I started my undergraduate studies in economics in the late 1970s after starting out as…

I am in denial – but I know children are dying

Governments around the world are being stampeded by financial commentators and international organisations (IMF, OECD, G-20) to implement austerity programs to get their “deficits under control”. All sorts of horrendous predictions are being touted in the press daily by the deficit terrorists who focus their gaze on charts showing movements in financial ratios – such as the deficit to GDP and public debt to GDP ratios. They largely ignore history and when they do invoke it the introduce erroneous analyses which do not apply to the issue at hand. They erroneously conflate the Eurozone with sovereign monetary systems. And they never let up. But in all the talk of austerity the real dimensions of the problem get lost. That is what today’s blog is about – getting our focus down to the fact that thousands of children will die as a result of these unnecessary austerity programs which are just designed to satisfy the ideological hangups of the (mostly) high income and wealthy elites in our societies.

The Editorial in the New York Times on June 9, 2010 was fairly to the point – The Wrong Message on Deficits. It said:

The whip-deficits-now fever is running hot on both sides of the Atlantic. In Europe, politicians are understandably spooked by investors dumping government bonds in the wake of the Greek meltdown. But the sudden fierce enthusiasm for fiscal austerity, especially among stronger economies, is likely to backfire, condemning Europe to years of stagnation or worse.

The United States is running the same very high risk. Democrats have soured on job creation and economic stimulus in favor of antideficit rhetoric, which Republicans have long seen as the easy road to discontented voters in a confusing election year.

The Editorial notes that the “economic crisis isn’t over” and cites the appalling unemployment that remains even though share markets have been recovering and some real economies are growing again, albeit slowly. They rightly conclude that “for everybody to slash public spending when growth is faltering and unemployment remains stubbornly high risks undercutting the goal of fiscal probity by slowing economic growth and reducing tax revenues”.

And, they note that there is now evidence that the world economy is slowing again as the budget cuts take their toll. They conclude that:

Right now, for the most robust economies – the United States, Germany, Britain, Japan – slashing budgets is the wrong thing to do.

Meanwhile, the Nikkei News for Thursday, June 10, 2010 (you need a subscription so it is pointless to link) announced that DPJ’s Fiscal Hawk Gets To Work As MOF Chief. The Report said that:

Yoshihiko Noda, the newly appointed chief of the Ministry of Finance, has long been considered one of the staunchest fiscal conservatives in the Democratic Party of Japan. Noda is eager to rebuild Japan’s finances with a motto of “there should be no talk of policies without talk of funding sources.” After the DPJ took power last September, Noda was named senior vice finance minister. He was front and center in cutting budget requests from ministries and agencies, rankling fellow DPJ lawmakers who formulated the requests.

So it might be a case of Sayonara Japan … it was nice knowing you! Back to 1997!

I also recall this article (June 9, 2010) – The Dark Side Of Stimulus – by one Thomas Cooley, who is a retired academic from NYU and a regular Forbes columnist. The article introduces a new term into the debate – deficit deniers.

Cooley notes that the recovery from the “deep recession” is not happening very quickly despite the “staggering … fiscal package” that the US President introduced. He concludes that:

But now people are realizing that there is a dark side to this spending orgy. It has to end, and then we have to pay the bill. If we need any reminders that the day of reckoning is coming we have only to look to Europe. There is no point in arguing about how many jobs have been created or saved by stimulus spending. We don’t get to rerun history, so we won’t know what the path of employment would have been absent the stimulus package.

I am wondering who the we is who has to pay the bill. The bill is already being paid – the real loss of incomes and the persistently high unemployment. The only bill is a real one.

However, if governments insist on pretending they have to “finance” their spending and follow the path the UK is now taking (among other nations heading down the austerity path) then the real bill will be the lost real income arising from the cuts in public spending, the lost private command on real resources arising from the tax hikes. These costs will enormous.

Further, the only way of calibrating the worth of the fiscal interventions is to estimate outcomes such as “how many jobs were saved”. We can roughly estimate the extra spending impact on GDP and hence employment growth. The important point is that in focusing on jobs we are displaying the appropriate priorities. In focusing on largely irrelevant aggregates such as the size of the deficit or the public debt ratio, we are exhibiting a wrong set of policy priorities.

Cooley notes that:

… nothing will solve the problem except economic growth. The problem we face is that the extraordinary deficits we created are likely to restrain economic growth in the future. We do have to honor that debt.

It is true that economic growth will reduce unemployment and, by definition, it increases incomes. But there is no robust empirical evidence that shows that rising deficits are associated with falling economic growth. The evidence points the other way. The fact that the US government has to honour the public debt is supportive of growth because the interest payments provide a higher income flow than if the funds were left in non-interest bearing reserves.

The Modern Monetary Theory (MMT) camp have been referring to the likes of Cooley as deficit terrorists. Cooley has his own term for those who think deficits are beneficial (when necessary):

There are deficit deniers out there, like Paul Krugman, who think we can and should ignore deficits for a long time to come because we can continue to borrow at such low interest rates. This is the same behavior for which they excoriate households who accumulated too much mortgage and credit card debt. They also blasted Alan Greenspan and Ben Bernanke for enabling this irresponsible behavior by keeping interest rates too low for too long. But by all means let the Government borrow and spend at our current low interest rates to keep this economic recovery alive.

MMT tells us that the size or continuity of budget deficits per se are not a sensible focus of analysis. The budget outcome is driven strongly by fluctuations in private spending. So a rising deficit usually indicates a slowdown in private spending. The discretionary component of the budget outcome should signal the extent to which the non-government sector desires to save (that is, withdraw spending from the income flow).

That spending gap has to be filled or else economic growth declines. There is no magic solution out there.

Further, while households may have taken advantage of low interest rates to over-borrow, that point is irrelevant to the question of public borrowing. There is no credible analogy between households (who use the currency) and a sovereign government (which issues the currency). The former are always revenue-constrained while the latter is never so.

The institutional structures that sovereign governments voluntarily erect to give the impression they are financially constrained are ultimately meaningless. They can be changed by the very government (in almost all cases) that they seek to “constrain”. A sovereign government can always service its public debt obligations whereas a household cannot.

Cooley makes another fundamental error:

There is certainly some truth to the view that we can kick the can down the road for a bit longer. Why? Because the U.S. dollar is and will continue to be the world’s reserve currency. It means that the U.S. can run a persistent current account deficit because other countries need dollars for reserves.

