I have been thinking about the recent inflation trajectory in Japan in the light of…

Rising prices equal an inflation outbreak (apparently) but then the prices start falling again

In my daily data life, I check out movements in commodity prices just to see what is going on. As I wrote recently in my UK Guardian article (June 7, 2021) – Price rises should be short-lived – so let’s not resurrect inflation as a bogeyman – the inflation hysteria has really set in. I provided more detail in this blog post – Price rises should be short-lived – so let’s not resurrect inflation as a bogeyman (June 9, 2021). Yes, I stole the title of my article for the blog post if you are confused. The inflation hysteria really reflects the fact that mainstream economists are ‘lost at sea’ at present given the dissonance between the real world data and the errant predictions from their economic framework. They cannot really understand what is happening so when they see a graph rising it must be inflation and that soothes them because rising deficits and central bank bond purchases have to be inflationary according to their perverted theoretical logic. The financial market press then just repeats the nonsense with very little scrutiny. But given many graphs are falling again, this Pavlovian-type response behaviour must be really doing their heads in. I have no sympathy.

The inflation scare rises on a number

The accelerating inflation narrative was given a boost last week when the US Bureau of Labour Statistics released the May 2021 their latest Consumer Price Index data.

In their ‘The Economics Daily’ article (June 16, 2021) – Consumer prices increase 5.0 percent for the year ended May 2021 – we learned that:

The Consumer Price Index for All Urban Consumers increased 5.0 percent from May 2020 to May 2021. Prices for food advanced 2.2 percent, while prices for energy increased 28.5 percent. Prices for all items less food and energy rose 3.8 percent for the year ended May 2021, the largest 12-month increase since the year ended June 1992.

This set off all the inflation scaremongers but they really should have been more circumspect.

At least the US Federal Reserve Monetary Committee didn’t really blink.

In their June 16, 2021 (released on the same data as the BLS data came out) – Federal Reserve issues FOMC statement – they maintained policy settings and repeated that it was “committed to … promoting its maximum employment and price stability goals.”

It announced that:

The Committee decided to keep the target range for the federal funds rate at 0 to 1/4 percent and expects it will be appropriate to maintain this target range until labor market conditions have reached levels consistent with the Committee’s assessments of maximum employment and inflation has risen to 2 percent and is on track to moderately exceed 2 percent for some time. In addition, the Federal Reserve will continue to increase its holdings of Treasury securities by at least $80 billion per month and of agency mortgage‑backed securities by at least $40 billion per month until substantial further progress has been made toward the Committee’s maximum employment and price stability goals.

So no rush to an inflation is out of control narrative.

If inflation is accelerating why are long-term bond yields falling?

I gave an after-dinner address to a financial markets conference in Sydney last week and inflation was on everybody’s tongue during the dinner.

I was not surprised how quickly the narrative has turned in this way.

As I noted during the talk, the mainstream macroeconomics narrative is so far out of kilter with reality that proponents are just coping with the dissonance by going back to Pavlovian-type triggers.

See food, and eat it sort of stuff.

In their case, they have been seeing relatively large fiscal deficits and central bank asset purchasing programs and the only thing their defective model says about that sort of conjunction is rising interest rates and bond yields and inflation.

They cannot ‘understand’ the world in any other way.

So their only ‘contribution’ is to scream ‘rising inflation’.

Except that they have constant troubles dealing with the reality that confounds this response.

If the US economy was overheating and inflation was about to break out then why would long-term US bond yields be falling recently?

That is a question I posed to the dinner.

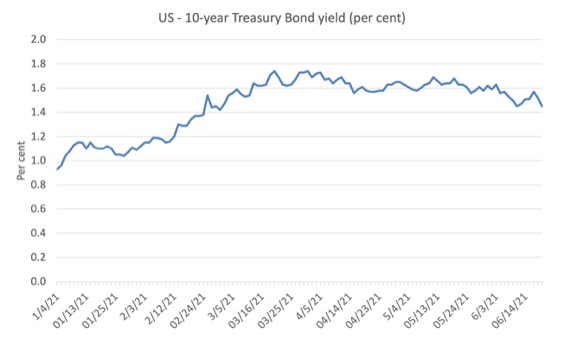

Have a look at the history of the US 10-year Treasury bond yields since the beginning of 2021.

