The other day I was asked whether I was happy that the US President was…

Friday lay day – some IT considerations of a Greek exit

Its my Friday lay day blog – and today we have a little digression in IT matters. The WWW site Naked Capitalism that has been less than hostile towards Modern Monetary Theory (MMT) perspectives over the last several years seems to have a fix against any notion that an exit by Greece from the Eurozone madness is a viable alternative. The logic evades me. Yesterday (July 23, 2015), they reproduced an article – Once Again on the IT Challenges in Converting to the Drachma – which is written from a ‘left’ perspective and the author claims to be one of the very few people who has any “inkling of the problem”. The author explicitly referred to my recent blog – A Greek exit is not rocket science – and noted that I had not referred to IT wants in my discussion. The arguments presented rely on a very old literature that was written for a different problem altogether – the introduction of the euro and the replacement of 11 separate national currencies and accounting and business systems. The challenges relating to that problem were solved and the knowledge is intact. Further, business systems have become much more homogenised and sophisticated since then. The exit of one Member State to create a new currency is a much smaller IT challenge. I wonder why Naked Capitalism chooses to lower its standard by on-publishing this sort of stuff.

The claim that I ignored systems issues in the cited blog isn’t exactly true because I noted that the euro nations already have practical experience with the sort of legislation that would be required for redenomination having performed the same feat less than 15 years ago.

And they already understand the processes that are required and the issues that might arise. They understand that people might get stuck in car parks and vending machines would need to be recalibrated, among the myriad of conversions that would be required.

This was clearly a recognition that computer systems issues are important at the most banal level when running a monetary system.

I chose not to elaborate further on the IT issues for the sake of brevity and general interest to the reader.

By way of background, I learned Fortran and COBOL early on as my first two ‘high-level’ programming languages. Earlier, I had been taught machine/assembly coding on large mainframe computer systems.

Over my career, I’ve have learned several other languages and still write a lot of computer code for various research and other purposes.

I am also a partner in an IT consulting firm which designs and implements fairly large-scale systems for various organisations. I was also the founder of Cyclingnews.com, which became the leading news and information site on the Internet for cycling. We pioneered IT systems for that site and developed innovative servlets and other IT related developments, which were up to that point unknown in relation to Internet applications (mid 1990s).

So with that background, I was not only interested in the economics involved in the creation of the Economic and Monetary Union (EMU) but also the technical systems issues involved in converting the 11 national currencies (at the beginning) into a common currency.

I spent a lot of time in the late 1990s studying the IT aspects of the creation of the EMU. I covered some of those issues in my current current book – Eurozone Dystopia: Groupthink and Denial on a Grand Scale (published May 2015).

However, I chose not to devote much space in the book to the technical IT issues involved in an exit by country from the Eurozone for various reasons. First, the book was already very long. Second, while the technicalities are of interest to me, the excruciating detail would be of limited interest and value to a broader audience. Third, I chose to minimise even the economic jargon in the book to make it more accessible. So there would be little reason to delve into technical computer systems type jargon.

And, based on all that previous research and subsequent developments in IT systems and software, my conclusion that a Greek exit is not rocket science might also be extended to the conclusion that a Greek exit is not particularly challenging from an IT systems perspective.

That doesn’t mean the process would be trivial, not prone to human error, or rapid.

But the knowledge of how to change a currency from an IT perspective does not have to be invented. The procedural technical manuals specifying the processes that have to be followed are all available. The IT know-how (that is, the human skills) are all available. And, all that is needed is a bit of time and some care.

Just ask Lithuania. They have just accomplished this task. There are quite detailed technical documents available which outline the legal, accounting and reporting, and adaptation of information systems involved in the transition from the litas to the euro.

I acknowledge this transition was done in full cooperation with the main EU institutions but they essentially were the responsibility of the Lithuanian government and the various working groups that it set up to manage the transition.

In its “National Changeover Plan – Approved by Government of the Republic of Lithuania, Resolution No 604 of 26 June 2013), the government required that:

… in adapting information systems to the adoption of the euro the existing information system functionalities are not changed.

In other words, the system design was to remain constant and only the currency unit had to be changed, which made sure the process was less complex and less error prone. It meant that practical things like the production of forms, invoices, statements and the account keeping tasks, pricing catalogues etc would be minimally disrupted.

