I started my undergraduate studies in economics in the late 1970s after starting out as…

Podcast – What is modern monetary theory and could it fix Australia’s problems?

It is Wednesday and just some odds and ends today, including a fabulous tapestry that has just been framed for me. In addition, there is a podcast and some great music. A typical Wednesday that is. And tomorrow, I am catching a plane for the first time in nearly 6 months as the internal borders open up within Australia, which means I can return to my Melbourne residence/office. I am worried about what state the fridge will be in after being idle for so long. And, on Friday, December 18, my Melbourne band will be performing live for the first time since March 2020 via a live stream of the show to YouTube. Details will follow. As the restrictions ease and zero cases continue, life is looking more … well … open!

<--more-->

Guardian Podcast – What is modern monetary theory and could it fix Australia’s problems?

Some weeks ago I recorded a relatively long interview with the team at the Guardian podcast the Full Story.

The final editing melange came out last week (November 18, 2020).

The Guardian’s page is – HERE.

It runs for 30:42 minutes.

My only comment is that Martin’s description of Modern Monetary Theory (MMT) being effectively just “money printing” is inaccurate.

It implies that government spending occurs in all different ways depending on whether the the fiscal balance is in deficit or not and whether the central bank buys debt issued by the government or not.

The fact is that every day that government spends it creates new currency by crediting relevant bank accounts (or issuing instruments (cheques) that end up as bank credits). There is no printing involved.

I guess Martin was trying to say that MMT economists are relaxed about government spending without the accounting matching of new debt being issued to the non-government sector, which is certainly true.

Anyway, many thanks to Gabrielle Jackson and Martin Farrer and their production team for inviting me to do this and put the final version together.

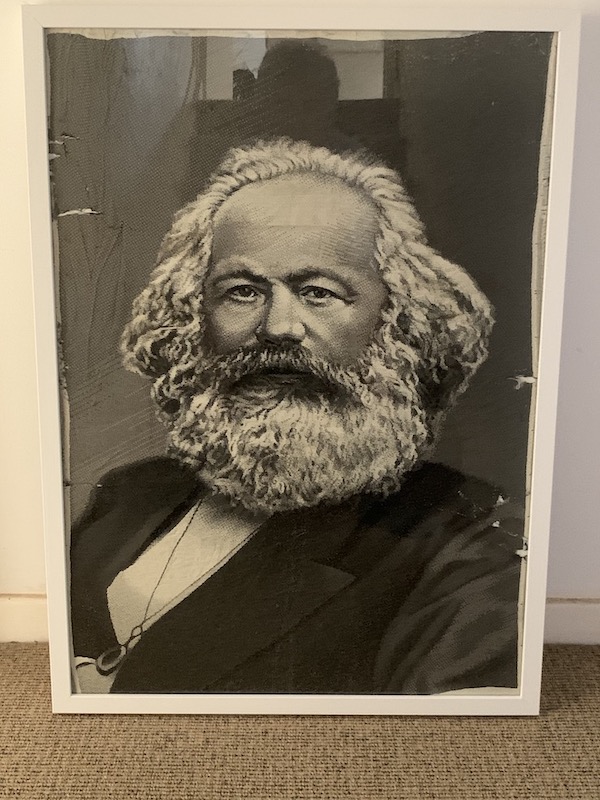

A relic framed

My best friend framed this tapestry for me as a gift.

I have had this tapestry since my teenage years (so it is very old). It was sold by the China Bookshop, which used to be in the now defunct Metropole Arcade off Bourke Street in Melbourne.

I used to haunt this shop as a teenager because it was one of the few places you could buy books from – Progress Publishers (Moscow) – Lawrence and Wishart (London) – and Foreign Languages Press (Beijing) – all sources of literature on Marx, Engels, Lenin etc.

The books were very cheap and I still have many of the volumes I bought in those young years.

They also sold posters and things like this tapestry, which I have kept since that time.

It is a bit worse for wear, given its age, but it now looks a treat in its new wooden glassed frame.

Music – The Necks

This is what I have been listening to while working this morning.

It is from the second album released by the Australian improvisation trio – The Necks – in 1990, called – Next.

This track is my favourite – The World at War – all 16:35 minutes of it.

I often play it while travelling and it brings a great sense of being to it.

I have seen the band live and they never disappoint. They just start with some motif and then improvise on that theme as they build the intensity and harmony of the piece.

The last time I saw them they only played 2 songs over a few hours but it was never dull.

Their drummer – Tony Buck – is one of the best.

This New York Times Magazine article (October 4, 2017) – My Obsession With the Necks, the Greatest Trio on Earth – is worth reading if you want to learn about this great band.

That is enough for today!

(c) Copyright 2020 William Mitchell. All Rights Reserved.

I did hear this podcast last week and I wondered how Bill would feel about the “printing money” comment.

Of course if people actually realized that what actually happens these days is that someone at the central bank just presses “enter” on a keyboard … now that would really set the cat among the pigeons!

Bullionists like David Ricardo and Robert Peel would have a fit!

At least “printing money” requires some effort and produces something you can hold in your hand. Now the vast majority of money exists as as nothing more than mere accounting entries stored in electronic form!

