I am travelling today to Tokyo and have little time to write here. But with…

Australia national accounts – heading for recession at this rate

When the March-quarter 2015 National Accounts came out three months ago I wrote that “the fragility of growth increases”, as the economy descended into a state of weak growth well below the accepted trend rate. The latest data – June-quarter 2015 National Accounts data – released by the Australian Bureau of Statistics today suggests that that fragility has worsened as net exports contracted sharply. Only household consumption and government spending (both consumption and investment) kept the Australian ecoomy growing, albeit at an aneamic rate of 0.2 per cent for the quarter and 2 per cent for the year to June 2015. But the trend is towards near zero growth and the ABS wrote that “Nominal GDP growth was 1.8% for the 2014-15 financial year”, which was “the weakest growth in nominal GDP since 1961-62.” The other notable result was that ‘income recession’ that Australia entered in the last quarter has consolidated wth the total market value of goods and services (GDP) outpacing the flow that Australian residents enjoy as income. Real net national disposable income fell by a further 0.9 per cent over the quarter and 1.1 per cent over the last year. While private consumption growth remained positive, the savings ratio continues to fall indicating indebtedness in on the increase as wages growth remains weak. The other notable result is that despite the call for austerity by the Federal government, gross fixed capital formation (investment) rose by only 0.4 per cen, driven entirely by public sector investment spending. Without the contribution of public spending overall, the Australian economy would have been in negative growth territory. Today’s data paints a very negative outlook for the Australian economy for the remainder of this year and into 2016. With real GDP growth well below that needed to reduce unemployment and underemployment, the government needs to stimulate the economy to boost income and employment growth. This would also allow wages to grow and take the squeeze off households.

The main features of the National Accounts release for the June-quarter 2015 were (seasonally adjusted):

- Real GDP increased by 0.2 per cent after recording a 0.9 per cent increase in the December-quarter. Take the blip in the March-quarter out and the annualised growth rate is approaching recession territory.

- The main positive contributors to expenditure were Public consumption (0.4 percentage points), Final consumption expenditure (0.3 percentage points) and Public investment (0.2 percentage points). The government sector overall contributed an overwhelming 0.6 percentage points to growth and without it the Australian economy would have contracted.

- The main negative factors were the decline in Net exports (0.6 percentage points) and Private gross fixed capital formation (-0.1 percentage points).

- Our Terms of Trade (seasonally adjusted) fell by 3.4 per cent in the quarter and over the last 12 months they have fallen by a substantial 10.6 per cent.

- Real net national disposable income, which is a broader measure of change in national economic well-being fell by 0.9 per cent for the quarter and 1.1 per cent for the 12 months to the June-quarter 2015, which means that Australians are worse off (on average) than in June 2014. This is the ‘income recession’ that economists are now speaking about.

Overall growth picture – weak and deteriorating

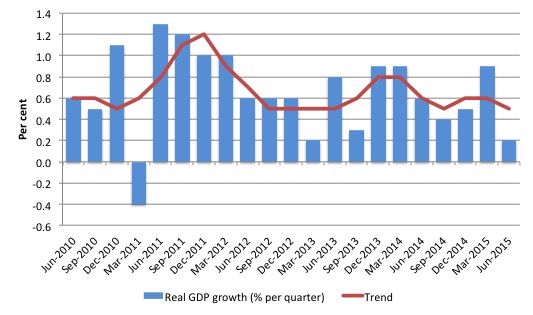

The following graph shows the quarterly percentage growth in real GDP over the last five years to the June-quarter 2015 (blue columns) and the ABS trend series (red line) superimposed. After the decline in trend growth was arrested by the fiscal stimulus in 2008-09 the decline in government support saw the dip in trend growth in 2010.

Initially, the growth in private investment associated with the record terms of trade and the resulting mining boom helped drive the new rise in trend growth which ended towards the end of 2013, notwithstanding the strong net exports in the March-quarter 2014 and the March-quarter 2015.