Whatever the international status of the US dollar is is irrelevant to the capacity of the US dollar to net spend in its own currency. All sovereign governments (who issue their own currency) can buy whatever is available for sale in their own currency at any time of their choosing. There is nothing special about the US government in this regard.

And … all sovereign governments can purchase any idle labour in their economies and put it to productive use any time they choose to do so.

Cooley continues to misrepresent the monetary realities:

This is also why we find it easy–even now with staggering deficits–to sell U.S. Treasuries at low interest rates. Every time markets get shaky, as they have in recent weeks, there is a flight to the safety of U.S. Treasury obligations. That reaffirms the belief in the long-term credibility of the U.S. and the viability of our debt.

The high demand for US Treasuries certainly keeps the yields down given the way the auction system works. And the US dollar is seen as being a safe haven. But any sovereign government can engineer low public debt yields if it uses it coordinates the central bank and treasury operations appropriately.

Cooley doesn’t think this will last though because markets will eventually work out that the US deficit is not on “a sustainable fiscal path”. To get there the US government has to “cut spending and increase revenues”.

After drawing false analogies between the US and the fiscal plight of the Eurozone countries he says:

Markets and consumers are much smarter than politicians. That is why they are jittery. You don’t have to be a rocket scientist to realize that the stimulus has not delivered the big bang people hoped for and that we can’t afford more stimulus.

The stimulus has delivered less than imagined because they have been continually hamstrung by the deficit terrorists. In nations with the largest fiscal stimulus packages things are better. By introducing pressure on governments from the early stages of the crisis the terrorists have conspired to derail the recovery.

But then what would I know … I am just in denial.

Anyway, this is just another one of the torrent of articles coming out which are pushing this line that austerity is needed and the larger and quicker the adjustment the better. But I have been reading some interesting research papers lately on the impacts of the stimulus packages and the likely impact of the austerity programs.

Fiscal stimulus proportions

UNICEF and other agencies have been doing work on the impact of the fiscal interventions, in particular the social protection measures that were introduced.

This UNDP paper – Social Protection in Fiscal Stimulus Packages: Some Evidence – by Zhang, Thelen and Rao, found for the 35 countries studied, that, on average they:

… spend about 25% of their stimuli on social protection measures. In total, this amounts to about USD653 billion, almost 1% of 2008 global GDP.

So not a lot at all. They also found most of the social spending was on infrastructure and there was no real focus on women (and their children) who take the brunt of any economic crisis.

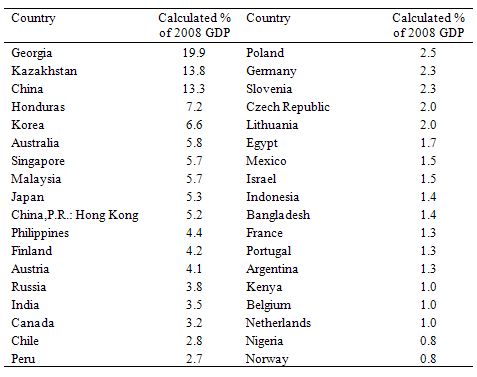

The following Table is derived Table 1 in the UNDP paper referred to above. It shows the size of the fiscal stimulus as a percentage of 2008 GDP by the countries that the UNDP studied. I ranked them highest to lowest.

The point I have regularly made when confronted with claims like those outlined by Cooley – that the fiscal stimulus hasn’t worked – is to note that the fiscal response has been relatively muted. They retort (shouting) asking whether I am blind – pointing to some public net spending ratio that has gone upwards. I reply that the ratios just tell me how deep the crisis has been.

I then say that the pools of unemployment tell me whether the fiscal response has been too much, just right or too little. And the unambiguous conclusion is that the fiscal responses have been inadequate by considerable margins.

The following graph uses the data on the size of the fiscal stimulus as a percentage of 2008 GDP and plots the change in unemployment rates between 2008 and April 2010 against it. The data for the unemployment rates is from the World Economic Outlook database as at April 2010. The plot only includes those nations for which the IMF published unemployment rates.

And while you don’t want to conclude too much from a simple scatter plot, there appears to be the relationship emerging that theory would predict. The larger the stimulus the better the unemployment outcome. I am sure that a more thorough statistical analysis of this relationship controlling for other influences would confirm the simple message being portrayed in the graph.

The Losers

In all this talk about fiscal austerity – being pushed to make the bond traders happy – they who represent the wealthiest individuals in our societies – you will rarely read anything about who will be the beneficiaries and the losers.

We know from the privatisations of the 1980s and 1990s that spectacular transfers of wealth occurred. Governments paid huge sums to private financial organisations to execute the sales. Governments also agreed to heavy discounts on the true net worth and expected net income flows flows from the public enterprises being sold off because they didn’t want the embarassment of a non-sale.

But who are the losers?

In its Global Economic Prospects 2010, the World Bank estimates that the global economic crisis pushed 50 million more people into extreme poverty in 2009 and a further 64 million will be added to this pool by the end of this year.

This paper – Crises and the Poor: Socially Responsible Macroeconomics – by one Nora Lustig from the Inter-American Development Bank is worth reading to get an idea of how economic crises damage the prospects of the poor. It was written in 2000. While her documentation of the implications for crisis on the poor is interesting, I don’t endorse her take on macroeconomics, which often wanders too far into the foibles of mainstream macroeconomics.

She does make on interesting point which is consistent with MMT. Lustig notes that “a flexible exchange rate” regime softens the blow of crises from a “pro-poor perspective”. She notes that fixed exchange rate systems promote quantity adjustments to an external crisis (which in the labour market means unemployment) whereas flexible exchange system tends to make adjustments via real wages (import prices rise). In trying to defend a fixed parity, nations resort to harsh domestic policies which exacerbate poverty.

In this UNICEF paper – Inclusive Crises, Exclusive Recoveries, and Policies to Prevent a Double Whammy for the Poor – Ronald Mendoza argues that:

When it comes to aggregate economic shocks, the poor and the near-poor often face a double whammy. First, they are often among the most adversely affected by the shock, suffering from crisis effects that push them and their children (the next generation) deeper into poverty. Second, the poor and near-poor are also the least equipped to participate in and benefit from the subsequent recovery.

You can read a lay-person summary of the paper also.

