I started my undergraduate studies in economics in the late 1970s after starting out as…

Debunking myths

My friend Sean Carmody, sometime commentator and always obstinately objective, introduced me to this work – The Debunking Handbook – written by a physicist and psychologist. It serves to focus thoughts because it considers the pitfalls that arise in an exercise aimed at debunking myths and strategies that might be deployed to effectively achieve this aim. The authors appear to be motivated by the climate change debate but the discussion is equally effective in the context that I work within – how to convince people that mainstream macroeoconomics is largely devoid of meaningful content and predictive capacity.

The motivation of the authors is one that I share:

It’s self-evident that democratic societies should base their decisions on accurate information. On many issues, however, misinformation can become entrenched in parts of the community, particularly when vested interests are involved. Reducing the influence of misinformation is a difficult and complex challenge.

I have taken a non-mainstream position on economics all my career. It is a more difficult path to walk given how vociferous my profession is in protecting its boundaries and expelling radical elements. They control the post-graduate education opportunities (largely); the appointments processes; the access to key journals (key defined by them as being the “top” journals rather than reflecting any intrinsic merit); the access to competitive funding; the promotions process; and more).

Getting through the labyrynth of controls that the mainstream paradigm has in place is tricky. I adopted the view early that I would need to be technically-oriented – that is, competent in mathematics and statistics (econometrics). Many heterodox economists do not follow that route and actively eschew what they consider to be the tyranny of formalism. That makes them sitting targets in the highly formalised postgraduate schools that the mainstream controls.

I could document the other strategies I employed to get through the controls but I don’t want to turn this into a biography. I would rather concentrate on the general principles of the article with respect to the development of Modern Monetary Theory (MMT). Suffice to say that very few people get through their net and assume senior positions in the profession (that is, gain full professorial appointments and gain a solid flow of competitive research funding).

But when we consider the mainstream macroeconomics that most students learn, that most people read or hear repeeated in the media, and that most economists practice – I would hope that most of my readers realise it is a complex web of inter-related myths.

Some of the body of mainstream theory was applicable to the convertible, fixed exchange rate currency systems that were defined under the Bretton Woods system. Under that system, the government was revenue constrained as a result of the link between currency on issue and the stock of gold held by the central bank. As a consequence, the government had to raise taxes and/or borrow from the non-government sector in order to spend.

It is true that the constraint was voluntary in the sense that the nations could have exited the fixed exchange rate system and suspended convertibility almost any time they desired although the political repercussions might have been severe. By the 1960s, a series of what were called “competitive devaluations” (adjustments made to the fixed parities of certain currencies against the USD in order to render that economy more competitive) were made and set up a series of leapfrogging actions among trading rivals. The system collapsed soon afterwards when it became obvious that the US government could not longer support it.

But the point is that to restore currency sovereignty under that system, the country would have to leave it and create a new monetary system. This is the difference between say the UK which is artificially binding its options but could change direction any time they chose and the Eurozone nations which are truly revenue-constrained and face solvency risk. To change that status, these nations would have to introduce a new monetary system based on their own currency and floating exchange rates.

So, at present, the overwhelming perception that the wider society has of economic affairs, options available to government, causalities between economic variables etc is based on a myth. There is mass deception which is propogated by my profession for various reasons.

I have wondered about this all my career – how people live and die thinking they know about economics when in fact they have no understanding at all. Normally, ignorance disqualifies a person from having input into a debate. In that case, education is the indication.

But in the public debate about economic matters – from politicians down – ignorance is a characteristic of entry. Those who actually have some insights into how the system operates are vilified and accused of being socialists or worse.

Recall the comment made by that obnoxious character, the now Mayor of Chicago Rahm Emmanuel that progressives were “fucking retarded”.

So how are we to overcome this state of affairs?

The Debunking Handbook notes that:

A common misconception about myths is the notion that removing its influence is as simple as packing more information into people’s heads. This approach assumes that public misperceptions are due to a lack of knowledge and that the solution is more information – in science communication, it’s known as the

“information deficit model”.

They conclude – “that model is wrong”.

Their reasoning is that “people don’t process information as simply as a hard drive downloading data”. Given the “complex cognitive processes” involved there is a strategy that is needed driven by an understanding of “how people process information, how they modify their existing knowledge and how worldviews affect their ability to think rationally”.

So it is what and how!

I think in the case of economics there is more to it than knowledge deficits. We are dealing with a discipline that goes to the heart of power relations in our societies. I still consider it important to think in “class terms” – by which I mean the capitalist class which owns the material means of production and the working class that doesn’t and has to work for the former to survive.

I am aware of the complex layers that operate on top of that dichotomy, especially in relation to the position of the financial sector which bleeds both sides of production.

I have noted in the past that the body of theory we call neo-classical (characterised by marginal analysis) emerged in the fourth quarter of the C19th as a counter to the growing popularity of Marxist thinking and the threat it was posing for the wealthy capitalist class. Industrialists provided funding to economists of the day to develop a theory that would show capitalism to be “fair”. This was the basis of marginal productivity theory, which claims that all rewards taken from the system are in strict proportion to the contribution the recipient makes to the production process.

So wages and profits are alike – each goes to the recipient (worker and capitalist) as a reward for their respective contributions.

Mainstream macroeconomics was built on this microeconomic theory which “proved” that free markets were optimal and self-regulating and that most of society’s ills were the result of government distortions of the market.

The theory has survived despite being internally inconsistent (for example, the Cambridge controversies of the 1960s) and lacking predictive capacity.

There are vested interests therefore in preserving a body of theory that promotes, for example, damaging deregulation which has allowed national income to be redistributed to profits and undermines the security of worker entitlements (including their jobs). It is thus not a battle with ignorance but a hegemonic struggle.

However, the elites exploit the ignorance of the majority to maintain these myths.

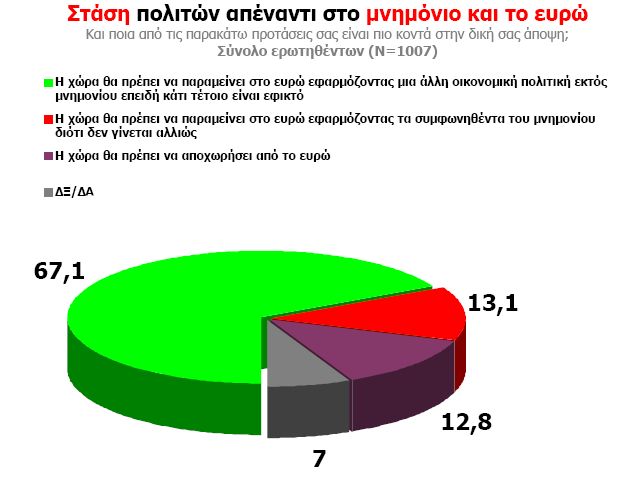

A recent MRB Hellas poll in Greece (April 18-19, 2012) produced the following graphic which covers the “Attitudes of the citizens towards the euro”. The question is “Which of the following suggestions are closer to your view?” – (a) Greece can stay in the euro while applying measures different to those agreed with the International Monetary Fund and the European Union; (b) Greece can stay in the euro and follow the current austerity plan; and (c) Greece should quit the Eurozone.

Of the 1007 respondents, 67.1 per cent opted for Option (a), 13.1 per cent opted for Option (b) and only 12.8 per cent of respondents wanting to quit the Eurozone.

Given that the Euro is the problem that is a stunning result and reflects confusion and ignorance among other things. Further, Thomas Frank talks about “intransigent idealism” in his current book “Pity the Billionaire” where people hang onto ideals in the face of all evidence to the contrary that such a view is damaging to even themselves.

