In an early blog post - Inflation targeting spells bad fiscal policy (October 15, 2009)…

RBA loses all credibility with further interest rate increases

Yesterday, the Reserve Bank of Australia lifted the interest rate target for the ninth consecutive time (they didn’t meet in January) claiming that they had to do this to stop inflation accelerating and restoring price stability. Except inflation already peaked in the March-quarter 2022 as a result of the driving factors abating. Further, none of the major driving factors are remotely sensitive to domestic interest rate movements. The RBA’s excuse is that there are dangerous domestic demand pressures that need to be curtailed. Except the evidence for that claim is lacking. Most of the demand measures are in retreat. So what gives? Well there is a massive income redistributing being engineered by the RBA from poor to rich and if they keep going unemployment will certainly rise, in part, because the lame Australian government is claiming it has to engage in fiscal restraint to ensure the RBA doesn’t hike rates even more than they are. It would be comical if it wasn’t damaging the prosperity and solvency of tens of thousands of the most vulnerable Australians. Disgraceful.

In the official – Statement by Philip Lowe, Governor: Monetary Policy Decision (February 7, 2023) – we read:

1. “Global inflation remains very high. It is, however, moderating in response to lower energy prices, the resolution of supply-chain problems and the tightening of monetary policy” – note there is no coherent or robust statistical modelling that shows that the ‘tightening of monetary policy’ has caused any moderation in the inflation rate. That is just an assertion from the RBA to

2. “Global factors explain much of this high inflation, but strong domestic demand is adding to the inflationary pressures in a number of areas of the economy” – the RBA has assertion as its only defence but even its own data cannot support the claim that there is strong domestic demand pushing up inflation. I will come back to this.

3. “Inflation is expected to decline this year … Medium-term inflation expectations remain well anchored, and it is important that this remains the case” – so there is no case that can be made that the current inflation is morphing into a drawn out structural type episode with a wage-price spiral feeding self-fulfilling expectations.

The RBA gives us the impression that it will decline when the reality is that inflation is already declining and the trend both globally and locally has been downwards for some months.

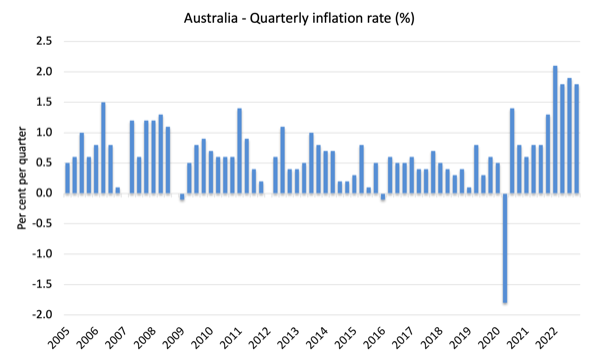

I recently analysed the latest CPI data from the Australian Bureau of Statistics (ABS) in this blog post – Australia – quarterly inflation rate declining

(January 25, 2023) – which showed the the inflation rate is now falling from a peak earlier in 2022.

The following graph shows the quarterly inflation rate since the December-quarter 2005.

4. “The central forecast is little changed from three months ago, with GDP growth expected to slow to around 1½ per cent over 2023 and 2024 … The central forecast is for the unemployment rate to increase to 3¾ per cent by the end of this year and 4½ per cent by mid-2025.” – digest that for a moment.

It means that the unemployment rate will rise significantly over the next two years.

Using the Okun rule of thumb – where the change in the unemployment rate is equal to the difference between actual GDP growth and the growth in the labour force and labour productivity – we can roughly compute what a 1.5 per cent annual GDP growth rate will render in unemployment terms.

Since January 2000, the annual labour force growth rate has averaged around 1.83 per cent per annum.

Since the March-quarter 2000, annual labour productivity growth has averaged around 1.25 per cent per annum.

So for the unemployment rate to remain unchanged, annual real GDP growth should average around 3.1 per cent (give or take).

The current unemployment rate in Australia is 3.5 per cent.

So if the RBA’s forecast of a sustained GDP growth rate of 1.5 per cent over the remainder of this year and all of 2024, then the unemployment rate will be around 6.7 per cent by the end of 2024.

This is a ballpark figure but certainly the days of relatively low unemployment are being deliberately undermined by RBA policy.

For the RBA’s ‘central forecast’ of 4.5 per cent by mid-2025 to be realistic, then some weird labour supply behaviour would have to occur (like a dramatic fall in the participation rate) and/or a collapse in productivity growth.

It is amazing that the Governor and his Board of unelected and largely unaccountable members blithely just dismiss all this.

5. “Wages growth is continuing to pick up from the low rates of recent years and a further pick-up is expected due to the tight labour market and higher inflation … the Board will continue to pay close attention to both the evolution of labour costs” – as I show later, this is nonsensical.

Wages growth is moderate and delivering significant real wage cuts and unit labour costs are in decline.

