I started my undergraduate studies in economics in the late 1970s after starting out as…

What is Wall Street for?

Last night, I was listening to the ABC Current Affairs program PM and they were running a segment – ‘Occupy Wall Street’ protest growing and they were interviewing American journalist Jeff Madrick. At one point in the interview he said: “I hope the American establishment has the courage to ask one fundamental question; what is Wall Street for? What are they supposed to do?” The answer to those questions are in order: not much that is worth anything; and not what it was created to do.

Madrick was talking about the Occupy Wall Street action that is now into its third week and is spreading to other cities including Los Angeles and Chicago. The obvious aim is to demonstrate against the unproductive financial corporations who misappropriate real income for their own gain and corrupt politicians to avoid appropriate regulation.

These are grass roots movements that are increasingly being organised via the Internet through social networking capacity.

The movement describes itself in this way:

Occupy Wall Street is leaderless resistance movement with people of many colors, genders and political persuasions. The one thing we all have in common is that We Are The 99% that will no longer tolerate the greed and corruption of the 1%. We are using the revolutionary Arab Spring tactic to achieve our ends and encourage the use of nonviolence to maximize the safety of all participants.

Key publications are changing their titles as the “Occupation” continues:

Madrick was asked whether the movement “can last that long?” and he replied:

… let’s keep in mind the history of protests. All protests begin small. We never can predict which ones will take off. Martin Luther King did not lead his march the first day. He decided to go out and fight for integration in America.

The Vietnam War was not stopped the first day. Young people who were much like these people now went out and started protesting. They were called all kinds of names and mocked in the early and mid 1960s continually by the mainstream press, which we know in retrospect was dead wrong about the Vietnam War.

So that is how protests start. Can I say this will end in complete victory? No, you can never say that. But it may begin to change public opinion enough to give Congress people in Washington the courage of their own convictions. Many of them are disgusted by what’s happening and can’t get any traction for their own ideas and maybe they will begin to get the courage to come forward.

The Vietnam Moratorium movement was a case in point where persistence finally ended a corrupt war that had been supported by the whole military-industrial complex of the US as a major profit-making venture.

It is arguable how successful these mass demonstrations were. The conservatives claim that governments ignored the protests and for several years the protesters were singled out as traitors.

Sentiment in the US changed after the Kent State massacre (May 4, 1970s) and the anti-war movement swelled after that. Then the New York Times started publishing the Pentagon Papers (June 13, 1971) which probably accelerated things. The anti-war movement became mainstream at that point (and was no longer considered to be a bunch of traitors). It is clear that when Nixon announced the end of US involvement in January 1973 that the political shift had occurred in response to the growing citizen dissent.

But the point is that citizens can if there is solidarity around an issue force their political representatives to listen.

Madrick was then asked “what material, constructive and positive changes do you think that they can make? How would you shape the agenda?” and he said:

Well first of all we’ve got to get over this obsession with austerity economics and we need very serious stimulus in this economy. But secondly we have to reinvest in this economy in significant ways. Third, we really need a different regulation scheme for Wall Street which will be very difficult to do given the power and money on Wall Street.

We have not solved the problems of how to make a financial system allocate our precious savings to productive resources. We’ve got to work on that. The prosecution of wrongdoing on Wall Street has been almost negligible.

Is it really true there was almost no wrongdoing on Wall Street that led to this crisis? Just a bunch of well meaning but foolish people who made a lot of money by abusing a system innocently? I hardly think so.

And we can go on but I hope they ask one fundamental question and I hope the American establishment has the courage to ask one fundamental question; what is Wall Street for? What are they supposed to do?

Do we need a Wall Street that takes 40 per cent of American profits? No way. Let’s rethink that. But the American establishment seems anyway afraid to ask that question and we have to start asking that.

To get us in the mood I took the liberty to re-write the lyrics to Edwin Starr’s classic 1969 song – War. For some reason I started singing:

Wall Street, yeah

What is it good for

Absolutely nothing

Uh-huh

Wall Street, yeah

What is it good for

Absolutely nothing

Say it again, y’allWall Street, good God

What is it good for

Absolutely nothing

Listen to meOhhh, Wall Street, I despise

Because it means destruction

Of innocent lives

You can enjoy the real song on YouTube and I would recommend singing my lyrics to imbue an appropriate level of determination before you start your local “Occupy Wall Street” cell.

