The other day I was asked whether I was happy that the US President was…

Conceding to Greece opens the door for France and Italy

The economics news is currently dominated by the Greek election results and their implications, and, rightly so. Without assuming anything about how much Syriza will compromise (although I suspect too much), the voting has demonstrated that a large proportion of voters in Greece have rejected the basis of the European Commission strategy. The Greek voters know from personal experience, what armchair commentators like me know from theory, that fiscal austerity fails to achieve its aims. It is not rocket science – spending equals income and if you hack into it then the economy contracts. A private spending resurgence is not going to happen when sales are falling, unemployment is sky-rocketing, and incomes are being lost. The basis of Keynesian economics – that when the private economy is caught in a malaise the way out is for government deficits to kick-start economic activity, which, in turn, engenders confidence among private spenders and allows a sustainable recovery to occur – has been amply demonstrated by the GFC in all nations. Where that strategy has been employed the nations have been recovering (at a macroeconomic level). Where it has been defied, such as the Eurozone, the economies have stagnated. Thinking ahead (speculating) the election results have clearly shocked the cosy ECOFIN club, which has smugly swanned around Europe over the last 6 or so years dishing out misery to the disadvantaged citizens in the Member States. But I doubt that they will agree to a 50 per cent write-off in Greece’s debt because then the citizens of Spain, Italy and, even France, would line up for the same. Then it is game-over for the Eurozone. More likely, if Syriza sticks to its promises, then there will be an organised way to ease them out of the game. Greece will win either way.

One of the more revisionist commentaries on the Greek election outcome appeared in the UK Guardian (January 27, 2015) – Germany will relent on Greek debt – and Europe will suffer.

The author – Josef Joffe – is the “publisher-editor … of Die Zeit, a weekly German newspaper”. Die Ziet – represents the centre of German political opinion and provides a more in-depth approach to current affairs analysis.

The Guardian article opens with this:

… the “Club Med” countries plus the mainstream left – are quietly triumphant. The southern tier and Europe’s social democratic parties never liked the diktat of the Germans, who have been cracking the whip of fiscal discipline and market-oriented reforms since the great crash of 2008. For years they have all preached cheap money and unfettered deficit spending.

Not quite.

First, the low interest rates are a direct consequence of the structure of the monetary union, which was, in no small part, the product of German dominance of the economic debate in the 1980s. The ‘one-rate-fits-all’ approach led to low rates

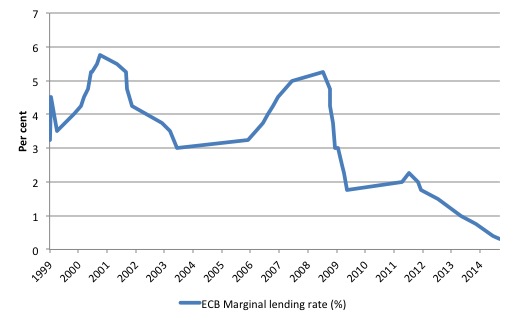

The following graph shows one of the Eurozone’s key interest rates – the ECB Marginal lending facility rate – from January 1, 1999 to September 10, 2014.

The marginal lending rate is the “interest rate on the Eurosystem’s marginal lending facility which banks may use for overnight credit from a national central bank that is part of the Eurosystem”.

The marginal lending facility is a “standing facility of the Eurosystem which counterparties may use to receive overnight credit from a national central bank at a pre-specified interest rate against eligible assets”.

In other words, it is the rate that the ECB sets to provide overnight loans to commercial banks to allow them to manage short-term liquidity.

The cuts in the early years of the Eurozone were due to recession in Germany and France (to mention the two largest economies in strife during that period).

As a result of their membership of the Eurozone, nations such as Spain, Ireland, Greece and Portugal had to accept the lower interest rates.

That recession caused the first crisis in the Eurozone’s early history.

Given the poorly conceived nature of the SGP it was no surprise that it would fail its first test. What was surprising was the way the politicians and bureaucrats behaved in the face of what any reasonable assessment would consider to be extraordinary hypocrisy.

The history of the EMU to date has taught us that if Germany is unable to meet rules, then the rules will be altered. Otherwise, the rules will be used as a blunt weapon to devastate the employment base and living standards of weaker nations without the political clout of Germany.

In 2003, Germany was one of the first nations to transgress these rules. By early 2002, the German economy was slowing quickly and the European Commission gave Germany an ‘early warning’ under the Stability and Growth Pact (SGP) rules governing so-called excessive deficits (above 3 per cent of GDP).

The Commission demanded that Germany balance its fiscal position even though they knew it would cause a deterioration in the already high unemployment rate.

