I started my undergraduate studies in economics in the late 1970s after starting out as…

Celebrate Living Wage Week

Regular readers and those who hear me in the media regularly will know I talk and write a lot about unemployment. I do so because it is a principle cause of poverty and disadvantage. It is also the tip of an iceberg of lost economic, social and personal opportunities. But we should not forget about trends in employment especially the rising incidence of the working poor. I raise this issue today because on Sunday the British celebrated the start of the – Living Wage Week – which runs from November 4-10. There are celebrations in all the major British cities and both sides of the labour market – workers and employers – are urged to embrace the notion that paying a living wage is not only ethical but also good for worker productivity and morale, and, hence good for private businesses.

The Living Wage push is in contradistinction to the way the Europeans are behaving at present. The on-going program of internal devaluation in many the nations that the Troika is pillaging – aka cut wages and pensions – is deliberately aiming to reduce the fortunes of workers who are already poorly remunerated

I last considered this topic in this blog – Rising working poor proportions indicates a failed state

The Living Wage Week is a strategy designed to illustrate to employers the benefits they can gain from paying wages, which allow their workers to live above the poverty line in a socially-inclusive manner.

My profession has a long-record of blaming unemployment on what they term excessive wages. The usual policy recommendation from mainstream economists when there is mass unemployment is to cut the real wage (via money wage cuts) to allegedly stimulate the demand side and to simultaneously cut welfare benefits to stimulate the supply side (aka making workers desperate).

The latter strategy is being employed by the Australian government at present. As I note below, the Australian government is deliberately forcing workers who are jobless to live in deep poverty, in the misguided belief that they will have more incentive to get jobs.

The problem is that there are not enough jobs and so the incentives are all perverse. The government then wonders why the youth turn to drugs (selling and using) and house-breaking. Both activities are what we might call “work” – deliberate activity and effort in pursuit of a weekly income.

Keynes noted in his battles against the Classical economists during the Great Depression that the classical remedy of attempting to cut real wages was bound to fail for a multitude of reasons.

First, it is not guaranteed that a cut in nominal wages will result in a cut in real wages if prices fall as the economy moves into recession.

Second, wages are not only a cost (part of the firms’ supply side decision making) but also an income, upon which aggregate demand depends. He argued convincingly, that wage cuts would probably undermine aggregate demand as much as they “improve” aggregate supply and so nothing is gained other than the workers are worse off and still unemployed.

Third, workers would resist money wage cuts because a bulk of their liabilities are denominated in nominal terms. So the house mortgage contract specifies so many dollars a month have to be paid. If the worker’s money income falls below this sum then insolvency occurs. So while the worker might accept a real wage cut as a result of prices rising against a slower moving or static money wage level, they will resist the same percentage decrease in real wage arising from a money wage cut.

The reason is that a real wage cut engineered via the first route allows the worker some flexibility, in the first instance, to change the composition of their spending in real terms, while still being able to meet their nominal commitments.

Fourth, and most relevant to the Living Wage Week aims – Keynes also argued that most firms would resist cutting wages of their work force because they would not want to be seen as being a capricious employer. They soon work out that if they hold their workforce to ransom when times are tough, the tables will turn in goods times.

In periods of strong growth, firms have more at stake (profits are high) if there is an industrial dispute or a lack of willing labour. They realise that loyalty works both ways and so it is in their interests to avoid creating an environment of low morale, which, in turn, is typically associated with higher rates of absenteeism, higher rates of sabotage and theft, and higher rates of turnover in good times.

The Living Wage Week is very important for Britain because there is strong evidence that a growing number of workers there are in the working poor category.

Management consultants, KPMG recently (October 29, 2012) released a major study – Current Trends in Household Finances and Structural Analysis of Hourly Wages – which showed that “one-in-five workers across the UK are earning below the Living Wage … This amounts to some 4.82 million people … “.

The hourly living level in the UK is at present £8.30 an hour in London and £7.20 for the rest of the UK. Readers should not confuse the living wage with the minimum wage. In the UK, the latter is currently fixed for adults at £6.19 per hour.

The The Living Wage in the UK:

… is a voluntary rate of pay that some employers give their staff, designed to enable workers to afford a basic standard of living.

