The Reserve Bank of Australia (RBA) increased the policy rate by 0.25 points on Tuesday…

The last thing policy makers should be thinking about right now is creating a recession

There was an informative article in the UK Guardian over the week (January 13, 2022) – Australia’s supply chain issues likely to continue despite drop in Covid cases – which documented the many ways in which the pandemic has led to difficulties in getting goods supplied to retail outlets or their destination (in the case of overseas mail deliveries). The majority of recent articles about the economy and policy options have erred on the side of the need for interest rate hikes and fiscal policy cutbacks, which assume the rising inflation rates around the world are the demand-side events. But it is obvious to anyone other than private bank economists who are lobbying for interest rate rises to increase the profits for their banks, or, mainstream economists, who oppose central bank bond-buying and fiscal deficits, that the cause of the problems at present is not being driven by an explosion of nominal spending – neither from the non-government sector or through fiscal policy. Here is some more evidence to support that conclusion.

The UK Guardian article quoted the boss of the Australian Retail Association, who said the on-going shortage of goods available :

… is due to the sheer volume of products and supplies within the global supply chain and the profound shortage of freight space on ships, shipping containers and pallets exacerbated by the limited flights into the country

If the supply contracts, at the same time as incomes are largely intact, then it is likely there will be price pressures.

But the causality is coming from the abnormal event – the supply constraints.

The UK Guardian article also noted the behaviour of unregulated cartels, who quickly move in to profit when these imbalances occur.

We read:

All these shipping lines are registered to countries such as Panama, Mexico, the Dominican Republic and things like that, so they’re not really regulated …

So essentially, they’re modern day pirates at the moment because the prices are not really controlled or regulated by any government.

That is an industry policy question rather than a fiscal or monetary policy issue.

Further, we know that many distribution centres around the world are in chaos because “up to half the staff … were off work at any one time.”

All of which tells me that when the abnormal consequences of the pandemic abate, things will settle pretty quickly. But not before. And before could be several years.

The policy advice then is to be patient and not be flustered by the current spikes in inflation rates, especially when the mechanisms that would be needed to solidify these supply constraints into a full-blow distributional struggle of real shares of national income between workers and capital is not evident yet.

Personal Consumption Expenditure in the US is declining

One indicator to watch is the trajectory of Personal Consumption Expenditure (PCE). I have been following the recent shifts in the US data, given that nation seems to be having the highest price levels shifts in the advanced world at present.

We will get an update from the US Bureau of Economic Analysis for January on February 25, 2022, but the last several months provides a guide to what has been happening.

The most recent release (January 28, 2022) – Personal Income and Outlays, December 2021 – told us that:

Personal income increased $70.7 billion (0.3 percent) in December … Disposable personal income (DPI) increased $39.9 billion (0.2 percent) and personal consumption expenditures (PCE) decreased $95.2 billion (0.6 percent) …

… and Real PCE decreased 1.0 percent; goods decreased 3.1 percent and services increased 0.1 percent.

Read: “decreased”.

But also the shift in composition is important to understand.

In this blog post – Central banks are resisting the inflation panic hype from the financial markets – and we are better off as a result (December 13, 2021) – I noted that both the productive and spending sides of the economy interact to create an inflationary episode.

But the important point is to understand how that interaction changes to motivate a shift from stable prices to rising prices and then accelerating prices.

I showed that the pandemic, which is a highly unusual event by any stretch, has created a major imbalance in the relationship between spending and production.

The pandemic did three things in this context.

First, the government stimulus payments, though imperfect, helped maintain incomes and spending capacity among households.

Second, the lockdowns prevented consumers spending on services by and large – hospitality, entertainment, travel etc.

And with income still intact, the spending shifted to goods-production – renovations, gadgets, flat-screen TVs, you name it.

Households brought forward spending plans on some goods purchases while normal spending patterns were short-circuited by the inability to spend on services.

Third, the lockdowns and health concerns also reduced the capacity of the goods-producing sector to meet the new demand. This is what we are referring to when we talk about supply-side bottlenecks.

