I grew up in a society where collective will was at the forefront and it…

Parents are advance secret agents for the class society

Dutch economist Jan Pen wrote in his 1971 book – Income Distribution – that “Parents are advanced secret agents of the class society”, which told us emphatically that it was crucial that public policy target disadvantaged children in low-income neighbourhoods at an early age if we were going to change the patterns of social and income mobility. The message from Pen was that the damage was done by the time the child reached their teenage years. While the later stages of Capitalism has found new ways to reinforce the elites which support the continuation of its exploitation and surplus labour appropriation (for example, deregulation, suppression of trade unions, real wage suppression, fiscal austerity), it remains that class differentials, which have always restricted upward mobility and ensured income inequality and access to political influence persist, are still well defined and functional. This was highlighted in a new report published by the the American Economic Policy Institute (EPI) – Early Education Gaps by Social Class and Race Start U.S. Children Out on Unequal Footing (June 17, 2015). Not much has changed it seems for decades.

The Report summarises the “main findings in Inequalities at the Starting Gate: Cognitive and Noncognitive Skills Gaps between 2010-2011 Kindergarten Classmates ” which:

… explores gaps by social class and race/ethnicity in both cognitive skills-math, reading, and executive function-and noncognitive skills such as self-control, approaches to learning, and interactions with teachers and peers.

A more detailed discussion including methodology etc is – HERE – and you might like to read that document if you are curious about the underlying literature that reinforces the hypothesis development and research design.

The study “refer to these skills gaps as gaps in school readiness”.

The dataset is the rich “National Center for Education Statistics’ Early Childhood Longitudinal Study, Kindergarten Class of 2010-2011 (ECLS-K 2010-2011)”, which tracks kids who began “kindergarten in 2010”, and “seeks to determine how much social class matters, both absolutely and relative to other factors, such as race and ethnicity.”

The sample is stratified by:

1. Individual characteristics – ethnicity, gender, disability incidence.

2. Family characteristics – living with two parents or not, language spoken, US born, living in poverty, SES status – in quintiles, low, low-middle, middle, high-middle, high.

3. Early education practices – pre-K care, centre-based or not, other parental enrichment activities.

The aim of the study is to:

… focus on the association between these characteristics and children’s readi- ness for school.

The broad results of the research are:

1. In America, “social class is the single factor with the most influ- ence on how ready to learn a child is when she first walks through the school’s kindergarten door.”

2. “Low social class puts children far behind from the start. Race and ethnicity compound that disadvantage, largely due to factors also related to social class.”

3. “A substantial minority are so far behind that school success will be very hard.”

In other words, the “large share of children entering … [US] … schools from disadvantaged context” are pretty much doomed from the start as a result of who their parents are and the resources the parents have at their disposal.

That is what Jan Pen meant when he said “Parents are advanced secret agents of the class society”.

It also means that as fiscal austerity has further pushed people towards to the bottom of the income distribution that increasing numbers of children will inherit the disadvantage of their parents and it becomes a vicious circle of poverty and alienation.

The results are presented in terms of the five quintiles based on ‘social class’, which is measured in terms of “socioeconomic status (SES)”, which is a composite index that of five factors – “parents’ (or guardians’) educational attainment, occupational prestige score, and household income”.

They measure skills such as reading, maths, memory, cognitive flexibility, self-control, approaches to learning, social interactions, closeness to teacher, eagerness to learn, persistence, focus (attentiveness), creativity, etc.

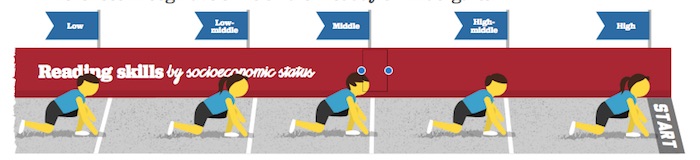

The Report produces a range of graphics which arrange the quintile groups or ethnic groups in terms of a athletics race starting line to provide a visual depiction of the relative status of each across the different measured skills.

I will leave it to you to investigate all the different presentations.