When I talk about the need for employment guarantees I use the term a living wage (which effectively would become the minimum wage) as an indicator of the weekly sum a worker would need to live an inclusive life within the society as currently defined. It is broader than being able to achieve adequate housing and nutritional requirements.

It encompasses concepts such as social inclusion and aspirations. In work I have done for the ILO (in South Africa) I noted that when considering:

an appropriate minimum wage … we consider an ordering (or hierarchy) of needs (in order): (a) Basic food and non-food needs (absolute poverty line constructs); (b) Social needs (relative poverty constructs); and (c) Capacity building (Sen’s capabilities constructs).

Poverty reduction should not be considered only in terms of moving people above an absolute poverty line. We should use a broad framework of social inclusion and exclusion, which relates directly to Sen’s concept of ‘capabilities poverty’.

Sen constructs development as a process of increasing both incomes and the capabilities of the people, where the latter involves the social, economic and political institutions of the country at all levels. Within this context, poverty deprives one of basic capabilities.

The main findings of the KPMG Report were:

1. 24 per cent of workers in Northern Ireland were earning under the living wage (23 per cent in Wales).

2. “Exactly 41% of people earning below the Living Wage reported worsening finances”.

3. “Six times as many saw savings fall (30%) as those that indicated a rise (5%)”.

4. “Higher debt contrasted with a decline in debt among people above the Living Wage”.

5. “Squeeze on cash availability much greater for people earning below the Living Wage”.

6. “people earning below the Living Wage reported a much steeper drop in their appetite for major purchases”.

So some of the things that would be required for Britain to enjoy a robust economic recovery are absent. A rise in the living wage would stimulate spending and allow individual balance sheet restructuring (deleveraging) to occur swiftly.

The lack of private spending, in part, because of the huge private debt overhang is constraining the British economy. The fiscal austerity then exacerbates the spending gap.

The Report also makes it clear that the poorest workers typically bear the major brunt of the downturn. They are not only more vulnerable to unemployment and underemployment but their bargaining power is negligible and their wages growth suffers as a result should they retain their employment.

In Australia, the – Australian Poverty Line – is computed by the Melbourne Institute of Applied Economic and Social Research, which is located at the University of Melbourne. They provide quarterly data (the latest being June 2012).

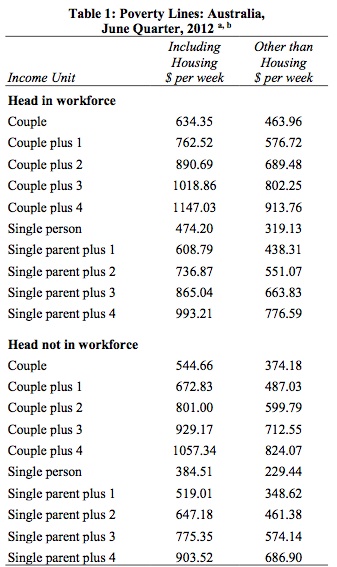

The following Table is taken from their June 2012 publication and shows the different rates for different employment status (working or unemployed) and different family structure.

In Australia, the minimum wage is currently set at $606.40 a week. So a single person earning the minimum wage finds him/herself above the poverty line according to this measure. But a single, working mother or father quickly finds themselves among the working poor.

Once the family size increases, a minimum wage lifestyle is one of poverty.

Note the poverty line for, say, a single, unemployed person is $384.51 per week while the federal government unemployment benefit is just $244.85 per week. Even if we adjust for rental assistance, the unemployed remain well below the poverty line.

The Federal government has consistently been called upon to raise the unemployment benefit above the poverty line but have refused claiming they want to motivate the jobless to get work.

The only problem with that scenario is that the Government’s own macroeconomic obsession with budget surpluses is starving the economy of aggregate demand sufficient to ensure there are enough jobs created.

So the Federal government simultaneously condemns a group of Australians to joblessness and poverty.

Some will argue that because income support recipients in Australia receive rental assistance, for example, the problem is less severe than I have suggested. That is correct but the scale of assistance for the unemployed is short of pitiful.