There are many lessons to be learned from the crisis but unfortunately policy makers seem incapable of absorbing the main ones. First, politicians are in denial about the effectiveness of fiscal policy because their conservative paymasters (the media and corporations etc), who took the bailouts to save their own skins, are now vehemently enforcing the mainstream neo-liberal line. 1937, 1997, 2011. Public awareness of what is going on is low and needs to change.

A series of short messages need to be created by the alternative press/media/social networks to disabuse people of the ridiculous idea that if you cut public spending private spending suddenly bounces forth to fill (overly) the gap. The austerity proponents are ruining lives all around the globe – unnecessarily and without any empirical support.

Second, there has been no meaningful policy aimed at curbing the size and impact of the unproductive financial sector. Those who caused the crisis are trading freely as before and the paradigm that supports their parasitic behaviour continues to justify it as “efficient” “optimal” and “wealth generating”. The crisis has demonstrated beyond doubt that we can do without Wall Street. How does that message get out?

Third, the public debate is still entertaining the mainstream idea that somehow unemployment is a supply-side problem – excessive wages, poor skills and attitudes etc. They avoid explaining how these “causes” suddenly triggered a mass loss of jobs in about 2 quarters of 2008. It is like in the Great Depression – some 30 per cent of the labour force suddenly became lazy and walked off their jobs. There are academic articles that try to make that case.

Fourth, relatedly, is the denial that the massive redistribution of income to profits is not a basic cause of the crisis. The diminution in the wage share in GDP engineered by neo-liberal policy changes aimed at reducing the power of workers to gain real wage increases in an environment of persistent excess supply of labour provided the real income bonanza which allowed the financial sector to grow so quickly. It also meant that growth in real income via consumption could only be maintained by credit growth.

The two trends were linked. The financial sector took the real income as gambling chips in the casino we call the financial markets and kept the real economy going by pushing increasing volumes of debt onto households and firms. It was an unsustainable growth strategy. It has to change. There has to be a fundamental redistribution of income back to workers such that real wages grow in proportion to productivity growth.

Fifth, the ruse now is that crisis is actually about sovereign debt rather than private debt. All sorts of lies are spread about this – government insolvency risk; bankrupting our grandchildren; hyperinflation; escalating interest rates; turning Greek; and the rest of it. The crisis is about excessive private debt. There is no sovereign debt crisis. There is a crisis in the EMU about national government debt but those governments are not sovereign. They surrendered that capacity when they joined the EMU and now exclusively trade in a foreign currency and incur liabilities in that currency. All conflations between the EMU situation and elsewhere with respect to government debt are erroneous and reveal only the ignorance of the person making them.

The “Occupy Wall Street” exercise needs to become more fully organised around clear themes. I suspect (from what I have heard on radio and seen on TV) that there is a “looseness” about the action. Looseness in the sense that there is no clear agenda means that the action is less likely to spread and persist. The Vietnam anti-war movement was highly focused against conscription, against the war and against the involvement of capitalist firms in the production of napalm etc.

This focus allowed the movement to effectively educate a broader population and allowed the message to spread.

Would we suffer if Wall Street was closed? The “What is Wall Street For?” question is related to the “How much of the transactions of Wall Street are related to real activity?” question.

Real activity is what generates increases in our material standard of living. Real wealth is not nominal wealth. We gain real income by employing people to transform inputs into outputs which are of use to us.

So what does “Wall Street” do?

Free market proponents have historically justified speculative transactions, particularly in an increasingly integrated global economy accelerated by innovations in information technology, and financial instruments allow capital to be efficiently allocated across different uses.

From a Keynesian perspective, the concern was whether the government retains any power over domestic economic policy. From the perspective of financial markets and regulators, the concern is over the risks for economic activity introduced by the systemic risks of global financial markets trading complex derivative instruments.

From the perspective of Modern Monetary Theory (MMT) there is no question that governments can still use fiscal and monetary policy to pursue public purpose but the real question is why allow an essentially unproductive financial sector to gain access to real income at all.

Speculation is the act of taking a net asset position (long) or a net liability position (short) in some asset class, say a foreign currency. Speculation is simply defined as the purchase or sale of goods or assets in the expectation of gains from favourable price changes.

In this case, people take a punt on future exchange rates and deliberately take a risky position hoping that the rates will move favourably and deliver them a profit. There are several preconditions that have to exist before speculation is possible. Most importantly, speculators exploit uncertainty about the future price level.

