Well my holiday is over. Not that I had one! This morning we submitted the…

Australian PBO – hard to take seriously – is it vaudeville or what?

The Australian government is currently engaging the population in an agonising discussion about taxation reform and proposed spending cuts. It is almost vaudeville when the Treasurer, or the Opposition Shadow Treasurer or some business leader gets up and gives us their ‘two bob’s worth’ of nonsense. We have a “revenue problem”, “no we don’t, we have a revenue problem”, “we need to raise taxes”, “no we don’t we need to cut spending”. Then the government appoints a former investment banker as Treasury Department head and he starts raving on about how government should limit its spending to a maximum of 25 per cent of GDP without any argument being provided as to why that limit is meaningful, how it is derived, how it can be achieved if desirable, and all the rest of it. Sounds like a good idea. The Eurozone has destructive fiscal rules (Stability and Growth Pact) that we just whipped out of thin air and sounded important. We may as well, like dumb sheep, follow the race to the bottom. Meanwhile, real GDP growth falls further below trend and the disadvantaged workers endure elevated levels of unemployment and hardship. It is enough to drive one to drink. And then yesterday, the Australian Parliamentary Budget Office (PBO), which is one of those neo-liberal concoctions introduced by governments around the world to deflect responsibility for decisions from the politicians and frame the public debate in a particular way, published a new report (February 3, 2016) – National fiscal outlook – Report no. 01/2016. The mind boggles how people can write this stuff and go homeat night and take themselves seriously.

The PBO considers the fiscal situation as at the 2015-16 mid-year fiscal updates (which were provided in December 2015) and you get a clear idea of its ideological slant in the first sentence:

The national fiscal outlook has deteriorated significantly since the Commonwealth, state and territory governments delivered their 2015-16 budgets.

What exactly does “deteriorated significantly” mean in the context of a currency-issuing government such as Australia? Answer: not much.

It is language designed to inculcate in the public’s mind that when the fiscal deficit rises (gets larger) it is deteriorating, which means it is bad.

Alternatively, it indoctrinates the public into believing that when the fiscal balance moves towards or into surplus it is improving, which means it is a preferred option.

What if the fiscal deficit was 1 per cent of GDP and rose to 2 per cent of GDP as new large-scale public works programs stimulated employment and unemployment fell from 6 per cent to 5 per cent?

Would we consider that a deterioration that made any sense?

What if the fiscal deficit fell from 2 per cent of GDP to 1 per cent of GDP as government austerity impacted poorly on economic growth and unemployment rose from 5 per cent to 6 per cent?

Would we consider that an improvement that made any sense?

It is only when the discussion about fiscal statistics (spending and taxation) is conducted as a stand-alone exercise and deliberately divorced from any context relating to the real economy – production, employment, and unemployment.

Once we realise that the fiscal balance at any point in time is of no particular interest in itself, and must be interpreted in the context of what is happening in the real economy then ridiculous statements that the “national fiscal Outlook has deteriorated significantly” become transparent in their idiocy.

From the perspective of Modern Monetary Theory (MMT) perspective, national government finances can be neither strong nor weak but in fact merely reflect a ‘scorekeeping’ role.

And then you open the newspaper this morning and see that a Fairfax journalist has chosen to uncritically plagiarise the same ridiculous assessment.

See – Australia’s fiscal deficit billions worse than expected, Commonwealth largely to blame

We read in the journalist’s first paragraph that “The combined health of Australia’s federal and state budgets has deteriorated significantly since they were published last year.”

So the journalist adds the ‘sick person’ metaphor to the ideological slant that rising deficits represent a deterioration.

Among the other neo-liberal frames in the article:

2nd paragraph – “deterioration”.

3rd paragraph – “national fiscal deficit … is projected to deteriorate by $34.1 billion more than expected over the next four years”.

6th paragraph – “falling government revenues are mostly to blame for the multi-billion dollar blowout”.

8th paragraph “pushed the government’s fiscal balance further into the red”.

