These notes will serve as part of a briefing document that I will send off…

Further evidence the government should and can be doing more to help the most vulnerable

I am tied up most of today in Sydney and so am handing over the blog responsibilities to our regular guest blogger, Professor Scott Baum from Griffith University who has been one of my regular research colleagues over a long period of time. Today he is writing about the impact the Australian Government’s COVID income supplement has had on financial stress and the need for continued support for our mot vulnerable households. Over to Scott who shows clearly that the persistence of poverty is a government choice …

New data … further evidence the government should and can be doing more to help the most vulnerable

In several of my previous blog entries here (go to guest blogger category to trace them) I’ve written about the issues of poverty and disadvantage in support of our Just, Urgent and Sustainable Transition blueprint.

It seems that everywhere one looks there is some new data that furthers the case for more intervention and change.

Recently (April 21, 2021) the Australian Bureau of Statistics (ABS) released the preliminary estimates for the – the Household Income Wealth and Housing Costs – for the September 2020 reference period taken from the 2020-21 Survey of Income and Housing.

Once again, the data shows that we are all in this together, except when we are not!

The ABS’s headline statistics related to early access to superannuation and the impact of the government’s COVID income supplements (more on this later).

For those who are unaware, one of the Australian Government’s COVID economic responses was to let eligible people access up to $AUD20,000 in two instalments of their superannuation – their retirement income balances – to allow them to meet financial emergencies during the pandemic.

It was obvious then and now that this was a bad policy decision and would leave many Australians short of income when they reached retirement age.

But this is not what this blog post is about.

Digging into the data beyond simply the headline statistics, tells a couple of stories.

The first one is a story about financial stress and inequality.

The ABS measures – Financial Stress – with reference to indicators:

… such as being unable to raise emergency funds within a week, pay bills on time, seeking assistance from welfare or community organisations or going without dental treatment when needed due to a shortage of money in the last 12 months.

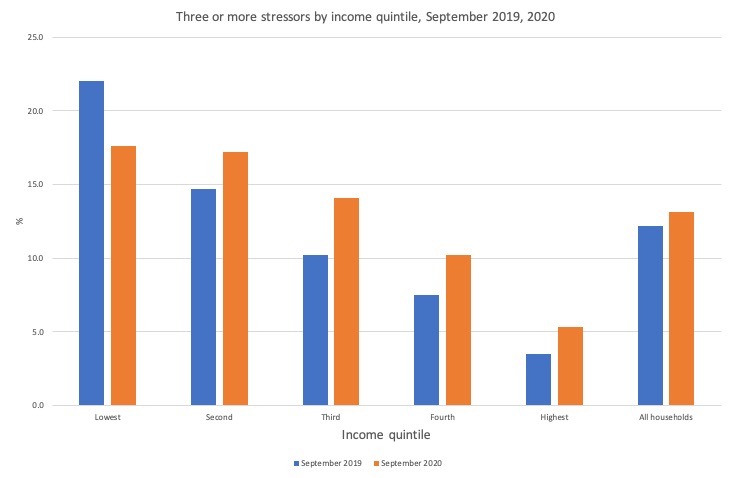

According to the September 2020 estimates (shown in orange in the bar graph below), there are marked differences between households in terms of financial stress.

Not surprisingly, those with less to spend suffer the most.

The difference between the poorest and the richest in terms of income distributions is a stark reminder of the types of issues we are concerned with in our JUST blueprint.

The estimates show that households in the lowest two income quintiles were much more likely than households in other quintiles to report experiencing three or more financial stressors over the year between September 2019 and 2020.

The ratio between the highest and lowest quintiles is around 1:3 (5.3 per cent versus 17.6 per cent)

Some well-heeled households do suffer financial stress, but the burden falls disproportionately on the poorest of our society.

Digging further we soon learn that:

1. Those households receiving the lowest incomes were more likely to spend more than they earned (11.5 per cent for the lowest quintile).

2. They were less likely to be able to raise $2,000 for an emergency (29.1 per cent for the lowest quintile).

3. They were more likely to miss dental appointments because of cost (10.8 per cent for the lowest quintile).

4. They were more likely to have to turn to friends or family for help (11.8 per cent for the lowest quintile).

5. They had far lower financial assets and more liabilities and hence much lower levels of financial resilience.

I could go on, but the patterns are clear to see – being among the poorest in Australia carries with it the spectre of multiple and compounding difficulties as a result of a lack of financial resources.

And it’s not just the statistics.

We all hear anecdotal evidence of low-income households such as older people reliant on the pension, going without basic care due to the high cost, suffering from what the experts refer to as energy poverty because they can’t afford to heat or cool their homes or putting off going to the doctor due to the cost.

And we hear stories of children of single parents missing out on basic school supplies or going to school without appropriate nutrition.

My blog post – Not enough food: The case for a Just, Urgent and Sustainable Transition continues (January 5, 2021) – touched on this problem.

