I started my undergraduate studies in economics in the late 1970s after starting out as…

Australian government’s monumental fiscal failure

Last week marked a turning point in Australian politics when the Australian government finally admitted that they had made a monumental political misjudgement by promising to deliver a budget surplus in the next fiscal year despite an economy that was not capable of generating sufficient revenue to render that promise realistic, much less, economically responsible. They didn’t actually admit all of that but that is what has happened in the last week. The Government has abandoned its promise to deliver a budget surplus in the coming fiscal year as tax revenue collapses around them. The reasons for that collapse relate to the slowing Australian economy, due in no small measure to the fiscal contraction already forced on the expenditure system. There was never a need for that fiscal contraction and it was obvious that the Government would fail to achieve its promised surplus. That was obvious. But the problem was that in trying to pursue the surplus they have undermined our prosperity and caused labour underutilisation rates to rise with the commensurate lost national income. They are now being pilloried on the political front for breaking their promise. The fact they made that promise suggests their political acumen is as bad as their economic management.

Last Thursday, the Australian Treasurer finally caved into the reality that a Government cannot really fight against the power of the automatic stablisers.

He gave a press conference where he “admitted for the first time the government is unlikely to deliver its promised surplus this financial year ” (Source: Swan admits surplus unlikely).

The Government had forecast a small surplus in the coming year (2012-13) but with the release of the October tax revenue data on Thursday (provided to the Treasury from the Tax Office), we learned that the actual tax revenue in October 2012 was $3.9 billion below the Budget forecast and falling.

The data showed that falling commodity prices had impacted on tax receipts (via the decline in company profits) and the budget balance is forecast to be at least a $3 billion greater deficit that planned.

That night (December 20, 2012) the ABC 7.30 current affairs program (television) interviewed the Federal Finance minister, Penny Wong, who has no economics training at all.

The segment – Penny Wong defends ditching the budget surplus – revealed how contorted (and plain imbecilic) the Government’s macro policy is.

The interviewer reminded the Finance Minister that she and the Treasurer and the Prime Minister had been categorical about the surplus promise over the last three years.

Even last week (December 14, 2012), the Prime Minister rebuked one of her own senior parliamentarians who had said that the Government should “give up on delivering a budget surplus” because the economy was too weak to support it. This was coming from a right-wing member of the Labor Government.

In the Sydney Morning Herald article (December 14, 2012) – Give up budget surplus plan, says Fitzgibbon – the PM is quoted as saying:

Oh well, Mr Fitzgibbon is entitled to his views but these decisions will be made by me, the Treasurer, the Finance Minister and the cabinet … We have released the most recent economic forecast. We don’t jump at people’s figments of imagination here. We deal with the facts, we deal with the forecasts and I refer you to what we said in that mid-year statement

It seems the Prime Minister knows as much about economics as the Finance Minister.

In response to the 7.30 interviewer claims that the the Government has made the surplus the epitome of “responsible economic management” and now faced a deficit because the economy was weakening (he didn’t draw the link between the pursuit of the surplus and the weakening economy), the Finance Minister said:

I disagree. The key to this decision today is responsible economic management. The key to this decision today is jobs and growth. And I think it’s important to remember how we’ve got to this place. Since mid-2009 this government has offset every cent of new spending decision – every cent. We’ve taken savings to ensure we could make those spending decisions. We’ve also been confronted by substantial revenue downgrades … Now, we have continued to make savings to offset that, but with the release today of this new data, what we’ve said to the Australian people is we’re seeing further revenue downgrade. We don’t believe it’s responsible for us to continue to make cuts to offset this revenue downgrade if that is bad for jobs and bad for growth and that is why the Treasurer’s made the announcement he has today.

So spending equals income – but then it always did. The Government has reacted to previous revenue shortfalls with macho-type statements that it would cut harder.

QED tells us the rest. Revenue shortfall rises, as growth falls because spending is cut.

The Finance Minister was also asked why the Government defied the warnings that this would happen in the past and that the Government was pursuing a surplus “for political reasons”. She replied that the data has suddenly changed for the worse.

The interviewer challenged the timing of the decline, saying that the slowing economy had “been evident for some time now”. She responded that the data was “monthly” and they have just found out that things are so bad.

The interviewer then said that the Government’s strategy to now had “already endangered jobs”, which was based on the Finance Minister’s continual claim that the Government cared about jobs. She responded:

I accept, Chris, that it’s – there will be people who criticise this for politics, but what we’ve got to do as the Government is do what’s right for jobs.