The mining boom was thought to be in two stages. First, the investment boom as new productive infrastructure was being constructed (railways, ports, loaders, new sites etc). Second, the export boom that would result from the enlarged productive capacity. The second stage relied on continued growth in China to boost volumes and the prices remaining stable (at elevated levels).

The problem is that China is now slowing fairly substantially and our net exports plunged quite sharply in the June-quarter 2015. There is now a serious glut of mineral exports to China (iron ore etc) and the excess supply has driven the terms of trade down and volume demand is in decline.

Australia’s terms of trade have fallen sharply – 3.4 per cent in the quarter and 10.6 per cent over the last year.

The sharp decline in net exports drained 0.6 percentage points from real GDP growth in the June-quarter 2015 (after adding 0.2 percentage points in the March-quarter 2015).

In the June-quarter 2015, exports of goods and services fell by 3.3 per cent while imports of goods and services also fell (by 0.7 per cent). The decline in import spending results from the declining income growth rate in Australia – a bad sign

The overall assessment is that the Australian economy is now growing well below trend and with terms of trade expected to fall further.

Domestic wages growth is flat and consumers are reducing their saving out of disposable income to maintain consumption growth. Private household indebtedness is also rising.

Only public spending – both consumption and investment – kept the economy in positive growth territory in the June-quarter 2015, which makes the Federal government’s call for sharp cuts in government spending look pathetic – an ideological statement rather than anything driven by economic necessity.

Policy austerity now would plunge the economy into recession and represent an irresponsible government policy stance.

The opposite policy shift is needed – there is clearly a need for a boost in the public contribution to growth (see below).

Analysis of Expenditure Components

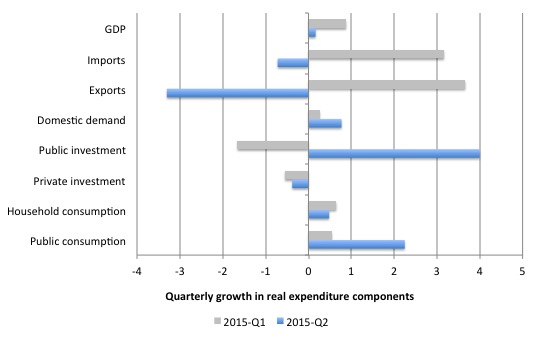

The following graph shows the quarterly percentage growth for the major expenditure components in real terms for the June-quarter 2015 (blue bars) and the March-quarter 2015 (grey bars).

Domestic demand grew by 0.8 per cent in the June-quarter 2015 as a result of household consumption growth of 0.5 per cent (down from 0.7 per cent in the March-quarter), public consumption (2.25 per cent up from 0.6 per cent), and public investment (4 per cent up from a negative 1.7 per cent).

The other main private sector components – private investment fell by 0.4 per cent consolidating the decline of 0.6 per cent in the March-quarter 2015, and exports (down 3.3 per cent reversing the 3.7 per cent growth in the last quarter).

If public spending support declines then Australia will go into recession.

Contributions to growth

What components of expenditure added to and subtracted from real GDP growth in the June-quarter 2015?

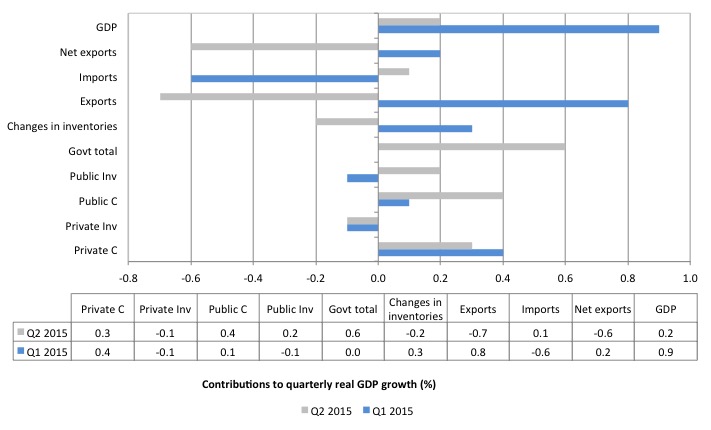

The following bar graph shows the contributions to real GDP growth (in percentage points) for the main expenditure categories. It compares the June-quarter 2015 contributions (grey bars) with the March-quarter 2014 (blue bars).

