In the annals of ruses used to provoke fear in the voting public about government…

ECB researchers find fiscal policy is very effective and more so if central banks buy up the debt

The ECB published a Working Paper recently (September 2021) – Monetary and fiscal complementarity in the Covid-19 pandemic – which represents progress in the narrative. While the technical model that the ECB uses is just an ad hoc attempt to reverse engineer the reality so they can claim they can explain it, what is useful from the exercise is that the old mainstream narratives that fiscal policy is ineffective in providing permanent boosts to real output (or that austerity does not permanently damage the growth trajectory) can no longer be sustained. The taboo surrounding central bank purchases of government debt because they cause accelerating inflation can no longer be sustained. The claims that fiscal deficits drive up interest rates can no longer be sustained. Now the public debate just has to reflect that reality and we will have made progress. Of course, this is all core MMT – we knew it all along!

The ECB authors, Jagjit S. Chadha, Luisa Corrado, Jack Meaning, and Tobias Schuler analyse the implications of the way that monetary policy is interacting with expansionary fiscal policy.

They note that in the US we see “the Federal Reserve System purchasing extraordinary quantities of securities and the government running a deficit of some 17% of projected GDP”.

And the US central bank has also “pushed the discount rate close to zero” and has provided banks “with emergency liquidity … through a new open-ended long-term asset purchase programme.”

Their overall conclusion that is this approach:

… the central bank uses reserves to buy much of the huge issuance of government bonds and this offsets the impact of shutdowns and lockdowns in the real economy. We show that these actions reduced lending costs and amplified the impact of supportive fiscal policies.

And if monetary and fiscal policy was not working together for once, the US would have “experiences a significantly deeper contraction as a result from the Covid-19 pandemic”.

The point is obvious and runs counter to the way in which mainstream macroeconomics has been taught and practiced in this New Keynesian era, where monetary policy was assigned the primary role (adjusting interest rates) and fiscal policy was deemed to be passive and biased towards surplus creation.

It also establishes that fiscal policy is highly effective in reducing the negative consequences of a significant non-government spending reduction.

Which runs counter to the received wisdom of the standard New Keynesian approach.

The NK approach to fiscal policy is exemplified by the 1993 textbook of John Taylor – see Macroeconomic Policy in a World Economy: From Econometric Design to Practical Operation (Norton) – or the analytical model presented by Frank Smets and Rafael Wouters (2007) – Shocks and Frictions in US Business Cycles: A Bayesian DSGE Approach (American Economic Review, 97 (3), 586-606).

The Taylor approach characterises the response of the economy to a fiscal stimulus as being immediately positive (typically) then diminishing more or less quickly as the crowding out impacts of higher interest rates bite on private sector investment and acceleration inflation squeezes real profits.

In the Smets-Wouters approach the crowding out is more or less immediate as the government injects each new dollar into the economy.

Private consumption and investment expenditure immediately declines and mostly offsets the fiscal stimulus.

The point is that within the NK paradigm there are less and more extreme versions in the short-run after a fiscal stimulus but they all converge on the same result in the long-run – that fiscal policy essentially has no long-run impact on output but worsens the inflation profile of a nation.

In relation to yesterday’s blog post – They never wrote about it, talked about it, and, did quite the opposite – yet they knew it all along! (September 20, 2021) – the mainstream economists who claim that Modern Monetary Theory (MMT) is unnecessary because the standard NK framework is perfectly capable of allowing a fiscal stimulus in the short-run to deliver positive output effects, will all converge on this long-run ineffectiveness conclusion.

The debate within NK economics is the speed to which the economy converges on the long-run equilibrium after a shock and how strong the short-term impact of a stimulus turns out to be.

But make no mistake, the conventional paradigm in economics believes that fiscal policy stimulus has no long-term positive impacts and only, ultimately invokes a higher inflationary path.

That is what the ‘we knew it all along’ crowd teach and build into their research models.

Further, the NK economists are not really macroeconomists at all, despite them claiming to be.

Why would I say that?

I discussed this point in this blog post – Mainstream macroeconomic fads – just a waste of time (September 18, 2009).

The reason is that they build their aggregate framework (what they call the ‘macroeconomic’ level) from simple maximising, microeconomic principles beginning with an individual.