The shift to the provision of rental subsidies in Australia was part of the ideological shift away from the government taking responsibility for social policy.

In the past, the Federal government (in liaison with the states) provided public housing to low income earners. While in short supply and of a fairly rudimentary quality, most lost income earners could expect to be given access to a secure, affordable home.

That changed when the neo-liberal ideology became dominant and the Government moved progressively to providing rent subsidies to private market suppliers.

There is a large literature which analyses the consequences of this shift for low income earners, which is tangential to this blog. But the major conclusions are as follows:

1. Commonwealth Rental Assistance (CRA) is capped and so the rising housing costs have undermined the value of the subsidy.

2. This erosion in value has meant that single unemployed people find it almost impossible to rent in the private markets in the major capital cities such as Melbourne and Sydney which means that the spatial concentration of disadvantage rises and the unemployed are forced to live in areas where there is less job creation (notwithstanding the overall lack of job creation in Australia per se.

3. CRA relies on an adequate provision of affordable housing being made available by private providers. It is clear that supply has been lagging well behind demand for a number of reasons including the incentives given via the tax system to high income earners to invest in higher valued investment housing as tax dodges under negative gearing. This high income-earner welfare is a major source of inequity in the Australian system.

4. Many unemployed are forced to live in group (shared) housing and the maximum CRA entitlement is then dramatically reduced.

The conclusion is that while there is some rental assistance in addition to the unemployed the amounts are trivial and do not push them above the poverty line.

Please read my blog – Our pathological meanness to the unemployed is just bad economics – for more discussion on this point.

Taken together, it is no surprise that the recent Australian Council of Socially publication – Poverty Report October 2011 Update – found that a stunning:

2,265,000 people or 12.8% of all people … [in Australia] … living below the internationally accepted poverty line used to measure financial hardship in wealthy countries.

If we use a poverty line definition that allows for comparison with the UK results, for example, the problem becomes worse. The ACOSS Report concludes that:

A less austere but still low poverty line, that is used to define poverty in Britain, Ireland and the European Union, is 60% of median income … When this higher poverty line is used, 3,705,000 people, including 869,000 children, were found to be living in poverty. This represented 20.9% of all people and 26.1% of children.

The main groups that comprise the 2.2 million people living in poverty (600,000 are children) are the usual suspects – unemployed, children in single parent families, and other income support recipients.

But the ACOSS analysis also shows that 7.1 per cent of those in full-time employment and 24.6 per cent of those in part-time employment are living below the comparable poverty line.

I will leave it to you, if you are interested, to explore all the dimensions of poverty discussed in the Report.

In designing minimum wage systems (which I consider should be also Living Wages), policy makers should be aiming to eliminate absolute poverty and also provide for an improved personal capacity to manage risk via savings (that is, reducing relative poverty).

In many nations, particularly where there is widespread poverty, this aim will come up against the private employers who pay poverty wages.

My view of economic development is that maintaining sectors in the private labour market that pay “poverty wages” is not consistent with the aim of creating a Living Wage as part of the development mix.

It is in the interests of all economies, rich and poor, that higher productivity employment is fostered rather than relying on low-wage, working poor jobs to absorb the unskilled labour force.

The introduction of a Job Guarantee should be seen as one of the essential stepping stones in the development process.

It can serve as an industry policy to promote a quickening of this move to a high-wage, high productivity economy by placing pressure on market economy employers through the wage floor it establishes

If nations moved in that direction then there would be both demand and supply effects in response to the imposition of a Living Wage as the minimum.

Employers currently paying below the wage would be confronted with the decision of operating that new legal minimum or closing down. Those workers might lose their jobs but their incomes would rise because they would have access to the Job Guarantee.

Further, the higher wages at the bottom end of the labour market would stimulate spending and overall job creation in the non-government sector. There would also be a dynamic present to restructure existing employment.

The introduction of an unconditional wage offer to anyone who wants a jobs (the Job Guarantee) would probably invoke substantial supply effects.

The employers paying below the proposed minimum would now be forced (by market forces) to invest in productive capital to increase the productivity of labour and pay at least proposed minimum per month to retain labour.

