The Reserve Bank of Australia (RBA) increased the policy rate by 0.25 points on Tuesday…

The ideology that the RBA operates within needs a review not it legislative charter

There are calls for the Reserve Bank of Australia to be forced to undergo a major review of its operations, given that it has failed to achieve its own stated inflation targets for many years now. The RBA is resisting that call. The Australian Labor Party, which is in opposition at present, is trying to politicise the issue by claiming it will review the RBA once it becomes government. The problem is that the call to review the RBA is being made by those who would make the worst aspects of the central bank worse. Further, the legislative structure that defines the RBA and its charter already allows the RBA to pursue employment as a goal with equal priority to inflation. The fact that it hasn’t done that is because it adopted the NAIRU myth and used the unemployed as a tool to discipline inflation rather than a policy target to be maximised. That occurred in the 1980s and beyond as neoliberalism became dominant. The problem is not the legislative structure that the RBA operates within. The problem is that it is part of a broader ideology that has demonised discretionary use of fiscal policy and prioritised interest rate changes, which has reduced our growth rates, undermined employment, suppressed wages and more. The Labor Party has echoed that same ideology and is just being hypocritical now. That ideology is what needs a ‘review’. And urgently.

Brief history lesson

In late 1992 (Source):

The Governor and the Treasurer have agreed that the appropriate target for monetary policy in Australia is to achieve an inflation rate of 2-3 per cent, on average, over time.

While other central banks adopted an informal definition of price stability, the RBA chose this formal band as its policy target.

It also said that:

The inflation target is also, necessarily, forward-looking. This approach allows a role for monetary policy in dampening the fluctuations in output over the course of the cycle.

That meant that it would not wait for annual inflation to exceed the 3 per cent upper bound before increasing interest rates.

Rather, it would start tightening monetary policy settings if it thought that some time in the future the upper bound might be exceeded.

Critics, like me, argued that this biased settings towards excessively high interest rates and elevated levels of unemployment and broader forms of labour underutilisation, such as underemployment.

In a Lecture given in Freiburg (April 6, 2000), Italian economist Franco Modigliani, who was one of the economists who coined the term NAIRU, which drove the bias towards monetary policy dominance over fiscal policy, reflected on his legacy:

Unemployment is primarily due to lack of aggregate demand. This is mainly the outcome of erroneous macroeconomic policies … [the decisions of Central Banks] … inspired by an obsessive fear of inflation … coupled with a benign neglect for unemployment … have resulted in systematically over-tight monetary policy decisions, apparently based on an objectionable use of the so-called NAIRU approach. The contractive effects of these policies have been reinforced by common, very tight fiscal policies.

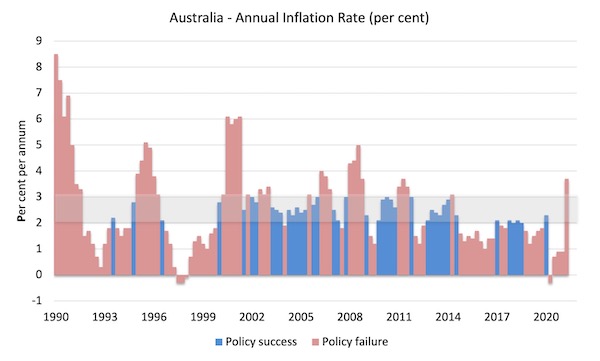

To bring you up with history, here is the annual inflation rate from the March-quarter 1990 to the the June-quarter 2021.

The RBA began its inflation targetting regime in 1993 and the greyed area defines their 2-3 per cent target range.

The pinkish bars show the times that inflation has been higher or lower than the RBA’s target band, while the blue bars show when the inflation rate has been held within the targetting range.

While we can allow for lags – that is, policy changes and inflation takes time to respond – the track record suggests that the RBA, like many central banks around the world, has overseen inflation rates well below their lower-bound target range (2 to 3 per cent) for 64 per cent of the quarters.

So even in their own terms of meeting their inflation targets (and ignoring the unemployment impacts), the RBA has consistently failed over the many years now.

The US Federal Reserve has recognised the austerity bias in the forward-looking, inflation first approach and Jerome Powell announced on August 27, 2020 that the US central bank was abandoning the approach.

In a path-breaking speech – New Economic Challenges and the Fed’s Monetary Policy Review – the Federal Reserve Chairman indicated that the Bank was rejecting one of the core theories of the New Keynesian macroeconomics mainstream (Phillips curve) and would no longer be adopting a forward-looking, inflation-targetting approach.

The Federal Reserve Bank released an accompanying statement – Federal Open Market Committee announces approval of updates to its Statement on Longer-Run Goals and Monetary Policy Strategy (August 27, 2020) – which marked a new phase of the paradigm shift in macroeconomics.

Essentially, the Federal Reserve Bank acknowledged the dominance of the fear of “high and rising inflation” in the macroeconomic policy debate had skewed policy so that:

… expansions had been more likely to end with episodes of financial instability, prompting essential efforts to substantially increase the strength and resilience of the financial system.