That micro level of analysis yields certain conclusions – for example, a single firm might benefit if its workers took a pay cut because while the unit costs the firm would face would fall, it would be unlikely that the damage to sales would be significant if no other workers took a similar pay cut.

Whether that increased employment for the firm or whether it just pocketed the increased gap between costs and revenue is moot.

But if all firms tried the same strategy – cutting wages – unit costs would fall across the economy but so would incomes and consumption expenditure which would damage sales, and, probably push the economy into recession.

This is the famous case of the fallacy of composition, which I analysed in this blog post (among others) – Fiscal austerity – the newest fallacy of composition (July 6, 2010).

Consequently, treating macro as if it is micro means there is a tendency to conclude that what applies at the individual level also applies at the aggregate level, which is demonstrably false.

Why is this important?

It is important because the NK approach to ‘macroeconomics’ claims the higher authority because it says it is derived from consistent, microeconomic optimising principles – a sort of appeal to technical superiority, which they claim the old-style Keynes approach lacked.

The problem then is that to escalate the single consumer/firm micro analytical results up to economy-wide relationships – all households, all firms, all industries etc – the link between the micro optimisation and the aggregate proves to be impossible to achieve.

To resolve that problem, the NK approach creates the ultimate fudge – it assumes what they call the ‘representative agent’ – which they assert obeys the same behaviour and motivations as the micro optimising agent.

So there is one ‘infinitely-lived household’ or one representative firm used in the framework at the macro level.

Which means that, in fact, they never really leave the world of neoclassical microeconomics and in trying to assert any results about what happens at the aggregate level they fall into the fallacy of composition trap.

The ‘we knew it all along’ crowd don’t often admit to that do they? They just pretend to be doing macroeconomics.

If we dig deeper, we find that NK models essentially predict financial instability and accelerating inflation will inevitably accompany a zero interest rate policy deployed by a central bank.

The NK approach is an amalgam of what has been referred to as fixed wage Keynesian economics and the classically-inspired real business cycle theory based on rational expectations.

I won’t go into the details of that conflation here except to say that it effectively abandons everything that is Keynes from the Keynesian part and replaces it with the old Classical beliefs that governments cannot change the course of the real economy in the long-run and only influence nominal variables (inflation etc) if they try.

The rational expectations influence really began with the 1975 publication by Thomas Sargent and Neil Wallace – Rational Expectations, the Optimal Monetary Instrument, and optimal Money Supply Rule (Journal of Political Economy, 83, 241-254).

When I started studying economics in the mid 1970s, this was a raved about paper. I read it and couldn’t believe how asinine it was. But that was the times.

Sargent and Wallace effectively established the framework that permeates NK economics to this very day.

If we took the model seriously then Japan would have hyperinflated two or more decades ago

The ECB find that fiscal policy is very effective and more so when the central bank ‘funds’ it

Anyway, the ECB paper shows that the world is moving beyond this moribund framework, which is a good sign.

They seek to conjecture about the following juxtapositions:

1. A large supply shock (the shutdown).

2. A large decline in money velocity – how much the money supply turns over in transactions per period (the lockdowns stifling expenditure).

3. A massive fiscal stimulus – accompanying by debt-issuance.

4. The stimulus accompanied by the central bank buying the debt issued with credits to bank reserve accounts.

The hard-core NK framework predicts rising interest rates, accelerating inflation, and, only short-term real output gains followed by falls in household consumption expenditure (rising saving to pay for the implied higher taxes to pay back the public debt increase) and business investment (as the rising interest rates crowd out non-government borrowing), which, ultimately, undermine any temporary output gains.

The reality that the ECB authors want to try to understand is why the NK predictions systematically failed.

They find that, in fact:

… the provision of reserves stabilised the value of collateral and amplified the impact of supportive fiscal policies … the fall in output in the first stage of the pandemic might have been as much as twice as large, with a significant deflation, loss of employment and falls in asset prices, if such extensive fiscal and monetary policies had not been implemented.

Which is the standard result that core MMT has come to 25 years ago!

