Yesterday, the Reserve Bank of Australia finally lowered interest rates some months after it became…

National income continues to be redistributed from wages to profits in Australia

One of the salient features of the neo-liberal era has been the on-going redistribution of national income to profits away from wages. This feature is present in many nations. As I noted in yesterday’s blog – Employer group demands free labour from Government – employer groups in Australia are upping the ante and demanding that the Government provide them with free labour. It goes like this – the government runs a fiscal austerity campaign, which creates rising unemployment. They then harass the unemployed for daring to apply for the below poverty line income support. If that is not enough, then the private sector demands the Government hand these unemployed workers over to them for free to “make coffee” and other tasks. Its a lovely world that we are living in. Meanwhile there is growing pressure on Australia’s wage setting tribunals to scrap penalty and overtime rates, allegedly because they damage employment and firms are just busting to put more workers on as long as wages drop. The Australian Bureau of Statistics published the latest – Wage Price Index, Australia – for the December-quarter today and we learn that the annual growth in wages is now at the lowest level since the data series began in the June-quarter 1997. The annual hourly wage inflation is now down to 2.5 per cent overall and 2.4 per cent in the private sector. With productivity growth running slightly slower and the annual inflation rate dropping sharply in recent quarters as the overall economy slows down (and oil prices fall), the shift to profits slowed marginally in the December-quarter. But Real Unit Labour Costs (RULC) continued to fall. Further, the long-term trends are still alarming with employment growth flat or negative and unemployment rising.

I have had a long association with these tribunals as an expert witness and I cannot recall the employers’ representatives ever agreeing that the time is right for wage rises. If their submissions are to be taken on their word then there would never be any wage increases.

And with nominal wages growth slowing rapidly over the last several quarters and the redistribution of national income towards profits continuing, they are still not satisfied.

That is the nature of capital – always wanting more and harassing the government to take their side and help them get it.

The problem with this neo-liberal era is that governments around the world have agreed to working on that side of the struggle against workers. Something has to give.

The wage series is the quarterly ABS Wage Price Index published by the ABS. The Non-farm labour productivity per hour series is derived from the quarterly National Accounts.

A compact dataset can be downloaded from the RBA Table H2 Labour Costs and Productivity. I extrapolated the average growth over the last five years to get the December-quarter productivity result, given the national accounts data is not released until early March.

Nominal wage and price inflation

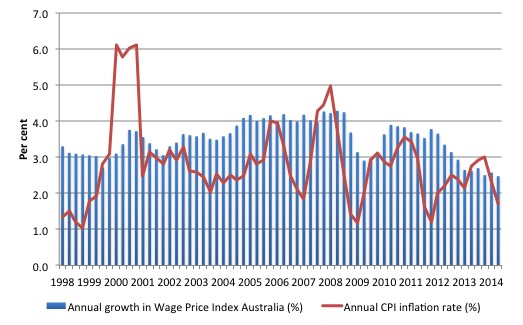

The first graph shows the overall annual growth in the Wage Price Index since the September-quarter 1998 (this series was first published in the September-quarter 1997).

I also superimposed the annual inflation rate (Consumer price index) – the red line. The bars above the red line indicate real wages growth and below the opposite.

The big funny-looking jump in 2001 was the introduction of the Goods and Services Tax which created a once-off adjustment in the level of the CPI.

So after falling for three quarters, then steadying, the real wage grew modestly in the December-quarter 2015 – at an annual rate of 0.8 per cent.

But as we will see later, this is still well under the productivity growth rate, which means that the redistribution of national income towards profits is still on-going.

Real wages growth subdued in December-quarter

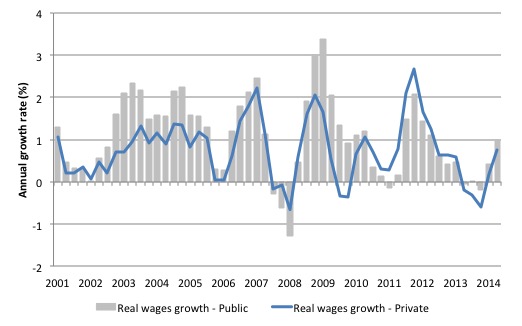

The following graph shows the annual growth in real wages from the first-quarter 2001 to the December_quarter 2014 (I cut out the GST effect).

