These notes will serve as part of a briefing document that I will send off…

Turkey tells us nothing about MMT – but MMT tells us a lot about why Turkey is in trouble

I have noticed a lot of Internet traffic about Modern Monetary Theory (MMT) and the situation in Turkey at present. Apparently, as the narrative goes, MMT is finally being revealed as a fraud because Turkey’s economy is going backwards and its currency is depreciating rapidly. The logic, it seems, is that if a nation enters rough economic waters and the financial markets sell its currency (although remember someone has to be buying it simultaneously) then that proves MMT is false. An extraordinarily naive viewpoint if you think about it. This viewpoint has somehow missed the train on understanding what MMT actually is and seems to think that MMT economists have seen Turkey as a policy model. In this blog post, I consider some aspects of this naivety. It won’t silence the critiques, but it, hopefully will educate those who are interested in the topic and are learning about MMT.

First, the discussion will also talk about ‘starting points’.

Too often I read commentary on, for example, exchange rate movements, where it is immediately assumed that a depreciation indicates a movement to a worse outcome.

That assessment, of course, requires the commentator to make a judgement about what constitutes a desirable state.

I am not talking about changes or rates of changes here. At any level, a rapid change in any direction can be destabilising because it imposes adjustment costs.

Second, and I have written this before but it still seems to evade a lot of commentators who seem to continually be on the lookout for some ‘gotcha’ moment on which to declare the poverty of the body of work known as MMT.

MMT is not a policy regime.

The fact that the Turkish central bank has very high interest rates, or has cut them under direction of the President, or that the government deficit is rising, or that the President just announced the minimum wage would rise by 50 per cent to maintain its USD value has nothing at all to do with MMT.

MMT is a system of understanding how modern monetary systems work and the capacities of the currency-issuing government.

It also allows us to understand the consequences of using that capacity or giving up the currency sovereignty altogether.

So trying to conclude that the Turkish dilemma is an example of what happens when a government applies MMT policies is nonsensical and reveals the ignorance of the person drawing those conclusions.

This is tied in with the stupid conclusion that MMT can be summarised as saying that governments should just ‘print money’ and ignore the size of the fiscal deficit.

There is nothing in MMT that would allow such a conclusion.

There is nothing in MMT that says that a nation cannot hit skid row or that the external financial markets might get edgy about a currency and sell it off to bargain hunters at lower prices – thus depreciating the currency.

A depreciating currency simultaneously being recorded with a fiscal deficit tells us nothing interesting.

To appreciate these points is crucial to getting to stage 1 of your MMT education.

Turkey tells us nothing about MMT.

But MMT tells us a lot about why Turkey is in the situation it is in.

This is what the fuss is about.

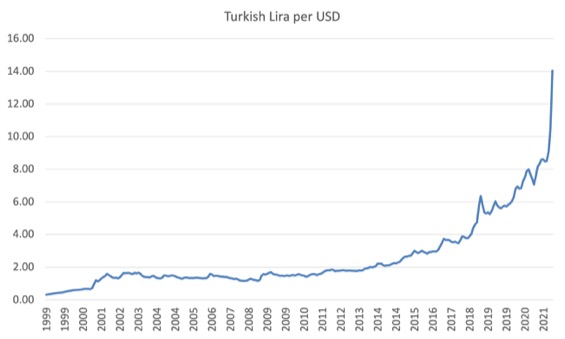

The Turkish lira has depreciated sharply over the course of 2021. But it hs been depreciating for some years – since about September 2013, when it breached the 2 lira per USD level.

How should we judge this shift?

What is the appropriate rate?

How we answer this question goes to the heart of what we think interest rates should be.

The President thinks that rates should be lowered to help farmers etc.

Mainstream economists everywhere think that rates should rise because that will help shore up the currency and stifle demand, which they claim will reduce the inflationary pressures.

An MMT understanding suggests that the mainstream analysis is wrong.

To comprehend that statement, one needs to ask whether the level that the currency is depreciating from was a sustainable level given what else was going on.

Were there imbalances that allowed a rate, of say 2 lira per USD to persist for a while, which are finally revealing themselves to be unsustainable?