I might be tempted to say ‘we knew it all along’ but I won’t (-:

The US situation is thus:

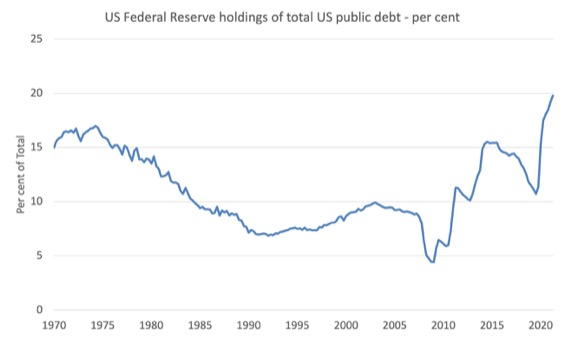

1. Total US public debt has risen by $US5,328.1 billion since the December-quarter 2019.

2. The US Federal Reserve Bank holdings of the debt since then has risen by $US3,007 billion.

3. Which means that the US Federal Reserve system of banks has purchased around 56.4 per cent of the debt issued over the pandemic.

4. The US Federal Reserve holdings has risen from 11.4 per cent to 19.8 per cent (by June-quarter) of all outstanding public debt.

That is quite a shift.

The following graph shows the proportion of outstanding US public debt held by the US Federal Reserve Banks since the March-quarter 1970.

You can see that over the Monetarist period, the proportion fell steadily and then the two big jumps coincided with the GFC and the pandemic.

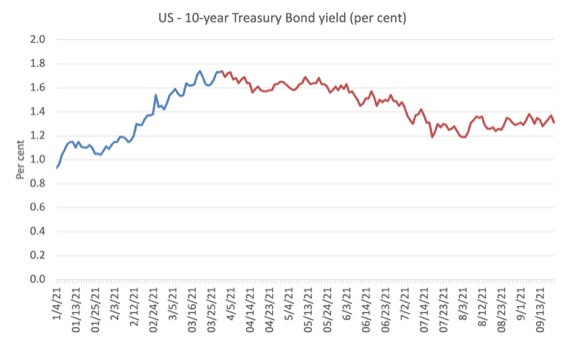

Long-term US bond yields remain low.

Have a look at the history of the US 10-year Treasury bond yields since the beginning of 2021.

You can get for all available maturities from the US Department of Treasury’s site – Daily Treasury Yield Curve Rates.

As the economy started to opened up a bit in February and sentiment improved, investors started to diversify their portfolios away from the risk-free Treasury bonds and yields rose a little.

This set the mainstreamers off into a conniptive-fever (don’t look that word up as I just made it up. Etymology – derived from conniption or hysterics).

They started to increase their attacks on MMT economists like me with the ‘I told you so’ banter.

Well then mid-March came along and yields fell again and they have been largely flat since the middle of July.

Nothing going on here is the message.

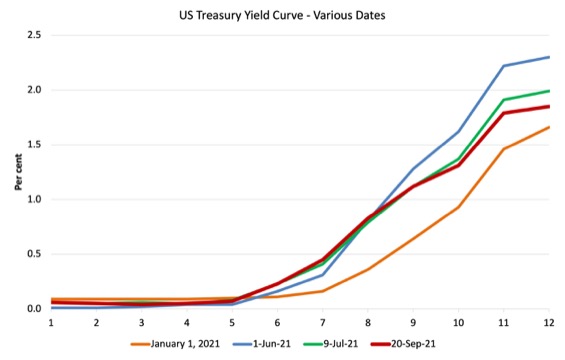

Another way of looking at this is shown in the next graph, which shows the US Treasury yield curve across all maturities since the start of the 2021 – at various snapshots.

The longer end certainly rose in the first six months but since then, the yield curve has flattened rather than steepened.

In this blog post – Rising prices equal an inflation outbreak (apparently) but then the prices start falling again (June 21, 2021) – I explained why these trends militate against the accelerating inflation narrative.

If investors expect that inflation is becoming an issue, then they will demand higher yields at the primary issue and will be prepared to pay less for outstanding bonds in the secondary market.

The higher the expected inflation, the higher the risk premium that will be built into required yields.

The facts thus do not support the mainstream ‘inflation’ narrative.

The ECB authors tried to come to terms with these results that run counter to the standard NK framework – that used by the ‘we knew it along’ gang.