After a few quarters of hard real wage cutting, the private sector returned to positive real wages growth but at very subdued rates.

The rise in real wages in 2012 into 2013 was the result of the strong growth encourage by the fiscal stimulus. The declining profile after that is associated with the end of the mining investment boom exacerbated by the obsessive fiscal austerity that was introduced (too early)

Workers not sharing in productivity growth

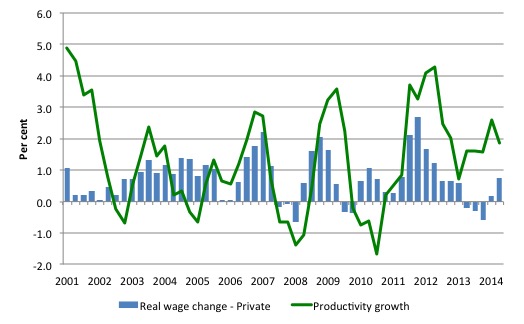

The next graph shows the annual hourly real wage change for the private sector (blue bars) and the annual hourly productivity growth (green line) since the March-quarter 2001.

Productivity growth has been relatively strong in recent quarters, which is one reason why employment growth is so flat. For each extra dollar of real output, less workers are needed when productivity growth rises.

Historically (for periods which data is available), rising productivity growth wass shared out to workers in the form of improvements in real living standards. Higher rates of spending then spawn new activity, which soaks up the workers lost to the productivity growth.

The neo-liberal period marked a shift in that relationship as we discuss below.

Clearly, since the September-quarter 2011, the payoff to workers from the positive productivity growth has been absent with real wages growth lagging productivity growth.

In recent quarters, the gap has been large.

Real wages and productivity growth – a massive redistribution to profits

To understand the significance of the gap between real wages growth and labour productivity growth the following points should be noted:

- Employment is measured in persons (averaged over the period).

- Labour productivity is the units of output per person employment per period (in this case per hour).

- The wage and price level are in nominal units; the real wage is the wage level divided by the price level and tells us the real purchasing power of that nominal wage level.

- The total economy-wide wage bill is employment times the wage level and is the total labour costs in production for each period.

- Real GDP is thus employment times labour productivity and represents a flow of actual output per period; Nominal GDP is Real GDP at market value – that is, multiplied by the price level. So real GDP can grow while nominal GDP can fall if the price level is deflating and productivity growth and/or employment growth is positive.

- The wage share in national income (GDP) is the share of total wages in nominal GDP and is thus a guide to the distribution of national income between wages and profits.

- Unit labour costs are in nominal terms and are calculated as total labour costs divided by nominal GDP. So they tell you what each unit of output is costing in labour outlays.

- Real unit labour costs are calculated by dividing Unit labour costs by the price level to give a real measure of what each unit of output is costing. RULC is also the ratio of the real wage to labour productivity and through algebra I would be able to show you that it is equivalent to the Wage share measure.

From the last point, if real wages growth is above productivity growth then RULC are rising, which is the same thing as saying that national income is being redistributed to wages (workers).

However, if real wages growth is below productivity growth then RULC are falling, which is the same thing as saying that national income is being redistributed away from wages (workers) to profits (capital).

It can get a little more complicated if the share that government claims changes but that is normally stable, which means the dynamics of national income distribution are between wages and profits.

From the last gap, we can see that RULC have been falling and national income has been redistributed towards profits since September-quarter 2011.

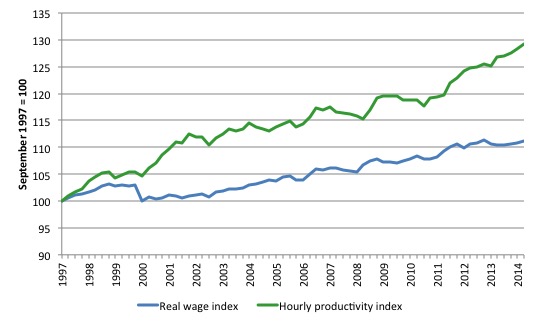

The following graph shows the indexed growth in hourly real wages and labour productivity per hour since the September-quarter 1997 (the start of the Wage Price Index series).