From a MMT perspective, keeping the Euro but changing policy to foster growth would be near impossible unless the ECB played the role of Federal fiscal authority. That will not happen. So the Euro and drawn out recession are tantamount. No sane person would support a system that continued to undermine their prosperity if they really could make the links. Only those with vested interests would promote such a system.

This UK Guardian article (May 2, 2012) – Why I’m leading the march of Italy’s ‘recession widows’ – is a sad testimony of what is happening on the ground as a result of the fiscal austerity.

The Debunking Handbook is focused on how “people process corrections to information they have already acquired”. In other words, how do we get people to abandon their mainstream macroeconomic beliefs and ways of thinking?

Such misinformation (a belief in something that is wrong) is obstinate. The Debunking Handbook provides examples of the persistence of false information.

The last four years have demonstrated categorically how myths persist even though they are shown to be patently false.

1. Remember all the calls four years ago that the fiscal intervention would do nothing positive? The overwhelming evidence is that the interventions generated growth. They were, in many cases, poorly designed and implemented but the extra spending created positive output responses.

2. Remember all the calls that the rising deficits would drive interest rates up? No they didn’t and an understanding of how interest rates are determined and how budget deficits impact on the liquidity and reserve system within the banks would never have predicted otherwise.

3. Remember all the calls that inflation would accelerate because the central banks were expanding their balance sheets rapidly? Inflation has generally subsidised as you would expect during a persistent recession or stagnant growth environment. But an understanding of banking operations, the role of reserves, the fact that banks were never liquidity constrained in their lending and more – basic MMT principles – would never have led one to think otherwise.

4. Remember the claims that fiscal austerity would promote growth because the households and firms were saving (not spending) so as to meet their future tax liabilities that would arise from the deficits? That is one of the most evil myths. Fiscal austerity has killed the nascent growth spurt that followed the downturn in 2008-09. Not one nation that has imposed austerity is achieving anything like what was promised. Again, no-one who understood how aggregate demand works to stimulate growth and the psychology of households and firms when unemployment is rising and sales are flagging would dare suggest that there could be a fiscal contraction expansion.

I could continue listing myth after myth that has failed the evidence test even though they already failed the theoretical test. It is understandable that a citizen might not get to the bottom of some technical argument between economists. But when a political leader says that the economy will grow as long as we cut government spending and the economy does exactly the opposite then it is surprising that the myth persists.

At the Eurozone seminar the other night in Melbourne I raised the question of Japan. The mainstream theory collapses when it is applied to Japan. MMT stands tall. This is a nation that for 20 odd years has run increasing budget deficits, has the most public debt to GDP outstanding, but has had virtually zero interest rates and deflation over the period.

The conservatives got their way in Japan in 1997 and pressured the government into increasing taxes (exactly the same agenda they are trying to push through now – under similar circumstances) and the economy collapsed back into recession – predictably.

The Debunking Handbook asks us whether it is “possible to completely eliminate the influence of misinformation?”:

The evidence indicates that no matter how vigorously and repeatedly we correct the misinformation, for example by repeating the correction over and over again, the influence remains detectable … There is also an added complication. Not only is misinformation difficult to remove, debunking a myth can actually strengthen it in people’s minds.

This is the concept of “backfire effects” where attempts to kill of lies makes the lies more plausible.

Which establishes the raison d’etre of the Debunking Handbook:

– providing practical tips to effectively debunk misinformation and avoid the various backfire effects.

That appears to be a very productive agenda for someone such as yours truly. While MMT is spreading and there are now people aware of it all around the world, the development base is still thin (a few of us really) and already splinter groups have formed which based on their own misunderstanding of MMT are advancing ideas that really take it back into the orthodoxy (for example, the so-called MMR).

What are these backfire effects?:

The Familiarity Backfire Effect

The authors say that:

To debunk a myth, you often have to mention it – otherwise, how will people know what you’re talking about? However, this makes people more familiar with the myth and hence more likely to accept it as true.

I am always struggling with the length of the blogs I write. I like writing and type fast but I wish I could work out a way of streamlining the process. But I formed a view that I had to explain things – both the mainstream and MMT concepts – in some detail so as not to be accused of setting up “straw person” arguments and the like.

So repetition is a deliberate strategy employed here. Otherwise, when I am talking about something that MMT has developed (for example, liqudity effects of budget deficits) I feel obliged to provide the context – which might in this case be the “crowding out debate”. Whereupon, I feel obliged to let the readers know what the conservatives believe here.

My blog thus probably introduces MMT but also provides coverage for the myths. How do I avoid the Familiarity Backfire Effect?

The Debunking Handbook suggest that, ideally, one should “avoid mentioning the myth altogether while correcting it” but recognises that this is not a “practical option” in many cases (a view I think is correct when debating these economics issues) and so “the emphasis of the debunking should be on the facts”.

They say that one should not “headline the debunking with the myth in big, bold letters” but, rather, “communicate your core fact in the headline”. I am busily checking the titles of my blogs – the last several (Quiz aside) were:

– Why the Eurozone is destined to fail

– Fiscal austerity obsession – that’s a dud policy!

– Cancer is bad but budget deficits are generally good

– Are the Euro bosses going all growth on us?

– The UK government in a race with the Eurozone to ruin their economies

– When does the experiment end?

– Australian inflation plummets as the fiscal vandals undermine the economy

– The left – entranced by the fiscal austerity mantra sold to them by the conservatives

You can judge how well I do on that basis but the Handbook has given me an awareness that I will consider in future titles.

The Handbook also says that:

Your debunking should begin with emphasis on the facts, not the myth. Your goal is to increase people’s familiarity with the facts.

I try to meet this consideration and present data where relevant as much as I can. But I also feel as an educator explanation is important and just presenting a graph and saying “see, I told you so” doesn’t really advance understanding.

It clearly demonstrates the mainstream theory has no predictive capacity but doesn’t provide the alternative (which does).

The Overkill Backfire Effect

The principle explored here is that it is common wisdom to think “that the more counterarguments you provide, the more successful you’ll be in debunking a myth”. They claim the “opposite can be true” and there is evidence from psychology that too many refutations may “end up reinforcing the initial misperception”.

So KISS!

The Handbook notes that this myth:

… occurs because processing many arguments takes more effort than just considering a few. A simple myth is more cognitively attractive than an over-complicated correction. The solution is to keep your content lean, mean and easy to read. Making your content easy to process means using every tool available. Use simple language, short sentences, subheadings and paragraphs.

This is harder to avoid. Economics is a complex area of study – especially macroeconomics, because everything is related to everything. Trying to impose some ordering on how causality operates is difficult.

MMT approaches that task in a very different way to the mainstream exposition. MMT introduces the government at the beginning of the analysis and focuses, initially, on its currency-issuing role (and the options that arise). The mainstream starts with households and by the time the exposition reaches the government sector, several myths are already entrenched.

It is thus very hard to relate these esoteric concepts in a manner that is both “lean and mean” but accessible to the lay person. I struggle with that. There are so many connections between the variables in the macroeconomy that if I leave something out I run the danger of some gold bug accusing me of misleading the reader. It is a constant tension as I write trying to decide how simple my explanations should be.

But I would agree that my blogs need to be streamlined better to avoid this particular backfire effect. I continually work on that with varying levels of success.

I definitely use short sentences and try to write (here) in a non-technical manner. That restricts what I can say and the depth of the topics that I can write about to some extent. I am still trying to work out how to write a layperson’s guide to the Reswitching Debate (part of the capital controversies) without resorting to technical language. It is on my list of things to do but the list gets longer every day.

