I started my undergraduate studies in economics in the late 1970s after starting out as…

When things get back-to-front

I have been busy today writing computer code to reconfigure a new server to replace our dearly departed main server. Once I get embroiled in that sort of process I recall how much I forget. Fortunately, it comes back. But the good news is that we have a new machine working now and are retrieving material from various backups. Anyway, that seemingly pedestrian activity is, in fact, a pleasant relief from reading what is out there in the economics media masquerading as informed comment. One of the worst articles for 2011 so far was in today’s Wall Street Journal which tried to introduce a new notion of crowding out – that deficits are forcing foreign investment into government bonds at the expense of private capital formation. The authors then applied the usual neo-liberal nonsense that only private markets can allocated financial flows productively to conclude that the deficits are undermining growth in the US and destroying jobs. Their analysis not only stretches the empirical truth but also conceptually gets things back-to-front.

The lead article (July 5, 2011) – America’s Troubling Investment Gap is about as bad as it gets although I suspect the majority of causality-strained readers will consider it well written and alarming.

I am developing a rule of thumb as the deficit/debt hysteria reaches irrational proportions that I didn’t believe were possible among populations that at least purport to have primary school education. The scarier the headline or by-line the worse the article will be. I stand ready to be judged by that empirical benchmark!

The by-line in question – “For the first time in decades, America is on net losing, not attracting, growth capital”. Hmmm, sounds scary.

Their principle argument is that:

1. “Americans are taking their investment dollars abroad at a faster pace than foreigners are bringing capital to these shores”.

2. “foreigners still park a huge amount of money in this country, but in the last several years they’ve shifted their investment toward U.S. Treasury securities and government-guaranteed bonds, and away from the private-sector staples”.

3. “To produce rapid growth, most capital must be allocated by markets”.

4. “Today, foreigners are financing food stamps and the next bridge to nowhere while Americans are building state-of-the-art production systems abroad. This is the real pernicious “crowding out effect” of the federal government’s borrowing”.

That is it!

The WSJ article authors (one a WSJ hack and the other the “President” of a financial institution but formerly Chief Economist of Bear, Stearns – that is, highly qualified) claim that:

The real truth of the recession and limping recovery is that for the first time in decades America is, on net, losing, not attracting, growth capital. That may be the single most important explanation for persistently high unemployment and stagnant wages.

It may be but it isn’t.

The real truth of the recession and limping recovery is that with private spending flat and the external sector not adding net aggregate demand to the US economy the public deficit is insufficient to close the spending gap.

There is only one reason why growth slows relative to productive capacity. Some sector spends less than before (or this can be case in growth terms if you like) and another sector(s) do not plug the spending drain.

So the recession was so severe because the US government did not accept its responsibility and redress the private spending collapse. The recovery is dragging out and will deteriorate if things continue as they are at present because the US government (by that I mean the Congress) is doing everything it can to undermine private confidence and withdraw public support.

The WSJ authors then get empirical. They say:

Foreigners of late have not found the U.S. to be a receptive, high-return home for investment … Much more worrisome is that Americans are taking their investment dollars abroad at a faster pace than foreigners are bringing capital to these shores … Economic recoveries are periods when investment capital usually surges into a country, but since this weakling rebound began in the middle of 2009 the U.S. has lost more than $200 billion in investment capital. That is the equivalent of about two million jobs that don’t exist on these shores and are now located in places like China, Germany and India.

I will come back to the empirical veracity of this claim later.

But it is true that most recoveries gather pace on the back of private investment. But that only applies to economic downturns that were originated in the “real sector” rather than the financial sector. When recessions are driven by a collapse in asset prices and major defaults on debt obligations which then spread into the real sector because governments do not insulate aggregate spending from the financial woes, the recoveries are much slower and private investment takes a lot longer to sort out.

The reason is simple – private households and firms have to not only regain confidence but also sort out precarious balance sheets. That is what is going on at the moment.

