The other day I was asked whether I was happy that the US President was…

Friday lay day – Italy’s time to demonstrate leadership

Its my Friday lay day blog and I am limping into the weekend to rest up some more. There was an interesting article in the Washington Post (July 31, 2015) – Why Italy is the most likely country to leave the euro. This accords with the view I outlined in my book – Eurozone Dystopia: Groupthink and Denial on a Grand Scale – that a large economy such as Italy should demonstrate leadership in the Eurozone and pave the way for the weaker nations to restore their own growth. We would not have witnessed the torturous brutality that was dealt out to Greece recently if the Troika were dealing with Italy. The question is whether Italy is likely to provide that leadership. On July 22, 2015, Eurostat released the latest government debt data for the Eurozone which showed that – Government debt rose to 92.9% of GDP in euro area – which, of course is well above the 60 per cent threshold allowed for by the Stability and Growth Pact (SGP). In the last 12 months “fourteen Member States registered an increase in their debt to GDP ratio at the end of the first quarter of 2015, twelve a decrease and in Estonia there was no change.” In the last quarter, fifteen states increased their debt ratios. Greece shows up as having the highest debt ratio but the largest reduction over the last year. But the interesting thing about the data is that Italy has the second-large public debt ratio (at 135.1 per cent) and is among the nations with the largest increases. On the numbers, Italy is being left behind, stuck in recession with high unemployment and a rising public debt ratio which will surely bring it into conflict with the Excessive Deficit Mechanism before too long.

Unemployment in Italy remains at 12.4 per cent down ever so slightly on the 12.6 per cent a year ago. Youth unemployment (15-24 year olds) remains at the elevated level of 41.5 per cent.

The Washington Post article poses the following question:

What do you call a country that has grown 4.6 per cent – in total – since it joined the euro 16 years ago? Well, probably the one most likely to leave the common currency. Or Italy, for short.

It is actually worse than that.

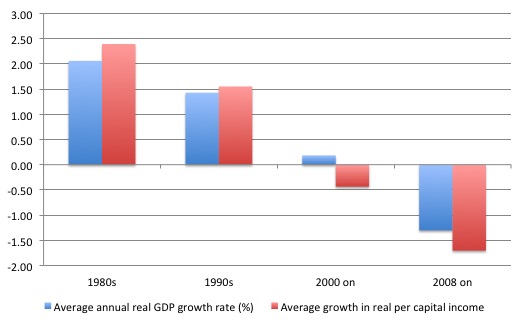

The following graph (taken from annual IMF WEO data) shows the average real GDP growth rates per annum for the 1980s, 1990s, 2000-14 and since 2008 (blue bars) and the same metric for real per capita income.

The results are stark as they are disastrous. It has barely grown on average in any year during its period inside the Recession Cult of the Eurozone and real per capita income has fallen on average each year by around 0.44 per cent.

Since 2008, the deterioration has been nothing short of sensational relative to Italy’s long history of recorded data.

The short conclusion that Italians have to come to is that this currency arrangement does not work for their economy which is not just the sum of its productive income generating processes but the social and cultural aspects that these productive processes are embedded within.

Just like Greece, the claim is lazy Italians – corrupt, too many regulations, too much red tape, too difficult to do anything. Solution – TINA – hack into the place, which just amounts to strategies which redistribute national income to the top-end-of-town and increase inequality.

Rising inequality undermines growth and even the IMF admit this now.

But the TINA model cannot easily explain how these ‘structural’ problems suddenly materialised when one other major change came along (the euro).

The Washington Post paper is onto this ruse as well:

But, at the same time, Italy had these problems even before it had the euro, and it still managed to grow back then. So part of the problem is the euro itself. It’s too expensive for Italian exporters, and too restrictive for the government that’s had to cut its budget even more than it otherwise would have.

Part of the problem is the euro itself. How much a part? I assert almost 100 per cent. If Italy abandoned the euro and restored its currency sovereignty, expanded the fiscal deficit to stimulate domestic demand and allowed the exchange rate to float it would return to the growth rates of the 1990s fairly soon.