The pro-market types claim that financial markets are productive because they reduce uncertainty for real producers. They use the example of hedging which is used to reduce exposure to across-border transactions.

When is speculation reasonable?

It would be wrong to consider all hedging and speculation to be damaging. When it accompanies trade flows and provides security to a trading concern then it can be beneficial. When we talk about hedging in this context we are referring to a strategy to avoid foreign exchange risk (sometimes called covering an open position).

Take the example of an Australian manufacturer which exports into the world market. The firm incurs all their costs in $AUD but contracts, say in $USD and has to deliver in say 3 months time whereupon the foreign purchaser will pay them in USD. Any rise in the AUD against the USD in the meantime will damage the firm’s revenue (in $AUD) but not alter its costs – thus the firm is exposed to losses or profit squeeze. Any fall in the $AUD will benefit the firm when it comes time for the foreign buyer to pay up on the delivery contract.

The firm might “hedge this exposure” in the forward exchange markets by buying a contract to sell $USD at a preferable exchange parity against the $AUD in 3-months time. So say it had worked out that a $USD rate of $AUD1.20 would be profitable then it will seek a 3-month forward contract to sell the contract amount of $USD at that rate.

So in 3-months the firm will get the contract amount (say $USD1000) and sells it to the counter-party at the agreed rate for $AUD (thus, $AUD1200) thereby avoiding all exchange rate exposure.

The same sort of arrangement might benefit an importer who has to deliver foreign exchange at some future date.

Whatever the basis of the contract, a counter-party (the speculator) is required to insure the hedger. While the hedger is willing to pay to cover its foreign exchange risk. the speculator accepts the foreign exchange risk (an open position) and hopes to profit from the contract.

In the case above, if the $AUD appreciates in the 3-month period (say to $AUD1.10) then the speculator who has to deliver $AUD1200 to the manufacturer at $AUD1.20 per USD has to buy $AUD1200 for $USD1091, which means it loses $USD91 less the hedge fee it charges.

If the $AUD depreciates (say to $AUD1.30) then the speculator gains pays $USD923 or the $AUD1200 and gets $USD1000 back, thus making a profit of $USD77 plus its hedging fee.

The important point is that the risk is transferred to the speculator and it is likely that arrangements like this increase the volume of international trade because the trading firm bears none of the risk of the exchange rate exposure involved in the cross-border transactions.

It is more complicated than this but in general this example demonstrates when speculation is beneficial. The common element is when it is helping the facilitate trade in real goods and services which improve material standards of living.

It would be futile to deter speculative behaviour that assists international trade in goods and services even though from a MMT perspective the benefits of trade are evaluated differently.

Speculation is beneficial because it provides hedgers with opportunities to lay off risks. It also helps to smooth price movements. In the first sense speculation acts like insurance. Speculators become agents who are prepared to bear the risk of unexpected price or interest rate changes while others divest themselves of the risk.

In return the risk-averse parties are prepared to pay the speculators a fee. So a hedger who has an open position may seek to use the forward market.

Speculation also may reduce the amplitude of price movements by pushing down the value of assets that are deemed to over market value and vice versa. Speculators add volume to the market promoting continuous price adjustment and liquidity.

But the mainstream economists underplay the fact that speculation can be destructive because they emphasise rational behaviour. Sometimes investors seem to go mad and get too greedy. In this case, speculative manias driven by herd-like behaviour is destructive to economic activity.

The Rolling Stone article from July 9, 2009 – The Great American Bubble Machine – is a good introduction to the way hedge funds operate.

In 2009, the WIFO (Austrian Institute for Economic Research) Report – A General Financial Transaction Tax: A Short Cut of the Pros, the Cons and a Proposal – outlined the explosion of global financial flows and derivative markets in recent decades.

WIFO describe this dominance as follows:

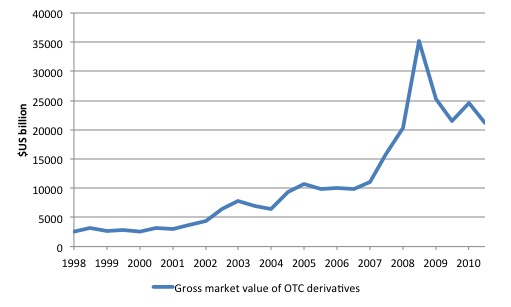

Observation 1: The volume of financial transactions in the global economy is 73.5 times higher than nominal world GDP, in 1990 this ratio amounted to “only” 15.3. Spot transactions of stocks, bonds and foreign exchange have expanded roughly in tandem with nominal world GDP. Hence, the overall increase in financial trading is exclusively due to the spectacular boom of the derivatives markets …

