I started my undergraduate studies in economics in the late 1970s after starting out as…

Rising inequality demonstrates we haven’t learned much

I am now back on Terra Firma and have been greeted with beautiful Spring weather. Among the headlines I read when I returned to my office today were those predicting that the Greek economy will have shrunk by 25 per cent by 2013 and the Troika are demanding more cuts. What I learned from being in the lands of austerity over the last few weeks is that there is no coherent plan to salvage economic growth. Rather, the same economic policies that caused the crisis remain dominant. In saying that, I discount the trends in monetary policy including quantitative easing, which are crisis-specific, because they really don’t make much difference. What is apparent is that one of the pillars of social stability is now under threat. I refer to the deteriorating position of the middle class in the advanced nations. The latest data from the US supports the view that the inequality in income distributions continues to worsen. There is a hollowing out of the middle class continuing at a pace. This rising inequality demonstrates we haven’t learned much and are continuing to repeat the errors in policy that created the crisis and is preventing nations from leaving it behind.

By now the world is aware of how appalling the US Republican candidate after the Mother Jones magazine managed to get hold of a video of a talk Romney gave to some very wealthy Americans in May 2012.

The candidate categorically lied during that speech when he said that Obama supporters “are people who pay no income tax. 47% of Americans pay no income taxes.”

A study by the Tax Policy Center published July 27, 2011 – Why Some Tax Units Pay No Income Tax – puts to rest those claims.

But what I found interesting with this leaked speech was his strategic claim that while 47 per cent of Americans were spongers on government there was some middle ground that was contestable. He said “What I have to do is convince the 5% to 10% in the center that are independents, that are thoughtful, that look at voting one way or the other depending upon in some cases emotion.”

The swinging voter phenomenon is not confined to the US. The Tories are in power in the UK because of this cohort and the syndrome is well-known in Australia.

But what is now emerging from the data on income and wealth distributions is that the middle class have been hollowed out during the neo-liberal years and this trend accelerated during the crisis and in its aftermath.

Last November, the High Pay Commission in the UK published its final report – Cheques with Balances: Why tackling high pay is in the national interest – which found that:

As Britain enters times of unparalleled austerity, one tiny section of society has been insulated from the downturn. That is the top 0.1% of earners, with company directors in particular continuing to enjoy a huge annual uplift in rewards.

The Report found that:

– In 1979 the top 0.1% took home 1.3% of the national income; by 2007 this had grown to 6.5%.

– In 1979 the top 1% took home 5.93% of the national income; by 2007 this had grown to 14.5%.

– In 1979 the top 10% took home 28.4% of the national income; by 2007 this had grown to 40%.

This “dramatic shift in income distribution” has been part of the wider story where the real wage prospects of workers have been undermined by labour market deregulation, persistently high unemployment, rising underemployment (due to the casualisation of many positions) and a host of anti-union regulations.

Real wages growth in many nations has clearly lagged behind productivity growth with more of the national income being distributed to capital.

From a macroeconomic perspective this meant that real wages growth was insufficient to drive consumption growth and to prevent a realisation crisis, a new source of consumption funding had to be found.

The rise of the financial sector and the concomitant financial engineering, courtesy of the deregulation and lax financial supervision and oversight, spawned the massive credit binge which exploded as the financial crisis emerged.

The High Pay Commission found that:

Previously unpublished figures show that pay at the top has spiralled alarmingly to stratospheric levels in some of our biggest companies. In BP, in 2011 the lead executive earned 63 times the amount of the average employee. In 1979 the multiple was 16.5. In Barclays, top pay is now 75 times that of the average worker. In 1979 it was 14.5. Over that period, the lead executive’s pay in Barclays has risen by 4,899.4% – from £87,323 to a staggering £4,365,636.

The excessive pay at the top of the income distribution identified by the High Pay Commission in the UK was made possible by the massive redistribution of national income that was deliberately engineered by governments pursuing neo-liberal deregulation. The same trends are seen in many advanced nations.

The current policy debate has not considered these trends. But it is clear that rising inequality undermines the capacity of nations to grow in sustainable ways.

Even the IMF (April 8, 2011) – Inequality and Unsustainable Growth: Two Sides of the Same Coin? – concluded that:

… longer growth spells are robustly associated with more equality in the income distribution.