The strongest contributor to growth in the June-quarter 2015 was public consumption (0.4 percentage points), followed by private consumption (0.3 percentage points), and public investment (0.2 percentage points).

Thus the overall contribution of the government sector to growth was 0.6 percentage points – and if the Government’s austerity intentions had not been thwarted by the Senate – Australia would be in recession by now.

The net exports contribution to growth in the June-quarter was negative (-0.6 percentage points) and was attenuated by the decline in import spending as national income growth declined.

The overall contribution of private investment on growth was negative (-0.2 percentage points), which confirms that the investment cycle associated with the mining boom is over and non-mining investment is not picking up the slack.

The contribution of public investment was negative in the June-quarter 2015 (-0.1 points) and built on the negative contribution in the March-quarter 2015.

Thus the overall contribution of the government to growth was neutral (0.0 percentage points).

Inventories contributed 0.3 points to growth in the March-quarter but reduced growth by 0.2 percentage points in the June-quarter. It is always hard to interpret quarterly shifts in inventories. Are retailers building stock because they are being overwhelmed with orders or are they unintentionally accumulating inventory as actual spending falls below their expectations?

My surmise was that the rise last quarter was largely due to slowing domestic demand and that seems to have been borne out by the negative contribution in the June-quarter 2015.

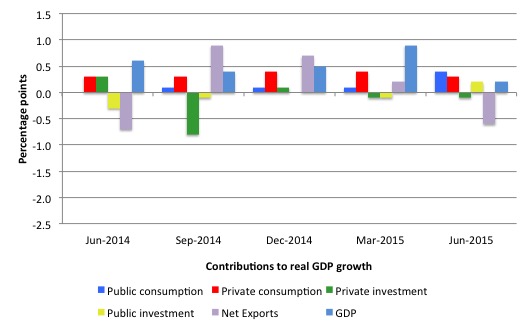

The next graph shows the contributions to real GDP growth of the major expenditure aggregates since the June-quarter 2014 (in percentage points). The total real GDP growth (in per cent) is also included as a reference.

Real GDP growth positive but real net national disposable income negative

The ABS tell us that:

A broader measure of change in national economic well-being is Real net national disposable income. This measure adjusts the volume measure of GDP for the Terms of trade effect, Real net incomes from overseas and Consumption of fixed capital.

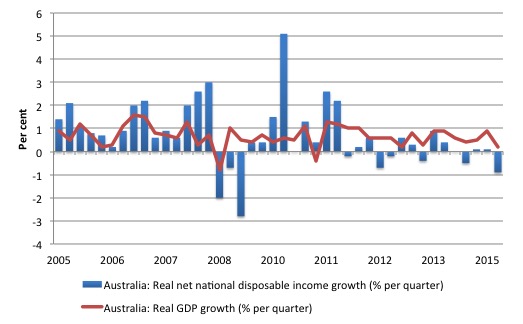

While real GDP growth (that is, total output produced in volume terms) grew by 0.2 per cent quarter, real net national disposable income growth fell sharply by 0.9 per cent and has been criss-crossing the zero line for the last three or so years.

Real net national disposable income growth has been weak since 2011.

Over the last year, real net national disposable income has declined by 1.1 per cent – which suggests that Australia is caught up in a “national income recession”.

The following graph shows the evolution of the quarterly growth rates for the two series since the March-quarter 2005. You can see the divergence between real growth in output (and income that is generated by the economy) and the real net national disposable income (the real income Australians get) over the last few years.

So while the economy was pumping out mining exports at increasing volumes, Australian households were going backwards in real income terms.

The decline in real income has intensified as the mining contribution to real output growth has declined.