The following graph shows the “Differences in cognitive skills on the first day of kindergarten” that the study found between these quintile groups, arranged in terms of a athletics race starting line. The cognitive skills include reading, maths ability etc This graphic is in terms of reading.

The study concluded that:

Children in the highest socioeconomic group (the high SES fifth) have reading and math scores that are significantly higher – by a full standard deviation – than scores of their peers in the lowest socioeconomic group.

That is a huge statistical difference.

They also find that:

Black and Hispanic ELL children begin kindergarten with the greatest disadvantages in math and reading, due largely to links between minority status and social class

But the gaps between the ethnic groups (Asian, White, Hispanic, Black) “are much smaller than gaps based on social class.” The race gaps “shrink significantly” when social class is controlled for.

So it is socioeconomic status rather than race which “largely explains gaps that appear to be due to race”.

This raises the importance of choosing controls in statistical studies. Many studies in economics, for example, only consider individual outcomes in terms of so-called ‘supply side’ factors (education, age, gender etc) and ignore ‘demand side’ influences. They then conclude that individuals are to blame for their own outcomes (usually low education) when if the state of the economy (demand side) is taken into account, the supply side influences, often become insignificant.

For example, in this study, once race is controlled for by SES and “a set of parenting characteristics and practices”, the “gap in reading between black and white children disappear almost entirely”.

The study also finds that:

Low social class also affects children’s social, behavioral, and other noncognitive skills

Thus students from poorer, disadvantaged backgrounds are behind in terms of “self-control and approaches to learning” and “social skills”.

Why do these gaps occur at such an early age?

The single most influential determinant is the “child’s social class or socioeconomic status” which operates in two ways. It influences the “environment in which a child grows up”, the “participation in early childhood programs, the quality of those programs, and even the type and quantity of instructional and motivational activities that parents engage in with their children and that affect child development and school readiness.”

It also leads to spurious correlations between ethnicity and education gaps. The authors emphatically conclude that:

… this attention to conditions in which children live has, for the most part, disproved the misleading theory that innate or genetic factors partly explain the gaps

In other words, if you are black and grow up in a high SES household you will tend to be at the start of the queue.

Children who “live in concentrated poverty” have limited “role models”, a more polluted natural environment (which impacts on neurobiology), higher levels of stress, and lower quality pre-school opportunities.

The learning problems inherited in childhood then are carried into less teenage and early adult development – “skills beget skills – so that if the “basic, foundational knowledge” is impaired it is very hard to “to acquire skills in the future”.

The adult then experiences a life of job instability, low pay, long unemployment spells if there is a entrenched unemployment due to macroeconomic policy failure, and other characteristics of disadvantage including poor health, higher incidence of mental illness, etc.

Which leads me to discuss the latest bias towards fiscal austerity.

Fiscal austerity increases inequality and suppresses dynamic forces in labour markets that promote upward mobility.

Recessions impact on a number of economic aggregates in addition to the most visible impact – the rise in unemployment. The great American economist Arthur Okun coined the term The Tip of the Iceberg and I borrowed that for the title of a book I co-authored in 2001.

The point is that the costs of recession and the resulting persistent unemployment extend well beyond the loss of jobs. Productivity is lower, participation rates are lower, the quality of work suffers and real wages typically fall.

The facts associated with the current downturn are consistent with this general model.

However, within this context, Okun outlined his upgrading hypothesis (in the 1960s and 1970s) and the related high-pressure economy model, which provided a coherent rationale for Keynesian demand-stimulus policy positions.

Two references are Okun, A.M. (1973) ‘Upward Mobility in a High-Pressure Economy’, Brookings Papers on Economic Activity, 1: 207-252 and Okun, A.M. (1983) Economics for Policymaking, Cambridge, MIT Press.

Okun (1983: 171) believed that:

… unemployment was merely the tip of the iceberg that forms in a cold economy. The difference between unemployment rates of 5 percent and 4 percent extends far beyond the creation of jobs for 1 percent of the labor force. The submerged part of the iceberg includes (a) additional jobs for people who do not actively seek work in a slack labor market but nonetheless take jobs when they become available; (b) a longer workweek reflecting less part-time and more overtime employment; and (c) extra productivity – more output per man-hour – from fuller and more efficient use of labor and capital.