CHRIS UHLMANN: But you’ve done what’s right for politics all the way along.

PENNY WONG: Oh, Chris.

CHRIS UHLMANN: This is entirely what this was intended to …

PENNY WONG: I don’t agree with you. No, I don’t agree with you.

She also told the program that the Government “made this decision … because we have to put jobs and growth first”.

The reality is very different to the Finance Minister’s claims that the government cared about jobs. In fact, its entire political strategy has been to create unemployment. That is obvious even from their MYEFO forecasts where unemployment was projected to increase by 41 thousand over 2012-13 (from a rate of 5.3 per cent to 5.5. per cent). I suspect it will deteriorate by more than that at current trends.

So while the Finance Minister says it is all about jobs it is clear that up until now, the Government hasn’t considered this to be a major issue. The MYEFO review (page 28) says that the “unemployment rate is forecast to increase slightly” but in people terms that 41 thousand people without jobs, not to mention the 55 odd thousand workers who are assumed to exit the workforce into hidden unemployment as a result of the assumption that the participation rate will fall from 65.3 per cent to 65 per cent.

So around 100 thousand extra workers were being forecast to be lost to productive employment because the government thought it could win votes by pursuing a surplus. 100 thousand workers lost to production and income generation is what this Government calls a “slight” adjustment.

Next day (Friday 21, 2012), the Treasurer appeared on the ABCs AM current affairs program in the segment – Swan: ditching surplus responsible decision”> – and repeated the pathetic claims that the abandonment of the surplus ambition was their decision and it was responsible.

Here is section of the interview:

SABRA LANE: Mr Swan, back in 2010 you said come hell or high water you’d deliver a surplus this financial year. Will this be as damaging for you as the broken promise on the carbon tax?

WAYNE SWAN: Well, I think if the worst that is said is that we got the big economic decision right here then I’ll let the politics work its way through the system. It’s not my concern. What my concern is …

SABRA LANE: But for a long time you argued that this was an economic imperative.

WAYNE SWAN: Yes, and we are still making a very significant fiscal consolidation. and we are implementing particularly on the expenditure side of our budget a fair degree of expenditure discipline so we are still moving in that direction.

But what we’ve had here is a huge revenue whack if you like, out of the blue, which has made it very hard to get to surplus in 2012/13. And if we were to get the surplus in 2012/13, we’d have to take cuts to the budget which would impact on jobs and growth and as a Labor government our first priority is always jobs and growth.

It is clear they haven’t learned the lesson of the automatic stabilisers no matter how often they recite the mantra that their first priority is “always jobs and growth”.

They are still planning to continue with the “very significant fiscal consolidation” – that is, spending cuts. All they have been forced to admit is the arithmetic – that there wasn’t a hope in hell that they could generate enough revenue in the next 7 months or so to reach their forecast.

And … they have claimed it is virtuous not to chase the tail down the drain any further – that is, engage further spending cuts to match the increasingly collapsing revenue (as they have done in the past) – in order to keep their surplus dream on track.

The point is that the fiscal contraction will continue and they haven’t understood that when its contraction is offsetting the other growth components (such as private investment) tax revenue will continue to decline with the declining growth that follows the spending cuts.

Lets briefly trace the reality.

In the – Mid-Year Economic and Fiscal Outlook 2012-13 – that the Treasurer delivered to the Australian public on October 22, 2012 (brought forward from its usual December unveiling because the Government was trying to play tricks with the timing of ABS data releases (to maximise its hype about the “surplus”), the Government modified the May 2012-13 Budget estimates in significant ways.

At the time, I wrote that “this is high farce, high deception, vandalism, and ultimately, shocking politics, despite politics being the motivation for the strategy that the Treasurer is pursuing”. Please read my blog – Australia’s MYEFO – some lies amidst the fiscal irresponsibility – for more discussion on this point.

When the MYEFO was announced the September-quarter National Accounts data had not yet been published. We had to wait another 8 weeks or so for that to be revealed. At the time the June-quarter data was telling us that real GDP growth rate over the next 12 months would be around 2.6 per cent (extrapolating out the quarter).

But it was clear the more recent evidence was suggesting that the growth rate was slowing. In the May 2012-13 Budget, the Government forecasted that real GDP growth would be 3.25 per cent. By the MYEFO some 5 months later, it had revised the estimated down to 3 per cent. Note that the average of the last decade has been 3.4 per cent.