The Handbook says that one should:

Use graphics wherever possible to illustrate your points.

I think I meet that recommendation almost every day – even today as above – even though it is in Greek!

They also say that one should “End on a strong and simple message that people will remember and tweet to their friends”. Someone wrote to me once and said that I should put the conclusion at the start. I have been experimenting with that.

The Worldview Backfire Effect

The Handbook says that this is “arguably most potent backfire effect” and:

… occurs with topics that tie in with people’s worldviews and sense of cultural identity. Several cognitive processes can cause people to unconsciously process information in a biased way. For those who are strongly fixed in their views, being confronted with counter-arguments can cause their views to

be strengthened.

This relates, in part, to the intransigent idealism I mentioned above. I will write a review of the book “Pity the Billionaire” when I get time because it covers this area of psychology. It is about how the right-wing conservatives have been able to focus the current debate on the benefits of the free market despite the move towards the free market being the cause of the problem.

Thomas Frank says that the right-wing have:

… a certain remoteness from reality, a kind of politicized groupthink that seems to get worse each year as the Right withdraws even farther into a world of its own … Americans are increasingly separated from social reality … a deliberate cognitive withdrawal from the shared world …

He talks about Hayek’s Road to Serfdom, a book held in the highest regard as the bible for Austrian free marketeers. This is a book which predicted the Post-War Labour Governments in the UK would result in totalitarian rule. Thomas Frank says:

The book’s weakest point … is that Hayek’s main prediction never came true.

But according to the believers – it might – it is only a matter of time. Some 70 years later they are still believing but the sun hasn’t risen for them yet.

These insights relation to the “Worldview Backfire Effect” which is driven by “confirmation bias” where people seek out evidence that “bolsters their view”.

At the Eurozone seminar on Tuesday, my discussant put up a slide with photos of Hayek and Keynes. He had previously shown data (without commenting on its source) that showed the share of government in national income was well over 25 per cent in most nations and had been growing. That data alone is contentious but that is another point.

He then asked: Which of these two economists said that if government share of total output exceeds 25 per cent it is dangerous? (or words to that effect). The suck-in was that we were meant to say Von Hayek whereas in fact it was Keynes.

But he didn’t also put that quote into context. Keynes was talking about an entirely different type of monetary system to that which most nations operate within today. The quote was simply inapplicable to the modern fiat currency systems with floating exchange rates. But the “evidence” was selectively used.

The Handbook then asks:

What happens when you remove that element of choice and present someone with arguments that run counter to their worldview?

The result is that cognition leads to “Disconfirmation Bias” which is “where people spend significantly more time and thought actively arguing against opposing arguments”.

I have mentioned before the story of a professor who taught me who told us in class one day – when he was confronted with some facts from the US Bureau of Labor Statistics that made a mockery of his theoretical propositions relating to unemployment – said the “data was wrong”.

The data in question showed that quit rates rose when the cycle improved whereas neo-classical theory was predicated on the claim that they were countercyclical – which allowed the theory to assert that the unemployed chose their lot as a result of alleged maximising choices between labour and leisure (mediated by the current real wage rate – the so-called price of leisure).

The evidence is totally at odds with that assertion as is the psychology. But the mainstream hold this world view and deflect any arguments to the contrary. They live in their own parallel world devoid of the reality that most of us share.

The Debunking Handbook then turns to what can be done to avoid these backfire effects. They propose two avenues (of hope!).

First, it is better to try to reach those who are not entrenched – “This suggests that outreaches should be directed towards the undecided majority rather than the unswayable minority”.

The original MMT crew (Randy, Warren, Stephanie, Scott, Matt) discussed this at length a long time ago. Randy reflected on some of this in his Keynote Speech at the 2011 CofFEE Conference – MMT: A Doubly Retrospective Analysis.

I would recommend people read the transcript of his Speech because it gives some interesting insights into the early days of MMT.

In the context of today’s topic, Randy wrote:

And there were meetings in Florida and later the Virgin Islands. With CFEPS and Coffee and then Coffee Europe we had bases for subversion.

And to skip forward a few years, Bill started a blog. I had no idea what a blog was, and thought he was wasting his time. But if we want to credit one thing for spreading MMT all over the planet, it was Bill’s blog. While the academic journals and the policy makers and the mainstream press could mostly ignore us, the blogosphere was wide open to new ideas.

This was a conscious effort on our part to spread the message to those who might still be undecided. The early days of MMT saw us appearing at conferences all over the world and being vilified by our mainstream colleagues. It became obvious to me that my profession was so entrenched in the myths they were propogating that it was a waste of time dealing with them.

We had also published widely so the ideas were out there in the normal published academic domain.

As technology advanced, and self-publishing became possible, I decided that blogs were the way of the future and eventually CofFEE suspended its Working Paper series and I concentrated on writing in this forum.

Second, the Debunking Handbook also recommends that “worldview-threatening messages” should be “coupled with so-called self-affirmation”, which can be achieved in a number of ways. One way is to use “framing” – presenting the argument in a way that is “less threatening to a person’s worldview”. Using terms like “carbon offset” instead of “tax”.

The original MMT crew have had long debates about terminology. So for example, Randy wrote (in his Speech cited above) that:

And then there was the job guarantee, which I immediately recognized as Minsky’s employer of last resort. I can’t remember what Warren called it but Bill called it BSE, buffer stock employment.

I had never thought of it that way, but Bill’s analogy to commodities price stabilization schemes added an important component that was missing from Minsky: use full employment to stabilize prices. With that we turned the Phillips Curve on its head: unemployment and inflation do not represent a trade-off, rather, full employment and price stability go hand in hand.

Unfortunately, a bunch of cows came down with a disease called BSE and we were forced to search for an alternative name. I never liked ELR, anyway, even though it had a long tradition in the US, at least back to the 1930s. So we tried PSE (public service employment). Bill settled on JG (job guarantee) and that is the one that mostly stuck.

This is an application of the way that terminology and “framing” has been considered by us.

Final part of the Debunking Strategy

Once one has successfully negotiated “the various backfire effects, what is the most effective way to debunk a myth?”

In this blog – When common sense fails – I discussed how people fall into the “common sense trap” and build theories to accord with data presented to them even if the data is false but confirms their world view.

The Handbook tells us that:

When people hear misinformation, they build a mental model, with the myth providing an explanation. When the myth is debunked, a gap is left in their mental model. To deal with this dilemma, people prefer an incorrect model over an incomplete model. In the absence of a better explanation, they opt for the wrong explanation.

Which goes back to the earlier point about having to be thorough in one’s explanations – to fill in all the gaps that are left when one debunks a long-held notion.

The problem for me is that it makes my blogs longer notwithstanding my verbosity.

So I try to meet the principle in the Handbook that:

The most effective way to reduce the effect of misinformation is to provide an alternative explanation for the events covered by the misinformation.

The “alternative … must be plausible and explain all observed features of the event”. I consider the predictive accuracy of MMT to be strong.

This made me recall a section in Thomas Frank’s book (cited above) where he was talking about Glen Beck’s telephone to nowhere. This Wall Street Journal article (November 4, 2009) – Glenn Beck’s Hotline to Nowhere – by Thomas Frank extends the story. You will laugh.

Thomas Frank says:

Glenn Beck, the popular Fox News host, has a red telephone on his desk that never seems to ring. Every now and then, in a moment of acute frustration, he will pick it up and give the camera his trademark pleading-puppy look.

