In the annals of ruses used to provoke fear in the voting public about government…

Central banks can operate with negative equity forever

The global press is full of stories lately about how central banks are taking big losses and risking solvency and then analysing the dire consequences of government bailouts of the said banks. All preposterous nonsense of course. It would be like daily news stories about the threat of ships falling off the edge of the earth. But then we know better than that. But in the economic commentariat there are plenty of flat earthers for sure. Some day, humanity (if it survives) will look back on this period and wonder how their predecessors could have been so ignorant of basic logic and facts. What a stupid bunch those 2022 humans really were.

Background reading

I have previously considered this topic:

1. The ECB cannot go broke – get over it (May 11, 2012).

2. The sham of ECB independence (October 24, 2017).

3. Repeat after me: Central banks can make large losses and who would care (February 16, 2022).

4. Central banks should just write off all their government debt holdings (February 15, 2021).

5. Banque de France should write off its holdings of State debt (April 24, 2019).

6. The US Federal Reserve is on the brink of insolvency (not!) (November 18, 2010).

7. Better off studying the mating habits of frogs (September 14, 2011).

Reserve Bank of Australia reports a loss!

The Reserve Bank of Australia released its – Review of the Bond Purchase Program (published September 21, 2022) – which reported that the RBA purchased:

… a total of $281 billion of Australian, state and territory government bonds between November 2020 and February 2022.

That is most of the debt that was issued in that time period.

They concluded that the action “lowered the whole structure of interest rates in Australia, and supported confidence in the economy in the face of serious downside risks.”

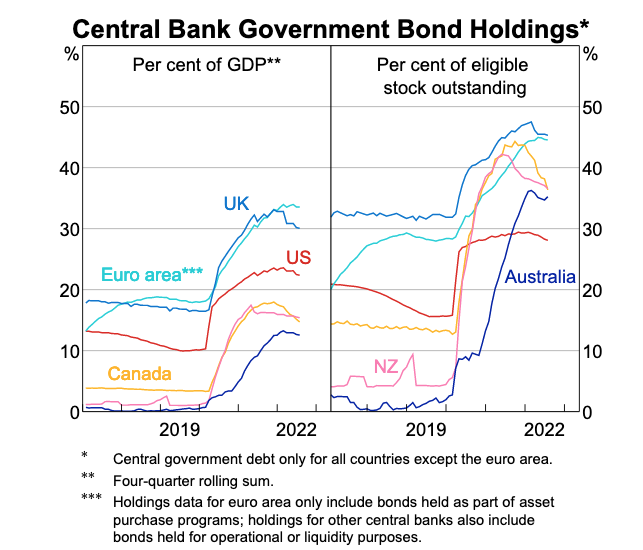

The review provided this graphic to show the scale of these bond-buying programs around the world.

It is hard not to conclude that the programs were ‘massive’ in relation to the debt issued and the size of the economies.

It also puts the claims that public debt ratios are rising above acceptable solvency levels into perspective.

First, this is debt that the government effectively has issued to itself. Left pocket-right pocket sort of gymnastics.

Second, the right pocket will always be able to pay the left pocket back and the left pocket will then remit the payments above costs back to the right pocket.

The Review also rejects the claims that the QE program conducted by the RBA has caused or exacerbated the current inflationary episode.

They show that the so-called ‘quantity theory of money’, used by Monetarists etc, is not functional because “there has not been a stable relationship between monetary aggregates and economic activity or inflation in Australia for several decades”.

1. The velocity of circulation “has declined over time, falling sharply during 2020” – which means that the money stock has been turning over more slowly in transactions.

2. “Moreover, different components of the money supply can move independently over time. While the BPP led to a sharp increase in ES balances and thus ‘base’ money, the increase in the broader money supply, which is relevant for nominal expenditure in the economy, was not as large”.

So the QTM cannot be used as a framework for explaining the current inflation – exit Monetarism and the rest of Milton Friedman’s fictions.

What has agitated the media is the following statement:

For the RBA, the purchased bonds pay a fixed return, while the interest paid on the Exchange Settlement (ES) balances created to pay for the bonds varies with monetary policy settings. As interest rates increase there is a financial cost to the RBA from this. The ultimate cost will be known only once the last of the purchased bonds matures in 2033, with various scenarios presented in this review. Under most scenarios, the Bank will not be in a position to pay dividends to the government for a number of years.

The ES balances are what Americans call bank reserves.

The bond-buying programs just swapped assets – bonds from the bond-holders and reserves to their bank accounts.

The question that the press then pursued was the implications of this ‘financial cost’.

This is the sum of known returns – the yields on the bonds and face value – the unknown costs, which relate to the interest paid on ES balances that are sensitive to future monetary policy movements.

The RBA estimates that

Overall, the cumulative financial cost of the program to the Bank over the period to 2033 is $35 billion, $42 billion, $50 billion and $58 billion under the scenarios from lowest to highest ES rate path.