At the time the May Budget was released, I predicted that real GDP growth would be lucky to reach 2 per cent for the fiscal year 2012-13.

When the September-quarter National Accounts were released, the ABS told us that real GDP growth was 0.5 per cent (down from 0.6 per cent in the June-quarter). Annualised that would deliver a 2 per cent growth rate. The problem is that the economy is still slowing under the weight of the fiscal contraction.

The data revealed for the first time the damaging impact of the fiscal austerity that the Government had begun to pursue in quest of its surplus. The government contribution to real GDP growth in the September-quarter was -0.5 percentage points, which totally nullified the positive contribution from private investment.

Any reasonable assessment at the time was that the national growth rate was running at around 2 per cent and falling, which is already well below trend, despite the Treasurer constantly lying to us – that the economy was on trend.

Further, real net national disposable income, which is a broader measure of change in national economic well-being fell by 0.7 per cent in the September-quarter and by 0.2 per cent over the year to September 2012. In other words, we are going backwards in real terms.

Please read my blog – Australia National Accounts – its getting worse – for more discussion on this point.

The day before the September-quarter National Accounts data was released (December 4, 2012), the former RBA Governor Bernie Fraser told reporters that he thought that the Government’s pursuit of a budget surplus was “just plain dumb”.

The Sydney Morning Herald article (published December 5, 2012) – ‘Just plain dumb’: Swan rejects fiscal ‘stupidity’ warning – quoted the former Governor as saying that:

Australia is suffering from the “stupidity of government” by looking for a budget surplus while monetary policy is going the other way. It’s just plain dumb …

Employment and real net national disposable income are falling and the outlook is decidedly negative. As the former governor of the RBA said yesterday – fiscal policy is “just plain dumb” at present.

One by one the economic commentariat has been joining the surplus is stupid chorus despite most of them being on the other side of the line as late as the May Budget.

It has been interesting to see how those who were advocating fiscal consolidation have shifted – first hedging their statements in temporal terms – with talk about “medium-term adjustment” then “well-defined long-run consolidation paths” then “a deficit in the circumstances is not a bad thing”.

The reality was that the pursuit of a surplus was never a sensible economic strategy to pursue given the clear intent of the non-government sector in terms of spending and saving decisions and the overhang of private debt that followed the credit binge.

The reason the Government should not be pursuing a surplus at present is because broad labour underutilisation remains around 12.5 per cent and that is a conservative estimate. There has been no significant reduction in that proportion over the last few years.

That tells us that the economy is not generating either enough jobs and/or enough working hours and is being constrained by deficient aggregate demand (that is, spending).

The Government’s mantra (solidly supported by the bank economists and the other commentators) has been that the economy is in the midst of a once-in-a-hundred-year commodity price boom and the major threat is inflation. Hence the need to curtail net public spending.

It is true that primary commodity prices, particularly base metal prices, have been at record levels courtesy of the growth in China (which, of itself, has been driven by a strong fiscal commitment to growth by the Chinese government).

However, the external sector has barely been adding to growth over the course of the boom. Where the boom has generated real economic growth in Australia is via the private capital formation that has been attracted – to building mining infrastructure – roads, rail lines, port facilities and extraction capacity.

But despite that source of spending being strong over the last few years, the signals have been strengthening this year that investment plans are becoming more modest and will spending will decline significantly in 2013. Further, as noted above, by the September-quarter 2012, the fiscal contraction was exactly offsetting the contribution to growth coming from private investment.

When you recast your attention to what the Government was promising it becomes almost comical.

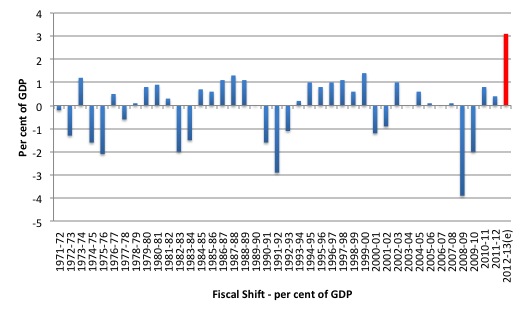

As noted in my commentary on the – May 2012-13 Budget – the planned fiscal retreat was unprecedented in our history.