That is more in line with my thinking.

This, of course, then leads to the question of interest rates.

The mainstream approach is that the high interest rates are necessary to attract speculative capital, which provides strength to the lira, which in turn, eases the inflationary pressures that they see arising from the impact of the depreciation on import prices.

The President thinks the high interest rates actually contribute to the inflation via their impact on business costs.

Another plausible view is that the high interest rate regime has been protecting the privatised banking sector, which is heavily exposed to external borrowing denominated in foreign currencies.

So by running high rates, the lira is propped up and the solvency of the banks is boosted.

Now, ask the question: if the banks are engaged in a sort of speculative frenzy fuelled by foreign capital (which they are), then is it in the long-term interests of the population to prop them up with very high interest rates?

And the corollary is whether the propped up lira value is sustainable and/or appropriate for the long-term welfare of the citizens?

These questions thus relate to the first point I made – what starting point or benchmark are we going to use.

Sure enough, the lira is depreciating and that causes disruption.

But if the value it has been depreciating from was just part and parcel of these major imbalances in the economy that were themselves part of the short-term grab by the financial elites then that puts the shift in a different light.

Perhaps by reducing rates and exposing the debt of the banks, the government will eventually restructure the economy away from this dependence on hot money denominated in foreign currencies.

The short-term grief thus puts the economy on a more sustainable footing.

IMF stamp all over it

The other point to understand is that Turkey is now where it has been. In 2001, it took a major change in policy direction towards the standard IMF export-led, privatisation, deregulation agenda.

This agenda has finally come home to roost and the structural imbalances it created will have to be addressed as part of the new strategy to stabilise the economy (reregulation, curbs on foreign currency debt, etc).

After a major financial crisis in 2001, the Turkish government floated the lira on February 22, 2001.

The IMF released a press release on May 15, 2001 – Press Release: IMF Approves Augmentation of Turkey’s Stand-By Credit to US$19 Billion – after the Turkish government sent the IMF a – Letter of Intent – on May 3, 2001 outlining its plan to reduce inflation, stabilise the currency and engage in widespread structural changes of the economy.

They promised the IMF a primary fiscal surplus (and to get there they need a 9 percentage point cut in net government spending between 2000 and 2002).

They claimed their approach would reduce external debt exposure.

Their strategy was IMF-par excellence – cutting the public sector contribution to growth, replacing it with an export boom, particularly in tourism and cutting domestic costs (wages) to enhace international competitiveness.

They also rationalised (privatised) large swathes of their banking system, which had carried massive debt, in addition to recapitalising many private banks.

In general, they embarked on what they called an “ambitious privatization agenda” to allegedly “reduce the stock of public debt”, with the implication that foreign debt exposure would be transferred to the private sector.

Key state enterprises (Turk Telekom, Petroleum refineries, Turkish Airlines, Sugar and Tobacco, Electricity generation and distribution, etc) were put up for sale.

They specifically targetted “private capital … to participate in restructuring the banking sector.”

And, importantly, they continued to sell Treasury debt in foreign currencies to help them “rollover … external debt.”

The IMF’s response in its press release approved the plan and increased the nation’s debt exposure even further.

So if you ask an MMT economist what they might expect to happen, you would be told that with so much external debt denominated in foreign currencies, and a program aiming to free up the banking sector and allow it to expand foreign liquidity into the economy, it would be likely that the nation would eventually reach an unsustainable point.

Turkey – External debt

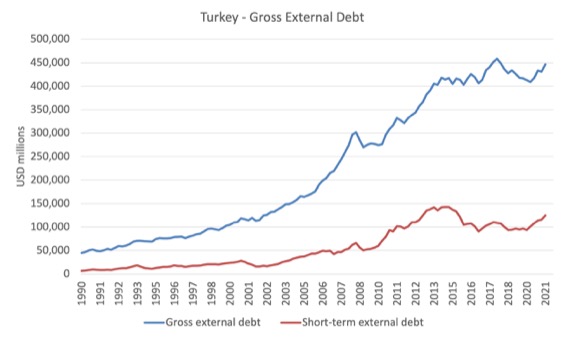

Here is the external debt history since 1990 for Turkey (data is from the excellent CBRT portal).

