder how more silly can the Swedish central bank prize in economics become. And then, after all that, we have the music feature to rescue the day.

The US yield curve inverts

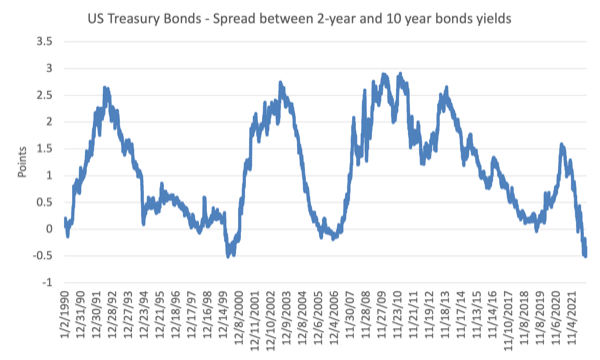

Yesterday, the 3-month yield on US Treasury bonds rose above the 10-year yield, which is a relatively rare occurrence.

It has happened on just 6 per cent of the trading days since the beginning of 1990.

I noticed after that result, several commentators claiming that it was the signal for recession, given that the last several (8 or so) recessions have followed such an event.

The last trading day that spread inverted was March 2, 2020 – as the pandemic was unfolding. Then it inverted first on January 31, 2020 and for the next 21 trading days, the spread was negative (3-month higher than 10-year) on 13 days.

A recession certainly followed but that was the predictable result of the chaos the uncertainty and closures caused at the onset of the pandemic.

However, typically, in the US context, the difference (spread) between the US 10-year Treasury bond yield and the 2-year yield is used as a signal of the shape of the yield curve (normal or inverted).

For more detail on what an inversion means or doesn’t mean, please read this blog post – Inverted yield curves signalling a total failure of the dominant mainstream macroeconomics (August 20, 2019).

There are broadly three shapes that the yield curve can take:

- Normal – Under normal circumstances, short-term bond rates are lower than long-term rates. The central bank attempts to keep short rates down to keep levels of activity as high as possible and bond investors desire premiums to protect them against inflation in longer-term maturities. Combined, the yield curve is upward sloping.

- Inverted – occurs when short-term rates are higher than long-term rates. The usual events which lead to an inverted yield curve are that the economy starts to overheat and expectations of rising inflation lead to higher bond yields being demanded. The central bank responds to building inflationary pressures by raising short-term interest rates sharply. Although bond yields rise, the significant tightening of monetary policy causes short-term interest rates to rise faster, resulting in an inversion of the yield curve. The higher interest rates may then lead to slower economic growth.

- Flat – A flat yield curve is seen most frequently in the transition from positive to inverted, or vice versa. As the yield curve flattens the yield spreads drop considerably. A yield spread is the difference between, say, the yield on a one year and a 10-year bond. What does this signal about the future performance of the economy? A flat yield curve can reflect a tightening monetary policy (short-term rates rise). Alternatively, it might depict a monetary easing after a recession (easing short-term rates) so the inverted yield curve will flatten out.

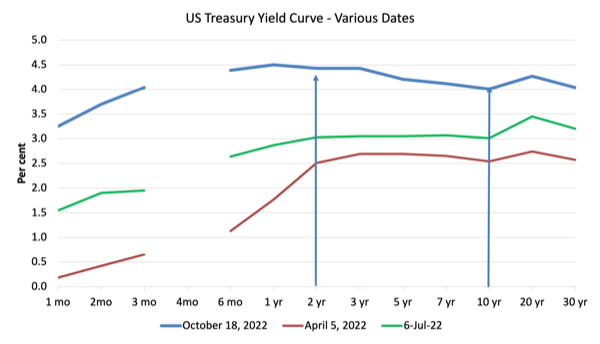

The short end of the yield curve reflects the interest rate set by the central bank.

The short end of the curve is the primary determinant of its slope. In other words, the curve steepens mainly because the central bank is lowering the official cash rate, and it flattens mainly because the central bank is raising the official cash rate.

The 2-year US Treasury bond yield is usually seen as the proxy for interest rate expectations.