Wow, that sounds bad.

The press certainly think so.

The BBC report (September 21, 2022) on the Review carried lurid headlines – Covid: Reserve Bank of Australia takes $30bn hit on bond purchases.

Sounds bad.

That is, if you don’t understand things.

Importantly, the RBA notes that:

The Reserve Bank Board considered whether to seek a government indemnity for the BPP, but decided it was not necessary. The Board recognised that an indemnity would insulate the Bank’s balance sheet from the effects of the BPP, but it would have no effect on the overall public sector balance sheet; the impact of the BPP would simply be transferred from the Bank’s balance sheet to the government’s balance sheet.

Left pocket and right pocket.

The Deputy Governor of the RBA, Michele Bullock gave a presentation in Sydney on the – Speech: Review of the Bond Purchase Program.

She specifically homed in on the erroneous claims about the RBA making losses and outlined how the accounting losses are treated.

She noted that all discussions about RBA capital reserves are made in consultation with the Federal Treasurer – left and right pocket.

It is “the Treasurer” who “determines” how much of any positive earnings the RBA makes on trading go into the capital reserves and the amount that goes into the Treasury account as ‘dividends’.

And accounting losses are subtracted from the capital reserves

So in the financial year 2021/22, the RBA recorded:

… an accounting loss of $36.7 billion …

The implications are that the RBA made a loss bigger than current reserves (by $21 billion), which the Deputy Governor said:

… means that the Bank has negative equity.

Is that a problem?

Not at all.

The Deputy governor told us why:

If any commercial entity had negative equity, assets would be insufficient to meet liabilities and therefore the company would not be a going concern. But central banks are not like commercial entities. Unlike a normal business, there are no going concern issues with a central bank in a country like Australia. Under the Reserve Bank Act, the government provides a guarantee against the liabilities of the Reserve Bank. Furthermore, since it has the ability to create money, the Bank can continue to meet its obligations as they become due and so it is not insolvent. The negative equity position will, therefore, not affect the ability of the Reserve Bank to do its job.

Therefore no issue.

End of story.

The current Treasurer has apparently agreed to forego ‘dividends’ so that future RBA ‘profits’ will just restore the accounting capital but as the Deputy Governor admitted:

… the Bank can continue to operate with negative equity …

Forever, it is wanted to without any loss of capacity or function.

But it seems that journalists around the world don’t understand the reality.

For example, the Toronto Star newspaper ran a story by its economics expert (one might say alleged expert once you read the article) – The Bank of Canada, for the first time in history, is losing money. Is that a problem? (September 12, 2022).

The article could have simply said: No, it is not a problem and the moved on.

Instead, the readers were subjected to a litany of fictional claims.

1. “Canada’s central bank is losing money, in the red for the first time ever, because of the emergency quantitative easing measures” – no, it is not losing anything. An accounting is just recording a negative number for the same reasons the RBA reported above.

2. “Taxpayers could very well end up holding the bag for a couple of years, to the eventual tune of some billions of dollars – another nasty and unintended consequence of the COVID-19 economy.”

No taxpayer will be paying anything to address the capital loss made by the Bank of Canada.

3. Then to the point: “the losses won’t interfere with monetary policy”.

That is, won’t alter the functional capacity of the bank.

If a private bank recorded these losses it would be declared insolvent unless it could restore its capital base.

The Bank of Canada has no such urgency. It can operate at an accounting loss forever.

4. “The clock is ticking, however, and the losses are piling up” – the only clocks that might be ticking are old analogue jobs that allow the Bank’s employees to know when it is time for a lunchbreak or to go home!

There is no threshold of accounting losses beyond which something bad happens at the Bank of Canada.

The article wheeled out an “economics professor” (of course, they create the fictions) who made predictions laced with forebodings – “We don’t currently know exactly what this will mean for the federal government’s losses.”

Hold on!

I thought the Bank of Canada was making the losses.

Aah, the professor is admitting that the central bank and the treasury are just part of government.

At least we have that.

The point is that despite all the gloom and forebodings about losses and lack of plans about how to pay for them, the reality is simple.

Back to left pocket and right pocket.

Some accounting numbers will appear in each, respectively and all will be well.

Conclusion

Really!

That is enough for today!

(c) Copyright 2022 William Mitchell. All Rights Reserved.

This is where having a few hundred years more experience in central banking pays off. In the UK Parliament just voted through a ‘capital injection’. Four accounting journals later the issue disappeared and nobody other than the accounting nerds was any the wiser.

We all agree in the movement of “left pocket to right pocket”.

No question about it.

We all agree in central banks (issuers of currency) beeing always able to meet their liabillities, by adding zeros to a computer screen (or “printing money”, if you prefer it that way).

Even the neoliberals agree, as they are continuasly doing it, since they seized power (even if they deny it, as the ECB usually does).

The question is distributional: if the government runs a eternal deficit , who gets the benefits?

Inflation is distributional too: if real income of the lower classes goes down, the real income of the upper classes goes up.