The combination of a declining GDP (total sales in the economy) and the expansion of bank reserves and bank deposits (coming from the fiscal stimulus) has reduced the velocity of money in the US (the turnover rate of the stock of broad money).

The ECB authors note that this was due to households cutting back “spending sharply” and increasing their saving.

They write:

Total household income did not fall by nearly as much as spending, largely because those who are still employed, working from home or elsewhere cut back on their purchases. Savings jumped as a result …

Fiscal policy thus had significant increased space in terms of real resources to operate in.

Remember, MMT defines fiscal space in terms of idle real productive resources rather than in terms of current numbers pertaining to deficits/surpluses or public debt.

Fiscal space is not a financial concept but a real resource concept, which is totally at odds with the way the IMF and conventional economics defines it.

And the US Federal Reserve bought up a significant quantity of the new debt issued, which meant the private investors really no longer determined yields.

The technical model that the ECB has contrived is designed to reverse engineer the empirical reality.

I wouldn’t study it in detail.

The point is that they have had to fundamentally alter the standard NK approach to generate the intended results.

But the conclusion is inescapable.

1. “A combined fiscal-monetary response may have helped avoid turning the Covid-19 crisis into an economic recession of even greater magnitude and severity”.

2. “if the Federal Reserve had not intervened, output would have fallen by more than 10% more on impact and in the following quarter”.

3. “Real wages would be down by more than 15% more and unemployment up by more than 20%. Wages would be 20% lower than with QE. As a result inflation would have fallen even further.”

4. “we find that prompt, combined fiscal-monetary interventions mitigated the impact of the pandemic shocks and helped to establish a more rapid recovery to pre-crisis levels of activity.”

Conclusion

The point is that the old mainstream narratives that fiscal policy is ineffective in providing permanent boosts to real output (or that austerity does not permanently damage the growth trajectory) can no longer be sustained.

The taboo surrounding central bank purchases of government debt because they cause accelerating inflation can no longer be sustained.

The claims that fiscal deficits drive up interest rates can no longer be sustained.

Now the public debate just has to reflect that reality and we will have made progress.

Of course, this is all core MMT – we knew it all along!

That is enough for today!

(c) Copyright 2021 William Mitchell. All Rights Reserved.

It should be obvious by now and not some conspiracy theory.

That Geopolitics is what was hidden behind the green curtain. The exact same thing played out in Greece, Rome and the British Empire.

The Central bankers knew exactly what to do buy the debt, set the interest rates low and in some cases start using the ways and means account. They knew exactly how it works and as I’ve said many times before you can’t run a central bank for over a 100 years and not know how it works. You can’t set up the Eurozone exactly the way they did ( geopolitically) without knowing how it works and the French couldn’t set up the African currency without knowing how it works.

When you read Zach Carter’s book the price of peace you can see the Americans thought process in action and everything today stems from the fall of the Berlin wall. That is when the pivot took place from fiscal policy that helps your own country to geopolitical economic policies to raid and take over the East.

Every empire has tried it and what the Nazis did in Holland described beautifully in the award winning World at war series that is currently on PBS in the UK when they took control of the Netherlands. Was a blue print of things to come across Europe. Keep the Dutch government in power but put your men in charge and control the media and change their culture. EU uber alles but this time with the Americans in charge. who took the whole strategy of the Nazis further by creating the Euro. Making sure it was so easy to control nation states within Europe in their fight against Russia.

They had to lie about and create smoke and mirrors to fool Dorothy as they moved ever eastwards and had to show to the East that this is what they do at home in America thus Friedman and Mankwi and the whole Chicago School became a cupboard at the Pentagon.

Russia fell for it a couple of times with their dollar debt and interest rate backwards theories so did Turkey and the whole of South America in order to keep the left at bay. However, not anymore the game is up. China never fell for it and specifically set up their monetary system to fight against the Chicago School and to protect themselves.

It still rolls on in Europe and South America because the elites in each country are rewarded well to keep up the charade.Just like with Greece, Rome and the British Empire and the Nazis the governors of colonies are rewarded and allowed to sit at the top table and share the spoils.

Now what, now that Dorothy has pulled the curtain back. Now that the geopolitical charade is over and the East see as clear as day what the West strategy has been for the last 50 years with their wall street infested central banks ? Now what – what is next geopolitically now that their game is up ?