He argued that this approach had led to elevated levels of labour underutilisation, declining productivity growth, and declining living standards.

And, now, when unemployment does fall, inflation does not accelerate, which was the core proposition from New Keynesian macroeconomics that drove this policy bias.

He indicated that the Federal Reserve would, instead, adopt a new approach aimed at achieving:

… maximum-employment and price-stability.

The Bank will no longer tighten monetary policy as employment growth strengthens before there are inflationary effects – that is, they are rejecting all the ‘forward-looking’ bias that mainstream theory imparted that policy had to kill off employment growth before unemployment had fallen significantly.

He said:

… going forward, employment can run at or above real-time estimates of its maximum level without causing concern … Of course, when employment is below its maximum level, as is clearly the case now, we will actively seek to minimize that shortfall by using our tools to support economic growth and job creation.

This was a massive shift in approach.

I analysed that game-changing shift in this blog post – US Federal Reserve statement signals a new phase in the paradigm shift in macroeconomics (August 31, 2020).

One should not get too excited however.

You will note that the Chairman was still channeling the idea that monetary policy adjustments, principally achieved by adjusting the short-term policy interest rate up and down, could be effective in controlling inflation in a predictable manner.

That predictability requires that interest rate cuts stimulate aggregate spending in the economy and push inflation rates upwards and vice versa.

The evidence doesn’t support that sort of causality.

Interest rate changes are ineffective in fine-tuning aggregate spending and there is evidence that suggests, for example, that pushing rates up, as a response to rising inflation pressures, actually exacerbate those pressures through their effects on business costs where firms have market power.

But, the point is that the Federal Reserve shift was a significant sign that central bankers were realising that they had caused wastage through elevated unemployment and that there was no clear relationship between falling unemployment and rising inflation.

Calls for RBA review

The Australian Labor Party has indicated that if it wins government at the next federal election (2022) it will conduct a review of the RBA.

The Shadow Treasurer claims that, while the RBA is (Source):

… a crucial institution but not beyond criticism or reproach after a long period of stagnant wages, underemployment and weak business investment, which is more a failure of government policy settings

Many mainstream economists are calling for a review although the reasons advanced are varied.

Some argue that the RBA has not achieved its stated aims – as above – and that indicates some sort of policy dysfunction.

Others are outraged that the Governor Philip Lowe, comments on a wide range of economic matters, including government wage caps, and the like, which they claim breaches his independence and gives him “a degree of power that is well beyond his remit”.

Others think the RBA is not transparent enough and its monthly meetings are excessive, given the frequency of the inflation data (quarterly).

Others think the RBA has too many staff doing meaningless work – “whiting out the dates on one graph and putting in the next meeting’s date”.

Others think the RBA governor and top officials are overpaid.

Others think that the inflation data should be published monthly instead of quarterly, which would then give the RBA clearer signals upon which to base monetary policy decisions.

Others think the RBA Board, which determines monetary policy and chosen by the Federal Treasurer (effectively) are often not qualified to make the assessments they are required to make.

These are political appointments and are dominated by business sector appointments.

The RBA Governor has resisted these calls (Source).

My own views are as follows.

First, in a perfect world, the RBA would be dissolved into Treasury, and a new division entrusted with maintaining financial stability and the integrity of the payments system, would then set the policy rate at zero and ensure that liquidity was maintained in the system.

We would finally do away with the idea that adjusting interest rates up and down is an effective counter-stabilising policy tool and thus end the celebration of this large technocracy that has allowed our attention to be diverted away from what really matters, the fiscal policy settings.

But, I realise that sort of reconstruction is not going to happen any time soon.

Second, reflecting reality a little better, we should understand that the RBA is a part of the consolidated government combining monetary and fiscal policy.

The claim that the Bank is ‘independent’ is a flawed construction of the daily reality that the Bank and the Treasury must coordinate their separate arms of macroeconomic policy.

It is essential that the Bank integrates the daily impacts of fiscal policy on the overall state of cash system liquidity to maintain their current monetary policy stance.

The RBA must manage that liquidity daily.

So, while at the political level, the RBA and the Treasury can claim that the Bank is independent of the government, the reality is quite different.

Third, the Reserve Bank Act 1959 already requires the RBA to fulfill several functions.

Section 8 empowers the central bank “to buy and sell securities issued by the Commonwealth and other securities”, “to establish credits and give guarantees” and more.

More importantly, under Section 10 Functions of the Reserve Bank Board, Clause (2) are:

It is the duty of the Reserve Bank Board, within the limits of its powers, to ensure that the monetary and banking policy of the Bank is directed to the greatest advantage of the people of Australia and that the powers of the Bank under this Act … will best contribute to:

(a) the stability of the currency of Australia;

(b) the maintenance of full employment in Australia; and

(c) the economic prosperity and welfare of the people of Australia.

In other words, the RBA was not constituted to target inflation as a single goal.

It was always intended that its capacities would be to maintain full employment with price stability so that all people in Australia are prosperous and secure.