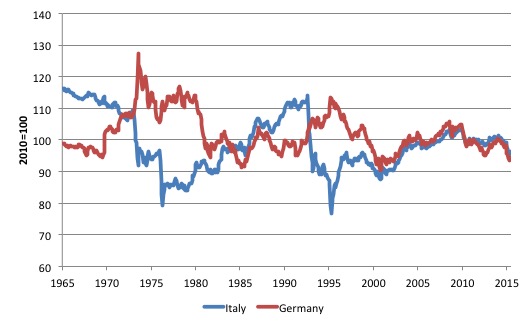

The following graph tells a story. It uses the data from the Bank of International Settlements monthly Effective exchange rate indices – which are published from January 1962 to February 2015.

You can learn about this data from their publication – The new BIS effective exchange rate indices – which appeared in the BIS Quarterly Review, March 2006.

There was an earlier publication – Measuring international price and cost competitiveness – which appeared in the BIS Economic Papers, No 39, November 1993.

Real effective exchange rates provide a measure on international competitiveness and are based on information pertaining movements in relative prices and costs, expressed in a common currency. Economists started computing effective exchange rates after the Bretton Woods system collapsed in the early 1970s because that ended the “simple bilateral dollar rate” (Source).

The BIS ‘real effective exchange rate indices’ (REER) adjust nominal exchange rates with other data on domestic inflation and production costs.

The BIS say that:

An effective exchange rate (EER) provides a better indicator of the macroeconomic effects of exchange rates than any single bilateral rate. A nominal effective exchange rate (NEER) is an index of some weighted average of bilateral exchange rates. A real effective exchange rate (REER) is the NEER adjusted by some measure of relative prices or costs; changes in the REER thus take into account both nominal exchange rate developments and the inflation differential vis-à-vis trading partners. In both policy and market analysis, EERs serve various purposes: as a measure of international competitiveness …

If the REER rises (falls) then we conclude that the nation is less (more) internationally competitive.

You can see that before the introduction of the Euro Italy and Germany experienced considerable variability in their international competitiveness as their exchange parities shifted and their inflation rates varied. It is also noticeable that the two evolutions were mirror images of each other.

So, when Italy was losing competitiveness, Germany was also gaining it and vice versa.

Once the Eurozone was in place the variations has more or less ended and the rates move more in a lock-step fashion, given no chance for Italy to build growth on manufactured exports boost, which was a strong driver of income growth prior to the Euro.

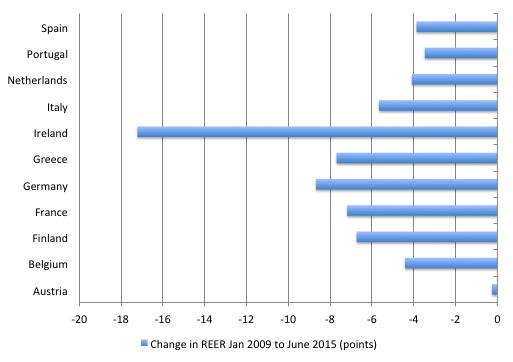

Moreover, since the onset of the GFC, Germany through domestic wage suppression has seen its REER fall by 8.7 percentage points (since January 2009), whereas the decline for Italy has been of the order of 5.6 points. So relative to Germany, Italy has gone backwards in its international competitiveness.

Even Greece has fallen behind Germany in relative terms over this period despite the massive internal depreciation (wage cutting that has been going on). Only Ireland’s REER has fallen more than Germany’s (17.2 points).

The reasons are many but a major attack on wages accompanied by a protracted recession (depression in Greece’s case) often undermines productivity growth, which is a key determinant of a nation’s REER.

The next graph shows these shifts for a selection of Eurozone nations.

The Washington Post article also acknowledges one of the central points I have been making about Greece, that:

… more than anything else, the common currency has given Europe a severe case of cognitive dissonance. People hate austerity, but they love the euro even more – they have an emotional attachment to everything it stands for.

The problem, though, is that the euro is the reason they have to slash their budgets so much in the first place. So anti-austerity parties have felt like they have to promise the impossible if they want any hope of gaining power: that they can end the budget cuts without ending the country’s euro membership.

That was Syriza’s dilemma. It was on a ‘hiding to nothing’ from day one because it refused to show leadership and explore the advantages of exit. It fell too easily into the mantra that it would be catastrophic.