The recent skirmish between France, Australia, UK and the US regarding submarines is just a small glimpse of things to come.

Yes, they knew all along but used universities and business schools to hide it from view. It was a masterclass in espionage. With anybody highlighting the fact being side lined or shut out of their career. The history of economics removed from the curriculum with groupthink taking its place. Not a science but a tool in the sand box of geopolitics like Greece, Rome and the British Empire before it.

About time! Great article explaining the beginning of what I hope will be a long delayed reality check on the mainstream dogma. They can no longer run from, nor hide, their mistakes.

Although it’s possible, God forbid, that we might blunder our way into nuclear war, I suspect that world wars of any kind are ancient history. And I think that all the major powers know this, despite continuing childish displays of aggression, and that even the US has resigned itself to the inevitable evolution of a multipolar world. No doubt the US still wants to be top dog as long as possible and will do everything in its power to slow down this process, but Covid has now added an accelerant to this geopolitical evolution. It has prevented IMHO the outbreak of more of those smaller, regional wars to which the US had resorted to delay the erosion of its dominance. Now if only Covid, horrible as it is, would move us further in a humane, ecologically-sensitive direction, a move for which MMT alone lays the monetary foundation. It staggers the imagination, for example, to envision the repurposing of the massive, pervasive US military toward preserving life rather than taking it. So dream we must to keep sane.

I hope you are right Newton but change won’t come from the top it will be via different grass roots movements from the bottom. I feel it will take another assault on capitol hill to get their attention.

The media keeps the geopolitical show on the road. Those politicians who we are allowed to choose from In elections all pass the geopolitical litmus test with flying colours. In the UK the Labour party has to either split or a new left wing party needs to be created. America’s 2 party system is the same corrupt to the core. The EU is a geopolitical shit show.

I’ve never liked the term MMT is lens. I would prefer ” MMT is the true middle ground “as the statement because quite simply it is. MMT is the middle ground and where all economic debates should start from – the middle.

“MMT is the true middle ground ” slogan would catch on and grab the attention simply by saying the middle ground is the starting point of how the monetary system works and from there the left and right can do anything they want with it. Or those that like the lens narrative can say ” MMT is a lens it is the true middle ground” MMT is the middle ground would be a good title for a book and also snag some liberals in the process and small c conservatives and the liberal left. Who always think they are voting for the middle but are really voting for the middle of the right wing spectrum.

Liberals who refuse to believe the middle ground is currently in the middle of the right wing spectrum which it is. Who actually vote for the liberals believing they are voting right in the middle between left and right and who are deluding themselves.

In 1988 the one and only time I ever voted. I voted for the what I thought was the middle now I am called a marxist and my political views never changed between now and then. What changed was the culture of the UK by a systematic step by step process to fit a geopolitical agenda. The SNP are carrying out the same step by step process in Scotland as we speak each and every day moving further right in everything they do. So they can slip nicely into the EU uber alles narrative and live in the middle of the right wing spectrum under Brussels control and call themselves progressive.

” MMT is the true middle ground ” would move the middle back to where it belongs. That is what MMT activists the world over need to achieve. Drag the middle ground back to where it belongs and away from the middle of the right wing spectrum. So the hard work can then begin of what policies you want to add to the true centre of the political spectrum. That should be where the debate should be from the centre moving left or right. The starting point of ideas.

For me ” MMT is a lens ” doesn’t quite capture the fact that MMT is the true middle ground. even though MMT describes the starting point of any debate with perfection.

If we can achieve that and get MMT known worldwide as the true middle ground we have won. If we don’t we will ever be living in a world of geopolitical madness and insanity. On our way to complete destruction of the planet one way or the other.

“MMT is the true middle ground” works because it is the truth. We just don’t sell it that way enough in my opinion. A lens just fails to grab those that vote for the middle attention.

Whoever writes the Book with the title – MMT is the true middle ground.

Is onto a winner and just has to show why and be brave enough to “feed” both the left and the right when they write it.

Derek Henry is pretty well on the money in his analysis of the contest that is in play for geopolitical dominance of our planet.