10th paragraph – “the fiscal balance of the Commonwealth budget is now projected to be $27.3 billion worse than expected …”

11th paragraph – “The remaining deterioration in the national fiscal balance ….”

12th paragraph – “It means Australia’s national fiscal deficit is projected to deteriorate by $34.1 billion more than expected …”

16th paragraph – “Shadow Treasurer Chris Bowen said Labor has supported more than $30 billion worth of improvements to the Budget bottom-line …”

And so it goes … Just a constant barrage of irrelevant terminology and ideologically-framed words.

Please read my blog – Framing Modern Monetary Theory – for more discussion on this point.

You also might profit from reading – How to discuss Modern Monetary Theory and watching – Framing Modern Monetary Theory – Presentation

Okay – so after reading this type of article everybody goes back to their lives and takes with them the message of the article – the spurious conclusion – DEFICITS ARE BAD, RISING DEFICITS ARE WORSE, A NATION IS SICK WHEN THERE IS A RISING DEFICIT AND MEDICINE NEEDS TO BE INTRODUCED TO CUT THE DEFICIT.

They never really learn anything about what the concept of a fiscal balance is. The article contained zero critical analysis or educative material.

The article doesn’t differentiate between a rising deficit due to discretionary stimulus and a rising deficit due to a faltering economy, in part, as a result of prior attempts to cut discretionary net spending.

It contains no mention of the elevated unemployment, which is directly due to previous attempts by government to cut its deficit at a time when non-government spending could not support sufficient growth to reduce unemployment.

It doesn’t inform the reader that the rising deficit in this case is helping to put a floor in the declining real GDP growth rate through the function of the automatic stabilisers – in this case, declining tax revenue and rising welfare payments.

That is what passes for journalism in our national daily papers these days.

When Reports like this are issued the fiscal surplus obsessions, the mixed metaphors – all come out to play and the journalists reach fever pitch.

It is a very sad indictment on our educational system that such rubbish is interpreted as knowledge.

The intent is obvious – it serves the neo-liberal austerity agenda which is helping to redistribute real national income away from workers towards profits and increasing income and wealth inequality in our societies.

It is totally erroneous analysis when we realise that the national government issues its own currency and can never run out of money.

The fiscal balance can never be “sick”. It is not a patient that goes into deficit when a heart-attack is imminent. It can go into increasing deficit if there is insufficient net public spending in the economy because real activity falters (as it is at present in Australia) and the automatic stabilisers push out the balance.

That is not a sickness. It is just the scorekeeper telling the government that it needs to increase its net spending to push against the non-government spending cycle and stimulate real GDP. That is exactly the situation we are in at present in Australia.

Alternatively, if the government did take that responsible fiscal position (that is, deliberately increased its net spending to stimulate economic growth and employment), the rising deficit would signal and improving real economy, higher national income, increased well-being in the society as a result of reduced unemployment.

So in one sense, the rising fiscal deficit at present is a bad outcome but not for the reasons the PBO and the journalists would have us believe. It is a bad outcome because it means the government is neglecting to ensure that overall spending in the economy is at a level sufficient to ensure real GDP growth is capable of achieving full employment.

The deterioration is in the output and labour market consequences of the poorly framed fiscal policy. That is what needs to be focused on not the specific movement in the fiscal balance, up or down.

The PBO Report also provides little economic context preferring to conduct a self-contained exercise as if the fiscal numbers themselves mean anything much.

It is also highly misleading in other ways:

First, it calibrates the analysis in $A billions which always biases the reader into thinking ‘big’. In its graphs (see Figure 1-1, for example) there is no scale provided which would allow one to interpret the evolution of the $A billions deficit line in terms of the overall economy.

Not that the data can be interpreted without further context anyway, but our deficit in $A billions is minute compared to, say, the US government deficit. Given the PBO claim that our situation is sick, what would we say about the US situation?

Of course, the question is as ridiculous as the whole PBO approach.