The positive side of this thinking is that disadvantaged groups in the economy were considered to achieve upward mobility as a result of higher economic activity. The saying that was attached to this line of reasoning was “all boats (large or small) rise on the high tide”.

Okun’s (1973) results are summarised as follows:

The most cyclically sensitive industries have large employment gaps, and were dominated by prime-age males, offered high-paying jobs, offered other remuneration characteristics (fringes) which encouraged long-term attachments between employers and employees, and displayed above-average output per person hour.

In demographic terms, when the employment gap is closed in aggregate, prime-age males exit low-paying industries and take jobs in other higher paying sectors and their jobs are taken mainly by young people.

In the advantaged industries, adult males gain large numbers of jobs but less than would occur if the demographic composition of industry employment remained unchanged following the gap closure. As a consequence, other demographic groups enter these ‘good’ jobs.

The demographic composition of industry employment is cyclically sensitive. The shift effects are in total estimated (in 1970) to be of the same magnitude as the scale effects (the proportional increases in employment across demographic groups assuming constant shares).This indicates that a large number of labour market changes (the shifts) are generally of the ladder climbing type within demographic groups from low-pay to higher-pay industries.

So prior to the neo-liberal onslaught and during the period that governments were cogniscant of their responsibilities to maintain full employment (and actively used fiscal and monetary policy to attack high unemployment relatively quickly), a recovery reversed the damage caused by the recession.

The evidence supported the proposition that when the economy is maintained at high levels of employment, workers in low paying sectors (or occupations) also receive income boosts because employers seeking to meet their strong labour demand offer employment and training opportunities to the most disadvantaged in the population. If the economy falters, these groups are the most severely hit in terms of lost income opportunities.

The upgrading thesis also focused on the mapping of different demographic groups into good and bad jobs. The groups who experience the greatest relative employment gains when economic activity is high are those who are stuck in the secondary labour market, typically, teenagers and women.

While these groups were proportionately favoured by the employment growth, the industries with the largest relative employment growth are typically high-wage and high-productivity and employ mostly prime-age males. Expansion is therefore equated with ladder climbing whereby males in low-pay jobs (as a result of downgrading in the recession) climb into better jobs and make space for disadvantaged workers to resume employment in their usual sectors. In addition, favourable share effects in predominantly male industries provide better jobs for teenagers and women.

So there were many benefits from growth which spread out across rising participation, rising wages, rising hours of work, rising employment and falling unemployment.

But the downside is that the iceberg takes a long time to melt if (a) it is large; (b) if the recovery is not robust enough; and (c) if the policy stimulus is poorly designed and targetted. Recovery alone is not sufficient. Real GDP growth has to be consistently strong for some years before the iceberg melts and the upgrading bonuses accrue.

Please read my blog – The aftermath of recessions – for more discussion on this point.

The full employment era (roughly 1945 to the late 1970s) to some extent, therefore, eroded the worst effects of the class differences that we discussed earlier.

However, once full employment was abandoned and governments adopted the austerity bias that is now chronic, The upgrading benefits that used to accompany growth have been hijacked by the rich and the vast majority of the population now miss out.

In part, this is due to the increased casualisation of the labour market, the suppression of real wages growth, the attack on trade unions, and the shift away from high productivity job creation towards the FIRE sector, which is a largely unproductive sector.

The neo-liberal attack on the role of government in ensuring policy advances the well-being of all has changed the way the distributional system operates – with workers now finding it harder to gain access to real income growth despite contributing more per hour (productivity growth stronger).

Under these circumstances, the old class screening and channelling that the schooling system has provided for the Capitalist system is intensified and inequality accelerates.

Conclusion

The Report argues that early intervention is crucial if societies are to reduce the “poverty-related early skills gap”.

They suggest a range of interventions (homevisits by nurses, quality child care, prekindergarten participation) etc. These are seen as “mitigating” the effects of poverty rather than solving (reducing) it.

