My friend Alan Kohler, who is the finance presenter at the ABC, wrote an interesting…

The GFC only temporarily interrupted the trend towards rising inequality

The UK Guardian Editorial ran a sub-header yesterday (January 21, 2018) “Democracies will fall under the spell of populists like Donald Trump if they fail to deal with the fallout of globalisation?”, which I thought reflected the misunderstandings that so-called progressive have about ‘globalisation’ and its impacts on the capacities of the sovereign state. The UK Guardian Editorial was responding to the release of the latest Oxfam report (released January 16, 2018) – An Economy for the 99%: It’s time to build a human economy that benefits everyone, not just the privileged few – timed to coincide with the gathering of “billionaires and corporate executives” at Davos this week. The Oxfam report reveals further staggering shifts in inequality across the globe, that the GFC barely interrupted. A major shift in political sentiment on the Left is needed to arrest these trends before they break out in destructive social instability.

Oxfam Report

The Oxfam Report (released January 16, 2018) – An Economy for the 99%: It’s time to build a human economy that benefits everyone, not just the privileged few.

The results are staggering really in their indecency.

While the rest of us have been sedated by mass consumption and Internet shopping, the top-end-of-town have been firmly focused on extracting as much of the pie for themselves as they can (at our expense).

We have acquires lots of fairly useless plastic bits and pieces and massive debts, they have accumulated massive gains in their wealth holdings.

Oxfam conclude:

1. “Since 2015, the richest 1% has owned more wealth than the rest of the planet.”

2. “Eight men now own the same amount of wealth as the poorest half of the world.”

3. “The incomes of the poorest 10% of people increased by less than $3 a year between 1988 and 2011, while the incomes of the richest 1% increased 182 times as much.”

4. “The very design of our economies and the principles of our economics have taken us to this extreme, unsustainable and unjust point.”

Oxfam argue that “despite world leaders signing up to a global goal to reduce inequality, the gap between the rich and the rest has widened”.

What the corporate leaders say should be disregarded by progressives politicians. They clearly do not operate in the interests of society in general.

Although it is becoming more apparent that rising social instability is the result of the redistributions of income and wealth.

The Oxfam Report is clear:

Left unchecked, growing inequality threatens to pull our societies apart. It increases crime and insecurity, and undermines the fight to end poverty. It leaves more people living in fear and fewer in hope.

I had a meeting with a visiting US academic over the weekend who was interested in my work on Reclaiming the State, which is the title of my recent book with Thomas Fazi – Reclaiming the State: A Progressive Vision of Sovereignty for a Post-Neoliberal World (Pluto Books, 2017).

In out conversation, I mentioned the contribution of Arthur J. Altmeyer who was the founding father of the American social security. Altmeyer famously said:

What motivates people and leads them to high endeavor is not fear but hope. (Arthur Altmeyer, 1968)

His contribution to the book – Social Security Anniversary 1968 – A Third of a Century – was entitled ‘Social Security and the Human Touch’.

At a ceremony, held in Washington on August 14, 1968, which was celebrating the 33rd anniversary of the signing of the Social Security Act, various key players gathered to witness the “Department of Health, Education, and Welfare’s Award for Distinguished Public Service” being presented to Arthur J. Altmeyer, who carried the nickname “Mr. Social Security”.

One of the Keynote speakers was the US Secretary of Health, Education and Welfare, Wilbur J. Cohen who was representing the President at the time, Lyndon B. Johnson.

Cohen commented on Altmeyer’s contributions to the welfare of disadvantaged Americans in this way:

To those who declared that if men were no longer afraid to lose their jobs America would become a nation of loafers, Arthur Altmeyer replied that there was a motivating force in the lives of men that was even stronger than fear-that force, he said, was hope. A democratic society, he said, must rely on hope and incentive rather than fear and compulsion to influence the conduct and aspirations of its citizens. And I think that is a worthy note for us to remember in the issues that face us today. Social security, he taught us, replaces fear with hope. As he put it, liberty means more than freedom to starve. It means a real opportunity to make the fullest use of one’s capacity. Far from destroying individual initiative and thrift, social security, by providing a degree of protection to families against the major vicissitudes that beset them in this modern and complicated and hazardous world, releases energies because it substitutes hope for fear as the mainspring of human endeavor.