At the very least, this sort of analysis has to be conducted with proper scaling which means we discuss things in proportion to the population (per capita), or, in this context, in proportion to GDP (per cent of GDP).

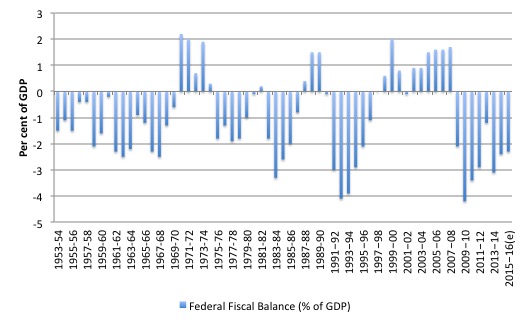

The following graph is a reasonably reliable depiction to the history of Federal government fiscal outcomes outcomes over the period 1953-54 to the present day. Please read the blog – Australian fiscal statement – attacks the weakest and will undermine prosperity overall – if you are curious as to how I compiled the dataset.

The columns show the Federal fiscal balance as a per cent of GDP (negative denoting deficits). The average deficit over the entire period was 0.9 per cent of GDP but if we take out the damaging surpluses between 1996-2007 the average becomes of 1.9 per cent of GDP, not much higher than it is now (around 2.3 per cent).

It is billions higher but when scaled to the size of the economy it is slightly higher than average and that is because real GDP growth is well below trend and the World has undergone a massive recession.

Second, it only provides graphs that begin with the fiscal year 2002-03 so as to grossly distort the historical context. I have written before about the abnormality of the period of fiscal surpluses between 1996 and 2007.

This recent blog – Listening to past Treasurers is a dangerous past-time – is my latest effort to get this message across.

The point is that fiscal deficits have been the norm over any of the successive economic cycles in Australia. There is no evidence that Australian governments ‘balance budgets’ over the cycle.

Refer back to the graph above.

On the rare occasions the fiscal balance was pushed into surplus (usually by discretionary intent of the Government) a major recession followed soon after. The association is not coincidental and reflects the cumulative impact of the fiscal drag (that is, the surpluses draining private purchasing power) interacting with collapsing private spending.

There is no notion over this period that the fiscal outcome was ‘balanced’ over the business cycle. The historical reality is that the federal government is usually in deficit. If I had have assembled more historical data back to the 1930s then it would have just reinforced the reality that surpluses have been rare in our history.

The fact that the conservatives were able to run surpluses for 10 out of 11 consecutive years (1996 to 2007) is often held out as a practical demonstration of how a disciplined government can run down public debt and provide scope for private activity. The reality is that during this period we have witnessed a record build-up in private indebtedness as a result of an abnormal credit binge.

The international analogue of that credit binge created the pre-conditions for the financial collapse (GFC).

The only way the economy was able to grow relatively strongly during the period that the federal government was running those surpluses was because private spending, financed by increasing credit growth, was strong and pushed tax revenue up.

This growth strategy was never going to be sustainable and the financial crisis was the manifestation of that credit binge exploding and bringing the real economy down with it.

The higher deficits in the recent period are testament to the fiscal stimulus package and, perversely, the fiscal contraction that followed. Remember this is a ratio of the fiscal balance to GDP. So if the numerator (fiscal balance) goes up faster than the denominator (GDP) then the ratio rises and vice-versa. But if the denominator falls more quickly than the numerator (at a time of fiscal austerity) the ratio can also rise. The previous government cut hard in their second last fiscal statement and that caused the economy to slow.

We thus have to place the evolution of the fiscal balance into this historical and real economy context before we can make any sense of what is ‘good’ and what is ‘bad’.

Merely concluding that a rising deficit is sick or a deterioration is ignorant at best.

As an application of this nonsense, consider today’s news report from the national broadcaster the ABC (February 4, 2016) – Climate science on chopping block as CSIRO braces for shake-up.