If I started the index in the early 1980s, when the gap between the two really started to open up, the productivity index would stand at around 170 and the real wage index at around 115.

Starting the index in the September-quarter 1997 produces a smaller gap, which just goes to show that one can manipulate data to achieve a range of ends (often quite contrasting) by altering the sample size.

What is clear is that since the September-quarter 1997, real wages have grown by only 11.2 per cent (so just over 0.6 per cent on average per year), whereas hourly labour productivity has grown by 29.2 per cent (or 1.7 per cent on average per year).

This is a massive redistribution of national income to profits and away from wage-earners and the gap is widening each quarter.

The gap widened further in the December_quarter 2014.

Where does the real income that the workers lose by being unable to gain real wages growth in line with productivity growth go? Answer: Mostly to profits. One might then claim that investment will be stimulated.

At the onset of the GFC, the Investment ratio (percentage of private investment in productive capital to GDP) was 23.9 per cent.

It peaked at 24 per cent in the June-quarter 2013. But in recent quarters as the gap between real wages growth and productivity growth widens, the Investment ratio has fallen and in the September-quarter 2014 it stood at 22.3 per cent.

The downward shift in the non-mining investment ratio is more stark than that.

Some of the redistributed national income has gone into paying the massive and obscene executive salaries that we occassionally get wind of.

Some will be retained by firms and invested in financial markets fuelling the speculative bubbles around the world.

For workers, the problem is that they rely on real wages growth to fund consumption growth and without it they borrow or the economy goes into recession. The former is what happened around the world in the lead up to the crisis (and caused the crisis).

The latter is more or less what is happening now.

One of the essential changes that needs to happen to ensure that another bout of financial instability doesn’t hit soon is that real wages have to grow in proportion with productivity growth – exactly the reverse of what is happening now.

Real wages growth and employment

The claim that real wage cuts are necessary to stimulate employment are never borne out by the evidence. Wages have two aspects.

First, they add to unit costs, although by how much is moot, given that there is strong evidence that higher wages motivate higher productivity, which offsets the impact of the wage rises on unit costs.

Second, they add to income and consumption expenditure is directly related to the income that workers receive.

So it is not obvious that higher real wages undermine total spending in the economy. Employment growth is a direct function of spending and cutting real wages will only increase employment if you can argue (and show) that it increases spending and reduces the desire to save.

There is no evidence to suggest that would be the case.

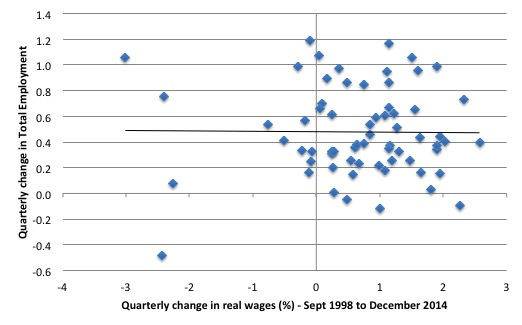

The following graph shows the quarterly growth in real wages (horizontal axis) and the quarterly change in total employment. The period is the September-quarter 1998 to the December_quarter 2014. The solid line is a simple linear regression.

Conclusion: No discernible direct relationship! There is strong evidence that both employment growth and real wages growth respond positively to total spending growth and increasing economic activity.

At present, total spending in the economy is subdued and moderating.

Conclusion

Not a wages breakout or explosion in sight! In fact, nominal wages growth is now at the lowest level since the data series began (September-quarter 1997).

And a very damaging fiscal strategy being deployed.

The employer groups are mounting massive pressure to further cut the growth in wages – presumably to negative numbers. As I noted yesterday, they even want the government to give them free labour and to cut the fiscal deficit further, which would create even more unemployment – and presumably a bigger pool of this free labour.