In short, Arthur Altmeyer preached and practiced the idea that liberty and security are interrelated and that we cannot have one without the other. With this kind of faith that he demonstrated in man’s perfectability, with this kind of vision of democratic government …

Please read my blog – Why we should close the ‘unemployment industry’ (August 28, 2014) – for more discussion on this point.

That is Oxfam’s message as well.

The dramatic shifts in income and wealth inequality over ‘neoliberal era’ has been accompanied by increased use of fear by governments to ‘discipline’ those who have been left behind.

Governments obsessed with fiscal austerity these days (but not when it comes to handing out corporate welfare) invoke pernicious policy regimes that seek to punish the most disadvantaged in our societies and isolate them via nomenclature that casts them as lazy, corrupt, dishonest, and unmotivated.

They instill fear among those on the miserly income support that if they don’t comply with the regimes in place they will lose that support.

Oxfam lists several causal factors in the rising inequality:

1. “corporations increasingly work for the rich”.

2. “Squeezing workers and producers”.

3. “Corporations maximize profit in part by paying as little tax as possible”.

4. “Super-charged shareholder capitalism … corporations are increasingly driven by a single goal: to maximize returns to their shareholders” – see below.

5. “Crony capitalism – corporations … use their huge power and influence to ensure that regulations and national and international policies are shaped in ways that enable continued profitability.”

The Report also lists the “False assumptions driving the economy of the 1%” which include:

1. “The market is always right, and the role of governments should be minimized” – which has become key progressive Left dogma too.

2. “Corporations need to maximize profits and returns to shareholders at all costs” – see below.

3. “Extreme individual wealth is benign and a sign of success, and inequality is not relevant” – rising inequality actually undermines growth.

Please read my blogs on – Inequality – for more discussion on this point.

The Oxfam solution is to reestablish the “human economy” as the primary purpose of economic activity.

I have written about this many times.

Please read my blogs under the – Reclaim the State – category for more discussion on this point.

This blog (July 18, 2016) – Towards a progressive concept of efficiency – Part 1 – also outlines a model of a ‘human society’ in contradistinction to the neoliberal ‘free market’ (not!) model.

Oxfam wants governments that “will work for the 99%” by resisting the entreaties of the “wealthy minority and their lobbyists”.

They want a “a reinvigoration of civic space, especially for the voices of women and marginalized groups”.

This is the central theme of the manifesto we lay out in Reclaiming the State: A Progressive Vision of Sovereignty for a Post-Neoliberal World (Pluto Books, 2017).

Credit Suisse Report

The latest – Credit Suisse Wealth Report (released November 14, 2017) – revealed that:

… total global wealth has now reached USD 280 trillion and is 27 percent higher than a decade ago at the onset of the financial crisis.

And who is getting it?

The Report concludes that inequality:

… has been rising in all parts of the world since 2007 … the top 1 percent of global wealth holders started the millennium with 45.5 percent of all household wealth, but their share has since increased to a level of 50.1 percent today.

For Australia, the Report found that:

Switzerland (USD 537,600), Australia (USD 402,600) and the United States (USD 388,600) continue to occupy the rst three positions in the ranking of wealth per adult.

But, these ‘per capita’ aggregates are meaningless without accompanying distributional information.

The Fairfax report (January 22, 2018) – Inequality gap grows as Australia sees massive leap in billionaires – notes that:

… the level of wealth held by the top one per cent richest Australians in 2017 also grew 23 per cent, up from 22 per cent the previous year, while the wealth of the bottom 50 per cent fell and wage growth stagnated.

An Oxfam representative was quoted as saying that “The richest one per cent of Australians continue to own more wealth than the bottom 70 per cent of Australians combined. While everyday Australians are struggling more and more to get by, the wealthiest groups have grown richer and richer”.