It is clear that since the IMF program was agreed that the foreign debt has escalated significantly and the proportion of short-term debt has also risen from 12.1 per cent in the March-quarter 1990 to 21.6 per cent in the June-quarter 2021.

The short-term debt tends to be speculative in nature rather than FDI, although in recent years (since 2018) a rising proportion of the short-term external debt exposure has been from CBRT borrowing to maintain foreign exchange liquidity.

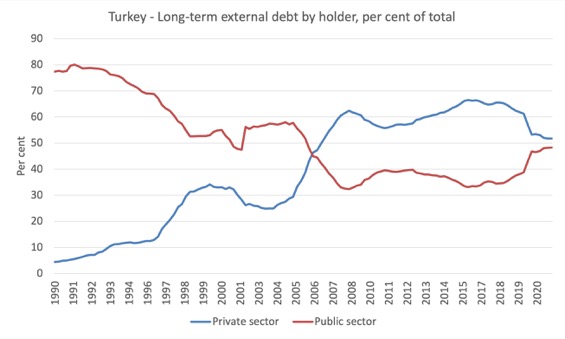

The next graph shows the long-term external debt situation since the March-quarter 1990.

Long-term external debt accounts for around 72 per cent of the total gross debt and its evolution reflects the massive changes that Turkey has gone through as part of its relationship with the IMF programs and the rise of neoliberalism.

The more recent increase in public sector long-term borrowing is due to the CBRT actions noted above.

Once the nation (both public and private sectors) are borrowing in foreign currencies, the exposure to insolvency increases.

The nation has to maintain its export revenue in order to earn the foreign exchange necessary to ensure the debt can be serviced.

If export markets blip, then the nation enters a ponzi situation – it has to borrow more externally just to service its existing exposure.

Investors know this is a slippery slope and will respond to that exposure risk in the way that we are seeing in Turkey now.

Thus, no-one should be surprised that the foreign exchange traders are in sell mode.

The central bank of Turkey (CBRT) has also been trying to defend the currency level in recent years by selling foreign exchange – a fixed exchange rate strategy really designed to slow down the pace of change.

The problem with that strategy is that the traders know it is finite and their bets become self-fulfilling.

Living beyond a nation’s means

The IMF’s agenda that Turkey succumbed to, was like a magnet to the global financial speculators.

They suddenly had an advanced economy that they could use as a gambling token and the government played along with that.

Historically, Turkey has run an external deficit on the current account.

In a sectoral balances framework, we can see the external deficit as being driven by the gap between domestic saving and investment.

It has 2.3 per cent of GDP since 1980 but rose to 4.3 per cent after 2003.

After the IMF agenda began, the private saving rate started to fall and the access to foreign credit for households and firms increased substantially as part of the lax supervision of its banking system.

The low saving ratio was, in part, due to the young population, which encourages consumption over capital accumulation.

Business investment steadily grew on the back of foreign currency denominated debt.

The fiscal drag that the IMF agenda created also squeezed private domestic sector liquidity.

An economic growth strategy (and Turkey did experience strong growth) based on private debt accumulation to drive domestic expenditure and dependency on imported energy (as well as other things) is unsustainable in the medium- to long-term.

Eventually, the reliance on foreign currency credit destabilises the local economy and the currency is targetted.

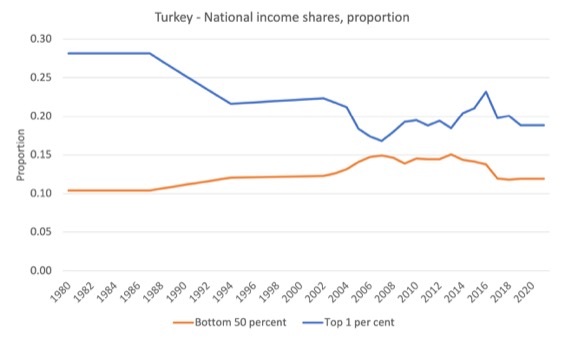

That evolution has also seen income inequality rise in Turkey over the time that the IMF agenda was being followed.