There is a very real need for a new political party to form in Australia to reject this rubbish. The Labor Party will not do it. The Greens are neo-liberals on bikes (given their macroeconomic policy platform) and there are not other contenders at present to fill the gap.

Maybe Australian readers would like to air their views on this and make suggestions about how that sort of progressive party could form.

The Syriza success (up to the election) shows that progressive left grass roots movements can be spectacularly successful.

Tomorrow I will write about the ‘reforms’ proposed by Syriza yesterday. I was going to do it today but then the wage data came out.

There is a lot of “give Syriza a chance” sort of narrative out there now – “they are just buying time” and the rest of it. But apart from achieving a “Don’t mention the War (Troika)” sort of change, the situation looks like it will remain bleak.

The reforms proposed have no conditions on them that the Eurogroup will create a massive stimulus from the European Investment Bank into Greece, which would allow them to run fiscal balances yet gain the strong growth in employment and wages that they need.

Unless that massive stimulus comes, sticking to fiscal austerity, which is all we have seen in the reform wording, will not achieve anything much good.

And when you compare it with the mandate they sought and received – they are light years away.

The problem is that the mandate was inconsistent. I do not believe they can achieve what they claimed they would while staying in the Eurozone. But more on that tomorrow.

That is enough for today!

(c) Copyright 2015 Bill Mitchell. All Rights Reserved.

Great data, Bill, and I enjoyed your editorial comments, too.

“The claim that real wage cuts are necessary to stimulate employment are never borne out by the evidence. Wages have two aspects.

First, they add to unit costs, although by how much is moot, given that there is strong evidence that higher wages motivate higher productivity, which offsets the impact of the wage rises on unit costs.”

Explains why employer groups and the government seek punitive measures in their assault on worker’s rights and conditions. They seek to use fear and uncertainty to drive productivity in lieu of decent wages and conditions.

Perhaps one word will suffice to account for the drive to do the workers down.

Greed ?

Just one thing. I see you have shown wages growth in decline vs labour productivity. I obviously can’t post a graph.

http://i.guim.co.uk/static/w-620/h–/q-95/sys-images/Guardian/Pix/pictures/2013/8/12/1376285320201/jericho-market-prod-graph-001.jpg

Multifactor productivity is in decline with capital productivity in serious decline. Just wonder if this could be the reason behind the decline in wages growth and the shift to profit.

It seems to me that if the employers’ lobby succeeds in getting their wish of free labor from the unemployed, that would drive the demand for this free labor thru the roof. It would then become necessary for the government to throw people out of work just to meet this demand, and for the clever employers, it could then become a game to see if they could fire people and then get the same people back on dole labor.

Is it true that Australia was founded as a prison colony?

If Bill gave up in his belief in the current monopoly of credit then people would need much less work to access purchasing power.

So sad , you seem such a nice guy on the surface but its clear to me now you are working for the other side.

I still can’t fully grasp the scale of the money conspiracy but am getting close.

Thanks to CH Douglas and modern writers such as Anthony Migchels as well as bitter experience in absurdly corrupt corporatist unions.

Bill is wrong wrong wrong.

The post war inflationary world was a bloody nightmare – this is very clear.

People must reject this ultimate seizure of the commons by the banking power.

Woodside has just cut contractors rates by 25%. Termination letters and new severly reduced contracts arrived in the same email. This occurred the day after the announcment of the $2.8 billion profit and multi-million increase the CEO Coleman.

Dork of cork, what are you talking about?

According to a friend, Paul Meli, “It has never been safe to trust banks. These days it isn’t safe to trust any institution or elected official…they’re grifters, the lot of ’em.”

Since even the newly graduates ones are, by default, I blame our failing schools (and culture), for not rising to emerging demands.

We’re dissociating, rather than maintaining or building national teamwork & solidarity.

http://mikenormaneconomics.blogspot.com/2015/02/as-always-real-angst-is-not-over-public.html

So of course our return-on-coordination is dissolving.

That return is the only one big enough to save us from our own frictions, the “cost of coordination.”