The neo-liberal mindset was thus firmly in place despite the obvious risk that Germany’s insipid growth would falter under the intensified fiscal austerity.

A similar narrative was applied to France. Its fiscal deficit was also outside of the SGP rules.

It was obvious the rules were ridiculous given the real conditions in both nations – high unemployment and declining output growth.

In October 2002, the European Commission’s president Italian Romano Prodi told the French daily newspaper Le Monde that:

… the SGP was stupid, like all decisions that are rigid and there was a need for a more intelligent tool with more flexibility”.

German growth had stalled completely by the end of 2002 as it tried to reign in its fiscal balance to meet the SGP rules. However, worse would come as the economy moved into recession in 2003. German unemployment, already high in 2001 at 7.9 per cent, rose to new heights over the next four years: 8.7 per cent in 2002, 9.8 per cent in 2003, 10.5 per cent in 2004, and finally peaking at 11.3 per cent in 2005.

This was all down to the mindless fiscal austerity that Germany adopted within the recession-biases of the SGP.

Millions lost their jobs as a result, while others increasingly found their jobs becoming more precarious and their wage prospects suppressed under the so-called Hartz reforms (the creation of the ‘mini-jobs’). If there was ever a time for reflection on how damaging the EMU structure could be, then this period should have been it.

The Commission, however, pushed ahead with a Excessive Deficit Procedure (EDP) and Germany was now caught up in the trap it had set for Italy, Greece and other ‘suspect’ nations.

The German economy contracted in 2003 and the fiscal balance rose to 4.2 per cent of GDP up from 3.8 per cent in 2002.

On November 18, 2003, the Commission recommended to the Council that Germany be declared ‘non-compliant’ under the EDP, which would require much harsher cuts and fines. A parallel process had been going on with respect to France.

The French government was publicly hostile to the process but the Member States had all signed up to a discipline that they found impossible to maintain if they were to meet their responsibilities to maintain domestic growth and reduce unemployment.

The situation came to a head on November 18, 2003 when the Commission recommended to the European Council that the response of both the French and German governments to their earlier demands was inadequate under the terms of the Treaty and that further action under the EDP be triggered and a much tighter frame be required for resolution.

Five days later, the Finance Ministers met in Brussels to vote on these recommendations. Under the Treaty, it was Ecofin who oversaw the EDP process.

The outcome was a farce. Germany and France bullied other nations into voting down the Commission recommendation despite the majority of nations voting in favour of the recommendation.

The Council not only ignored the recommendation of the Commission, but also suspended any action under the EDP against France and Germany.

Where did that leave the whole enterprise? A report in the Financial Times (November 27, 2003) was representative of the media response:

France and Germany won: they usually do. But the European Union is assessing the damage of a joyless victory, secured in the small hours of Tuesday morning, that did much more than shred the EU’s fiscal rulebook … The message was clear. The European Union has rules, but not everyone has to obey them. France and Germany, long seen as the driving force behind European integration, looked more like a pair of playground bullies.

The Commission sought a ruling from the European Court of Justice (ECJ) on the grounds that the Council had not followed the rules and procedures as set out in the Treaty.

But despite the ECJ siding with the Commission, the real politics meant that the rules had to be renegotiated.

The ‘law breakers’ got away with it because the impasse led to a renegotiation of the SGP and no sanction against France or Germany was imposed.

German contribution to the imbalances

The Guardian article talks of “cheap money” as if it was a “Club Med” issue only.

First, the funds to underwrite the credit explosion came from the redistributed national income towards profits. This was caused by the neo-liberal obsession with restraining real wages growth below the rate of productivity growth. Germany led the way in the Eurozone bloc in this regard as a result of the pernicious Hartz reforms.

Second, the large German export surpluses also provided the funds to loan out to other nations. Germany didn’t experience the same credit explosion as other nations but German banks were prominent in the debt build-up elsewhere in Europe.

The suppression of real wages growth in Germany and the growth in the (very) low-wage ‘mini-jobs’ meant that Germany severely stifled domestic spending up to 2005. Schröder’s austerity policies forced harsh domestic restraint onto German workers, which meant that Germany could only grow through widening export surpluses.

The suppression of consumption in Germany and the reliance on exports to maintain growth was very damaging to the peripheral states.

The growth in employment in Germany in the lead up to the crisis was not due to a well-functioning monetary union.

Rather, it reflected its malfunctioning because it depended on widening trade imbalances – huge surpluses in Germany and some of its neighbours against widening deficits in the periphery, covered by unsustainable capital flows from the former to the latter.

That sort of unilateralism is not sensible in a monetary union, especially one that deliberately eschewed a federal fiscal transfer system.

It not only undermined the welfare of Germany’s EMU partners, but also meant that the living standards of German workers were reduced.