Once the adjustment to the Job Guarantee was made, the workers in the Job Guarantee pool would retain an economic incentive to work in the conventional labour market when an opportunity arose. Employers would need pay little more than they presently offer to poach workers from the buffer stock employment pool, since the ‘Job Guarantee’ system would make no counter-bid to retain them.

Conclusion

I have noted this view of the minimum wage before but any sophisticated society requires a decent minimum wage that is determined on the basis of what we want the floor in living standards to be.

In the absence of regulation it is almost certain that the “market” would drive the wage below that level. In such cases, the employment is not desirable in relation to the aspirations of the nation to become a sophisticated place to live.

In this case, a Job Guarantee could set the minimum alternative employment that the private employers then would have to better. They would need to invest and ensure productivity could support the higher wage level. Its called a win-win.

So let us celebrate Living Wage Week and demand our legislatures everywhere pass the relevant laws to enhrine a living wage in every economy.

The dynamic adjustments that would follow would provide huge benefits to everyone.

That is enough for today!

(c) Copyright 2012 Bill Mitchell. All Rights Reserved.

Look the UK is a very large Monaco – although rather then a sunny place for shady people it is a cloudy place for shady people.

The most recent deal between the rulers of the UK & the city was they shaft the local workers so that they could export the now surplus North Sea capital to the PIigs and the rest and thus earn a larger income from such operations.

And they have done very well from such operations.

The UK imports all sorts of high quality Grot onto it shores….most of it destined for London and the south east.

When the oil began to run low they needed to push the PIigs into current account surplus so that they can remain in physical goods deficit.

England did the deal with the devil when it allowed Cromwell and his Venetian gang of bankers total money control with them promising legal freedom and all that other good stuff as long as you have “growth” and pointless growth at that. (to pay off a stock of debt)

This illusion of freedom can only come via stripping other shores of their wealth and indeed Londons immediate hinterland post Bretton woods.

We are now living through a second Plantation phase in Irelands history.

I have seen this tactic played out so many times – in Corsica for example you can see these commerical operations played out in miniture when the Bank of St George brought in Greek settlers to divide and conquer a once cohesive and therefore difficult to control population. (Corsicans are very very unfriendly people)

The dramatic face off of the Greek and Catholic church in such a small village is well dramatic…….

en.wikipedia.org/wiki/Cargèse

Of course it has nothing really to do with God and stuff but MONEY

The Anglo banking construct is now becoming dangerously exposed as there is no more worlds to conquer.

With the overwhelming amount special favours by governments over the years to sectional interest groups the cost of living in Australia is astronomical (but still cheap relative to Switzerland!). Everything from utility bills to the cost of buying a decent (that’s not a word I use often) car are artificially inflated in this country due to direct government policy (policy failures, in my view).

In these circumstances, it is no wonder that it is nigh on impossible to temporarily get by on the dole or to make ends meet on the minimum wage. Rather than legislate higher minimum wages and hurt the most vulnerable in society (e.g., single mothers, the low-skilled, etc.) we need to slash the cost of living (mostly for non-tradables but also tradables).

Removing these ridiculous parallel import bans on cars would be a good START (as well as scrapping the various sneaky non-tariff barriers where we pretend we need different windscreens to those acceptabe in the UK, etc.). Holden exports cars to the US for less than two-thirds of the price it gouges Aussie battlers.

Cheers!

@Esp

Oh God – another free trader.

What happens when you have the perfect free trade nirvana in place ? – the banks kick the stool from under you.

National Kingdoms are the only defence from such entropy operations which seek to reduce former countries redundancy and turn them into ever more extreme colonies.

See Ireland – the model “open economy” pupil.

Open to catastrophic capital , trade and the labour flows.

A country modeled as a conduit and nothing more.

@Dork – What are you on about? A well-regulated banking system can coincide with a low cost of living. Why should Aussies pay a 50% premium for a car for goodness sake? Why should our power bills be more than double than in the US? There are ways to slash living costs WITHOUT r@ping workers. That has absolutely nothing to do with free market dogmas or socialist dogmas or any other dogma. Please provide sensible direct answers the questions I have asked – hand-waving won’t do.

