Regular readers will know that I hate the term NAIRU - or Non-Accelerating-Inflation-Rate-of-Unemployment - which…

Deliberately creating mass unemployment now would be the work of vandals and New Keynesians

Last week, the New York Times published the latest Paul Krugman article on inflation (which is behind its paywall). It is syndicated elsewhere and you can access it here at The Berkshire Eagle (April 13, 2022) – Paul Krugman: Inflation is about to come down – but don’t get too excited. I wondered whether the author had offered his services cheaper to the NYTs and elsewhere given his concern for inflation, and, apparently, his assertion that wages are a critical factor in sustaining it. What this article highlights is mainstream New Keynesian macroeconomics – the dominant paradigm in our teaching, research and policy circles. What it also highlights is how different the mainstream is to Modern Monetary Theory (MMT), despite characters like Krugman and his fellow New Keynesians trying to tell the world that there is nothing particularly different about MMT and the way they do economics. It also provides another chance for me to add nuance to the Job Guarantee.

The US Bureau of Labor Statistics released the latest CPI data on April 12, 2022 – Consumer Price Index Summary.

The facts are:

1. “The Consumer Price Index for All Urban Consumers (CPI-U) increased 1.2 percent in March on a seasonally adjusted basis after rising 0.8 percent in February”.

2. “Over the last 12 months, the all items index increased 8.5 percent before seasonal adjustment.”

3. Monthly growth in food was 1 per cent for March; 11 per cent for Energy (Petrol 18.3 per cent).

4. “The index for all items less food and energy rose 0.3 percent in March following a 0.5-percent increase the prior month.”

So there is an inflationary episode under way being driven largely by oil prices, which are fixed by an uncompetitive international cartel.

There is also evidence – and Krugman acknowledges this – that:

Inflation will probably fall significantly over the next few months.

This morning oil prices were lower than they were a month ago.

But the pandemic continues and there are contrary factors at play on the supply-side at present.

While it is hard to know exactly what is going on in China at any point in time, my intelligence (contacts with the suppliers and shipping companies) tells me that the latest lockdowns in Shanghai (financial centre) and Guangzhou (manufacturing and distribution hub) will impart a renewed supply shock to the rest of the world, which has built a dependency on Chinese manufactured and assembled goods.

The – Port of Shanghai – is called a ‘large-port Megacity’ and is the worlds largest container port, edging Singapore out of that position in 2010.

Guangzhou Harbour is ranked fifth largest port by volume in the world (Source).

These ports shift huge volumes of cargo relative to say, the total import volumes that enter the US economy each year.

The lockdowns mean that workers do not go to their workplaces, trucks don’t shift cargo and the ports stop loading goods.

I read a Reuters report (April 13, 2022) – China is at risk of self-inflicted recession – which if full of propaganda but reports that:

At least 373 million people in cities contributing to 40% of China’s GDP have been affected … an index tracking freight traffic in China dropped by about 25% during the first week of April.

China’s GDP in 2021 was around $US14,866 billion compared to the US GDP of $US22,893 billion (according to IMF data).

40 per cent of China’s productive output would be around $US5,950 billion. Japan, for example, the third largest economy, produced GDP in 2021 of $US5.1 billion. Australia produced $US1.3 billion.

So the lockdowns are withdrawing output worth nearly as much as the entire output produced by Japan and Australia together.

That is not an insignificant temporary supply cut.

We don’t know how much of that supply withdrawal is going to flow into China’s export markets but it will be a lot.

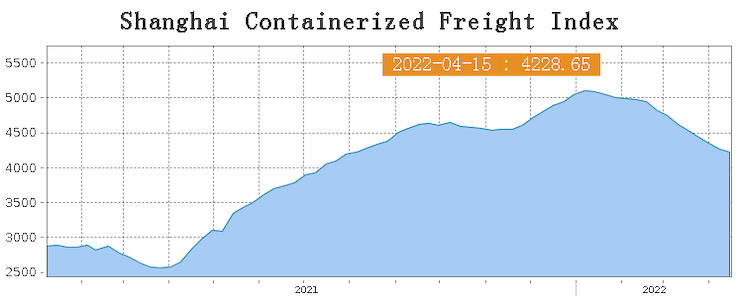

This graph shows the Shanghai Containerized Freight Index up to April 15, 2022.

It fell 35 index points in the last week.

Freight data from other Chinese ports also show large falls in volumes.

There is also the question of China’s own supply chain. With Just-in-Time methods now exposed by Covid for being risky, the closed factories will also disrupt other producing areas in China, with the further impact on export volumes down the chain.

Moreover, my shipping mate tells me that the ships that leave China’s export ports also bring essential productive inputs (components, etc) into China’s supply chain, which means if they cannot unload they cannot deliver and things cannot be produced.

The whole shipping conduit has been disrupted by Covid – containers are stuck in places they are not required and so are not being loaded and trucked to ports.

And, then, there was war in the Ukraine, which has created further chaos in the supply-side of the economies around the world.

In this blog post – The current inflation still looks to be a transitory phenomenon (March 28, 2022) – I updated analysis of the shift in US consumer spending towards goods and away from services during the pandemic restrictions.