At the time of the May 2012-13 Budget the planned budgetary shift was estimated to be at least $A38.5 billion. In the October 2012 MYEFO the proposed fiscal shift was to be $A44.1 billion or 3.1 per cent of GDP. That sort of shift towards surplus has never been achieved in our known history.

The following graph shows annual fiscal shifts since 1972-73 in terms of proportions of GDP to put the Government’s intentions into some broader perspective.

However, there was also some dishonesty in the way the government presented the data to us.

In the May 2012-13 Budget statement it was obvious that at least $A8.5 billion in spending that will flow this year was shifted to be recorded against the 2011-12 outcome. So the deficit in 2011-12 was artificially inflated, which just happened to allow them to record a paper surplus in the forward estimates despite the degree of contraction associated with the 2012-13 fiscal position being less than would be forthcoming if there really had have been a 3.1 per cent of GDP withdrawal in one year.

In other words, the degree of contraction this fiscal year is actually less in 2012-13 than the nominal figures suggest. How much less is a guess but if we subtract the $A8.5 billion from last year and add it to this year then you are talking a $A27 billion fiscal shift, which is about 1.8 per cent of GDP.

More importantly, this means the underlying fiscal position in 2012-13 is not a surplus at all but a deficit of some $A7.4 billion (0.5 per cent of GDP).

Whatever the actual numbers are (and turn out to be) and the deliberate Government deviousness aside, the direction of fiscal policy is completely wrong. Even if it had ended up being a 1.8 per cent of GDP contraction, that scale of fiscal shift in one year is also unprecedented historically and is totally unsuitable at a time when non-government spending will not offset the loss of public net spending.

The question that has to be asked is under what circumstances would a Government be responsible in taking out net spending equivalent to 1.8 per cent of GDP in one year (when inflation is forecast to be constant or falling)?

You have to ask this question in the context of actual real GDP growth is running at around 2 per cent at present and trending downward and the main growth engine – private investment slowing as a result of the slump in commodity prices.

The answer to the question is that the economy would have to be pushing well above trend and straining the inflation barrier – with full employment and zero underemployment – and private growth would have to be very strong and becoming even stronger during the forecast period.

There have never been conditions like that in the last 40 years. Nor will there be in the next 12 months.

That is why this scale of fiscal withdrawal was always an act of vandalism and driven by misguided (miscalculated) political machinations and is devoid of any economic rationale.

The Government’s strategy has been as simple as it has been perverted. The Treasurer’s claims that the government’s surplus promise has allowed the RBA to cut interest rates.

When you reflect on that it demonstrates the perversion. The Government’s strategy has been to deliberately create unemployment in the non-mining regions so that the idle resources could then service the mining boom.

Not only will the required migration patterns fail to occur but non-government spending is not strong enough to support trend growth – mining investment boom notwithstanding. Many large employing sectors are declining due to a combination of an appreciated currency (exacerbated by high interest rates) and the withdrawal of the fiscal stimulus.

But what the fiscal strategy amounts to is forcing the RBA to cut interest rates as the only aggregate policy response to a deliberately created weakening in the economy and rising unemployment.

A responsible fiscal strategy should never aim to deliberately create unemployment and force the central bank to backfill the damage.

Conclusion

It is obvious that the Australian government now runs fiscal policy as a political tool to garner short-run popularity in the lead-up to next year’s federal election rather than tailoring it to the economic needs of the nation.

It is also now obvious that its political acumen is as deficient as its economic management capabilities.

In trying to implement pro-cyclical fiscal outcomes, the Government is not only damaging the prosperity of the nation but also undermining its own political capital because it has now been forced by reality to admit it will not achieve its surplus objective.

It was never going to meet it and the more it tried with successive cuts in net public spending the harder it became to reach the target. The unemployed and underemployed are the testament to this folly.

The reason is that the target should never have been set in the first place. There was no urgency, no need and no justification for it.

Fiscal austerity has not only been killing growth in Australia and elsewhere but it is also seriously undermining the development effort that major advanced nations agreed to many years ago.

In 1970, the 25th Session of the General Assembly of the United Nations passed a – Resolution on Financial resources for development – (Paragraph 43) that said:

In recognition of the special importance of the role that can be fulfilled only by official development assistance, a major part of financial resource transfers to the developing countries should be provided in the form of official development assistance. Each economically advanced country will progressively increase its official development assistance to the developing countries and will exert its best efforts to reach a minimum net amount of 0.7 percent of its gross national product at market prices by the middle of the decade.

