I started my undergraduate studies in economics in the late 1970s after starting out as…

When economists lose the plot entirely and show their colours

When I started studying economics at University, I had a lecturer in microeconomics who, thankfully, was an antagonist of the mainstream micro mantra about perfect markets and their capacity to deliver optimal, efficient outcomes for all. She is no longer with us but her early teachings have stayed with me (thanks Kaye!). She used to say that the market was like a voting system where the votes were cast in dollars. The rich have more votes and can sway the outcome in their favour. At the extreme, they can deprive the poor of the essentials of life, yet mainstream economists, who recite the mantra in those textbooks, would claim that outcome was optimal and efficient because supply and demand interacted to determine a ‘market-clearing’ price. For those who resisted the socio-pathological tendencies that arise from a complete undergraduate program in mainstream (neo-liberal) economics, it was obvious that the narrative was a fantasy. The real world is nothing like the requirements that the textbooks specify before ‘markets’ deliver optimal outcomes. Deeper study, not usually, taught in standard, mainstream economics programs also allowed one to understand that when the ‘market’ is not as specified in the textbook (read the real world) attempting to engineer ad hoc shifts towards that ‘idealisation’ probably resulted in even worse outcomes. At any rate, application of ‘perfectly competitive’ theory is fraught. And that is before we invoke basic morality and human valuation. Unfortunately, events like Hurricane Harvey, bring out economists who think it is smart to apply these ridiculous textbook models and claim authority over the rest of the citizenry. All they achieve is that they utter venal garbage and shame on the media outlets who give them oxygen.

In the wake of Hurricane Harvey, which has devastated significant parts of Texas including the large city of Houston. When the hurricane was doing its work, I was thinking about how people, who have already experienced a massive decline in their economic fortunes over the last three decades in that area would cope.

I recalled a report published last year by the Kinder Institute for Urban Research at Rice University – Disparate City: Understanding Rising Levels of Concentrated Poverty and Affluence in Greater Houston – which showed that:

The poverty rate of Harris County, which surrounds Houston, rose from 10 percent in 1980 to 17 percent in 2014. That alone is a troubling trend, but equally concerning is the increasing tendency in the Houston area for that poverty to be highly concentrated …

It concludes that economic segregation is tightening its grip on Harris County and that the area’s neighborhoods are increasingly economically polarized. There is a declining number of middle-class neighborhoods in the region, and Greater Houston is experiencing an increasingly stark division between the “haves” and “have nots.”

The research found that:

1. “From 1980 to 2010, the percentage of high poverty census tracts in Harris County more than quadrupled to 39 percent.”

2. “Harris County’s percentage of high poverty census tracts is nearly double the national rate of 20 percent.”

3. “These high poverty areas largely supplanted areas that were considered middle class in 1980.”

4. “Nearly a third of Harris County’s census tracts transitioned from having low poverty rates to high poverty rates from 1980 to 2010.”

5. “income diversity is most likely to be found in areas of high poverty rather than in wealthier neighborhoods.”

Their results are supported by numerous studies of increasing poverty and income diversity following the GFC. The pattern they uncover is replicated on a national level in the US, although the increase in high-poverty census tracts in Houston is much higher than is occurring nationwide.

They showed that while poverty in Houston used to be an inner-city (black) problem, over the last three decades (particularly the last decade), the problem has spread out and once middle-class suburbs are now considered to be high-poverty neighbourhoods.

The problem is not necessarily due to the GFC because, Houston overall has been a growing economy. The problem, which is nationwide, is that the benefits of growth have been captured disproportionately by high income earners at the expense of other workers who have endured flat income growth for some years and increasing costs.

So, in that context, how would these increasingly impoverished neighbourhoods cope?

I also recall reading a ridiculous Op Ed published (to their shame) by the Australian Broadcasting Commission on January 24, 2014 – It’s not just the rich who benefit from free markets.

It was written by a member of the Institute of Public Affairs, which is one of those right-wing think tanks in Australia that publishes propaganda in support of government deregulation and privatisation to help capital increase its share of the national income.