The 2-year/10-year spread went negative on July 6, 2022 and has remained that way since.

The following graph shows the difference (spread) between the US 10-year Treasury bond yield and the 2-year yield from January 1990 to October 18, 2022.

Here is the yield curve at various recent dates.

So what do we make of this?

It is highly likely that the as a result of the rising interest rates and the certainty of more to follow in the US, that the investors are expecting short term interest rates to be rising and higher in two years than now.

The likelihood of slower inflation down the track is also reducing the risk premium demanded at the longer end of the yield curve.

Taken together that is pushing the inversion.

Historically, a flattening to inversion has been a fairly reliable predictor of recession some 6 or so months down the track.

That might also be the case in this period given the circumstances.

We will see.

Banks gouging higher profits

I am not a fan of commercial banks.

I think that the banking system – as a necessary public service – should be publicly-owned and significantly regulated to emphasise service delivery rather than the present preoccupation with profits.

My model would eliminate the ‘too big to fail’, ‘privatise the gains and socialise the losses’ approach that is now the norm across most of the world.

While interest rates were held low by central banks, commentators from various banks were often in the media claiming interest rates had to rise to forestall any risk of inflation and all that stuff.

Even public broadcasters like the Australian Broadcasting Commission would give these characters the platform on the assumption they were expert independent commentators.

They were not.

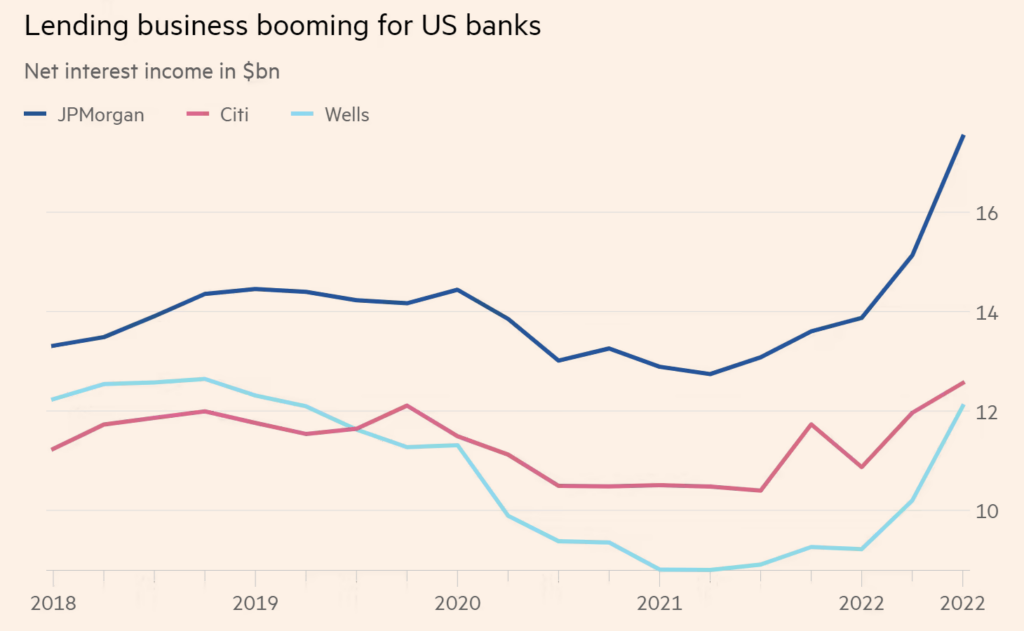

Clearly, the private banks profit more when interest rates are higher as they can drive a bigger spread between their deposit rates and their loan rates.

Even the mainstream financial press is now acknowledging that the central bank interest rate hikes are just channelling largesse into the hands of the already wealthy shareholders of the private banks.

For example, the Financial Times article (October 15, 2022) – US banks gain from Fed rate hikes while keeping deposit interest low – reported that:

The largest US banks are benefiting from the Federal Reserve’s campaign to increase interest rates, charging more for consumer loans and corporate lines of credit without offering customers significantly better rates on deposits.

This is a global problem.