Please read my blog – Balance sheet recessions and democracy – for more discussion on this point.

The WSJ authors claim that the current period “is a recent and dramatic reversal of fortune” because:

Huge net inflows of productive capital into the U.S. in the 1980s and ’90s helped finance the 25-year boom in jobs and broad-based prosperity from 1982-2007. Over that period, foreigners invested just over $6 trillion more in the U.S. (in total capital) than Americans invested abroad … with most of it going into businesses.

As we will see this is not an entirely accurate statement.

The capital inflows were not necessarily “productive”. Direct investment inflows were dwarfed by foreign investment in “U.S. securities other than U.S. Treasury securities” which may cannot be exclusively assumed to have flowed into job creation or productive capital. Most likely real estate and financial speculation were the targets.

Further, the trend in rising inflows and outflows began in the late 1980s well before this recession. In fact the recession has been responsible for a major reversal in outflows as well as inflows.

But it is also true that where the flows manifest as demand for US-based goods and services this was good for the economy.

The second part of their argument is that:

To be sure, foreigners still park a huge amount of money in this country, but in the last several years they’ve shifted their investment toward U.S. Treasury securities and government-guaranteed bonds, and away from the private-sector staples – corporate bonds, intellectual property, ownership of businesses – that create sustainable jobs.

Which is no surprise given the parlous state of the US private sector. Investors will only seek to augment productive capacity if they are confident that the firms will be able to sell the goods and services at an acceptable profit margin.

With US unemployment stuck at 9 per cent and US households still struggling with record levels of debt courtesy of the financial deregulation and rapacious behaviour of the investment banks, no firm in their right mind would exude confidence that sales will grow rapidly any time soon.

And the behaviour of the US Congress at present is surely further undermining private sector confidence. There is a very real prospect of the US economy going back into recession if the austerity plans that are currently before the Congress become law. It is little wonder that direct investment in the US private sector is slow.

But as we will see the claims by the WSJ authors also stretch the truth. Foreign private investment in government bonds are not overshadowing foreign direct investment.

The rise in government debt levels though is a direct reflection of the decline in private spending given the institutional arrangements the US Congress imposes on itself in relation to budget deficits.

The only thing that has been keeping the US economy growing are the budget deficits (with some minor help from exports).

The WSJ authors though are just warming up – they really want to get to their ideological point

To produce rapid growth, most capital must be allocated by markets. The effect of $4.5 trillion of borrowing since 2009 is that foreigners and Americans are buying Treasury bills instead of investing in the next Google, Oracle, Wal-Mart or biomedical company. Today, foreigners are financing food stamps and the next bridge to nowhere while Americans are building state-of-the-art production systems abroad. This is the real pernicious “crowding out effect” of the federal government’s borrowing.

What does “most capital” mean? What proportion? The private markets have demonstrated categorically that they cannot be trusted with “most capital”. The reason the world economy has destroyed so many jobs and foregone (forever) billions of dollar in income flows is because the capital was trusted to private markets by deregulating governments.

The proposition that the neo-liberals live for – that self-regulating private markets are the exemplar of wealth creation has been shown to be a sham.

If the US private sector was not so debt-laden – courtesy of the “markets” – and if private confidence was higher – then the capital markets would be allocating investment funds to the private sector.

It is totally rational to park your saving in risk-free assets (like US government bonds) when there is so much uncertainty in private markets. The deficits did not cause that uncertainty. Indeed, they are a reflection of it. Budget deficits after all are endogenous – that is, driven by private spending decisions.

If governments stop spending and investing in capital infrastructure (and therefore under current arrangements offering Treasury bonds) – what do the WSJ authors think will happen to the US growth rate? Hint: a large slow down, an inevitable return to recession with firms and jobs further being destroyed.

And … more investment funds going into US Treasury securities.

The cause and effect they are trying to claim is back-to-front.

But their empirical grasp is also somewhat questionable.