They realise that “Poverty poses such huge challenges to life success that mitigating its effects is insufficient.” In this context, we are back to the usual themes of this blog.

There is a need to ensure that the statement “all boats rise on a high tide” is an accurate reflection of the dynamics of the system. That means we have to allow those dynamic upgrading effects to work again and we have to prevent the elites monopolising the gains of growth.

That means we have to (the Report makes the same recommendations):

1. “Raise wages” – “starting with the federal minimum wage” to ensure workers fully participate in the productivity gains of the economy and that the concept of the working poor is eliminated. No one who works should be below the poverty line.

2. “Boost employment” – there has to be a return to the commitment to full employment. People from “Low-SES families are particularly vulnerable in times of high unemployment” and a true full employment state ensures these families always have adequate income. The introduction of a Job Guarantee should be an essential aspect of that commitment.

3. “Sustain the social safety net” – there will be times that people need further income support – sickness, disability, age, etc. There is never a reason to deny families (and the children within them) access to an adequate income that allows the family to avoid social alienation.

There are a range of other suggested strategies relating to immigration, prison reform and ethnic segregation, which maybe US-centric.

But the three I have listed apply to all economies and once those structures are restored to their proper levels, then the poverty problem will be very small and easily dealt with.

That is enough for today!

(c) Copyright 2015 William Mitchell. All Rights Reserved.

Bill,

A good article as usual. Pen’s arguments make just as much sense now as they did 44 years ago. Everyone is in favour of upward social mobility for their own children but not downward mobility! So getting the upper orders to send their children to the local state school aren’t any better now than they were then.

Are MMTers any better than anyone else when it comes to fighting for a more equal society? We argue more for increased deficits that we do for taxes on the wealthy. Furthermore, we risk falling out out with progressives who make calls to “tax the rich” unnecessarily. Our argument veers dangerously close to saying that we should excuse the rich their taxes because they aren’t spending it anyway. So, if that argument applies to the rich why not everyone else? Why don’t we all have the option of just saving our money instead of paying it out in taxes? It would make no difference to inflation.

It only means governments would need to run bigger deficits, and who cares about that?

“So, if that argument applies to the rich why not everyone else?”

It does apply to everybody else. Financial saving is essentially voluntary taxation.

Taxes are excused to all depending upon the overall level of net-saving. That’s what functional finance is all about.

But importantly the other changes that MMT brings about (such as shrinking bank lending and Job Guarantees) ensures that the dynamic expansion of the economy is directed largely to the lower end – which helps close the equality gap.

You don’t pull the rich down to your level. You improve your level to that of the rich by making them work harder for their corn.

In a sense redistribution should be seen as a failure to get your distribution system working properly in the first place.

Peter, the problem is basically activists not familiar with MMT are putting the cart before the horse. The government can pay for full employment and social programs and whatever else without increasing taxes on anyone.

The issue of the rich not paying a fair share is an effect of inequality, not the cause of inequality.

Neil,

Financial saving is essentially voluntary temporary taxation. I suppose you could argue that burning or shredding pound notes or dollar bills would be voluntary permanent taxation. I’ve no objection to that!

The wealthy can move around their income and declare it some tax haven like Luxembourg or the Republic of Ireland. They can claim non-dom status in the UK if it suits them for tax purposes. Since when did the average tax payer have that option?

Of course, it’s easier for a currency issuing country like the UK to ignore tax-dodging by the wealthy and just run an increased deficit. It doesn’t make much, if any, difference in the short term.

It’s not healthy for our society though despite what economic arguments may be used to justify it. It transgresses everyday notions of fairness. Ultimately the tax system can only run on consent and trust. That’s in dangerously short supply at present.

Dear Bill

There are 2 letters missing in your analysis: IQ. There is no reason to assume that IQ, whatever it stands for, is equally distributed among socio-economic classes. If there is some correlation between income and education and also some correlation between education and IQ, then there is a correlation between income and IQ. To put it bluntly, we have no reason to assume that children born to parents with 6-digit incomes have, on average, the same IQ as children born to parents with incomes under 25,000. I’m a man of the left, but I see no reason for believing that we are born equal. Precisely because we are not born equal, we need egalitarian policies to reduce inequalities.