Observation 2: Futures and options trading on exchanges has expanded much stronger since 2000 than OTC transactions (the latter are the exclusive domain of professionals). In 2007, transaction volume of exchange-traded derivatives was 42.1 times higher than world GDP, the respective ratio of OTC transactions was 23.5% …

In other words, most of the financial flows comprise wealth-shuffling speculation transactions which have nothing to do with the facilitation of trade in real goods and services across national boundaries. This is significant and conditions what my conclusions are later.

Over-the-counter (OTC) derivatives markets became increasingly dominant in overall trading as the financial markets grew. Unlike options contracts, OTC contracts are non-standardised and are negotiated on a party by party basis. Forward contracts and swaps are generally OTC. They are more customised and less liquid.

An example might be the case of a company purchasing a foreign currency forward contract from a bank dealer. The two principals negotiate the amount, delivery time and price of the forward transaction. The negotiation will reflect the needs of the company. They are not traded in secondary markets because of their customised nature. They are also not marked-to-market because of the lack of adequate price information. So huge losses can accumulate and counter-party default becomes a major risk. Credit risk in the OTC market is huge.

If we compare the BIS estimate of “Amounts outstanding of over-the-counter (OTC) derivatives” in December 2010 – $US 601.048.366 trillion – to the World Bank estimate of World GDP for 2010 (published in the BIS since mid-1998 in $US billions.

What about foreign exchange transactions? This BIS publication (December 13, 2010) – The $4 trillion question: what explains FX growth since the 2007 survey? – provides a useful analysis of the relationship between foreign exchange turnover and international trade.

It concludes that:

FX turnover is several times larger than the total output of the economy … The FX turnover/GDP ratio is smallest for the largest economies, the United States and Japan. In these two countries, FX turnover is more than 14 times GDP. In most cases … FX market turnover is many times larger than equity trading volumes. Again, the ratio of FX turnover to equity turnover is smallest for the United States and Japan, but still sizeable …

Gross trade flows are defined as the sum of imports and exports of goods and services. FX turnover is much higher than underlying trade flows …

Overall, looking at developments since 1992, it is clear that FX turnover has increased more than underlying economic activity, whether measured by GDP, equity turnover or gross trade flows.

Wall Street used to be about providing capital for productive businesses. So a firm would sell shares or issue corporate paper (bonds) and Wall Street would facilitate the capital provision. That was a productive activity. Clearly, speculators (investors) would bet on the company making returns which was the incentive to participate in its ownership.

Wall Street (and I am using this term as a general description of the financial markets rather than some geograpically-specific set of firms) no longer serves that purpose. Now it is a wealth-shuffling casino.

The trading in derivative products of increasing complexity is divorced from the capital-provision function that the investment banks used to play. The focus is not on the prospects of the firm but on macro issues – how stable is the currency etc.

On top of that minor changes in macro aggregates (growth, etc) trigger automated trading decisions which quickly diffuse through all the share and index prices. So the share prices of a specific firm become hostage to the casino.

Some would suggest that providing capital for firms constitutes a miniscule percentage of the volume of Wall Street transactions.

I had lunch with a banker today and his organisation is the classic financial intermediary – carefully crafted deposit base, low risk hedging activities and well-managed loan book. No sneaky off-balance sheet transactions just astute management of its liquidity. It represents what we have to get back to.

Wall Street does not create jobs or prosperity for the wider population. When we talk about “investors” on Wall Street this is a grand mis-nomer. They are not investing in productive capacity.

The question that has to be answered is why would we want to allow destabilising financial flows anyway? If they are not facilitating the production and movement of real goods and services what public purpose do they serve?

It is clear they have made a small number of people fabulously wealthy. It is also clear that they have damaged the prospects for disadvantaged workers in many less developed countries.

More obvious to all of us now, when the system comes unstuck through the complexity of these transactions and the impossibility of correctly pricing risk, the real economies across the globe suffer. The consequences have been devastating in terms of lost employment and income and lost wealth.

There is no public purpose being served by allowing these trades to occur even if the imposition of the Tobin Tax (or something like it) might deter some of the volatility in exchange rates.