While most of the research in this area of enquiry is focused on less developed (developing) nations, the research in advanced countries reveals similar outcomes. The poor are less exposed to crisis in the advanced nations and there are better safety nets.

But a person plunged into long-term unemployment in the US or Australia faces a high chance of becoming poor (relatively in this sense) and losing a significant proportion of the assets they had built up while working (housing etc). Their children also inherit the disadvantage that they grew up with and face major difficulties in later life.

So it is not just a developing country problem – although in the poorer nations the impacts mean death in many cases. In poorer nations, a crisis has devastating impacts. Mendoza notes that “tens of thousands of children in some of the poorest countries in the world could die, paying the ultimate price as a result of this crisis”.

But the recovery is also fraught for the poor.

Mendoza notes that:

During a typical crisis episode, spending on the social sectors are often cut at precisely the time when these resources are needed the most. It is not uncommon that social spending suffers the largest cuts, and that part of social spending that has the greatest benefit for the poor is most retrenched … we do know from past crises that families often have to sell off what little productive assets they might have, reduce health-seeking behaviour, pull children out of school, take on more debt, and in dire cases, eat less or less nutritious food in order to cope with the income shock. All these coping strategies hinder the ability of poor families to quickly recover.

This is the point that Lustig also emphasises.

The other point that Mendoza makes is that the meagre funds that:

… do allocate to the social sectors are now also at risk, as public budgets across the world are squeezed by declining tax and other revenues. If the food crisis, fuel crisis and financial crisis were the first three waves of crises – then the fourth wave is an impending public finance crisis now sweeping across developing and even some industrialised countries.

You will rarely read anything like this is the daily financial debates about how much austerity to impose. While the erroneous construction of the monetary system by the deficit terrorists has an intellectual curiosity about it – that is, I wonder about motives etc – the reality is much more important.

Even Mendoza thinks there is “an impending public finance crisis” sweeping the world. In general, there is no public finance crisis (Eurozone nations excluded). Sovereign nations should be focusing fiscal policy on improving domestic outcomes, in general, and ensuring, in particular, that the weak and vulnerable in their nations are protected. That is what public purpose is about.

If you just spend each day reading and debating at the level of the evening finance report then you will quickly lose sight of the human dimension of the crisis.

Mendoza’s focus (in UNICEF) is on children and he says:

Tomorrow’s youth – today’s children and infants – are at risk. Roughly about half of the developing world faces imminent or anticipated youth bulges within the next 20 years … They are infants and children in some of the poorest countries today – many of the very same countries struggling to cope with the aftershocks of the food and fuel price crises, as well as the global slowdown.

Stock markets will bounce back; but children who miss an important window of nutrition, education, and care will shoulder the scars of the recent crises for the rest of their lives. Stronger social budgets, more nuanced and gender responsive policies, and where necessary support from the international community, could help to ensure that social and economic recovery from the most severe crises in recent history will be much more inclusive than in the past.

I was thinking about that statement in the context of the so-called intergenerational debate and the spurious arguments about transferring the burdens of public debt onto the next generation.

I have said it often but you cannot say it enough – the burden we are transferring to the future generation is the diminished opportunities they will have as a result of growing up in poverty. But it a burden that is also being borne now – every day – and manifests are malnutrition, lack of education and the other related pathologies that accompany poverty and social exclusion.

The austerity programs typically focus cuts in the areas where the poor are most reliant on public support.

Conclusion

Lustig says that:

Macroeconomic crises not only affect the current living standards of the poor, but their ability to grow out of poverty.

Governments have a responsibility to use fiscal policy in a pro-poor manner and that “crisis prevention has to be a top priority of any anti-poverty strategy”. This requires governments do not cut “pro-poor” programs during a crisis or in its aftermath. They should implement viable safety nets.

The Job Guarantee is one such safety net and ensures that any person who can work and wants to work is able to access a socially-appropriate minimum wage at all times. This policy is the first thing any sovereign government should implement. The first policy that a non-sovereign government should implement is to make themselves sovereign, then introduce a Job Guarantee.

Governments should always use counter-cyclical net spending to advance social protection. Failure to do this not only impacts now but stifles human capital development in the future and thus ensures that poverty is transferred between generations.

Lustig says that:

Permanent reduction in the stock of human capital of the poor, due to malnutrition and deteriorating skills, might also lead to lower economic growth. Socially responsible macroeconomic policy in crisis avoidance and crisis response can contribute simultaneously to lower chronic poverty and higher growth.

So the New York Times editorial is largely correct (although they did say some nations should still implement austerity programs). No nation should implement discretionary cutbacks in net public spending at a time when the economy is in crisis. No exceptions!

But then I am just in denial – although I wonder how many children died today because of the crisis and the poor response by governments?

Saturday Quiz

The Saturday Quiz will be back sometime tomorrow – even harder than last week!

That is enough for today!

More on Japan from the BBC:

“Naoto Kan, in his first major speech since taking over, said Japan needed a financial restructuring to avert a Greece-style crisis.

“Our country’s outstanding public debt is huge… our public finances have become the worst of any developed country,” he said.

“After years of borrowing, Japan’s debt is twice its gross domestic product.

“It is difficult to continue our fiscal policies by heavily relying on the issuance of government bonds,” said Mr Kan, Japan’s former finance minister.

“Like the confusion in the eurozone triggered by Greece, there is a risk of collapse if we leave the increase of the public debt untouched and then lose the trust of the bond markets,” he said.”

Shikkari shite, shikkari!

The “last mile” that has been talked about much around here is having to be negotiated at Everest like grades/altitudes and Death Valley like temperatures. The terrorists have turned up the heat and due to their media monopoly they get first word on the front page. The “deniers” get relegated to third page rebuttals and painted as radicals and loons. I am not hopeful of how this will turn out.

We have turned out to be too stupid to question the very same people who told us all was well in 2007. I sometimes marvel at the effectiveness of the terrorists campaign to hide the truth from the people they are ripping off blind but then I realize that this group ostensibly has been at it for thousands of years, fighting everything that has the capacity to loosen their grip on the power levers of society. They are a well oiled machine that uses religion, advertising and academia as covers for their ever tightening grip.

I feel quite pessimistic now. Not my usual state and I’m going to have to find something to renew my optimism………golf didnt work yesterday (too many 3 putt double bogeys!!)…..maybe I’ll fly to a state with medical marijuana. claim depression, and try and revive my college spirit.