But membership of the Euro, with its recession-biased fiscal rules, means that the Member States will always be limited in their capacity to protect national income and employment, unless there is a sudden export boom (such as in Ireland at present). That is not a solution that can work for all nations.

The Washington Post article holds out more hope for Italy because its “anti-austerity parties have learned the opposite lesson. Don’t rule out leaving the euro, or things will never get better for you”.

Syriza collapsed back into become the next in a line of governments dealing out vicious austerity because they refused to consider exit.

In Italy, “the Five Star Movement, has gone from being a vague euro-skeptic to an outspoken one” and its leader is reported to have said that Syriza’s “refusal to exit the euro was his death sentence”.

The Five Star Movement leader has acknowledged that Italy’s high and rising public debt ratio (in clear contravention of SGP rules) should be used:

… as an advantage that allows us to be on the offensive in any future negotiations.

Sooner or later the dogmatists in Brussels will have to call Italy to account under the Excessive Deficit Mechanism rules. Then the fun might begin.

Its short-term outlook is for more public cuts and on-going recession and loss of real income per capita.

Conclusion

When the Brussels bullies call them up to demand more austerity, Italy would be best to flex its muscle. It is too big for the Troika to steam roll.

And, I suspect, the Italians have a better understanding of their place in Europe than Greece and won’t fall for any threats that they will be expelled from Europe.

It is a bit hard to cut of ones ‘boot’ without also severing the ‘foot’!

I would recommend that Italy take the initiative and ignore the fiscal rules and introduce some large public spending programs – like Job Guarantee – to get the economy moving.

Brussels can fulminate in whatever fashion they like – probably by taking it out of the defenseless Greece. But they can do very little against a nation as powerful within Europe as is Italy.

Music

I haven’t listened to much music this week as part of a headache management strategy. I have played less myself and it is lucky my band is not working this weekend.

But today I put some records on the turntable again and this is what I was listening to.

This is from – Joe Ferry – and the tune is Satta Masa Gana which in the Amharic language of Ethiopia is taken to mean to ‘give thanks to all people’.

It was originally made popular by The Abyssinians on their 1976 Album – Satta Massagana – which defined the roots reggae movement.

This is Joe Ferry’s version taken of his – Big Ska album released in 2003. He is a bass player, producer of many of the great reggae albums, an academic at SUNY (Purchase), and the band leader of Joe Ferry and The Big Ska Band.

The saxophonist Jim McElwaine features on this track. His tone is soothing for any ‘head’ condition.

Book launch event – advance notice

The official book launch for my new book – Eurozone Dystopia – Groupthink and Denial on a Grand Scale – will be held on Monday, August 31, 2015 at the University of Maastricht, the Netherlands.

The event will run from 13:00 to 15:00 and there will be two excellent speakers:

1. Dr László Andor, former Commissioner for Employment, Social Affairs and Inclusion in the Barroso II administration of the European Commission.

2. Professor Arjo Klamer, Professor of Economics of Art and Culture at Erasmus University in Rotterdam, The Netherlands. He “holds the world’s only chair in the field of cultural economics”.

The public is welcome to the event and there will refreshments available. I hope to see a lot of people there in Maastricht on August 31.

I am also to offer a Special 35 per cent discount to readers to reduce the price of the Hard Back version of the book.

Please go to the – Elgar on-line shop and use the Discount Code VIP35.

Saturday Quiz

The Saturday Quiz will be back again tomorrow. It will be of an appropriate order of difficulty (-:

That is enough for today!

(c) Copyright 2015 William Mitchell. All Rights Reserved.

I do agree that a more or less organized exit would be the best solution for Italy (where I live).

However, many Italians think they have been living in a hopelessly corrupt country, where nothing works as it should, for decades. So they don’t see the Euro as the major issue of Italy. What they should realize is that the Euro is an ADDITIONAL problem, and that getting rid of any problem is always a good thing.

I think the whole mess will end badly. Europeans don’t want to drop the Euro (there’s so much propaganda going on), but at some point they’ll have enough.

Ireland’s mainly corporate boom these past few years have been used to reduce net external wealth.

Irish (non Ifsc) net external debt has shrunk from 181.786 billion in Q12012 to 42.096 billion in Q12015…………in 3 years the Irish conduit people delivered back nearly 140 billion euros of debt……..data the Irish CSO.