To some extent the German government understood the logic of the flawed design of the EMU more fully than the other nations.

They knew the monetary system encouraged a race to the bottom and exploited the ‘solidarity’ of its workers to game the other nations.

The huge current account surpluses resulted in German banks accelerating their lending to other nations, in particular Spain and Italy, and less so Ireland.

The common monetary policy meant that interest rates fell in the peripheral nations because rates were essentially set to reflect conditions in Germany rather than elsewhere.

The lower interest rates encouraged this massive borrowing spree, which then in Spain and Ireland, among other nations, found its way into the construction and housing boom. Much of the debt was private.

The massive shift in the employment mix across Europe (towards construction and FIRE sectors) was caused by these imbalances in trade and financial flows.

German capital had to find profitable opportunities abroad, given that domestic conditions were suppressed by the imposed austerity.

In turn, the poorly regulated banking sector allowed the European banks to build up risky portfolios. That is another part of the neo-liberal story that needs to be understood.

The accusations that would emerge as the crisis hit that the PIIGS were ‘spending beyond their means’ and gorging on debt were rather thin when you realise that Germany’s growth strategy required the PIIGS to borrow heavily. For every dollar borrowed there had to be a lender.

It is amazing that commentators in 2015 are still denying the central role of Germany in all of this. Joffe’s interpretation of history is very poor.

Fiscal deficits

The UK Guardian article also claims that the Club Med nations had preached “unfettered deficit spending” – where preaching implies some religious obsession.

Why the Guardian editors allow that sort of rubbish to appear in their newspaper is beyond me. It certainly reflects badly on the quality of the work.

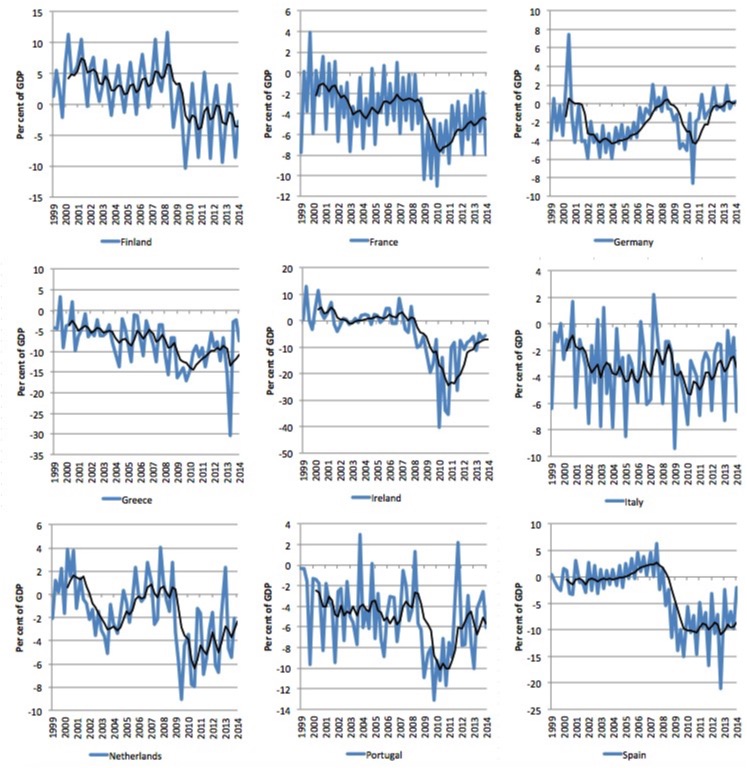

The facts are quite different as the following graphs show. The graphs depict the fiscal deficit as a percent of GDP from the first-quarter 1999 to the March-quarter 2014 (latest quarterly data available from Eurostat – table gov_q_ggnfa). The data is not seasonally-adjusted which is why is moves around a lot. The black lines are 6-quarter moving-averages of the underlying deficit series, which allows you to see the trend around the seasonal variations.

First, the Club Med nations had quite different fiscal histories over the course of the Eurozone. Spain and Ireland were exemplars of the neo-liberal fiscal myths – they were running fiscal surpluses prior to the crisis – hardly unfettered deficits.

Second, Greece, Italy and Portugal had relatively stable fiscal deficits, which reflected the reality they were facing in terms of external sector deficits and the private domestic saving desires. Their inflation rates were falling from 2002 (2003 in the case of Italy) and were not very much higher than the Eurozone average.

So the fiscal deficits can hardly be said to be excessive in any way and were certainly not “unfettered” – a term implying out of control.

Third, fiscal deficits were recorded by France, Germany and the Netherlands in the early years of the Eurozone (as discussed above). These deficits were largely cyclically-driven (recession causing tax revenue to fall).