Checking the data

You can get detailed data from the US Bureau of Economic Analysis for U.S. International Transactions, 1960-present which allows you to see what has been going on over a long period.

To fully understand what this data is about you should also read the BEA publication (June 2011) – U.S. International Transactions Accounts: Concepts and Estimation Methods, particularly the Chapter on Concepts, Definitions, and Principles

There you learn that:

The financial account measures transactions in financial assets and liabilities between residents and nonresidents. None of these transactions are included in the NIPAs. Financial assets may be exchanged for goods, services, and income flows, for other financial assets, or they may represent the offsets to unilateral current transfers or capital account transactions.

The data is then presented by distinguishing between “U.S-owned assets abroad” and “foreign-owned assets in the United States”.

The BEA further breaks the data down in a “functional” way as follows:

U.S.-owned assets abroad:

- Distinguishes among U.S. official reserve assets, U.S. government assets other than official reserve assets, and private U.S. assets.

- Private U.S. assets are classified into direct investment, foreign securities, nonbank-reported claims, and bank-reported claims.

Foreign-owned assets in the United States”

- Distinguishes between assets held by foreign official agencies (primarily foreign monetary authorities) and those held by other foreigners.

- Foreign official assets are classified into U.S. Treasury securities, other U.S. government securities, other U.S. government liabilities, bank-reported liabilities, and other foreign official assets.

- Other foreign assets are classified into direct investment, U.S. Treasury securities, U.S. securities other than U.S. Treasury securities, nonbank-reported liabilities, and bank-reported liabilities.

In other words, you can trace the investment inflow and outflow of the US by official (government) and private and see whether the flows are going into financial assets or direct investment (presumably into private productive capacity augmentation).

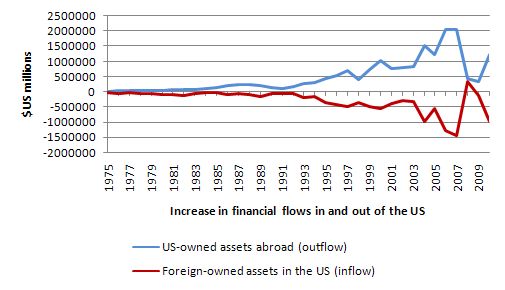

The first graph shows the aggregate picture for financial inflows and outflows for the US from 1975 to 2010 in %US millions (excluding financial derivatives). The inflows also include official transactions which we exclude in the latter graphs.

The trends are clear as is the cyclical variation. But the divergence between the two flows began in the late 1980s rather than as a result of the recent cyclical event and subsequent fiscal response.

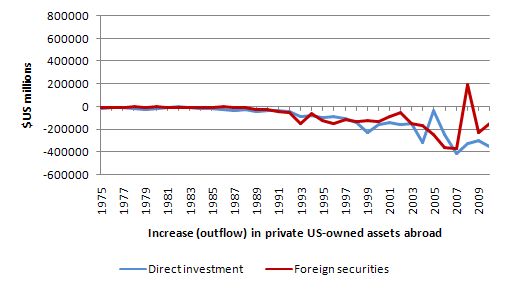

The next graph breaks the outflows down and shows the movement in US private assets by direct investment (blue line) and purchases of foreign securities (red line). The recession has not so led to an acceleration of direct investment outflows but severely curtailed the investment in foreign securities by US entities.

The data makes it hard to argue that the rising deficits and low interest rates have caused a change in preferences of US-based investors away from investing locally in jobs.

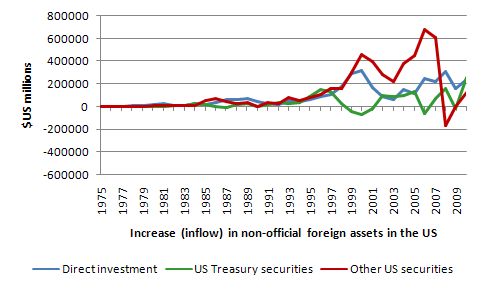

The next graph shows the Foreign-owned assets in the United States, excluding financial derivatives and official flows for three major categories: (a) Direct investment; (b) U.S. Treasury securities; and (c) U.S. securities other than U.S. Treasury securities (that is, private financial investment).