The widespread impacts of living in financial stress are significant.

As a society we know this is true.

Living with financial stress impacts on a person’s mental health and the mental health of the people around them.

Sharp increases in financial stress are likely to result in a raft of social problems including increased crime, increased domestic violence and increased homelessness.

For children living in a household living in financial stress the impacts are likely to reach well beyond their childhoods.

A stressed home environment and/or homelessness, poor nutrition and limited opportunities to undertake optional school activities impacts on their social and emotional development with known impacts.

The potential impacts are therefore significant, and we must and indeed can do something to rectify the situation.

This brings me to story Number Two.

The government has shown what can be done to improve (at least partially) the financial position of some of our most vulnerable.

One of the key planks in the Australian Government’s COVID-19 economic support package was to provide recipients of selected government income payments a supplement.

According to the Australian Government’s – Parliamentary blog (March 23, 2020) – the supplement was a:

$550 per fortnight Coronavirus Supplement for new and existing recipients of JobSeeker Payment…, Parenting Payment, Youth Allowance for jobseekers, Farm Household Allowance and Special Benefit. The supplement will be paid for six months and almost doubles the maximum payment rate for a JobSeeker Payment recipient.

The introduction of the COVID-19 income supplement as part of the economic response to the pandemic had noticeable effects with the poverty financial stress alleviating impacts being widely discussed.

In recent report – Making a difference to children and families in financial stress and poverty – published by Social Ventures Australia, in conjunction with the Brotherhood of St Laurence (April 2021), we learned that:

Prior to Covid-19, 39 per cent of children in single parent families were living in poverty. With the $550 per fortnight Coronavirus Supplement this reduced to 17 per cent.

Similarly, in a NATSEM (University of Canberra) paper entitled – The Impact of COVID-19 and Policy Responses on Australian Income Distribution and Poverty – we learn that:

… without government interventions, both gross market and disposable incomes would have plunged considerably, with severe consequences in terms of raising income inequality and poverty levels. In absence of any policy response, the poverty rate would have jumped in the range of 3-12 percentage point compared with the pre-COVID period.

So, by effectively lifting its level of income support the Federal Government made the lives of many households and the communities they live in better.

The Australian Bureau of Statistics estimates also show the generally positive impact of the COVID-19 income supplement for the vulnerable.

Comparing the two years (2019 and 2020) in the graph above we see that the percent of the lowest income suffering three or more financial stressors fell.

There was also a narrowing of the gap between households in the lowest quintile and those in the second and third quintiles.

Notably, the COVID-19 pandemic appears to be associated with an increase in financial stress for households in all income quintiles, except for those in the lowest category.

These changes were among the Australian Bureau of Statistics headline numbers.

Considering the changed numbers the Bureau’s estimates showed that:

for households in the lowest private income quintile in September 2020, fewer reported

– at least one indicator of financial stress, when compared to the previous September (50 per cent to 43 per cent);

– not being able to pay gas, electricity, telephone or internet bills (16 per cent to 10 per cent); and

– experiencing difficulty paying bills more than 5 times in last 12 months (8 per cent to 5 per cent).

The estimates also showed that:

The proportion of households in the lowest private income quintile that reported saving regularly increased from (23per cent to 30 per cent).

Sure, the income supplement provided by the government didn’t completely reduce stress for the lowest income most disadvantaged households, but for many it allowed breathing room in their day-to-day financial lives.

Many welfare agencies recorded stories that put a human face on the changes that receiving the income supplement meant for low-income households.

In the above-mentioned Social Ventures report, a mother was quoted as saying:

The extra money means that I can pay my rent, without skipping meals and stressing. We have kept warm this winter and made a veggie garden. One of my boys has food allergies, his health, his skin has been awesome.

While another said:

This allowed me to get my little boy’s bike back on the park. Now he meets his friends and rides his bike.

These types of outcomes have to be a good thing.

Right?

They are good for the individuals involved and they are good for the wider community.

You would think that a caring government would have looked at these outcomes, read the anecdotal stories and seen that what they had achieved during COVID in terms of boosting the incomes of vulnerable families was a good thing.

Often, Australian Prime Minister Scott Morrison and others would emerge from the Canberra bubble to front the media with a story about a note, letter or email they had received from a ‘battling Australian’ thanking the government for helping them by way of the extra income supplement, or talk about people approaching him on the street to thank him for providing them with extra financial stability, something they hadn’t had in a long time.

But despite this there was a definite policy disjuncture between these good news stories and the government’s desire to start getting back into some form of business (being mean-spirited) as usual.

In the UK Guardian article (July 21, 2020) – Treasury cautioned Scott Morrison over cutting jobkeeper payment – we read:

The prime minister said the income support was vitally important and had done its job but was always designed to be temporary. Morrison told reporters it was necessary to reduce the rate of the two programs because the current scheme was “burning cash … to the tune of some $11bn a month.