Fourth, all nations went into deficits of various sizes with the onset of the GFC as a result of the collapse in private spending and the resulting loss of national income (and tax revenue). Even Finland, which was running constant fiscal surpluses in the period leading up to the crisis went into deficit and remained in that stage into 2014.

The swings in fiscal balances were more severe where the loss of real output and income was greater. Those swings had nothing to do with “unfettered” public spending.

What about France and Italy?

Where the Guardian articles moves closer to reality is that it recognises that it is not so much the Syriza victory in Greece that matters for the Eurozone but rather what is likely to happen in France, Italy and Spain.

But while Josef Joffe thinks Germany will concede to the threat posed by France and Italy, I suspect the threat will harden Germany’s position – and Greece will be the winners.

Both France and Italy are up against it – low or negative growth, fiscal deficits that violate the SGP rules and rising unemployment.

Spain is still not looking very good.

These nations have a limited tolerance for so-called ‘internal devaluation’ – code for cuts to pensions, wages and working conditions – which is the only way that the nations can become more internationally competitive given their exchange rate is fixed.

The UK Guardian writer thinks that Syriza would probably tone down their opposition to fiscal austerity and walk a moderate line if they had not gone into coalition with the right-wing Independent Greeks.

He says:

Tsipras has decided to get into bed with the rightwing Independent Greeks, a party that shares none of Syriza’s ideological convictions, save two: contempt for fiscal probity, and resentment of Europe.

With the far-right breathing down his neck, how will Tspiras change his colours, especially since the coalition represents not only the anti-reformist consensus of the country, but also a slew of deeply entrenched special interests such as public unions and sheltered industries? Let him move against Greece’s vast state sector, its patronage networks and its anti-competitive regulations, and he’ll court a coalition break-up from day one. So on the road to Brussels, don’t count on Saul turning into Paul, let alone on the government’s longevity.

As a result, he thinks Germany “will relent” and that “the Greek debt will be rescheduled and a chunk of it forgiven, together with a fourth rescue package for Athens”.

But then France and Italy will line up for relief.

Josef Joffe think that such a scenario will then leave Europe struggling “on a diet of cheap money, deficit spending and devaluation … [and] … the absence of painful pro-competitive reforms.”

Conclusion

If Germany does give up on its austerity mania and fiscal deficits expand then all of the Eurozone will return to growth.

Greece could resume growth tomorrow if the new government announces a large-scale public employment program.

It is a lack of spending that is causing stagnation. The obsession with structural reforms is a side-issue. The recession was due to a collapse in spending not any shift in competitiveness.

It will be amazing if Germany agrees to write off half of Greek debt. We will see whether that happens.

Soccer in Newcastle via Indian TV to Colombo

As an aside, I was working in my hotel room in Colombo this afternoon and in the background is the live TV coverage (via the Indian sport’s channel Star 4) of the soccer game between Australia and U.A.E, which is being played in Newcastle, NSW – the stadium being a few kms away from my home!

Australia scored early and went on to win.

I am not a soccer fan but am happy the game is getting some coverage. The TV coverage also told me that my vegetable garden was getting a solid watering – given the storms.

That is enough for today!

(c) Copyright 2015 Bill Mitchell. All Rights Reserved.

…These nations have a limited tolerance for so-called ‘internal devaluation’ – code for cuts to pensions, wages and working conditions – which is the only way that the nations can become more internationally competitive given their exchange rate is fixed….

In Greece elderly of a great age had pensions cut to 100 E. Internal devaluation equals deaths by suicide or early deaths by hunger and living rough.

This is what is happening in the UK and we have no EU debt.

I have found out my state pension is cut to zero and this will happen to huge numbers of people with no other income in old age on and from 6 April 2016.

See why under my petition to bring about a debate before parliament shuts up shop for the election

in my WHY IS THIS IMPORTANT section, at:

https://you.38degrees.org.uk/petitions/state-pension-at-60-now

I especially ask membership of UK’s Green Party in Scotland, England and Wales to sign it, as The Greens are the sole party that offer us pension losers any pension for life.

It makes me so damn mad thinking back over the past few years.

Without going into too much personal detail I worked for a very successful Australian software company that was bought out by a multinational. My job was to help countries throughout the world make money by using our software in the retail sector. Mainly the EU and North America.

The extreme lack of demand in nearly all economies particularly the EU zone was so frustrating I had to leave end of 2014. Thankfully I’m in a financial position to do so and currently on holidays. It was particularly frustrating as I’ve been following the macroeconomics of it all (mainly Paul Krugman’s blog) as it’s become a real interest of mine that just makes do much sense to me in regards to the political system we have.