This is an example of ideological agendas using other ideological agendas as cover. So the conservatives (and I have to say, the Labor Party in Opposition who are meant to be representing the workers) craft the deteriorating national fiscal outlook narrative and ram it home relentlessly until the majority of Australians believe it to be true.

They have no reason to form that belief other than the lies that they are fed by the elites aided and abetted by ignorant or lying economists.

So once that layer of myth is rammed down everyones’ throats, the climate change denialists enter the fray and claim, under the cover of the fiscal lies, that cut backs to our world-leading scientific research organisation have to be made – to improve the ‘efficiency’ of the organisation.

No guess where the cuts are focused – the climate science divisions – which lead the research into “measuring and monitoring climate change”.

The point is that if there is no data or insights then it is hard to make a case that climate change is upon us as a result of our own behaviour.

Conclusion

The current debate about tax structure and government spending in Australia promises to be an agonising and drawn out display of neo-liberal mythology supplemented by ignorant contributions from the media.

The PBO should be closed down if the government is looking to save money and the labour freed to pursue productive activities. At present, the staff are engaged in pumping out nonsense.

That is enough for today!

(c) Copyright 2016 William Mitchell. All Rights Reserved.

There is no need “to make a case that climate change is upon us a result of our own behaviour”.

Anybody of average intelligence who has followed the science knew that years ago. The obvious corollary is that the deniers and the uninterested are of considerably less than average intelligence. That would include the majority of our fearless leaders.

The CSIRO was one of the world leaders in many scientific disciplines. Over the last several years The Tory Party and the Tory Lite Party have been steadily gnawing away at CSIRO funding like the rats they are. The CSIRO has been forced to beg for corporate funding with strings attached. This is dangerous.

This situation is not only due to mad monetary and fiscal ideology. It is a deliberate descent into convenient and willful ignorance. A Faustian bargain,indeed.

The current so called debate over increasing the GST rate is part of the same mindset.It seems to have occurred to nobody that the GST is a highly regressive tax.It shouldn’t have been introduced in the first place and it should be abolished. We have a trio of political turds to thank for that abomination. Their names are Keating,Costello and Howard.

Lest we forget.

Yes but it all stems from the “loanable funds” – all this nonsense and framing.

People are easily poisoned with “loanable funds” thinking because it is intuitive – here I have a coin, a piece of metal with a “1” stamped and I can only spend it after getting hold of one. All the government does is either gets these coins from people in taxes or borrows them from the people. If the government takes too many coins away from people it’s baad, everyone wants to have more these metal objects. Baaa…

And baanks borrow coins from the savers and lend them to the borrowers. Baaa…

Here is how the loanable market works – ask prof Krugman this is how he described it in his book and he got a Noble price or a prize or whatever for it . Anyway he looks smaart because he grew a beard. Baaa…

Now here comes the hard bit. How to explain to people the true nature of the modern monetary system in such a way that they don’t start yawning after the first 2 sentences… Growing a beard is one of the options but not in the summer.

“From the perspective of Modern Monetary Theory (MMT) perspective, national government finances can be neither strong nor weak but in fact merely reflect a ‘scorekeeping’ role.” Bill Mitchell

Meaning the monetary sovereign provides the “points” that the rest of the economy competes for?

Then, in that sense, the commercial banks are the only real players since all spending by the monetary sovereign is directed toward them and not to inherently risk-free individual, business, etc. accounts at the central bank since these are not allowed. Instead, the rest of the economy must deal with inherently risky* commercial bank liabilities or be limited to mere physical cash**, a decidedly inferior form of fiat compared to an account at the central bank.

*hence government-provided deposit insurance, another subsidy of commercial banks.

**And there is a move to eliminate even that inferior form of fiat.

Thanks Bill. Terrific article. John Fraser’s role in this is extraordinary. Have made sure the Herald journalist sees it.

No, please no!