You can get for all available maturities from the US Department of Treasury’s site – Daily Treasury Yield Curve Rates.

As the economy started to opened up a bit in February and sentiment improved, investors started to diversify their portfolios away from the risk-free Treasury bonds and yields rose a little.

Since mid-March, yields have flattened and now falling.

Why does this militate against the accelerating inflation narrative?

For those who are a little hazy about bond markets – or fixed income markets – a bond represents a future flow of cash returns which comprise regular ‘coupon’ (interest) payments that are fixed and the refund of the principal (face value) upon maturity.

Given there is no default or credit risk in holding a US government bond (or any bond issued by a currency-issuing nation) the only uncertainty that a investor faces is the path of inflation over the time that these cash payments are relevant.

I explained the relationship between movements in yields and prices of government bonds in this blog post – Whether there is a liquidity trap or not is irrelevant (July 6, 2011).

We also discuss the difference between primary and secondary markets in that post.

The simple rule is that when bond prices rises (fall) due to demand fluctuations, yields fall (rise).

Expectations of inflation become part of this dynamic because inflation reduces the real value of the these future cash flows.

So if investors expect that inflation is becoming an issue, then they will demand higher yields at the primary issue and will be prepared to pay less for outstanding bonds in the secondary market.

The higher the expected inflation, the higher the risk premium that will be built into required yields.

The bond investors closely watch the central bank’s monetary policy.

If they form the view that the policy interest rate that the central bank sets is too low, then they will up their inflation expectations (because they have been conditioned to believe this state will promote inflation), and demand higher yields at the investment maturities (long-term).

So the so-called yield curve, which depicts the current bond yields at all maturities will steepen.

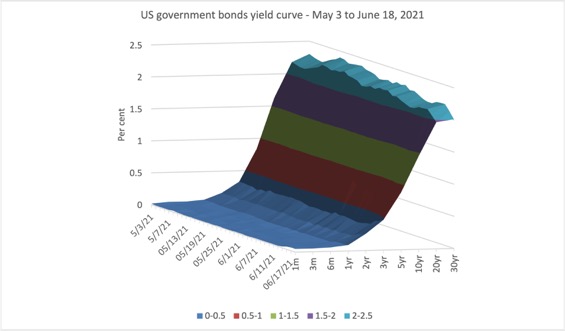

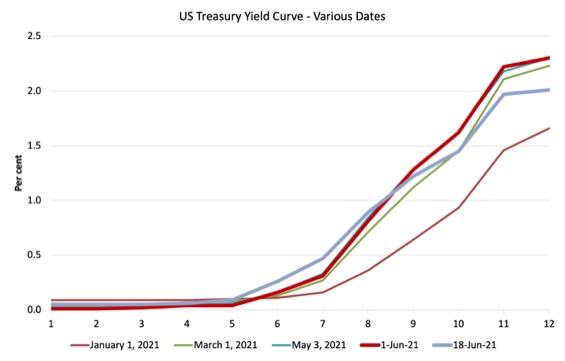

Here are two visual depictions of the US Treasury yield curve.

The first surface graph shows the movements across the maturities between May 3, 2018 and June 18, 2021.

The second compares yield curves from the beginning of 2021 to June 18, 2021.

You can see in this graph (which is easier to see than in the previous surface graph) that over June (compare the thicker red and blue lines), the yield curve is flattening rather than steepening.

If inflation was about to runaway, then we should not expect to witness that sort of dynamic.

US real wages down 2.2 per cent

One day after the US Bureau of Labour Statistics released the US CPI data, they released (June 17, 2021) the published an article – Real average weekly earnings down 2.2 percent from May 2020 to May 2021 – in their excellent ‘The Economics Daily’ publication, which highlights the big data news of the day.