They also accepted that all outstanding “pre-paid items” like postage stamps, transport tickets etc would be valid for up to 2 years after the adoption of the euro.

This is an important though small example of how a currency change could be quite minimalistic at first.

A Greek exit, aiming to restore full currency sovereignty which includes full currency issuance powers, the capacity to set its own monetary policy (interest rate etc) and a currency float on foreign exchange markets could in fact involve only a fairly small first step.

The government could make that first step by announcing that it was spending in drachma from some date and would require all taxes to be paid in that currency. It would also announce it would redenominate all its outstanding euro liabilities in the new currency (barring those which the IMF had cooked up under foreign jurisdictions as part of the previous bailouts).

In those cases, the new government would just offer restructuring or default to the creditors.

That would give the new nation time to make all the other necessary and relatively time-consuming steps in changing over and eventually banning the euro from daily use. But, even then, it would not matter if people still dealt in euros. As long as they were required to get the new currency to extinguish their tax liabilities, the new currency would stick.

Which means that the exit would have to make tax reform a priority in the first instance to ensure the tax base was enforceable. This would not be required to raise funds to allow the government to spend but rather to ensure the new currency is in demand.

The Naked Capitalism article ostensibly seems to be about IT matters but spends a lot of time arguing that Marxists fail to understand that Greece’s problems are not the euro but “the underlying economy”.

I agree that “Leaving the Euro is not a sufficient condition to break with austerity”. My Eurozone book discusses, at length, the need to also undergo an economic transformation and a rejection of the neo-liberal Groupthink that promotes the Recession Cult of Austerity.

I also made that point in the blog – Euro exit will not be enough for Greece – among many other blogs I have written on that topic over the past decade.

The Naked Capitalism article launches into arguments about hyperinflation etc which are not related to its aim of exposing the IT difficulties. The economic risks of an exit are well-known and there are also well-known remedies to minimise the risks.

But then we get onto a discussion about Y2K. Remember that? Remember all the loonies who started to stockpile tins of food and store water, and buy boats to sail off-shore while the mayhem and the riots destroyed orderly urban life?

Remember the doomsday scenarios, the Armageddon that awaited us.

Well it was a massive con, partly promoted by large management consulting and IT firms, who knew that they were on a winner. At the time, I attended various strategic planning sessions at the University facilitated by some private consultant or another who was charging good money for blabbering about the need to alter a some computer code if at all.

As the Naked Capitalism author notes it was really about software that had used two numbers to designate the year (MMDDYY) instead of four (MMDDYYYY). Several straightforward computer changes were made to resolve the possible problems depending on the situation (date expansion, date re-partitioning in overfull databases, windowing patches etc). Very trivial.

The corporates who promoted the scaremongering that planes would crash out of the sky, that ATMS would stop delivering cash, and that we would get stuck in elevators if we dared use them any longer made healthy profits from the Y2K solutions they started to offer.

There were even claims that nuclear rockets would accidentally launch themselves and cause a world conflagration.

At the time, big corporations and bankers waged a campaign against small businesses who were struggling to afford the costs quoted to them to make them ‘Y2K ready’.

The US Senate Special Committee on the Year 2000 Technology Problem – Senate Special Report on Y2K – (June 1999) reported on a special hearing it undertook to examine whether small business in the US would “survive the Year 2000”.

The Senate Committee learned that “80% of American small businesses are potentially exposed to Y2K problems” and that only a “two-fifths are aware of the problem but do not plan to take any action prior to the year 2000”.

The Committee heard predictions that these firms would incur “a production or sales loss of 85%” should their computers malfunction.

Another organisation told the Committee that “a lack of action apparently comes from 77% of small business not considering Y2K to be a serious problem”.

The US Small Business Administration issued a press release on September 22, 1999 – Small Business Not Quite Ready for Y2K – that said that “Twenty-eight percent of small business have not taken corrective action … With the Y2K deadline just 100 days away … The clock is ticking louder”.

It was reported in early 2000, that of the “1.5 million small businesses that didn’t prepare for the Year 2000 problem” no significant consequences were reported. Apparently, the “Commerce Department’s Y2K Help Center for Small Business” reported on the first day of business in the new year “The help center received about 40 calls that day” and the issues were a few “minor glitches” like some “corrupted data in spreadsheets”. Nothing terminal at all (Source).