What Mr. Beck wants to hear from the phone are answers, and he wants to hear them from the highest authority in the land: the phone, he says, is “a dedicated line right to the White House.” And when Mr. Beck gets things wrong, he wants his antagonists on Pennsylvania Avenue to correct him. But “They don’t call. They’re not going to call.” …

“They won’t call me,” he tells the camera. “Communists, revolutionaries, socialists, Marxists, followers of Chairman Mao appointed by Obama to the executive branch in positions of the government-call, call me. Explain it. Explain it any other way. Call me, right now.”

Yet there the mute telephone sits, a quiet symbol of Middle America’s frustration. The diabolical liberals in the White House refuse even to acknowledge our queries. “Their silence is their answer,” the host sighs.

So the MMT crew are always on standby waiting for our mobile phones (our hotlines) to call and for someone to tell us we are wrong. No-one calls us about this. Obviously, we are right. Glen Beck’s logic is impeccable 🙂

The Handbook correctly notes that:

When you debunk a myth, you create a gap in the person’s mind. To be effective, your debunking must fill that gap.

That is the purpose of our blogs to give as much information and perspectives about the monetary system as possible with references to other research and data.

The Handbook provides guidance about filling gaps:

1. “by exposing the rhetorical techniques used to misinform”.

2. “explain why the misinformer promoted the myth … Arousing suspicion of the source of misinformation”. Sometimes I try to find who funded various think-tanks and who is funding specific research. I tend not to get involved in conspiracy theories although I recognise their merit in certain situations.

3. “using an explicit warning” – so setting the reader up to recognise they “might be misled”. I try to do that in the Saturday Quiz. Whether I succeed is another matter.

4. “Graphics are also an important part of the debunker’s toolbox and are significantly more effective than text in reducing misconceptions”. That is why I try to use graphs a lot and tables.

Conclusion

The Handbook provides a guide to effective debunking. The advice is based on studies in psychology about cognitive processes and the like. Some of the points are contentious but I found it to be a very interesting framework to assess the way I write and communicate. Learning is always a good thing.

Thanks Sean for making this article available to me!

That is enough for today!

Bill,you aren’t doing too bad a job of debunking myths.Just keep it up.

You remind me of Chomsky who said that he once taped a television interview but it never aired because he had to explain his views in detail whereas all the reporter wanted was a quick line that confirmed what everyone already knew. In my experience trying to understand MMT took time and a complete reversal of what I understood to be the case. It was like looking at one of those drawings where you can see two different images depending on your focus. I am afraid that the conventional image may hold sway for quit awhile longer, but I do appreciate the effort you are putting forward to change the picture.

Very interesting stuff. Guess it will take a lot of work to a) get more people to understand all this and b) get the story itself in better shape (in other words find out what the best ways are to explain these counter intuitive and sometimes complex issues in a simple way).

It took me, as a complete amateur in economics but with a higher education background, many evenings reading dozens and dozens of articles and really trying hard to understand things. I’m curious by nature and always want to know how things really work, even if that means I have to throw away my old believes. And that’s an ongoing process, so even if you convince me about something right here on this site, I will immediately try to think about ways you might be wrong. But what about the general public? How are you going to convince someone who does not spend that time and energy to (re)learn all this stuff? It’s going to be difficult.

What’s difficult is that macro economy is about a big complex system. If you want to explain all that and start with a smaller subsection, your explanation will immediately be rejected on different grounds. Only until someone sees the complete picture will he/she “get it”. For example, I bet that as soon as someone hears the term “job guarantee”, he will think about another wasteful government spending program, using his hard earned (tax) dollars. Or when I try to discuss with someone and I mention the fact that a government can issue any currency it wants, the other person will immediately say “inflation!” and that’s the end of the discussion. Unless that person spends a lot of time and energy to understand the rest of the topic, but that’s not probable.

Bill,

I prefer your style. For those of us with an open mind and the patience to learn it works better, whilst maintaining your credibility as an educator.

As someone who is neither an educator nor an accademic, I see it as my role to convert what you teach into something more digestable for those who do not have the time to understand. Those of us who follow MMT should be the ones applying the principles shown in the Debunking Handbook, whilst using your blogs as source material for more detailed issues.

If you were to give up the technical details, it would deprive us of the ability to then translate these into more digestable language, and would deprive us of the credible analysis we need to be sure we are are correct.

Kind Regards

Dear Bill

The reason why everybody has views on economics is that economics is a very practical science. It isn’t like Egyptology but it deals with bread and butter issues. Since we all are consumers of bread and butter, we take an interest in it. Also, we all have vested economic interests. Accepting economic reality may be hard because it is injurious to out interests. If you are rich, you have an interst in believing that lower tax rates for the higher brackets can accomplish wonders for the economy. An employer may have an incentive to believe that raising the minimum will cause unemployment.

Regards. James

So there is method in your madness Bill after all?

I’m glad to hear it.

Long may you continue

Off topic , I’m afraid, but Mervyn King, when asked to comment about the finances of the Premiership football clubs on the radio news this morning, stated that some might have debts, but they could be bailed out by rich men – “… but the problem with the UK debt is that there is nobody to bail it out”.

Marks out of ten?

From the “handbook”…

“It’s self-evident that democratic societies should base their decisions on accurate information. On many issues, however, misinformation can become entrenched in parts of the community, particularly when vested interests are involved.

…

To successfully impart knowledge, communicators need to understand how people process information, how they modify their existing knowledge and how worldviews affect their ability to think rationally. ”

This is a very dangerous myth itself. Humans especially interacting with the society (the structure consisting of other humans) do not make rational decisions and moral judgements based on accurate information. In economics this myth is packaged as the “rational expectations” axiom. I thought that at least that axiom had been abandoned…

One of my professors at the university died because of liver cirrhosis caused by excessive drinking, another professor (a very intelligent and decent human being) succumbed to a heart disease after years of heavy smoking. He couldn’t stop smoking even in a hospital after having a heart bypass operation… these very sad and depressing stories are all what I can say about human rationality. It is not debunking the myths what really matters. Debunking myths may be a precondition for a change but it is not a satisfactory condition. It is the attitude what matters…

In the book I mentioned yesterday the author Jonathan Haight presents results of his own study contradicting mainstream moral psychology views from the 1960-1970s. The mainstream moral psychology views (such as that “human nature is a clean slate on which any utopian vision can be sketched”) were a part of the “progressive” consensus among the Western “intelligentsia” in the 1970s.

In essence Haight claims that “people sometimes have gut feelings – particularly about disgust and disrespect – that can drive their reasoning. Moral reasoning is sometimes a post hoc fabrication. … Social and political judgements depend heavily on quick intuitive flashes”. This is perfectly consistent with the latest findings made by neuropsychologists and evolutionary psychologists. Intuitive processing of information coming from interaction with other humans and the social structures is not irrational or just emotive. It is still quite complex information processing – but it is not rational. Rationalisations based on verbal reasoning come later.

The attitude towards the institution of state belongs to the sphere of emotions and moral judgements. It is that attitude what in my opinion leads to rejection of MMT (or to “conscious ignorance”). Average people hate bureaucracy and don’t trust the government which is considered to be an inherently corrupt and evil institution trampling on their liberties. Stating that the government has to play an active role in controlling aggregate demand and providing employment goes straight against these gut feelings of the majority of the people – at least in the Western culture. Virtually nobody trusts “the government” in “printing” just the right amount of money despite knowing that all the money in the fiat era is ultimately “printed” (created by the government sector).

It is therefore not enough to debunk the mainstream myths and to show to people that a modern monetary system in the fiat money era functions in a certain way described by the Chartalists, Abba Lerner and Michal Kalecki.