A prerequisite for resolving the unsustainable imbalances that led to the financial crisis will be to dramatically redistribute income back to workers – so that real wages growth closely tracks productivity growth and workers in sectors with little union representation are able to similarly participate in national productivity gains.

The other point about the rising inequality under the neo-liberal policy is not only attacking the poorest members of society but has seemingly been eroding the middle class – the cohort, which arguably has been instrumental in maintaining social stability via its willingness to trade consumption-rewards for political docility.

Around this time last year, the Atlantic Magazine (September 20, 2011) published the following article – The Global Hollowing Out of the Middle Class (No, It’s Not Just the U.S.) – which summarised the September 2011 release of the IMF World Economic Outlook.

The article noted that:

Some consider the erosion of the middle class an American phenomenon driven by greedy capitalists at the top or an especially impotent education system at the bottom. This thing is global … In the 14 years before the Great Recession, there was already a great recession for the the middle-paying swath of workers in the U.S., Europe, and Japan. Advanced economies saw “a shift away from middle-income jobs” to jobs in industries with lower productivity …

The issue of income inequality was also taken up in this article in the New Statesman (September 14, 2012) – Explaining rising income inequality – which noted that:

The ongoing crisis of the major Western capitalist economies has citizens on both sides of the Atlantic asking why the incomes of the business elite keeps rising even as companies cut jobs, banks foreclose homes, and the threat of penury faces many families who thought they were solidly middle class.

This is one of the puzzles of the crisis. The crisis was caused by managers in financial institutions acting in corrupt and incompetent ways after being given too much leash by governments, who were seduced by the ideology that self-regulating markets optimise wealth. The crisis should have disabused us all of that lie.

But then how can the same cohort of managers continue to reap ridiculous rewards at the expense of other workers? The New Statesman says “these overpaid corporate executives are getting these huge bonanzas for not doing their jobs.”

That has been the ultimate con. Students get taught a lot in business schools about risk and return. High executive salaries are meant to reward those who can deliver high returns to companies but risk losing their jobs in the case of poor performance.

The problem is, as the New Statesman points out, is that it is not just the shareholders and the managers that take all the risk. Workers bear the risk of enterprise as much as anyone given that they lose their jobs if the company performs badly.

Further, the New Statesman argues that “the growing concentration of income at the top in the United Kingdom is both unfair to workers and taxpayers, and damaging to the growth and competitiveness of the economy”.

Has the crisis changed anything? Answer: the inequality is getting worse.

Analysis by the Pew Research Center – (August 22, 2012) – The Lost Decade of the Middle Class – shows that in 2011 dollar terms, the “middle-tier” median household income in 2000 was $US72,956. This had fallen to $US69,487 by 2010. This is a measure of the “middle class” annual median income.

The Report concludes that “America’s middle class … has endured a lost decade for economic well-being. Since 2000, the middle class has shrunk in size, fallen backward in income and wealth, and shed some-but by no means all-of its characteristic faith in the future”. Presumably, some of these are Romney’s swinging voters.

On Wednesday, September 12, 2012, the US Census Bureau published its Income, Poverty, and Health Insurance Coverage in the United States: 2011 – which shows that in the aftermath of the crisis, the fortunes of the American middle class continue to deteriorate.

The US Census Bureau data showed that:

Real median household income in the United States in 2011 was $50,054, a 1.5 percent decline from the 2010 median and the second consecutive annual drop … [and] … In 2011, real median household income was 8.1 percent lower than in 2007, the year before the most recent recession, and was 8.9 percent lower than the median household income peak that occurred in 1999.

The US Census Bureau also found that “Based on the Gini index, income inequality increased by 1.6 percent between 2010 and 2011”.

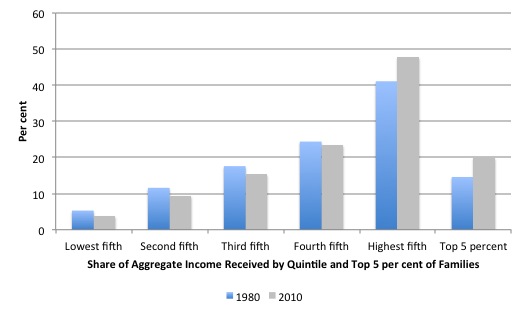

The following graph is taken from the latest US Census Bureau data and shows the quintile shares of families in total income (and the top 5 percent) in 1980 and 2010.

This is roughly the neo-liberal years and it is clear that there has been a squeeze on the bottom 4 quintiles in terms of shares in income.