The so-called ‘tight labour market’ is also being vandalised by the RBA.

6. “The Board recognises that monetary policy operates with a lag and that the full effect of the cumulative increase in interest rates is yet to be felt in mortgage payments” – the fact is that the RBA Board has little idea of the lag structure of the impacts of its interventions.

It doesn’t know:

– when the impacts occur over time.

– the quantitative impact – there is plausible evidence that interest rate rises push inflation up due to the short-term impact on business costs.

– further, it has no knowledge of the distributional impacts – creditors gain, debtors lose. What is the net impact? The RBA hasn’t a clue.

7. “Some households have substantial savings buffers, but others are experiencing a painful squeeze on their budgets due to higher interest rates and the increase in the cost of living. Household balance sheets are also being affected by the decline in housing prices.”

This is where things get pointed.

The appeal to ‘household savings buffers’ – is the RBA’s suggestion that spending may not collapse because households can absorb the higher mortgage costs by drawing down their savings.

Think about that.

The RBA is happy to deliberately destroy the wealth of households (by forcing them to liquidate their savings), while at the same time redistributing massive income gains to banks and their shareholders, who are arguably already at the top end of the wealth distribution.

That juxtaposition is obscene in my view.

Further, household debt is at record levels, in part because of the fiscal squeeze in the late 1990s into the 2000s up to the GFC.

The RBA regularly used to lecture us about how this is not a problem because the wealth embodied in housing values was, in part, offsetting the growth in indebtedness.

That justification is waning as the RBA is systematically wiping value of housing in Australia.

The latest data shows that home values have declined by 8.4 per cent in the 12 months leading up to January 2023. That decline continues.

And what about that demand boom the RBA claims is driving domestic inflation?

In its – Graphs on the Australian Economy and Financial Markets (released February 8, 2023) – we learn that:

– Private dwelling investment has declined in the last quarter of 2022.

– Residential building approvals are falling sharply.

– Consumer sentiment has collapsed.

– Business investment in productive capacity has declined significantly in late 2022.

– Capacity utilisation is falling.

– Unit labour costs fell sharply in the last two quarters of 2022.

Where are the demand pressures?

Certainly not in the retail sector.

Last week (January 31, 2023), the ABS released the latest – Retail Trade, Australia – for December, which was updated on February 6, 2023 to include more information.

The following graph shows the monthly growth in retail sales in Australia since January 2021.

There was some wide fluctuations as Australia came out of the lockdowns.

December is usually a strong month because of xmas but sales contracted significantly in December 2022 (partly because a lot of cash was spent on so-called Black Friday splurges in late November, which is one of the American capitalist cultural practices Australia has unfortunately followed).

This is a particularly odious period of policy making in Australia (and around the world bar Japan).

Central bankers are claiming they have the only tool that can suppress inflation but the evidence is that the inflation has been driven by factors that are not remotely sensitive to interest rate movements and are resolving on their own as the transitory circumstances that drove them are waning.

So what the hell is the central bankers doing?

Well:

1. They are engaging in a massive redistribution of income to the rich from lower income mortgage holders.

2. They are destroying the saving buffers that households have built up to better manage their own risk.

3. They are pushing some households to mortgage default which in a housing market that is in decline will see negative equity rising and homes lost.

4. They are deliberately enacting policy to push the jobless rate up and add further misery to households.

For what?

And what is the Government’s response to all this?

Lame to say the least.

Yesterday, the Treasurer told the Australian people that the rising interest rates meant that fiscal policy had to be restrained this year.

Can you believe these guys?

He told the Parliament yesterday that:

I think we understand in this place, certainly the Australian community understands, that the Reserve Bank makes these decisions independently and it is not our job in this place to interfere or to second guess their decision making or pressure them in any way.

So, classic depoliticisation.

The elected officials who are accountable to the voting public are happy to allow a central bank board, which they appoint under their legislative authority, to inflict pain on normal Australians and take their incomes and redistribute them to the rich.

That is one of the ultimate shams of neoliberalism.

The Treasurer actually under the legislation has the authority to overturn RBA decisions any time they want.

A responsible government at this time would invoke that power given the caprice that the RBA is engaging in.

Further, the RBA Governor’s current seven-year term ends in September 2023 and I urge the government, who appoints the RBA governor and its board, to send him on his way.

He has been an abject failure and his performance now, as he inflicts pain on low income mortgage holders who just before the hikes began he was urging to borrow up big, is beyond the pale.

Remember the RBA governor continually told us that rates would not rise until 2024 and that pushed households to borrow heavily (many beyond feasible limits given the greed of the banks).

Now, he is inflicting pain on those same households who had followed his earlier advice.

Punishment? He continues to receive an annual salary of $A1,076,209 (as at August 2022).

Disgraceful.

MMTed and edX MOOC – Modern Monetary Theory: Economics for the 21st Century – enrolments now open

MMTed invites you to enrol for the edX MOOC – Modern Monetary Theory: Economics for the 21st Century – is now open for enrolments.

