In the annals of ruses used to provoke fear in the voting public about government…

Australia – inflation declines sharply

Today (June 28, 2023), the Australian Bureau of Statistics released the latest – Monthly Consumer Price Indicator – which covers the period to May 2023. On an annual basis, the monthly All Items CPI rate of increase was 5.6 per cent down from 6.8 per cent. There is some stickiness in some of the components in the CPI but overall inflation peaked last year and is now declining fairly quickly as the factors that caused the pressures in the first place are abating. I doubt that any of this decline is due to the obsessive interest rate hikes by the Reserve Bank of Australia. Anyway, a quick analysis of the data then some discussion of the British teachers’ pay dispute, the latest Australian Covid numbers (worrying) and some music to cheer us all up after the economics. The overwhelming point of today’s data is that this period of inflation is proving to be transitory and did not justify the rate increases. It was a supply-side event and trying to increase unemployment to kill off spending (demand) will just leave an ugly legacy once those supply-side factors abate (which they are and were always going to).

Inflation decline sharply in Australia

Here is the headline from the national broadcaster today:

The last three months have recorded the following CPI changes:

1. March 2023 – increase of 0.77 per cent.

2. April 2023 – increase of 0.68 per cent.

3. May 2023 – a decline of 0.25 per cent

So we have deflation in the May result.

This new experimental monthly series from the ABS only covers about 60 per cent of the items that appear in the more detailed quarterly release, although the ABS noted that it “is continuing to improve the monthly CPI indicator where possible and has added a new monthly series for electricity prices in the indicator”.

So as time passes, the indicator will get closer to the more accurate standard quarterly measure.

However, as it stands, it still provides good information for assessing where the inflationary pressures are heading.

The ABS Media Release (June 28, 2023) – Monthly CPI indicator annual rise of 5.6% in May 2023 – noted that:

This month’s annual increase of 5.6 per cent is the smallest increase since April last year. While prices have kept rising for most goods and services, many increases were smaller than we have seen in recent months.

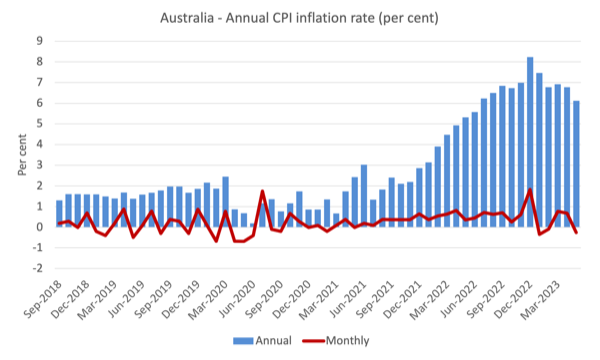

The next graph shows, the annual rate of inflation is heading in one direction – down and quickly.

The blue columns show the annual rate while the red line shows the month-to-month movements in the All Items CPI.