So to claim that the Y2K experience is somehow a guide to the challenges facing Greece in introducing its own currency is somewhat a stretch.

The examples used like needing to do string searches for “the Greek equivalent of ‘amount’ or ‘amt'” in some COBOL program I would think irrelevant. As Lithuania demonstrated simply redenominating the IT systems from LTL to EUR is not a big deal.

In fact, as I noted in an earlier blog, in June 2012, Bloomberg tested in its foreign exchange screens a possible Greece exit. Traders suddenly saw a new code XGD appear on the screens with “among the options listed, a spot exchange rate for a post-euro Greek drachma”. See – Bloomberg Tests Post-Euro Greek Drachma Code.

The transition to the euro was in fact a much larger challenge from a systems perspective than a single currency exit would be.

One of the big challenges of introducing the euro was to stop currency speculation on the cross-rates during the transition phase. In a bi-lateral currency valuation, the arithmetic is trivial – invert the quoted parity to get the rate expressed in the other currency unit.

The problem is that depending on how many decimal places the parities are expressed in, small margins can be made by buying a quantity of another currency and selling it straight back to regain the original currency.

On June 17, 1997, the European Council introduced – Council Regulation (EC) No 1103/97 of 17 June 1997 on certain provisions relating to the introduction of the euro – which was aimed at establishing the “Legal certainty: conversion rates and rounding rules”.

Essentially, they introduced what was called “Triangulation”, which was based on the regulation (Article 4(4)) that said:

The conversion rates, adopted as one euro expressed in terms of each of the national currencies of the participating Member States, will have six significant figures (not to be confused with six decimal places.

The conversion rates cannot be rounded or truncated when making conversions.

The conversion rates are used for conversions either way between the euro unit and the national currency units. Inverse rates derived from the conversion rates cannot be used …

Monetary amounts in euros must, when a rounding takes place, be rounded up or down to the nearest cent … Monetary amounts converted into a national currency unit must be rounded up or down to the nearest sub-unit or in the absence of a sub-unit to the nearest unit.

Which meant that the euro parity established at the outset became the third part of the triangle for currency conversions. Bi-lateral conversions were outlawed by the regulation.

The IT demands of that new system, even though it was only to operate during the transition period where dual currencies were in operation.

There were a myriad of other large IT demands to ensure the accounting systems could cope with the introduction of the new currency and the abandonment of 11 old currencies (then 12 when Greece joined in 2001).

For example, some of the pre-euro currencies did not use decimal points (for example, the Italian monetary system) and systems had to be changed to cope with the decimal nature of the euro.

But most of the issues that were pertinent then would not apply to say a Greece exit and introduction of a new currency. In the first instance, it would simply be the replacement of a currency code with another and the euro would be added to the lists of currencies that already require conversion in the Greek system.

The Naked Capitalism article raises the issue of so-called ‘hard coding’ of variables in programs instead of “variable declarations”, without any assessment of whether this is an actual problem or just a conceptual problem that might arise.

The issue is simple. Rules for determining eligibility for a service (mortgage etc) might have thresholds hard-coded into the computer system. So if your bank balance is above 1000 you qualify for a loan. Good programming clearly creates variable definitions (say, $threshold = 1000) in easy to find and edit part of the system and then uses symbolic references ($threshold) throughout the rest of the system so that when the threshold might require alteration there is one data entry required which feed the old system.

So if there is a lot of ‘hard-coding’ in the Greek financial and business systems it would require some work. The reference the Naked Capitalism article uses was written in 1999 and relevant to rather dated practices and the big challenge of converting all the currencies into the euro and all the different national business systems into an integrated set of systems that could cope with the common currency.

I would suspect the assessment that there is a lot of ‘hard-coding’ now would be amiss. Business systems have become much more sophisticated and homogenised in the 16 years since that article was written.

The Naked Capitalism article also draws on another 1999 article (that analysed the transition to the euro) to argue that further problems would be encountered in a Greek exit.

These include the historical presentation of records, for example, bank statements. These problems were already encountered and solved in the transition to the euro. There is no reason to suspect that any new issues have arisen. The Bank of Greece knows how to do this and could easily issue a procedural manual to the commercial banks and other financial institutions.