The banks told the FT that they were facing higher costs in the future because people would go broke as a result of the interest rate rises and default on loans and so the banks had to increase their “provisions for potential credit losses”.

Of course they would say that.

But usually if the situation reaches the point of foreclosure, the bank hardly loses anything when the property is sold.

In the case of the US, we learn about the current state of the mortgage market from the Office of the Comptroller of the Currency’s – OCC Mortgage Metrics Report, Second Quarter 2022.

The OCC is a division of the US Treasury.

The latest Report tells us that “97 percent of mortgages included in the report were current and performing at the end of the quarter” an improvement on last year’s figures at this time, despite the successive interest rate rises.

There are less “seriously delinquent mortgages” now than a year ago (1.5 per cent compared to 1.8 per cent) and less foreclosures.

Around 2 per cent of outstanding home loans were classified as “Sub-Prime”, while 2 per cent were “Alternative A-paper”.

These categories are higher risk loans which generate higher returns and are most at risk of delinquency.

The question that should be asked is why are the banks screwing the 94 per cent of Prime mortgage holders, which have hardly any chance of default, to cover any losses that the 2 per cent of loans might deliver, given the banks took the risk in the first place to extend credit to high risk borrowers.

The vast majority of the forced sales upon delinquency are “foreclosures” rather than “short sales” (the latter defined by the fact the bank makes a loss for a quick sale) – 2,618 compared to 237.

One bank official told the FT that the current quarter:

… will be a record quarter for net interest income.

He was referring to the sector as a whole.

The FT published this graph to show the net interest income gains as a result of the interest rate rises.

My recommendation to those who hold bank accounts.

Move them if the “deposit betas” are widening. If deposits dry up, the banks have to source higher cost finance and they will quickly move to increase deposit rates.

And while we are talking about banks – the Swedish Central Bank Prize in Economics reaches farcical proportions

I wrote about why the so-called Nobel Prize in Economics has nothing to do with the actual prize and reflects an inferiority complex among mainstream economists about not being included in the original bequest in this blog post – Nobel prize – hardly noble (October 13, 2010).

This year’s announcement that Ben Bernanke, Douglas Diamond and Philip Dybvig were the winners was one of the most crazy decisions in this long history of Groupthink.

The work of these characters offered nothing much that was already well known years ago.

Bernanke’s main contribution was using the infinite financial resources of the US Federal Reserve to bail out the banks and their CEOs and shareholders, while the rest of the population suffered enormous losses from unemployment and foreclosures.

His academic contribution is minimal.

Further, the so-called – Diamond-Dybgig model – which was published in 1983, just added mathematical opaqueness to the obvious fact that depositors can get skittish and call in their funds, which under certain, known circumstances can cause the banks solvency issues.

Of course, if you have read the monetary history literature, then you would know that in the 1873 book – Lombard Street: A Description of the Money Market – written by Walter Bagehot as a response the the financial collapse of one of London’s Lombard Street’s bigger wholesale discount banks.

That was all about bank runs.

Nothing new really came out of DD’s work in 1983. I remember when I read the paper at the time, while I was a graduate student that it was a matter of ‘so what’ reaction.

Further, DD’s big conclusion was the bank runs can be solved by the introduction of deposit insurance.

In the US, such insurance was introduced in 1933 during the Great Depression.

So there was no contribution from DD by way of any new knowledge or insights.

And there work has never dealt with the reality that in an environment where more financial market deregulation is being pushed by mainstream economists, the presence of deposit insurance just opens up the door to banks to engage in more risky behaviour, knowing that they will be bailed out if they get too greedy and cause a financial market meltdown.

Perhaps the award from a central bank to known central bank ‘inflation first’ sympathisers is just an attempt to convince us that the conduct of modern central banking is driven by ‘nobel prize winning’ theoretical work.

Groupthink exemplified.

MMTed Update

The third run of our edX MOOC – MMT101x Modern Monetary Theory: Economics for the 21st Century – was concluded last week.

Another large class worked their way through the 4-week course.

I cannot give a date yet as to when the next offering will be.