I doubt the governments will even blink when it comes time to bail BP out of their current situation. The talks have already started about how damaging it will be to pension funds and other investments.

Before we know it the corporate welfare packages will be on their way to “save the investors” but we really know who they are for.

The western capitalist democracies seem in mass to have set themselves on the path to an occidental “Great Leap Forward”. Pure ideology will now be deployed by central authorities against external reality and human nature. The employed, the marginally employed and the unemployed will now all join in the great collective effort, against their will of course, to force fiat money to work like gold.

Bill you said,

“The first policy that a non-sovereign government should implement is to make themselves sovereign”

I would add that already sovereign nations should also properly recognise their sovereignty by abandoning democratic repression; fully using government law making (something the markets cannot do) to control the negative effects markets can have on sovereign nations e.g. Fitch’s warning to the UK recently, and proper regulation which is still not happening.

Your description of the Job Guarantee is the most succinct i’ve seen and I will use it. On the UK news websites i’ll also keep banging-on that cuts now are pro-cyclical and so will make things worse.

Alan: I doubt the governments will even blink when it comes time to bail BP out of their current situation. The talks have already started about how damaging it will be to pension funds and other investments.

Before we know it the corporate welfare packages will be on their way to “save the investors” but we really know who they are for

Another nail in the coffin of free market capitalism as loss is socialized. The result is that imprudent risk-taking is further incentivized for those regarded as to big to fail, and moral hazard is increased and extended. This creates systemic dead weight and is not going to end well.

BTW, Marshall Auerback was in the lede at Paul Krugman’s blog yesterday. Woo hoo! Congrats, Marshall.

Oy, Canada

Yikes. Gallup poll has the federal debt tied with terrorism as Americans’ most feared threat. (h/t Yves). Looks like the propaganda is working.

“Looks like the propaganda is working”

Like a charm

Bill –

The first policy that a non-sovereign government should implement is to make themselves sovereign”

Making themselves sovereign right now is not such a good idea. Starting your own currency and finding it’s collapsing is worse than useless.

Alan Dunn –

“I doubt the governments will even blink when it comes time to bail BP out of their current situation. The talks have already started about how damaging it will be to pension funds and other investments.”

There will be no bailout. Cameron was opposed to bailing out the banks. And other businesses aren’t as dependent on BP as they were on the banks.

Cameron isn’t stupid. He knows the majority of BP shares aren’t even British owned. If there’s pressure to bail it out, he’ll just claim the country can’t afford it.

Cameron isn’t stupid. He knows the majority of BP shares aren’t even British owned. If there’s pressure to bail it out, he’ll just claim the country can’t afford it.

Right, he’ll get Obama to bailout BP instead. The US Chamber of Commerce is already lining the GOP us for it.

Tom Hickey –

“Right, he’ll get Obama to bailout BP instead. The US Chamber of Commerce is already lining the GOP us for it.”

Struth, you’re beginning to sound like the CEC! * Even if he had the inclination to get Obama to do it, he wouldn’t have the power.

Obama knows it would be political suicide. I’m sure even Sarah Palin’s smart enough to know that.

* The Citizens Electoral Council of Australia think everything’s a British conspiracy.

Aidan, I was writing somewhat tongue in cheek about Obama, but it’s a matter of record about the Chamber of Commerce and the GOP (although House Minority Leader Boehner was forced to walk his initial statement back a bit). The fact is that both parties need the financial contributions of Big Oil, Big Pharma, the health insurers, Wall Street, etc., and neither party is going to rock the boat by opposing these interests in any kind of serious way. They always “work a deal.”

Moreover, BP really is too big to fail, and the Obama administration is not going to take it down, especially with the economy in bad shape and tough election years (’10 & ’12) in the offing. If the economy doesn’t turn around very soon (unlikely), then the Democrats are pretty certain to lose big, since Americans vote their pocket books, especially in hard times. Please refer to L. Randall Wray, The Great Depression and the Revolution of 2017. 🙂

Realistically, no one is anticipating BP paying more than a fraction of the true cost. Most of the externality will be socialized, and the oil subsidy will continue with risk-taking incentivized. When the media hullabaloo dies down, it will be business as usual, accompanied by a few essentially meaningless gestures and maybe some wrist-slaps. Same with finance (despite the GFC), mining (despite the recent disaster), and the rest. We’ve been through this kind of thing many times before, and the result is essentially the same.

BP may be too big to fail in the sense that it’s big enough to survive this disaster. But it’s NOT too big for the government to ALLOW it to fail. If BP goes bust, their operations will just get taken over by other oil companies. BP shareholders will lose out, but few others will.

The Obama administration is likely to gain more votes from prosecuting BP to the full extent of the law than by taking money from Big Oil. But the law doesn’t extend far enough, so your final paragraph may well be right.

“To big to fail” actually means too well connected to fail. The TBTF’s are bastions of the oligarchy. We they get in trouble politicians jump over each other to help them in hope of getting a bigger handout from them when it comes time to campaign for reelection. It’s disgusting.

BILLYBLOG IS A COMMUNITY.

Why is a community? Here is a hypothesis.

Symbiosis in the blog forges common ideas/opinions based on the posts by Bill. These common ideas form a public domain (forum) that blog participants can share. Blog participants sharing these ideas constitute a community that react with responsibility posting comments that attempt to clarify and promote these ideas. Members of this community participate and share these comments subject to solidarity with the public purpose of this blog (full employment and well being of society/environment) and cooperate in the joint formation of the ideas that combine in a corresponding public domain. Blog members operate with the criterion of aesthetics and construct ideas subject to consistency and identify ideas subject to honor of the public purpose. Their behavior is an adjustment of ideas with the criterion of ethics, fairness of decisions and equity of idea posting so the operating public purpose can be reached.

On the other hand, Billyblog is not a market of shelfish participants trading proprietary ideas/opinions formed by osmosis in the blog. They are not trading from the private domain of proprietary ideas in competition and synergy with each other attemting to establish and promote private purpose (professional enhancement). Blog participants are not traders operating with the criterion of shelf security (ownership) of construction and identification of marketable value. Their behavior is not shelfish, composed by isolating reasoning criteria such as rationality for decisions and rules of posting as if behavioral adustment is about optimizing the private ownership and price of these ideas in professional markets.

BIlly blog is not a market but a community. I am proud to be a member by volition………….