COBOL is still used (some 56 years after its introduction) in a significant number of back-office batch processing tasks in banks etc (although it is now a fully modern procedural, imperative, object-oriented language). This is especially the case in businesses that still use large mainframe computer systems.

So it is even likely that all the programs are still available. But at any rate, Greece could contract the IT skills from Lithuania to assist!

Other problems are raised including small businesses ripe for takeover because they can’t alter their spreadsheets to cope with a change in currency code and the “sharp devaluation as all experts predict” in the new currency.

I doubt that foreign capital is poised to “make a killing” by taking over Greek small businesses that cannot sort out an element or two in a spreadsheet for a few days.

Further, I don’t predict a sharp devaluation in the currency. First, it will be floated which means the term ‘devaluation’, which only applies to fixed parity arrangements that undergo discretionary adjustments by central bankers etc is inapplicable. Second, it will initially be in short supply. It is not akin to the situation where a nation breaks a peg with another currency and has plenty of the domestic currency circulating around foreign exchange markets.

But moreover, whether it does depreciate or nothing to do with IT problems involved in the introduction of the new currency and just reflects the rambling nature of the author’s narrative.

He clearly has not studied transitional currency systems in any depth and is drawing on a literature that was intended for a different and much larger problem (the introduction of the euro) at a time when IT systems and software development was considerably backward, compared to now.

Conclusion

I don’t want to suggest there would be no problems. But I assess the costs of transition (doing the work and fixing the glitches) would be dwarfed many times over by the costs of on-going austerity.

Sure enough some systems operators and programmers can make stupid errors. The other night at the football in Melbourne a particular club membership category was refused admission at the turnstile because their membership cards could not be read by the scanner. I was one of them. We waited and soon enough the system glitch was fixed. Someone probably entered a FALSE instead of TRUE in some config XML file somewhere which toggled the problem.

Further, Greece can exit in stages just as the euro introduction was in stages. As noted above, it only has to establish a creditable tax base in the new currency and start spending in that currency for it to regain the capacity to end austerity and start rebuilding the wrecked economy.

I wonder why Naked Capitalism chooses to lower its standard by on-publishing this sort of stuff.

I have dealt with the operations of the payments system in earlier blogs. There are no major IT issues to be found there with a Greek exit. The only thing that could happen is if the ECB bans any interaction with the Greek monetary system thus freezing it out altogether. That is not an IT problem and a highly unlikely political development. I don’t believe they would do that because it would not only wreck Greece but also significant financial and productive interests elsewhere in Europe.

I note the former Finance Minister told the Australia ABC TV current affairs program Lateline last night (July 23, 2015). In the – Interview – he claimed that a Greek exit would be ” absolutely catastrophic”.

He said:

It’s like a bridge that you cross and once you’ve crossed it, it collapses. So, reversing your path, getting out of that monetary union, however ill-designed it might’ve been, is not a good idea.

Well we found the printing presses he had told Australian radio had been “smashed” – see A Greek exit is not rocket science – and I am sure there are few bridges left for Greece to take back to prosperity.

They all lead out of the Eurozone.

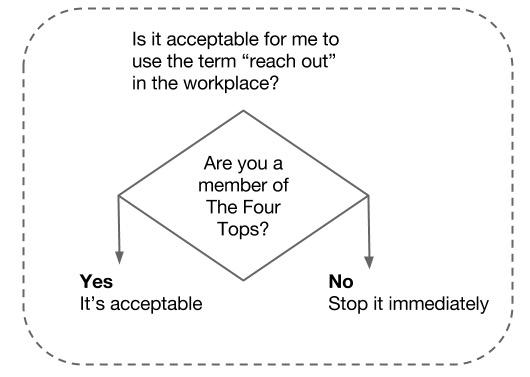

And while on the IT programming front, this little flow chart, decision tree is about the managerial-speak that workplaces have become infested with … sort of like European Commission declarations after some talk fest or another – full of fluff with little positive intent.

This might be as hard as a potential Greek exit is in IT terms 🙂

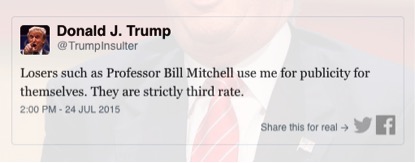

Trumps insults Mitchell

Time Magazine has a neat – Donald Trump Insult Generator – for those who are “Feeling left out that Trump hasn’t gotten around to insulting you or your friends”.