Obsession with Shareholder Value

These trends towards rising inequality accelerated in the 1970s, when the idea of ‘shareholder value’ was elevated to primacy by corporations and their lobbyists.

There was an article in the Fairfax newspapers (January 18, 2018) – Is the ‘dumbest idea’ in capitalism on its last legs? – which argued that the mainstream views in corporate behaviour are now “finally falling out of favour”.

The concept of ‘shareholder value’, where companies “put returns for their shareholders (profits, dividends and stock price gains) over and above everything else” is now “being questioned”.

Milton Friedman wrote in his 1962 book Capitalism and Freedom that corporations should not be socially responsible but rather seek to maximise profits and increase shareholder value.

He believed that if companies were forced to engage in practices that were socially responsible, totalitarianism would result.

He reprised that sentiment in a New York Times Magazine article (September 13, 1970) – The Social Responsibility of Business is to Increase its Profit:

There is one and only one social responsibility of business – to use its resources and engage in activities designed to increase its profits so long as it stays within the rules of the game, which is to say, engages in open and free competition without deception or fraud.

The rub is in his “rules of the game” reference. These rules, some of which are set by governments, are continually targetted by the corporate lobbyists to reconstruct them in their best interests.

But the ‘rules’ also are conditioned by what society is prepared to accept and it is in this realm that the lobbyists, think tanks etc have been very active in trying to change the way the ‘rest of us’ think and feel about our share of the pie and the power that our elected officials have transferred to Capital.

Milton Friedman and his disciples were early venturers trying to recondition the way we felt and thought about the ‘economy’. What we should expect from it. What role governments should play.

Their goal was to instill the belief that if left alone the ‘market’ would self-regulate and deliver maximum wealth to all of us. Then shareholders would determine how much largesse was transferred via charity to the non-shareholder class.

That was to Friedman the exemplar of a free society.

Of course, the growing sentiment that ‘free markets’ would deliver better outcomes for all hasn’t panned out that way. The capture of the State by Capital has ensured that Friedman’s rhetoric was hollow.

And the obsession with ‘shareholder value’ has been, according to the Fairfax article cited above, “driven an explosion in executive compensation relative to worker pay, and is one of the reasons why inequality in the US is, on some measures, back at Depression-era levels.”

It has also “stifled investment” and shifted funds to unproductive financial markets.

The problem is, as the Oxfam Report indicates, is not confined to the US.

A recent Australian report – Because you’re worth it? Executive remuneration in the 2016/17 financial year – found that the “average CEO is paid 78 times the average Australian worker” and that:

CEO pay has risen 3.5 per cent in the past 12 months which is 46 per cent higher the average Australian worker, which has had a 1.9 per cent wage increase.

And, note, that for the average Australian worker, that nominal wage increase amounts to a real wage cut.

The Report argues that:

What seems to be happening is that the value contribution is not being spread across the organisation, but is being assessed on a macro level and thus credited to a limited number of people with companies …

As pressure builds on business to better align practices to community standards, remuneration is part of that discussion.

This is in line with the general discontent now being aired about ‘shareholder value’.

I last wrote about CEO pay in Australia in this blog (August 28, 2017) – CEO pay trends in Australia are unjustifiable on any reasonable grounds.

In fact, the ratio of CEO Statutory Pay to Total Average Weekly Earnings was 76.2 in 2001, peaked at 123.1 in 2007 at the height of the ‘greed is good’ frenzy and is now back to 85.2 and is rising again.

In that blog, I provide links and arguments to establish that the claim by the conservatives and the business lobby that these wage differentials were essential to attract top quality executives fails to find any evidence in the data.

There is no particular link between company performance and executive pay.

The US Economic Policy Institute Report (released June 21, 2015) – Top CEOs Make 300 Times More than Typical Workers – showed that:

… CEO pay gains are not simply the result of a competitive market for talent … high CEO pay reflects rents, concessions CEOs can draw from the economy not by virtue of their contribution to economic output but by virtue of their position. Consequently, CEO pay could be reduced and the economy would not suffer any loss of output … what the executives earned was not available for broader-based wage growth for other workers.