Conclusion

No doubt this data will provide some very rich narratives as it is analysed in more detail. The obvious message is that the same forces that have led to increased inequality in income and wealth distributions also led to the crisis.

The same policies that governments are now pushing are also undermining the recovery and causing the income inequality to worsen.

Until the citizens rebel against that trend, there will be no sustainable growth path defined.

Relatively short blog today – tired from travel and a million other things to do.

That is enough for today!

(c) Copyright 2012 Bill Mitchell. All Rights Reserved.

There are two articles I have read in the past week that speak to these trends:

“The Strategy of Economic Policy and Income Distribution” – Hyman Minsky

“Incorporating the Rentier Secors into a Financial Model” – Michael Hudson

The irony is that income inequality hurts the economy which in turn will hurt the wealthy. A strong economy needs a healthy middle class to consume its products and governments rely on the middle class for taxes (both consumption and income). There’s only so many haircuts, pedicures, meals out and nights at the movies that a billionaire can purchase. Spread that same cash around thousands of people and the boost to consumption is massive. Not to mention all the other social benefits of a strong middle class in terms of social cohesion.

We can’t get American politicians to address these issues squarely, because recognizing that capitalist economic practices naturally generate widening income gaps and disemployment, when not suppressed by labor solidarity backed by serious government regulation and redistribution, is a blasphemy on the American religion. Fighting bank is class warfare, and only the rich are permitted to wage class warfare under the religion.

The pathological dysfunction in American politics is not a new thing, but goes all the way back to the McCarthy era, I fear. The left in America received a terrible body blow during that period from which it has never fully recovered. The country has been hemorrhaging egalitarian spirit since then. There was a brief surge in a partial egalitarian outlook with the civil rights movement and the women’s movement, and then a 40-year hard right, bipartisan turn.

We could have avoided these problems with money forms that “share” wealth and power such as common stock for private* money.

Instead, we opted for a government backed/enforced usury for stolen purchasing power cartel that works for the benefit of the so-called “credit-worthy” and the banks to concentrate wealth and power.

* Government money should be inexpensive fiat that is spent, not borrowed into existence.

“* Government money should be inexpensive fiat that is spent, not borrowed into existence.”

It always is.

There is no borrowing going on any more than the bank borrows from you when you have your salary credited to your checking account.

It always is. Neil Wilson

Indeed. So let’s cut out all borrowing by the monetary sovereign. Or are you in favor of that “corporate welfare” as Bill calls it?

There is no borrowing going on any more than the bank borrows from you when you have your salary credited to your checking account. Neil Wilson

And there’s another problem. Why doesn’t the monetary sovereign itself provide a risk-free fiat storage and transaction service instead of insuring deposits in the supposedly free market?

Or in other words, why don’t all citizens qualify for the equivalent of reserve accounts at the Fed? Why the distinction between banks and people?

“Or in other words, why don’t all citizens qualify for the equivalent of reserve accounts at the Fed?”

US political issue. I had a ‘reserve account’ at my Central bank before I was a month old.

I had a ‘reserve account’ at my Central bank before I was a month old. Neil Wilson

Good. So why not abolish government insurance for bank deposits? Why is it necessary? It isn’t, is it? Except for the banks?

Dan has a good understanding of the situation in the US. I would say that there are a lot of people that ‘get it’. Talking about the 99% and the 1% is a terminology understood everywhere at this point. In fact, the ‘Occupy’ movement has it right.

Whether this will translate into action remains to be seen. President Obama is to be preferred over Romney (who doesn’t take his orders from Wall Street vultures … he is one), but he has made no attempt whatever to reign in the criminals that now dominate our financial sector.

People have to get pretty miserable before they will march in the streets in large numbers, and that is what it will take. I’m afraid it may be a little like the story of the frog in the boiling water. Heat it up slowly enough, and he doesn’t notice until he is dead. ‘Occupy’ is still probably the main vehicle where one might hope for change, at least at present.

President Obama is to be preferred over Romney (who doesn’t take his orders from Wall Street vultures … he is one), SteveK9

The banks hold the economy hostage; we should end that intolerable situation.

“Good. So why not abolish government insurance for bank deposits? Why is it necessary? It isn’t, is it? Except for the banks?”

Insurance reduces the amount of central bank liabilities required to operate the system. Essentially the central bank liabilities are contingent.

And that means that the central bank doesn’t have to pay interest on them.