I think that a lot of people who were brainwashed by studying Economics 101, developed incorrect intuitive models of functioning the economy. These people will never be convinced or converted. People who can absorb non-mainstream ideas must be interested in the topic (for the majority of people economics is profoundly boring) but must also be open-minded. It may be relatively easy to explain the principles of functioning of the monetary system and economy at the macro level to IT professionals or engineers because they must have quite robust intuitive models of the physical reality to do their jobs. They may have a kind-of “clean slates”. But is this enough?

I don’t disagree with the Marxist interpretation of class struggle however to me this is just one of the perspectives. Only by combining different and superficially conflicting perspectives one can build a better model of the social reality. I will never be a Marxist because to me believing that their theory is complete and fully describes the social reality is also based on faith, exactly like some religious views criticised by the Marxists themselves.

What still remains an unanswered question to me is whether it makes sense to make attempts to destroy the mainstream myths at all. Speaking the truth just for the sake of the truth is probably my only personal reason why I pay attention to the economic debate.

Let’s assume that our current political oligarchs switch over to Functional Finance doctrine. Will they use the rediscovered spending capacity to build a sustainable new economy based on the principles of social justice and conservation of non-renewable resources? I doubt it. What if they reverse defence cuts and make an attempt to restart the cold war to fight the Chinese? What if we just increase the churn rate of non-renewable resources? A book written by Zbigniew Brzezinski “Strategic Vision” offers a clear answer – the “democratic” and “progressive” elites just want more of the same. Brzezinski is aware of the terminal decline of the current post-colonial order and the American Empire. He knows that the third-world countries which used to be suppressed by the colonial powers have finally managed to find a way to grow their economies. Brzezinski is deeply concerned with the level of the American public debt what clearly shows the level of naivety shared by the American political elites. His vision is quite simple – he wants to convince Russia to switch sides, assume the role of a junior partner of the US and to help containing China. Frankly speaking I don’t care whether he succeeds or not.

Perhaps it is good for the humanity as a whole and for the global environment that the Austrian school philosophers and economists are winning the battle for the hearts and minds of the European and American people. It is a great irony that the Austrians who blindly believe in rational actions of humans may be those who win (at least for a while) because their rather obsolete and non-scientific doctrine is so emotionally appealing.

I don’t know… as long as there is no Hitler or Stalin rising from the ashes of the old social order, “she’ll be fine”…

“10 out of 10 for style but minus several million for clear thinking yeah?”

Sorry Adam my previous comment was for Gastro and is nothing to do with your post.

You nipped in a bit quick

>… are vilified and accused of being socialists or worse.

Socialist or worse? Does this imply being a socialist is bad?

bill,i am a self educated old fella who struggles with the technical stuff,but the basic’s of mmt are compelling once you get your head around it.if i can manage this anyone can with a little effort.the most damaging myth,as i see it, is this analogy of equating the household budget with a national budget.this is a very powerful tool for the conservatives,as the ordinary person can readily personalise and understand it.until a competing analogy can be found i feel we of the converted will struggle.

Dear Stephan (at 2012/05/03 at 21:30)

You asked:

From the perspective of the vilifier – definitely and being a communist is the ultimate evil.

best wishes

bill

The issue addressed by this post can be probably be summarised by paraphrasing H L Mencken, “Complex problems have simple, easy to understand wrong solutions”.

Bill,

Your blog is not for the uninitiated. I love it now, but it took a while. Most of us non-economists need to sort through a lot of info before we can tie it together. I think I read Warren’s book three times before it started to sink in. But my curiosity was based on the fact that mainstream econ did not make sense. How could Japan still exist? How could there be so much credit? Where does all this money come from?

But I am not a politician. Reaching me was easy. I have no agenda other than intellectual stimulation. Getting to the decision makers is where the real debunking needs to happen.

Dear Bill

Let me give the thoughts of a person who is interested in MMT but not a convert. I did my sociology PhD at Newcastle Uni – and have a sympathy for Marxist economics but not a great technical understanding (and I did basic micro/macro as a submajor).

I first heard of you and CofFEE around the ‘Just Transition’ report and then the ‘Community Development Job Guarantee’. I am the president of a regional social development NGO and so I was interested in finding an alternative economic discourse I could draw on – and full employment sounded like a good focus – so I started reading your blog to try and get the idea of MMT.

I must say I subscribe to the blog and generally read about half of each blogpst before it gives me too much detail. I avoid the quizzes because I just don’t have enough background to answer them. I appreciate that developing an deep understanding is important – but for my purposes I was sympathetic but I wanted to know the basics and how to answer the basic objections. All I could hear if I was to propose the CD job Guarantee was someone suggesting that it was just a giant government employment scheme that would be expensive and create more dole bludgers. Now I am sure this is not what you have in mind – but I needed to know how to answer these immediate objections – hopefully not hugely technical – so I could ‘see’ the logic of it. Most people’s objections are not that complicated so just asking them basic questions about how they think it works is enough to show they are wrong. Otherwise I am talking to journalists who don’t require complex explanations. Obviously if I was going to carry this argument to my academic colleagues who are economists I’d need a lot more firepower but at the moment I’d like to be able to convince myself that I could convince my non-economist community development colleagues that there might be an alternative way to see it. Personally I am sympathetic to Marx but obviously that’s not a plausible economic discourse in the present climate even if the income redistribution effects of a revolution based on common ownership would be welcome.

After getting the basics right I would have to think harder about the complications. I am more than willing and able to master complex material but if I am going to make the effort I need to be convinced that its got some legs. I have thought about buying your book on ‘Full Employment’ because I think thats an important goal and be useful to shift the discussion about economics. Here regional economics dominates discussion about ‘development’ (I am in Mackay at the centre of the mining boom) and I have created some conversations about ‘liveability’ and ‘well-being’ but while these allow us to talk about social justice issues it doesn’t challenge the hegemony of economics. I can’t tell my small NGO to say a deficit is not a bad thing unless we can meet the basic responses – rather than the technical ones of mainstream economists.

Forgive me if there is such a place on the blog and I have missed it but I think what I am saying connects to the debunking issue. I read this whole blogpost today because I was interested in de-bunking (the sociologist stock in trade) rather than MMT directly and thought I’d share my thoughts for the first time – after reading quite a lot of your blogs. You make clear here that you recognise its not about technical competance (important though that is – in the long run) but about an ideological hegemony – so perhaps more focus on how to challenge that and a little less technical detail would help me at least.

Bill,

This is the first time I have come across your writing. I will have to go ahead and research MMT! You are a brilliant writer, thank you for this post.

One thing I will say, and I hope this can be received by you as a constructive point, but I disagree with you that you are including enough graphical content. I am a visual thinker and a visual communicator and this post, as I perceived it was very textual and long.

In the name of being constructive I would suggest two things. First I would challenge you to go and find a cartoonist and ask them to think of as many way as they can to turn your text into cartoons, images or anything that is more attention grabbing to your target audience, lay-people like me. Second I would suggest that I have a very strong intuition that people are consuming ideas more and more in video format and less and less in textual form. You Tube is a case in point, it has more traffic than any other site (and not just funny video of people falling over and cats).

Theories must make accurate predictions. That is the main criterion I use. There is a time and place for conjecture, but not in the applied sciences.

Bill, I think you make a central point here:

I think in the case of economics there is more to it than knowledge deficits. We are dealing with a discipline that goes to the heart of power relations in our societies.

The more I learn about mainstream economics, the more it just seems like is a theology constructed to defend the prevailing social order, and the established disposition of wealth and property rights. And it’s a depressing and mind-numbing field of inquiry because the list of permissible topics and allowable policy considerations is so narrow. I find the more I try to engage with it, the more depressing it gets. And you are bound to lose when you play a game on someone else’s home field according to their rules, rules that they make up on the fly as they go along.