1. In December 2022, the annual rate recorded was 8.2 per cent.

2. In January 2023, the annual rate was 7.5 per cent.

3. In February 2023, the annual rate was 6.8 per cent.

4. In March 2023, the annual rate was 6.9 per cent.

5. In April 2023, the annual rate was 6.8 per cent.

6. In May 2023, the annual rate was 5.6 per cent

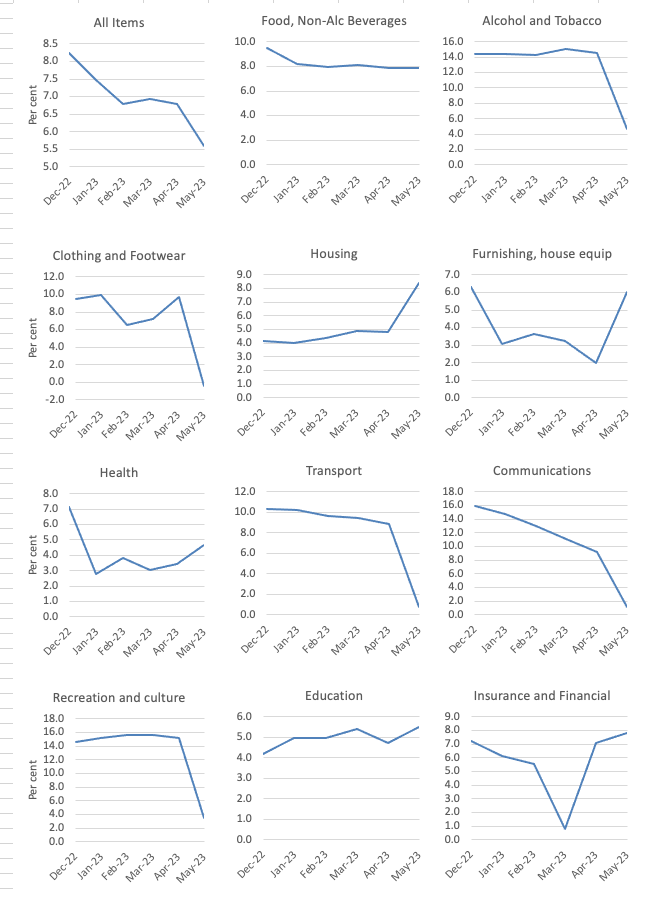

The next graph shows the movements between December 2022 and May 2023 for the main components of the All Items CPI.

In general, most components are seeing dramatic reductions in price rises.

The housing price rises are to some extent due to the on-going supply shortages, which are impacting new dwelling construction costs.

But the significant component here are rental increases.

And here the impact of the RBA’s interest rate hiking escapade is evident – in the opposite direction to their claims.

As they hike, the landlords are passing on the higher mortgage costs to the renters. In a tight rental market they are able to push rents up to not only compensate for the rate hikes, but then some.

It is a massive fail by our central bank.

Fight inflation by causing it!

And the financial sector is back in town with massive profit seeking – the insurance price rises were “the strongest annual rise on record reflecting higher premiums for house, home contents, and motor vehicle insurance.” No other explanation than profit gouging.

But overall, the inflation rate is declining as the supply factors ease.

There are no great schools without great teachers!

The – School Teachers’ Review Body (STRB) – is the British public body that “makes recommendations on the pay, professional duties and working time of school teachers in England and reports to the Secretary of State for Education and the Prime Minister.”

It is advisory only and is funded by the Department of Education.

Each year, the STRB makes recommendations, after receiving submissions from various interested parties, on the annual pay rise for British teachers.

The heading comes straight from the British government’s submission to the School Teachers’ Review Body (STRB) – Government Evidence to the STRB – which was published on February 21, 2023, as part of the deliberations for the 2023/24 pay round.

As in any sector, the quality of the workers is crucial for success.

The British government also noted that:

Teaching should be recognised as the important, highly qualified and essential profession that it is, and teachers’ pay should reflect that. Teachers are the single biggest in-school factor affecting pupil outcomes1 and pay is one of the most effective ways that the Department can invest in teachers.

Again, I concur.

But the grand plans to improve the lot of the British teacher then gave way in the narrative to questions of “affordability”.

In the – Autumn Statement 2022 – delivered by the Chancellor on November 17, 2022, the Government committed the following nominal sums to the “core schools budget”:

- 2022-23 – £53.8 billion

- 2023-24 – £57.3 billion

- 2024-25 – £58.8 billion

The nominal growth will not be sufficient given the current and projected inflation rate to even preserve the real value of these outlays much less expand the value over time.

This is despite the Government recognising the “higher costs that schools are facing”.

However, they asserted that ” the cost of each year’s teacher pay award, in mainstream schools, special schools and alternative provision, needs to be covered from the total funding available through the core schools budget.”

As a consequence of this ‘artificial’ financial constraint being imposed on the outcome, the Government recommended to the STRB:

The Department’s view is that an award of 3.5% (3% awards for experienced teachers, plus awards to raise starting salaries to £30,000) will be manageable within schools’ budgets next year, on average, following the additional funding provided at Autumn Statement.

Although, they added an additional caveat that higher than expected energy costs would further reduce the scope for pay rises.

After a wave of industrial action, the Government offered a 4 per cent rise with an additional £1,000 one-off payment.

However that offer would still see a massive real wage cuts for British teachers.

At present, Britain is in the grip of industrial action after the NASUWT (The Teachers Union) members rejected the Government’s pay offer.

In terms of the previous government decision (2022-23), there were already massive real wage cuts – around 7 per cent in real terms in the 2022-23 round.

Since 2010, the real pay cuts have amounted to 23 per cent (Source).