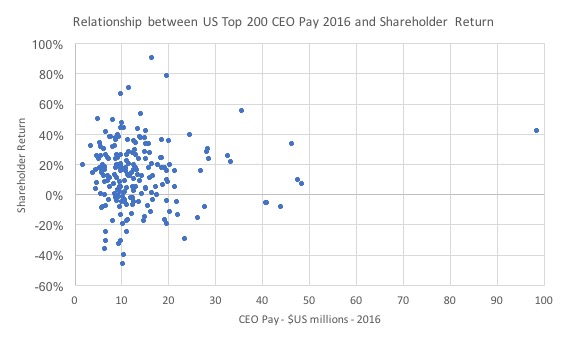

The following graph shows the CEO pay ($US millions) on the horizontal axis and the corresponding shareholder return (%) on the vertical axis for the top 200 companies in the US in 2016 (see Data source).

A CNBC report analysing the same data (June 4, 2016) – CEO raises don’t mean bigger shareholder returns – concluded that:

… there’s little evidence in the data that suggests a company’s performance is connected to increases in the chief executive’s pay.

In fact, the evidence suggests that the ongoing CEO salary binge is often at the expense of the well-being of their own companies – a sign that capitalism is once again getting ahead of itself.

We saw it at the end of the 19th century, which provoked the rise of trade unions and broad social movements designed to force elected governments to act more broadly in terms of the interests that it served.

These movements led to the Social Democratic era in the West. The lesson was that workers will only take so much and when their material living standards are so threatened, they retaliate and will not remain passive.

At some point, this neo-liberal era will be brought to an end by some similar type of worker reorganisation and uprising.

Reclaiming the State

Which all brings me back to the UK Guardian Editorial, which argues that “The very wealthy think they no longer share a common fate with the poor” and that:

… no company bosses will put their hands up to the fact they play one country against another in order to avoid taxes; no firm will be honest about their attempts to stymie trade unions or about how they lobby against government regulation on labour, environment or privacy that tilts the balance of power away from them and towards the public. The largest western corporations and banks now roam the globe freely. As memories of the financial crisis recede, they are going back to the myth that they are no longer dependent on national publics or governments. Lobbyists for the corporate world claim that markets are on autopilot, that government is a nuisance best avoided.

The lobbyists do not think “that government is a nuisance best avoided” but rather is the power that has to be co-opted into serving their interests.

The start of the paragraph and the end are inconsistent.

Capital needs government. It manipulates weak politicians who are guaranteed career paths post politics into the corporate world for abandoning their duty to advance public interest.

Capital rarely invades a nation with martial force and uses that sort of dictate.

And while “western corporations and banks” may “roam the globe freely” (which, in itself is not quite true anyway), the point point that is missed is that these corporate behemoths still have to sell their goods and services within nations, where laws are set by the nation state.

A nation state calls the shots and the Right know it. It is the Left-side of politics that has been duped into believing the nation-state is powerless in the face of these global trends in supply-chains and capital flows.

That is, of course, the argument that we set out in our latest book – Reclaiming the State: A Progressive Vision of Sovereignty for a Post-Neoliberal World.

Larry Elliot’s Guardian article (December 14, 2017) – Think our governments can no longer control capitalism? You’ve been duped – which reflected on our book wrote:

… the left has given up on the politics of class and concentrated on the politics of identity. And while this has led to some worthy victories, none of them has actually challenged turbo-charged capitalism, which has had the field to itself.

Even, yesterday’s UK Guardian Editorial acknowledged that:

In fact, government provides the infrastructure and investment that private enterprise needs. Government patrols property rights, giving inventors monopoly profits. When a crisis strikes, it is home governments that come to rescue of big business … When governments have stepped in, whether through bailouts or quantitative easing, it has generally further enriched the rich rather than the toiling classes. These matters are determined by policy choices. From afar it seems that the rules have been written to redistribute income upward. Those rules can be re-written, and it’s clear the world needs new progressive ideas …

In the absence of such measures and concerted international action on social dumping, populism will spread – aided by elite selfishness, introspection and its capture of the political process.