I say ‘to their shame’ because the Op Ed was base propaganda and should not have been published by our national broadcaster as if it was educative material.

The article was attacking an Oxfam Report – Working for the Few – that had documented well, the way in which the wealthy in the World had captured a disproportionate share of the growth over the last 30 years and the consequent rise in inequality.

Oxfam had conjectured that:

This massive concentration of economic resources in the hands of fewer people presents a real threat to inclusive political and economic systems, and compounds other inequalities – such as those between women and men. Left unchecked, political institutions are undermined and governments overwhelmingly serve the interests of economic elites – to the detriment of ordinary people.

The IPA retort (published by the ABC) was that:

Free market reforms haven’t just made the rich richer – they have also spread economic opportunities and helped lift millions of people out of poverty.

The author claimed that if the Oxfam recommendations were ever implemented they “would be a recipe for continuing impoverishment of the many.”

The basic claim though was that:

In an unhampered, free-market economy, the distribution of income is wholly determined by the interplay of mutually beneficial market transactions between sellers and buyers.

Incomes are attained by selling goods and services to customers willing to pay for them, and suppliers who most closely meet the needs and desires of consumers are rewarded with revenues that more than cover production costs.

The resultant inequality, therefore, derives from the personal choices of the millions, or even billions, of participants in the market process.

Which is the sort of rubbish that appears in the microeconomic textbooks.

The presumption is that there is an “unhampered, free-market economy” or there should be. There is not and there never has been. That is a problem with this sort of narrative designed to hide behind ‘scientific logic’ but barely able to disguise its ideological intent.

I will come back to that.

With that background, I came across a Forbes article this week (August 27, 2017) – Hurricane Harvey Is When We Need Price Gouging, Not Laws Against It – written by one Tim Worstall.

In that article, we saw the mindless ‘free market’, immature undergraduate textbook narrative repeated at a time of massive human crisis. It was indecent to say the least. Moronic is too kinder a description.

British-born Worstall lists himself as a “Senior Fellow of the Adam Smith Institute” and his bio tells us that he stood as a candidate for UKIP (UK Independence Party) and has acted as its propagandist (“press officer”).

UKIP is a right-wing, socially conservative (homophobic etc) and racist (anti-immigrant) political party. Its political narrative came out of the right-wing elements of the Conservative Party and promotes the sort of damaging policies that Margaret Thatcher extolled. They are also into climate change denial,

So you know the mire that Worstall comes out of.

When I read the Forbes article I tweeted:

And children of poorer families to die of dehydration … among other social catastrophes. Idiocy by economists knows no bounds really …

This blog expands on that 132 characters.

Interestingly, if you click the original link to the article on the Forbes WWW site – https://www.forbes.com/sites/timworstall/2017/08/27/hurricane-harvey-is-when-we-need-price-gouging-not-laws-against-it/ – you will come up blank.

A search of the Forbes site for Worstall, lists all his articles to as far back as you want to go.

But the article in question is now gone! So who withdrew it and why?

The link I provided above came from the Google cache, which is beyond the control of Forbes. Was the deletion of the article from Forbes a reflection that even their lax editorial standards had found that the rantings of Worstall had gone too far and their corporate ‘brand’ was being threatened?

Just as the IPA article (cited above) intoned the ‘free market’ rhetoric, Worstall also tried to argue from the undergraduate textbook position that students are forced to rote learn even though they know that it is intrinsically a fairy tale (gone wrong).

His argument was rehearsed by several journalists who wanted the ban on price gouging lifted.

On his own blog, Worstall ran a heading in relation to responses he had received on his Forbes article “There’s an awful lot of people who don’t get economics you know” – he provided a link to the article just in case we had all missed it (that link is the original and finds a ‘dead’ page).

The point is not that we fail to understand microeconomic theory. We understand it very well.

The point is, rather, that what Worstall calls “economics” – and the ‘economic theory’ Worstall’s argument doesn’t relate to the real world at all.

To attempt to use the this undergraduate textbook theory as if it has anything to say about the real world and how we should deal with complex policy problems is intrinsically dishonest.