The goods supply could not keep up with the demand, given the supply constraints and sudden shift in spending, while the demand for services languished.

The overall GDP was still below where it would have been had the pandemic not occurred, so it was hard to say there was ‘too much’ spending overall.

There clearly wasn’t.

The problem was sectoral and the question I have been posing (and answering) is what proportion of those shifts in spending between goods and services permanent.

My conclusion has been they are transitory, created by the extraordinary circumstances that the pandemic had created.

In time, the patterns will revert back towards where they were and the sectoral bottlenecks will ease.

And so will the price pressures.

The shift back to spending on services will be one correction.

The demand for goods will come back into line with available supply (we are seeing that happen across an array of goods – cars, household items, etc).

And firms will find the goods inventories they have built up must be sold and they will discount.

My shipping mate tells me that contract prices for bulk ships have started to decline significantly.

The latest lockdowns in China will not help speed up things though. Nor will the Ukraine War.

Which brings me to Krugman and the New Keynesians.

In his Op Ed he wrote:

The U.S. economy still looks overheated. Rising wages are a good thing, but right now they’re rising at an unsustainable pace. This excess wage growth probably won’t recede until the demand for workers falls back into line with the available supply, which probably – I hate to say this – means that we need to see unemployment tick up at least a bit.

In the next sentence he added:

The good news is that there’s still no sign that expectations of high inflation are getting entrenched the way there were in, say, 1980. Consumers expect high inflation in the near future, but medium-term expectations haven’t moved much, suggesting that people expect inflation to come down a lot.

He also claimed that inflation was not “spiralling out of control”.

So let’s put those three statements together.

The BLS – Employment Cost Index – December 2021 (latest) – shows that:

Compensation costs for private industry workers increased 4.4 percent over the year.

So real wages are falling as workers are unable to gain nominal wages growth to compensate for the inflation rate.

It means that, even though the unemployment rate is at 3.6 per cent in March 2022, the bargaining power of workers is still not strong enough to protect real wages.

We think of an excessively tight labour market as one where the unions and workers’ representatives are able to push nominal wage bargains ahead of inflation.

If we use the data from the BLS’s monthly establishment survey, we see that average weekly earnings in the private sector rose by 4.6 per cent over the 12 months from March 2021.

And the rate of nominal increase fell between March and February 2022 compared to February and January 2022.

In other words, wage pressures are not driving the inflation trajetory, which is also the reason why measures of inflationary expectations are, as Krugman admits, not revealling any medium-term acceleration.

People are smart enough to know that this is an extraordinary period of history with massive supply disruptions, a war and a cartel that is calling the shots for the time being.

All of which raises the question: Why would we want to worsen the situation by deliberately altering policy to force workers onto the jobless heap?

The government can certainly tighten up fiscal policy and push the unemployment rate up – quickly if it wants to.

But how will that alter the situation say in Chinese ports?

How will it make the trucks move when Chinese workers are in lockdown and workers around the world are getting sick in large numbers still from Covid?

How will it address the supply constraints (yet to be fully understood) that are arising from the Ukraine War?

The only thing that is certain is that the rising unemployment will increase poverty rates, drive families into mortgage default, and undermine the prosperity of millions of families.

Here we need to think about what ‘overheated’ means.

Yes, creating mass unemployment will certainly bring overall spending (demand) down and eventually will bring it into line with supply capacity.

In some contexts – specifically, if nominal demand is racing ahead of the growth of productive capacity – then government has to manage that nominal spending downwards if it wants to avoid inflationary pressures.

But, in that situation, we are assuming that productive capacity is at full use and investment has not been strong enough (to build capacity) relative to nominal spending growth.

That is not the situation we are in now.

The factories and all the productive equipment have at various times over the last few years been idle and working at below full capacity as a result of Covid.

The capacity is there and will bounce back quickly once we work out how to deal with Covid.

In other words, we are dealing with an abnormal supply constraint situation.

In that context, it would be highly damaging to treat it like the previous instance, where demand outstrips a supply-side capacity that is already at full utilisation levels.

Creating mass unemployment now will just undermine future investment in new capacity and create massive hardship for the workers made redundant.

The one caveat in all of this, which complicates matters, is that a move towards recession would probably force the OPEC nations to reduce oil prices quickly.

But that is a costly exercise and with medium term inflationary expectations benign, not one that would be justified.

Conclusion

The correct policy position at present is to tolerate the rising inflation and work to address the supply factors that are creating the pressures.

Compounding the inflation with a deliberate increase in mass unemployment would be the work of vandals and New Keynesians.

No MMT economist in the current situation would advocate that because we know that the inflationary pressures are not being driven by excess demand in a time of normal supply capacity utilisation.

That is enough for today!

(c) Copyright 2022 William Mitchell. All Rights Reserved.

Dear Bill

“The correct policy position at present is to tolerate the rising inflation and work to address the supply factors that are creating the pressures.”

Would an increase in minimum wage and benefits risk more inflation?

Best wishes.

Carol

Oops, should have added: or could tax increases mitigate?