Solution: All governments should sign an agreement which would make all financial transactions that cannot be shown to facilitate trade in real good and services illegal. Simple as that. Speculative attacks on a nation’s currency would be judged in the same way as an armed invasion of the country – illegal.

This would smooth out the volatility in currencies and allow fiscal policy to pursue full employment and price stability without the destabilising external sector transactions.

Please see these blogs – Operational design arising from modern monetary theory and Asset bubbles and the conduct of banks .

In Australia there is a mini-fightback going on at present. The Sydney Morning Herald article (October 4, 2011) – Toxic Rembrandts – ratings agency ‘sandbagged’ – provides a fairly comprehensive report on the first days of a Federal Court of Australia hearing which is “the first legal case against a credit ratings agency”.

The action is being “brought by 12 NSW local councils, who quickly lost 90 per cent of their capital after buying the “grotesquely complicated” Rembrandt-structured finance products in 2007″ which Standard & Poor’s had been “bulldozed” by ABN Amro into “delivering its premiere “AAA” credit rating for a high-risk, and ultimately disastrous, financial product.”

The evidence is compelling so far. It has been revealed that:

1. “S&P didn’t … bother to do its own research for an “independent” report on the Rembrandt notes” – but “cut and pasted a chunk of ABN Amro’s own analysis of the notes – even though this was the very bank seeking the credit rating and trying to sell the notes.”

2. “one employee of S&P chided another, writing, “You are the wuss for bending over in front of bankers and taking it… You rate something AAA, when it is really A-?””

3. “ABN Amro concocted them, S&P was cajoled into delivering its AAA rating in late 2006, Local Government Financial Services (LGFS) bought them and on-sold them to the councils, despite it being also a financial advisor to the councils”.

The councils lost 90 per cent of their investment.

There is a string of E-mails being made available to the court which show how ABN Amro coerced S&P into rating the dud derivatives. The evidence adds to “the notorious email which came to light during a US congressional inquiry into the role of ratings agencies in 2009. In that, one S&P staffer said to the other, “We’d rate a cow” if they paid us.”

Conclusion

I have run out of time … there is much more to write on this topic.

So what is Wall Street for? Answer: nothing that we cannot do without in its entirety.

And cue:

Wall Street, yeah

What is it good for

Absolutely nothing

That is enough for today!

Great stuff! But this sentence

is mangled.

How About:

“Free market proponents [have] historically justified speculative transactions[,] particularly in an increasingly integrated global economy accelerated by innovations in information technology[,] and financial instruments [allow] capital to be [efficiently] allocated across [different] uses.”

I watched a protester interviewed on the BBC. He came across as a conspiracy advocate, unfortunately. He should have read this before he spoke.

Bill, you gonna be in New York soon? Maybe you can speak to the occupiers, give them direction and a purpose. Excellent article.

The head of the UK’s Financial Services Authority, Lord Turner said that much of the City of London’s activities were “socially useless”. See:

http://www.guardian.co.uk/business/2009/aug/27/fsa-bonus-city-banks-tax

Norme:

The news coverage you cite is hardly unique. The media here in the US (apparently now including the some bureaus of the foreign press) has been trying to marginalize the protesters by focusing in on people and actions that can be made fun of. This is quite typical of [left wing!!!] protests and [corporate] media here, and is the step always taken after Step 1 (completely ignoring the protests) is no longer practical.

[Note that right wing protests here, even when they are paid astroturf, are ALWAYS treated seriously and with the ultimate of respect.]

I’m not sure about that view of “right wing protests”. The Tea Party protests, when portrayed by media, tend to show people that can be made fun of, usually racist people. It may just be all media prefers compliant populace, but probably more likely reason is that the crazies sell more.

Nice article Bill. I was born late 70s, so haven’t seen a productive, general protest in my lifetime. That may bias my feeling that nothing will happen.

Great stuff, Bill.

You and the protesters – and people like Bill Black – are right to emphasize that there was a lot of wrongdoing that helped precipitate this crisis, and that the wrongdoing has not been prosecuted.

But I think it is important for the protesters to recognize that illegal acts are only a small part of the systemic problem. That’s the problem with a bad and defective financial and economic system. People can fuck up the world by doing things that are perfectly legal. To the extent people focus on illegal conduct, they might draw the mistaken conclusion that we can fix our problems simply by enforcing existing laws. But we can’t. We need new laws.

Very interesting article-

Toxic Rembrandts – ratings agency ‘sandbagged’

October 4, 2011.