Another thing to consider is that the more room there is at the top, the less talent there is below the top, if talent facilitates access to the top. Suppose that we have an army of 100,000 men. It has only 1,000 officers. Now the army becomes more like the Canadian army (top-heavy), so it has 20,000 officers. If promotion to officer status has something to do with talent, then the average level of talent among the 80,000 of the rank and file is lower than it was among the previous 99,000.

Now suppose that we have a country where 1% of 18-year-olds go to university. After some time, 20% of 18-year-olds go to university. If admission to university has something to do with intellectual talent, then the average level of intellectual talent among the 80% who don’t go must be lower than the average level of intellectual talent of the 99% who didn’t go before. If university attendance stays at 20%, then it now becomes harder for the children of parents without university education to go university.

I’m all in favor of equality of opportunity, but more important is equality of condition. I can live in a country where the son of a doctor has a higher chance of becoming a doctor than the son of a carpenter, even if both sons have equal intellectual talent, but in which carpenters also have a decent standard of living and safe working conditions and in which the lifetime after-tax income of a doctor isn’t 12 times higher than the lifetime after-tax income of a carpenter, but is much lower.

Regards. James

“Ultimately the tax system can only run on consent and trust. That’s in dangerously short supply at present.”

I would rather we shifted taxes onto land and other monopolies than the “wealthy.” Location values are created by the community – better schools, hospital, public infrastructure, etc.

What is “trustful” about a man with a gun demanding you hand over your savings?

“The government can pay for full employment and social programs and whatever else without increasing taxes on anyone.”

Well er.. yes. It can always buy anything in its own currency.

The question is always about real resources. The cost of anything is the real resources it uses.

If there is not enough “space” then you may have to increase taxes or increase savings (voluntary taxation.)

“So, if that argument applies to the rich why not everyone else? Why don’t we all have the option of just saving our money instead of paying it out in taxes? It would make no difference to inflation.”

Indeed – why not? If you limit bank borrowing and promote financial savings you can cut taxes heavily. Which would you prefer?

And MMTers are not some blob (neither are the “rich”.) There are left wing MMTers, libertarian MMTers, MMR, socially conservative MMTers etc.

We all have our own ideas on what tax system is fair and what we should spend money on, etc. Personally my view is we should tax economic rents as much as possible and earned income as least as possible. Rent seeking is the real problem.

Wayne Rooney having a million pounds is no problem. Him owning a big house in the middle of London is, as it means others cannot live there and he is taking up space.

You are also forgetting taxes create demand for the currency. Which is another reason why I support land value tax because at 30%-40%+ it ensures strong demand for the currency.

James, I was a little confused by your comment. But let me make only one point. You have neglected Galton’s regression to the mean (what he called “regression to mediocrity”). If, ex hypothesis, some of the rich are there because they are intelligent, ignoring IQ which is a contentious measure, their children will, on average, be less intelligent than they are. The same argument applies to the bottom end. If people at the bottom of the economic ladder are there because they are stupid, then their children will, on average, be more intelligent than they are. You can no doubt see where this kind of argument takes you and renders your argument more complex.

Even if intelligence were completely determined by genetic inheritance, which we know it isn’t, this could never form the basis of a decent economic policy. When we see a “lucky” poor student “getting on” in society, statistically, we must ask ourselves where the others are, that is, why we aren’t seeing more of them. Because by the laws of probability and the random distribution of intelligence throughout the population, there should be more “successful” poor than there are. It is I think clear why there aren’t more, but that is not the point I am addressing.

James, I neglected to mention that correlation is not causation, which I think you are implicitly conflating. And there is every reason to think that intelligence is randomly distributed throughout the population. Or to put it another way, there is no reason to think otherwise.

Curious about your take on the following:

http://www.pbs.org/newshour/making-sense/america-inequality-begins-womb/

http://blog.oup.com/2015/05/african-american-unequal-birth/

@James

“I see no reason for believing that we are born equal.”