I have a science background and when facts are so ignorantly ignored by people (in so called power) and cause so much human hardship; like suicide rates in Greece et al. I really do question whether humans deserve this beautiful, amazing and hospitable (the only place we know of in the whole universe that can support us!) planet it drives me beyond despair but to a place of somewhat uncomfortable peace.

Humans seem to be but a minor and short lived virus like plague to the planet earth. If we can’t learn to live and appreciate this “Place” then it’s best we give it back to the unintelligent (to humans) animals that can’t destroy it like we can.

How can we collectively redeem humans to deserve this beautiful blue ball we live on?

Thank you Bill as always! You are an extreme breath of fresh air., even if it ain’t so fresh where you are 🙂

“Joffe’s interpretation of history is very poor.”

In the week of the anniversary of Winston Churchill’s death I suspect one of his quotes is pertinent here:

“History will be kind to me for I intend to write it”

Dear Bill,

The current crisis in Europe has reached its climax and it is multidimensional. We must not forget about the horrible war raging further East. The 70th anniversary of the liberation of Auschwitz coincides with the ongoing mass-murder of the civilians in Donbas. This is in my opinion an attempt to erase the breakup of the Soviet Union and undo the statehood of Ukraine by destroying not only the industrial infrastructure but also terrorising the people and exterminating Ukrainian nationalists who flock to the honeytrap of Donetsk Airport, Mariupol and Debaltsevo led by their treacherous generals only to be professionally finished off with Grad and Uragan missiles.

The Greek crisis is linked. There might be a new international order established in Europe “proper”, too. So please do not consider the goals of the new Greek government (where Yanis Varoufakis is the finance minister) as too moderate. Honestly we don’t know.

Why didn’t Vladimir Putin just invade Ukraine and carve up its Eastern and Southern part – like he did with Crimea? Because he is not a soldier but a KGB-man. His main enemy is the very idea of Ukrainian nationhood for Russian-speaking inhabitants of what he considers New Russia (partially overlaps with Little Russia from the 19th century). Yet these people (who used to consider themselves just Soviet People or “Russkiye”) started calling themselves Ukrainians. This poses an unacceptable threat to the oligarchy ruling in Russia as there is an alternative to the current Moscow regime for the Russian-speaking people living in Russia “proper”. It is the repetition of the rivalry between Moscow and Lithuania / Poland in the period between 14th and 17th centuries establishing crystallising centres for the Russian world then. For some, not only living in Transdniestria, the Soviet Union has never ceased to exist.

Knowing from my ancestors what NKVD/KGB people were up to it is easy to understand that Mr Putin’s objective is not the establishment of a satellite state. Some of the US and European politicians still don’t fully understand this. Mr Putin wants to terrorise people of what’s now Eastern but also Central Ukraine, to destroy the very fabric of the society by repeating on the smaller scale the “successful” Holodomor policy of Stalin or mass extermination of the opponents of Russia in Chechnya during the second Chechen war. Look up on the Wikipedia please – Second Chechen War: “Chechen forces strength – 22,000-30,000 in 1999, losses Total killed: 16,299”. Oh by the way – estimate up to 25,000 killed and up to 5,000 “disappeared” civilians in Chechnya.

This should also explain why these psychopaths bombed Mariupol. I also tend to believe now that shooting down MH17 could have been done on a purpose – the same as above. The same message was conveyed when they killed Litvinenko. This is all to tell the Western “partners” that Russian generals won’t hesitate using tactical nukes should the West meddle too much with the social engineering in Ukraine or elsewhere within their exclusive zone of influence. That’s why we only hear deafening silence from the usual defendants of Western democracy. Economic sanctions? The Russians don’t care, they endured the siege of Leningrad so they can survive without iPhones in Crimea. For a while it looked the sanctions including oil shock worked (the capital flight forced the central bank of Russia to impose sanctions on Russian economy by increasing interest rate but then Comrade Putin picked up the phone and said that he doesn’t care about what Harvard-educated economists have to say, the tanks must roll on, their engines won’t stop working just because of the falling exchange rate).

Mrs Merkel’s austerity obsession is in this context “peanuts”. The Russians seized the moment of the increased Islamic terrorist activity in France and elsewhere, the deflation and Greek instability and the rising tide of Euroscepticism to give go-ahead to the “separatists”. But the Russians were provoked by the USA and Europeans as their plan “A” was a slow re-absorption of the whole Ukraine (together with Belarus and Kazakhstan) into the Euro-Asiatic CCCP Mk 2. The plan “B” is more ambitious and involves social engineering by destruction of the current post-1991 reality.

Also – the Ukrainians themselves play the ball into Russian hands, too. They shoot and bomb their “own” cities, vigorously committing war crimes against civilian inhabitants of Donetsk and Lugansk. Let’s don’t forget the genocidal legacy of Stepan Bandera.