If workers are locked down, getting sick, and ports and freight terminals are disrupted, the normal smooth supply chain is interrupted and so there are inventory shortfalls, delivery delays and the like.

Then overlay market power – which allows producers, wholesalers and retailers to profit gouge the shortages via mark-up increases and you see the problem.

So there has been a fairly rapid shift in spending patterns towards goods demand as service demand fell, while the supply-side for goods oduction has not been able to meet that shift quickly enough and there has been massive buildup of excess capacity in the services sector.

As I have previously noted, I am surprised the inflationary pressures have not been greater given this combination of events.

But, I still argue that these spending shifts and production constraints will give way once we move beyond the pandemic, and you can see that happening a but already.

The next graph shows, for the US, which has the highest inflation response in the advanced nations, the monthly growth in nominal and real PCE over the last several months in 2021.

Focus on the nominal aggregate because this tells us the growth in dollars that households are spending on consumption goods and services in total.

The real aggregate reflects the inflation impact on that nominal spending.

Conclusion: consumer demand is falling not increasing. It is hard to claim the inflation is being driven by demand forces.

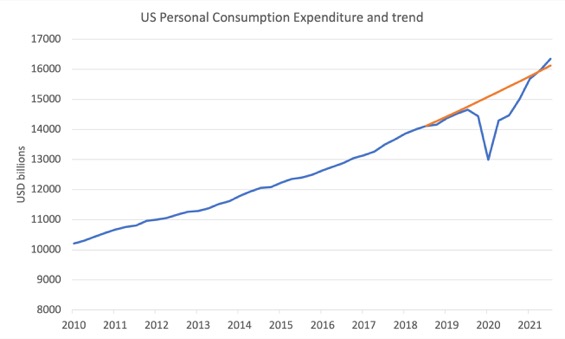

The next graph shows the trajectory of PCE since the March-quarter 2010 and the orange line is the trend extrapolated from the average monthly growth rate between the December-quarter 2017 and the December-quarter 2019 (last 8 quarters before the pandemic impacted).

Remember that this is quarterly data. The reason I say that is because as the first graph shows, over the course of the December-2021 quarter, each successive month has seen PCE growth decline, to the point that the monthly observation for December 2021 was negative.

But even using the quarterly data, the catch-up since the pandemic trough has really only put PCE back onto its previous trend.

Which means that there doesn’t appear to be a blow out occurring in nominal PCE in the US and the last month, Xmas spending notwithstanding revealed negative growth.

Fiscal stimulus and inflation

I have also compiled a database using data from the IMF – Fiscal Monitor Database of Country Fiscal Measures in Response to the COVID-19 Pandemic (last updated October 2021) and – Consumer Price Index (CPI) – data from their Macroeconomic and Financial Data repository.

The IMF fiscal database:

… summarizes key fiscal measures governments have announced or taken in selected economies in response to the COVID-19 pandemic as of September 27, 2021 for 20 G20 Advanced and Emerging Market Economies, 26 Non-G20 Advanced Economies, 82 Non-G20 Emerging Market Economies, 59 Low-Income Developing Countries. It includes COVID-19 related measures since January 2020 and covers measures for implementation in 2020, 2021, and beyond. The database categorizes different types of fiscal support (for example, above-the-line and below-the line measures, and contingent liabilities) that have different implications for public finances in the near term and beyond … It focuses on government discretionary measures that supplement existing automatic stabilizers.

Matching that data with the inflation data is not straightforward.

But, after cleaning the data (to remove null observations, and anomalies), I ended up with 122 countries including all the advanced nations, but also including many so-called ’emerging markets’ nations, and ‘Low-income Developing Countries’.

The annual inflation rate used varies between the September 2021 observation and the December 2021 observation, with the latter being used for the majority of nations. For some nations, only the first observation was available, for others, the October 2021 observation and so on.