This goal has been re-affirmed many times since. Please read my blog – Neo-liberals can’t even identify self-interest when it is staring at them – for more discussion on this point.

Most recently, the – Report of the International Conference on Financing for Development – which emerged out of the Monterrey, Mexico meetings of the United Nations (March 18-22, 2002) said that (Paragraph 42) in the context that “a substantial increase in ODA and other resources will be required if developing countries are to achieve the internationally agreed development goals and objective” and:

In that context, we urge developed countries that have not done so to make concrete efforts towards the target of 0.7 per cent of gross national product (GNP) as ODA to developing countries …

You will also find the resolution re-affirmed at the – World Summit on Sustainable Development – which was held in Johannesburg, August 26-September 4, 2002.

In 2007, in recognition that Australia had dramatically failed to meet is international obligations in meeting the agreed 0.7 per cent target, the Federal Government embarked on a strategy to steadily increase our ODA/GNI ratio to 0.5 per cent by 2016-17 (ever the nasty and mean little nation!). This was a doubling of the existing ratio.

At present the ratio is at 0.35 after a few years of increase after the 2007 commitment. The improvement in the ratio has now stalled.

In the lead-up to this year’s Budget, as rumours spread that the Government would cut the aid budget, the Prime Minister was asked about this on the ABC 7.30 current affairs program segment (April 4, 2012) – Australia prepares to sacrifice foreign aid for balanced budget.

The interchange went like this – “Are you committed to keeping this aid increase going so that by 2015 it’ll be in excess of $8 billion a year?”:

JULIA GILLARD, PRIME MINISTER: Well, the Government is committed to the millennium development goals. Once again, Greg, you are inviting me to engage in individual items of speculation about expenditure and I’m not going to do it.

Of-course she knew that (a) the 0.5 per cent goal was not consistent with the MDGs, and (b) that the Government would announce cuts in the ODA budget in less than a month after this interview as it pursued its moronic budget surplus obsession.

In the subsequent May 2012 Federal Budget the Government announced it would cut $A3 billion from the ODA budget over the next four years. The Budget allocations are summarised in this – Document.

There you see that the Government allowed for spending to increase from $A4.8 billion to $A5.1 billion (an estimated 4 per cent real increase) but the ODA/GNI ratio would remain static at 0.35 per cent.

So while the aid budget still increased in nominal terms the actual increases necessary to bring the ODA/GNI ratio up to even 0.5 per cent would be twice the amounts actually budgets for over the relevant time horizon.

The pretext is the so-called need to push the federal budget back into surplus in the coming year. But with the economy now slowing (our September national accounts will be out in a fortnight) the cut-backs in fiscal policy amount to pro-cyclical policy – the anathema of sound fiscal practice.

Fast track to early December 2012. The Government announced that it was cutting foreign aid by diverting $A375 million into maintaining its off-shore refugee program (that is, the system of imprisonment of refugees in NAURU etc) to save money for the budget.

In the AM interview cited above, the Treasurer was asked about these cuts. He responded:

SABRA LANE: There are calls now for you to restore the cut of $375 million in foreign aid funding. Will you do that?

WAYNE SWAN: Well I don’t accept that Sabra. Well, there hasn’t been a cut in foreign aid.

SABRA LANE: Well, there are calls.

WAYNE SWAN: Well, there may be calls but there haven’t been any cuts in foreign aid. We’ve got a record foreign aid…

SABRA LANE: Well you’ve diverted to onshore processing and that surely is a diversion by anyone’s language.

WAYNE SWAN: Well, it’s a very legitimate use of foreign aid and it is within the guidelines and it’s a practice followed by many countries.

Enough said.

A dirty and ill-conceived fiscal strategy has now failed on its own terms and is further damaging the most disadvantaged citizens in our midst – Australians and imprisoned refugees.

Things are going to go quiet around here for the next few days – so I wish every one safe holidays. I might or might not blog in the next few days.

That is enough for today!

(c) Copyright 2012 Bill Mitchell. All Rights Reserved.

I’m certain they knew a surplus was a pipe dream all along, Bill. It served a political purpose, but as you say, undermined the economy at the same time.

The emptiest words in politics are ‘jobs’, ‘economic management’ and ‘growth’. To politicians they simply have no meaning. They are just empty rhetoric.