Dear Carol Wilcox (at 2022/04/19 at 7:37 pm)

I will write about these matters in the coming days. It does matter what policy mix the government maintains at this stage.

But creating mass unemployment should not be part of that mix.

best wishes

bill

Central bankers are determined to be seen to be doing something, and as all they can do is set rates, they are going to play to the orthodoxy and raise them, which will likely cause a recession. Perhaps this will reduce inflation by crushing demand, but it’s the sort of logic that brought us “in order for the village to be saved it had to be destroyed.”

Inflation alone is capable of starting a recession.

If prices keep going up, many businesses will close, because people with low-income won’t buy what they are selling.

Those people will start saving to buy food, keeping the rest at low priority on the shopping list, including apparel products (which should be a priority).

If businesses close, we’ll have rising unemployment, that further feeds the crisis.

Less money to spend, and the essential buying will turn into luxury buying.

I believe (and You can call me leftist if You want), that the cure for this spiraling of prices lies in the hands of governments.

We forget that markets exist since, in remote times, people started to barter with what they produced and crop; when someone had apples in surplus, and needed vegetables to make soup, he would go to the village’s weekly fair and negotiate with someone who had vegetables (in Portugal, many big cities still have weekly fairs, no to barter, of course – now with euros).

And then, before the middle ages, came the need for a central authority to rule markets.

Only the supidity of the 1950’s was able to try to make markets replace governments.

It was more than 70 years ago.

It’s old, obsolete and gortesque.

It needs to be dumped, a long with reaganism, thatcherism, clitonism, blairism and the like.

> I hate to say this – means that we need to see unemployment tick up at least a bit.

As long it’s “unfortunate, but necessary”, then deliberately causing the mass suffering of those below you is okey dokey!

> No MMT economist in the current situation would advocate that [a deliberate increase in mass unemployment] because we know that the inflationary pressures are not being driven by excess demand in a time of normal supply capacity utilisation.

I’m certain no MMT economist would ever advocate for deliberate unemployment ever. So, any time when mass unemployment is a potential option, I presume this is where the job guarantee, along with many other policies and approaches, would step in and render that option moot.

Any solution that would require supporting (NOT torturing) the poor, would by definition be torture to those who require exploiting them on a mass scale. (No surprise, I recently read Polanyi. – I tried putting a link here but unfortunately the spam filter won’t let out through.) Hence, the conflict theory of inflation. Outside of catastrophe, government must be complicit in order for the inflation to persist. Government stands with those who choose for workers to be the only ones who must sacrifice.

Government also stands with those who choose to measure inflation in this particular way. A measurement that assumes mass unemployment to always be the cure and genuinely low unemployment always the disease. What’s worst is that, thanks to a big assist by corrupted media, most average people buy fully into this definition.

In other words, those in power really don’t care about genuine inflation. (Inflation that would actually affect them is very, very far off.) They only care about targeting their bogus measurement of it, which is a cartoonish monster that can only be satisfied by eating more poor people. So, basically, their inflation measurement is Audrey III. As long as the plant is satisfied then EVERYONE (“everyone”) is happy.

Don’t Feed the Plant.

Please explain why we worry about Russ sales of oil and gas when the $ they receive go to accounts controlled by Western banks that are under sanctions. Also the Russ are unable to spend their $ outside Russ due to sanctions. In addition, please address the fact that the Russians do not need outside income to provide to operate their economy

Yes yes yes and yet more yes!!!

The short lived recession of 2020 is attributed to both demand and supply shocks as a result of the pandemic initiated restrictions. On this I think economists of all persuasions would agree. However, whereas the demand setbacks were mitigated in part because of the generous income support programs undertaken by governments around the world, the supply bottlenecks not only continued unabated but were also intensified by the international energy cartel and the war in Ukrain. All these developments are well understood and acknowledged by everyone. But what is concealed is that during the last forty years the degree of concentration in some key industries has increased substantially and these oligopolies instead of absorbing higher costs they pass them on to consumers in the form of higher prices. It’s not surprising that profitability has reached such high levels. Thus, increased market power coupled with laxed enforcement of antitrust laws gave rise to this unique phenomenon international oligarchs accumulating unimaginable amounts of wealth in the face of increased economic inequality. It’s worth mentioning that the world’s richest billionaire Elon Mu(a)sk has personal wealth equal to the bottom forty percent of American people. That’s one individual worth 135 million people! This guy and the rest self made(!) oligarchs spend millions to curb their employees from unionising themselves, because they see their wealth creators as an existential threat. A real threat to their lavish lifestyle and conspicuous consumption of mega-yachts and space travelling. Not only that but they get away without paying any taxes due to the fact they do not report any income from work and instead finance this enormous personal spending through loans with ridiculously low interest rates secured against their vast wealth. All these parasites are becoming an increasing threat to our democracy and society, and it’s about time governments do something about it before it is too late.

Paulo, central authorities established (and circumscribed) markets long, long before the period you describe. The archeological record tells us that the palace/temple authorized weights and measures since the Bronze Age. Record keeping in those economies (before even the invention of coinage) predates and ultimately led to writing. It’s a very, very old story indeed.

Instead of correlating wages to inflation, paul should correlate corporate profits to inflation.