The question is: is MMT applied to the benefit of the 1% (denying it and telling fairy tales about the government need to fund its spending)?

Or is MMT applied to the benefit of the 99%, giving people health services, education and other services?

As a Canadian I found this very timely!! 🙂

I note from the RBA document that it is very ironic that the RBA is happy to let the private banks monetize the debt, but not the central bank. … I assume if RBA and the Bank of Canada bought directly, they would not be paying interest on the reserves, or exchange settlements (settlement balances in Canada).

https://www.rba.gov.au/education/resources/explainers/pdf/unconventional-monetary-policy.pdf page 6:

The role of monetary policy and fiscal policy can become blurred because, if the central bank is purchasing large amounts of government bonds at low interest rates, this could be interpreted as government spending (a fiscal activity) being financed by money creation. However, this is not happening in Australia, where the RBA is only buying government bonds from investors in the ‘secondary market’, not directly from the government in the ‘primary market’ (see Box on ‘Government bonds and the risk-free yield curve’). Furthermore, the government must pay back all bonds purchased by the RBA when the bonds mature. …and page 7 – Central banks almost always purchase bonds from financial institutions in the secondary market and so do not purchase bonds directly from the government

Technically there is no need for a Central Bank to run on negative equity, you can resolve the loss of capital issue in a very “elegant” way from an accounting perspective.

The Treasury (or Ministry of Finance if you wish) can issue special non-marketable perpetual bonds with zero coupon to inject new “capital” in its Central Bank. The Treasury balance sheet will record such bonds as liability and the additional CB shares as assets. Conversely, these bonds will be obviously placed on the left side of the Central Bank balance sheet. Et Voila’ the CB is recapitalized, easy peasy.

Now, I have a question for the experts: As we already discussed, Central Banks can obviously operate with negative equity if they run into problems but they still have to somehow follow accounting rules.

After the GFC, the balance sheet of the Fed and the other major CBs exploded and so did again during the pandemic. Did any of these Central Banks formally receive a capital injection (capital ratio rules) in order to support such bursts of dramatic expansion??

Thank You!

re: “but they still have to somehow follow accounting rules.”

You mean like RRPs?

x Spencer Bradley Hall

I assume CBs must have their own capital adequacy ratio rule to follow.

For example, after the financial crisis the Fed balance sheet zoomed from $800B to almost $3T in a short period of time. A regular bank needs to add capital to increase its balance sheet.

I wonder if Bill can clarify this.

The FED’s Ph.Ds. aren’t good at accounting. MSB’s balances were included in the money stock from 1913 to 1980. The MSBs were customers of the DFIs.

Then with the DIDMCA, the interbank demand deposits of the S&Ls and CUs are misstated.

All monetary savings originate within the payment’s system. Demand deposits are just shifted into time deposits. The banks collectively pay for the deposits that they already own. Hiking rates induces nonbank disintermediation, where the banks outbid the nonbanks for loan funds. The opposite scenario cannot exist. This destroys the transaction’s velocity of funds. I.e., it reduces R-gDp relative to N-gDp. It is backwards.

Louis Stone — whom the movie “Wall Street” was dedicated to – Vice President Shearson/American Express wasn’t fooled:

WSJ: “In a letter of March 15, 1981, Willis Alexander of the American Bankers Association claims that: ‘Depository Institutions have lost an estimated $100b in potential consumer deposits alone to the unregulated money market mutual funds.’

As any unbiased banker should know, all the money taken in by the money funds goes right back into the banks, in the form of CDs or bankers’ acceptances or other money market instruments; there is no net loss of deposits to the banking system. Complete deregulation of interest rates would simply allow a further escalation of rates by the banks, all of which compete against each other for the same total of deposits.”

Very interesting proposal by Domenico – I have heard Huber propose something similar, and Kumhof, and maybe Adair Turner’s Overt Monetary Financing.

This Fed link may be relevant https://www.frbsf.org/education/publications/doctor-econ/2013/march/federal-reserve-interest-balances-reserves/ Perhaps the simplest solution is to stop paying interest on the reserves: “In 2007, required reserves averaged $43 billion, while excess reserves averaged only $1.9 billion. This relationship was typical for the past 50 years when the Fed did not pay interest on reserves with only two exceptions. Those occurred when the Fed provided unusual levels of reserves to depository institutions in September 2001 following the terrorist attacks and in August 2007 at the onset of the global financial crisis.”

Re Dominic’s thread:

Worth pointing out the “accounting rules” can be changed any time by the parliaments. It is all just shuffling points around on scoreboards if we are strictly talking relations between Treasury and Central Bank balance sheets.

So the “negative equity” is meaningless. Sure, the negative digits can be turned into positive digits by some formal arrangements, but they are still only formal arrangements, no gold is at stake, no one’s blood is being drained (except for perhaps the mainstream economists and journalists who go pale white whenever central bank independence is revealed to be a farce.)