It’s a free 4-week course and the course starts on February 15, 2023.

For those who have already completed the course, there will be some new material in Week 4 to cover the current inflationary situation and the conduct of monetary and fiscal policy.

Further Details: https://edx.org/course/modern-monetary-theory-economics-for-the-21st-century

Starts next Wednesday!

Music – Jackie Mittoo

This is what I have been listening to while working today.

This is the second track – Drum Song – from the the album – A Tribute to Reggae’s Keyboard King – Jackie Mittoo – Interpretations and Improvisations – which was released on March 16, 2004.

The artist providing the interpretation is Jamaican pianist – Marjorie Whylie – who was the musical director for the Jamaican National Dance Theatre Company for 45 years as well as being in several bands in Kingston over the years.

The original version of the track was from the legendary Jamaican keyboard player – Jackie Mitto – who is one of my favourite organ and piano players.

He was a Jamaican ska star who died of cancer at the age of 42 before his full potential was realised.

Like a lot of Jamaicans he migrated to one of the richer Commonwealth nations (Canada) and died there.

But what he left behind is magic.

He was a founding member of the famous band – The Skatalites – and a musical director at Clement ‘Coxsone’ Dodd’s – Studio One – record label.

One commentator who was summarising Jackie Mittoo’s contribution said (Source):

Without Jackie Mittoo … there would be no reggae. He was an integral part of the Skatalites and the whole creation of rock steady. The evolution from rock steady to reggae is Jackie Mittoo. Is him really create reggae and even the piano skank on the rock steady bassline dem, is Jackie Mittoo. I don’t know if we can ever pay back Jackie Mittoo for what he did for Jamaican music.

Quite a statement.

This original version of – Drum Song – was released on the 1968 album (Track 12) – Evening Time by Jackie Mittoo & The Soul Vendors.

The Soul Vendors were Clement Dodd’s studio band who later became the ‘Sound Dimension’. It included all the great players at the time –

1. Roland Alphonso – tenor sax.

2. Johnny ‘Dizzy’ Moore – trumpet.

3. Lloyd Brevett – trumpet.

4. Hector ‘Bunny’ Williams – drums.

5. Errol Walters – bass.

This is Rocksteady at its best. Both the interpretation and the original are genius.

That is enough for today!

(c) Copyright 2023 William Mitchell. All Rights Reserved.

The RBA is doing what it has been designed to do as an aristocratic institution inimical to labour. That Australians elected representatives allow this terrible arrangement to persist is an indication that they do not have working people’s best interests in mind, but rather those of their donor class.

As you point out, Bill, the depoliticization is cover for an abdication of responsibility on the part of elected representatives.

ISTM that what the Western central banks are doing now is maintaining a dirty peg to the US dollar – ostensibly to avoid further ‘imported’ inflation.

In which case why bother with a floating rate at all?

This is another failure of the monetary policy fad. They can’t shift the costs due to changes in terms of trade from ‘needed’ imports to ‘luxury’ imports. Instead all they can do is try to prop up financial exports by maintaining interest differentials.

This is a major policy concern for those of us in countries that are not burdened with the ‘global reserve currency’. We need to move the policy from relying on excess financial exports to allowing the exchange rate to suppress excess luxury imports as it is supposed to.

There are no “independent” central banks in Japan and China: they respond to the government.

In the west, central banks are very far from “independent” too.

Through outright corrupt means, the elites achieved to take control of central banks to their interest.

How was that?

By taking control of the main and centralistic political parties, that don’t even question the status quo: they all think alike.

By taking control of the media, including public broadcasting.

By taking control of the judicial arm of the state (trying to keep the facade of neutrality, for class peace purposes).

@Neil Wilson I’m sure you’re right that it is about fixing the exchange rate. It’s not mentioned by, for instance, the BofE. They let the media do the work of leading the fake cries of pain whenever the £ loses value, but never mention a, usually slower, return to the previous rate against say the Euro. And no-one will ever try an analysis of just how much impact there is on prices as a result of a currency change and how much is absorbed by importers, or results in substitution when they can just associate a currency fall with a price rise. There is also the need to enact monetary policy to show that it works, as Bill says, ignoring the difference between correlation and causation, and the wealth transfer which is the name of the game for our elites. Presently I’d also say that putting up interest rates, and thus penalising renters and mortgaged workers is also aimed at forcing workers to call strikes off and settle for whatever pittance the boss says is ‘affordable.’ It’s a double shafting for workers, hit by higher housing costs and hit by pitiful wage increases. The BofE boss wouldn’t last 2 minutes of ‘independence’ if he wasn’t playing the policy tune of the Treasury.

Next federal election the ALP will be slaughtered by the Coalition because they allowed interest rates to rise.

That’s how stupid the average Australian is and why this country is so easily exoploited by the elites.

Terriffic commentary Dr Mitchell!

“Wall Street” remains one of my favourite Mittoo tracks. Fabulous artistry.