Meanwhile, we are now in the final stages of editing a smaller course which will comprise 4 modules on the theme of Monetary Sovereignty.

I am hoping this will be open for enrolments in December 2022, depending on the editing progress.

We are always constrained by our limited funding base.

And thanks to all those who have made donations – they are really appreciated.

Music – Koto Song (Dave Brubeck)

This is what I have been listening to while working this morning.

Last weekend, I went to a vegan festival in the Okazaki Park near where I live in Kyoto. There was great food stalls (Kyoto is friendly for vegetarians, which is a relief).

In addition there were lots of musical acts performing.

Some – Taiko – drummers.

A – Koto – band.

And even a Hare playing the ukulele.

I recalled an album I bought years ago by – Dave Brubeck.

It was his 1964 album – Jazz Impressions of Japan – which sort of documented his quartet’s trip to Japan in 1964.

It was the band’s attempt to fuse jazz with the ‘sights and sounds’ of Japan.

The sound of the Koto, a very complex instrument is unmistakenly Japanese, even though the instrument originated in China.

Playing on this track (and the album) are the quartet at the time:

1. Dave Brubeck – piano.

2. Paul Desmond – alto sax.

3. Joe Morello – drums.

4. Eugene Wright – double bass.

This was the classic lineup during the late 1950s and 1960s.

This is a pretty cool track – Koto Song.

You can read more on the provenance of this song at – Koto Song. It is essentially a 12-bar blues, with complex overlays.

Here is the album version.

And here is a live performance recorded in Belgium on October 10, 1964. They were such great musicians.

I will be doing a live gig with a band in Kyoto on November 5, 2022. Not sure where yet but it will be a really nice thing to play with 4 of the best players in the city.

That is enough for today!

(c) Copyright 2022 William Mitchell. All Rights Reserved.

Thanks Mr Mitchell, as always for a most useful explanantion of the Bond curve.

kind regards

Arron

Bill,

Have been trying to find an MMT aficionado who can suggest what kind of economic plan Jeremy Hunt WOULD have proposed this week had he had a road-to-damascus moment in the night, and woken up a committed advocate of MMT – it obviously would have been very different; but how? I’d have a better idea if I understood bonds better, but I find all that confusing.

However, haven’t had any luck finding anyone so far.

Am trying to match the reading and listening I’ve done (your edx course 3x for instance) to real world situations. Having trouble matching the ideas to what’s actually happening.

Can you suggest someone who wouldn’t mind being asked such a thing … or preferably of course, tackle this yourself!?

Cheers

x

Bill, could you advise me as to whether MMT has anything to say regarding neo-classical microeconomics. Best wishes.

Dear Terry Ian Gibson (at 2022/10/20 at 3:10 pm)

Thanks for your question.

MMT is about macroeconomics and in that sense has very little to say about microeconomics.

However, writers such as Michal Kalecki provided a good basis for linking imperfect competition theory and markup pricing with several macro concepts.

best wishes

bill

Something that seemingly flies under the radar is interest on reserves, which has gone from 0.15% in March to 3.15% at the Federal Reserve Bank of the US today. That’s free money for banks which are swimming in reserves. Also, the reserve requirement was quietly lifted, so all deposits are excess now and get the 3.15%.

Raf,

I find it very clarifying to think of government bonds simply as future money, created out of the same thin air and printed on the very same press as any other form of government money.

As to your question about economic plans in the real world, I’m going to guess that Prof. Mitchell might point you to Japan as an example.

Raf,

Re: your question on what an MMT-aware government would do, Abba Lerner (Functional Finance, 1943) gets to the core of economic policy objectives when he states “The first financial responsibility of the government (since nobody else can undertake that responsibility) is to keep the total rate of spending in the country on goods and services neither greater nor less than that rate which at the current prices would buy all the goods that it is possible to produce. If total spending is allowed to go above this there will be inflation, and if it is allowed to go below this there will be unemployment. The government can increase total spending by spending more itself or by reducing taxes so that the taxpayers have more money left to spend. It can reduce total spending by spending less itself or by raising taxes so that taxpayers have less money left to spend.”