The ‘theory’ is a concoction designed to advance the ideological interests of the elites. It was formalised as an antidote to the growing attraction of Marxism in the C19th.

In the Forbes article, Worstall wrote:

Hurricane Harvey has hit Texas and is doing a great deal of damage to both life and property. Which is exactly when we need, positively desire, there to be price gouging, instead of the laws we have against it. The basic underlying economics being that we want whatever scarce resources there are to be applied to their most valuable uses. Further, we want to encourage the provision of more supply of them–both of these being the things which the price system manages for us. That is, allowing prices to rise in the aftermath of a disaster does exactly what we want to happen.

He then railed against laws in Texas that prevented ‘price gouging’ of items in short supply. He said that we should “thank” the

“price gougers … for the good work they’re doing”.

According to Worstall the “economics of this is really terribly, terribly, simple”. If a product is in short-supply, for whatever reason, then “rationing by price is always the efficient way of doing this”.

He used the example of how the Hurricane had knocked “out the municipal water supply, leaving people needing bottled water” and thus favoured suppliers of such water gouging the market by hiking the price to as high as the consumer would go to get hold of the water.

We die without water. Hence my tweet!

He considered the price gouging would then lead to companies “trucking bottled water from Louisiana to Texas” in search of the higher profits and so supply would increase.

He consider this market response would also work because:

We want people to use less of the scarce resource …

That is, Worstall was advocating a situation where there was less clean, safe drinking water available to sustain life to those who were unable to pay the higher prices.

That is “really terribly, terribly, simple” isn’t it.

And he thought laws against allowing this sort of price gouging to occur was:

… going much too far toward that equity and against that efficiency.

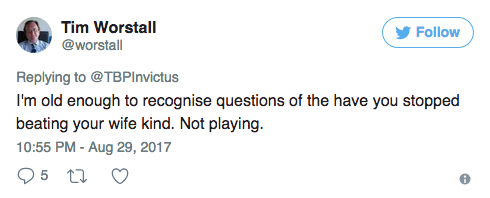

I checked his twitter feed and he had obviously been getting flack for his ridiculous stance.

The following image shows that he gave up arguing, resorting to attacking the questions for being loaded.

Typical.

A professor told me once when, as a student, I was pushing him on the real world consequences of the economic theory he was sprouting (as if it was knowledge) and its obvious disconnect with the data. that “when there is a conflict between the theory and the data, the data is wrong” (quote more or less).

These neo-liberal types also avoid scrutiny using the “do you beat your wife” defense. When cornered, they respond by saying ‘the question, sir, is loaded and assumes I was advocating beating my wife’.

No, the questions addressed to Worstall were different. Specifically, my tweet demanded to know whether he thought it was okay (“efficient”) for young children of poor families to be deprived safe drinking water because their parents did not have enough income to purchase it at the gouged prices.

By avoiding these actual, real world type issues, Worstall can just assert the immature undergraduate textbook conclusions as if they are some authority about the real world.

How do we deal with that view? Easy.

There is no such thing as a ‘free market’.

All these ‘markets’ that use prices to allocate resources are underpinned by highly unequal sets of endowments (the rich have more votes!) and a complexity of regulations, laws, and other constraints that work to reflect societal values.

There is nothing efficient about a person with a high income or stored wealth being able to corner the market for drinking water and then gouging consumers desperate for hydration.

High income earners or those with stored wealth always distort market outcomes because they have more ‘votes’. We would not tolerate an electoral system which openly (rather than implicitly) advocated giving votes out on the basis of income – a vote per dollar of wealth, say!

Why should a person with higher voting power in the market because of say inherited wealth (that is, they have done nothing themselves) be able to hydrate themselves and their children while poorer people with no voting power in the market are forced to do without?

This demonstrates that the concept of efficiency is loaded. What it means in the textbook version is that the allocation of resources via the price mechanism only generates so-called ‘normal’ profits, which are the return on capital that is just required to maintain the capital in that use.

Super-normal profits are not part of the efficiency story.