It seems to me that a lot of the problem with economic discourse in general is that it presents the world inside out. It presents a vision of a realm of economic transactions that somehow exists apart from most social institutions and relations, and strives to study that purely economic realm as some kind of pure and morally neutral science, and then offer policy suggestions that take as neutral a stance as possible toward moral, political and social questions. But in the real world, for most people, economic transactions serve other more important goals and aspirations.

I think people need to start with a powerful, attractive and simple vision of the kind of society they want to live in, and then build in the supporting economics as needed to deflect arguments against that vision. The way to overturn the old theology is not to ride off to debate it in the theology departments, but to build a radiant model of a better world, stand one’s ground with that model, and then let the theologians do their worst to attack it.

Thanks for this blog.

When discussing MMT with others, I have found many hurdles to overcome.

1 People are not prepared to listen beyond the first phrase of the first sentence, before saying ‘Oh, you’re wrong. In my experience …..’ They then switch off and walk away.

2 Where the discussion contradicts the ‘household economics model’ (used by Thatcher and many others), it is immediately discounted and they make it clear they think I am an idiot. (Perhaps I just express myself poorly).

3 The business oriented individual will state ‘if I ran my business like that, I’d have been broke within a year’.

4 Few even recognise that there is any problem with mainstream economic ideas and theory.

5 Explaining the difference between a currency issuer and a currency user seems very difficult, although it seems obvious to me. Thus, many equate the UK’s economy to that of the countries within the eurozone.

6 ‘Printing money’ is always equated to immediate hyper-inflation

etc …………………………………..

I could go on, but I am sure you get the idea. I suspect the reason, in part, is due to the daily economic output from the media reinforcing the neoliberal ideas. There is rarely a serious discussion/ talk about alternatives that truly challenge neoliberalism. Commentators and jounalists rarely debate properly as they have their 4 minute slot to challenge a politician on some point of policy. Both are trying to score off the other, not to challenge the truth, or otherwise, of the neoliberal mantra.

Breaking through all these myths and prejudices needs a major effort to get the general population to start asking questions with a more open mind.

Summary:

– I think there is some value is providing just enough information so that people begin to question and come to some answers on their own.

– I’ve always preferred to know the destination, I find it gives me context for the information along the way.

– We all need to be engaged if we have any chance of seeing change. I’ll keep trying to do my little bit.

– Some thoughts on how I came to MMT below.

Nice reflective piece Bill. We should all be so engaged and passionate.

I too have difficulty when I broach this topic with friends or family. People generally don’t want to have the discussion and think I’ve kind of gone off the deep end. Also, like you, every time I try a short note on the subject, it goes on an on – I think my energy intimidates them. Recently, I’ve tried to draw out questions in an attempt to engage, but not much luck there either. I’ve pretty much given up on them (for now at least). Ironically, IMO it is this lack of engagement by the public that let us get where we are. I can only imagine how frustrating it must be and have been for you over the years. Still, I think the GFC has created a crack in the orthodoxy and it looks to my like there has been progress. Just this past week-end Chris Hayes on MSNBC had some segments where he seemed to get it.

So, I reflect back on why I was drawn to MMT. Like many, I was a govt=household budget only a couple of years ago. I applauded Paul Martin for his balanced budgets. I’m now embarrassed after hearing him at INET. I really can’t put my finger on what changed in me or what in the information changed me. I wish I could so you could bottle it for others.

My MMT journey started with the 7DIF’s and the video’s of the sustainability conference in New York. I suppose I was just at the right place and time mentally to actually listen. MMT as a macro theory is pretty deep and can be quite technical, but in my mind MMT as a concept is pretty straight forward. I suppose one of the challenges is that we have become a me! me! me! world, otherwise how could we accept more than 1/10 of our fellow citizens who want to work, but cannot and think all is OK. I used the dog bone analogy the other day with 100 dogs and 90 bones. The immediate response was that 5 dogs would be too lazy anyway. I tried to deflect and focus on the 5 who did so as not to go down that path – but still, no interest, let alone anger at the fact we let this happen. There has been a lot of brainwashing to overcome. Also, I think people are focused on the micro. How can there be anything wrong if companies like instagram are succeeding. I succeeded, why can’t they. I listened to a talk by a Canadian economist by the name of Jim Stanford where he questioned why we should take away a public service persons pension just because a private company went bust and a few people lost theirs. He said it would be like a copy showing up to a wallet snatch, stopping the next passerby and taking their wallet to make things even.

After reflecting on what you wrote, I just moved my conclusion to the top.

Well, one of the greatest, if not the greatest, myth is that of democracy. How is that conceivable in populations numbering in the millions, in vast urban agglomerations, in an extremely complex industrial-technological context, with enormous bureaucracies and enormous and immensely wealthy and powerful corporate entities, the whole linked in exceedingly complex manners with all sorts of international realities? How is the average citizen to evaluate such things intelligently? Obviously, he cannot. In fact no one can scarecely do so. Man has entered the terminal phase of the sorcerer’s apprentice or that of the faustian bargain. The wings of Icarus are starting to melt.

Dear Bill,

I think conclusion in the beginning is a very good idea.

Actually I’ve been reading your blogs lately starting with the conclusions anyway.

It is something that confuses me -the capital controversy. I found mentions of it and went to Wikipedia – much to my unhappiness I was unable to understand what it was and what it represents.

Dear Dr. Mitchell,

How much value would you ascribe to your blog’s “outreach” in providing non-orthodox information to non-economists? Is educating the layman a worthwhile effort, or just a side-effect from your perspective?

Bill said: “I found it to be a very interesting framework to assess the way I write and communicate”

A useful exercise — and thanks for sharing some of the handbook’s insights! I’ve definitely read that studies show graphics to be a powerful tool in learning (and unlearning!), which is why they’ve been at the core of my approach.

Some thoughts about format (even though I realize the focus of your post was more about content)… With posts as long as you manage to write daily (!), the more structure the better, IMHO. So, using section headings whenever possible (like you did in this post), bolding key points, etc all may make it easier to navigate the content for those who are time-constrained and just skimming rather than reading top to bottom.

It seems like your commentary often falls into categories, and sometimes more than one within a single post, e.g.: (1) analysis of economic data, (2) rebuttals, (3) generalized explanation of core macroeconomic theory, (4) other commentary. When blocks within your posts fall into those neat categories (not always), I would certainly find it helpful to have these visually coded in some way for easy scanning, such as different colors for each category of content, or section headings, or indentation of boilerplate theory text that you reuse from past posts, or something… But I realize that doing so may not be practical with your fast and high volume writing style, and/or that there may be too much crossover of content between categories, and/or that others might find this distracting rather than helpful. Just an idea, since I can’t remember whether I’ve shared it previously.

Dear Mr Wolf

What side effect are you implying?

@Andy

That non-economists are learning about MMT, and probably faster and more comprehensively than professional economists.

Ben Wolf,

I would repeat myself – the majority of “professional” economists are pre-brainwashed while doing Econ 101. If one really, really wants to understand how the economy works (or used to work about 60-70 years ago – with the much smaller finance sector and with the gold standard still not fully abolished) at the basic level, there is just one book to read:

“Theory of Economic Dynamics” Michal Kalecki

It costs only USD15 on Amazon. This is the book where the sectoral balances approach has been introduced.

There is a Polish macroeconomic textbook written recently by one of the last living colleagues of Kalecki, Kazimierz Laski: „Mity i rzeczywistość w polityce gospodarczej i w nauczaniu ekonomii”. It is not MMT because it lacks the explicit Chartalist / Functional Finance content – but it is close. Laski published a couple of debunking articles which can be found on the Internet.