The next graph shows the Pre-tax national income shares in Turkey from 1980 to 2020.

It was clear that before the crisis in 2001, the bottom half of the income distribution was increasing its share while the top 10 per cent (and the top 1 per cent, as shown) were receiving a reduced share.

On the new agenda kicked in, that tendency has been reversed.

The crisis tells me that Turkey has relied extensively on capital inflows to drive growth with fiscal policy largely dragging on growth (except for the last few pandemic years).

The private domestic sector spending boom has exposed the economy to global financial markets and there is a limit to that exposure before things get ugly.

Reliance on foreign currency loans is a highway to hell.

That means that a stable growth path has to be less ambitious and better develop the local resource base.

Note also: I haven’t mentioned the US-imposed sanctions on Turkey as a result of th elatter’s choice to deploy Russian military equipment.

I also haven’t mentioned the flight to US government debt during the pandemic which has distorted the gambling markets against the Turkey lira.’

I also could talk about exchange rate pass through impacts to the domestic price level.

At some point, I will also return to this topic and talk about what needs to be done in Turkey based on my understanding of MMT.

As a hint, I covered these sorts of issues in these blog posts (among many):

1. Tunisia is a classic example of the failed IMF/World Bank development model (August 4, 2021).

2. There is no internal MMT rift on trade or development (January 10, 2019).

3. Timor-Leste – challenges for the new government – Part 3 (May 24, 2018).

4. Timor-Leste – challenges for the new government – Part 2 (May 16, 2018).

5. Timor-Leste – challenges for the new government – Part 1 (May 15, 2018).

Conclusion

Trying to tie in the body of knowledge known as MMT with the difficulties that Turkey is facing at present is the work of scoundrels or dopes.

MMT is not a set of policies.

What has been happening in Turkey does not provide a blueprint of what an economist with an MMT understanding might or might not do about policy.

What is clear, an MMT understanding leads one to worry intensely about a nation that has built a growth strategy on vast amounts of foreign currency debt and expanding exports. The two arms of this sort of growth strategy leaves a nation highly vulnerable to changes of circumstances in world export markets.

Add in a central bank that is also borrowing foreign currencies and showing it intends to use their stores to defend the lira.

Add in a deregulated banking sector that is flooded with foreign debt to maintain profits.

Result: disaster pending.

It is only a matter of time.

That is enough for today!

(c) Copyright 2021 William Mitchell. All Rights Reserved.

“Reliance on foreign currency loans is a highway to hell.”

It seems to me this is the key factor in the problem. The Turkish central bank is following the Consensus Playbook and making all the mistakes we expect from that. Five interventions in the FX market so far that has done nothing other than let speculators know there was a patsy in the market. Unsurprisingly they have doubled down. It’s free US dollars for rapacious shorters.

Now if instead of intervening they had required Turkish banks to make a 100% margin call for all Lira trades…

We need to develop an alternative central bank/government playbook using MMT. Policies that an economy can deploy once they are stuck up the IMF blind alley that allows them to get out with the minimum amount of suffering for ordinary people. It’s not just Turkey that needs help. Zimbabwe’s new dollar, for example, is caught in the same straitjacket – along with a damaging peg to the US dollar.

It seems to me, using the MMT lens, that high interest rates creates a sort of ‘Dutch Disease’ problem, where the primary export is savings with excessive income payments. In Turkey’s case that has been the Yen-Lira Carry Trade.

Turkey saying they will no longer provide high interest savings is like Saudi saying they will no longer be exporting oil.

Unfortunately unwinding that carry trade means a world of pain for the Turkish, stuck as they are with exports the world doesn’t seem to want that much at the moment and imports the rest of the world does desperately. That reverses the usual MMT induced understanding that government spending is offsetting neo-mercantilism from export-led nations trying to buy demand to prop up their own under stimulated economies.

A few things spring to mind, posted for discussion:

– should we be saying that central bank must not, under any circumstances, intervene in the FX market in a foreign currency. Instead foreign currency reserves should be controlled by government and used only to settle invoices for needed goods and services, and then only if those turning up with the begging bowl put themselves through administration/bankruptcy to shed themselves of foreign currency loans.