So what does Mr Worstall know about the structure of the water delivery market in the Houston and wider area? Are there any firms earning profits in excess of what is required to keep them in the water supply business?

Is there any capacity of firms to set prices in the Houston consumer market?

Do prices truly reflect the full cost of production – that is, do they fully include all external costs such as environmental costs?

If these (and more that I don’t have time to list) factors are not present, then what does Mr Worstall have to say about the second-best consequences of the Houston consumer markets?

In this blog – Defunct but still dominant and dangerous – I introduced the work of the late Kelvin Lancaster, who was an Australian economist who like many of my profession ventured to the US to graduate school because that was increasingly thought to be where it was at! Cultural and ideological cringe mostly.

In 1956 two economists (Richard Lipsey and Kelvin Lancaster) came up with a very powerful new insight which was called the Theory of the Second Best.

This was, in fact, a devastating critique of mainstream welfare economics and the type of reasoning that Worstall deploys.

You won’t hear much about the theory any more because, like all the refutations of mainstream theory, it got swept under the dirty neoclassical carpet and economics lecturers using homogenised, ideologically-treated textbooks continue blithely as if nothing happened.

In English, the Theory of Second Best basically says that if all the assumptions of the mainstream theory do not hold in a particular situation, then trying to apply the results of the theory in that case is likely to make things worse not better.

So “if one optimality condition in an economic model cannot be satisfied, it is possible that the next-best solution involves changing other variables away from the ones that are usually assumed to be optimal” (Source).

This is very applicable to the use of the model of perfect competition which requires several assumptions to be valid (for example, perfect information, perfect flexibility of prices, perfect foresight, no market power being wielded by firms, workers or anyone etc) for the main theoretical insights (results) to have validity.

Virtually none of the required assumptions apply in the real world.

So if they do not then it cannot be concluded that it is efficient to price gouge in a market where the essential characteristics of the textbook model are not fully present.

It is “really terribly, terribly, simple”.

Economists often say that governments should try to dismantle real world “rigidities” (as they call them), which would include laws that prevent price gouging, so that they can move the economy closer (but not to) perfect competition – because in their fantasy world textbooks this is the ideal state.

The Theory of Second Best tells us that if you do not have that “ideal state” and you dismantle one so-called “rigidity” but leave others then you can make things worse off.

The other point is that often it is “better” for governments to introduce new “rigidities” to confront existing departures from perfect competition.

The point is that the theory of second-best destroys the capacity of the mainstream economists to use “perfect competition” models, as in Worstall’s case, as an authority in the policy debate. The text book models have no legitimacy in the policy domain.

That is why you won’t read much about it in the newspapers or other media where economic policy is discussed.

So even before we invoke moral or other value type judgements, it is unlikely that it is efficient to allow price gouging in this situation.

It is also unlikely to be efficient to deprive a significant proportion of the population access to essential goods and services when society has invested so much in them by way of early health care, schooling, and other resources.

But, beyond those arguments, we note that the view that the economy is somehow separate from us and sacrosanct denies our essential humanity.

Research shows that humans intrinsically think it is better to have collective outcomes.

Think about sport. It is a major aspect of our collective lives. Millions of people watch it, play it and obsess about it every week.

We talk about competition – one team outcompeted another! That competitiveness is the secret to good sporting outcomes.

But that perception is fraught. We organise and regulate sport to suppress competition or at least harness it so as to elevate equity to ensure it remains interesting and exciting.

The ‘free market’ doesn’t exist in sport. We would not tolerate sporting competitions being distorted year after year by moneyed interests being able to deprive less moneyed clubs/teams of resources that would render the competition meaningless.

Even in the so-called heartland of market competition – the US – the US sporting teams revenue share to ensure there is evenness. Draft systems, salary caps, constraints on engine specifications, sizes of golf clubs etc are all designed to keep the playing field level – or at least interesting.

Our basic propensities appear to be collective and cooperative.

Please read my blog – Humans are intrinsically anti neo-liberal – for more discussion on this point.

So to bang on as if there is a ‘free market’ operating as in the textbook is quite obscene when you consider the real world consequences of his suggestions.