It’s a shame this book is not available in English. It’s an even greater shame on me I had no idea about Kalecki and Laski when I was living in Poland… but at that time I considered economics to be too boring and irrelevant to even look at this kind of stuff and I was pre-brainwashed a bit…

Bill,

Hunt’s “History of Economic Thought” (2nd edition) has a non-technical explanation of the switching debate.

Perhaps you will find it useful.

@AK

I’m curious as to Dr. Mitchell’s evaluation of his success regarding this blog. There’s been relatively little penetration of the economics profession by MMT, but there’s been a very wide dissemination it amongst interested layman. In other words it’s become popular much faster than it’s been accepted by our economic priesthood. Does Dr. Mitchell find this has been a valuable and worthwhile outcome, or was his primary goal to make a direct impact within his field? MMT has become more a successful grass-roots “movement”, wouldn’t you agree?

Dear Bill,

From the Yoga sutras of Patanjali, (dating as far back as 10,000 years BC according to Hindus), and taking them out of their original context, but just as relevant to the context of your post:

5. The mind states are five, and are subject to pleasure or pain; they are painful or not painful.

6. These modifications (activities) are correct knowledge, incorrect knowledge, fancy, passivity (sleep) and memory.

7. The basis of correct knowledge is correct perception, correct deduction, and correct witness (or accurate evidence).

8. Incorrect knowledge is based upon perception of the form and not upon the state of being. [The human being is sacrificed to the ‘form’ (ideology) ….]

9. Fancy rests upon images which have no real existence.

10. Passivity (sleep) is based upon the quiescent state of the vrittis (or upon the non-perception of the senses.)

11. Memory is the holding on to that which has been known.

12. The control of these modifications of the internal organ, the mind, is to be brought about through tireless endeavor and through non-attachment.

13. Tireless endeavor is the constant effort to restrain the modifications of the mind.

14. When the object to be gained is sufficiently valued, and the efforts towards its attainment are persistently followed without intermission, then the steadiness of the mind (restraint of the vrittis) is secured.

15. Non-attachment is freedom from longing for all objects of desire, either earthly or traditional, either here or hereafter.

16. The consummation of this non-attachment results in an exact knowledge ……….. when liberated from the qualities or gunas. [Gunas – three states of energy~matter or ‘form’]

So, the almost ‘unconscious’ use of the energy of desire (emotional energy) manifesting as attachment colours the mind, eclipsing the more conscious use of the ‘clear light’ of mental energy, leading to exact knowledge.

42. When the perceiver blends the word, the idea (or meaning) and the object, this is called the mental condition of judicial reasoning.

A lettered word is a symbol (object) masking meaning; meaning in its turn masks purpose (word). When the perceiver mixes them all up, judicial reasoning is the result.

43. Perception without judicial reasoning is arrived at when the memory no longer holds control, the word and the object are transcended and only the idea is present. An idea like ‘public purpose ….

All comes back to the ability to concentrate the mind and tune it as an instrument into fine rhythmic harmonic vibration; control the grosser waves like lust, anger, attachment, avarice, ego – contemplate; formulate clear logically connected thoughts based on (7) above. When the ego and grosser waves are subjugated the inner self is seen as a reality, sees itself in other selves, the energy of the heart is active, and service is the central pursuit. People just don’t realise how beautiful they are! Humanity is a work in progress (evolution) but we have no excuses …..

Cheers.

Bill,

Firstly, +1 to CharlesJ’s comment above.

I’ve been reading your blog & most of the other MMT blogs for about 15mths. I struggled at first but have found your blog easily the most comprehensive. It’s been especially useful for formulating comments on online media because a lot of your writing uses topical information & data etc. My background is a BSc in Electronics with some MBA studies, pretty good on Financial Accounting.

I think you need to consider where you are, your key role, in the information chain. You can’t inform everyone singlehanded. Even when people are interested, the subject matter is complicated & counter intuitive.

From my perspective, totally behind MMT from an early stage (& never disappointed the more I’ve learnt) you’ve provided (I believe) a solid foundation for me to counter the TINA myth & introduce key concepts. So, in terms of equipping a reasonably well educated body of ‘lay’ advocates, your blog is very good as it is, for me at least. The only thing lacking occasionally has been knowledge to best refute the neo classical arguments or ‘goldbug’ nonsense that gets spewed out, particularly the latter. I’ve found Mike Norman & Naked Capitalism most useful for broadening my knowledge.

I get what you say about balancing the length of posts with including enough explanation. I struggle with this too. Even tho’ I write long comments they can’t include anything like the detail you do. If I think other commenters will be receptive I’ll include links to your blog (or others), but, righly or wrongly, I’m concerned not to immediately ‘overload’ people. That said, it surprising how much people will read & take in – one lengthy comment recently got 61 ‘thumbs up’. There is a real ‘window of opportunity’ just now. A lot of people in Europe want to know what’s gone wrong & what policies could/should be adopted.

What I would suggest is that yourselves of the MMT core try & do more youtube or even text/graphics pieces explaining key concepts in a very simple way, which people like me can link when we post a comment in online media.

One such that particularly drew me in to MMT, right at the beginning was a CoFFEE talk you video’d with you & Randy explaining the Buckaroos & other basic ideas. Very powerful stuff, but the sound is barely audible. I knew nothing of money systems prior to watching it but grasped immediately the implications.

But keep up the rigour & depth of what you’re doing now to provide the foundation I need to translate it (& of neccesity simplify) for a wider, more time/education constrained audience.

A final point, mainly about your position on the Eurozone (I live in Ireland). I agree, of course, with your conclusions, but I’m putting forward a different option to full fiscal union or exit. I’m proposing that to deal with the immediate need for growth, from both debt dynamics & unemployment perspectives, the Eurozone could introduce a JG programme financed debt/cost free by currency issuance. Arguing that this simple measure, that could be done on temporary basis (say 2 or 3 years) would relieve pressure for kneejerk (false) ‘solutions’. Allowing time for Eurozone flaws to be properly considered & agreed (or not). By the time this process has run its course, even if no satisfactory agreement is reached, three things will have been achieved. The myth that ‘free’ money cannot be issued for public purpose is broken, the effectiveness of the JG established, & the public debate considerably expanded. Additionally, if the conclusion is Euro break up, we will all be able to do this from much stronger economies & near (ish) full employment.

I fear that the two options – fiscal union or break up – from where we are now are much too extreme for citizens to contemplate, but I am not suggesting you change your stated position. Let others take the more tactical/politically expedient position. (I’m thinking that ECB sourced low interest loans could also work effectively too.) From the simplicity point of view, this approach might just get some traction.

Dear Richard1,

I would not be so pessimistic, try to convert people from slightly different angle. The easiest way of converting people to MMT is to ask them about how would they change the tax system. You simply start from rhetorical question: “What are taxes for?” Taxation is an important issue for any citizen; therefore it is very easy to embark on origin of money argument after that. With 100% success rate I could persuade my opponents that taxation is mere redistribution of wealth. It is very easy to embark on origin of the money argument after that.

Ben Wolf,

Please check out “Spanish ‘Second Conquest’ backfiring in Latin America?” on “Russia Today”. Governments in Latin America have started undoing the “reforms” imposed during the IMF dominance era. Convincing to these free-market “reforms” was what the mainstream economists were paid for. Now the ideal world designed by Milton Friedman and implemented by Augusto Pinochet and the others has started to unravel, it is not just China what causes a headache but also more and more Latin American countries. There IS an alternative to T.I.N.A. …

Do you think that the majority of mainstream economists can be convinced to anything? They obviously can switch sides but in my opinion the majority of them cannot be convinced because they hold no personal views, they are merely intellectually corrupt members of a social cast playing the same social role as drug-snorting celebrities, greedy politicians and paid thugs.