Usual mis-informed discussion about how the government can’t keep funding things because they are burning through their cash.

As soon as the government turned their combined attention to an end to the economic troubles (a highly premature viewpoint, as we all know) they quickly whisked away the support, with the predictable impact being vulnerable families were pretty much back to square one – in abject poverty.

I talk about the potential impacts here – I vote, I am unemployed and I live in your electorate (March 30, 2021) – and there was no shortage of calls for the government to rethink the decision to withdraw support.

It’s the time of year when the Australian government announces their annual financial statement (they call it the ‘federal budget’) and no doubt the Treasurer will stand up and talk up how well the government has handled the COVID-19 induced downturn.

There will likely be the usual neo-liberal speak about ‘if you have a go, you get a go’, or how it is now time for individuals and companies to start doing the heavy lifting for the sake of the economy.

Chances are there will be little thought to the vulnerable Australians the government has thrown under the bus when they decided to end the extra income supplement payments that were a large part of their COVID-19 package.

They will be among those who are told ‘if you have a go, you get a go’.

But maybe we can live in hope that the past 12 months or so have seen those operating in the Canberra bubble all become educated in Modern Monetary Theory (MMT) and realise that they have misunderstood the way a sovereign currency issuing government’s finances work.

Maybe they will realise that the government can support our most vulnerable without the usual hand wringing and worry about the need to ‘balance the budget’.

Conclusion

Perhaps the opening line of the Treasurer’s address will go something like ‘My fellow Australians, tonight is an exciting night in history, for we have discovered MMT’.

Ahh, as my Grandmother always told me it’s nice to have a dream …

As always, the fight continues.

Hopefully, as we continue to develop our Just, Urgent and Sustainable Transition blueprint, the calls for change will become louder.

That is enough for today!

(c) Copyright 2021 William Mitchell. All Rights Reserved.

‘if you have a go, you get a go’.

A meaningless piece of dribble.

It’s also quite possible, as with most things, the government gets this meaningless affirmation arse backwards.

To paraphrase Clark & Dawe, “In order to ‘have a go’ on the bike, first someone needs to say it’s your turn so you now “get a go’ on the bike.” That’s assuming someone is actually sharing their bike, or that it’s a communal bike everyone is supposed to share and ‘get a go’ on in the first place.

The Morrison regime is always able to “find the money” or raise debt, for their favourite causes but not for lowest income people. It looks to me as a variation on the “undeserving poor” mantra of centuries ago.

I doubt Morrison is ignorant of MMT. It just does not suite ideological biases,.

Western governments are “printing” money (or adding zeros on a computer screen) and give it away to oligarchs as stimulus.

With that money, they buy government bonds, (rather than investing in the economy, which is getting trickier every day to extract profits from).

So, as the story goes, they will demand higher interest rates, as inflation rises.

Because Money loses value with inflation.

What if the stimulus were in the form of public investment on infrastructure like railroads, wind farms or solar panels?

What if oligarchs were not given a penny?

All this is voluntary.

We’re still electing black cats.

It looks like some looney tunes cartoon.

“But maybe we can live in hope that the past 12 months or so have seen those operating in the Canberra bubble all become educated in Modern Monetary Theory (MMT) and realise that they have misunderstood the way a sovereign currency issuing government’s finances work. Maybe they will realise that the government can support our most vulnerable without the usual hand wringing and worry about the need to ‘balance the budget’.” It may well take a global resurgence of Covid, as terrible as this would be, as likely as it is to happen, to bring this hope to fruition. I have this strange feeling (which some might view as a form of madness) that this pandemic, one way or the other, is going to force our hand, will not allow us to return to our exploitative, ecocidal normal. That it has brought us to a fork in our evolutionary road and will keep us there until we make the inescapable choice: evolve or die. Few might join me right now in this “prophetic” perspective, but turning points are rarely seen…except in retrospect.

Thank you professor for writing this piece.

My mother has taken most of her retirement out for COVID. I work full time, but we are spending more than taking in. Haven’t paid rent for almost a year now. The professor is definitely right also that mental health problems are more prominent. I would get some minor panic attacks here and there, which NEVER happened to me before.

A lot of young people are realizing that most of social promises are complete and utter lies and so is the idea of class collaboration, if our academics can even think in terms of class. Without beating on academics so much, we admit that its hard to swim against the tide of business propaganda.

Its a terrible realization but Its really not a society that we are living in. Yes, I think there is a time to be honest.

I have noticed that people would use the word “community” very often these few years. And then, you have real life experience and you see the analysis above. What hypocrisy and bankruptcy. Clearly profit of the few is made possible for poverty of the many.

Just in general, even when one understands MMT, one needs political power. Just by looking at MMT vs mainstream, we learn that black becomes white and white becomes black when the bourgeoisie have political power. That is a fact. MMT is essential and so is organizing. I say this so that a reader who wandered into the comment section may be encouraged to take that step.