I hold the RBA more accountable though. Politicians are known to be clowns, just with serious faces. The RBA is supposed to be apolitical, and with the army of economists and real time data at their disposal, ought to understand economic and financial cycles. The fact they championed the China story so long and completely ignored the process of gutting of the local economy borders on criminally negligent. Then again, they were tightening for too long based on phantom inflation, missed the secular decline in inflation over recent years, misread growth regularly and showed no aptitude for analysing the effect of not only the obvious decline in resources revenues, but also the government’s fiscal policy.

It’s all because of wrong terminology. When more money comes into the economy through exports than goes out because of imports, it is called a surplus. But when more money comes into the economy via government spending than goes out as taxes, it is called a deficit. As somebody else has suggested, this should be called a surplus, not a deficit. That makes it sound like the good thing that it is more often than not.

Enjoy your family and thank you for all you do for everyone.

Bill:

I recently came across the English translation of Vladimir Putin’s recent address to the Duma and the

Deputies. This address is a direct analogue to the annual “State of the Union Address” given by the

US president to a joint session of the House and Senate.

Because the text is very long, I chose to put the link to it here:

http://www.voltairenet.org/article176952.html

I found many of the ideas proposed to be quite enlightened from an MMT perspective, and I hope

you can find the time to read it. I also hope that you might be able to use it in a post or two, regarding

effective and ineffective sovereign policies.

Warmly,

INDY

“It is obvious that the Australian government now runs fiscal policy as a political tool to garner short-run popularity in the lead-up to next year’s federal election rather than tailoring it to the economic needs of the nation.” – Bill.

Yep, and John Howard made an art form of it. Instead of the budget being used counter-cyclically it was used election-cyclically. First two budgets of a new term are contractionary austerity budgets. The government can trumpet that they are being “economically responsible”. As the damage from these (usually) inappropriate budgets really bites, the government is into its 3rd year. Suddenly, it “discovers” the “economy is weak” and needs stimulus. Stimulus arrives as election bribes targeted at those demographic segments the government perveives as swinging voters.

And of course, the huge run-up of private debt in the Howard years was the direct result of all those surpluses.

I have some simple technical questions for Bill.

1. In a country like Australia are there just two legal forms for money creation?

(a) creation of fiat money by the Federal Government.

(b) creation of debt money by the Banks licenced to lend in that manner?

(I understand that debt money is destroyed again when the debt is repaid. Is that correct?)

2. Do non-bank mortgage lenders and commercial “loan-shark” operations create debt money?

3. Could debt money conceivably “power” the economy as a “pseudo-deficit”? That is, could it do the stimulus job that government deficit should be doing?

4. Why did all the debt money creation of the Howard era (in particular but not exclusively) tend to drive asset inflation (house prices in particular) rather than deliver a broader stimulus to the economy? After all, unemployment remained high despite all that debt-fuelled spending.

My goodness, another political speech filled with cliches about the future (ie. competition, challenges, more competition) necessitating, yet again, the need for sacrifice. Vladimir Putin’s actions speak for themselves.

Happy Holidays, Professor!

Thank you for all your great work and efforts for a much better world!

Hopefully next year will bring us the much needed first MMT macroeconomics textbook. 🙂

The backdown (for the moment) from the surplus obsession is certainly welcome.What it does illustrate is the stupidity,ignorance and arrogance so widespread in the governing classes in Australia. This is not confined to economic matters. It is evident in such critical areas as the environment,population,immigration and defence.

I doubt if this cohort is capable of changing their behaviour.The outlook for 2013 is not good,election or not.

As for “imprisoned refugees”,I certainly don’t favour locking up these people. The great majority of them are economic “refugees” of which the world has an inexhaustable supply.Just how many of these singularly selfish migratory birds are we supposed to shelter? Australia does not have inexhaustable resources to cater for an increasing population,whether from “refugees” or from the migration policies of the above mentioned governing classes.

The “imprisoned refugees” should be deported to their country of origin with no appeal as should future arrivals.If this action contravenes some treaty or agreement entered into by the “governing classes” then that treaty or agreement should be cancelled.I’m sure that there are many other agreements,especially relating to trade,which also need to be cancelled in the long term national interest of Australia.

But since when did the “governing classes” think in the long term? Fools,bleeding hearts and do gooders do nothing for Australia whatever their protestations to the contrary.

The refugee issue could be much more positively and humanely handled. It is always worth starting with some simple statistics about what is happening currently.

Settler arrivals in 2010-2011 = 127,460.

Net permanent migration 2010-2011 = 39,000.

Refugee intake 2010-2011 = 13,799.