Its fun for Friday-time after all this IT stuff.

Music – Soul, soul, soul

And after that Trump attack I needed some music. Here is what I have been listening to as I worked today.

The song – Need Your Love So Bad – comes from – Little Willie John – and was recorded by him in 1956 (achieving No 5 on the Billboard R&B charts). His brother Mertis John Jnr wrote the ballad.

Little Willie John died at the age of 30 in 1968 in prison allegedly as a a result of a heart attack but the case is far from clear. He had been convicted of manslaughter in a drunken knife fight.

He influenced a lot of the later R&B singers and musicians.

I was asked the other day to recommend a song for a Wedding. I suggested this. I love all his songs.

Later (in 1969), Fleetwod Mac put a longer version out on their – The Pious Bird of Good Omen – album, with the magnificent guitar playing of Peter Green (my absolute favourite guitar player) adding the length and extra soul.

They made the song into a big hit in Europe. It was when Fleetwood Mac was a real band rather than a pop group.

You can listen to that version – HERE.

Saturday Quiz

The Saturday Quiz will be back again tomorrow. It will be of an appropriate order of difficulty (-:

Advertising: Special Discount available for my book to my blog readers

My new book – Eurozone Dystopia – Groupthink and Denial on a Grand Scale – is now published by Edward Elgar UK and available for sale.

I am able to offer a Special 35 per cent discount to readers to reduce the price of the Hard Back version of the book.

Please go to the – Elgar on-line shop and use the Discount Code VIP35.

Some relevant links to further information and availability:

1. Edward Elgar Catalogue Page

2. You can read – Chapter 1 – for free.

3. You can purchase the book in – Hard Back format – at Edward Elgar’s On-line Shop.

4. You can buy the book in – eBook format – at Google’s Store.

It is a long book (512 pages) and the full price for the hard-back edition is not cheap. The eBook version is very affordable.

I think the real problem for the Greeks exiting will be the mischief from the EU afterwards. They will do whatever it takes to make sure that the left in Greece fails regardless of the cost. This battle isn’t about 85 billion euro it’s about extracting as much as possible from the workers and teaching them a lesson about the cost of rebellion.

Regards

Sid

Lithuania also has an experience of leaving “ruble zone” and introducing national currency ~25 years ago.

There were no option of leaving “ruble zone” or Soviet Union in the “treaties”, but we did it somehow!

Greetings from Lithuania!

The ‘IT wants’ some of these people are throwing around are just trying to frighten people with gobbledegook. They are talking mostly about things that *do not need to change* and dressing them up as though they do.

Essentially its the usual psychological game played by somebody who want to show something is impossible – the ‘But you *can’t prove* God doesn’t exist’ argument requiring absolute proof.

The simplest thing that will work in Greece is not to change anything at all. The Greek currency floats automatically when the TARGET2-ECB account of TARGET2-Greece is cancelled. What that means then is that any cross border transactions sent over the wire will simply fail on the clearing cycle – exactly the same as they would if a bank was offline in the system for any length of time.

Beyond that you pass the Bank of Greece and likely all the commercial banks through a statutory defined pre-pack administration process to cast off their old ‘Euro’ shells’ and acquire new ones that are free of all the Euro obligations. That fixes any Euro claims in the insolvency process and frees the Bank of Greece from any ECB imposed obligations. It also demonstrates clearly and legally to the ECB that they have a loss on their books which will not be recovered.

Greece already left the Euro when the ELA restrictions were put in place. Internal electronic transfers continued unimpeded. It was only cross border and cash transactions that froze up – but only because of the intransigence of the central bank system.

The freeze was actually caused by the indecision of that ‘temporary’ state. If the government at that point at said – “we’re not going back and have nationalised the central bank’, then the cash situation would have been freed up since the Greek central bank would then back stop the existing banks to the extent of their deposits. Additionally smart entrepreneurs with a leg in both Greece and in the rest of the Eurozone would then move in to provide exchange facilities if the main banks struggled to cope on their backup procedures. Those who can move fastest make the most money.