The BLS reported that:

Real (adjusted for inflation) average weekly earnings decreased 2.2 percent from May 2020 to May 2021. The change in real average weekly earnings resulted from real average hourly earnings decreasing 2.8 percent from May 2020 to May 2021. The change in real average hourly earnings, combined with an increase of 0.6 percent in the average workweek, resulted in the 2.2-percent decrease in real average weekly earnings over this period.

No wages explosion visible there.

Nominal wages grew by 2.6 per cent only.

In May 2020, average (nominal) hourly earnings were $US29.74 and a year later they had crept up to $US30.33 (Source).

Average weekly hours had risen from 34.7 to 34.9 hours.

Which brings me to the data again

Here at the latest FT Commodities graphs – for Metals and Agriculture and Lumber as at June 18, 2021.

Metals

Agriculture and Lumber

Here are two more detailed graphs – for Soybeans and Lumber – over 2021 to June 18, 2021.

Soybeans

Lumber

Where are the screams of deflation?

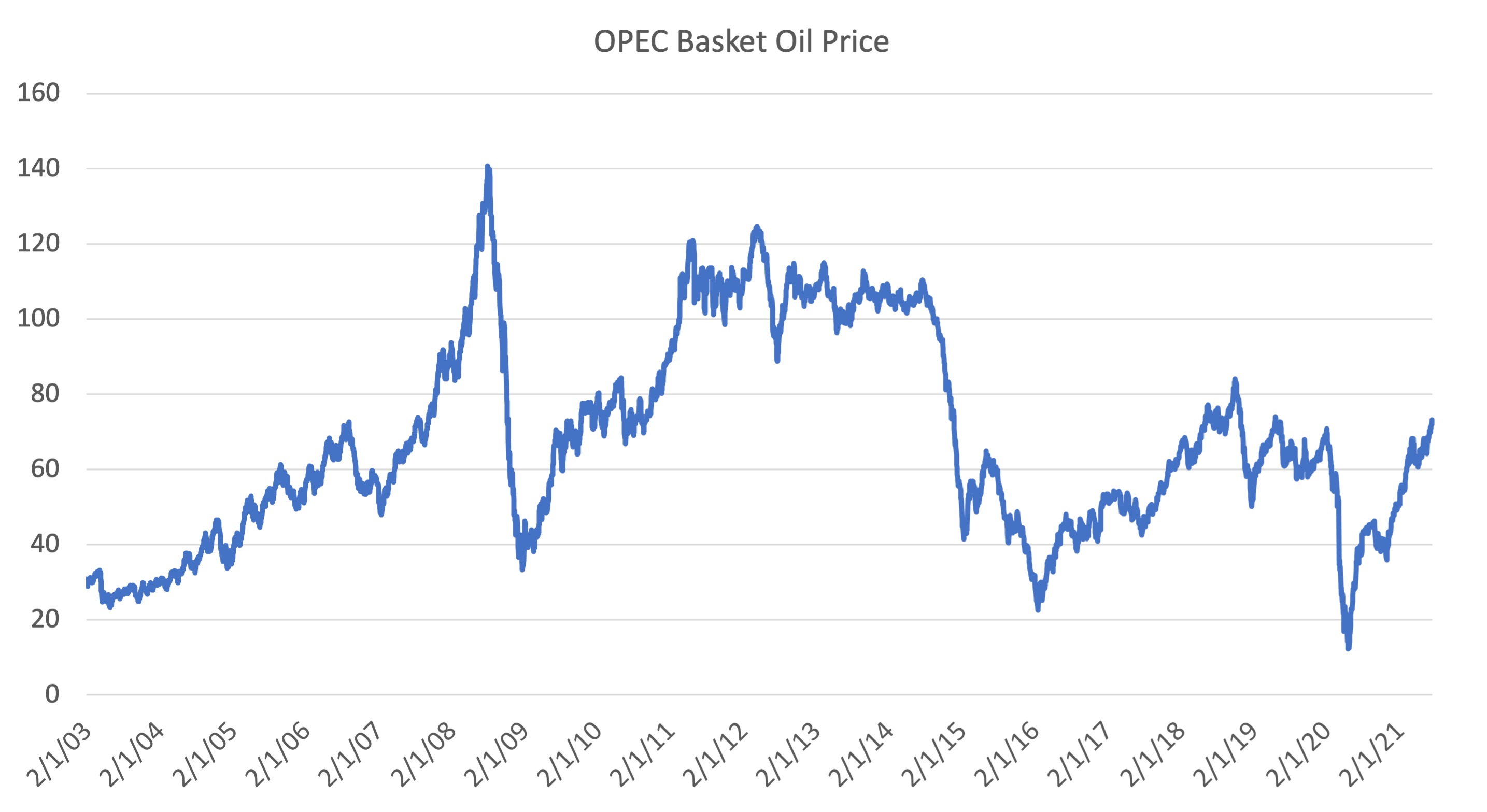

I could have shown the movements in energy prices, which have been used to give credence to the accelerating inflation narrative.

Here is the OPEC – Basket Oil Price – from 2003 to June 17, 2021.

Sure enough oil prices have risen in the last few months as more cars are returning to the roads.

This is just a reversal of the price falls that occurred when the cars left the roads during the lockdown.

Note that the current level did not yet reach the pre-pandemic level and in recent days has started to taper off (see the next graph).

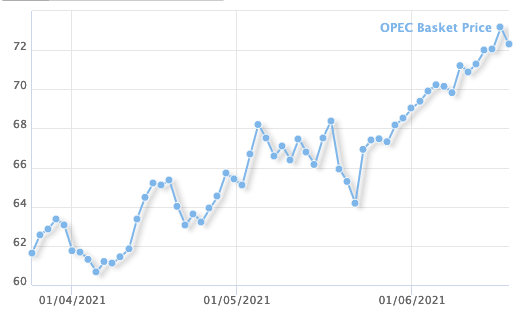

This graph shows the data from April 2021 to June 18, 2021.

Conclusion

I realise that it is easy to just be trapped by the data of the day, which doesn’t disclose underlying pressures and just reinforce one’s views.

And, to understand the inflationary potential one has to appreciate the levers that can be stimulated by some cost or demand triggers to generate a new inflationary spiral.