Well this will certainly be a story for the real news reporters AKA: Peter Martin. 😉

Who would have guessed empirical evidence shows that contrary to improving the fortunes of small business the drop of in aggregate demand (from what i’d call slavery employment contracts) will manifest itself in less customers for small business as their customers have all had their wages slashed.

Never mind the plethora of studies from around the world that show low income brackets live hand-to-mouth and attacking their spending power directly affects the solvency of small business. (never seems to deter these supposed thinking groups).

The so called ‘Australian Chamber of Commerce and Industry’ rename itself to something more appropriate.

Its all a build up to next ‘budget’ night where LNP will attack workers as the cause for their own policy failures.

Bob

Bill wants us to work work work.

This will overproduce goods , the goods will depreciate on a massive scale , the costs will be socialized.

More work will be required to pay the costs of previous production etc etc etc.

He essentially wants a consumer war economy.

He seems to dig Japan for some funny reason.

All that savings / debt cannot be spent baby.

Its a forever autumn economy.

“The ruling passion of the age is to convert wealth into debt in order to

derive a permanent future income from it – to convert wealth that perishes

into debt that endures, debt that does not rot, costs nothing to maintain,

and brings in perennial interest.”

― Frederick Soddy

Dork, if there was some force in the world made all debt payable at once, you might be right. But there isn’t. There’s always more income. And people can just default. The world will still turn.

Dork,

Are you nuts? Bill has said repeatedly that there is a better way to have everyone employed than to keep manufacturing doodads and digging up resources out of the ground. Are you so stuck inside your own echo chamber that nothing else gets in?

@ Matthew

The world will no doubt turn but peoples life force will be sucked out to a even greater degree.

A national dividend ( not basic income ) would pay the debt baby.

No need for this puritan pathology of “savings”

This constant force feeding of industrial overproduction on to the population forces it to save in the interests of preserving life.

According to Mmt groupies people save because they want to.

This is in most circumstances not the case.

A Saving culture is forced on the individual as a result of the waste of resources by the people who currently hold the monopoly of credit.

Check out the latest Ft alpha ville piece.

I kid you not – the bank of England wants to go green.

This from the institution which destroyed the last of the British isles forests as they went into furnaces and royal navy shipyards.

Its now thinking of using the very idea of global warming to further industrialize the landscape.

The best way to reduce the scouring of the shires is to hunt Saurman out of his tower and fling him into the abyss.

@Jeff

Bill wants to direct people into employment

I however suggest a different route.

Just give then their share and they will cooperate with other people.

Its natural you see.

Our brains are designed to operate in a village ecosystem of 100~ people.

I am happy long lining kenmare bay in my she kayak and simply giving away food to people I know.

Its the way most of us are designed.

May I suggest you read” 20 years a growing “by Maurice O Sullivan to see how real humans interacted (isolated Gaelic islands somewhat away from the Tudor capitalist nightmare) before this pox came upon us.

“There is a very real need for a new political party to form in Australia to reject this rubbish. The Labor Party will not do it. The Greens are neo-liberals on bikes (given their macroeconomic policy platform) and there are not other contenders at present to fill the gap.”

In the past, great political parties of either persuasion’ did at least aspire to have the courage of their OWN convictions. You may not agree with them, but they at least they tried to implement their program, eg: Whitlam’s “crash or crash through”. They had an idea of where they were going. Whether you were a capitalist or a socialist you had a philosophy that informed your decision making. Nowadays, governments as well as government departments are so busy listening to “stakeholders” they have no time to form their own opinions. Whenever politicians pledge to “listen more”, as Tony did recently, that’s code “I’m all out of ideas”.

Neoliberalism is “chicken soup” for the clueless; it makes them feel as if they are actively seeking solutions.

However, as Sir Humphrey Appleby once said: “Politicians love activity; it’s their substitute for achievement”.

President Obama/Council of Economic Advisers:

There are two directly opposing mind-sets which drive our policy for addressing unemployment….

One is that we need employees without rights to be used and discarded “at will”….i.e., a mind-set which still has one foot on the plantation [the one we are using now in the U.S.]….