Dear Panayotis

That was a lovely comment. And you are a very valued member of our community as are all the commentators and other participants (who just read).

best wishes

bill

Dear Bill

I am not an economist and understand much less than one half of what you write. I am nevertheless drawn your blog because the bits I do understand I find very enlightening. I would be very grateful if you would humour me by answering a simple question, one that has been nagging me for a while.

In this article you state: “There is no credible analogy between households (who use the currency) and a sovereign government (which issues the currency). The former are always revenue-constrained while the latter is never so”. This is a point that you emphasise quite regularly.

My question is simply this: if sovereign governments issue the currency, why do they also borrow? I don’t see the sense in buying back money you’ve already issued and paying interest on it. Why not just issue more?

Late in on this, BUT …

Here are a few quite numbers I scratched up. The Deepwater Horizon hole (@$70/BBL) is worth about $80 billion (recoverable crude plus natural gas). This represents (using BP figures) about 4% of proven (and “owned”) reserves. That’s about $2 trillion total. Could someone please explain to me how a company with $2 trillion is going to go bankrupt over a claim that might run 1-2% of it’s assets?

No, of course not. So here’s the deal …

Institutions in the US and UK own about 60% BP outstanding shares. Individuals in these two countries own about 20% more of it. All BP has to do is scare the crap out of these two groups, and Obama and Cameron will have to fold. (Cameron is already in the process.) At that point, guess who gets stuck with the bill? That’s right: You and I.

Please folks, don’t help spread BP’s propaganda. The only place BP is going to go is right into your wallets.

Michael ~

Excellent question! The answer is simple. They don’t. Not to fund expenditures at least, which I believe is the context in which your question was meant.

(They might however choose to borrow simply to set a floor on interest rates … what is currently known as monetary policy. In this case however, they should FIX that floor wherever deemed appropriate, and if no one lent the government a penny at that rate, that would be just fine. It would simply mean everyone thought they could get a better deal elsewhere. — This of course is NOT how it is currently being done.)

So why do they? Mostly because most of what is taught as macroeconomics is wrong. The rest of it? Unfortunately, it a great way to control the rubes when they ask for a bigger slice of the pie.

Benedict@Large: many thanks for your reply. So the reasons are essentially political. I had a funny a feeling that would turn out to be the case.

Dear Bill,

[It’s a bit long so I’ll understand if it doesn’t pass moderation]!!

Why do children die unloved? This set me thinking in a (non-economist’s) motif around a MMT theme.

The built environment is an outcome of human creativity and the planetary eco-fabric, whereby humans use and transform natural resources for consumption and exchange; weaving the carpet of nature into new forms. The energy system that overlays and motivates this ‘real economy’ is an aspect of human energy: the balance sheet of transactions in such ‘money’. Money is just numbers; quantifiable but without intrinsic quality. Credits may be thought of as symbols, concretised units of this transforming and creative aspect of human energy, significant just so long as they are translatable in the real economy. This energy system has precedence over and is the pre-cursor of the real economy.

However it is ‘controlled’ the real economy and the crediting system follow this control.

Human energy does have qualities (or aspects Will, Love, Intelligence – I won’t focus on those), but instead contemplate its overall dynamic nature, expressed as direction. Basically this direction is towards fulfilment of the self, even if the means are altruistic. [One should really think about this statement and not just accept it: 1) because the longing for fulfilment arises from within and is a feeling – not subject to intellection – and can only be understood through feeling; and 2) the realisation is central to the improvisation here and allows anybody to look at what is happening on planet earth in an entirely new light]. If you disagree then I will not argue with you as I know your experience may be different. However what I have stated is a common experience and I sit fairly comfortably with it! This engine, for me at least – drives the world – there is also an ongoing debate about what the ‘self’ actually is.

One almost unchallenged formula extant in the world is that fulfilment is only available outside of the self, through interaction with the world, its people and resources – there are many formulas that are societal, political and religious born from this; therefore fulfilment becomes a competition between selves and the use of territory and resources. These formulas are reinforced daily in a dull media cycle; the newly born are soon conditioned to the times. The human engine is so powerful the end result is bloodshed.

The other extreme is that back and behind of everything, lies an Universal Energy that always was is and will be: the self is thought to have no ultimate reality, though within the human heart is a door to that which is actually Real (not temporary for example, like the moon, the stars, the sun and your job), hence fulfilment is a possibility: – however this is not the province of macroeconomics, and I have strayed (necessarily) far enough already.

Suffice to say that individual human energy is best controlled by each; and that I believe that at the wellspring of this energy is a quest. Collective expressions of human energy (quests) such as culture or civilisation belong to the collective – the only global collective and individual use of human energy on which most agree (although often forget to implement) is energy harmonised as harmlessness, freedom, respect, love, kindness, generosity etc. Collectively, the human energy engine is huge, impacting upon the entire planet. So, how does this apply to macroeconomics??

Well, basically my first point is you cannot discount human nature. The engine is greater than all of its parts, or ever-changing expressions like politics, religion, economics, psychology and football! Common sense says that things should be recognised for what they are, and compartmentalised for ease of use (but still consciously linked). The sky is blue, the earth is green, and we have feet of clay that seek food clothing and shelter as an anchor to our aspiration. It is generally the Intelligence (Activity) aspect of human energy applicable to macroeconomics. This aspect may be utilised for example by the self, or on the behalf of others. As noted above, both seek the same goal and are valid uses of energy. It is quite natural that we have a private sector and a public sector, and their offspring the not-for-profit sector. All arise if the above holds to be true, from the same wellspring. It is also quite natural that human energy expended in these sectors should seek realisation and require organisation, coordination and control of some kind; (preferably without wasting energy in intra/inter sectorial conflict).

Human energy is like music, whether expressed melodically, harmonically or in rhythm – always gravitating towards a centre; even when held atonal by force, or made chaotic, muted or held in tension, it will always seek out its key and work its way back towards resolution. In terms of creativity and destruction, human energy is causal, appropriated by the self generally as the motivating power of desire, aided and abetted by the intellect: in the economy, the consequent use and transformation of natural resources by sectors for consumption and exchange are an effect – (the credit system ensuing as MMT would have it, as a mere record of account).