In Houston, where poverty has increased dramatically in the last three decades, and where drinking water is now being sold by private sellers at ridiculously high prices, the incentives are there for people without means to compromise their values and steal or else suffer dehydration and negative health consequences.

Young children dying of dehydration is not an efficient outcome for a society.

It would also be an indecent outcome and reflects a value system that had been distorted by a socio-pathological tendency.

Conclusion

It is no wonder Forbes withdrew the article. Even within the spectrum of lunatic articles they feel free to publish, Worstall went too far.

He disclosed the tendency of those trained in economics to engage in anti-people logic and deploy these textbook models as if they are reality and authorities.

Fortunately, society has a habit of winning out when the chips are down and these sociopaths should just get back in their dirty box and refrain from uttering their obscene but also non-authoritative garbage.

And that is from a person with a PhD in economics who understands it as well as anybody.

That is enough for today!

(c) Copyright 2017 William Mitchell. All Rights Reserved.

A brilliant article! Bill- looking forward to hearing you speak in Brighton.

I especially liked your reference to 1 dollar equal one vote. It is succint and explains a lot. It is particularly relevant to the once voting system in Northern Ireland which led to the Civil Strife there.

A landlord with a 10 room apartment was allowed 10 votes, so the electoral system was heavily weighed against the minority class. The ensuing revolt was to be expected.

“British-born Worstall lists himself as a “Senior Fellow of the Adam Smith Institute” and his bio tells us that he stood as a candidate for UKIP (UK Independence Party) and has acted as its propagandist (“press officer”).

UKIP is a right-wing, socially conservative (homophobic etc) and racist (anti-immigrant) political party.”

Homophobia, eh? My time as press officer meant working rather hard to get elected the UK’s first transgender (and also lesbian) MEP, my co-press officer was bisexual, our phone bank manager, who went on to become an MEP for Ukip at the next election, is gay, that sure does look like a lot of homophobia there. And that’s just the people I know well enough for me to know anything about their sexuality.

On the economics clearly we disagree

Worstall is just another scumbag.

By the way, interesting comment: “The ‘free market’ doesn’t exist in sport. We would not tolerate sporting competitions being distorted year after year by moneyed interests being able to deprive less moneyed clubs/teams of resources that would render the competition meaningless.” I think the Spanish football league suffers precisely from this problem. Barcelona & Real Madrid have more money, get the best players and have won nearly all the championships since then. We need to get rid of the “free market” in Spanish sports.

” . . . because supply and demand interacted to determine a ‘market-clearing’ price.”

I think this is a nice summary of why there is no empirical evidence whatsoever that demand equals supply in any market.

“This “equilibrium” graph (Figure 3) and the ideas behind it have been re-iterated so many times in the past half-century that many observes assume they represent one of the few firmly proven facts in economics. Not at all. There is no empirical evidence whatsoever that demand equals supply in any market and that, indeed, markets work in the way this story narrates.

We know this by simply paying attention to the details of the narrative presented. The innocuous assumptions briefly mentioned at the outset are in fact necessary joint conditions in order for the result of equilibrium to be obtained. There are at least eight of these result-critical necessary assumptions: Firstly, all market participants have to have “perfect information”, aware of all existing information (thus not needing lecture rooms, books, television or the internet to gather information in a time-consuming manner; there are no lawyers, consultants or estate agents in the economy). Secondly, there are markets trading everything (and their grandmother). Thirdly, all markets are characterized by millions of small firms that compete fiercely so that there are no profits at all in the corporate sector (and certainly there are no oligopolies or monopolies; computer software is produced by so many firms, one hardly knows what operating system to choose…). Fourthly, prices change all the time, even during the course of each day, to reflect changed circumstances (no labels are to be found on the wares offered in supermarkets as a result, except in LCD-form). Fifthly, there are no transaction costs (it costs no petrol to drive to the supermarket, stock brokers charge no commission, estate agents work for free – actually, don’t exist, due to perfect information!). Sixthly, everyone has an infinite amount of time and lives infinitely long lives. Seventhly, market participants are solely interested in increasing their own material benefit and do not care for others (so there are no babies, human reproduction has stopped – since babies have all died of neglect; this is where the eternal life of the grown-ups helps). Eighthly, nobody can be influenced by others in any way (so trillion-dollar advertising industry does not exist, just like the legal services and estate agent industries).