Your example of Ireland is a classic case of government failure – they relinquished the punt and it was all downhill from there, e.g., completely unsuitable monetary policy (German level interest rates during high-ish inflation and strong aggregate demand and money demand = MASSIVE POLICY FAILURE). The free market has many flaws but it’s a damn sight better than the incomprehensible trash that you regularly espouse in the ‘comments’ section of this here blog.

Dear Bill,

I don’t know if you have looked in detail at the report you linked to? While it is obviously a good idea to calculate a living wage – what other rational basis could there be for government social planning in a market economy – the figure presented in the report is of doubtful value. Let’s start with the fact that they give a single headline figure – a weighted mean of mimima for different types of household – while in reality the fact that people live in different circumstances is important and shouldn’t be hidden. If they want to present a minimum, then use the figure for the household type with the lowest requirements (childless couples), and make this clear in the presentation.

Then there are the hidden assumptions. For example, couples with children are assumed to be able get council housing. But really, how many can in 2012? This minimum is only viable for a small fraction of the population (not calculated). Then, there is the fact that both partners in the couples households are assumed to work full time (52 weeks a year if I’ve calculated correctly) – certainly this gives a lower minimum, but the (non-obvious) positive fact can have normative consequences, depending on the uses that this report is put to.

Summary: it is useful to calculate a minimum wage, but not everyone can live on it, and that fact should be front and centre of any presentation of the findings.

@Esp

It was more then about having national currencies or not having national currencies…………when the city of London did its Big bang thing of mass credit note production in the early 80s the already highly mercantilist Germany gave up on any notion of investment in its domestic national energy systems.

Why should it ?

It can sell a unlimited amounts of Mercs and BMWS in London or the people who are on the receiving end of Londons credit note production to pay for its energy imports.

Why have a national economy programme ?

It is no coincidence that the national nuclear programmes of european countries shut down at that time.

Germany can merely borrow off the rest of the European account and sell us high quality grot.

Ireland at that time began to manifest unbalanced trade – not so much with the Uk but with Europe in general which was becoming a conduit for London operations.

I.e. the city produced credit notes …….Germany and others supplied this machine and Ireland supplied Europe with electronic and chemical stuff at low corporate tax rates.

These are not rational national economic hinterlands trading with other national economic hinterlands – these are non national economies or economies which choose not to be national trading with other absurd market state creations creating huge distortions and externalties in trade capital and subsequent labour flows.

I.e. these market states must try to game multinational and banking activities which (are the true sovs in our modern world) such as what happened in Ireland as they are really colonies.

Don’t believe the punt independence meme – the punt was only given to Ireland in 1979 so that we could integrate with the Euro monster

Remember in the mid 80s we had the Punt but our balance of trade and internal economy was becoming ever more neo liberal in nature. (especially after 1987)

Also the domestic UK economy has Sterling but that could not save it from Londons entropy operations

PS

“Why should our power bills be more than double than in the US? There are ways to slash living costs WITHOUT r@ping workers”

You are falling for the euro inflation meme trap.

They compare a fixed euro with the price of goods.

They don’t compare wages with the cost of living.

Wage deflation is a form of inflation ,it just affects different people – people who depend on a wage rather then fixed income.

Its a form of inverted inflation but it is real , very real.

Listen esp – look at my posts about the Euro car industry which is at the very heart of the Euro mess.

The car industry is moving east so as to reduce labour costs.

The UK ford transit site is moving to Turkey because they pay 4 Euros a hour , much of the Industry is moving beyond Poland into Russia.

This is happening in all industry , indeed this has happened already …just little bits remain.

The Euro is a gigantic capital export engine making money from labour arbitrage but the waste and externalties from this demonic project is on a huge scale.

The banks must continue to increase leverage in the home markets to buy these products as very few are paid a decent wage.

Renault is now is deep trouble because its banking arm is in trouble …..i.e.it cannot now give the credit.

Just look at china and its energy balance if you don’t believe me.

At physical introduction of the Euro in 2002 china and its coal consumption went into a ballistic trajectory.

That is not a coincidence.