Besides the coterie of MMTers, providing so much enlightenment on money, banking and macroeconomics, I have found the interpretations and explanations of Michael Hudson (author of Super Imperialism) most compelling in tying it all together to expose the reality of what’s really going on. Hudson’s website is a must read as well as listening to his interviews and discussions on YouTube (no need to watch as that just distracts from the listening).

I have learnt so much from Bill’s teachings and blog and could never have imagined, in an earlier paid working life, that money, banking and economics would be something that I just had to deep dive into.

Congratulations Bill and the other key formulators of MMT, you all did indeed know it all along or at least 25 years ago. In a rational world this article would suffice to destroy the credibility of the Neoclassical economists and the descendants of the Monetarists and all those economists that still incorporate parts of those ideologies such as the Neo Keynesians. Unfòrtunately just like our systems of justice, our world does not in general act rationally and money and power rule these deliberately corrupted systems.

Derek you rightĺy blame the ‘Chicago School’ and it’s underlying forces for the euro and no doubt global neoliberalism in general but at least the US is now following a fiscal path much closer to that of Japan than the Chicago Shool’s poisonous ideology. Trump and the rich in the US willingly chose tax cuts in favour of balanced budgets as well as a fiscal response to the pandemic while Biden is trying to enlarge the fiscal response to the pandemic and implement at least part of Bernie Sanders’ ‘Socialist’ policy agenda. Perhaps the rats in Europe and elsewhere are continuing to whistle the tune after the Pied Piper has long since departed and the rats now have only themselves to blame?

Sorry if this is all a bit trivial, but I believe not everyone who reads this blog has a big brain.

I did my economics degree 80/83 in my 30s, having just an A level completed in 1 year at a college of further education. I remember the problem of ‘Keynes’ not fitting into the econometricists’ fantasies. I hated econometrics because, although I liked maths, I was out of my depth with an O level taken 16 years before. But I also did not see the point of it.

The ‘smart’ lecturers were monetarists. It is delightful to know now that they were rubbish and that my instincts were correct. I could never accept the micro stuff and I love it that the neoKeynesians with whom I argue now are just basically microeconomists with sophisticated maths. (Haven’t they read Keen?)

One of the first essays I had to write was on ‘crowding-out’ – I knew it was wrong but did not have the time to research and it was pretty poor. Not sure now I could write it much better but it’s good to know I was right at least.

I couldn’t help but be reminded of this by Lajos Brons….

” … (On a side-note, the word “law” in economics seems to be an (accidental?) euphemism for “lie”, as virtually (?) every so-called economic “law” is false, and every well-informed economist should be able to know that.)”

“It doesn’t matter that all of the assumptions the theory is based on are false because all scientific theories are based on false assumptions, they argue, and all that does matter is whether the resulting theory is a useful tool. This is really mainstream economics’ last line of defense, and it fails as miserably as everything that came before.”

“perfectly rational, perfectly informed, and perfectly selfish, profit/utility-maximizing beings don’t exist, and economists thus restrict the domain of their theories to nothing – their theories have no application.”

“… it depends on fictitious supply and demand curves that bear little (if any) resemblance to reality. But this also reveals why these fictitious curves are so pervasive anyway: they serve an ideological agenda. They serve a pro-market and anti-government agenda that favors deregulation and small governments. They serve an agenda that benefits the financial sector and large corporations and that harms almost everyone else. It is in this sense – and only in this sense – that mainstream economic theories are “usefull”: they are useful to serve the interests of the global financial and industrial elite.”

“… mainstream economics is a surprisingly fragile ideology. Its main result – the religious belief in the market as savior – depends entirely on a false assumption about the nature of production costs. Discarding that assumption while keeping the rest of the fallacious theory would turn it into an argument for socialism instead. Instead, what I want to suggest here is to stop ignoring reality, and to reject fallacious reasoning and false assumptions. In other words, what I want to suggest is to throw out mainstream economics.”

Economics as Malignant Make Believe,

Derek Henry said above “China never fell for it” (the Chicago school). That is why I am very interested to watch how the Chinese government unwinds the capitalist excesses that have bubbled up there. Mainstream economics commentators have been blathering about all the value destroyed by aborted share market floats (I would posit that these floats don’t create value, they extract it – but that’s a different discussion) and about the property bubble that’s going to “take down the world economy”.

