The Reserve Bank of Australia (RBA) increased the policy rate by 0.25 points on Tuesday…

US inflation falling fast as Europe prepares to go back into a deliberate austerity-led crises

The transitory view of the current inflation episode is getting more support from the evidence. Yesterday’s US inflation data from the Bureau of Labor Statistics (March 14, 2023) – Consumer Price Index Summary – February 2023 – shows a further significant drop in the inflation rate as some of the key supply-side drivers abate. All the data is pointing to the fact that the US Federal Reserve’s logic is deeply flawed and not fit for purpose. Today, I also discuss the stupidity that is about to begin in Europe again, as the European Commission starts to flex its muscles after it announced to the Member States that it is back to austerity by the end of this year. And finally, some beauty from Europe in the music segment.

The US inflation situation

The BLS published their latest monthly CPI yesterday which showed for February 2023:

- All Items CPI increased by 0.4 per cent over the month (down from 0.8 per cent in January) and 6 per cent over the year (down from 6.4 per cent in January).

- The peak monthly rise was 1.37 per cent in June 2022.

The BLS note that:

The index for shelter was the largest contributor to the monthly all items increase, accounting for over 70 percent of the increase …

The all items index increased 6.0 percent for the 12 months ending February; this was the smallest 12-month increase since the period ending September 2021. The all items less food and energy index rose 5.5 percent over the last 12 months, its smallest 12-month increase since December 2021.

Both CPI increases relating to goods and services overall were down significantly on the month.

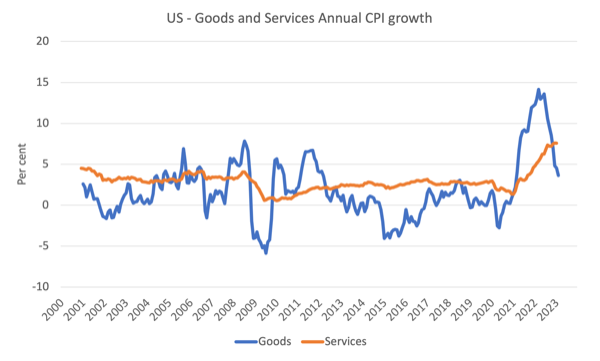

The next graph shows the evolution of annual price rises for the goods sector and for the services sector since 2000 – up to February 2023.

The contention always has been that the inflation has been largely driven and instigated by the supply factors that constrained the ability of the economy to meet demand for goods – the Covid factory and shipping disruptions and the like.

The graph shows clearly that those factors have been in retreat since the second-half of 2022 as the supply chain constraints ease.

The services sector is also approaching peak inflation and usually lags the price trends in the goods sector.

So expect to see that index heading south rather quickly in the coming months.

The question for all those who think this is the work of the Federal Reserve and justifies the rate rises relates to the juxtaposition of last Friday’s employment data and yesterday’s CPI data.

I analysed the employment release in this blog post – US labour market slows a bit but no sign of a major contraction yet (March 13, 2023).

While there was a slight slowdown in employment growth, the result exceeded what the ‘market forecasters’ had predicted by more than 50 per cent.

They were predicting on average a monthly payroll change of around 200,000 whereas the actual result was 311,000.

The employment release also demonstrated that real wage cuts continue, which really takes wages out of the picture when assessing the dynamics of the CPI at present.

The Federal Reserve logic is all about the strength of the labour market (they believe the actual unemployment rate is below the NAIRU) and that drives their zeal to create more unemployment and kill off wages growth, which, in turn, stops inflation in its track.

We also know that household consumption expenditure is not declining very quickly.

The data is thus not kind to the Federal Reserve logic.

Inflation is falling fairly quickly because the main drivers, which are not particularly interest rate sensitive, are in decline.

The problem is that that the ‘one-trick pony’ central bank will likely see yesterday’s data as a signal to push rates even higher.

They don’t seem to be content unless they can actually generate a recession, which will clearly put a dent in all nominal aggregates fairly quickly.

While they haven’t yet caused such a state because there are complex distributional effects militating against a major collapse in spending (creditors are get a massive bonus given the scale of household debt), eventually they will.

What about the bank failures?