Now, I do not think we can have a deficit or surplus of human energy – we have what we have at any given time; and the natural resources and eco systems are also allocated. The real economy and its transaction records are now global interchanges. From an human energy perspective, there is absolutely no reason why we could not industrialise, and create for ourselves the best in food, clothing, shelter, infrastructure, education, health, etc. that humans might sustainably aspire to, and resources hold in potential – all over the planet. It is just humans who prevent humans from enjoying this. We even have the Intelligence (activity) capability available to us in these modern times necessary to achieve it. The constraint is just unconsciousness: blind dull conditioning and thought patterns, and greed (blind desire); the misuse, disuse, refuse and abuse of human energy and aspiration. I know there is nothing new in all of this, but it is not accepted and intelligently acted upon. When selves compete they live in fear; when selves cooperate they live in peace. Regulations and Law keep selves from tearing each others throats out and are good – but ultimately peace has to come from human beings themselves. The epicentre of this miasma manifests in the real economy as MMT’ers tirelessly point out – in pleading there are not enough credits (numbers) to allocate to ourselves!! (children call this sharing). Beautifully Neanderthaloid! On the one hand I want to laugh; when children die and soldiers get blown to bits and I listen to the media I want to cry!

It is even vacuous: we ourselves are the source of our own prosperity; always have been. Science, politics, religion, economics, psychology – should celebrate the power of creativity and aspiration in human nature. Aspiring is the song of the human heart! The Intelligence (activity) aspect is meant to deliver that song – in the same way a musician touches a feeling within, and uses his knowledge, skills and the instrument to bring it alive. So much of the music extant in the world today is based on hate, confusion, anger and frustration. Doesn’t that say that there is something seriously wrong in our world?

It’s akin to saying reproduction is a function of algebra. Oh my God wouldn’t your partner complain if you started reciting formulas around something that is meant to be so simple and natural!

It is pathology that the Intelligence aspect is used to enslave and control, criticise and berate, pitting self against self instead of liberate and fulfil. It is Love that motivates a family to intelligently use all of their resources to assist a family member, no matter the cost. Love is the motivating energy and the Intelligence (activity) aspect simply the means of deliverance. Love the motivating power of the quest for self-fulfilment – it’s what we fall in love with that counts! The ‘love of money’ has long been favoured as the ‘root of all evil’. Since morality does not seem to be on the agenda these days, I prefer the modern expression as a ‘misuse of energy’. This should be hammered home in schools and parliaments – that is, if we are a “true human beings” as Blake penned it! Without the leavening energy of Love, Intelligence and ego together just produce a Dictator – alone just a well meaning Dreamer. Feeling is our most fundamental reality (as every child knows)!

It bunker-bombs this human, natural evolution in creative energy that strongly desires to establish harmonious living and welfare conditions on this planet – to tell anyone ‘WE CAN’T AFFORD IT’. What a reversed statement of stark blind arrogance and ignorance that was! Empty handed we come and empty handed we go – that is a truth; the quest for fulfilment in the human heart is another; with a fiat monetary system we could easily harness human energy and create those livings conditions that infuse our better nature – that is another! It has absolutely nothing to do with money and everything to do with who we are.

For myself, I am not holding my breath hoping human beings will globally give peace a chance. However, individually, it also comes down to use of our own human energy. The quest has always been the same; the world changes as people change, one by one. Each the musician in their own life and a player in the orchestra. To your own heart be true! The mind, like a parachute is of little use unopened; or caught up in distractions. So I guess all other points are the same as the first – we cannot discount, mark-up, or mis-price human nature. Or that universal energy which brought it into being. We can however, always ‘afford’ to be human and humane. We actually prosper thereby!!

Why do children die unloved?

Cheers,

jrbarch

The euro-dreamers are willing to throw 1/3 of their population under the bus in order build their tower of babel. They would rather have mass unemployment than currency reform.

I live in a MUD district in Texas. MUD is a political organization that came into being in order to allow developers the right to tax. In effect, the MUD district became its own small government…neighborhood sized. This is a perfect test case for Federalism, or pushing power down to the local level.

In the last 10 years, both the State and the City have attacked the MUD three times: 1) Installing low income housing by buying up land with false pretenses. This would have overloaded the school system, in effect transfering wealth from the MUD taxpayers to the City. 2) Installing low income housing for the eldery (we already have that, so it would have exceeded normal bounds). 3) Installing a Toll Road with no exit for the neighborhood. Fortunately, a local MUD member went found that out as well. In all three cases the City and State were rebuffed by the neighborhood government. The peoples will was expressed.

Government at local levels works for the People. Banking should work for the people as well. Sovereign banking and local government are flip sides of the same coin. Statism and Too Big to fail institutions skim wealth away from the productive, leading to the world we have where many go wanting. With power pushed down, and wealth reserved by the people (not transfered to statists or others who have gamed the system for skimming), then the People will use wisdom. Charity, and Love can be expressed more easily by The People, than by Goverment or Corporations or any other large entity that is self serving but lacks Human Compassion.

Dear REN

Thanks for your comment.

You said:

But you do not have currency sovereignty and you run a fixed exchange rate in someone else’s currency.

So who do you look to if a natural disaster wipes out your housing stock?

best wishes

bill

As even i myself have tried to emphasise again (With little regret.), and again, banks do not create the interest or the fees and charges into the money supply to pay down a loan when the principal of the loan is created.

The net effect is that the loans cannot be serviced into retirement because only the principal of the loan was created. The money to service interest is not created at that “Big Bang” moment of money/debt creation.

And what is more bizarre is that when the loan is retired, the principal is destroyed and ceases to exist in the current \”fractional reserve\” banking model.

It is more or less word for word from a blog i did recently highlighting Ellen Browns most recent article.

For me, these two elements help me to understand, not coming from an economics background.

A: Money is destroyed or uncreated when the principal of a loan is paid.

B: Money to pay the principal of the loan is created into the money supply, but not the money required to service the interest, fees and charges on those loans.

Here is a quote from a site i found recently which supports a peoples bank.

I hope it is edifying for the readers here.

http://peoplesbankparty.org/

The People’s Bank Party

We live in the age of technology and automation; we live in a country with huge natural resources; Australians are resourceful hard working people. We have everything we need to create a prosperous, environmentally conscious and people friendly country. Why are we going backwards? Why does Australia have huge levels of foreign debt, foreign ownership and crippling taxation. Why are Australian workers being stripped of hard won conditions and left with little job security. Why are Australian businesses finding it harder and harder to stay afloat. Why are so many Australians saddled with huge debt and uncertainty about the future. Why have young Australians been priced out of the home market.