If you want to see how absurd these things have become look at the history of the chicken tax.

en.wikipedia.org/wiki/Chicken_tax

en.wikipedia.org/wiki/Ford_Transit_Connect

“To circumvent the 25% tariff on imported light trucks, Ford imports all Transit Connects as passenger vehicles with rear windows, rear seats and rear seatbelts.[9] The vehicles are exported from Turkey on cargo ships owned by Wallenius Wilhelmsen Logistics, arrive in Baltimore, and are converted into commercial vehicles at WWL Vehicle Services Americas Inc. facility: rear windows are replaced with metal panels and rear seats removed (except on wagons).[9] The removed parts are then recycled.[9] The process exploits a loophole in the customs definition of a commercial vehicle. As cargo does not need seats with seat belts or rear windows, presence of those items exempts the vehicle from commercial vehicle status. The conversion process costs Ford hundreds of dollars per van, but saves thousands over having to pay the tax.[9] Partly because of this, only the long-wheelbase, high roof configuration is exported to North America. In most places, the high-roof Transit Connect, like most Ford Econoline vans, is unable to access multi-story parking because of its height (6′ 6″).”

This explains why France has been destroyed by the Anglo model or manchester trade economics using oil rather then corn to break open domestic energy systems.

French market towns have been the core wealth base of that once great state – wonderful planned towns frequently built around the local 1 meter gauge railway station……

Now its a farce , using these machines as Joy rides

A 86 million Euro Turkey ?

fr.wikipedia.org/wiki/Panoramique_des_Dômes

“Opened so early Saturday, May 26, 2012, the new cog train was stopped for an indefinite period the afternoon to17 h 30 following a storm causing mudslides on rails and water the stations of departure and arrival. Some tourists were stranded a few hours at the top and halfway before being discharged 4 . The operation finally restarted June 16, 2012, after completion of repair 5 .

October 28, 2012, a train without passengers derailed on a switch and flipped at the intersection. The General Council of the Puy-de-Dôme request the suspension of operations ”

6 .

http://www.youtube.com/watch?v=Dp_6Qw82WVQ

This is a private investment yet……….

Funding [ edit ]

General Council of the Puy-de-Dôme : 30 million €

TC Dome / SNC-Lavalin : 27.6 million €

Auvergne : 6 million €

Clermont Community : 6 million €

European Union ( ERDF ): 12 million €

State (supported by the Recovery Plan): 5 million €

This is not a investment of the commons

Need I say ERDF is widely known to be extremely corrupt.

Meanwhile on the last 1 meter gauge railway not mainly used for tourism ( its used for the school run etc) they have been lucky to get some spare steel from TGV Atlantique.

fr.wikipedia.org/wiki/Chemin_de_fer_du_Blanc-Argent

Cost of project : 13.6 million.

http://www.rff.fr/fr/le-reseau/pres-de-chez-vous/regions/centre-limousin/projets-949/modernisation-1021/ligne-le-blanc-argent-7186

http://www.rff.fr/IMG/pdf/20120710_Cpresse_Le_BLanc-Argent_-_Basse_def_1_.pdf

This video shows the Labour rather capital intensity of the rail line i.e. under the franc it would be viable.

http://www.youtube.com/watch?v=CUzVWwjO0Ps

http://www.youtube.com/watch?v=H70YFxn3x8w

This is a investment in the commons…….but most of SNCF resourses go into wasteful high speed stuff.

The largest town on the line has a interesting industrial car history.

fr.wikipedia.org/wiki/Romorantin-Lanthenay (pop : 18,353)

“For 150 years, the brothers Normant factory was installed in the Faubourg Saint-Roch, it spread over six hectares on the edge of the Sauldre, employing up to 1500 people in its workshops 13 . This large family drapery business has provided the industrial development of the city, before closing its doors in December 1969 14 , a victim of the serious crisis affecting the entire textile sector 15 .

The factory Matra produced for Renault in 1980 and 1990, nearly 870,000 units of the Renault Espace . It was closed in 2004 by its owner, the Lagardère Group , following the slump model Renault Avantime . Matra factory was demolished and cleared in 2011-2012, and has been replaced by a real estate project, including the construction of housing (such as the site of the former goods station). However, plant parts remaining, employing 110 employees, it also assembles electric bikes.