Many commentators are postulating that the SVB failure will force the Federal Reserve to stop the interest rate hikes even though the Federal Reserve chair Jerome Powell announced in a session last week (March 7, 2023) with the Senate Banking Committee – Semiannual Monetary Policy Report to the Congress – that:

… there is little sign of disinflation thus far in the category of core services excluding housing, which accounts for more than half of core consumer expenditures. To restore price stability, we will need to see lower inflation in this sector, and there will very likely be some softening in labor market conditions …

Our overarching focus is using our tools to bring inflation back down to our 2 percent goal and to keep longer-term inflation expectations well anchored. Restoring price stability is essential to set the stage for achieving maximum employment and stable prices over the longer run. The historical record cautions strongly against prematurely loosening policy. We will stay the course until the job is done.

So he is not looking at a slowing inflation rate but a negative inflation rate – which is ground zero sort of stuff.

This is the same sort of ‘bank-speak’ that all the central bankers bar the Bank of Japan governor are using at present.

Hairy-chested stuff – “we will do what ever it takes”; “we will stay on course until the job is done”, etc

So I don’t see the SVB situation as altering much.

First, the SVB failure is not a Lehmans repeat.

Second, the failure was triggered by sudden withdrawals of deposits by the ‘google crowd’ who have been badly hit by the Federal Reserve interest rate hikes.

The depositors were riding high on large revenue gains from streaming services etc, which have lost ground as households cut back in the face of the cost-of-living squeeze and then the rising mortgage costs.

SVB’s own balance sheet value fell quite quickly as the rate hikes continued because they had invested heavily in US government bonds (risk free asset).

They are risk free in terms of defaulting on the principle value upon maturity.

But if bought in the secondary bond market then the ‘market value’ of the bond varies inversely with interest rates.

That is what speculation in the bond market tries to profit from – shifts in the market value of the bonds rather than the face value which is always paid out.

SVB also, it seems, bought long-term bonds with the ‘short-term’ deposits – a classic mismatching mistake.

However, as the interest rates started to squeeze the tech companies, they sought increased liquidity by drawing down their deposits, which ultimately forced SVB to start liquidating their assets (the US government bonds) to cover the demand for cash.

That liquidation effort created losses and soon enough it became ‘news’ and the ‘bank run’ began.

Then the bank collapses because it hasn’t enough capital to meet the cash demands.

As far as I can ascertain, the SVB debacle is replay on the 1990s Saving and Loan collapse.

The principle for banking is that the assets have to be diversified and not dependent on one segment of the market (in this case the Tech companies).

It goes well when the big customers are going well, but quickly heads into disaster when that same segment struggles.

The point is that it is unlikely to spread to other elements in the financial system.

The bank runs were stopped virtually immediately the regulator took control and guaranteed the deposits.

Europe about to walk the plank again if the technocrats get their way

Even though Europe is mired in trouble with a war on its Eastern flank, an on-going pandemic that is still killing thousands, a cost-of-living squeeze hitting households hard, and the unemployment starting to turn up again, the European Commission is sounding tough and promising to end the application of the escape clause in the Stability and Growth Pact, which effectively suspended the application of the fiscal rules and the imposition of the Excessive Deficit Procedure.

On March 8, 2023, the European Commission issued a new memo – Fiscal policy guidance for 2024: Promoting debt sustainability and sustainable and inclusive growth – with all the buzz words they could squeeze into a heading.

In its new – Fiscal policy guidance – the EU announced to the Member States that:

1. “Overall, fiscal policies in 2024 should ensure medium-term debt sustainability and promote sustainable and inclusive growth in all Member States” – which means the general escape clause is being ‘deactivated’ at the end of 2023.

2. “Moving out of the period during which the general escape clause was in force will see a resumption of quantified and differentiated country-specific recommendations on fiscal policy” – in other words, the austerity will resume.

3. “The Commission, therefore, stands ready to propose country-specific recommendations on fiscal policy for 2024 that include a quantitative requirement as well as qualitative guidance on investment and energy measures” – so flying squads of Brussels-based technocrats are pack – marching into treasuries of the Member States and demanding wage cuts, privatisations, pension cuts, and more of the brutality that saw Greece become a colony rather than a nation.

4. “The Commission will propose to the Council to open deficit-based excessive deficit procedures in spring 2024 on the basis of the outturn data for 2023, in line with existing legal provisions” – so Member States will have to start cutting this year to avoid even harsher cuts next year as the procedure is applied.

Happy days.

The ECB is continuing to exacerbate the CPI squeeze by increasing interest rates and redistributing income from poor to rich.

Now, the European Commission is going to get in on the punishment and impose austerity.

None of these policy shifts will do much to deal with the supply-side factors that are driving the inflationary pressures.

They will not cure Covid.

They will not send Putin’s troops back to Russia.

They will not get shipping and land transport moving goods any quicker.

They will exacerbate the massive redistribution of income so the poor will get poorer and the rich richer.