Exactly.

Yet this newspaper has been one of those leading the charge against Jeremy Corbyn, who Larry Elliot considers is “unembarrassed about espousing the politics of class”.

Elliot considers “Bernie Sanders is one; Jeremy Corbyn is another. Neither has bought into the argument – increasingly prevalent on the left since the 1970s – that nation states are powerless in the face of global market forces.”

‘We the people’ need to educate ourselves to fully appreciate the capacities of the state and to reject the lies that the mainstream political Left (the Blairites, the European Socialists, the US Democrats, the Australian and NZ Labor Parties, etc) pump out about the need to run fiscal surpluses and all the rest of the neoliberal litany that these characters have become besotted with.

We will then be better placed to demand our politicians serve our interests and corral the greed that defines the DNA of Capital.

Conclusion

The rising inequality will precipitate changes that will seek to arrest it.

This could be a chaotic process – similar to the rise of the National Socialists in Germany after World War 1.

But it could be a process that progressive politicians guide by reasserting the capacity of the nation state to serve the interests of everyone rather than the 1 per cent and their hangers on.

We should start with an education program, which would include the understanding that governments that issue their own currency and can never run out of money and can always use their unlimited financial resources to purchase anything that is for sale in its own currency at any time it likes, including the labour services of the unemployed labour.

A progressive government should employ no divide-and-conquer strategies to vilify one segment of the population who happen to be at the back of the unemployment queue.

As a collective we should stand with all citizens and demand from our governments that they cease attacking the welfare of the unemployed, who are in that state (overwhelmingly) because of failures by the government to run sufficient fiscal deficits.

A progressive government must ensure there is full employment, which means there should be enough work and working hours for all those who desire it.

It should regulate financial markets to ensure that the unproductive transactions are illegal.

A progressive government should ensure companies that sell goods and services within their sovereign borders pay their workers appropriately (wherever they may be), and limit CEO pay. If that is rejected then the products should be banned from sale.

And more.

Logo competition

I am launching a competition among budding graphical designers out there to design a logo and branding for the MMT University, which we hope will start offering courses in October 2018.

The prize for the best logo will be personal status only and the knowledge that you are helping a worthwhile (not-for-profit) endeavour.

The conditions are simple.

Submit your design to me via E-mail.

A small group of unnamed panelists will select the preferred logo. We might not select any of those submitted.

It should be predominantly blue in colour scheme. It should include a stand-alone logo and a banner to head the WWW presence.

By submitting it you forgo any commercial rights to the logo and branding. In turn, we will only use the work for the MMT University initiative. It will be a truly open source contribution.

The contest closes at the end of March 2018.

That is enough for today!

(c) Copyright 2018 William Mitchell. All Rights Reserved.

Really excellent article,Bill. I remember seeing the “shareholder value” article and was interested that it is starting to be on the nose. I am wondering however if we can get politicians to be less susceptible to vested interest largesse. I did see a presentation on the roll out of domestic electric services where the speaker was able to get results by seeing the protagonists resign their position when it was made clear to them that they were not upholding their oath of office. Unfortunately I lost the link. I think every politician is not upholding their oath to uphold the Constitution if they make laws or regulations that benefit one sector over another.

If there was a way to enact this then the vested interest weight would be lifted and government could begin to do its job. I guess we need some constitutional legal mind to look into it.

I should add that the Australian oath is only one of swearing allegiance to the Queen. The US oaths swear to defend/uphold the Constitution. So we need that type to be able to act.

John, are you serious? Have you noticed the effect which the US ‘pledge of allegiance’ has on discouraging the influence on politicians of lobbyists and wealthy donors? Neither have I, because there is none.

“Milton Friedman wrote in his 1962 book Capitalism and Freedom that corporations should not be socially responsible but rather seek to maximise profits and increase shareholder value.

He believed that if companies were forced to engage in practices that were socially responsible, totalitarianism would result.”