I am thinking about leaving Italy and emigrate to Australia so that there is the biggest amount of miles between my family and the new nazism that Bankers, “investors”, the Rentiers have already put in place here (Greece the first, the other will follow) and that in short time will burn again Europe with a colossal slaughtery.

Don’t tell me that this nazi thing is taking place also in Australia.

If Australians are wise people they should immediately oust from their institutions all those predators who preach the resource scarcity mantra, with the only aim to keep all resources just for them.

” How to explain to people the true nature of the modern monetary system in such a way that they don’t start yawning after the first 2 sentences”

That’s simple. Don’t.

Just get on and explain what you’re going to do for people – guaranteed Job, guaranteed pension, decent housing.

And then when somebody ask how you’re going to ‘pay for it’, just say ‘by spending the money’.

That’s it.

A smartass question deserves a smartass answer.

“Don’t tell me that this nazi thing is taking place also in Australia.”

From my brief inquiries there isn’t anywhere to go where the infection hasn’t taken hold. It is world wide and it is dragging the planet backwards – possibly terminally for the human species.

Ultimately if people don’t take an interest in the monetary system of their country it will nonetheless take an interest in them.

This is flat earth economics as per the education of the prime minister and his groupthink ecosystem (merchant banker) with his linear (multiply out the micro + make assumptions methodology) is in effect neutering a complex systems (weather forecasting models) which 100+ years of refined observation, maths and science have refined eg: lorenz, mandelbrot.

CSIRO makes good climate predictions that a vast gaumut of industry can reliably plan from.

The CSIRO forecasts took into account interactions between a lot of complex systems: tropical cyclones, monsoon, madden-julien oscillation, el-nino/la-nina, indian ocean dipole continent centered troughs, trade winds, southern cut off lows, southern frontal systems (over the great australian bite), east coast low pressure systems and annular mode and its interaction with blocking highs. (thank you high school geography education)

And we get accurate forecasts out of this!

Lets just juxtapose complex system analysis to an axiom fallacy of flat earth economics that the conservatives will use to aid their ideology. Quantity theory of money:

MV ≡ PQ

Even the inputs are wrong. Wont measure M properly (money multiplier myth at work here), wont measure the V properly (just assume its constant), And of course Q (full employment) we all know how the full employment definition is no more than garbage.

Its a political statement: but to follow the Liberal party you have to view their intentions through a prism: un-educate yourself, dumb oneself down, forget the empirical evidence, forget the stuff you learned at school, ignore the utility of a service to society and embrace the false metaphor.

Neil Wilson,

I am sorry I disagree. I recently visited Poland and met my old friend who is (among about 500 thousand others) a victim of a CHF-denominated recourse mortgage loan. The PLN/CHF rate increased from 2..2.5 to 4 so you can imagine the scale of capital losses (which were also capital gains of the banks and probably some foreign hedgers).

You can’t do a jingle mail in Poland, it is easier just to leave that place then go through a so-called personal bankruptcy. It is a huge social and economic problem. I hadn’t been aware of the scale until I visited the country.

Anyway – you would expect that the affected people would have worked out how the banking system operates, that banks do not re-lend deposits, CHFs “lent out” and immediately converted onto PLN were synthetic etc. I would say that about one person active on the mailing lists has managed to fully crack the basics of the CHF loan creation and only just very recently. He did it only because he read Bank of England white papers.

Banks were lending in PLN but charging interests based on LIBOR. Then they have been using CIRS contracts to boost the interest rate from LIBOR+spread to WIBOR+spread since LIBOR < WIBOR. As a result at least some of the capital gains were pocketed by the banks and they managed to get the usual spread minus extra costs of additional hedging. But they deny this and peddle the usual rubbish about making losses.

I am not claiming that Polish bankers didn't know what was going on but they have no incentive to help these people who are pushing for a just solution to their problem, most likely a forced re-denomination like in Hungary.

We need to move on.

Until we manage to create a simple set of convincing models for high-school students and people with a similar level of understanding of the macroeconomic reality – we can only keep ranting and complaining about brainwashing, rotten narratives, etc. Talking about social justice is cheap – until someone asks "How are you going to pay for it? By printing money? Haha!"