For example, the NASUWT calculates that for the lowest paid teacher (M1 classification) on £28,000 per year, their pay would have been £33,321 had the pay been indexed to the inflation rate since 2010.

The cumulative real loss in pay over the period of this government (since 2010) for that worker is £35,801.

Similar outcomes occur (in proportional terms) across the entire pay scales.

The NASUWT contend that the last pay outcome represented the “largest real-terms pay cut suffered by teachers since 1977”.

So those introductory words from the government are rather hollow.

The unions want an ‘inflation-plus pay rise’ – the NEU, for example, want a 6.5 per cent rise (although there are four relevant unions).

Such a rise would be insufficient to maintain the real value of the pay.

This is one issue that we would expect a Labour government to be on the side of the teachers after the 13 years of Tory attrition to their living standards.

After all, Labour is the party of the workers, n’est-ce pas.

Ce n’est pas!

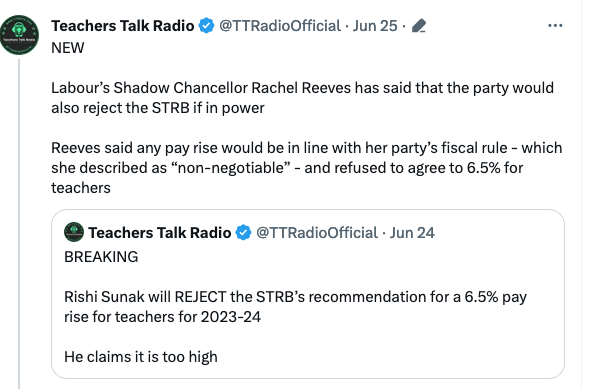

The Teachers Talk Radio Twitter account has been following the industrial campaign in the UK and recently tweeted (June 25, 2023) the following statement from Labour’s Shadow Chancellor Rachel Reeves:

Reeves added that:

I’ve also always been very clear that Labour’s fiscal rules are absolutely non-negotiable.

But unlike the Conservatives, myself and my colleagues would sit down with workers in the NHS, in our schools and negotiate, whereas this Government refuses to do that.

Ce n’est pas!

Labour will likely win the next general election but will not provide much hope for the British people.

I imagine I will once again scrutinise the new (old) fiscal rule they are going to run with as we get closer to that election.

But by converging with the Tories on mainstream macroeconomic fictions, the future is not bright for the country much less the teachers.

Remember ‘There are no great schools without great teachers!’ and the British government and the Opposition are doing their best to ensure the standard of education in Britain continues to degrade and the consequences will eventually reveal themselves to be devastating for the country.

At a time when the nation should be redefining itself after Brexit, the political class is intent on sticking to the same austerity bias that has blighted the capacity to progress.

Latest Australian Covid data

A new wave is underway in Australia and the death rate has risen recently.

We used to freak out when traffic fatalities exceeded 1,000 deaths per year.

Recently, the traffic authorities published the road traffic death toll for the 12 months to March 2023 – 1,204 nationally (a rise of 5.9 per cent).

That caused some alarm.

Yet, there is almost silence when the Covid data is released.

The Australian Bureau of Statistics released the latest Covid data today (June 28, 2023) – COVID-19 Mortality in Australia: Deaths registered until 31 May 2023 – which tells us that in the 12 months to March 2023, Covid has killed 7,308 Australian citizens.

The ABS notes that “The number of deaths occurring in April and May 2023 is not reflective of the true total and will increase as additional death registrations are received by the ABS.”

Of the 14,289 deaths from Covid since the onset of the pandemic, 10,166 died from the illness in 2022, as restrictions were abandoned and people pretended the pandemic was over.

Why do we freak out about 1,000 road accident deaths but are oblivious to a death incidence of around 8 times that from a serious respiratory disease.

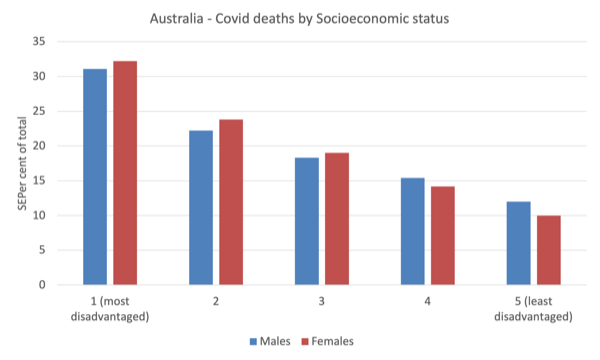

The other issue that today’s data release reveals is that poorer people are more likely to die from Covid than those in better-off socioeconomic circumstances.