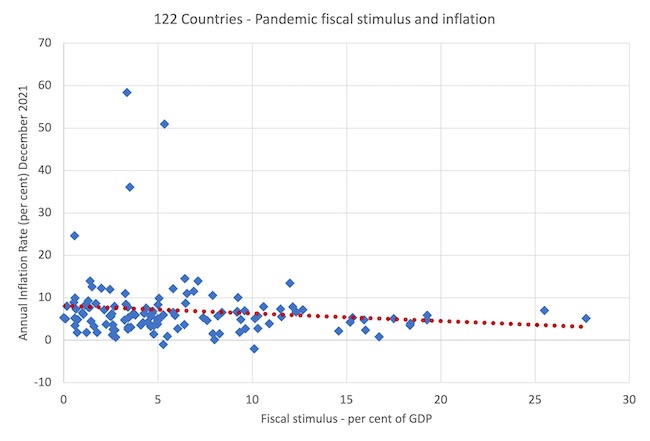

The first graph plots the fiscal stimulus response in per cent of GDP for each nations on the horizontal axis and the corresponding inflation rate on the vertical axis.

The red dotted line is a simple, linear regression through the observations.

Now the first point to emphasise is these cross plots may disguise causality and/or omit other variables that jointly cause the two shown.

Remember though that the fiscal measure is the discretionary measures separate from the cyclical effects (automatic stabilisers). So the measure reflects explicit government policy in dealing with the pandemic.

Further, while we can only say so much based on a cross plot, it would be hard to mount a case, even with more sophisticated statistical analysis (isomg hard core econometric techniques, etc), that there was a significant relationship between the inflation outcome and the fiscal response to the stimulus.

The red dotted line indicates a negative relationship but the underlying statistical diagnostics suggest no relationship.

One might note the outliers – Argentina with an inflation rate of 50.94 per cent, Haiti 24.6 per cent, Turkey 36.1 per cent, and Zimbabwe 51.6 per cent.

Does this distort the graph?

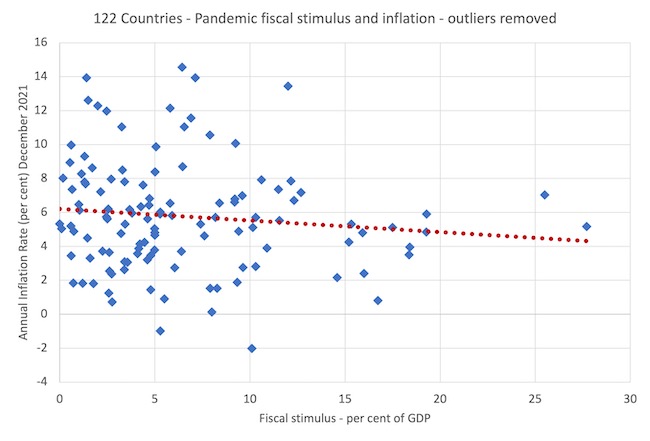

Well I deleted those observations to produce this graph.

Answer: the dotted line is still downward sloping, so the higher inflation outliers don’t change the conclusion.

There is no clear relationship between the fiscal measures taken by governments to deal with the pandemic and their nation’s recent inflation experience.

Again – the demand-side is not driving this current inflation episode.

Assessment

The point is that calls for interest rate rises are in denial of these insights.

Even worse, are calls for fiscal cutbacks.

There was an article from the Executive Editor for Bloomberg (reproduced in the Melbourne Age) – The Fed may have to force a recession to get inflation under control (February 11, 2022) – which really summarises how far fetched some analysis has become.

The writer claims that the “money markets priced in the possibility that the central bank will be forced to raise interest rates higher and faster than it has projected”, which just says the speculators have placed bets on that and are enlisting all sources of pressures, including captive journalists, to lobby the central bank to ratify their bets and allow them to make millions.

The conclusion the writer reaches is:

What all this means is that the markets increasingly see the only way for the Fed to get inflation under control is to engineer a sharp slowdown in the economy, and perhaps even force a recession.

Manic really.