It is only in this theoretical dreamworld defined by this conflagration of wholly unrealistic assumptions that markets can be expected to clear, delivering equilibrium and rendering prices the important variable in the economy – including the price of money as the key variable in the macroeconomy. This is the origin of the idea that interest rates are the key variable driving the economy: it is the price of money that determines economic outcomes, since quantities fall into place.

But how likely are these assumptions that are needed for equilibrium to pertain? We know that none of them hold. Yet, if we generously assumed, for sake of argument (in good economists’ style), that the probability of each assumption holding true is 55% – i.e. the assumptions are more likely to be true than not – even then we find the mainstream result is elusive: Because all assumptions need to hold at the same time, the probability of obtaining equilibrium in that case is 0.55 to the power of 8 – i.e. less than 1%! In other words, neoclassical economics has demonstrated to us that the circumstances required for equilibrium to occur in any market are so unlikely that we can be sure there is no equilibrium anywhere. Thus we know that markets are rationed, and rationed markets are determined by quantities, not prices.”

The ‘rich’, on aggregate, do have more electoral votes?

How the ‘poor’ in the US are disenfranchised?

“And it’s deadly. Doubtless, Crosscheck delivered Michigan to Trump who supposedly “won” the state by 10,700 votes. The Secretary of State’s office proudly told me that they were “very aggressive” in removing listed voters before the 2016 election. Kobach, who created the lists for his fellow GOP officials, tagged a whopping 417,147 in Michigan as potential double voters.”

For those who think UKIP has no history of homophobic remarks consult this page:

http://www.pinknews.co.uk/2014/05/22/eight-of-the-most-homophobic-things-ukip-candidates-and-supporters-have-said/

The examples given only scrape the surface.

best wishes

bill

Can you expand upon ‘It was formalised as an antidote to the growing attraction of Marxism in the C19th.’ or point me to a text or journal talking about that? I’m a noob to the history behind the theory, and I’d love to have a reference or two to read about the way in which the beloved ‘free market’ was explicitly propaganda from the start.

Relating to Harris County’s problems, The Fed has been checking banks to see how much cash they have so it can be given out to flood victims. I saw this news just a couple of days ago. As we suspect, MMT ideas actually make it to action when the need arises. They might even print more to fill any shortfall.

Good points, as usual, Bill. Pity Jane & Joe Sixpack are pre-conditioned in school to believe orthodox propaganda.

my intro analogy for J&J 6pack:

militaries learned long ago that letting generals hoard all the weapons does NOT make a winning military – at some point it’s self defeating

the most secure people are those surrounded by adequately provisioned, educated & practiced constituents

if Generals & Admirals have understood that for >2000 yrs, why can’t orthodox economists?

Until someone writes similarly simple messaging into the comics that 8yr olds start with … we’ll be facing an uphill battle to reduce our Output Gap

So glad to come onto this blog today as I have been trying to explain something similar to several people over the past few days. Unfortunately I am not as articulate in explaining the concepts above. I was originally introduced to similar criticisms in the CFA curriculum. The curriculum claimed that the “market clearing theory” was originally intended to be an analytical framework for assessing the price level. It went through the reverse engineering process that academics go through to develop understanding of different phenomenon. In this context, reverse engineering means to start from scratch and add assumptions until reaching the condition you are seeking, in this case the equilibrium price level. All this does is give us a way to understand why a price would diverge from its equilibrium. For example, if the equilibrium price is $2 but it should be $3, the divergence must be being caused by a violation of one of the assumptions. The problem came about when we decided that the market clearing price is an optimal policy goal. As Bill discusses above, unless you could somehow recreate the entire set of assumptions, the theory does not hold. Its not like you automatically get closer to the market clearing price by partially creating only a portion of the assumptions. Some of the assumptions are impossible on a stand alone basis (i.e. infinite time horizon), and others are contradictory. For example, the theory assumes a market free from government interference and perfect information of buyers and sellers; however, we know that government must intervene to get anything approaching perfect information. Just seems that the issue is more with the application of theory in real world then with the theory itself.