The problem has been that the RBA has echoed the prevailing neoliberal orthodoxy and been significantly influenced by the now defunct NAIRU concept.

This meant that under its inflation targeting approach it became part of the abandonment of true full employment and unemployment ceased to be a policy target (to be as low as possible) and became a policy tool.

The unemployed thus became pawns in a flawed strategy to maintain low inflation.

The persistently high unemployment and underemployment in Australia over the last 30 years, would suggest that the RBA has not been working within its legal charter.

The RBA and the Treasury fudged this shift by claiming that the concept of full employment was a moving target (the shifting NAIRU), which meant they could always say they were fulfilling their legislative charter.

Of course, we now know that claim was false and the current shift in US Federal Reserve strategy where they have abandoned the NAIRU mantra is testament of that.

So, the legislative structure is already in place for the RBA to pursue employment as a goal with equal priority to inflation.

Its obsession with inflation-targetting just means it has been mismanaged.

Fourth, what about the Labor Party Opposition’s demand that the RBA should be reviewed and reformed?

The problem for the Labor Party is that it has been complicit in this violation of the RBA’s legislative charter as both a government and opposition.

When in government it produced the first fiscal surplus in decades and drove the economy into the 1991 recession, which was the worst downturn since the Great Depression of the 1930s.

It eulogised surpluses and set in place the changes that now undermine the capacity of the government to deliver first-class public services and infrastructure.

It privatised major utilities, the national airline, deregulated banks, outsourced a massive array of services without ensuring quality was maintained, it pushed the move to privatise the Commonwealth Employment Service, and it introduced the harsh activity testing that the unemployed are now subjected to.

In Opposition, it screams about the need for surpluses and reduction of public debt.

In economic terms, the Labor Party is neoliberal to the core.

So it can demand changes to the RBA Act until the cows come home, but that will deliver nothing of value if it maintains its neoliberal orientations towards fiscal surpluses and central bank ‘independence’.

The current RBA Act contains all the latitude the Bank needs to be a significant part of a progressive policy structure.

It can buy as much government debt as it likes (given it issues the currency), can write off as much of that debt as it likes (without consequence) and support fiscal deficits (or surpluses) that are necessary, given non-government spending and saving decisions, to maintain true full employment.

Conclusion

The problem is not the legislative structure that the RBA operates within.

The problem is that it is part of a broader ideology that has demonised discretionary use of fiscal policy and prioritised interest rate changes, which has reduced our growth rates, undermined employment, suppressed wages and more.

That ideology is what needs a ‘review’.

And urgently.

That is enough for today!

(c) Copyright 2021 William Mitchell. All Rights Reserved.

As I understand monetary policy, using the theory of so-called New Keynesianism , the idea is that the central bank loosens monetary policy, or lowers interest rates, to stimulate the economy and tightens to slow it down. The so-called ‘money supply’ increases when they lend and decreases when they don’t. This sounds superficially plausible.

However, we all know that when Commercial banks lend they aren’t adding any net overall spending capability to borrowers. You or I can can take out a loan from the bank, and go off to buy a car or whatever. But our borrowing doesn’t give us any extra pounds or dollars to spend over the course of the loan period because we have to repay them. If we include the interest we have to repay more than we borrow. The loan brings forward our spending ability to give us more in the shorter term at the cost of less in the longer term.

Only a currency issuing Government can give us a bit extra when the economy needs it. And can take it from us when it doesn’t, by using the sensible application of fiscal policy.

I’m not sure if this is entirely MMT consistent, I haven’t heard it said quite the same way, but it makes a lot more sense to me than all the usual neoliberal guff about ‘money supply’.

Central bank policy ,parcel of the whole neoliberal trend in macroeconomic policy. The essential thing underlying this, try to reduce the power of government and social forces that might exercise some power within the political economy-workers s and others-and put the power primarily in the hands of those dominating in the markets.

That’s often the financial system, the banks, but also other elites. The idea of neoliberal economists and policymakers being that you don’t want the government getting too involved in macroeconomic policy. You don’t want them promoting too much employment because that might lead to a raise in wages and, in turn, to a reduction in the profit share of the national income.

So, sure, this might increase inflation, but inflation is not really the key issue here. The problem, in their view, is letting the central bank support other kinds of policies that are going to enhance the power of workers, people who work, and even sometimes manufacturing interests. Instead, they want to put power in the hands of those who dominate the markets, often the financial elites.

Peter, it’s straight Monetarism, once QTM died a quick lonely death of empirical failure they lent on interest rate manipulation as a means of affecting the wider economy… Plausible? Check their record…

Reasons for the rich and powerful imposing NAIRU monetarism and fiscal austerity:

– inflation favours debtors over creditors

– the prospect of unemployment disciplines the work force

– privatised monopolies are a rentier’s wet dream.

No doubt there are more, but avowedly social democratic parties have been nothing short of treacherous.

Quite an interesting read on the ABC website today regarding the complicity of the media in manipulating the discourse on unemployment.

https://www.abc.net.au/news/2021-08-15/when-politicians-manipulated-employment-data/100368622