Because at the back of the minds of the people you will still find images of these round pieces of metal stamped with a number "1".

If you are trying to convince someone, giving smartass answers is not the best known strategy.

It does make one weep in frustration, that mind boggling ignorance combined with wilful mischief making by those who just might know the truth, but dare not to mention it.

Recently “The Conversation” had an article about Fraser’s stand. Michelle Grattan wrote about his saying Australia should not be complacent about its credit rating. Just about every response was extremely critical.

It turns out that MMT has plenty of support, even if important nuances are off in detail, so I hope eventually we will cut through and stop politicians arguing for budget cuts etc. In the time I have been a blogger with TC there has been a noticeable surge in respondents with at least some understanding of MMT, including myself.

So we keep pushing.

“Until we manage to create a simple set of convincing models for high-school students and people with a similar level of understanding of the macroeconomic reality …” Adam K

The system is difficult to understand because it was created for the commercial banks, not for the general population. How many know, for instance, that reserves, a banking term, are simply fiat account balances at the central bank? But are called reserves since only commercial banks in the private sector may have accounts at the central bank and not individuals, businesses, etc? And that’s why, for example, that reserves cannot be “lent out”, ie to non-commercial banks, since they don’t have accounts at the central bank?

So I suggest we reform the system to remove the privileged position of the commercial banks. This will not only make the system much more just* but also much simpler and easier to understand.

*The elimination of government-provided deposit insurance should require the creation of large amounts of new fiat (aka reserves) for the transfer of at least some of the currently insured deposits to inherently risk-free individual, business, etc. accounts at the central bank. This new fiat could be equally distributed to individual accounts at the central banks for lending to or asset purchases from the commercial banks as the deposit insurance limit is reduced by degrees to zero and thus eliminate a great deal of obviously unjust private debt but without disadvantaging non-debtors.

“…it’s enough to make one want to drink”

Indeed and sadly as we see out of the USA the extremely high rates of alcoholism and opiate abuse (mainly in lower socioeconomic white people) leading to suicide. The neo-liberal end game. Make people remove them self from being a burden. I’m trying my best on all media articles I see to comment and spread the word of MMT and advise them to read your blog Bill. It’s very slowly getting through to some sothere is hope like John Doyle mentioned.

We can only keep spreading the word. Thank god for the Internet and the ability to spread information widely.

Jason H…..here in Britain we have a revolving door between the banking sector and the BBC top brass; Newspapers that you wouldn’t insult your haemorrhoids with; Crass garbage television that acts as a narcoleptic; d an incipient racism and xenophobia that neo-liberalism is happy to use as a scapegoat; a one party state at least until Labour manages to say something coherent about the ‘living beyond our means’ meme that the Tories sick up at every opportunity.

Constant articles about the ‘housing ladder’ with no coherent explanations for why there has been one bubble after another since 1983. Even now there is very little sign of anyone waking up.

My own view is that we need a a resurrection of a highly energetic Workers Education Authority (probably renamed) which did a good job in the 30’s in helping people become aware of what was going on with top-class academics like Karl Polanyi teaching. Perhaps this won’t work, though, as people are stressed to hell and may no longer have the head space to deal with it. Stress and fear -the main neo-lib tool.

Talk about being driven to drink:

“Britain will still be borrowing hundreds of millions of pounds by the end of the decade as the Chancellor fails to balance the books, according to experts.

George Osborne has promised to run a surplus of £10.1billion in 2019-20 – the first for nearly two decades – as he clears up the mess left by Labour.

But a report published today says he will miss his target and will still be forced to borrow £600million that year.