“If there is some correlation between income and education and also some correlation between education and IQ, then there is a correlation between income and IQ.”

IQ has come under fire a lot in the last 2 decades especially from science/neuroscience has kind of debunked it.

IQ is not ‘static’ and increasingly hard to use as a pure metric in these sorts of studies.

For instance:

A child in kidergarten turning 5 may be developmentally behind a child of 5 years and 6 months. Because we’re partitioning childrens learning into yearly time slices the 5 years and 6 months child may appear gifted versus his/her younger (both participating in the same class+time slice) and go to special classes further lifting that childs IQ. Repeat the cycle/time slices several times and the richness and menatal aptitude of the slightly older child may have repeatedly augmented with greater quality of education. Now measure IQ at 10 years of age (neuroplasticity at work here) 😉

It comes down to class advantage, children not having to worry about the micro-socioeconomic impacts of poverty. (poverty is mentally taxing). Whenever looking at these class issues try to see IQ as an emergent property derived from a subset of variables not as an atomic variable in itself.

The Mismeasure of Man by Stephen Jay Gould has a lot to say about IQ. IQ and its testing has been very much based on ideas of race and class,. It is white persons testing to prove themselves clever. Gould wrote his book in in 1981. Here is a recent article about it: http://www.theguardian.com/science/2009/nov/12/race-intelligence-iq-science

“The idea that intellect had something to do with cranial capacity was – and to some people, still is – an attractive one, and generations of researchers tried to find new ways to measure brain size and shape, and match it with apparent intellectual performance. These experiments tended to prove that white people were cleverer than black people because they were bigger-brained.

In The Mismeasure of Man, Gould revealed that they could only prove this by massaging the results, cooking the data, and eliminating the unwelcome findings. One researcher found that German brains, on average, weighed 100 grams more than French brains. He was, of course, German. Measurements also produced inconsistencies: some Caucasian geniuses had very big brains, other intellectual giants had a quite modest cranial capacity.”

I’m not sure quite what IQ has to do with all this.

Even if we allow that there are measurable differences between intelligence of different individuals, why shouldn’t we do what it takes to reduce the “poverty-related early skills gap” which is the point of Bill’s article?

I agree petermartin2001. IQ has nothing to do with it.

How about we get rid of most taxation anyway? Since we understand tax pays naught towards government spending we could work out a way to substitute for taxation with other controls, such as the Central bank uses already. Some taxes such as a limited GST could remain as long as the other methods can’t keep up. Getting rid of most corporate taxation might well repatriate offshore industry and add jobs to the workforce. We could mandate living wages without cutting industry out of the market. We could subsidize industries which are not working within a level playing field to better compete with outsourced production. Plenty of nations do it already so we might as well join them, without compromising well paid work. It would only take a generation or so for parent attitudes to change.

Dear Larry

Regression to the mean occurs, but it isn’t continuous. Suppose that we take 100 men who are 195 cms tall and 100 women who are 185 cms tall. We send them to an unpopulated island, where they form a separate breeding community. Their descendants may have an average height that is less than 195 cms for men and less than 185 for women, but they will still be quite tall on average. Now we take 100 men with an average height of 160 cms and 100 women with an average height of 150 cms. We also send them to an unpopulated island, and they also will be a separate breeding community. The average height of their descendants will be higher than 160 cms for men and higher than 150 cms for women, but they won’t be tall. The difference in the average height of the 2 islands will be less than 35 cms, but it won’t reach zero, far from it.

Continuous selection will reduce regression to the mean. Suppose that the milk production of the cows of a certain dairy farmer varies between 8,000 and 13,000 liters per year. The farmer does not allow the cows with less than 11,000 liters to reproduce. If he keeps this selection process going, then eventually there won’t be any cows left which yield less than 11,000 liters per year.

It isn’t reactionary to say that people are naturally unequal. What is reactionary is to say that we can’t or shouldn’t reduce natural equality. Let’s take an uncontroversial quality: eyesight. Every sane person recognizes that people aren’t visually equal, even if we make comparisons between people of the same age. Some people just have better eyesight than others. However, we don’t passively accept this inequality as God’s or Nature’s will. We equip people with poor eyesight with glasses and perform eye surgery on them. Optometry and ophthalmology are powerful reducers of visual inequality, and that is all for the best.