The point is that there are price pressures at present but I consider them to be transient as our economies and markets adjust to the massive disruptions in the global supply chains that have arisen during the pandemic.

And while in another era, these might have triggered a real wage-profit margin struggle between labour and capital, I cannot see the institutional machinery in place now to facilitate such a ‘battle of the markups’.

Trade unions are too weak and pernicious legislation has made it very hard for workers to fight for higher real wages.

That is enough for today!

(c) Copyright 2021 William Mitchell. All Rights Reserved.

“If the US economy was overheating and inflation was about to break out then why would long-term US bond yields be falling recently?”

The usual response to that is “QE”

Here are two sentences next to each other in what passes for economic opinion in the UK

To which the obvious answer would be “just do more QE then, targeting a price not a quantity”.

This catastrophic thought spiral thinking looks very similar to the thought spiral issues that are indicative of chronic depression and mental illness. Assuming of course they actually believe this stuff and aren’t just saying it to keep their place in the club.

Mainstream economics got itself trapped in a egg-chicken conundrum.

Who was born first, inflation or the monetary base?

So they say the monetary base will play the chicken and inflation will play the egg.

As Professors Bill Mitchell, Fabiano Dalto, Fadhel Kaboub and Caio Vilella showed last week, the cockroaches failed once again in giving the chicken the lead in the race.

The 1990s hyperinflation episode in Brasil was due to the will of the Brasilian government to protect the “savings” of the elites, because the interest rate of the treasury bonds was pegged to the inflation rate, which means that money was “printed” in response to inflationary pressures, that lurked elsewhere.