Read more: http://www.thisismoney.co.uk/money/news/article-3428701/Struggling-UK-economy-means-Chancellor-won-t-able-fulfill-promise-balance-books-2019.html#ixzz3zEBbPg00

Follow us: @MailOnline on Twitter | DailyMail on Facebook

Note the ‘clears up the mess left by Labour’. Osborne and all the politico short-term shysters don’t give a damn as lang as wallets are lined in the right places and they can sod off into the history books having sold off as many public assets as they can (in Osborne’s case it’s about to be more than the Thatcher years-58 Billion by the end of this year). Glad I don’t have a TV so I cant see their oleaginous smirks!

I’m very worried that the TTPA, signed in Auckland yesterday, will have clauses that prevent participating countries from ever implementing MMT type fiscal stimulus.

Has anybody read the details of this agreement who could comment?

Bill check out Philip Soos article in the Guardian talking about this.

Called

Public debt is not the issue – that’s just a neo-con scare campaign

http://www.theguardian.com/business/2016/feb/05/public-debt-is-not-the-issue-thats-just-a-neo-con-scare-campaign#comment-68071543

In terms of reaching out to people, to a large extent it’s got to come from the top. It requires political leadership coupled with the nous to explain the reality. It will be difficult to find those politicos, they’re probably not even in elected office yet, but it will happen in time. Don’t underestimate how much neoliberals want to *avoid* having this debate – they know the truth of the matter is absolutely toxic to their ideology.

@John Doyle and Jason H:

I too have only recently developed an understanding of MMT (though still very much consolidating my understanding). I have been challenging people to question the prevailing macro-economic paradigm and have had some success but overall I have to say I am failing to “cut through”.

By and large the “taxes fund federal government ability to spend” mantra is accepted without protest and people argue incessantly and bitterly about “who should pay” for federal spending.

@simonsky the media in Australia is no better and all mainstream media is constant neo-liberalism. All I can do is attempt to get into the lively comments sections on these articles if open for comments and help to spread the word. I keep it simple by saying our government is monetary sovereign so how can our government ever not pay debts in its own currency?

@Barri Mundee I try to steer away from the whole taxes thing as it starts to confuse people. I like to keep it simple with an example below.

I write comments like this on articles with ridiculous framing like Bill mentions in this article about “debt and deficit disaster” blablabla: “How can our monetary sovereign government be unable to pay debts in its own currency? The answer is it can always pay bills in its own currency. Neo-liberalism is a lie that resonates with people by saying our federal government has a budget like a household. The only limit to government spending is inflation and with very low inflation and under and unemployment at 15% or more there is a huge amount of wasted capacity in our economy. High levels of unemployment have real social costs like crime, family breakdowns, mental health issues and drug/alcohol issues and suicide. Why do we as a society accept this human suffering. Our government should implement a job guarantee program at minimum wage for anyone who wants to work. This will act as a permanent automatic stabiliser for our economy and remove a lot of the human suffering that comes from booms and busts.”

Here’s an article I got my comment published 1st on a ridiculous article about our government debt:

BusinessDay Economic Survey: “budget outlook bleak but housing market will have soft landing”

http://www.smh.com.au/business/the-economy/economic-survey-the-growth-in-sydney-and-melbournes-house-prices-is-over-20160128-gmgkkp

“I recommend anyone who believes our monetary sovereign government can run out of its own currency to read economist bill Mitchell’s blog particularly this timely article: https://billmitchell.org/blog/?p=32861

He provides examples of how when Swan cut the deficit by 1.7% of GDP during the GFC the economy contracted by 1.8% of GDP and hence the cut cost more than it saved as a perfect example. Our government should initiate a job guarantee program at minimum wage for anyone who wants to work as a permanent automatic stabiliser and aim for full employment like we had prior to 1975 with unemployment around 2%.”

@Barri I would also encourage you to keep referring people to Bill Mitchell’s blog if they are interested which they can easily Google search. I was lucky enough to be referred to it by someone on the Guardian comments section a couple of years ago and it’s changed my total world view. I think that is the best way for those who are really interested to learn to start reading here and hopefully continue spreading the word. If only someone in the mainstream media would start to seriously talk about MMT….