– should we be recommending assessing firms/banks for solvency not just in the reporting currency, but in all their operational currencies. If they don’t have the hedges in place to ensure they can settle their debts in each currency as they come due, then the firm should be put through adminstration/bankruptcy.

– what should we do with physical collateral in a country that is pledged against a loan in a foreign currency. If the loan goes bad, then the collateral will be sold priced in foreign currency. How can we ensure adminstration/bankruptcy causes the loss to be absorbed by the foreign currency lender in that currency.

– would a lira tax on lira to us dollar exchange transactions help drain excess liquidity.

– capital controls have often been mentioned, but what exactly are they in operational terms and how would they work.

Every situation is different of course, just like every airplane is flown differently and pilots have to learn how the specifics of each aircraft works. But there is still a core understanding of how to fly a plane, and that it is very different from driving a bus.

The current central bankers are bus drivers. We need to replace them with properly trained pilots.

Yes, Neil, at a minimum, MMT should be out in front of all of these economic crises and immediately put forward an analysis of what caused them, along the lines of what Bill has done here. I still feel that MMT is much too much in the reactive mode, fending off inevitable criticisms rather than proactively offering its own. A short statement with a title like “The Truth About Turkey: How Misguided Economics Is Ruining It” should have been put out BEFORE the country’s problems were predictably used to bash MMT. Right now, MMT should be putting every country on the globe under its lens and anticipating the economic problems in store, placing itself in a position to say “I told you so” when the crap hits the fan. The best defense is a good offense.

Thanks Bill. A timely intervention! It was getting really silly out there!

Bill,

Thank you for this excellent summary of Turkey’s economic plight and for all the outstanding work you do year-round.

Re Neil Wilson@21:38

Interesting comments and questions. Clearly there are many interlocking complexities to deal with.

With respect to foreign exchange intervention I recall Randall Wray a few years ago pointing out that while MMTers normally prefer a free floating currency regime to prevent speculation (among other reasons) there can be cases where some central bank intervention is preferable. I believe he noted that countries that are not self-sufficient in energy might need intervention to slow the dramatic decline of their currency since it could have serious negative effects on their population such as not being able to afford cooking and heating oil. I suppose this would be a stop-gap measure until the underlying problems could be dealt with, at least in part.

With respect to capital controls, most European countries had capital controls in the 1960s-80s (at least those years) and I remember having to deal with them as a tourist from Canada. Many other countries have had them as well so I imagine there is a fair bit of information about them, although probably not using an MMT lens. I do think they are very complicated to actually put into effect since they affect imports, exports, and individual travelers.

(I still remember trying to open a bank account in London in the 1970s. I had UK pounds purchased in Canada and I hadn’t brought the receipt for the transaction. Phew! It did all work out after a long interview with the bank manager at Barclay’s at Piccadilly Circus).

Re Newton Finn @ 1:51

I think it is great Bill has written this analysis. However economic mismanagement and self-serving elites are so widespread that I think it would take the relative handful of MMT economists a great deal of time sorting out prospectively what could go wrong in particular countries.

Fadhel Kaboub has written about economic problems from an MMT perspective in a number of third world countries. The issues are numerous and fiscal and central bank actions are only a small, albeit important, part of the problem. Industrial structure, legacy of colonial rule, exports of things that shouldn’t be (e.g. food), the self-serving power of elites, backward infrastructure, corruption, etc, come to mind.

In Canada we have somewhat similar dynamics but our overall wealth tempers some of the worst effects. Of course we have a vast country that is self-sufficient in energy and food, and exports large quantities of raw materials, three big advantages.

Argentina is a very interesting case. What options they had available to them at the time but we’re forced to go down the wrong road. Or willingly went down the wrong road depending how you look at it.