The world economy is still well short of where it was pre-pandemic, and the pre-pandemic situation was hardly glowing with prosperity for those outside the top 10 per cent of the income distribution, and particularly, for low-paid workers.

The US economy is well short of its pre-pandemic employment level.

Wages growth has been suppressed around the world for years and any sign that things are changing is for the better and should not be seen as a justification for quashing it with recession-targetted policy.

The last thing any policy maker should be aiming for at present is a recession or even a “sharp slowdown”. You can be sure that the only ones damaged by that sort of strategy will be the workers, while the banksters will get away with millions.

And, a recession will not ease the supply constraints.

It would just bring the demand side down in line with the reduced supply capacities at present, cause massive income and job losses, and then, sometime in the future, as the pandemic eases, and ships and trucks start moving again, we would all wonder what the hell it was all for.

Well, it would be clear what the motivation would have been.

Continue the transfer of national income to the top-end-of-town and keep the workers from gaining some much needed real wages growth

Conclusion

Policy makers should ignore the noise from the financial markets and decline to ratify their gambling.

They should be patient and let the supply side constraints ease as the pandemic eases. Their attention should be on protecting the health of their populations and ensuring people can work safely.

The last thing they should be thinking about is creating a recession.

Our edX MOOC – Modern Monetary Theory: Economics for the 21st Century continues

We are off and running again for another year with the first day of our MMTed/University of Newcastle MOOC – Modern Monetary Theory: Economics for the 21st Century.

The course is free and will run for 4-weeks with new material each Wednesday for the duration.

It is not to late to enrol and became part of the already large class.

Learn about MMT properly with lots of videos, discussion, and more.

This year there will be some live interactive events offered to participants, which adds to the material presented previously.

So even if you completed the course last year, these live events might be a reason for doing it again.

Further Details:

https://edx.org/course/modern-monetary-theory-economics-for-the-21st-century

If you want to do the course, get in early as then you avoid having to catch up.

All are welcome.

That is enough for today!

(c) Copyright 2022 William Mitchell. All Rights Reserved.

Bill, you wrote, “There was an informative article in the UK Guardian over the week (January 13, 2022) – Australia’s supply chain issues likely to continue despite drop in Covid cases – which … ”

I checked, you meant Feb. 12 or 13.

The phrase “central bank bond-buying” needs some MMT illumination. The Bank of England (BoE) has very little capital to BUY anything outright, it is the most under capitalised lending Bank in the UK. Hence, I keep reading that the BoE has BOUGHT £875 billion of the UK Treasury savings certificates, known as Gilts. Plus, it has BOUGHT only £20 billion of non-government sector corporate Bonds. Why so little of the latter? Because to buy outright non-government Bonds, it would have to be financed by a Treasury creation of new money for the BoE to spend.

Quantitative Easing by the BoE doesn’t BUY anything; it just swaps Gilts back into the cash (reserves) that bought them originally. The BoE just moves Sterling units-of-account from the Treasury securities account to the Treasury reserves account, which turns up on High Street banks’ balance sheets, mirrored, to the penny, by a deposit in a customers account.

No new Sterling units-of account are created to exist outside of the UK National Loans Fund, (which is where the magic money tree lives). Alas those now empty Gilts stripped of there units-of-account, are still assumed to be paying interest back to the Treasury via the BoE. The Treasury paying interest back to itself.

A long while back, someone I think from the UMKC / Levy gang wrote that “the government always spends twice”. For instance, if the government pays my state pension into my current account at my high street Bank, creating a liability for the bank; then, it has to pay the equivalent amount to create an asset in my Banks balance sheet to balance it. Does anyone know which MMTer said that?

Echoing remarks by “the UMKC/Levy gang” to the effect that the government always pays twice, acorn explains “that if the government pays my state pension into my current account at my high street Bank, creating a liability for the bank; then, it has to pay the equivalent amount to create an asset in my Banks balance sheet to balance it.” Wouldn’t it be more accurate, if we push MMT far enough, to say that the government doesn’t pay AT ALL? Instead, it merely initiates electronic entries in two separate data bases as a (deceptive) mode of accounting. Accounting for what? For fiat money–a purely mental, not physical, phenomenon.