This subdued state is the result of the declining export prices manifesting in the significant decline over the last 12 months in Australia’s terms of trade and the flat wages situation.

In other words, our capacity (in real terms) to purchase imports has declined per unit of export and Australian workers are not sharing in productivity growth.

It means that Australians overall are poorer even though we are still producing more than 6 months ago.

This discrepancy is one reason why an export-led growth strategy will not necessarily increase the standard of living of domestic residents, even if it exports grow.

Household saving ratio rises slightly to 8.8 per cent

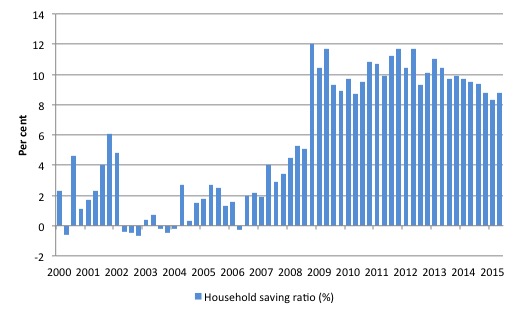

The squeeze on wages in Australia is manifesting in two ways. Rising indebtedness and fall saving out of disposable income.

The following graph shows the household saving ratio (% of disposable income) from 2000 to the current period. The household saving ratio rose slightly in the June-quarter 2015 to 8.8 per cent (up from 8.3 per cent).

But it remains below the levels that were seen after the credit binge prior to the GFC ended and households sought some refuge in a return to higher saving ratios.

After the GFC hit, the household sector sought to reduce the precariousness in its balance sheet exposed by the GFC.

Prior to the crisis, households maintained very robust spending (including housing) by accumulating record levels of debt. As the crisis hit, it was only because the central bank reduced interest rates quickly, that there were not mass bankruptcies.

In June 2012, the ratio was 11.7 per cent. Since the September-quarter 2013, it has been steadily falling as the squeze on wages has intensified.

The downward trend in the Household saving ratio tells us that household consumption growth is being maintained by a reduction in saving and a rise in credit access – both worrying trends.

While the recent trend is downwards, it is unlikely that households will return to the very low and negative saving ratios at the height of the credit binge given that the household sector is now carrying record levels of debt.

At some point, household consumption growth will fall unless growth is supported by public spending (given the poor outlook for private investment and net exports).

This also means that government surpluses which were strong>only were made possible by the household credit binge are untenable in this new (old) climate. The Government needs to learn about these macroeconomic connections. It will learn the hard way as net exports weaken if it tries to impose austerity.

Real GDP growth and hours worked

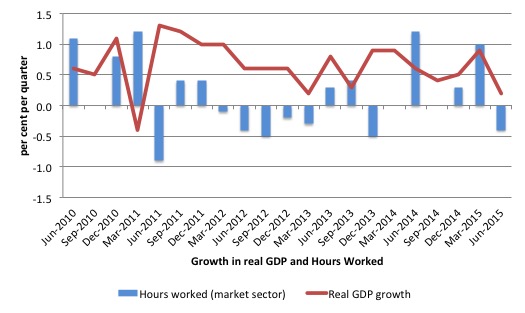

One of the puzzles over the last several years or so has been the sharp dislocation between what is happening in the labour market and what the National Accounts data has been telling us.

Employment growth and hours worked has been virtually flat over the period while annual real GDP growth has been between 2 to 2.5 per cent but falling

Today’s data shows that the link between real GDP growth and hours worked in the economy is re-establishing itself with productivity growth (GDP per hour worked) flat and real GDP growth declining on the back of hours worked falling.

The following graph presents quarterly growth rates in trend GDP and hours worked using the National Accounts data for the last five years to the June-quarter 2015.

You can see the major dislocation between the two measures that appeared in the middle of 2011 persisted throughout 2013 but is less evident now.

Just in case you think the labour force data is suspect, the hours worked computed from that data is very similar to that computed from the National Accounts.