And now we see the consequence of this moral bankruptcy.

You don’t encourage greed, you just don’t.

Toynbee in today’s Guardian, ‘It’s not just Carillion. The whole privatisation myth has been exposed’, provides information that completely supports your contentions about the private sector in its role as provider of public services, particularly with respect to the UK PFI. The sector can’t and doesn’t provide adequate public services. In addition to the Carillion collapse, the National Audit Office lists a whole host of private failures in the public sphere, some companies appearing more than once in the frame. You couldn’t make it up.

This is off topic. The MMT macroeconomic text book is available for pre-order on Amazon. Just in case any one is interested.

I have pre-ordered mine.

IMO, the primary problem with inequality is the influence that inequality buys. So long as we allow money in politics, there can be no (real) democracy – the <1% has total control of our lives. That money could be removed with two simples rules: 1) No public servant is allowed to take outside money (for any purpose) or have direct outside business ownership. 2) No public servant is allowed to return to private practice. I don't see either as an impingement on personal freedom – simply requirements of the job. Nor would I expect any loss of candidates- just a different set (ie, public servants rather than wealth seekers.

Tom,

A businessperson must focus solely on making a profit (by providing products/services at minimal price and maximal quality). Attempting to do otherwise will lose to competition. It's the role of government to ensure that mission is not abused.

3. “The incomes of the poorest 10% of people increased by less than $3 a year between 1988 and 2011, while the incomes of the richest 1% increased 182 times as much.”

.

That is in total, 23 years, added the sum of $69 for the poorest 10%, while for the one percent $12558, a huge difference but still peanuts. Accumulated incomes gain for top one percent the paltry sum of $12558. There must be something seriously wrong with those numbers.

I’ve observed that something seems to happen to (many? most?) individuals who become employees of privately-owned profit-seeking corporate bureaucracies. Put simply, they lose their moral compass. I start from the proposition that the vast majority possess a moral compass to begin-with (I believe I did) which guides them intuitively as to what behaviours they should and which they should not countenance. Very quickly all that baggage is jettisoned and there ceases to be any ethical constraint upon the behaviours engaged-in (although most preserve some sense of there being a line somewhere which they wouldn’t be prepared to cross, in practice it’s a pretty fuzzy line). The individual becomes conditioned not to feel any compunction, is encouraged to ignore the dictates of his or her own conscience, at first unwillingly and guiltily but very soon as a simple matter of habit. The very few brave whistleblowers shine out like beacons precisely because they contrast so blindingly with the moral complicity of the vast majority of their fellow-employees (and I don’t exonerate myself by the way).

This unconscionable behaviour is rife within corporations: we see its outcomes every day in the wider society. Everything it touches it corrupts. From corporations it spreads into our political and civic institutions, the intelligence community, the military and law-enforcement agencies and the very machinery of state.

Its wellspring is the limited liability conferred upon the shareholders of a joint-stock company and the complementary, preposterous, legal fiction which makes a corporate body a person. Those twin (once excoriated but now deeply-entrenched) bastions of outrageous corporate privilege combine to absolve corporate servants and employees, from CEO down through the professional cadres to the salesperson, the security guard and the humblest employee, of personal responsibility for their own moral transgressions WHEN PERPETRATED IN THE CORPORATE BODY’S NAME. Only lawyers could have had the sheer gall to come up with such an unprincipled piece of casuistry.

By any normal commonsense definition, a corporate body is an inanimate thing not a person; a thing cannot be endowed with a conscience or any sense of right and wrong – any more than it can love or hate. Those are attributes attaching only to living breathing human beings.

If corporations are permitted (as they are) to make profit and shareholder-return their only lodestar that, combined with the subsuming of personal responsibility into an all-encompassing corporate accountability, which itself became deliberately emptied of all meaning by the way in which the law was re-framed starting in the 19th century and continuing down to the present day (with the aim of bringing about exactly that result), our society was foredoomed sooner or later to arrive at the dystopia in which we now find ourselves.

Who are those top 8 rich people worth more than 70 percent of the rest of the world ?