Why did I write all of this? Is it out of topic? I disagree. These are the core issues. This is the true and proper context of the conflict between the Greek anti-austerians and the austerian lobby within the EU. We must not dogmatically apply any economic theories to the reality. What about the Greek army? What about the Greek Orthodox church. These are the sacred cows. No amount of Marxist rhetoric will save an enlightened professor if someone points a gun to his head. And the majority of the people think about Marxism in terms of mental health issues anyway. (I am sorry but my personal experience gives me multiple hints that socialism has never worked and will never work in the future, too).

Fixing Greek situation requires not only changing stocks (debt reduction) but also fixing flows (an increase in spending). If this doesn’t happen nothing will change and there will be another iteration – this time with Golden Dawn or something similar. So for now – either there will be another attempt to sweep everything under the carpet in the usual EU way (seems to be plan “A” for Syzira – Mr Schauble will blink) or there will be a Grexit and then Italexit, Spainexit and Portugalexit.

From pure, “dry” economic point of view the immediate leaving of Euro is the best option. But this is not all. The new European order (or “disorder – I hope not) has to emerge.

Let’s hope people will finally sober up. Auschwitz was liberated only 70 years ago. We should all wish Yanis Varoufakis all the best. The walls of mindless austerity have finally started cracking and Western Europe will never be the same.

Let’s not forget that Germany has a deep moral debt to assist Greece which it trashed during WW2. As per BloombergView;

“Germany should recognize that it has a moral obligation to help, just as the U.S. and its allies, including Greece, helped Germany after World War II. This is a largely forgotten history that, if recalled, might counter the false narrative of virtuous Germans and feckless Greeks that has hardened popular opposition to bailouts.

Under the aegis of the U.S., the introduction of the deutsche mark in 1948 wiped out most of Germany’s domestic debt, both public and private, which amounted to roughly four times the country’s 1938 gross domestic product. This move helped Germany to start afresh and begin the economic miracle at which we all still marvel.

Germany was granted a waiver on its external debt, including the deferral of interest payments, from 1947 to 1952 as the Marshall Plan was implemented. In 1953, the U.S. also imposed the London Debt Agreement on its wartime allies, which wrote off Germany’s external debt.

Albrecht Ritschl, an economic historian at the London School of Economics, estimated earlier this year that the total debt forgiveness West Germany received from 1947 to 1953 was more than 280 percent of the country’s 1950 gross domestic product, compared with the roughly 200 percent of GDP that Greece has been pledged in aid since 2010.

Greece also contributed to the postwar German debt relief. Signatories to the London agreement, including Greece, agreed to defer settlement of war reparations and debts incurred after 1933 until a conference to be held after Germany’s reunification. Although Germany paid compensation to individuals in the 1960s, the conference never took place and many Greeks think that more was due.

The bailout of Germany was at least as controversial as the Greek one today. Just like Greece, Germany’s tax system in the 1950s was imperfect. Difficulties in changing it had led to revenue shortfalls in the interwar period.” – BloombergView.

Germany has a moral duty to tak the lead in forgiving Greece its entire debt.

hi bill,

any chance you could write an article on the mechanics and strategy of how greece could exit the euro zone.

re denominating the debts into dracmas i agree is the preferable option, but the devils in the detail of how you manage the capital flows and the effects on the banking system and central bank in greece.

pretend that Yanis Varoufakis has been run over by a german tourist bus, and you have been put in charge of getting greeces economics house in order.

Ikonoclast,

I largely agree with your sentiments but I’d just make the point that the Greek debts are only part of the problem. There’s no point just forgiving the debts if the Greek economy is going to function no better afterwards than previously.

Those of us who advocate that Greece should re-introduce its own sovereign currency, know how the Greek economy could function effectively. What about those who advocate of their continuation with Euro? What’s their plan?

mahaish

“any chance you could write an article on the mechanics and strategy of how greece could exit the euro zone.”

I can’t find the link now but I remember Warren Mosler addressing this issue. It was along the lines of:

1) The Greek Government declares that from a certain date all Taxes will be collected in New Drachmas.

2) The Greek Government declares that from a certain date all Government Payments will be made in New Drachmas

Job Done!

I’m sure Bill would be able (if he hasn’t already) to present a slightly longer answer! But essentially that’s it. It would put the ball well and truly into the ECBs court. What would they do about all those Euros held in Greece? Would they accept liability for them?

petermartin2001,

Certainly, I agree economically that Greece should exit the Euro and the EU. Technically, they should;

(1) Exit the Euro, the EU and anything related that they need to exit as well.