ARGENTINA: FROM THE “CONFIDENCE FAIRY” TO THE (STILL DEVILISH) IMF – By Pablo Bortz and Nicolás Zeolla, Researchers at the Centre of Studies on Economics and Development, IDAES, National University of San Martín, and CONICET, Argentina.

https://criticalfinance.org/2018/05/17/argentina-from-the-confidence-fairy-to-the-still-devilish-imf/

Argentina followed the IMF playbook as it is all about control and geopolitics and US foreign policy. The IMF and world bank are the jailers for the neoliberal globalist project.

There were other ways to obtain dollars and to cap the foreign exchange run. The government could have forced exporters to sell their foreign currencies; they could have negotiated a swap agreement with some major central bank; or they could have erected barriers to capital outflows. Which I hope Bill goes into more detail tomorrow. Including how difficult it is to get $ swap lines if you don’t pass the ideological test.

They are trying to force Turkey to adopt that Euro. When the voters see the crises it is easier for the media to encourage them to give up their sovereignty and sign on the dotted line and be enslaved by the Euro. That’s what the Volker shock was all about in the US. They could virtually do any reforms they wanted after that. Same playbook was carried out in the UK by Thatcher. Cause a crises and make hay with it.

Scotland is sleepwalking into the Same Orwellian Traps. The supporters of Scottish independence can’t even see the traps that have been laid out before them right in front of their faces. That the EU convergence programs are copy and paste jobs of the IMF blueprints on how to enslave a nation. That the Scottish growth commission was a copy and paste job of an EU convergence program. That a large number of Scottish voters don’t actually see any problem with using the Euro. If there was a referendum on it they would adopt the Euro in a heart beat.

Michael Hudson organised the first Third World bond fund. It was issued by Scudder, Stevens & Clark. At that time in 1989-1990. Merrill Lynch, which under wrote the bond fund, sold all its shares in Latin America. The fund was organised and the Dutch West Indies, so it was an offshore fund. The bond buyers turned out to be the wealthiest families in Brazil and in Argentina.

It was class war at its finest fully supported by the Americans.

https://michael-hudson.com/2018/07/argentina-back-on-the-debt-train/

After the Vietnam war was such a disaster they had to come up with a new way to purge left wing forces out of countries without sending body bags home. Financial capitalism was what they came up with as the solution. Not only have they managed it and made left wing politics weaker than it has ever been. They have allowed and used the far right to steal the natural ground of the left and mop up the votes of the populists who are angry at the neoliberal 30 year war from above. Which is nothing short of genius when you think about it. As they have no problem at all with the middle moving even further right than they would have even dreamed to go.

I believe the left have just won back Chile after years of living with the HUGE inequality of neoliberalism a guy called Gabriel Boric. Just watch what happens next. Keep a very close eye on Chile. Both the leisure class in Chile and Wall Street and the Pentagon are about to show you what they think about that. The interest rate in Chile as we speak is 4% and inflation is running at 6%. I fully expect both to be in double digits before long with the IMF flying in to give them advice saying they are there to help. Or they will find a way to Jail the new leader and carry out a cop de tat putting in a technocratic stooge. A hand picked person that is there to support US interests. The Kier Starmer of Chile is waiting in the wings just waiting on the call. Like they did with Italy when they threatened to leave the Eurozone.

That’s with Biden in Charge a Democrat. Starmer silence on the matter has been deafening.

I would hate to live in a world without China and Russia. Who would then keep these lunatics at bay. If Russia and China were ever defeated. I sometimes wonder what they have in store for the left. What they have planned. After watching them exterminate left wingers across South America in their hundreds of thousands. We can’t even help Julian Assange and it is happening in 2021 right in front of our faces. As we retreat to our middle class lifestyles and wrap ourselves in a comfort blanket saying it could never happen to us.

Ted Cruz might spare the left on the condition we provide free Labour to the Southern states. All in the name of God and liberty and freedom of course.

I would suggest China as an example of a monetarily sovereign state which successfully commands its real resources (recognising its horrendous record on human rights, of course).

Thank you very much for your country insights Bill — highly valuable to read your insights on contemporary situations.

Carol Wilcox, very prescient point re China. Interest in it as a model of economic management is rising as the failures of the western free market model pile up.