The answer is simple. Foreign controlled private banks have hijacked the role of creating our money supply and our government be it Liberal or Labour does nothing about it. Australia is run for the benifit of International Bankers and their associated soul-less Trans-national Corporations and not for the benifit of the Australian people.

The People’s Bank Party has been created to bring about the most important political reform in Australia’s history. That is to bring about a democratically elected people\’s government which creates the money supply for our country.

The name “People’s Bank Party” has been used to draw attention to the once proud history of the Commonwealth Bank of Australia which in its early days conferred huge benefits upon the Australian people and came to be affectionately known as “The People’s Bank”.

In 1911 the Andrew Fisher Labour Government established the government-owned Commonwealth Bank. Under the management of Sir Dennison Miller, the “People\’s Bank” financed Australia’s effort in World War I, built the Transcontinental Railway, established the Australian Steamship company and conferred many other benefits on the Australian people. All of this was achieved without the government having to increase taxes or borrow from overseas. The People\’s Bank created the money using the \”whole of the resources of Australia\” as backing for that money. In contrast to this Great Britain which financed it’s World War I effort by borrowing from private bankers was still paying off it’s WWI debt in the 1990’s.

\”In the Australian Press of July 7, 1921, Sir Dennison Miller is reported to have said this:-

\”The whole of the resources of Australia are at the back of this bank, and so strong as this continent is, so strong is this Commonwealth Bank ……Whatever the Australian people can intelligently conceive in their minds and will loyally support, that can be done.\”

In other words, that which is physically possible can be made financially possible.\” (1)

In 1924 the Nationalist Party government lead by Sir Stanley Bruce appointed a board of directors to the Commonwealth Bank which favoured the foreign-controlled private banks. This was effectively the end of the “People’s Bank” and the Australian people went on to suffer greatly from the effects of the Great Depression.

In 1929 the Great Depression was intentionally caused by the international bankers. They did this by reducing lending which caused a reduction in the money supply to a level at which the economies of the world could not function properly. There was plenty of demand for food, goods and services, and there was plenty of productive capacity in the form of factories, farms, willing workers and willing business people, however, there was not enough money in the economies to match up the supply with the demand.

In the words of U.S. Congressman Louis T.McFadden talking about the Great Depression:-

\”It was not accidental. It was a carefully contrived occurrence… The international bankers sought to bring about a condition of despair here so that they might emerge as rulers of us all.\”

If Sir Dennison Miller had still been the manager of the Commonwealth Bank he would have injected enough money into the Australian economy to keep it functioning healthily and thus Australia would have avoided the ill effects of the Great Depression.

In 1937 after 2 years of enquiry the Australian Royal Commission on Money in Section 504 of its report stated:-

\”….the Commonwealth Bank can lend to the Government or to others in a variety of ways, and it can even make money available to the Governments and to others free of any charge…\”

As this last clause led to a good deal of controversy as to its exact meaning, Mr. Justice Napier, Chairman of the Commission, was asked to interpret it, and his reply, received through the secretary of the Commission (Mr. Harris) was as follows:-

\”This statement means that the Commonwealth Bank can make money available to Governments or to others on such terms as it chooses, even by way of a loan without interest, OR EVEN WITHOUT REQUIRING EITHER INTEREST OR REPAYMENT OF PRINCIPAL.\” (2)

You might think that this should have heralded a new beginning for the \”People\’s Bank\”, however, C. Barclay-Smith had this to say in his book \”It\’s Time They Knew\”:-

\”The personnel of these Royal Commissions were mostly men in the fifty-sixty age bracket. they were men who had built up successful careers in industry, law, accountancy, and commerce. …………They had all personally done well under the financial system they were asked to inquire into………… They were pledged to the preservation of the status quo. ………….It is no reflection on the honesty of the men………..that their reports for the most part white-washed the prevailing financial and monetary system.\” (3)

C Barclay-Smith is not so kind to the politicians:-

\”…..finance is all-powerful. It controls the Press (by overdrafts) also the radio, the T.V., all means of dissemination of knowledge in fact, and is in a position to make and break anyone who dares to challenge and expose its power. Most politicians quickly learn that if they are going to \”get on\” , the simplest policy is to play safe, conform to orthodox practices and procedures, and \”don\’t stick one\’s neck out\”. (4)

King O’Malley, who had been instrumental in the formation of the Commonwealth Bank, wrote the following during the 1939 ‘Save The Commonwealth Bank Campaign,’ when he was over 80 years of age:-

“I trust that good and patriotic Australians will swear by the altar of their gods, the tombs of their ancestors and the cradles of their children, that they will never vote for Parliamentary candidates whose secret mission is to destroy the Commonwealth Bank … and whose brains, if extracted, dried and placed in the quill of a cocksparrow and blown into the eye of a bee, would not even make him blink.”

In 1947 the Ben Chifley Labor Government tried to re-establish the “People’s Bank” by nationalising the private banks. This effort was defeated by the High Court.

In 1991 Labor Prime Minister Bob Hawke put the final nail in the coffin of the “People’s Bank” by starting the privatisation of the Commonwealth Bank. Paul Keating continued in 1993 and John Howard finished the job in 1996. Since then the burden of taxation, foreign ownership and foreign debt has continued to get worse while Prime Minister Howard continues to sell off our Nation.

At present about 97% of our money supply is created by the private banks which are not controlled by Australians. Our economy is being run for the benefit of international bankers and their associated multi-national corporations. The proof of these claims is in the fact that Australia has huge levels of foreign debt and foreign ownership. We are constantly told we need foreign investment. This is and always has been a complete hoax. The only thing we receive from foreign investment is perhaps some pieces of paper or some digits on a computer screen. The real investment is Australian people-power, know-how and raw materials.

Only by giving the role of creating the money supply to a people’s government will we be able to ensure that the money supply is used to guarantee a prosperous, environmentally conscious and people friendly economy. Only then will all Australians, present and future, be able to have a “fair go” in what used to be called the “Lucky Country.”

Why the People’s Bank Party?

Money plays a central role in most of our activities. It lies at the heart of all political policies. Our present money supply system is responsible for so many of the country\’s economic, social, political, environmental, medical and other problems that only a reform of the money supply system itself has any hope of addressing them. Without reform of the money supply system, any other political reform will never go anywhere near solving these problems.