Looks like the price gouging post was moved to a different website:

http://www.washingtonexaminer.com/in-houston-after-hurricane-harvey-price-gougers-have-the-moral-high-ground/article/2632942

Text from: It’s not just the rich who benefit from free markets:

As recently discussed by American economist Mark Perry, about 5 per cent of the population lived on $US1 a day or less in 2006 compared with about 27 per cent in 1970, a massive decline in global poverty of 80 per cent.

Assuming that this change is a result of free market / trade and all the outsourcing of jobs / importing low cost crap from SE Asia: Is it beneficial for humanity for 1 westerner to go into poverty so that 10 easterners can be lifted out of poverty? If so, is not free market / trade not beneficial for humanity as a whole? And won’t things even out in many decades / centuries (easterners on the whole become wealthier and westerners on the whole become poorer)?

Not saying one way or the other if free market / trade is responsible for the drop in poverty, or if the evening out point will be 99% of world just scraping by, but it is an interesting philosophical thought.

Speaking of free markets, Worstall authored this (and linked from his Twitter):

https://capx.co/theres-no-such-thing-as-a-free-market/

He states this obvious fact. But then of course then goes on to explain how 4 providers is close enough so all the acedemic modeling is correct.

I mean, does he look around him? My favorite is airplane flights. I am right now looking to fly. The gigantic airport closest to me has 8 carriers that go to where I want to travel. However, the cost is about half to fly from the airport 1 hour away that has only 4 airlines total and less than 5% of the flights (and of course the second flight after the connection is on the exact same plane). If this 4 provider nonsense were true, flights from most any airport would be priced approximately based on distance (with higher prices for better times of day) which they obviously are not.

@Steve

A lot of the reduction in poverty is due to the success of China, a country that doesn’t follow the script sold from the IMF and other pro-free markets institutions.

For the rest, ( from https://www.theguardian.com/global-development-professionals-network/2015/nov/01/global-poverty-is-worse-than-you-think-could-you-live-on-190-a-day ):

“The World Bank didn’t raise the poverty line at all – it simply “rebased” the old line to adjust for depreciation in the purchasing power of the dollar. The bank claims that the new poverty line is roughly equivalent to the old line, in real terms. But in effect it is actually significantly lower, and therefore makes it seem as though there are fewer poor people than before.

This is why the bank has suddenly announced that the global poverty headcount has decreased by 100 million people overnight, and that the poverty reduction trend has been declining more rapidly than we used to believe.”

Robert:

The drop in poverty claimed by the “not just the rich benefit” article was from this post:

http://www.aei.org/publication/chart-of-the-greatest-and-most-remarkable-achievement-in-human-history-and-one-you-probably-never-heard-about/

My question really was not about the accuracy of any of that though. It was more philosophical? Is it better to improve the lives of hundreds of millions of the very poorest if it results in more suffering for tens of millions of people that are OK? And if that can be achieved by more free trade, then should it?

I suppose it’s safe to assume Mr. Worstall actually studied the economics he speaks of.

Narcissistic Psychopaths More Likely to Major in Business and Economics, Study Finds

Kimberly Lawson, May 9 2017 From the Vice website.

Never mind the “homophobic” Worstall. What about the “etc”? You know, the racism, the xenophobia, the jingoism …

Magpie,

Technology improves year after year, yet people are becoming harder and harder to make a living by working longer and longer hours.

Markets and businesses are so overrated by the right wing. Americans go to Mexico in droves to get seen by dentists. The problem is too much market and too much vested interest.

As a nation, you need doctors to take their of its old people, but you saddle medical students with debt.

IMF and world bank lay waste to everything it touches. Rent-seeking becoming the norm. Corporations in control of everything. Everyone is in debt. I am still waiting for the next crash.