The other says, NO, this undermines both the unemployed, and the market-it is a “No One Wins”-the jobless lose, it is a breeding ground for terrorists, and the market loses, to wit:

THE LAW OF DIMINISHED INCOME TO THE MARKET FROM UNEMPLOYMENT [hereafter the D/UE LAW]

Short Definition:

3% is the zero-sum threshold above which unemployment starts substantially undermining the Market–and the loss in income to the Market is compounded exponentially with each percentage point of increase in unemployment, above 3%.

Ironically, we have two laws, one proposed, the other enacted-one in the U.S., the other in India– which directly addresses the above:

In India, The National Rural Employment Guarantee Act 2005, and in the U.S., the Humphrey-Hawkins 21st Century Full Employment and Training Act of 2013 [HR 1000].

Since it passage in India, the Indian economy currently has a robust market with a solid middle class, as America’s middle class is disappearing.

The propaganda used in our current mind-set, above, is that “the market can provide anybody wanting a job, with a job”…..

Problem is, it is pure BS….only ONCE since WW II has this resulted in a UE rate below 3%–in 1953-leaving millions jobless in its wake to the detriment of the market, and when the market fails, the jobless are out of luck!

In spite of this, this week, the governor of Wisconsin, Walker, is going to sign a law-a law backed by the Koch brothers [a metaphor for the 1%]–with the SPECIFIC INTENT to erode “employee rights”-i.e., it is 180 degrees in the wrong direction from the inertia of history…

Specifically, unemployment is the most pernicious social problem facing America, today-and while we have the “legal authorization” to limit UE to “3%” [15 USC § 3101], and 86% of Americans believe that “anybody wanting to work should be able to find a job”-We are allowing 1% to call the shots….

Ref: A POOL OF SLAVES: To Be Used and Discarded “at will”, and FULL EMPLOYMENT IS A PRO-MARKET CONCEPT, Amazon

Jim Green, Democrat opponent to Lamar Smith, 2000

@The Dork of Cork

I dont want to encourage you to go off on a tangent. But there are plenty of options for exponential growth outside of polluting industry. Base load solar, hydrogen fuel cells, wind power, zero-emmissions building material, C02 neutral bio fuels etc.

Accelerated growth occurs sustainably in nature for example.

The scientific concensus is that things cant stay the way they are for a minute longer we’ll need exponential growth into sustainable alternatives. What better ‘next step’ option than MMT style idology to get fake constraints out of the way and solve the real problems.

Notwithstanding debate about falling rate of profit, surplus extraction of labor and CH Douglas’s observations of broken Riccardian armchair reasoning its still a better next step as provided by MMT.

If you want industrial growth you need concentrated energy sources – coal , fission etc.

You can use dispersed energy resources effectively only if you return to village life.

In my opinion burning biomass for direct heat is the only effective option in the northern latitudes.

But you cannot engage in our modern industrial life with solar, wind and all that crack.

Listen , european energy policy is not really a energy policy.

Its a sociological control mechanism.

Its designed to create physical scarcity so as to maintain concentration.

To give the drones something to do.

Just look at the Ieas November electricity report.

As the French economy implodes it is exhibiting massive net increases in elec exports.

Germany , Denmark etc are incapable of producing surplus energy even as they are imploding yet its population still live and wish to live. Industrial life.

You simply cannot have both.

See the above Soddy quote and reread it if needs be.

Current energy policy in Europe and elsewhere is designed to provide a revenue stream for the financial and national capitals.

Any casual look at real energy balances will show it will not solve current energy problems and indeed they are not deigned to.

Perhaps look back at Irish electricity consumption data which is accurate from the early 70s.

Ireland was still very much a rural / market town country back then.

Elec demand was one fifth to one quarter of current ( depressed demand)

I happen to think that on balance people lived happier lives back them.

Hint – current consumption is of a extreme corporate conduit nature.

You seem to think MMT and environmentalism are incompatible, Dork of Cork. They are not.

Having work is better than than letting resources run idle.