A more appropriate target for your ire would be the collateral requirements – which mean that private banks are really pawnbrokers rather than investment lenders.

Insurance reduces the amount of central bank liabilities required to operate the system. Essentially the central bank liabilities are contingent. Neil Wilson

The government deposit insurance allows the banks to create liabilities (“loans create deposits”) they need not (as a system) redeem. In other words it allows them to effectively counterfeit.

A more appropriate target for your ire would be the collateral requirements Neil Wilson

Actually, it is apparent that no one is “credit-worthy” when credit is correctly perceived as stolen purchasing power.

Btw, Karl Denninger would limit credit to ONLY those with marked-to-market collateral on the theory that if the credit can be “sterilized” in case of default that the credit creation is not counterfeiting. I, of course, disagree that it is not counterfeiting.

And who needs credit anyway when a universal bailout would provide plenty of new reserves to honestly lend? It’s not like reserves have to be mined, is it?

“The government deposit insurance allows the banks to create liabilities (“loans create deposits”) they need not (as a system) redeem. In other words it allows them to effectively counterfeit.”

It can’t be counterfeit if you have a licence from the central bank to issue money. As shown by the lack of prosecutions of banks for doing precisely what they are licensed to do.

“Actually, it is apparent that no one is “credit-worthy” when credit is correctly perceived as stolen purchasing power.”

Only somebody completely barking mad would perceive it as that.

“Barking mad?”

Your beloved banking system was the cause of the Great Depression which was a (the?) major cause of WWII which killed 50-86 million people.

I’d say I’m not the mad one.

Look, it’s easy to say, “Why don’t we do X? Why don’t we do Y?” The trick is to make X and Y happen.

The monetary sovereign in the US is the US Congress. It makes all the laws. It can spend what it wants, borrow what it wants and tax what it wants. It can establish a monetary system based on commercial banking, or one based on public utility banking, or one based on direct spending to the real economy. Congress could pass a law at any time authorizing the Treasury to spend a gazillion additional dollars into the real economy, and mandate that the Fed clear every damn check, no matter what balance is in the treasury account. The account itself is just an accounting tool with no deep intrinsic significance. These things don’t happen because Congress chooses not to let them happen.

It’s not primarily about the banksters strangling our money in the crib. The banksters don’t run things in the end – Congress does. If you want the world to be run differently, you have to focus on the government and pressure it to make things run differently. But you are going to have to convince a lot of people, because you have no doubt noticed that the US Congress is filled with a lot of rich and conservative people from both parties who currently have no intention of creating a people-oriented, democratic economy. Even if we had public utility banking, that would not generate economic activity unless Congress decided to use those banks and other tools at their disposal to build the economy, restore income balance and correct demand deficiencies. Public utility banks run by the likes of Mitch McConnell would be strangling us just as well as the current private system is.

Interest rates now are tiny. The economy is not being held back because of usurious lending rates. And public utility banking does not mean an end of debt. Those banks would still lend, and as a result people woulds still have debts. It might be a good idea in itself, but it’s a bit of a distraction from the fundamental problem.

And public utility banking does not mean an end of debt. Dan Kervick

Who’s arguing for public utility banking? Not me! Either everyone is equally credit worthy regardless of ability to repay or no one is credit worthy.

As for debt and usury, common stock is SPENT into existence. There is thus no debt and no usury. So why isn’t common stock widely used as a private money form? Because some hate to “share”? 🙂

There is no ideological support for the current money system. It is neither truly free market nor truly socialist. It is doomed to be replaced. We had best start thinking how to do so in the most pain-free, just manner.

Christine Lagarde has been given an honorary doctoral degree by the KU Leuven’s economic department for

“her strong leadership, her exceptional legal and macroeconomic vision, and her lucid analyses and straightforward proposals for understanding and addressing the current global financial crisis.”

https://www.kuleuven.be/english/news/ku-leuven-awards-honorary-doctorate-to-christine-lagarde-imf-chief

Either everyone is equally credit worthy regardless of ability to repay or no one is credit worthy.

Well that doesn’t make much sense to me. No matter how we organize our monetary system, we can’t inject infinite amounts of money into the economy. Decisions have to be made about priorities, and about how much money should be injected and to whom it will be given. Whether its the government or private firms making those decisions, there will always be limited funds available. We can’t treat Sally the Industrious Cupcake Baker on the same plane as Greg the Puking Barfly.