Well if the Chinese government was silly enough to follow the western approach – let the bubble pop then bail out the banks – it probably would take a chunk of the world with it, along with massive social and economic dislocation within China. But the government can’t and won’t let that happen, so we will soon see the results of the Chinese way of dealing with excess market power and asset bubbles. Do China’s economists understand MMT? Maybe, but they definitely understand that sometimes strong government intervention is required. Their banks will get buyouts, not bailouts, and I can only hope our government will have the wisdom to do the same when our own property bubble inevitably pops.

Meanwhile, those same mainstream commentators are already proposing that this will “destroy the dynamism that has given China spectacular growth”, but a few big players romping around in a “free market” is never the source of that dynamism.

Good stuff!

Quick note- Fiscal policy doesn’t need help from the CB outside of the euro area.

QE is just a placebo. The US Treasury, for example, would have done the same deficit spending

with or without the Fed’s QE or rate policy.

In the euro area qe is about the ECB has buying member nation debt (which would be analogous to the Fed buying debt of US states, which hasn’t happened). That’s because the euro area deficit spending is done by member nations and the ECB debt buying is part of the informal ‘do what it takes to prevent default’ guarantee.

Bradley Schott asked: “Do China’s economists understand MMT?”

I don’t think so, not the mainstream anyway; the sight of half-finished residential blocks being demolished would argue against it. I wrote in the ‘Global Times” that the PBofC should buy Evergrande and convert it into an agent for government-subsidized housing for low-wage workers, to fulfill Xi’s vision that “houses are for living in” (not for get-rich-quick speculation).

And I recall reading China has left some PV farms unconnected to the grid, or rather:

(from google)

“Despite the (covid) disruption, the government is set on having wind and solar compete with coal power on price and on schedule – ushering in an era of “grid parity”. Renewables have received subsidies since 2011 and their removal is expected to increase competition in the sector.”

All to try to reduce public debt, no doubt. Madness, in this present AGW emergency.

Ie, market orthodoxy still reigning supreme in China. Now we even see an approaching energy crisis, in the name of “competition in the (energy) sector.” Whereas China should announce to the world it will double its PV capacity backed by pumped hydro every year for as long as it takes to achieve net zero emissions, while simultaneously closing down the thermal coal industry. China is the one economy which could actually roll-out PV at that hectic pace, given its engineering and management skills.

btw, China is not yet as wealthy as the US; but watch the US claiming China is “not doing enough” in the upcoming talk-fest in Glasgow…..despite China’s per capita emissions being much lower than the US.

Actually, if the climate scientists are correct, we don’t have until 2050; which means the the fate of the world is in the hands of the PBofC – and the central bank of India – who together account for a third of humanity.

Neil you are right we don’t have until 2050 to get to global net zero. Even if greenhouse gas emissions dropped to net zero tomorrow, it is still necessary to extract CO2 from the atmosphere to avoid the catastrophic consequences that will arise from current atmospheric greenhouse gas levels.

Scientists have estimated that the world’s oceans delay global warming by at least 0.6C due to their high heat capacity so we are already locked in for about 2C warming above pre industrial levels within many decades if global net zero occurred tomorrow which it clearly will not.

Extracting CO2 is difficult, expensive and probably before the end of the decade will be economically horrendous to achieve given the current increasing rate of global GHG emissions. The best methods such as increasing levels of soil carbon using regenerative agriculture or by adding biochar for example, along with reforestation and environmental restoration have practical limits and we are set to exceed those limits well within the decade.

In fact global GHG emissions are increasing at a faster rate every year and current efforts are totally inadequate. We are heading towards global warming levels well above 4C and with bio feedbacks such as less reflection from ice and arctic methane emissions, any human induced temperature rises risk being further magnified.

One of James Hansen’s latest recommended trajectories was global GHG emission reductions of 6% p.a. starting in 2020 with concurrent removal of 75ppm of atmospheric CO2 so as to stabilise long term under 1.5C global warming and with 350ppm of atmospheric CO2. This would limit the destructive overshoot above 2C warming. This trajectory was achievable but nevertheless the world is not listening and we are all going to lose the opportunity to follow an achievable trajectory within just a few years.

It looks to me that aiming to end nearly all fossil fuel use by 2030 should be the current goal but the global warming trajectory that is to be followed is what is critical.