(2) Re-issue and float their own sovereign currency again.

(3) Repudiate and default on all foreign debt.

(4) Begin using MMT principles to run their economy.

However, if Greece did that then the US via their embassy and the CIA would collude with the Greek military. There would be a right-wing military coup to effect regime change. There is no way that ultra-right-wing, oligarchic, capitalist, USA will permit any nation in its sphere of influence to have a genuine left wing government. The USA’s sphere of influence currently is basically the whole world minus China, Russia, Iran and Nth. Korea.

all saliant points peter.

i was more interested in the mechanics of how the banking system and the greek central bank would cope under such circumstances,and the potential inflationary effects of a rapid decline in the currency after the float.

also to have a tax driven currency, best to have a taxation system that isnt corrupt. not sure what inroads the greeks have made in this regard.

on a additional point peter,

would capital flight, and market sentiment effect convertibility. the locals can be forced to pay their taxes in dracmas, and in theory if foreigners want to do business with the locals they will have to do it in the local currency, or will they still demand payment in a foreign currency.

if foreigners want to do business with the locals they will have to do it in the local currency

I wouldn’t see that as a big problem. There can be a mixture of currencies. Many shops in London will take Euros for example. Business deals can be negotiated in pounds, dollars or Euros. Whatever suits.

The key issue would be the attitude of the rest of the EU and the ECB towards the “Greek Euro”. Those Greeks who are fortunate enough to hold a few Euros, must be thinking about switching to German bank accounts or failing that, keeping their cash in German issued Euros rather than Greek printed ones! There will be some turmoil I expect in the none too distant future. But things will settle down rapidly afterwards.

The key thing would be that Greek taxes, Greek pensions and the salaries and wages of Greek government employees would be denominated in new Drachmas. The same economic laws would apply as with every other currency. Greeks could have too much inflation if they erred one way or too little economic activity if they erred the other. But they’d have things under their own control. That’s what needs to happen for an economic recovery to occur.

‘The UK Guardian writer thinks that Syriza would probably tone down their opposition to fiscal austerity and walk a moderate line if they had not gone into coalition with the right-wing Independent Greeks.’

The writer has this exactly backward, which most people recognized. Syriza wants an end to austerity, first and foremost. They picked an ally that is as adamant as they are on the issue, even though they agree on little else, precisely because Syriza wants no compromise on this issue. This is the clearest sign to me, that they mean business on austerity.

It could go either way, but I think it is likely that Germany will refuse, Greece will leave the EMU and that will quickly be the end of the Euro.

Mike Adams: ‘…the ongoing mass-murder of the civilians in Donbas.’

You do realize that those civilians are the Russian-speaking people of Eastern Ukraine and they are being murdered by the faction that controls the government in Kiev (the one the US largely created)?

You seem a little confused.

SteveK9

I am not a “Mike” and I seriously doubt whether any “Adams” would be able to read web pages in Russian and Ukrainian. You won’t smoke me out this way and actually my surname is totally irrelevant as I can’t lose or gain anything here in Australia by expressing my views on this topic.

If you read my comment more thoroughly you will see that I mentioned undisputed crimes against humanity committed by both sides. Such is the logic of war. It was precisely dragging the Ukrainian pro-independence and pro-Western forces into an armed conflict what constituted the greatest early victory of the Russian KGB oligarchy. The Western sponsors of Mr Yatseniuk made a grave strategic mistake by not discouraging an immediate seizure of power in Kiev and toppling Yanukovich about a year ago. But was it possible to stop the rage against Yanukovich after killing of about a hundred people by “unknown” snipers? Probably not.

The logic of peaceful demonstrations demanding democracy in Maidan (what possibly could have started the process of uprooting the dark legacy of the Soviet communism in Ukrainian society) was replaced by the logic of bullets. But we already know who has more mobile missile launchers in that region. The outcome of the military conflict between Ukraina and Russia is obvious. We are witnessing the realisation of this, worst possible for the people living there, scenario.

What is surprising is that the Russians are doing it slowly to inflict more pain. It looks like they don’t want to simply win. They want the enemies to lose and enemy ideas to be erased from the human consciousness.

We have to understand that there is a strong extreme nationalist presence in the Ukrainian public life. These people often supported by members of the Ukrainian diaspora from Canada, Germany and elsewhere, consider themselves the followers of war-time Ukrainian armed groups which were responsible for ethnic cleansing against Poles and mass-murder of Jews. That’s why I mentioned Stepan Bandera. The UPA wanted armed struggle against Poland and Soviet Union (like “Podargus”). They lost. They want to do it again. The outcome will be the same, thousands of innocent people slaughtered and the vast area of Ukraine turned into wasteland.