I still await an MMT economist who is also a quantum physicist and can thus explain how a fiat dollar or other unit of fiat currency, like a photon or other quantum particle, is collapsed into position (i.e., appears in a bank account) from nothing more than a field of possibility, collapsed not by observation or interference, in this case, but rather by the mere exercise of sovereign will.

@Newton E. Finn

You don’t need a quantum physicist to explain how it is the BoE can create currency. You only need to understand double entry bookkeeping ( invented by a monk in the late 14th Century)

It relies on matched pairs of credits and debits which sum to zero. So I can simultaneously create an asset on one side and a liability on the other side, which sums to zero… It’s how loans are created, and how the BoE can create a deposit in its Asset Purchase Facility.

The governments cash account is recorded as a liability on the BoE, (cash is not an asset to the BoE). It’s only a legal convention that prevents the account going into overdraft … If it did the minus sign would just change to a plus… Nothing else would happen.

I had thought that Alan Kohler was coming around to an MMT understanding – but this morning he is at the New Daily, trumpeting the need for interest rates to rise before inflation supposedly spins out of control.

Good Article. You convinced me.

“”the government always spends twice”. For instance, if the government pays my state pension into my current account at my high street Bank, creating a liability for the bank; then, it has to pay the equivalent amount to create an asset in my Banks balance sheet to balance it. Does anyone know which MMTer said that?”

I don’t know; it’s a strange thing to say.

Back in the day when the government mailed me pension checks, I would take my check, (representing an obligation from the government to me,) to the Credit Union and deposit it in my account there. They would increase the balance in my account there (representing an increased obligation from the Credit Union to me,) and deposit the check in their account at the government’s bank: the Central Bank (representing an increased obligation from the CB to the CU.) It’s handy for me to have the CU handle my money, so I convert the basic obligation

Gov’t & CB -> Mel

to a short chain

Gov’t & CB -> CU -> Mel

and avail myself of the CU’s services to customers.

Not quantum physics. Just check clearing.

A few blogs back you said that there are no fundamentals underpinning today’s inflation – unlike the 70s breakout

Actually the 70s was entirely artificial – the Arab nations punishing the US for supporting Israel in the 73 war.

Today you write that the profiteering of the shipping merchants is an industry policy question rather than a fiscal or monetary policy issue.

Again, the same can be said of the 70s.

The point is that artificial factors are just as capable as fundamentals of creating a wage price spiral that persists long after the initial shock.

If the inflationary pressures are supply side then won’t continual government fiscal stimulus exacerbate the problem by increasing demand for restricted supply?

Sergio,

Watch this by Scott Fullwiler and Fadhel Kaboub

https://m.youtube.com/watch?reload=9&v=ggcsd08LXFA

Government fiscal needs to be surgical. Directly aimed at what are causing the problems. The Q&A is good also.

Instead of the carpet bombing approach of tax increases and interest rate adjustments that hurt innocent passers by and leave them as statistical collateral damage.

Derek,

I have skimmed through the presentation by Scott Fullwiler and Fadhel Kaboub. I do agree that inflation is a real resource issue (labour, materials, services) and the only things that resolve these issues is to increase capacities, efficencies, and throughputs.

But nothing that Australia does will address a problem such as, for example, semiconductor chip supply. No amount of investment by Australia in, for example, local semiconductor chip manufacture now will resolve the issue. But this is only one issue. Does Australia localise all supply chains? But this is not feasible. It is also not feasible to control all components required in a supply chain.

If capacity is restricted then there may be no immediate solution and prices for the restricted resource will be bid up by local and foreign consumers of that resource until the capacity problem subsides.

Kaboud states that “The real risk to governments spending is the risk of inflation.” and that a key determinant of inflation is a “Lack of productive capacity, logistics & supply chains disruptions.”

So, I believe that government spending in areas that consume a resource whose supply is restricted and over which the government has no control of that resource’s supply, can only be inflationary.