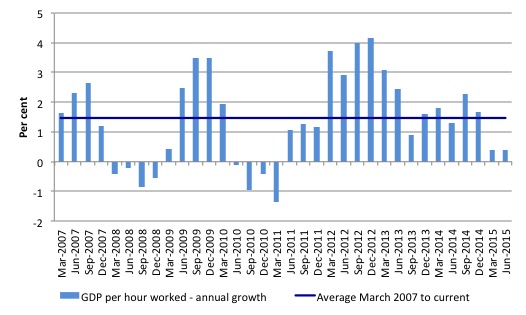

To see the above graph from a different perspective, the next graph shows the annual growth in GDP per hour worked (so a measure of labour productivity) from the March-quarter 2007 quarter to the June-quarter 2015. The horizontal blue line is the average annual growth since March-quarter 2007.

The relatively strong growth in labour productivity in 2012 and the mostly above average growth in 2013 and 2014 helps explain why employment growth has been lagging given the real GDP growth. Growth in labour productivity means that for each output level less labour is required.

In the June-quarter 2015, annualised labour productivity growth was only 0.4 per cent (well below the recent average).

Over the last year, labour force growth has average about 1.8 per cent, while productivity growth has averaged around 1.2 per cent. This means that real GDP has to grow by around 3 per cent before the unemployment rate will start to fall.

The relatively poor real GDP growth is one reason why the unemployment rate has been rising over the last two years or so.

The poor productivity growth in the June-quarter 2015 also helps to explain why the rise in the unemployment rate has stalled recently.

Conclusion

Today’s National Accounts data indicates that economic growth has weakened significantly and Australia is heading for recession unless there is a major shift in productivity aimed at stimulating domestic demand (both public and private investment).

The annual rate of growth is now well below trend, which explains why unemployment has been rising over the last 12 months

The main contributors to growth were private consumption and government spending.

Domestic demand was weak and with flat to negative wages outlook and persistently high unemployment, the outlook is not that positive.

Private consumption growth remained positive and contributed to growth, but it is falling and being funded by a declining saving ratio and rising indebtedness. Neither trend is sustainable.

The negative growth in private investment means that potential output in Australia and future growth rates will be lower than otherwise. Again, not a positive sign.

The collapse in net exports was also sharp and indicates the reliance on the external sector for growth cannot be sustained.

The other notable result was the increasing evidence that Australia is now in an ‘income recession’ with real net national disposable income continuing to decline.

A major policy shift is required.

That is enough for today!

(c) Copyright 2015 Bill Mitchell. All Rights Reserved.

“A major policy shift is required” – yeh,sure.

So,given that both major political parties and the Greens, plus the economic commentariat and their employers ,plus the movers and shakers in the public service,plus the business community,plus the unthinking tools and fools on the street, are enamoured of the current conventional wisdom (aka stupidity) just where is this “shift” going to come from?

My advice,for what it is worth (which is not much), would be for all those not in the above categories to prepare themselves for a “major shift” in reality.

Then let the devil take the hindmost.

” fools on the street” ??

Podargus,

I think I’ve had some success in getting across the MMT message. Bill’s had a lot more of course.

But, we’d both have had no success at all if we didn’t show some patience and resist the temptation to call people fools. It’s not so long ago that my own thinking wasn’t at all correct on economic issues. It was only when I came across a series of talks by Bill and Randall Wray on youtube that I thought “wow -yes, of course. Why didn’t I think of that?”

Thanks, Bill and Randall!

@petermartin2001

You are at the coal face (so to speak). Always admire the humanity you have in journalism. Especially the subject of penalty rates.

Your journalism in my opinion does ‘tread lightly’ but i understand why: because Australians and their politics are immature, personality based and adherent to the brand/party they have bought into, reinforced with their own confirmation bias and prone to cognitive dissonance when confronted with something they dont agree with (factual or otherwise).

I visited Australia after being away for 3 years. Its clear the place is in dire shape. Disadvantaged groups (unemployed, pensioners, middle class (yes those too)) were already thrifty and getting by with very little but now are in real trouble.