So the Irish were suckered into paying back the costs of mercantalist dumping of which we have no control (equity stake in)

Stuff just happens around us as we are mere conduits for the banking and corporate sector.

People without a equity stake in the commons do not have a functional democracy.

You just watch this space – when the debt is paid back the local politicos will put on false nationalistic clothes.

You state

“The short conclusion that Italians have to come to is that this currency arrangement does not work for their economy which is not just the sum of its productive income generating processes but the social and cultural aspects that these productive processes are embedded within.”

Yet much like the Irish it was not their economy and society ( even during the fake nationalistic phase of capitalism)

The Italians will export more of their wealth through currency devaluation when the owners are good and ready and not before.

Your talk of international competitiveness is yet another expression of capitalistic waste which will no doubt be imposed n the people according to the elites timetable.

How much more productivity growth is needed to pay for the usury machine ?

The answer is infinity.

However the planet is not a infinite resource.

In response to Yanis V blog post Steve from Virginia gets close to what a true nation should do under present circumstances.

“Varoufakis did not need a parallel currency … the country has one, it’s called the ‘euro’.

Believe it or not the euro is the official currency of Greece. The Greek government has the same right to produce payments as do commercial banks in Frankfurt … which produces all payments in Europe right now!

Greece and Varoufakis ran aground on their desperate desire to play by the rules. They had do know that anyone playing by the rules would lose. Now that Varoufakis has lost both creditors and Greeks are looking for his head.

– The Greek government needed to shut down the Bank of Greece.

– The Greek government needed to issue ‘greenback’ euros and use them to re-fund the Greek banks, to guarantee deposits and to keep the country liquid.

– The Greek government needed to repeal the 1927 ‘Statute of the Bank of Greece’ which prohibits the government from issuing ‘money’.

– The Greek government needed to ignore the ESM.

– The Greek government needed to repudiate ‘odious’ debt along with any debt taken on to buy petroleum. (+€300bn).

– The Greek government needed to institute stringent energy/fuel rationing.

– The Greek government needed to detain IMF, ECB, EC officials incommunicado at the airport for 48 hours before before packing them out of the country.

– The Greek government needed to investigate finance fraud including actions of ex-Greek officials, bankers elsewhere in Europe as well as Goldman-Sachs with an eye toward criminal convictions and long prison terms at hard labor.

– The Greek government needed to put its military on high-alert.

– It needed to square up with ordinary Greeks: admit that hard times are here to stay, that sacrifice is needed, to get rid of the stupid toys of European modernity: cars and all the crap that goes with them.

The Greek government needed to lead and it didn’t! The Greek government offered more of the same more failure, more feeble attempts to retrieve a vanishing way of wasteful life.”

Bill,

The Irish export boom is in part tied to the UK economic recovery. The latter is the result of a major housing bubble in London that is driving rapid fixed investment growth in construction. None of this is sustainable. You should look into it. Disaster waiting to happen.

Bill,

just a note

according to istat the employment situation in June was as follows

“Employment rate was 55.8%, -0.1 percentage points with respect to May 2015, unemployment rate was 12.7%, +0.2 percentage points over the previous month, and inactivity rate was 35.9%, -0.1 percentage points in a month.

Youth unemployment rate (aged 15-24) was 44.2%, +1.9 percentage points in a month, youth unemployment ratio in the same age group was 11.5%, +0.6 percentage points compared to the previous month.”

http://www.istat.it/en/archive/166070

“We would not have witnessed the torturous brutality that was dealt out to Greece recently if the Troika were dealing with Italy.”

I’m afraid that I disagree with you on that, Bill.

Besides, it was the usual suspects who removed Italy’s leader and installed their technocratic puppet. If the people had rebelled, I don’t doubt for one second that the usual suspects would’ve aimed to crush that rebellion come hell or high water. The usual suspects are like a kamikaze pilot, and would’ve treated Italy – or anyone – in the same way. They have threatened the UK several times, even though it’s outside the Eurozone.

Greece is just easier to bully, once you’ve got all the previous bullies’ victims lined up on the bullies’ side (Ireland, Spain, Italy, Portugal telling Greece it has to take a beating because they took it and recovered [sic]).