The other indictable element is that some of the cost-of-living problems emanating from the Ukraine situation are the direct result of the European Commission’s own sanctions on Russia.

So they create a problem, then make it worse by flexing the treaty muscles (the austerity bias).

A truly dysfunctional monetary system, with neoliberal stupidity embedded in the legal structure (the Treaties) and not easily changed from within the system.

Unilateral exit is the only feasible solution in my view.

Italy should leave first and take some of the other states with it.

It is hard to overstate how stupid the whole European Union has become.

Music – Recuerdos de la Alhambra

This is what I have been listening to while working this morning.

I have been playing a lot of classical guitar lately as I sort old scripts out that have been in cupboards for years (I am moving house).

I used to love playing this piece from Francisco Tárrega – when I was studying classical guitar in my younger days.

He was one of the originators of what we now call ‘classical guitar’ and I studies his playing closely.

The piece – Recuerdos de la Alhambra – is an exquisite piece of music and a great test of both right and left hand techniques.

The right hand part requires the ‘tremelo technique’ with the fingers playing the same string in quick succession to give the impression of a continuous sound.

The challenge is to be smooth so the listener can barely hear the individual finger strokes.

It is a very difficult thing to learn.

The piece is very nostalgic for me.

I spent hours learning how to play it.

It was written in 1899 for Tárrega’s patron after they visiting the palace of Alhambra in Granada.

I visited the palace some years ago and hummed the tune as I witnessed the wonders of the place.

Listening to the whole catalogue of Tárrega’s worth is a great backdrop to a morning’s work.

This interpretation is from Australia’s great classical player – John Williams.

I have his 1977 album – Spanish Guitar Favourites (Decca) – with this recording and it is a little different to the version here which appears to be off a 2004 release of ‘best hits’.

But still beautiful.

That is enough for today!

(c) Copyright 2023 William Mitchell. All Rights Reserved.

“The principle for banking is that the assets have to be diversified and not dependent on one segment of the market (in this case the Tech companies).”

From what I can tell with a preliminary look at this, the assets were diversified (in that they’d bought mortgage bonds, etc. to balance their standard loans to the Tech industry) but of poor value. The main problem seems to be that the liabilities weren’t diversified. They consisted of only a few tens of thousands of accounts amongst the Tech bros, nearly all of which were non-interest bearing deposits of considerable size and therefore uninsured.

When those went out the door, as first the tech companies burned through their money and then the deposit flight, SVB didn’t have enough collateral *or income* from their assets to meet the terms of the Fed’s cash letter [0]. The bank then became insolvent and was resolved by the FDIC.

SVB would likely have been solvent under ZIRP with a central bank providing Lender of Last Resort facilities under the Mosler Proposals [1]

Perhaps we need another term for banks: “insolvent at the current central bank rate”.

[0]: https://dfpi.ca.gov/wp-content/uploads/sites/337/2023/03/DFPI-Orders-Silicon-Valley-Bank-03102023.pdf?emrc=bedc09

[1]: https://moslereconomics.com/wp-content/uploads/2009/09/Proposals-for-the-Treasury.pdf

The limit on deficits only apply to Portugal, Spain, Italy and Greece.

France can continue with whatever deficit it pleases.

The only thing different now is that Germany will probably move away from surplus to deficit, as the industrial model, based on cheap Russian natural gas, was terminated.

But, just as surpluses were not allowed by the treaties, and Germany had no trouble in amassing them year-after-year, so deficits will have no trouble getting through.

They just need to harrass the PIGS, as usual.

The PIGS will pay whatever it takes to keep the blob running.

And they will pay for the german deficit.

People pressure politicians and the Fed to “lower inflation” with the expectation that a lower rate of inflation somehow implies that prices will decline. 🙂

My forecast? A minimum 25 basis points increase at the Fed meeting next week. The trimmed mean PCE inflation rate is coming down VERY slowly, and the sticky price CPI (ex food and energy) is high and flat (6.47, 6.62, 6.55, and 6.59 the last four months, through Feb). Services (less energy services) have not yet peaked (6.81, 7.03, 7.17, 7.27 the last four months, through Feb). Shelter (owner’s equivalent rent) lags, but also has not peaked.

Bill, you wrote, “The employment release also demonstrated that real wage cuts continue, which really takes wages out of the picture when assessing the dynamics of the CPI at present.”

I agree that this assertion makes sense on the face of it, but Bill, can you say anything to support this Maybe compare now to back in the 70s to show how real wage increasess were what was driving increased inflation.