If you think that all the money in the Australian economy was created by government agencies (the Australian Mint and/or the Reserve Bank of Australia) in the form of notes and coins, you are sadly mistaken.

At the present time, about 3% (or 3 cents in the $1) of the money in the Australian economy was created by the government. The remaining 97% (or 97cents in the $1) was created by the private banking system.

Bank-Created Money

Go into a bank for a loan and you might think that the money that you borrow is some fellow customer\’s hard-earned savings. It is not. Banks do not lend cash when they grant you a loan. Instead they grant you credit. This credit can be spent like cash and to all intents and purposes it is as good as and exchangeable for cash. Money is created out of thin air like this by the private banking system not only when they lend to private individuals, but also when they lend to businesses and to the government.

The banks have been able to extend their money creation to its present 97% of the total money supply because in today\’s economy, with increasing use of credit cards, debit cards, cheques and bank transfers, very little of the money that we use, either as individuals or as organisations, exists in the form of cash.

Our Constitution provides for our government to create money but the “Founding Fathers” probably did not foresee the explosion in bank credit and the cashless society.

Little Cash Needed

Banks only need to retain very small reserves of government-created money (cash) in order to meet the dwindling demand for cash. The rest of the time, they happily pass cheques and similar payments between each other which are \’backed\’ by nothing more than a ledger or computer entry in the form of somebody\’s debt.

Bank-created money is responsible for most of the economic problems that occur within Australia and throughout the world. Three of the problems are as follows:-

1. Government Borrowing

Most governments throughout the World have massive borrowings from private banks called the National Debt. This may seem odd in view of the fact that most governments have the power to create money for use in their economies. Perhaps the reason is that organisations (e.g. banks) which can create money are in a very good position to influence your average politician.

The government then has to tax the people to pay the interest on the National Debt and also to repay the loan to the private banks.

The Australian government has recently proudly announced that it has paid off the National Debt. This is not necessarily a good thing. Without a deficit the money supply may not be sufficient to ensure a healthy economy. Those countries which have run large deficits in recent times have tended to have the greatest economic prosperity. This is due to the abundant supply of money in their economies. In Australia the money short supply resulting from repayment of the National Debt has been overcome by:- 1. Selling off Australia’s National assets; 2. A massive increase in foreign debt and foreign ownership resulting from foreign investment (also a selling off of Australia); 3. Over-taxation of the Australian people including the introduction of the G.S.T.; 4. Degradation of services supplied by the government including Health, Education, Transport etc.

The fact is that the Australian people would be better off with a large National Debt. They would however be much better off if the government, instead of borrowing, would create the money supply and spend it into the economy in the form of capital works government services, and social security payments.

2. Boom and Bust Business Cycle

There is little control over how much money the banks create. The only influence that the government has upon the process is through appointing the members of the Reserve Bank Board. The Board in turn attempts to control the level of borrowing and therefore the amount of money created by the banks by raising or lowering interest rates. If the Board believes there is so much money being created that inflation becomes a problem, interest rates are raised so people borrow less. The trouble is that raising interest rates itself causes inflation, so inflation is only controlled when businesses start going bankrupt and when householders get their homes repossessed.

If too many people experience financial difficulties and the economy heads into recession, interest rates are lowered and the whole boom-and-bust cycle begins again. This \’natural\’ economic cycle is often referred to by politicians and economists, but there is nothing natural about it. It is caused by our reliance upon an unstable money system, and it can cause great hardship for people as businesses close and homes are repossessed. The boom and bust cycle is also intentionally used to bring about a transfer of wealth from the productive section of the community (e.g. manufacturers, farmers and businesses and workers who provide useful services to the community) to the unproductive banking class.

3. An Unrepayable Debt

As anyone who has ever borrowed money will know, the amount of money required to pay off an interest-bearing debt is always greater than the debt itself. So imagine that all (100%) of the money in the economy was in the form of an interest bearing-debt. Let us assume that we have to pay interest on this for a given period at 5%. We will need 105% of all the money that we have. This is an impossible sum as we cannot have more than 100% of the total!

The amount of interest-bearing debt money in the Australian economy is 97%, which is very close to 100%. Therefore the amount of money required to repay all of Australia’s debt plus interest is greater than the amount of all the money in the economy. Because of this problem of unrepayable debt, Australia and in fact the whole World is forced into the situation where there is only enough money available to sustain a functioning economy if and when the size of the economy continues to grow. With a growing economy, more money is continually being borrowed into existence, thus enabling the continued servicing of the already existing debt. If the amount of debt remained stable the payment of interest would cause the amount of money available in the economy to decrease, which would lead to an economic slowdown. This addiction to economic growth results in the environmental degradation we all see.

The Choice to be made.

Australia has to make a choice between two alternatives:-

1. Allow the government to continue selling off Australia’s assets, continue the massive increase in foreign debt and foreign ownership, continue the degradation of government services, continue over-taxing the Australian people and continue the mad commitment to economic growth at the expense of the environment, or:

2. We can replace our interest-bearing debt-based bank-created money system with a debt-free system of money created by the people’s government. This money would then be spent into circulation by paying for capital works (e.g. environment protection works, dams, water diversion projects, roads, hospitals, schools, railways, renewable power generation, defence assets, land regeneration, cultural assets etc.) government services and social security payments. This would dramatically reduce the need for taxation which in itself will greatly increase prosperity. It will put an end to the selling off of our nation and guarantee that government services such as health, transport, education etc. are supplied according to the needs of the community and not according to how much money is made available by the private banks. Productive members of the community will get to keep the rewards of their hard work and initiative, instead of slaving to pay interest and constantly worrying about how they will keep up the bank payments should there be a downturn in the economy or should they lose their job.

This is not a new idea, although it gets little attention in the mainstream media. This is hardly surprising considering the consolidation of the media into a few corporations and the dependence of those corporations upon the banks..

Abraham Lincoln proposed this system in 1865 shortly before his assassination in the following words:-

\”The government should create, issue and circulate all the currency and credit needed to satisfy the spending power of the government and the buying power of consumers. The privilege of creating and issuing money is not only the supreme prerogative of government, but it is the government\’s greatest creative opportunity. Money will cease to be master and become the servant of humanity. Democracy will rise superior to the money power.\”

ooo0ooo

\”All that is necessary for the triumph of evil is that good men (and women) do nothing.\” Edmund Burke.