The ABS note that:

The number of people who died due to COVID-19 was nearly 3 times higher in those in quintile 1 (most disadvantaged) than those in quintile 5 (least disadvantaged).

Like many diseases, the lower-income citizens bear the brunt.

I currently share Australian Research Council funding to investigate the spatial and demographic impacts of Covid in Australia and the question as to why poorer people are more likely to die from the disease will be part of the exploration.

The following graph shows the proportions of the cohorts dying from Covid across the five quintiles in the SEIFA – which is the ABS index for socioeconomic advantage.

Music from the late Shake Keane

This is what I was listening to this morning as I worked.

Ellsworth McGranahan “Shake” Keane – was a flugel horn player from a jazz tradition who in his later years worked with some of the hottest reggae musicians (30 May 1927, Kingstown, St Vincent, West Indies – 11 November 1997, Oslo, Norway) was a jazz musician, poet and government minister. He is most well known today for his role as a jazz trumpeter, principally his work as a member of the ground breaking Joe Harriott Quintet (1959-1965).

His nickname ‘Shake’ is a shortened version of Shakespeare, which he inherited during his school days because he loved reading and poetry. He was also known as a successful poet and when he left St Vincent in 1952 at the age of 25 for Britain he gave poetry readings on BBC radio.

His first big band was the ‘free jazz’ band led by – Joe Harriott – which prospered from Shake’s great capacity to improvise ‘outside’.

Here is an – Obituary – following his death in 1997.

This track – Prague 89 – is part of his collaboration with English poet Linton Kwesi Johnson and the Dennis Bovell Band (featuring drummer Jah Bunny and guitarist John Kpiaye).

It was released on the LKJ Label in 1991.

That is enough for today!

(c) Copyright 2023 William Mitchell. All Rights Reserved.

Yesterday, the ECB and the “cheerleaders” of eurozone central banks had a meeting in Portugal.

Besides the fine taste in the choice of the place for the meeting (the heavenly and expensive Sintra), there was the usual final speech by the “master-chef” of the ECB.

Just like an oracle, she came to say that she will keep hiking interest rates.

But, because inflation is abating, she had to find something else to say, and not keep repeating the same mumbo jumbo, as it can be seem as incompetence.

So now the trope goes something like this: we hope that employers will accomodate in their mark-ups part of the cost of inflation.

She’s hoping!!!

In 2023, in the EU, central banking became a religious affair.

Maybe next meeting will see some priests in shiny garments, or maybe they will bring their masters with the aprons, which is more or less the same thing.

Or maybe they will mourn the deceased euro.

Questions on raising interest rates to curb inflation:

The US central bank pays interest on reserves. With $3.25 trillion in excess reserves at an interest rate of 5.15% that is $167 billion annually. Is this a net injection of money into the economy equivalent to deficit spending and is it significant enough to increase inflation?

If the goal is to slow the economy, will that reduce the supply of goods and services and possibly lead to higher inflation?

If slowing the economy causes some businesses to fail will that give surviving businesses less competition and greater pricing power resulting in higher inflation?

After WW2 inflation spiked but interest rates were left low and inflation quickly subsided as the world rebuilt and geared production to peacetime. During the 1970s oil supply shocks interest rates were significantly increased and inflation persisted for years. When it comes to raising interest rates to fight inflation, in the infamous words of Han Solo “I got a bad feeling about this”.

Especial thanks for the section on teachers’ pay in the UK. I’d like to foward this to friends and family who are teachers, but please could you sort our this rather mangled paragraph:

“The unions want an ‘inflation-plus pay rise’ – the NTE, for example, want a 6.5 per cent rise (although the four relevant unoins), although that would likely be insufficient to maintain the real value of the pay.”

Also, did you mean the NEU, the largest teaching union in UK?

I’m a retired teacher, old enough to remember the Houghton Report of 1974, which brought large pay rises for Uk Teachers, based on the argument that teachers should be paid more in line with other professions! In subsequent pay rounds this was conveniently forgotten, or dismissed as unsustainable.