Kazimierz Laski called it “faith”. To me a more proper term is “corruption”.

—

(from “My career as economist and the role of Kalecki” by K. Laski which can be found on the Internet)

“Many students and even close collaborators of Kalecki in Poland experienced at about that

time [1989, the year of the collapse of communism in Poland] a kind of new ‘illumination’. They moved directly from the thesis that the market cannot spontaneously adjust the propensity to invest to the propensity to save to the opposite thesis that the invisible hand of the market solves all problems if one is only ready to accept its functioning, and first of all if the state does not interfere with this miraculous mechanism. The proponents of socialism with a humane face transformed themselves overnight into passionate free traders. I have become a witness of a real development which Joan Robinson invented only in her imagination. She wrote once that the border between ideology and science in economics is not sharp determined. Imagine, she continued, that somebody changes his political opinions and at the same time his whole economics. This proves that his economic views contained nothing but ideology. If, however, somebody changes his political opinions but sticks to at least part of his economics, this part is – at least subjectively – science, not ideology. Some people need faith. They can replace the belief in Marx and Kalecki by one in Smith and Friedman, but they cannot get rid of some faith.”

—

I witnessed this process from a pretty close distance as I was quite politically active in 1988-89. The trouble is that Central/Eastern Europeans poisoned themselves with neoliberalism while the Chinese follow the reformist advice found in the book “From Marx to the Market” written by W. Brus and K. Laski. To me the outcome of this experiment is the empirical proof who is right and who is wrong and this is precisely the reason why I developed interest in Kaleckian economics…

I am sorry but I have very little respect to the high priests of the Western Economic Science cult because I’m aware of the real damage they are inflicting upon the ordinary people. The best we can do in the current circumstances is to ignore them. Personally I would simply “privatise” (what precisely means close down unless someone rich fancies to sponsor the clowns) the economic departments of the universities so that no public money is spent on the cult members. Social science and public administration departments should take over the slack and the world “economics” should be replaced by something else so that there is no “con” in the name (like “astronomy” replaced “astrology”). To me the numeric measure of the success of MMT will be the involuntary unemployment rate close to the same rate which was present circa 1950 and sound environmental policies coupled with a moderate GDP growth. But I doubt whether this is going to happen soon in the so-called Western democracies. We are applying exactly the same poison which was tested in Latin American countries in the 1980-1990s on ourselves. The show must go on…

@AK

My question is regarding non-economists.

Good day.

Dear Bill,

A very quick suggestion: don’t cut-n-paste, link (to self-contained explanations of the various subjects and arguments that come up over and over again). That way, readers can decide for themselves exactly how far to pursue each topic, and the casual reader is able to get to the end of each article without losing the thread.

Hi Alex,

“With 100% success rate I could persuade my opponents that taxation is mere redistribution of wealth.”

Possibly a better way of explaining the purpose of taxation is to say it’s to manage aggregate demand.

If I get away with that I might then try to draw a picture of a water tank with 3 pipes in an 3 pipes out (drains).

A sort of pictorial representation of the sectoral balance identity. People do like pictures, or graphs.

I think that in explaining MMT we need start by challenging two root beliefs that nearly everyone seems to have, but which are, I believe, observably wrong. The first is that objects have intrinsic values, and the second is that money is the same thing as wealth.

In fact of course, value resides in the minds of thinking beings, and is an abstraction, and not an intrinsic quality of external objects. A man with a full stomach may value a few peanuts at nothing, whereas a starving man may be prepared to risk his life to obtain them. So the “value” of anything is clearly not a property of the thing itself.

And of course it’s surely easy to see that money is not wealth. If I am left upon a barren rock somewhere in the ocean with one trunk full of a million dollars and another one full of gold, and nothing else, these don’t make me wealthy because there is nothing I can spend them on. What I need and what would be wealth to me is food, water, shelter, and enjoyable companionship.

Money is really just a measurement of value, just as centimeters measure length. The difficulty with money is that we can all agree pretty well on the length of an object but our opinions will differ as to the value of any particular thing.

We never worry about running out of centimeters, but orthodox economists think that we can, somehow, run out of money. But as MMT points out, society can never run out of money anymore than it can run out of centimeters.

So I think that correcting what seem to me to be nearly universal delusions about the nature of value and the nature of money are the first things we have to do before we can explain why MMT works. I think any accurate economic theory needs to start with those two points as axioms. The advocates of MMT seem to understand them quite well and that gives a good start (though by themselves not sufficient of course) toward understanding MMT, but I wish you would start with these explicitly rather than implying them.

I think you would do well to emphasize these two starting axioms because the misunderstanding of the nature of value and of money vs wealth seems to me to be at the root of the delusions that prevent an understanding of MMT.

John,

I am pretty sure the aggregate demand argument would not touch the hearts of my opponents. Too complicated.

You are absolutely right about pictures. I think this is the biggest issue of BIll’s blog too much words and too few pictures. It is too boring for people familiar with MMT because of constant repetition of the basics but completely non-suitable for beginners due to the lack of narrative. I love comments, though.

Alex,

The problem with the redistribution of wealth explanation is that it implies a further use for taxes after they are collected.

And if you go down that road you might have difficulty getting across the idea that governments that are sovereign in their own currency create money ex nihilo, perhaps the most important fact underpinning modern monetary theory.

When you get your opponents over that counter-intuitive hurdle it makes it easier to then introduce the idea that deficits don’t matter when there’s a spending gap.

Ed, you make some good points. It is these mental leaps which are so difficult to make.

I think this relates to the “more pictures” question: even though I will agree that an image or graph now and then can and will help explain things better then many words, the most important kind of image is the conceptual one: the metaphor. What kind of image do people have in their minds about what money is? What kind of image about how governments spend money? Etc.

For me, the “image” that helped me most in understanding MMT was the one of the scorekeeper who keeps scores (and obviously cannot “run out of points”). Or one of a casino owner who has to make sure all players have enough plastic money to play with (and again, can never run out of chips). It’s those kind of metaphors that make things clear and are easy to visualize and remember. Of course, you still have to explain why these images are the right ones. But if these images are missing, it will always be very difficult for people to fully grasp the subject.

John,

I fully agree with your point but most people have practically religious believe in gold standard or more precisely household budget myth. You need to help them to come to conclusions how fiat money work by themselves. Understanding of tax systems brings the question of automatic stabilizers and unemployment along with concept of bank credit/deposits, interest rates, inflation and history of money. These are very down to earth examples and people are very interested to talk about them. It is much easier to introduce aggregate demand concept in the course of conversation and help the to derive how modern monetary systems work.

The toughest point is job guarantee program. I don’t believe myself that it is possible in democratic societies as you would never reach the consensus which jobs should be made whether with MMT or without MMT.

Alex,

Maybe I draw better pictures than you 😉

General Public’s conscience.

Joe Average’s knowledge of how economies work doesn’t go beyond the headlines of Taxes, Inflation, Deficit and Spending. The minutiae is too complex and therefore just not important. That’s all “best left for the Wonks”.

I would suggest that through this blog and it’s readers (and others like it), that the key points need to be identified and then “packaged’ into easily digestible and POSITIVE analogies, that Joe Average can read and have an “Ahhh, Really? Wow!” moment.

As with any “product” MMT needs to be marketed and sold to it’s “target” audience, which is everyone!

Kind regards and best wishes to all,

Helen