Sovereign command of its finances and resources has enabled China’s leading response to the virus. While China has its democracy deficit and human rights issues, and I don’t think I’d like to live there, arguably its zero covid policies show it places a higher value on human life than the neo liberal free market systems, with their millions of deaths.

Neil, you mentioned that the current central bankers are like bus drivers trying to fly a plane. Perhaps carjackers or hijackers would be an even closer analogy.

I am hoping the Turkish government and the Turkish banks ‘do an Argentina’ and default on their foreign currency loans imposed by the IMF and the global neoliberal order. It is either that or the imposition of the path of Greece – enforced extreme austerity, mass unemployment, the collapse of government services and pensions and asset selloffs to foreign capital and to the local oligarchs.

Even with high inflation Turkey can still implement a MMT compliant Job Guarantee program to ensure full employment, to set an adequate floor for wages and working conditions and to ensure everyone can feed and house themselves while the neoliberal economy is restructured. Capital controls to block or disincetivise foreign currency loans should be on the to do list.

Turkey with its huge external debt is not a sovereign currency nation and thus to argue that it’s a clear indication of MMT failure is at least naive.

That would be to mistake ‘external debt’ for ‘public debt denominated in a foreign currency’.

For example Turkey’s external debt is 60% of GDP, whereas the UK’s is 337% of GDP.

I doubt anybody would suggest that the UK isn’t sovereign in its own currency and able to deploy the full capacity of Sterling for the benefit of its people.

It’s always a mistake of the way the statistics are drawn up, which sees the country’s borders as the eliminator rather than holders of the denomination. When you do that you see that the UK’s currency area is bigger than the country’s borders (the balance is for more people outside the UK to hold GBP denomination assets, than for UK people to hold foreign denominated assets), whereas Turkey is somewhat smaller than the country’s border. (more Turkish people hold foreign denominated assets than foreign people hold Lira denominated assets).

Once you switch your frame to the current size of the currency area, then you see that Turkey actually has more room for manoeuvre because it has the power to drive out foreign denominated assets from its sovereign territory and expand the currency area by widening the tax base. That will result in foreign denominated operations going bust, and the losses running up in that foreign denomination. But that is what bankruptcy/adminstration is supposed to do.

Unfortunately it looks like Erdogan is still playing from the Consensus playbook with his latest scheme to ‘guarantee’ Lira deposits rather than just taxing them away if people try to exchange them.

Enlightening and thought provoking blog and comments, thanks Bill and all btl.

I can’t add any wisdom on Turkey, but feel I know a little about China (having made a living and life there for 7.5 years before covid struck). Re: Dan Murphy: ‘Sovereign command of its finances and resources has enabled China’s leading response to the virus.’ Certainly it’s in a better position compared to Turkey or Greece or others that have signed their financial sovereignty away, and also pending climate/environmental disaster, fortunate in being fairly self-sufficient, and where it isn’t, buying up external resources particularly in Africa, but it’s main advantage is in not letting its resources be financially constrained at the behest of a wealthy elite. In dealing with the pandemic, it has the advantage of politically directed control right down to apartment block level. There is also the fear, given city population densities, that a rampant virus would lead to a mortality rate that would put our body count in the shade. In terms of ‘successfully commanding its resources’, I like it’s swept streets and public transport and abundant cheap eats, but it has to be remembered, it also sweeps millions of migrant workers into a not great life making products for export and into the military and security. Its (the CCP’s) valuing of human life of course depends very much on one’s compliance and ethnicity.

Actual communists in China have a different story to tell about the government:

“Social Contagion [the book] presents the untold story of the COVID-19 outbreak in Wuhan. Chuang, a collective of communists living inside and outside China, chronicle the struggles of everyday people caught between a lethal virus and a repressive state. They argue that China’s rapid but fragile economic growth has created the social and biological conditions for new and deadly viruses, of which COVID-19 was merely the latest iteration. Through on-the-ground interviews, reports and analysis, Social Contagion gives us *a piercing portrait of the simultaneously draconian and ineffectual response of the Chinese state, as well as the self-organizing survival strategies of ordinary Chinese workers.* Chuang conclude that the pandemic has enabled a new mode of counterinsurgent governance, one rooted in decades of institutional experimentation and an emergent theory of statecraft. ” (emphasis mine)

I have no source I can be sure of, but it does seem rather hard that there can be a response without the support of the people; so, either way, let’s not congratulate oligarchs too much.