The final outcome is that there will be no viable alternative to Russian domination in this part of Eastern Europe. The very idea of a multi-national and democratic, pro-European Ukrainian state spanning from Lvov to Lughansk is already dead. Not to mention individual liberties. There is no such thing in Russian and Ukrainian public life. For being a libertarian you either get attacked by thugs or go straight to jail.

Vladimir Putin has a very difficult task. How to use propaganda, tanks and missile launchers to destroy the very idea that it is an individual, a human, his/her own life what is the little centre of the Universe, not a state or idea or religion or social class or hoarding money or any other obsolete and moronic idea. Ukrainian nationalists are his little helpers.

For us, living here in Australia or USA or UK, the idea that I may not care at all about the dirty and stupid politics is kind-of obvious – who cares about the imminent fall of Australian Prime Minister Peta Crediln and her top advisor Tony Abbott?. You can’t say this when mortar shells are falling on your home. Some of us (certainly not me) may dislike the Western especially American statehood but it is precisely this framework which allows breathing space for the individual liberty – despite all the economic pressure from the corporations, plutocrats etc. Yes you can opt out even if this is difficult. That’s why I am genuinely pro-American even if I may dislike some important aspects of their policies.

In Eastern Ukraine people have to choose between a corrupt post-Soviet Ukrainian state ruled by pro-Western oligarchs plus extreme nationalists and a resurrected Russian empire (also corrupt but doing a bit better in terms of GDP per capita).

The idea of using democratic process to get rid once and for all of the corruption and influence of post-Soviet oligarchs in Ukraine, of building an “Open Society” (whatever it means) has been replaced by the moronic 19th century nationalism and 20th century fascism. A kind-of T.I.N.A again. This great “reframing” is exactly what the Russians wanted. The more innocent civilians of Donetsk are killed by missiles launched by the Ukrainian army and Ukrainian volunteer corps the greater (im)moral victory of the KGB people is.

Both sides, the Russian separatists / Russian regular army “on holidays” in Eastern Ukraine and the Ukrainian patriots / nationalists have blood on their hands. A lot of blood.

But at least there is a good excuse to pump more money into the defence industry in the US and Russia. That’s why this horrible armed conflict in the heart of Europe is so Keynesian.

What are the Greeks doing in this context? They are not pro-Russian (I don’t think that Varoufakis has any warm feelings towards Comrade Putin), they just want to haggle. Again – we cannot divorce economics and politics.

Adam K,

America has the most blood on its hands, yet you support them?

Ukrainians, Syrians, etc, as pawns to be sacrificed – that is America’s strategy.

Robert,

What is a realistic alternative? I used to live in a country under Soviet domination. From end-user perspective I honestly prefer Pax Americana as long as I am not a pawn to be sacrificed.

I don’t deny the moral responsibility of the West for fanning the conflict in Ukraine. The trouble is that in a neoliberal world one needs a good excuse to increase spending on military R&D and this still remains the main driving force behind any technological progress.

If the Americans don’t spend enough on military R&D the Chinese will soon overtake them in technological development. So we need to live under a constant threat of invented or real forces of evil attacking us otherwise there won’t be enough money to continue inventing and developing drones, combat robots, future communication systems, quantum encryption, laser weapons etc. Global warming as a global threat advocated by Al Gore wasn’t fit for a purpose. Vladimir Putin, the Iranians and North Koreans are ugly enough.

Without the Second World War and Cold War we would probably be still flying propeller-driven planes with piston engines and computers would have cranks. Not to mention not having the majority of modern materials, space technology and nuclear power plants. Because corporations are supposed to maximise short-term profits not invest in what’s going to be useful in 20 years time. If you give too much money to the public sector research institutions without clearly defining their goals, the bureaucracy will eat away all the money.

Does it have to be like this? Theoretically, no. But in a (semi-)democratic society in a highly-competitive global economy, how to convince people to divert a few percent of GDP to R&D and provide enough supervision and competition?

Adam K,

R+D need not be military related. Research is needed in the Earth sciences, space exploration, and alternative energy systems. Spending a percentage of GDP on wide-ranging research is a good investment. Spending a trillion+ dollars on armaments is not, when we consider the opportunity cost.

The plutocratic elite that run the world need to go. Their priorities are not our priorities. They can’t even be bothered to offer up the crumbs needed to keep us complacent. The realistic alternative has always been democracy, in place of a sham where 99.9% of the population hold no power.

Peter Cooper summed ‘syriza’ (acronym from the Greek words meaning coalition of the radical left succintly here:

I was going to suggest Warren Mosler as someone who could write a plan for Greece to exit the Euro, but I see someone else suggested that. Mosler’s actual experience in banking gives him a very practical perspective.