The city hosted 1959 to 2000 a factory of cameras professional associations, institutions Beaulieu . The factory premises now house a museum of automobile.

The city has a branch of the Chamber of Commerce and Industry of Loir-et-Cher .

A project to build a village name “Le Carré des Marques” is now under consideration. Proceedings before administrative courts are under”

Half of this line will remain closed – 86 million would rebuild the entire line with money to spare.

http://www.panoramio.com/photo/74547978

The current french corporate state is spending 10s of billions on capital intensive , labour light programmes burning the Greek oil /capital ration as quickly as they get their dirty little hands on it.

For this absurd capital outlay 1000s of KM of ancient railway abandoned after the war and in the 1970s to pay for high speed could be brought back to life , thus bringing French market towns back from the dead.

But given that light railway operations are labour rather capital intensive operations to build and to run it is seen as a non runner.

This oil corn $ hegemony has destroyed Europe.

Its obvious now the EEC was /is a Anglo toy.

De Gaulle was so right.

Bill, the living wage at £7.29 is, of course nothing like what is required for a normal life. Assuming an average 40 hour week, paid holidays etc then we are talking about a salary of around £15k a year. Pitifully low, there is no room for savings (e.g. pension) at this level but many people are doomed to earn it or even less. I welcome the intiative (who, neoliberals aside, wouldn’t?) but a ‘living’ wage it is not.

My view is that the goods and services proided by private company that can only make profits by paying poverty wages are not worth having…

The thoughts on the matter from that well known socialist Henry Ford are pertinent I think:

“I have learned through the years a good deal about wages. I believe in

the first place that, all other considerations aside, our own sales

depend in a measure upon the wages we pay. If we can distribute high

wages, then that money is going to be spent and it will serve to make

storekeepers and distributors and manufacturers and workers in other lines

more prosperous and their prosperity will be reflected in our sales.”

My Life and Work – an autobiography of Henry Ford, pp 86

http://books.google.co.uk/books?id=bUbdMRx43JgC

The famous or not so famous battle between a “respected” free trader

http://en.wikipedia.org/wiki/Richard_Cobden

and a now little known mad Irishman

en.wikipedia.org/wiki/Feargus_O’Connor

“I am one of those who from experience has learned that consideration of foreign interests has been forced upon us by neglect of our domestic resources: and I believe that overgrown taxation for the support of idlers and the unrestricted gambling speculations upon labour, applied to an undefined and unstable system of production without regard to demand, is the great evil under which manual labourers are suffering”

The Whiteboy & later Rockite Irish movements new how hopeless their position was –

They were both anti Ascendancy and anti Catholic church in their outlook so had few friends.

Given that they knew what a rotten place the world was as their homeland was a hinterland for the financial interests extraction operations they could not honestly believe in anything or anyone.

Thus they lacked focus.

Therefore they were much like the occupy movement today……….rudderless.

People of faith on the other hand can achieve much – however they can be easily led up the garden path.

The unique properties of energy goods be it corn or oil make them special topics of discussion as their consumption or lack of changes all things.

Talk of free trade vs internal trade thus orbits around the question of “growth” or redundancy from very powerful goods that can change pretty much your entire physical environment.

But distant vital goods such as this can easily fall withen hidden monopolistic control …….this is surely worse then domestic monopolistic forces which must at least work withen domestic energy & political systems.

We can and should do better. Eliminate* the government-backed usury for counterfeit money cartel, the banking system, and employers would be forced to “share” wealth and power with the workers and general population instead of being allowed to steal their purchasing power.

* Including the bogus debt the population has been driven into but in a manner that does not disadvantage non-debtors, i.e. a universal bailout with new fiat.

Professor:

I thought that it was interesting as well as important that MMT, courtesy of Dr. Stepanie Kelton was afforded a slice of American air time.

http://harryshearer.com/le-show/october-28-2012/

I thought it was a wonderful presentation.

Hi Bill, I’m fairly new to your blog but I’ve noticed on a number of occasions that you mention The Troika. Who exactly are the Troika? Is there a blog post where you go into this in some detail?

Cheers

Anthony