All of which uses the existing IT infrastructure and procedures without changing anything of substance whatsoever.

One of the beauties of the capital flight system within the Eurozone is that anybody who wanted to ‘get out of Greece’ already has done. Which means that if they are still physically in Greece and have to pay taxes in Greek Euros, they suddenly have to get some with a more challenging exchange process.

And that would force the price of Greek Euros *up*.

So the actual challenge is keeping the flowing supply of Greek Euros tight enough and only discounting other Euros for new Drachma at the central bank if there is liquidity issues. And that means clamping down on what the commercial banks can lend (i.e. create) money for. No lending of new Greek Euros to clear foreign exchange transactions or any other purely financial transaction.

But that is a matter of policy, not IT systems. The trick with the IT system is to change as little as possible – even to the point of not changing the Currency symbol or the printing of the notes and coins. Greek Euro notes are already marked with a Y serial number and will tend to move back to Greece as people start refusing to accept them. Other Euro notes will tend to move to other countries.

We already know that happens, because we have Scottish notes and Irish notes here in the UK. You rarely find them outside of Scotland or Northern Ireland.

“The trick with the IT system is to change as little as possible ..”

That is always the key, and saves a lot of headaches.

It’s good to find out so much about the actual nitty-gritty of the banking and monetary systems, so that you can see through the bull-dust thrown up by other so-called experts. Since I know something about IT, let me say that what Neil Wilson says sounds reasonable. I haven’t looked at it in any detail (because I can’t) but broadly it seems to compute.

I wonder if someone at NC will accuse you of ‘hand-waving’ again Bill.

http://www.nakedcapitalism.com/2015/07/tentative-deal-strips-greece-of-sovereignty-makes-debt-relief-dependent-on-compliance.html#comment-2472846

That term gets a workout again in the comments thread to the post you cite, where someone has just noted your response. The comments are worth a read as there are some obvious experts contributing who agree with the author. The hostess herself is very clear:

‘People who casually assume that a Grexit is preferable to what is happening in Greece now are assuming total stupidity on the part of the Greek government. Why would Syriza repudiate both its own repeatedly stated red line positions and overwhelming support from the public for defiance of the creditors? Because a mere first pass look (which is all they’ve had the time and resources to do) at a Grexit has convinced them that it’s clearly, demonstrably worse than even the horrible creditor offer.

Readers seem utterly unwilling and unable to grasp that conditions will rapidly become worse with a Grexit, and will not get better for easily a decade. A Grexit will destroy Greece’s tourism industry and lead to famine unless the EU intervenes (they probably would since a famine in Europe would make them look really bad). So what would Greece have achieved if it imposes even more misery on its citizens, becomes a failed state, and has its citizens’ welfare depend entirely on the willingness and ability of the EU to intervene? Greece becomes a European dependency and an even worse off one than wearing the creditor ball and chain.’

The Peter Green was a nice antidote to all this. Whenever I hear the word ‘exquisite’ I think of ‘Man of the World’.

Bill,

Give yourself a pat on the back!

I reckon that when you have made it onto Donald Trump’s “hit” list, you have really made an impression in the world.

Keep up the good work.

PS

NC seems to be hard wedded to TINA in the Greek currency issue. Often referring to that Varoufakis have concluded that it an overwhelming task that would destroy the Greek economy.

Varoufakis arguments seems in general to be that Greece in large is a cash economy and the problems of getting cash in the new currency available and possible to use. And in general a economic catastrophe for Greece. Probably there of “smashed” printing presses, the difficulties of get an new Dinar going in Iraq by US led Coalition Provisional Authority, how many Boeing jets needed to fly in money printed abroad and so on.

Y Smith at NC is often present in the comments section when people attacking the articles, especially when they are arguing that it wouldn’t be “impossible” and a catastrophe to grexit.

A maybe not so PC comparison of a country ditching neoliberal austerity economics is Germany after H Brünnings devastating austerity policies. Probably very few could then imagine Germany’s economic rise to a great power. A Germany in shambles was during a few years restored and rearmed in a way that was admired by many e.g. Churchill albeit he didn’t like the political shift. People from neighboring austerity hit countries did go in great numbers to work in Germany. In a few years the Nazis could achieve their goals to remake Germany to achieve what they wanted and make it a European great power.