@Paulo Marques As an already grown-up foreigner living in China, with the ability to get a plane ticket out, I’m aware that my experience was not fully the same as a local and I don’t discuss anything political with Chinese friends. I haven’t read Social Contagion, but I’d make several observations. ‘China’s rapid but fragile economic growth has created the social and biological conditions for new and deadly viruses.’ How so? This is a country of 1.4 billion people. Yes, it has rapidly urbanised with high population density and thus increased risk. With increased affluence, they eat too much meat and I wouldn’t like to delve into their factory farming, but this isn’t just a China issue. I well remember BSE/mad cow disease in the UK, and we are presently slaughtering thousands of birds to try to deal with avian flu. Is China’s economic growth more fragile than the west’s? It seems that there are those still predicting China’s collapse in the same way as for Japan to go bankrupt. The response in Wuhan may have been ineffectual at the start of the pandemic, and I wouldn’t trust any early fatality statistics, the subsequent lockdown was certainly draconian, but ineffectual? That’s very hard to argue, when life got back to normal everywhere in May/June 2020 and has remained so bar occasional individual city clampdowns and mass testing. Their electronic mobile phone traffic light health control of individuals and areas is no doubt draconian, but people’s lives in China have been very much less interrupted than here in the UK. You are right that covid does seem to have provided the CCP with an opportunity for an even less liberal society, for instance in guiding ‘education’ but this was likely anyway under the current no 1. The people don’t get a choice as to whether to support health restrictions or not, but generally they do. As everywhere, there is a trade-off between communal thinking and individualism but avoiding the rampant individualism of our societies has served them well. Is life a struggle for the poorer section of society? Yes, but then we have awful levels of household poverty and proliferation of food banks here in the UK, with higher prices comparative to earnings for food, water, electricity, transport and compared to most Chinese cities, housing.

@Patrick

I heard the podcast interview on the Antifada, but it’s harder to quote or recommend a podcast. I’m afraid the dissonance between supporting a counter to the hegemony and the dark realities of China made it hard to remember many details, but what I mean is not that the measures don’t work per se, of course they do; but they necessitated communities scrambling to help each other much in the way Bill advised, except without help of the state. The communitarianism is pretty selective and brutal, so it’s important to keep in mind it’s not a model. And one wonders how good Sinovac is, or will be soon, compared to the one from Cuba.

As to the economy, I think they mean expansion into western production without adequate protective measures and health system, but that wasn’t a focus of the episode. I’m sure they misunderstand macro here and there too, exaggerating frailty where there actually isn’t one, but I find the anarchist critique good for thought, even if there is no path from there.

I’m afraid I can’t seem to make a decent go at a point due to that dissonance.

@Paulo Marques. Hi. My understanding is that the organisation/control of the lock-down was politically organised – the CCP is organised down to community/workplace level, but what, if any, financial support/food for households and businesses there was, is another (important) matter. Families/communities scrambling together is probably right, and I dare say it was pretty grim for some.

Re: the Healthcare system in China – I fortunately have no personal experience though I know people who have had good hospital treatment, but service and cost are variable. I really don’t understand why they don’t operate a NHS (and drive out the private market) and why they’ve let education be so taken over by the private market (though there are recent steps to reign this back). A ‘communist’ state is not necessarily a welfare state. I can say, that good dental treatment can be obtained at both public dental hospital and private clinic, both at an excellent cost compared to the UK, and doubtless to the USA.

Hello,

Great blog. I just wanted to add that Turkey is at war in Syria and this is a major cause of its inflation and internal problems.

Military expenditure has increased a lot over the last few years.

https://tradingeconomics.com/turkey/military-expenditure

Every land produces a surplus, and unfortunately, in this case, the surplus is being wasted on war, and in addition to that, it borrows externally to also fund the war effort.

When you see excessive inflation it almost always traces its origin to a senseless wasteful war of one sort or another.