Out of 19,370 detained people, 14,438 were asulym seekers who arrived in Australia by boat, unlawfully, at an excised offshore place.

I was unable to find deportation numbers after a short internet search. (One wonders how often these stats are deliberately made hard to find.)

Then we need to look at a few other facts. The world is over-populated now. Carrying capacity and footprint analyses along with negative externality problems like climate change, deforestation and extinctions seriously suggest this. Australia will soon be over-populated too on current trends. A reasonable estimate for Australia’s indefinite carrying capacity runs from 25 million to about 35 million but certainly no more. There is no real benefit in getting to our carrying capacity quickly. We are never going to become a great power and the power difference between 25 million and 35 million is not great.

Therefore step one would be to maintain zero net immigration. We could cut voluntary immigration by the amount necessary to achieve this. Step 2 we could cut voluntary immigration further to allow us the space to accept genuine asylum seekers at a rate commensurate with our size and UN committments.

We could do away with all expensive immigration detention centres, house asylum seekers in the community and process people quickly even if it meant doubling or trebling staff to achieve this. The monies wasted on punitive detention could be spent on rapid processing and rapid resolution; meaning admission or deportation in accordance with international humanitarian law and UN conventions.

Ikonoclast ,you have made some sensible comments about population levels and that is good to see.

I would like to see the source of your figures on migration intake as they appear far too low,especially the net figure.

The current method of dealing with illegal arrivals/overstayers is a sick joke and a waste of resources as you say.Both major parties have not proposed a sensible solution to date – a familiar story in other vital areas as well.

However your proposal to allow these people into the community where most of them will simply disappear into whatever ghetto suits their purpose is not practical either.We already have major problems with border control without making it worse by slack treatment of illegals.The illegal cohort needs to be restrained in Australia where the costs can be minimised but only so long as it takes to determine their country of origin and arrange their deportation.There should be zero possibility of appeals through the Australian legal system as is happening at present.

There are also many rorts involved in the legal migration field and migration agents are the source of a lot of the abuse.This “industry” need to be severely regulated if not abolished.

Re “international humanitarian law and UN conventions” – these were taken up by earlier Australian governments in earlier times for various reasons,some of which are no longer valid.In addition the people who signed on to them were/are of questionable judgement,particularly in the environmental field pertaining to human population levels (aka carrying capacity).

Just because we have signed up to treaties and agreements in the past does not mean that these are set in stone.A sensible future for Australia requires that we have freedom of action in defending our national interest. We do not need some self applied straightjacket of treaties and the like.

Wayne Swan was always the weakest intellectual link in this chain of government, and Julia Gillard was foolish to trust in his economic judgement — ahead of that of other government members who either had a better grasp of macroeconomic principles than Swan/Wong or were willing to listen seriously to the opinions of economists other than those in Treasury.

Dear Podargus,

“The great majority of them are economic “refugees” of which the world has an inexhaustable supply.”

Can you tell me the source of your information, please? I would like to know how you seem to know that the great majority of those coming to Australia are economic “refugees”.

Best wishes

Graham Wrightson

Ikonoclast, I would like to attempt an answer to your questions, which I find interesting. However, my answers are not authoritative as Bill’s would be.

1. There are two legal form of money creation, but we must not forget that fiat money that is created when the government spends is also destroyed when tax is paid. I would also say that money is destroyed when government bonds are sold and created again when they are paid out or bought back by the government, as in “quantitative easing”. However, this a little arbitrary as it depends on whether bonds held by the private sector are regarded as money like bank deposits.

I believe that debt money (aka endogenous money) is destroyed when the debt is repaid.

2. I understand that non-bank mortgage lenders have their money as deposits in banks until they lend it so that it is simply transferred to another bank account and is not created when they lend it. Nevertheless, when they lend money, the borrowers are pretty sure to spend that money so that economic activity is increased in the same way as bank lending.

3. I think the answer in general is yes. However, banks and others will lend money if and only if there are credit worthy borrowers and this depends on whether the borrowers themselves can make sufficient profit to repay the loan plus interest. This depends on whether there is already sufficient economic activity and whether the net financial assets in the economy are sufficient. This raises another question about what is sufficient and is a question that I would like to see discussed. Government spending is not constrained the same way and is, or at least should be, better targeted.

4. dunno. Since the Howard government ran a surplus, the net financial assets of the private sector were reduced which tended to increase debt levels, but this does not answer your question.