Thanks, Bill.

Your diligence here is impressive.

Arising from this analysis, how do you view the decision of the current Government to let large corporations off paying company tax? This appears to shift the burden to the PAYE taxpayers and may well lead to increased consumption taxes. Meanwhile, it seems to be enlarging (I almost said worsening …) the deficit and the debt.

Is this strategy sound, unsound or neutral? Why?

Thanks, Bill.

Cheers

Hi Alan, I can’t answer for Bill but I can offer my own suggestions:

1. Implement a land tax to capture rising property price value from government investment in local infrastructure. Nobody including multinationals can escape a land tax as it can’t be moved. It could be collected by local governments to help fund their own local infrastructure budgets and capture back some of the public god derived by increasing land values. It would also help to put a brake on property prices becoming excessive and bubble-like.

2. This idea may be more controversial but logically makes sense. Tax people not corporations. Corporations are just a legal construct and any taxes they pay will potentially drive up product prices anyway. It also causes companies to move to lower tax havens. At the end of the day its people who pay tax and it would be much easier to tax people than corporations.

3. If politicians would stop worrying about imaginary debt fears and invest in the real economy it would be a much better discussion. This is a good blog post to read by Bill helping to explain why we don’t need taxes for the government to spend: Governments do not need the savings of the rich, nor their taxes!

“Moreover, deficits place downward pressure on interest rate. Debt-issuance serves to allow the central bank to maintain a positive target interest rate by providing investors with an interest-bearing asset that drains the excess reserves in the banking system that result from deficit spending. If these reserves were not drained (that is, if the government did not borrow) then in an environment of government deficits, the overnight interest rate would fall (due to competition by banks to rid themselves of the non-profitable reserves) and this may compromise the central bank’s target interest rate, unless it offers a return on excess reserves, which most do.” Bill from http://e1.newcastle.edu.au/coffee/pubs/wp/2013/13-06.pdf

But both interest paying sovereign debt and interest on reserves (IOR) are clearly corporate welfare as you yourself have said, Bill.

So what’s the Progressive solution to excess reserves without resorting to corporate welfare?

Why not instead allow individual, business, etc. accounts at the central bank and have the monetary sovereign direct all its spending, by default of course, to those instead of to the commercial banks? And let the commercial banks borrow their reserves from those accounts?

How does this help with excess reserves? It helps because individuals, businesses, etc have risk-free liquidity needs that, in aggregate, exceed those of the commercial bank cartel and a risk-free savings preference too. In other words, individuals, business, etc would not lend all their fiat to the commercial banks as they are now forced* to do by default – especially if government-provided deposit insurance is abolished, as it should be, since that is corporate welfare too.

The problem then might be insufficient fiat/reserves for new lending but that’s easily remedied by equal fiat distributions to all individual citizen accounts until interest rates in fiat drop and spending increases until a politically agreed upon positive inflation rate is achieved (eg.2% or so).

*a clear violation of equal protection under the law, btw.

General response.

Although I think MMT is basically right, there is a distinction in our federal polity (and the states too) between the legislature and the government. And under the constitution, the executive spends money that is released to it by the legislature (see sections 81 and 83 of the Constitution). The Commonwealth AS A WHOLE is a monetary sovereign by virtue of the currency and banking powers, and effectively delegates credit creation to private banks under the banking power. But the division of the sovereign into legislature and executive sometimes does create a constraint on the government – most visibly, in 1975 when ‘supply’ was refused and everyone was peeing themselves because the government looked like ‘running out of money’.

In the Pape case 6 years ago the High Court gave a reasonably broad reading to the ‘executive power’ that every government needs, but it did certainly not read it as totally unlimited.

Even though in a way the budgeting by the Commonwealth (borrowing and taxing its own currency) does look a bit like ‘hoopla’, I wonder if there is in existence a State which does not use this ‘hoopla’ – ie, maybe it is not simply ‘hoopla’ and there is some point to it.