And after the war it was shown that ditching defunct neoliberal economic dogmas also good thing could be achieved.

Yves has no mechanism. She only has hysteria and a fixed position that she now cannot back down from because she would ‘lose face’ if she did.

And that is likely the position in Syriza – which is after all a European Nationalist party wedded to the idea of an integrated Europe. Denying the Eurozone is like denying God to them.

The Greek tourism industry will boom with the Drachma and you’ll get the Drachma the same way you get the Tanzanian shilling – at the airport when you turn up in exchange for any ‘hard currency’ you happen to have on you.

There are lots of parts of the world where you can’t get the local money until you get there.

Small issues blown out of all possible proportion that have tried and tested solutions implemented in other parts of the world already. Nick them, implement them and get trade moving again.

Since I’ve worked in IT for 25 years, for once I feel qualified to comment on an economics blog.

As Bill and others have noted, the nature of such conversions is not complex. It does not require highly skilled IT professionals, some work may be tedious but it will be completed by any competent firm. It will require significant planning, some development, and a great deal of testing to verify things are all in order. But the work is not highly specialized and could draw even from the ranks of the unemployed, who are considerable in number in Greece and Europe right now.

In the worst case some conversions will be hampered by systems that are badly out of date, built on e.g. Windows 2000 or even older. If a company finds itself in a pickle attempting to convert such an old platform, it may end up in a rush to upgrade, or find someone who can breathe a little new life into an old platform. But it would get done.

There would be a temporary increase in employment to perform the currency conversions, which would be even a small shot in the arm for the Greek economy.

The Y2K conversions were costly in part because they were done on top of the Internet “dot-com” bubble, at a time when unemployment was already low and wages correspondingly high. We don’t have that situation now.

Jeff

The Y2K conversions were costly because they were a scam in most part.

I was a technology business owner at the time and I wasn’t taken in by any of the hype and lived into the 21st century without mishap.

I had a similar experience as Bill being a mainframe assembler programmer/system programmer initially and then system analyst/developer in higher level languages of which there were many.

Certainly when storage was at a premium in the 1970s/1980s when I was developing in Cobol we did use “yy” to define the year in data, and yes that would certainly be a problem come Dec 31st 1999, but I doubt anyone was still using those systems by that time.

The systems affected that would still be in use were legacy mainframe systems, and I suspect most of those are still in use today

Regards

Brian

Bill, being Trumped is trivial. You need to be hacked by Hacker the Dog. He’s at Wimbledon every year.

More seriously, I began this article but like you I found it not up to date. Part of my reaction was the consequence of reading another like article in NC that harped on the “fact” that the ATMs would not work because the machines had to be re-jigged to accept the new currency. No mention in this article was made of employees known as bank tellers. They are able to do what an ATM can do and more. Except be available 24 hours a day. I see no reason why such employees can’t deal with the temporary disruption of the ATMs.

You mentioned Fortran programming. But you neglected that “wonderful” program that had to precede your program, JCL (IBM’s Job Control Language). If when the sysop ran your program “the machine” came across a JCL error, say, a misplaced comma, which meant it didn’t even get to your Fortran program, you got an error message which, even after consulting the JCL error manual, was generally totally incomprehensible. Those were not the days, and you often did have to “reach out” to the little priests in the control room. However, the response was not usually akin to the options mentioned by the Four Tops in the song. While they were there, they often did as little as possible for you.

It’s very clear the author of http://www.nakedcapitalism.com/2015/07/once-again-on-the-it-challenges-in-converting-to-the-drachma.html (Yves Smith or other, not very clear…) writes from a marxist perspective. No wonder he cannot completely endorse the euro exit solution, because, deep down, he cannot endorse ANY solution. Having a dysfunctional capitalist system allows Marxits to continue advocating a “revolution” with a mishmash of things like ‘getting rid of commercial exchanges’, ‘de-commoditization’, ‘moneyless economy’ etc. Reading Marx, it seems clear to me that he did not have a clue how modern money should work. I mean, his ideas about money are more or less those of Adam Smith (i.e. money is a thing). And Marx’s theory of value is to me ludicrous: people do not exchange working time when they trade! But maybe I miss some other points Marx made and which are important contributions to economics. What is your view on this Bill? How does MMT relate to Marxism?