”Although the likes of US pension funds have attempted to sue the agencies – indeed the Californian giant “Calpers” fund has been trying to get a case to trial for two years – this is the first case in the world to get to trial.

In the US, the First Amendment protections for free speech have assisted the agencies in deflecting claims – so far at least. After all, they contend their ratings are “just an opinion”.

The importance of this lawsuit is that a successful claim could set a precedent for further actions for bogus ratings in Australia, and indeed worldwide.”

Read more: http://www.smh.com.au/business/toxic-rembrandts–ratings-agency-sandbagged-20111004-1l71d.html

I had seen the remark regarding ‘First Ammendment protections’ regarding failed attempts to sue the ratings agencies, but was skeptical as such an argument would appear to be ridiculous assuming one is aware that those organizations are paid by the seller to provide optimalized opinions. Does anyone know whether there is any substance to such a claim?

Benedict, great point.

This is an interesting video that never made it on Fox.

http://www.youtube.com/watch?v=6yrT-0Xbrn4&feature=player_embedded

Prof Bill,

“If we compare the BIS estimate of “Amounts outstanding of over-the-counter (OTC) derivatives” in December 2010 – $US 601.048.366 trillion -”

Should be $US 601.048 billions, as per http://www.bis.org/statistics/otcder/dt1920a.pdf

Regards.

Dear p_al (at 2011/10/06 at 4:05)

Thanks for your comment. I am always happy for people to correct errors I make.

But in this case, if you read the publication you cite you will see that the December 2010 total is $US 601,048 billion not as you have read it $US 601.048 billion. The comma is the difference.

In any case, the transactions dwarf real activity by a considerable margin which is the point.

best wishes

bill

Dear Michael Norrish (at 2011/10/05 at 19:44) and Dale (at 2011/10/05 at 21:36).

Thanks for the grammar help.

In general I type the blog very quickly to get it done and sometimes my next paragraph is in my mind before I finish the last. Haste makes waste as my parents told me! I also realise there are spelling errors occasionally – I do check it quickly but the spell-checker is based on US spelling which means there are red underlines on the text all the time (labour, organised etc) and so my eyes get blurry trying to discern the differences and the “true” errors.

All help is appreciated.

best wishes

bill

@Ralph,

Regarding the regulators comments.

That was back in 09. It is now ’11, nothing has changed yet except for tentative plans in ’20.

“Solution: All governments should sign an agreement which would make all financial transactions that cannot be shown to facilitate trade in real good and services illegal. Simple as that. Speculative attacks on a nation’s currency would be judged in the same way as an armed invasion of the country – illegal.”

A beautiful dream but how would this be achieved? A detailed proposal on the specifics would be needed before we could get politicians to take it seriously. But this is definitely the medicine we need to repair much of the problems in the global economy.

Bill,

Not to defend “Wall Sreet’,

but in the case of your ’12NSWs’ wouldn’t it be simpler for your legislature to require more conservative financing operations for NSWs?

Dear JB (at 2011/10/06 at 12:32)

The legislation requires them only to invest in top-rated assets. That is why the banks bribed/paid the rating agencies to get AAA ratings. Yes, the legislation is stupid in that it implicitly assumes the rating agencies will be honest. But the intent is there to avoid these problems. The councils were victims of deceit – that is what the action will find I suspect.

best wishes

bill

Good post. I recommend The Big Short as a highly entertaining expose of Wall St shenanigans. Its focus is on the few traders who recognized the shenanigans for what they were and made fortunes betting against the ratings agencies, but it is very thorough in detailing the unstable towers of “derivatives of derivatives of derivatives” concocted by the Masters of the Universe to fool investors and enrich themselves.

There is no need to ban any kind of speculation like there is no need to ban casinos at all, although they serve no public purpose either.

The key is just to isolate these activities from those that serve public purpose like the banking system guaranteeing the payment system works smoothly and extending loans to individuals and companies based on risk analysis.

There was a recent BBC business program for the Lehman’s collapse anniversary where they interviewed the PWC guy brought in to deal with the bankruptcy. Three years after the collapse, there are still more than 700 PWC staffers working on trying to figure out who own who and how much!

I understand George Soros, some unions and even communists are supporting these protests. George Soros is know for manupulationg money on the market. There’s supposed to be many more organizations also in support of these protests. Does the name Jeffrey Immult mean anything to you? Last time around Obama got a lot of campaign money from wall street.