Yet, somehow this is progress.

Bill just mentioned that Harris county having more poverty than it used to. Shouldn’t economics be lifting people out of poverty instead of putting more people in it?

I think you can add insanity to tendencies for people who enter economics/business. You may also add supreme arrogance, too.

On Tim Worstall,

“On the economics clearly we disagree.”

Right, the right-wing side has always had their homophobic and racist tendencies. They are complete warmongers and corporate-owned. The left got into bed with the same wall street corrupters and now nobody represents to regular people. Even now, say what you want about the left, the right is against climate change consensus and environmental protection. The right wing riled up its base and more extreme with the Southern Strategy. Neo-nazis and KKK are all from the right-wing. Libertarians (corporate dictatorship sympathizers) and conspiracy theorists are also right-wing.

Somehow they get economics right. Sounds legit.

Only thing keeping some people in the right wing is cognitive dissonance and the need to make a living — I can’t be wrong! I have invested too much time in this. I need to pay the bills!

Sad.

Right-wing commentators and pundits are corporate stooges. They can take the rich’s money, but I get to spit their your faces (not even literally).

Please don’t pretend the right-wing has anything to add on any conversation about any policy. I live in America as a young adult, and I have never heard of right wing doing anything good for the citizens of United States and the world. The right-wing just wants to bring on Hell-on-Earth. I don’t even mention the right-wing in my regular political conversations because they are so transparent about their corporate objectives and their disregard for citizens of the world that criticizing them is a waste of time.

Finally, I read a bit of Steve Keen’s book Debunking Economics. In his book, he cited a study that states 95 percent of studied businesses chose a curve that was opposite to marginalist theory. All the fiscal contraction expansion, supply and demand curve, efficient market hypothesis are all ridiculous. Your economics is garbage so please stop promoting it as it hurts people.

Depressing but so true.

“We would not tolerate an electoral system which openly (rather than implicitly) advocated giving votes out on the basis of income – a vote per dollar of wealth, say!”

Unfortunately we have accepted through ignorance or neglect parliaments that legislate not in accordance with the best interests of constituents but in accordance with the wishes of the elites and governments that on the really important issues also act for the elites in violation of our constitutions. Our political representatives in most of the major parties have in general become harlots for hire and are overwhelmingly influenced by campaign donations, offers of lucrative post political career opportunities, threats for not towing the line, mass media support or opposition and highly effective lobbying by very talented and manipulative individuals and organisations. The honest and fair minded politician will soon face overwhelming obstacles.

We have a few exceptions and Bernie Sanders and Jeremy Corbyn come to mind and I think the Australian Greens are way ahead of the rest and being ‘humanist Keynesians’ are not far from the progressive MMT proponents policy position. For example Greens policy is ongoing fiscal deficits of 3% of GDP, repairing our very damaged progressive taxation system along with a very comprehensive social and environmental protection program.

https://m.youtube.com/watch?v=5tu32CCA_Ig

On economics you have my full attention and admiration. UKIP is clearly wrong in their understanding of how an economy really works. But they do have some decent populist policies. But UKIP is not homophobic in their published policy. I could cherry pick from Labour members and show they are bigots who deny there is terror. In fact UKIP wants to stop migrants who hold homophobic views. You should agree! As far as racist goes what is your case? They want to limit the migration of homophobes, many of whom happen to be Islamic. Have you ever read the Qu’ran? Do you know what the Hadith are? The Sira? Have you put any time into studying these? I don’t think so. Please limit the name calling. It does not serve you well.

Yes, the rich have the most votes in the economy but they are also the most so-called creditworthy of what is, due to extensive government privileges* for private credit creation, the PUBLIC’S CREDIT but for private gain.

Therefore, we should end those privileges, no?

*e.g. What need for government insurance of private liabilities, including privately created liabilities (“Bank loans create bank deposits”) when all citizens should be allowed inherently risk-free accounts at the central bank or National Treasury itself? Cui bono that they can’t if not the banks and the most so-called creditworthy, the rich?