Of course there a 10 types of people in this world.

Those who understand binary digits and those who do not!

‘Modern Monetary Theory (MMT) being effectively just “money printing” is inaccurate’. It really is disturbing to find seemingly intelligent people spouting nonsense phrases. It’s like they have an urge to keep repeating baby language. How the heck do they think nurses or any other government employee or contractor gets paid, and moreover into their bank accounts.

Best wishes for your Melbourne return Bill. I will be waiting a while yet to see the state of my clothes left in apt in China, although it isn’t the covid problem there that’s causing the delay. Like the poster. When the money printers get to grips with computers, they might also be rather less dismissive of Marx’s critique of capitalism. Intelligent thought can prevail.

Not all countries have the power to “print Money” or adding some zeros on a computer screen.

The countries on the eurozone cannot print Money, because the ECB has it’s own political agenda, supposedly “independent” (…everything but…).

Countries that do have their own currency fall in two categories: 1) big countries like the US, the UK or Australia, with strong economies; 2) small countries, with fragile economies, sometimes dependent on tourism.

MMT applies 100% to the first category but care must be taken on the second.

“Printing Money” can only be effective if it promotes the growth of productivity, if firms are able to produce better goods/sell better services with less cost, due to a better public infrastruture.

If you spend public money building socker stadiums, you will not improve any productivity.

On the other hand, if the industry is so weak, that it cannot take advantage of better roads, better data networks, of better ports, then you’re might just get an inflation issue.

I see MMT as being PRECISELY what an “undeveloped” country needs to begin development in a way that does not mimic the people oppressing/planet-killing model of “richer” nations. Such a country would inventory its available resources and those readily obtainable in its own currency, however initially meager. Starting there, it would employ those resources in ways that meet, in an ecologically sensitive manner, as many essential needs as possible, building toward the goals of maximum sustainability and self-sufficiency. No doubt this would be a slow and incremental process, rather painful and frustrating at the beginning. And no doubt there would be opposition to overcome, internal and external. But once the vision was achieved to the extent permitted by this intimately interconnected and perversely financialized world, this newly and differently developed country would become a tourist mecca, showcasing the future of humanity assuming we have one.

Other Paulo:

That comes up again and again here as people come and go, and it’s a big roadblock in understanding. The point isn’t that money is infinite, as even Lagarde joined the chorus, the point is that deficit, debt and monetary base doesn’t tell you much of value; what’s important is what you can buy with it. That is core the of MMT, and yes, it means that countries dependent on currency exchanges don’t have as many options, but most problems in the real world come down to politics, both internal and external, and you can’t point to those metrics being any particular value as a problem.

That everyone should care about productive usage of resources is a given. 🙂

@Newton Finn

Loved to hear you on the MMT podcast, but I have to point out you were wrong; the deficit myth is still beating strong in the Eurozone, at least in the outskirts. Oh no, the democratic process forced an extra 60M€ for the private sector, what a waste to our future according to the editor of a major newspaper.

MMT is invaluable tool to understand economy.

However, I don’t think we give it credit enough on the fact that it destroys credibility of mainstream economics.

If humanity is to march forward, economics and its experts must be thoroughly debunked and discredited.

Hey Paulo Marques, what podcast was I on? Don’t recall being on one, but then again the mind is slipping……….

@Newton

Sorry, I’m terrible with names, it was another regular, Neal Wilson. Easy mistake to make, they’re very similar names… Cough.

Well, worth a listen if you haven’t, some nice stories there. MMT Podcast with Patricia Pino & Christian Reilly.

“the deficit myth is still beating strong in the Eurozone, at least in the outskirts.”

It took a century for Catholicism to disappear completely in England, but the break from Rome happened in 1534. At that point you could no longer appeal to the pope no matter what you believed.

Very difficult for anybody to appeal to the “there’ll be inflation and high interest rates” in a world that has dropped billions of new money out of nowhere to little change. Anybody doing that just looks old fashioned and out of date to anybody under the age of 50.

” From each according to his ability; to each according to his need.”

The portrait looks great.

The Necks are great. The music takes me back to nights in the late 70’s early 80’s spent at The Basement in Sydney.

Plenty of good comments on:

> “Martin’s description of Modern Monetary Theory (MMT) being effectively just “money printing” is inaccurate”

But my 2 cents worth on this is even more outrage. We cannot let such gross distortions of MMT pass without severe rebuke. I get it that plenty of heterodox types think economics cannot be a science, but it is supposed to be a professional discipline, and to parrot simplistic and damagingly inaccurate one-liners like that is not just bad journalism, it is deceitful and, when you really think deeply about it, a kind of murderous manslaughter. This is true even when it comes from “friends of MMT” or “MMT adjacent” econs like Jared Bernstein and Mark Blyth. In fact they are worse, because at least they’ve been exposed to MMT and should therefore know better. People die from austerity and hyperinflation fear hysteria thinking, but the ones dying are never those who are doing that thinking!

Yes, I agree with Paulo, the podcast with Neil Wilson was well worth listening to. I do enjoy that program and think Christian and Patricia do a great job of it. Newton, don’t worry about your mind- it is all there. Would not mind listening to a podcast you were in either 🙂