“Your beloved banking system was the cause of the Great Depression which was a (the?) major cause of WWII which killed 50-86 million people.”

Now we’re into false cause logical fallacies.

Can’t really help those with locked positions I’m afraid.

Can’t really help those with locked positions I’m afraid. Neil Wilson

You’re the one defending usury for stolen purchasing power. It’s your position that is doomed.

We can’t treat Sally the Industrious Cupcake Baker on the same plane as Greg the Puking Barfly. Dan Kervick

That same logic was once (is still?) used to justify redlining.

As for Sally, she can borrow fiat or a private money at honest interest rates, issue her own money, or obtain financing some other way. She might even be able to save once the Fed and banking system can no longer suppress interest rates.

Also, don’t forget that Steve Keen’s universal bailout would provide plenty of new reserves to non-debtors to lend. It would take about $8.5 trillion just to cover US deposits 100% with reserves.

And I said nothing about “infinite money creation” though money creation (like progress) should be unbounded.

Our pensions systems are odd, we give huge pools of money to money managers who trade it betweem themselfs in zero-sum fashion but take huge fees out of that activity. Might as well give them right to tax economic activity that would give them same kind of huge income flow without all the trouble. Can anyone say that managing these pensions assets does any good to the society?

F. Beard, what you haven’t said in any way that I can clearly understand is precisely what kind of operational setup you are imagining. It’s not enough to say phrases like “debt-free”, “fiat”, etc. Tell us what kind of system you are envisioning? How is it run? How are decisions made? What kinds of policies does it pursue.

Tell us what kind of system you are envisioning? Dan Kervick

Basically, co-existing government and private money supplies per Matthew 22:16-22 “Render to Caesar …” Government money would be inexpensive fiat but would only* be legal tender for government debts (taxes and fees), not private ones. Private monies would only be acceptable for private debts, not government ones, and would be defined by the private sector (We don’t need Ron Paul defining what private money is, thank you). Of course, government money could be voluntarily used for private debts but it would be the ONLY means of paying taxes and government fees.

And, of course, all government privileges for the banks should be abolished after we make sure (via a universal bailout with new reserves) that all deposits are 100% backed by reserves. Those privileges include:

1) government deposit insurance (The monetary sovereign itself should provide a risk-free fiat storage and transaction service that makes no loans and pays no interest. That service should be free up to normal household limits).

2) a legal tender lender of last resort.

3) borrowing by the monetary sovereign.

4) legal tender laws for private debts.

5) the capital gains tax on potential private money forms such as common stock.

* After a universal bailout with full legal tender fiat.

I have for a long time felt that corporations should have to pay a special excise tax based on the ratio of CEO and/or top management pay to average worker pay. I think it would go a long way toward narrowing the income inequality gap. This along with a Financial Transaction tax.

F. Beard you know that 100% reserves would not stop banks from lending money because banks don’t lend out reserves? So why bother?

this gets to the heart of the chronic lack of demand in western economies

and poses a problem for mmt prescriptions

increasing net government spends into the economy

the job guarantee are not enough to target the falling purchasing power

of the majority

progressive taxation while reducing the incomes of the 1%

will not effect those who pay no taxes

and will not effect much those who pay little taxes

stimulus aimed directly at income could do

a minimum income( non bond accounted for) paid in full to say 70%

of the population and then reducing on a sliding scale to nothing

on say the 80% income percentile non taxable

when 80% are freeloaders nobody is a freeloader

this level of stimulus I do not have the figures

but if total incomes currently range from50% to 70% of gdp in OECD

say 30% of GDP should move towards a maximum of voluntary unemployment

without government involvement in supply side job guarantees

of course governments should be free to purchase the health

and education services it’s citizens needs

may be the rest of any necessary government net spending

could be accounted for by bond issue

it goes to say if supply cannot cope with such

long term demand stimulus when full voluntary employment is reached

central bank created incomes could be reduced

you know that 100% reserves would not stop banks from lending money because banks don’t lend out reserves? PZ

I’m not opposed to the banks lending money; I’m opposed to them creating money in an unethical manner – which they do.

And we’ll need for deposits to be 100% backed by reserves when government deposit insurance is abolished since that will cause a massive bank run as people transfer their deposits to risk-free accounts at the US Treasury or a Postal Savings Service or whatever Federal institution is established to handle risk-free fiat storage and transaction services.