And, as science knows all-too well, the egg was there long before the chicken.

Dinosaurs layed eggs and dinosaurs didn’t have chicken farms.

Just looking around locally as we emerge from a couple of months of being locked down, there doesn’t seem to be a lot of inflation in prices of goods and services sold by firms, as predicted in recent weeks by the financial types on mainstream media. When will the embarrassment of being wrong when they publicly repeat the mainstream economists predictions finally motivate them to seek a more reliable source of information?

There is scarcity of some non locally sourced goods and materials and the quality of some non locally produced foods available at the market has declined significantly but these things have real world causes.

Many surviving smaller businesses are teetering on the edge of oblivion though and the covid supports from government will end in soon.

“And while in another era, these might have triggered a real wage-profit margin struggle between labour and capital, I cannot see the institutional machinery in place now to facilitate such a ‘battle of the markups’. Trade unions are too weak and pernicious legislation has made it very hard for workers to fight for higher real wages.”

Would strong Trade Unions be problematic for MMT?

great post as usual,

however , i am not convinced we can dispel a narrative that the long run has an inflationary bias., mainly because , the pandemic will lead to growing political instability around the world , which will lead to supply chain instability around the world.

the mmt guys shouldnt fall into the trap that the government and the mainstream economic fraternity are indulging in , in that once we are all vaccinated, and covid is defeated, we can go back to business as usual.

there are growing autarchic tendencies in the world, and that is not good for peace or prosperity.

On the discourse of inflation:

“If they form the view that the policy interest rate that the central bank sets is too low, then they will up their inflation expectations (because they have been conditioned to believe this state will promote inflation)”

I wonder how much inflation is created by expectations, rather than an intrinsic economic logic of causation. At the moment the private press and capital class commentators (including most economists) are performing a massive ‘downramp’ – to use stockmarketspeak – on government and state finance. As Bill wrote, they are conditioned to do so. But the MMT perspective shows that this ‘narrative’ is more or less wrong in its understanding of economic mechanics. Downramping is a self-interest behaviour that generally seeks to devalue a competitor and does not require the checks and balances of reality to be effective. If the stewards of capital decide that the State has overreached into their fiefdoms, a near-unanimous agreement that it is poisoning the economy as such generates its own conclusion, because the majority of people believe commentators are neutral and consensus is truth.

MMT obviously challenges this mythology. It makes sense that it is straw-manned constantly by the anti-statists. It will be correct in the long run, again, but the mainstream is adept in forgetting its failures.

all very persuasive and comforting

but personal experience (which I agree mostly unreliable) does suggest at least some wage pressures

Our farmer partner said he has significantly increased wages for farm help to attract staff

He has paid about 20% more for cartage to Melbourne

and 25% more to find a driver on permanent contract

of course he can afford to do this as farm income is booming and he needs more help for his expanding business

the stats reflect the data 3 months ago and I suspect there will some wages growth at least in some sectors in the reports coming out in 6 months time.

james wilson leitch: Farmers have had to significantly increase wages due to the migrant workers they normally underpay being locked out. Once the borders are open again, I expect all the wage gains in the sector to be wiped out.

Jeff Lucas

I doubt that there is any MMTer to consider trade unions problematic, on the contrary. During the great era of unionisation real wages grew in tandem with labor productivity and prevented the wage share from falling. However, in the early eighties Thatcher and Reagan on both sides of the Atlantic embarked on a concerted endeavour of dismantling unions with the disastrous consequences for workers. Real wages have stagnated ever since, and now most societies throughout the world are trapped in a state of extreme income inequality, save Scandinavian countries. So, how strong unions would be problematic for MMT?

When interest rates fall, bond prices rise. Why isn’t an increase in bond prices inflationary? Aren’t bond prices a key cost to consumers. They have to pay more for bonds in a falling interest rate environment. So while borrowers are major beneficiaries of falling interest rates, savers have to pay more for bonds because those rates have fallen. And since the government doesn’t need the money, are they issuing bonds to provide savings vehicles for investors?