There is a clearer stratification (or delineation) of the lower classes in Australia now. Before it was less obivious.

And for those better off they seem to be obsessed with Moslers Deadly Innocent Fraud #6. Namely diverting disposable income into financial space (superannuation and property). This is constantly reinfored by the neoliberal narrative in the media to do so.

The ‘service sector’ (restaurants, cafe’s) seem to be growing but simultaneously the rotten industry bodies seem intent on cutting the wages of their workers not realising this will mean they will get less customers as the very same employees will have less money to spend.

Global coal trade has increased by 3 fold since 1990.

Under present circumstances (falling Asian demand for energy needed to sustain mercantile operations , and lower oil /transport costs enabling Australian boats the financial ability to travel to Europe) we should be observing major movements of coal into Europe

However European climate (in reality physical scarcity programmes ) objectives is preventing the flow of this coal.

Expect a major decrease in world energy consumption later this year and next year as the coal remains in the ground.

Although it is a very wasteful practice (transformation losses) half of the worlds electricity production comes from burning the oldest of fossil fuels.

Just saying………

Cheap coal should be flowing into Europe to sustain domestic heating given the inability of conduit people to afford the inflated costs of present energy utility ccompanies which in many cases are little more then nat gas monopolies.

Climate change policy somehow enables these dash for gas / renewable companies in the business of extraction.

Funny that.

Decline of global coal consumption = world crisis of production coming down the tracks.

Expect massive fireworks.

How did you learn to analyze an economy this way? How can I try to learn to?

Can someone please kick Stephen Koukoulus firmly up the arse?

For a self-described progressive from a self-described progressive think-tank, this ‘analysis’ sounding all superficially sensible and moderate, is absolutely woeful:

http://www.theguardian.com/business/commentisfree/2015/sep/02/economic-management-is-now-tony-abbotts-weakest-claim-to-re-election

supermundane – I recently tried to read a book authored by Koukoulas. It was so full of the conventional idiocy that I skipped large sections of it. You could write his genuinely progressive credentials on a postage stamp.

petermartin2001 – I support the efforts of everyone who promotes an eminently sensible economic method like MMT. My comment was simply pointing out,in unvarnished language, that the chances of a major policy shift in economic matters is just about zero at present. That also applies to even more important environmental and energy matters.

The elite and their camp followers have self interest,short sighted as it is, in promoting the present clusterfuck. The people on the street either don’t care about such issues or are happy to be fed the usual toxic nonsense when they are in the couch potato position in front of the idiot box.

As always there are exceptions to a general rule. If you can find the exceptions and talk sense to them then good on you and good luck.

Personally,I don’t circulate in the social circles where such matters are discussed. Which is just as well because I am about as diplomatic as a cranky bull.

The conservative economists have been praying for a lower exchange rate for awhile.

Now that the exchange rate has dropped the so called benefits this dickheads were expecting simply did not arrive.

How long will it take before the average person on the street sees these so called economic experts for the steaming turds they really are ?

The next master class from these idiots will be about how we [meaning not them] need to be more productive [i.e. work harder for less].

Meet the new boss same as the old boss still applies. We can have the current system or we can have a bastardised version of what Bill is proposing.

IEA 2015 coal trends publication.

In 2014 total GLOBAL coal consumption declined by .9%

the first such decline since 1999.

Just to remind dear readers – even during the 2009 crash period coal consumption grew…….

2014 contraction expressed in MTce

OECD : – 30.1Mtce

Non OECD : -18.9Mtce

OECD coal consumption lowest since 1983.

UK : -20%

Lowest coal consumption since IEA records began in 1960.

As for electricity production

Renewable growth not surprisingly is not adding to OECD electricity growth.

It is in dramatic reverse.

Provisional data from the IEA point to a .9% fall in OECD consumption in 2014.

All the signs point to a cutting apart of the global barbell economy.

If this is not a long term structural disintegration of the global production /consumption system I don’t know what is…….