I have little patience with people who state that nature is addicted to inequality and then put forward the non sequitur that efforts to reduce inequality are futile. We aren’t slaves of nature. Most of medicine can be regarded as an instrument to reduce natural inequality. Is medicine a violation of the natural order?

Equality of opportunity is more a liberal than a socialist idea. What would you prefer, a society in which the riches 10% have 60% of national income but in which everybody has an equal chance to become part of the richest 10%, or a society in which the richest 10% have only 25% of national income but in which the children of the richest 10% have a bigger chance of joining the richest 10% than the children of the other 90%. I would prefer the second society. The greater the equality of condition, the less important equality of opportunity becomes.

Regards. James

Dear sam w

People who argue that IQ is solely determined by genetics obviously haven’t heard of the Flynn effect. It is like saying that height is purely genetic and has nothing to do with nutrition. On the other hand, the more equal environmental conditions are, the more variety is explained by genetic factors. Suppose that in a country 1/3 of the children are well-nourished, 1/3 are poorly nourished and 1/3 are severely malnourished. Then, obviously, part of the observable height differences in that country are attributable to nutrition. By, contrast, in a country in which all children are well-nourished all height differences can be attributed to genetics.

The Netherlands has had conscription for most of the post-war period. The potential recruits also had to undergo a mental test, a rough indicator of intelligence. Well, between 1950 and 1980, the average score on that test went up by a whopping 23%. The likely explanation is that conditions for the non-elite part of the Dutch population improved considerably, so their average score increased. This can’t go on forever. The more we equalize conditions for all, the more the differences that remain are the product of genes. After all, in 1980 all Dutch males of 18 didn’t have the same score.

Regards. James

Dear James,

Of course, we are unequal in all kinds of things. Nothing I wrote should be considered to imply anything else. But that is not the point. The way to deal with the various kinds of inequalities is to create a level playing field, thus reducing discrimination on factors other than the skills or talents under consideration. While technological innovation can play an important part in this, the most important thing to do is to reduce and try to eliminate whatever social and cultural factors seem to be underwriting the kinds of discrimination we all have in mind.

Dear Larry

I’m all in favor of a level playing field, but what if it results in extreme inequality? Should we just accept that because we all had the same opportunity? Let’s use an analogy. There is a race between 100 people. The race is totally fair. No runner has an unfair advantage. At the end, the winner gets 10 million, the runner-up gets 5 million, and the third one receives 1 million. The other 97 are executed. That would be an example of equal opportunity with very unequal outcome. We all want some quality of life, and efforts should be made to insure that we all get it. Concentrating on equality of opportunity is a red herring.

Cheers. James

“How about we get rid of most taxation anyway?”

In principle we could just lend the money back to the government for a limited time. Say 10 years. It wouldn’t make any difference except that the govt’s deficit would increase. Deficits don’t matter much, do they? So that would be OK, wouldn’t it? But what would happen at the end of those ten years? Or if it was 20 or 30 years, would it affect our children?

I’m somewhat perturbed about this question. There seems to be some criticism from some MMT quarters when socialists argue that we should go after the rich for their taxes. As the rich are saving rather than spending, and are good at hiding their money, it’s much easier to just increase the deficit. But is it really a good idea to allow that?

Can not say I am as relaxed about the very wealthy as mr mandleson or many of the commentators

today.The rich get first pick of land and resources the rest of us and our forebears have worked on.

They inherit the history of human technology.I am not against private ownership or in favour of complete

equality and I know there is not fixed amount of stuff but it is inevitable that the more the rich take the less there is for everyone else .

We also know in a political economy based on the transfer of money tokens that power and influence

are dependent on spending power.Without active government unemployment and the working poor

will always be with us in our current system .Social mobility falls as inequality rises.

To mitigate the corruption of wealth and power progressive taxation is required.

To put it simply if the government did not destroy some of the elites money tokens they

would have even more power,more land etc