Sergio,

If the other country that supplies the semi conductor carries out what Scott and Fadhel suggest

Problem solved.

The key being find out why the resource that you supply to.others is restricted and using fiscal fix it.

Robert wrote:

“Actually the 70s was entirely artificial – the Arab nations punishing the US for supporting Israel in the 73 war”.

I began my professional career in the mid 1970s.

There were various conspiracy theories circulating at the time.

One was that US military industrialists had convinced the Saudis to up the price of oil so that they could fund their own rapid militarization, to counter Israel, which obviously was to the benefit of the military industrialists.

And hang the effect on the global economy.

It seems to me that Bill’s last two graphs do not necessarily demonstrate what Bill intends them to demonstrate.

What they more than likely demonstrate is that countries’ inflation response to fiscal stimulus varies across the samples used.

And of course the direction of causality cannot be inferred at all.

It could be that inflation behaviour determines the fiscal balance because of structural differences in taxation systems.

I was just a kid in the early 70’s but I think Robert has a better explanation than the conspiracy theory example you shared Henry. And sure, those graphs don’t show causality. But they do show a lack of correlation between government relief spending and inflation across many different countries. Which is pretty relevant all by itself, given the situation.

Jerry,

Robert’s is probably closer to the truth but mine is more fun.

I don’t think Bill’s graphs prove anything either way.

Whether time series data or cross sectional data is used it is not easy to demonstrate the relationship or not.

There are too many factors at play and the relationships that control inflation change over time.

Bill said as much, it seems.

@Robert,

The ability of wage earners to engage in an ongoing inflation-feeding wage-price spiral depends fairly heavily upon the industrial bargaining power of workers and their subsequent ability to demand – and win – significant wage rises.

I contend that this ability is largely absent today (in Australia).

In the 1970’s trade unions here were at their most powerful and were able to strike for and win wage rises again and again, with institutional arrangements allowing that to spill over across the economy. Today, they are a mere shadow of their former selves, representing only a small minority of the overall labour force and their ability to lawfully engage in industrial action is heavily shackled by legislation – they simply no longer have the power to rapidly push up wages across the labour market.

Further, the closed international borders that halted the policy of importing hundreds of thousands of people each year to compete with local workers have now re-opened and the flooding of the labour market looks set to resume (barring some new, more lethal variant appearing and causing borders to be slammed shut again), with 200 000 visas to be issued over the next 6 months I believe, concentrating on skilled migration and students (who often end up working in unskilled roles during their study).

Ordinary workers represent the bulk of the consumer base – if they cannot achieve strong wage rises (and borrowing to consume can no longer be made any cheaper)……….where do consumers obtain the funds to be able to keep on bidding up prices rapidly?

I think that’s part of what Bill was referring to.

@Henry Rech,

I used to sy that OPRC was the main cause of inflation in the 70s.

Recently, I was reminded that Nixon imposed wage and price controls in ’71.

So, inflation was a problem before the ’73 Arab-Israeli War.

However, OPEC was a huge part of it continuing and accelerating.

I still am saying that after the oil shock when the Fed raised rates it just make the situation worse.

IMO, only doing something so drastic that it triggers a serious recession is going to contain inflation in a situation like where we are now where OPEC or supplychain shocks are the cause.

And, this is not good for the working poor. Some other response seems better I have suggested a temporary UBI to tide the nation over the mess the world is in. This seems the best for Aust. too.

Steve A

The 1970s stagflation was the result of two shocks – the oil price supply side shock which everybody talks about. But also the massive transfer of income demand side shock which is hardly ever if not never mentioned. The macro policy response to such twin shocks is problematic. The adjustment process is pretty grim.

As Bill points out the current inflation can be sheeted home to Covid induced supply side constraints but it has to be said that these constraints appeared after the massive government spending that has occurred. Very tricky one to manage. The question is how long do you wait for supply side constraints to dissipate.

I don’t know much about UBI but it doesn’t seem to be relevant to short term stabilization issues.