The vertical scale is identical to the previous graph so that you can get an idea of the differences between outflows and inflows overall. The inflows are larger than the outflows.

This data shows that direct investment in the US by foreigners was as negatively impacted by the recession as investment in other private financial products.

Further the investment in US government debt has not been overwhelming and does not seem to have exceeded the private direct investment in recent years.

It is hard to make a case that the capital inflows have been dominated by private purchases of US Treasury securities at the expense of other financial assets that might lead to direct investment in productive capital.

Overall, foreign investment in the US has fallen sharply since the onset of the crisis and is only just starting to recover. But the same can be said about US-based investment abroad (see the first graph).

Conclusion

I haven’t much time today but I couldn’t let that article go through unchallenged. Several readers wrote in this morning expressing concern and seemingly believed the analysis being presented.

I reassured them!

That is enough for today!

You shouldn’t waste your time rebutting these people. The most effective technique is just to ignore them.

Lots of the publicity which helped the Tea party take off came from liberals wasting space attacking them, which just made them seem more important. It’s a mistake the right rarely makes. They keep initiating things.

There appears to be a move by some US banks to halve the debt outstanding on mortgages that are “underwater” but on which the homeowner has so far kept up the payments. Would you welcome this as a creative way to ease the burden on the private sector and (by reducing both bank assets and liabilities) proportionally increase bank reserves, so increasing confidence and stimulating demand??

http://www.zerohedge.com/article/banks-commence-wholesale-unsolicited-mortgage-forgiveness

Matthew,

The left doesn’t have the resources of the right. Remember this is a fight of wealth, privilege, highly organized business and entrenched political power against disparate groups of peons. Even the clergy in the US is a powerful voice protecting the interests of the wealthy. For people who exert very little power in their everyday lives, strength is in numbers and unity. It is only effective with one voice.

The socialist parties of Europe used to focus that one voice but they have been paid off and are failing the masses badly. In the feudal society of the US, I guess Liberals (being least to the right) are the voice of the downtrodden masses. Anyhoo….. in the

last 30 years, countless clever right wing ploys and the media induced cult of individualism has destroyed old style working class camaraderie. People have forgotten the importance of sticking together.

In the absence of unity and starved of media resources, guerilla style warfare is the only strategy the powerless can deploy against the powerful. If a genuine left of center revival gathers steam, they could start to go on the attack in open ground.

Bill is doing a great job plugging his finger in holes in the dyke as are the likes of Dean Baker, Krugman, Hudson et al. Mostly well intentioned left of center thought leaders who would be well advised to stop bickering amongst themselves in public. I say just get behind them, amplify the common themes and downplay the differences.

Class warfare has arrived, big time…… The Empire is all powerful and already deploying the death star. The rebel army is not yet at the cell group stage……..stay with the plot bro’.

Great Ideas like a Job Guarantee and Henry Georges Land Value Tax strike at the very heart of entrenched private capital interests. If they start to gain popular traction they will be stamped out any which way.

The Right ignore them because they are too incredulous to believe anyone can seriously challenge their power.

“You shouldn’t waste your time rebutting these people. The most effective technique is just to ignore them.

Lots of the publicity which helped the Tea party take off came from liberals wasting space attacking them, which just made them seem more important. It’s a mistake the right rarely makes. They keep initiating things”

@Matthew:

Well, while i agree that that’s a better tactic politically, that’s also lowering oneself to their level. Also, Bill is an economist (and an excellent one at that) more than an ideologue or politician and his work should be appreciated as the work of an economist! The rebuttals also provide ammo for others that debate conservatives and so on. I like the rebuttals personally because i’ve learned alot from them!